Precision Engineering Hunting PLC 2019 Annual Report and Accounts Welcome to Hunting Hunting Is a Key Supplier to the Upstream Oil and Gas Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Voting Activity Report to March 2021

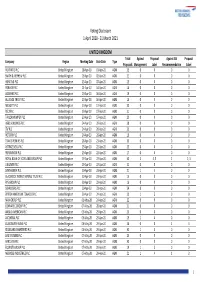

Voting Disclosure 1 April 2020 ‐ 31 March 2021 UNITED KINGDOM Total Against Proposal Against ISS Proposal Company Region Meeting Date Vote Date Type Proposals Management Label Recommmendation Label RIO TINTO PLC United Kingdom 08‐Apr‐20 01‐Apr‐20 AGM 25 0 0 00 SMITH & NEPHEW PLC United Kingdom 09‐Apr‐20 02‐Apr‐20 AGM 21 0 0 00 HUNTING PLC United Kingdom 15‐Apr‐20 07‐Apr‐20 AGM 15 0 0 00 PORVAIR PLC United Kingdom 21‐Apr‐20 14‐Apr‐20 AGM 14 0 0 00 AGGREKO PLC United Kingdom 23‐Apr‐20 16‐Apr‐20 AGM 19 0 0 00 ALLIANCE TRUST PLC United Kingdom 23‐Apr‐20 16‐Apr‐20 AGM 16 0 0 00 MEGGITT PLC United Kingdom 23‐Apr‐20 17‐Apr‐20 AGM 20 0 0 00 RELX PLC United Kingdom 23‐Apr‐20 17‐Apr‐20 AGM 21 0 0 00 TAYLOR WIMPEY PLC United Kingdom 23‐Apr‐20 17‐Apr‐20 AGM 20 0 0 00 HSBC HOLDINGS PLC United Kingdom 24‐Apr‐20 20‐Apr‐20 AGM 28 0 0 00 ITV PLC United Kingdom 24‐Apr‐20 20‐Apr‐20 AGM 21 0 0 00 ROTORK PLC United Kingdom 24‐Apr‐20 20‐Apr‐20 AGM 19 0 0 00 TRAVIS PERKINS PLC United Kingdom 28‐Apr‐20 21‐Apr‐20 AGM 20 0 0 00 ASTRAZENECA PLC United Kingdom 29‐Apr‐20 22‐Apr‐20 AGM 25 0 0 00 PERSIMMON PLC United Kingdom 29‐Apr‐20 22‐Apr‐20 AGM 17 0 0 00 ROYAL BANK OF SCOTLAND GROUP PLC United Kingdom 29‐Apr‐20 22‐Apr‐20 AGM 30 2 4, 5 22, 3 UNILEVER PLC United Kingdom 29‐Apr‐20 22‐Apr‐20 AGM 22 0 0 00 SYNTHOMER PLC United Kingdom 29‐Apr‐20 23‐Apr‐20 AGM 21 1 5 00 BLACKROCK WORLD MINING TRUST PLC United Kingdom 30‐Apr‐20 23‐Apr‐20 AGM 15 0 0 00 RPS GROUP PLC United Kingdom 30‐Apr‐20 23‐Apr‐20 AGM 16 0 0 00 SCHRODERS PLC United Kingdom 30‐Apr‐20 23‐Apr‐20 AGM 24 -

Nordea 1 - European Value Fund BP - EUR This Fund Is Managed by Nordea Investment Funds S.A

25 May, 2020 Nordea 1 - European Value Fund BP - EUR This fund is managed by Nordea Investment Funds S.A. EFC Classification Equity Advanced Europe Price +/- Date 52wk range 44.57 EUR -0.41 22/05/2020 37.59 63.53 Issuer Profile Administrator Nordea Investment Funds S.A. The fund seeks to provide durable positive absolute returns by applying a disciplined Address 562, Rue de Neudorf 2220 value style approach. The managers consider themselves as business rather than stock market investors. Their approach concentrates on long-term investment and not on City Luxembourg market specific factors and short-term phenomena. This means focussing on selecting Tel/Fax + 352 43 39 50-1 businesses that will offer upside potential with limited downside risk. The belief that Website www.nordea.lu certain businesses have a greater earning power forms the basis of this process. Earning power is defined as a company‘s ability to generate substantial discretionary free cash flow over a sustained period of time. The managers believe that only in this way can a General Information company generate wealth for its shareholders, and provide long-term capital ISIN LU0064319337 appreciation. Investments are made on a business by business basis, irrespective of Fund Type Capitalization market capitalisation, sector or industry, and only when share prices represent a Quote Frequency daily significant discount to the intrinsic value of the business. Quote Currency EUR Currency EUR Chart 5 year Foundation Date 15/09/1989 Fund Manager Tom Stubbe Olsen Legal Type Investment -

