Union Bank of India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bank Competition Using Networks: a Study on an Emerging Economy

Journal of Risk and Financial Management Article Bank Competition Using Networks: A Study on an Emerging Economy Molla Ramizur Rahman * and Arun Kumar Misra Vinod Gupta School of Management, Indian Institute of Technology Kharagpur, Kharagpur 721302, West Bengal, India; [email protected] * Correspondence: [email protected] Abstract: Interconnectedness among banks is a key distinguishing feature of the banking system. It helps mitigate liquidity problems but on the other hand, acts as a curse in propagating systemic risk at times of distress. Thus, as banks cannot function in isolation, this study uses the Contemporary Theory of Networks to examine banking competition in India for five distinct economic phases, emphasizing upon the Global Financial Crisis (GFC) and the ongoing COVID-19 pandemic. This paper proposes a Market Power Network Index (MPNI), which uses network parameters to measure banks’ market power. This network structure shows a formation of bank clusters that are involved in competition. Specifically, network properties, such as centroid, average path length, the distance of a node from the centroid, the total number of connections in the inter-bank market, and network density, do go on to explain banking competition. It is interesting to note that crisis periods witness a lower level of competition, with GFC bearing the least competition. The ongoing COVID-19 pandemic shows a lower trend, but it is of a higher magnitude than GFC. It was also found that big-sized, profitable, capital adequate, and public banks dominate the banking system. Notably, this study was conducted on a sample of 33 listed Indian banks from April 2008 to December 2020. -

March 2020 Contents Àh$Mez {V{W : 14-05-2020

¶y{Z¶Z Ymam UNION DHARA AZwH«$‘{UH$m OZdar-_mM©, 2020 January-March 2020 Contents àH$meZ {V{W : 14-05-2020 ‘w»¶ ‘hmà~§YH$ (‘mZd g§gmYZ) · n[aÑí¶ 3 · goÝQ´>a ñàoS : >bmhm¡b Am¡a ñnr{V 38-39 ~«Ooída e‘m© · g§nmXH$s¶ 4 · HR Intregration in successful Chief General Manager (HR) Bank Amalgamation 40-42 Brajeshwar Sharma · g§dmXXmVm gå‘obZ 5 · {db¶/g‘m‘obZ ‘| ‘mZd 43 g§nmXH$ · gm{h˶ OJV go... 6-7 S>m°. gwb^m H$moao g§gmYZ nj · H$mì¶Ymam 8-9 Editor · Triveni Sangam... 44-45 Dr. Sulabha Kore · {db¶-g‘m‘obZ/The Rebirth 10-11 · Union elite - a niche banking 46-47 g§nmXH$s¶ gbmhH$ma · The Amalgamation of banks 12-13 A{dZme Hw$‘ma qgh · AmAmo, {‘b OmE§ h‘... 48 · ew^‘ñVw 14 Ho$. nr. AmMm¶© · Merger/Amalgamation of Banks 49-51 {ZVoe a§OZ · {eIa H$s Amoa... 15 · ^maVr¶ AW©ì¶dñWm na 52-53 Zdb {H$emoa Xr{jV · h‘mao H$bmH$ma 16-17 ~¢H$m| Ho$ {db¶Z H$m à^md Editorial Advisors Avinash Kumar Singh · h‘| Jd© h¡ 18 · ¶y{ZdZ 54-55 K. P. Acharya · Iob OJV go... 19 · Role of Employee in Merger/ 56 Nitesh Ranjan Amalgamation · EH$ ‘O~yV Ed§ ~‹S>r Q>r‘ 20 Naval Kishor Dixit · · Cultural Integration & 21 MaH$ H$m H$moZm 57 Printed and published by Dr. Sulabha Kore Amalgamation · on behalf of Union Bank of India and godm{Zd¥Îm OrdZ go.. -

