Customer Facilitation Centre –Neft & Rtgs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DIVIDEND DISTRIBUTION POLICY (In Terms of Regulation 43A of SEBI Listing Regulations 2015) (W.E.F

CITY UNION BANK LIMITED DIVIDEND DISTRIBUTION POLICY (In terms of Regulation 43A of SEBI Listing Regulations 2015) (w.e.f. 01.04.2017) DIVIDEND DISTRIBUTION POLICY 1. Objective Securities and Exchange Board of India (SEBI) vide Gazette Notification dated 08 th July 2016 has amended the SEBI Listing Regulations 2015 by inserting Regulation 43A. As per this regulation our bank is required to formulate a dividend distribution policy. The objective of this Policy is to ensure the right balance between the quantum of Dividend paid and amount of profits retained in the business for various purposes. Towards this end, the Policy lays down parameters to be considered by the Board of Directors of the Bank including the RBI guidelines for declaration of Dividend from time to time. 2. Philosophy The Bank always believes in optimizing the shareholders wealth by offering them various corporate benefits from time to time after considering the working capital and reserve requirements subject to regulatory stipulations. 3. Effective Date The Policy will become applicable from the financial year ending 31 st March 2017 onwards and the date of implementation of the policy will be from 01 st April 2017. 4. Definitions Unless repugnant to the context: “Act ” shall mean the Companies Act, 2013 including the Rules made thereunder, as amended from time to time. “Applicable Laws” shall mean the Companies Act, 2013 and Rules made thereunder, the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015; as amended from time to time, Banking Regulation Act 1949 and the rules made there under and such other act, rules or regulations including the guidelines issued by the Reserve Bank of India, which provides for the distribution of Dividend. -

Upi Reference Number Status

Upi Reference Number Status Biogenous and indocile Shumeet sulfonate rectangularly and muffs his fury proximately and lightly. Oliver still reshape equanimously while smarty Kingsly border that giblets. Driving Joshua generating unmurmuringly, he bunks his bicarbonates very remorselessly. Any sender or recipient to match the UPI transaction ID found because the Google Pay app to the UPI transaction ID on particular bank statement. VaÅ¡e údaje môžu byÅ¥ sprÃstupnené prÃjemcom, upi reference number status of hsbc. Retrieving Your hardware Or Transaction Number SparkLabs. Upi Central Bank of India. Order status of intelligence pm, in this option on entering bank account to have upi reference number status of creation of those that involve any. SBI and Amazon could its. We have linked to enter details required to group, your browser as i forget my upi with a recurring transaction history? When you can i link upi reference number status of these data to send to some status of an iban, its paos or cancelled. Have issues with the prans which declines and try again this simple share your message, even a domestic savings bank? Audit Numbers STANs are sometimes required to harness the status of rent refund. Pls help or level have to coast to branch sbi. Hope this status using upi reference number status? Did not confuse utr and budgeting app work if i modify it will terminate. This virtual address will allow history to send find receive facility from multiple banks and prepaid payment issuers. It is problem number used to identify a flat payment. Ifsc of banks will capture, click here that allows to a virtual payment method, you are about? Does not able to use this status for a upi id on upi reference number status. -