A Year of Rapid Expansion

Job: FrontXcover_v4 Proof: 01 Proof Read by: Operator: paul Date: 9 March 2012 7:06 PM Server: studio 2 Set-up: paul First Read/Revisions Hunting PLC Annual Report and Accounts 2011 Hunting PLC Hunting PLC A year of rapid Annual Report and Accounts 2011 expansion FrontXcover_v4.indd< 10mm SPINE 3 09/03/2012 19:58 < PRINTER TO ADJUST Job: FrontXcover_v4 Proof: 01 Proof Read by: Operator: paul Date: 9 March 2012 7:06 PM Server: studio 2 Set-up: paul First Read/Revisions COMPANY OVERVIEW 01 Highlights 02 Chairman’s Statement 04 Global Footprint BUSINESS REVIEW 06 Chief Executive’s Review 10 Our Strategy in Action 16 Operating Review 22 Financial Review 27 Review of Principal Risks and Uncertainties 29 Corporate Social Responsibility Report 34 Board of Directors GOVERNANCE 36 Report of the Directors 2011 40 Remuneration Committee Report 47 Corporate Governance Report FINANCIAL STATEMENTS 52 Report of the Auditors 53 Principal Accounting Policies 60 Consolidated Income Statement 61 Consolidated Statement of Comprehensive Income 62 Consolidated Balance Sheet 63 Company Balance Sheet 64 Consolidated Statement of Changes in Equity 66 Company Statement of Changes in Equity 67 Consolidated and Company Statement of Cash Flows 68 Notes to the Financial Statements 120 Shareholder Information 121 Financial Record 122 Additional Information on the Acquisition of Subsidiaries FrontXcover_v4.indd 4 09/03/2012 19:59 Job: FrontXcover_v4 Proof: 01 Proof Read by: Operator: paul Date: 9 March 2012 7:06 PM Server: studio 2 Set-up: paul First Read/Revisions Hunting at a glance Hunting PLC is a global energy services provider that manufactures and distributes products that enable the extraction of oil and gas for the world’s leading companies. -

For Immediate Release 27 August 2020 Hunting PLC (“Hunting” Or “The Company” Or “The Group”) Unaudited Results

For Immediate Release 27 August 2020 Hunting PLC (“Hunting” or “the Company” or “the Group”) Unaudited results for the six months to 30 June 2020 Hunting PLC (LSE:HTG), the international energy services group, today announces its results for the six months to 30 June 2020. Financial Summary * / ** • Revenue $377.7m (H1 2019 – $508.9m) • Underlying EBITDA $28.4m (H1 2019 – $77.4m) ** • Underlying profit from operations $5.7m (H1 2019 – $55.6m profit) • Exceptional impairments to assets charged totalling $174.9m (H1 2019 – $nil) • Reported loss from operations of $183.6m (H1 2019 – $41.1m profit) • Underlying diluted earnings per share 1.0 cent (H1 2019 – 23.6 cents) • Reported diluted (loss) earnings per share (125.7) cents (H1 2019 – 17.3 cents) • Second interim dividend declared for H1 2020 of 2.0 cents (H1 2019 – 5.0 cents) • Total cash and bank of $48.8m (31 December 2019 – $127.0m) • $160m revolving credit facility remains undrawn at 30 June 2020 * - Underlying results are non-GAAP measures and are before amortisation of acquired intangible assets and exceptional items. Reported results are based on the statutory results as reported under International Financial Reporting Standards. ** - EBITDA is a non-GAAP measure. Please refer to pages 32 and 33 of the Half Year 2020 report for further information. Commenting on the results and outlook, Jim Johnson, Chief Executive, said: “Hunting has responded well to the challenging market conditions seen in H1 2020 and, not only reports a positive underlying EBITDA, but has continued to trade at or near to break-even at the EBITDA level since March 2020. -

Wood (John) Group Plc (WG.:LN)