Trevor Hart Banking in a New World: the Beginnings of ANZ Bank

Trevor Hart Banking in a new world: the beginnings of ANZ Bank Proceedings of the ICOMON meetings, held in conjunction with the ICOM Conference, Melbourne (Australia, 10-16 October, 1998), ed. by Peter Lane and John Sharples. Melbourne, Numismatic Association of Australia, Inc, 2000. 117 p. (NAA Special publication, 2). (English). pp. 39-46 Downloaded from: www.icomon.org BANKING IN A NEW WORLD THE BEGINNINGS OF ANZ BANK By Trevor Hart ANZ Bank, Melbourne, Australia For its first twenty-nine years proposed to the Government in Australia had no bank. The British England, the formation of "The New settlement of Australia began in South Wales Loan Bank" based on 1788, but Australia's first bank, the the bank at the Cape of Good Hope. Bank of New South Wales, did not In 1812 the government refused open until 1817. his proposal. Macquarie accepted this refusal but was still convinced of Australia was founded as a the need for a bank in the colony.4 In self-supporting penal colony and 1816 he acted again, this time monetary arrangements were ad hoc. "convening a meeting of the A local currency of small private magistrates, principal merchants and promissory notes grew up in gentlemen of Sydney ... at which my conjunction with the circulation of favourite measure of a bank was Government Store receipts. This led brought forward."5 Macquarie issued to a dual monetary standard in a 'charter' for seven years to the which 'currency' came to mean directors of the new bank (which "money of purely local was later disallowed by the British acceptability" and 'sterling' meant Government) and on 8 April 1817 "any form of money .. -

Customer Perception and Satisfaction Towards Union Bank Services with Reference to Chidambaram Town, Cuddalore District,Tamil Nadu, India

Volume 2, Issue 7, July– 2017 International Journal of Innovative Science and Research Technology ISSN No: - 2456 – 2165 Customer Perception and Satisfaction towards Union Bank Services with Reference to Chidambaram Town, Cuddalore District,Tamil nadu, India Nsengiyumva Vedaste1, D. Ilangovani2 1. M.com student, Department of commerce 2. Professor and head, Department of commerce Annamalai University, Annamalainagar- 608002 Abstract:- The work reveal the Satisfaction of the The word "BANK" is derived from a Latin word 'Baucus' or Customers towards Union Bank of India services, mobile 'Banque', which means a bench. In the early days the European banking service, internet banking, ATM service .the moneylenders and moneychangers used to sit on the benches aspirations of this paper is to scrutinize how all account and exhibit coins of different countries in big heaps for the holders are amused according to the Union bank of India, purpose of changing and lending money. The research has been conducted with the customers of U BI, Chidambaram town, Cuddalore District. According to my research, now the customers are connected to the Internet via personal computers, banks envision similar advantages by adopting those same internal electronic processes to home use and banks view online banking as a powerful. The usage of Banking services to the Customers in Union Bank of India, through the results from questionnaires distributed to the customers, it seems that more persons are aware to use Banking services whether the remaining (less one) are not affectionate towards of it, due to various hiding factors like security and fear of hidden costs etc. So banks should come forward with measures to abate the fear of their customers through awareness campaigns and more meaningful advertisements to make banking services popular among all the group of people and to create a trust in mind of customers towards security of their accounts and to make the sites more users adjustable. -