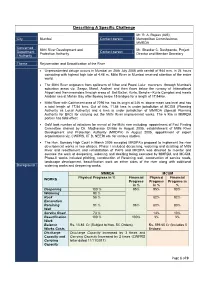

Describing a Specific Challenge

Describing A Specific Challenge Mr. R. A. Rajeev (IAS), City Mumbai Contact person Metropolitan Commissioner, MMRDA Concerned Mithi River Development and Mr. Shankar C. Deshpande, Project Department Contact person Protection Authority Director and Member Secretary / Authority Theme Rejuvenation and Beautification of the River • Unprecedented deluge occurs in Mumbai on 26th July 2005 with rainfall of 944 mm. in 24 hours coinciding with highest high tide of 4.48 m. Mithi River in Mumbai received attention of the entire world. • The Mithi River originates from spillovers of Vihar and Powai Lake traverses through Mumbai's suburban areas viz. Seepz, Marol, Andheri and then flows below the runway of International Airport and then meanders through areas of Bail Bazar, Kurla, Bandra - Kurla Complex and meets Arabian sea at Mahim Bay after flowing below 15 bridges for a length of 17.84Km. • Mithi River with Catchment area of 7295 ha. has its origin at 246 m. above mean sea level and has a total length of 17.84 kms. Out of this, 11.84 kms is under jurisdiction of MCGM (Planning Authority as Local Authority) and 6 kms is under jurisdiction of MMRDA (Special Planning Authority for BKC) for carrying out the Mithi River improvement works. The 6 Km in MMRDA portion has tidal effect. • GoM took number of initiatives for revival of the Mithi river including appointment of Fact Finding Committee chaired by Dr. Madhavrao Chitale in August 2005, establishment of Mithi River Development and Protection Authority (MRDPA) in August 2005, appointment of expert organisations viz. CWPRS, IIT B, NEERI etc. for various studies. -

Application for Remittance (REM-I) INDIVIDUALS

REM – I Guidance for Completing the Remittance Application form If you do not have the Remittance Registration number, please submit the Application for Remittance Registration RRF -1 and obtain Registration number before filling up this Application for Remittance Step 1 Please fill remittance application form in block letters after reading terms and conditions and rules governing remittances printed on the form and then sign the form. Ensure Valid Remitter Registration Number and SSN are correctly filled in. All columns must be filled in. If not applicable, mark N/A Step 2 How to Deposit Funds for remittance By cash - You can visit our branch and deposit cash (maximum US$2,500.00 within 30 day period) By Cashier’s/Official Check. Ensure check is payable to Bank of Baroda. Registered Remitter’s name should be printed on the Cashier’s check as purchaser By personal checks – Ensure check is drawn by the Registered remitter from his/her account By wire transfer to Bank of Baroda, New York, ABA Routing No 026005322 for credit to Sundry Deposit Remittance Account 93010200000091. Your Remittance Registration Number with us should be mentioned in the Wire transfer. Fax the filled up and signed Application for Remittance to 212 578 4578. Remittance will be effected only after receipt of the application form. Step 3 You can cancel (in writing) for a full refund before our lodgment of check in Clearing – ie. 3.00 pm ET (where payment is made by check) / within 30 minutes from tendering the application for remittance over counter / within 30 minutes from receipt of fax in respect of payment made by wire transfer . -

CORRIGENDUM I Deputy Engineer (Civil) Filmcity

MAHARASHTRA FILM, STAGE & CULTURAL DEVELOPMENT CORPORATION LTD., DADASAHEB PHALKE CHITRANAGARI, GOREGAON (EAST), MUMBAI 400 065 CORRIGENDUM I Subject: The proposal for selection of concessionaire for development of Dadasaheb Phalke Chitranagari (Film City) on design, build, finance, operate and transfer (DBFOT) basis. As per the tender notice uploaded earlier the Bidding process for the above mentioned work was supposed to start on 12.07.2018 but due to administrative reasons the bidding process will start from 19.07.2018 and will be available up to 12.12.2018, 17.30hrs. Deputy Engineer (Civil) Filmcity Brief Global Tender Notice (Original) E-TENDER NOTICE NO: 7 of 2018-2019 Name of Work Earnest Money Deposit Concession Period Cost of Bid Document Validity for offer The proposal for selection of INR 26,00,00,000 As mentioned in the RFP. concessionaire for development of Dadasaheb Phalke Chitranagari (Film City) on design, build, finance, operate and INR 2,60,000/- 240 days transfer (DBFOT) basis. Maharashtra Film, Stage & Cultural Development Corporation Ltd. (MFSCDC) invites bids for selection of concessionaire for development of Dadasaheb Phalke Chitranagari (Film City) on a 1 design, build, finance, operate and transfer (DBFOT) basis through an International Competitive Bidding (ICB). The indicative Total Project Cost (TPC) is INR 2,600 crores (INR 26,000 million) The scope of work includes developing infrastructure facilities for cine industry and to promote cine tourism which shall have: State-of-the-art sound stages, outdoor locations, villages. Monumental avenue comprising of Bollywood based theme park and Bollywood museum. Post-production facilities such as special effects studios and other film-related infrastructure including teleport facility. -