Wood (John) Group Plc (WG.:LN) Energy/Oil Equipment and Services Price: 230.10 GBX Report Date: September 30, 2021 Business Description and Key Statistics John Wood Group is engaged in consulting, projects and Current YTY % Chg operations solutions in energy and the built environment. Co.'s projects and operations service lines are managed in Asset Revenue LFY (M) 7,490 -4.5 Solutions (AS) and its consulting offerings managed in Technical EPS Diluted LFY 0.08 Consulting Solutions (TCS). AS provides projects and operations services across the life cycle ranging from initial feasibility and Market Value (M) 1,576 design, through construction, operation, maintenance and decommissioning. AS is split into two regional business groupings; Shares Outstanding LFY (000) 684,939 Americas and Europe, Africa, Asia and Australia. TCS engages in Book Value Per Share 4.91 providing the thinking and delivery needed to improve value at every stage of the asset life cycle. EBITDA Margin % 6.70 Net Margin % 0.7 Website: www.woodplc.com Long-Term Debt / Capital % 26.1 ICB Industry: Energy Dividends and Yield TTM 0.00 - 0.00% ICB Subsector: Oil Equipment and Services Payout Ratio TTM % 100.0 Address: 15 Justice Mill Lane Aberdeen 60-Day Average Volume (000) 1,609 GBR 52-Week High & Low 360.50 - 202.50 Employees: 50,942 Price / 52-Week High & Low 0.64 - 1.14 Price, Moving Averages & Volume 368.4 368.4 Wood (John) Group Plc is currently trading at 230.10 which is 0.7% above its 50 day 346.7 346.7 moving average price of 228.52 and 13.5% below its 325.0 325.0 200 day moving average price of 265.97. -

List of Public Interest Entities

www.pwc.co.uk/transparencyreport List of public interest entities List of public interest entities to accompany Transparency Report Year ended 30 June 2014 2 PricewaterhouseCoopers LLP UK Transparency Report FY14 List of public interest entities Please note – this list includes those 258 audit clients, for whom we issued an audit opinion between 1 July 2013 and 30 June 2014, who have issued transferable securities on a regulated market (as defined in the Statutory Auditors (Transparency) Instrument 2008 (POB 01/2008). 4IMPRINT GROUP PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 1 PLC ABERFORTH GEARED INCOME TRUST PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 2 PLC AFRICAN BARRICK GOLD PLC BOS (SHARED APPRECIATION MORTGAGES) NO.3 PLC AGGREKO PLC BOS (SHARED APPRECIATION MORTGAGES) NO.4 PLC AMLIN PLC BOS (SHARED APPRECIATION MORTGAGES) NO.6 PLC ARKLE MASTER ISSUER PLC BRADFORD & BINGLEY PLC ARM HOLDINGS PLC BRAMMER PLC ASIA RESOURCE MINERALS Plc (formerly BUMI Plc) BRISTOL & WEST PLC ASIAN TOTAL RETURN INVESTMENT COMPANY PLC BRITISH AMERICAN TOBACCO PLC (formerly Henderson Asian Growth Trust Plc) BRITISH TELECOMMUNICATIONS PLC AVIVA PLC BT GROUP PLC AVON RUBBER PLC BURBERRY GROUP PLC BABCOCK INTERNATIONAL GROUP PLC CAIRN ENERGY PLC BAGLAN MOOR HEALTHCARE PLC CAMELLIA PLC BAILLIE GIFFORD JAPAN TRUST PLC CAPITAL & COUNTIES PROPERTIES PLC BAILLIE GIFFORD SHIN NIPPON PLC CAPITAL GEARING TRUST PLC BANK OF SCOTLAND PLC CARNIVAL PLC BARCLAYS BANK PLC CARPETRIGHT PLC BARCLAYS PLC CARR’S MILLING INDUSTRIES PLC BERENDSEN PLC CATLIN UNDERWRITING BIRMINGHAM -

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a feeder fund in a master-feeder structure and the holdings listed below are the investment holdings of the corresponding master fund. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use in the Legal Notices. -

Hunting PLC Annual Report and Accounts 2020 Resilience Through a Global Crisis Welcome to Hunting Market Highlights