Minutes/2014-15 January 16, 2015

Convener - SLBC Maharashtra No. AX1/PLN/SPL SLBC/Minutes/2014-15 January 16, 2015 Minutes of the Special SLBC Meeting held on January 15, 2015 at Mumbai A special SLBC meeting was convened on 15.01.2015 at Mumbai. The meeting had a focused agenda to discuss progress under Pradhan Mantri Jan Dhan Yojana (PMJDY), saturation of the State with respect to PMJDY, flow of credit to agriculture and achievement under Annual Credit Plan 2014-15. Chief Guest of the meeting was Hon’ble Chief Minister, Maharashtra State, Shri Devendra Fadnavis. Shri Sushil Muhnot, Chairman, SLBC and Chairman & Managing Director, Bank of Maharashtra chaired the meeting. Shri Chandrakant Patil, Minister for Cooperation, Shri Swadheen Kshatriya, Chief Secretary, Shri Sudhir Shrivastava, Additional Chief Secretary (Finance), Shri S.K. Sharma, Principal Secretary (Cooperation), Shri Shrikant Singh, Principal Secretary (Planning) Shri V. Giriraj, Principal Secretary (Rural Development), Shri Rajesh Aggarwal, Principal Secretary, (Information Technology), Shri Chandrakant Dalvi, Commissioner (Cooperation), Shri Vikas Deshmukh, Commissioner (Agriculture) and other senior officials of the State Government attended the meeting. The Reserve Bank of India was represented by Shri S. Ramaswamy, Regional Director, Maharashtra & Goa and Smt. J.M. Jivani, Regional Director, Nagpur. NABARD was represented by Dr. U.S. Saha, CGM, MRO, Pune. Two banks were represented by their Executive Directors viz Ms Trishna Guha, ED, Dena Bank and Shri S.K.V. Srinivasan, ED, IDBI Bank. The meeting was also attended by Shri Pramod Karnad, Managing Director, MSC Bank, Shri U.V. Rao, Chairman, Maharashtra Gramin Bank, Shri SDS Carapurcar, Chairman, Vidarbha Konkan Gramin Bank and other senior officials of Reserve Bank of India, various banks and Lead District Manager of some of the districts in the State. -

Weekly Updated Current Affairs for Week 31/52 & 32/52

WEEKLY UPDATED CURRENT AFFAIRS FOR WEEK 31/52 & 32/52 WEEKLY UPDATED CURRENT AFFAIRS FOR WEEKS 31/52 & 32/52 (30 JULY – 12 AUG 2017) 1. RBI released 3rd Bi-Monthly Policy Statements – Reduced Key Policy Rates by 25 bps (a) On 02 Aug 2017, the Monetary Policy Committee (MPC) chaired by RBI Governor Urjit Patel released 3rd Bi- Monthly Policy Statements for the FY 2017-18 to be effective for the periods between 01 August and 30 Sept 2017. (b) The Repo Rate under the Liquidity Adjustment Facility (LAF) was reduced by 25 bps from 6.25 % to 6 % and accordingly Reverse Repo Rate under LAF adjusted at 5.75 % from 6.00 % by reducing 25 bps. (c) The current Repo Rate is the lowest in 7 years since November 2010 and the RBI had last cut the key policy rates in October 2016. (d) Marginal Standing Facility (MSF) Rate, the Rate at which Banks borrows Overnight Funds from RBI against Approved Government Securities has been reduced by 25 bps and adjusted to 6.25 %. (e) In lines with the Rate cut, Bank Rate, the Long Tern Borrowing Rate of RBI has also been adjusted to 6.25 % by reducing 25 bps from 6.50 %. (f) CRR as Reserve Requirement for Scheduled Banks remained unchanged at 4 % of the Net Demand and Time Liability (NDTL) since 09 Feb 2013. (g) Other Reserve Requirement for Commercial Banks including Regional Rural Banks, Payment Bank and Small Finance Bank i. e. SLR has been retained (no change) at 20 %. The SLR was last reduced by 0.50 % (50 bps) to 20.00 % effecting from the fortnight commencing 24 June 2017. -