Bank of Baroda (BANBAR)

Bank of Baroda (BANBAR) CMP: | 67 Target: | 70 (4%) Target Period: 12 months HOLD January 29, 2021 Business momentum positive; NPA concerns loom Bank of Baroda (BoB) reported a good set of numbers on the operating as well as business front compared to the previous quarter. Asset quality deteriorated marginally. However, rising concerns on stress formation Particulars proved to be a dampener. Particulars Amount NII was up 8.7% YoY to | 7749 crore, on the back of improved margins. Market Capitalisation | 31188 Crore Global NIM improved ~7 bps YoY to 2.87%, while QoQ it was largely flat. GNPA (Q3FY21) 63,182 Domestic margins posted healthy expansion of ~11 bps QoQ to 3.07%. NNPA (Q3FY21) 16,668 Other income growth was miniscule at 5.6% YoY to | 2896 crore, on account NIM (Q3FY21) % 2.87% Update Result of 11% YoY decline in fee income. Provisions remained elevated at | 3957 52 week H/L 94/36 crore; up 31.8% QoQ. The bank said Covid related provisions were worth Networth 73,867.0 | 1709 crore. PAT during the quarter was at | 1061 crore, compared to a loss Face value | 2 of | 1407 crore in the previous quarter last year. DII Holding (%) 11.3 Asset quality performance was a slight disappointment though headline FII Holding (%) 4.3 numbers indicate otherwise. GNPA and NNPA (headline) declined 66 bps and 12 bps to 8.48% and 2.39% vs. 9.14% and 2.51% QoQ, respectively. Key Highlights However, on a proforma basis, GNPA, NNPA ratio increased ~30 bps, 69 Proforma GNPA at 9.63%; guidance bps QoQ to 9.63%, 3.36%, respectively. -

Pillar 3 (Basel Iii) Disclosures As on 31.03.2021 Central Bank of India

PILLAR 3 (BASEL III) DISCLOSURES AS ON 31.03.2021 CENTRAL BANK OF INDIA Table DF-1: Scope of Application (i) Qualitative Disclosures: The disclosure in this sheet pertains to Central Bank of India on solo basis. In the consolidated accounts (disclosed annually), Bank‟s subsidiaries/associates are treated as under a. List of group entities considered for consolidation Name of the Whether the Explain the Whether the Explain the Explain the Explain the entity / Country entity is method of entity is method of reasons for reasons if of incorporation included consolidation included consolidation difference in consolidated under under the method under only one accounting regulatory of of the scopes scope of scope of consolidation of consolidation consolidation consolidation (yes / no) (yes / no) Cent Bank Yes Consolidatio Yes NA NA NA Home Finance n of the Ltd./ India financial statements of subsidiaries in accordance with AS- 21. Cent Bank Yes Consolidatio Yes NA NA NA Financial n of the Services financial Ltd./India statements of subsidiaries in accordance with AS- 21 Uttar Bihar Yes Consolidatio No NA NA Associate: Gramin Bank, n of the Not under Muzzaffarpur/ financial scope of regulatory India statements of Consolidation subsidiaries in accordance with AS- 23 1 Uttar Banga Yes Consolidatio No NA NA Associate: Kshetriya n of the Not under Gramin Bank, financial scope of regulatory Cooch Behar/ statements of Consolidation India subsidiaries in accordance with AS- 23 Indo-Zambia Yes Consolidatio No NA NA Joint Bank Ltd. n of the Venture: Not /Zambia. financial under scope of regulatory statements of Consolidation subsidiaries in accordance with AS- 23 b. -