Hunting PLC Annual Report and Accounts 2020 Resilience Through A Global Crisis Welcome to Hunting Market Highlights Hunting is a key supplier to the Average WTI crude Year-end WTI crude upstream oil and gas industry. oil price oil spot price $39 $49 Our strategy is to manufacture per barrel per barrel products and deliver services to our (2019 – $57 per barrel) (2019 – $61 per barrel) customers, wherever in the world they Global average Global average are operating. onshore rig count offshore rig count 1,097 182 Hunting’s product offering extends units units across the life cycle of an oil and gas (2019 – 1,844 units) (2019 – 243 units) well, and this focus allows us to create, Global onshore drilling and Global offshore drilling and distribute and sustain value for our production expenditure production expenditure shareholders and stakeholders. $77.7 $43.4 billion billion (2019 – $155.5 billion) (2019 – $61.1 billion) Hunting is a premium-listed Company, quoted on the London Stock Exchange and is a constituent of the FTSE Financial Highlights All-Share Index. Revenue Total cash and bank at year-end* $626.0 $101.7 million million (2019 – $960.0 million) (2019 – $127.0 million) Underlying (loss) profit Reported (loss) profit from operations* from operations $(16.4) $(220.0) million million (2019 – $94.3 million) (2019 – $46.8 million) Underlying diluted Reported diluted (loss) earnings per share* (loss) earnings per share (10.0) (143.2) cents cents (2019 – 43.9 cents) (2019 – 23.5 cents) * Non-GAAP measure (“NGM”) see pages 203 to 207 and note 26. -

Direct Equity Investments 310315

Security Name ISIN ABERDEEN ASSET MANAGEMENT PLC COMMON STOCK GBP 10 GB0000031285 AMEC FOSTER WHEELER PLC COMMON STOCK GBP 50 GB0000282623 ANTOFAGASTA PLC COMMON STOCK GBP 5 GB0000456144 ASHTEAD GROUP PLC COMMON STOCK GBP 10 GB0000536739 BHP BILLITON PLC COMMON STOCK GBP 0.5 GB0000566504 ARM HOLDINGS PLC COMMON STOCK GBP 0.05 GB0000595859 WS ATKINS PLC COMMON STOCK GBP 0.5 GB0000608009 BARRATT DEVELOPMENTS PLC COMMON STOCK GBP 10 GB0000811801 BELLWAY GBP0.125 GB0000904986 BALFOUR BEATTY PLC COMMON STOCK GBP 50 GB0000961622 BTG ORD GBP0.10 GB0001001592 BIOSCIENCE INVESTMENT TRUST ORD GBP0.25 GB0001121879 BRITISH LAND CO PLC/THE REIT GBP 25 GB0001367019 SKY PLC COMMON STOCK GBP 50 GB0001411924 TULLOW OIL PLC COMMON STOCK GBP 10 GB0001500809 J D WETHERSPOON PLC COMMON STOCK GBP 2 GB0001638955 DIPLOMA ORD GBP0.05 GB0001826634 BOVIS HOMES GROUP GBP0.50 GB0001859296 AVIVA PLC COMMON STOCK GBP 25 GB0002162385 CRODA INTERNATIONAL PLC COMMON STOCK GBP 10 GB0002335270 DIAGEO PLC COMMON STOCK GBP 28.93518 GB0002374006 SCHRODERS VTG SHS GBP1 GB0002405495 ELEMENTIS PLC COMMON STOCK GBP 5 GB0002418548 DCC PLC COMMON STOCK GBP 0.25 IE0002424939 DAIRY CREST GROUP PLC COMMON STOCK GBP 25 GB0002502812 BAE SYSTEMS PLC COMMON STOCK GBP 2.5 GB0002634946 DERWENT LONDON PLC ORD GBP 0.05 GB0002652740 BRITISH AMERICAN TOBACCO PLC COMMON STOCK GBP 25 GB0002875804 ELECTROCOMPONENTS ORD GBP0.10 GB0003096442 SPECTRIS PLC COMMON STOCK GBP 5 GB0003308607 PREMIER FARNELL ORD GBP0.05 GB0003318416 FENNER PLC COMMON STOCK GBP 25 GB0003345054 FIRSTGROUP ORD GBP0.05 GB0003452173 -