UPI Booklet Final

1001A, B wing, G-Block, 10th Floor, The Capital, Bandra-Kurla Complex, Behind ICICI bank, Bharat Nagar, Bandra (East), Mumbai, Maharashtra 400 051 Contact us at: [email protected] FAST FORWARD YOUR BUSINESS WITH US. SUCCESS STORIES Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience. It is available on all respective banking applications on Android and IOS platforms or via the BHIM application. HOW UPI OUTSCORES PAYMENT CAN BE DONE USING UPI ID/ AADHAR NUMBER/ ACCOUNT + IFSC/ SCANNING QR 24/7/365 DAYS ACCOUNT TO ACCOUNT SUPPORT SYSTEM TRANSFER OTHER PAYMENT SYSTEMS? PAYMENT CAN BE DONE REAL-TIME WITH/ WITHOUT INTERNET PAYMENT TRANSFER NO NEED TO SHARE ACCOUNT/ CARD DETAILS ONE INTERFACE, NUMEROUS BENEFITS BHIM (Bharat Interface for Money)/ UPI (Unified Payments Interface) powers multiple bank accounts into a single mobile application (of any bank) merging several banking features, seamless fund routing, and merchant payments into one hood. • Transfer money 24/7/365 • Single mobile application for accessing dierent bank accounts • Transfer money using UPI ID (no need to enter card details) • Merchant payment with single application or in-app payments • Supports multiple ways of payment, including QR code scan • Simplified authentication using single click two-factor authentication • UPI ID provides incremental security • Supports various transaction types, including pay, collect, etc. • Ease of raising complaints ANYTIME. -

Knowledge Technology

The Story RESPONSIBILITY ASSURANCE PROFICIENCY CONVENIENCE AGILE SUSTAINABILITY CONFIDENCE OPENNESS EXPERTISE SECURITY INSIGHTFUL CONSERVATION INTEGRITY CLARITY ACUMEN SPEED ASTUTE ETHICS TRUST TRANSPARENCY KNOWLEDGE TECHNOLOGY TRUST HUMAN CAPITAL RESPONSIBLE BANKING HUMAN CAPITAL HUMAN RESPONSIBLE BANKING RESPONSIBLE TECHNOLOGY KNOWLEDGE TRANSPARENCY Say YES to Growth ! Incorporation of NOVEMBER 2003 YES BANK Limited Capital infusion by promoters and key INDIA’S FINEST QUALITY MAR investors RBI license to commence banking business BANK MAY First branch at Mumbai & inclusion in second AUG schedule of the RBI Act 2004 Launch of Corporate & Business Banking AUG ISO 9001:2000 certification for back office FEB operations Maiden public offering of equity shares by the JUN Bank Rana Kapoor, Founder, MD & CEO adjudged 2005 Start-up Entrepreneur of the Year at the E&Y NOV Entrepreneur Awards 2005 FY2006-First full year of commercial MAR operations; Profit of INR 553 million, ROA 2% YES BANK's Investment Banking Group was ranked #1 in M&A 'Outbound Cross Border APR Transactions' in the Bloomberg League Tables Raised INR 1.8 billion of long-term OCT subordinated Tier II debt 2006 Launch of YES SAMPANN INDIA, our Financial Inclusion Initiative, in partnership DEC with ACCION International, USA RaisedR 1.98 billion of Upper Tier II capital MAR Launch of YES-International Banking AUG Selected as a Founding Member of the 2007 Community of Global Growth Companies at SEP ACTION + QUALITY = GROWTH x SCALE = the World Economic Forum, Geneva FINEST QUALITY -

Etrise Top Msmes Ranking: Etrise Top Msmes Ranking: Inaccurate That Msmes Don’T Get Finance Easily, Says Banking Official - the …

1/20/2020 etrise top msmes ranking: ETRise Top MSMEs Ranking: Inaccurate that MSMEs don’t get finance easily, says banking official - The … SECTIONS ET APPS ENGLISH E-PAPER ET PRIME 64 TimesPoints FOLLOW US LATEST NEWS BJP set to get new president, Nadda likely to succeed Shah SME New Home RISE SME Startups Policy Trade Entrepreneurship Money IT Legal GST ProductLine Biz Listings Marketing More Business News › RISE › SME › ETRise Top MSMEs Ranking: Inaccurate that MSMEs don’t get finance easily, says banking official Search for News, Stock Quotes & NAV's Benchmarks NSE Loser-Large Cap Stock Analysis, IPO, Mutual Funds, Bonds & More Sensex LIVE PFC 41,622.76 -322.61 114.65 -7.30 Market Watch ETRise Top MSMEs Ranking: Inaccurate that Related Most Read Most Shared MSMEs don’t get finance easily, says ETRISE Top MSMEs Ranking: As GST collections slip, compliance cost increases banking official ETRISE Top MSMEs Ranking: Recognising India's In a panel discussion under ETRise Dialogue, a top official of the Union Bank of India said best small businesses that MSMEs were getting loans sanctioned by banks, especially under the PSB loans in 59 minutes. The Bank, he said, was proactive in MSME funding. ET Online | Jan 18, 2020, 01.32 PM IST Save 1 Comments ET Online Dismissing notions that there is a lack of awareness on the government's ‘PSB loans in 59 minutes’ scheme launched in ET Rise Trending Terms November 2018, a top official from a PSU Amazon Flipkart Sale 2019 Startup India Oyo bank said that the scheme is well publicized, Flipkart Uber Paytm with many availing its benefits. -

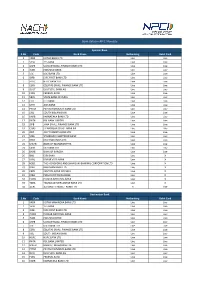

Live Banks in API E-Mandate

Bank status in API E-Mandate Sponsor Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK BANK LTD Live Live 2YESB YES BANK Live Live 3 USFB UJJIVAN SMALL FINANCE BANK LTD Live Live 4 INDB INDUSIND BANK Live Live 5 ICIC ICICI BANK LTD Live Live 6 IDFB IDFC FIRST BANK LTD Live Live 7 HDFC HDFC BANK LTD Live Live 8 ESFB EQUITAS SMALL FINANCE BANK LTD Live Live 9 DEUT DEUTSCHE BANK AG Live Live 10FDRL FEDERAL BANK Live Live 11 SBIN STATE BANK OF INDIA Live Live 12CITI CITI BANK Live Live 13UTIB AXIS BANK Live Live 14 PYTM PAYTM PAYMENTS BANK LTD Live Live 15 SIBL SOUTH INDIAN BANK Live Live 16 KARB KARNATAKA BANK LTD Live Live 17 RATN RBL BANK LIMITED Live Live 18 JSFB JANA SMALL FINANCE BANK LTD Live Live 19 CHAS J P MORGAN CHASE BANK NA Live Live 20 JIOP JIO PAYMENTS BANK LTD Live Live 21 SCBL STANDARD CHARTERED BANK Live Live 22 DBSS DBS BANK INDIA LTD Live Live 23 MAHB BANK OF MAHARASHTRA Live Live 24CSBK CSB BANK LTD Live Live 25BARB BANK OF BARODA Live Live 26IBKL IDBI BANK Live X 27KVBL KARUR VYSA BANK Live X 28 HSBC THE HONGKONG AND SHANGHAI BANKING CORPORATION LTD Live X 29BDBL BANDHAN BANK LTD Live X 30 CBIN CENTRAL BANK OF INDIA Live X 31 IOBA INDIAN OVERSEAS BANK Live X 32 PUNB PUNJAB NATIONAL BANK Live X 33 TMBL TAMILNAD MERCANTILE BANK LTD Live X 34 AUBL AU SMALL FINANCE BANK LTD X Live Destination Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK MAHINDRA BANK LTD Live Live 2YESB YES BANK Live Live 3 IDFB IDFC FIRST BANK LTD Live Live 4 PUNB PUNJAB NATIONAL BANK Live Live 5 INDB INDUSIND BANK Live Live 6 USFB -