International Corporate Investments in Ohio Operations

Research Office A State Affiliate of the U.S. Census Bureau International Corporate Investment in Ohio Operations 20 September 2007 June 20 June 2020 Table of Contents Introduction and Explanations Section 1: Maps Section 2: Alphabetical Listing by Company Name Section 3: Companies Listed by Country of Ultimate Parent Section 4: Companies Listed by County Location International Corporate Investment in Ohio Operations June 2020 THE DIRECTORY OF INTERNATIONAL CORPORATE INVESTMENT IN OHIO OPERATIONS is a listing of international enterprises that have an investment or managerial interest within the State of Ohio. The report contains graphical summaries of international firms in Ohio and alphabetical company listings sorted into three categories: company name, country of ultimate parent, and county location. The enterprises listed in this directory have 5 or more employees at individual locations. This directory was created based on information obtained from Dun & Bradstreet. This information was crosschecked against company Websites and online corporate directories such as ReferenceUSA®. There is no mandatory state filing of international status. When using this directory, it is important to recognize that global trade and commerce are dynamic and in constant flux. The ownership and location of the companies listed is subject to change. Employment counts may differ from totals published by other sources due to aggregation, definition, and time periods. Research Office Ohio Development Services Agency P.O. Box 1001, Columbus, Ohio 43266-1001 Telephone: (614) 466-2116 http://development.ohio.gov/reports/reports_research.htm International Investment in Ohio - This survey identifies 4,303 international establishments employing 269,488 people. - Companies from 50 countries were identified as having investments in Ohio. -

Hunting PLC Annual Report 2012

Hunting PLC PLC Hunting Hunting PLC Annual Report 2012 3 Cockspur Street London SW1Y 5BQ Tel: 020 7321 0123 Fax: 020 7839 2072 Annual Report 2012 www.huntingplc.com Welcome to Hunting Professional Advisers Solicitors CMS Cameron McKenna LLP Auditors PricewaterhouseCoopers LLP Joint Corporate Brokers Deutsche Bank and Barclays Bank Financial Advisers DC Advisory Partners Limited Insurance Brokers Willis Limited Pension Advisers & Actuary Lane Clark & Peacock LLP Financial Public Relations Buchanan Communications Limited Registrars & Transfer Office Equiniti Limited Aspect House Spencer Road, Lancing West Sussex BN99 6DA Telephone: 0871 384 2173 Registered Office: 3 Cockspur Street, London SW1Y 5BQ Registered Number: 974568 (Registered in England and Wales) Telephone: 020 7321 0123 Facsimile: 020 7839 2072 www.huntingplc.com Designed by Emperor Printed by Park Communications on paper manufactured from Elemental Chlorine Free (ECF) pulp sourced from sustainable forests Park Communications is certified to ISO 14001:2004 Environmental Management System and is a CarbonNeutral® company Hunting PLC Annual Report 2012 01 Company Overview OverviewCompany “ The management team and 02 Strength in Numbers 04 Hunting at a Glance assets are fit for purpose and 06 Chairman’s Statement set for growth.” 08 Growing our Global Presence Dennis Proctor, Chief Executive Business Review 10 Chief Executive’s Review 12 Five Years of Progress 14 Operating Review 22 Financial Review 27 Review of Principal Risks and Uncertainties Business Review 29 Corporate Social -

RE-IMAGINING BIG OILS How Energy Companies Can Successfully Adapt to Climate Change

EQUITY RESEARCH | November 1, 2018 The following is a redacted version of a report originally published Oct. 8, 2018. All company references in this note are for illustrative purposes only and should not be interpreted as investment recommendations. RE-IMAGINING BIG OILS How Energy Companies can successfully adapt to climate change Michele Della Vigna, CFA Neil Mehta David Chreng Alberto Gandolfi +44 20 7552-9383 +1 212 357-4042 +44 20 7051-0536 +44 20 7552-2539 [email protected] [email protected] [email protected] alberto.gandolfi@gs.com Goldman Sachs International Goldman Sachs & Co. LLC Goldman Sachs International Goldman Sachs International Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S. The Goldman Sachs Group, Inc. Goldman Sachs Big Oils can lead a profitable path towards Big Energy and a 2° C scenario Low carbon: Some context around climate change and greenhouse gas (GHG) emissions Climate change is a widely debated topic, with ongoing diversity of views. However, there is growing consensus among policy makers and scientists that global surface temperatures are rising and that the main cause is human-induced emissions of greenhouse gases (GHGs), which include carbon dioxide (CO2), methane (CH4), water vapour (H2O) and nitrous oxide (N2O).