June 2, 2020 National Stock Exchange of India Ltd

June 2, 2020 National Stock Exchange of India Ltd. (Symbol: INDUSINDBK) BSE Ltd. (Scrip Code: 532187) India International Exchange (Scrip Code: 1100027) Singapore Stock Exchange Luxembourg Stock Exchange Madam / Dear Sir, Moody’s Rating Action - Update We wish to inform that Moody's Investors Service (Agency) have, vide their Rating Action dated June 2, 2020 communicated that Moody's have downgraded IndusInd's long-term local and foreign currency deposit ratings to Ba1 from Baa3 and its BCA to ba2 from ba1. The rating outlook is negative. Moody’s have clarified that the key drivers for rating downgrade is caused due to economic disruptions caused by the coronavirus and the downgrade of the sovereign rating. The rating action of Moody’s follows Moody's recent downgrade of the Indian government's issuer rating to Baa3 from Baa2 with a negative outlook. The Rating Action Release by the Agency containing the reason for the above downgrade is attached. On March 9, 2019, Moody’s assigned Issuer Rating of ‘Baa3’ with a ‘Stable Outlook’ for the Euro Medium Term Notes (eMTNs) and our Bank raised USD 400 million in April 2019 which works out to 1% of the Balance Sheet at current level. These bonds are listed on India International Exchange and on Singapore Stock Exchange. This disclosure is being made in compliance with Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 20l5. A copy of this letter is being uploaded on the Bank's website at www.indusind com. We request you to kindly take this letter on record. -

September 2019

Fleveer Meefòeâ nceW osvee oelee ceve keâe efkeMkeeme keâce]peesj nes vee Fleveer Meefòeâ nceW osvee oelee ceve keâe efkeMkeeme keâce]peesj nes vee nce ÛeueW veskeâ jmles hes ncemes Yetuekeâj Yeer keâesF& Yetue nes vee Fleveer Meefòeâ nceW osvee oelee ceve keâe efkeMkeeme keâce]peesj nes vee otj De%eeve kesâ neW DeBOesjs let nceW %eeve keâer jesMeveer os nj yegjeF& mes yeÛeles jnW nce efpeleveer Yeer os Yeueer ef]pevoieer os yewj nes vee efkeâmeer keâe efkeâmeer mes nce vee meesÛeW nceW keäÙee efceuee nw Yeekevee ceve cesb yeoues keâer nes vee nce Ùes meesÛeW efkeâÙee keäÙee nw Dehe&Ce nce ÛeueW veskeâ jmles hes ncemes Hetâue KegefMeÙeeW kesâ yeeBšW meYeer keâes Yetuekeâj Yeer keâesF& Yetue nes vee meyekeâe peerkeve ner yeve peeS ceOegyeve Fleveer Meefòeâ ncesb osvee oelee Dees Dees ... ceve keâe efkeMkeeme keâce]peesj nes vee Deheveer keâ®Cee keâe peue let yene kesâ keâj os heekeve nj Fkeâ ceve keâe keâesvee nce ÛeueW veskeâ jmles hes ncemes Yetuekeâj Yeer keâesF& Yetue nes vee Fleveer Meefòeâ nceW osvee oelee ceve keâe efkeMkeeme keâce]peesj nes vee C O N T E N T S efJepeve SJeb efceMeve / Vision & Mission 4-5 ØeOeeve ceb$eer keâe mebosMe 6 efJeòe ceb$eer keâe mebosMe 7 DeOÙe#e keâe mebosMe / Message from Chairman 8 ØeyebOe efveosMekeâ SJeb cegKÙe keâeÙe&heeuekeâ DeefOekeâejer keâe mebosMe Message of Managing Director & CEO 9 keâeÙe&heeuekeâ efveosMekeâeW keâer yeele 10-12 ÙetefveÙeve yewbkeâ Dee@Heâ Fbef[Ùee kesâ efveosMekeâ / Directors of Union Bank of India 13 ÙetefveÙeve Oeeje SJeb ÙetefveÙeve me=peve keâe mebheeokeâerÙe meueenkeâej yees[& Editorial Advisors' Board of Union Dhara & Union Srijan 14 mebheeokeâerÙe / Editorial 15 je°^efhelee Deewj ÙetefveÙeve yewbkeâ 16 ieewjJeMeeueer Deleerle mes..