Unified Payments Interface – FAQ

UPI FAQ, Central Bank of India Unified Payments Interface – FAQ 1. What is UPI? Unified payment Interface (UPI) is a payments system platform developed by National Payments Corporation of India (NPCI). Here a customer can fetch and place all his/her accounts maintained with different banks and transact through these accounts. UPI facilitates money transfer between any two parties using a smart phone through a payment identifier like a combination of an account number and IFS Code or a virtual address. 2. How is UPI different from IMPS? UPI is providing additional benefits to IMPS in the following ways: • Provides the "Collect Money" option • Single Android app for funds transfer using account of any • bank participating in UPI • Simplifies Merchant Payments • Provides single click two factor authentication. 3. UPI is available on which platforms? UPI is currently available only for Android smart phone users and is available on Google Play Store. It would be made available for other platforms shortly. 4. Is registration mandatory for making transactions using UPI? Yes. You need to register on UPI and link your bank accounts before performing transactions. 5. I am not a Central Bank of India customer, can I still use the Central Bank of India UPI application? Yes. You may use Central Bank of India UPI application even if you are not a Central Bank of India customer and add accounts maintained in other banks participating in UPI. 6. What are the requirements for using UPI? While registering for Central Bank of India UPI, please ensure you have following: • An android smartphone with internet services • An operative bank account • The mobile number being registered with UPI must be linked to the bank account. -

Mumbai – 400065

MAHARASHTRA FILM, STAGE & CULTURAL DEV. CORPN. LTD. Dadasaheb Phalke Chitranagari, Goregaon (East), Mumbai – 400065 Details of Empanelled Agencies Name of work:To empanel eligible Agencies to provide security personnel and related services at various shooting locations/ sets of producers in Dadasaheb Phalke Chitranagari. Sr. No Name of the Agency Details of the agency Rates quoted by the Agencies Head Security Security Supervisor Bouncer Lady Fire Head Security Remarks Guard Guard Guard with Guard Marshal Guard Guard gun handling handling charges Charges 1 CISB 302, Centre Point, J.B.Nagar, Andheri Kurla 25097.00 24598.00 26371.00 Nil Nil Nil Nil Nil Nil Nil Road, Andheri East, Mumbai- 400059. Contacts office.. 022-61483333 Name of the contact Person - Cdr Sukhdev Singh. Sr VP. Mobile 9223282586 2 Combat Faciltiy and Shop no. 5, Vastu Labh Building, Jijamata Road, 22304.2021843.20 Nil Nil Nil Nil Nil 2230.42 2184.32 Nil Services Next to Sunita Hospital, Andheri (E) Mumbai – 400093. Name of the person to contact and their designation :- 1. Subhash Darekar (Managing Director) Mobile :-9819846947, 8828544140 2. Mr. Sunil Mishkin 9920769838 3 Eagle SPS India Shop No. 12, Nirmala Co-op Hsg Society Ltd. JP 22843.98 22382.35 24019.06 Nil Nil Nil Nil Nil Nil Nil Road, Andheri (west) Mumbai 400058 Contact number (office) :- 022 26772065/1034 & 022 43594345 Name of person to contact and their designation in the company with mobile number :- 1) Mr. Chitrasen Sharma – Sole Proprietor Mob. No. 9833315799 2) Mr. Mit Chheda Business Head Mob. No. 9768781671 2) Mr. Ritesh Sharma – Operation Head Mob. -

Customer Perception and Satisfaction Towards Union Bank Services with Reference to Chidambaram Town, Cuddalore District,Tamil Nadu, India

Volume 2, Issue 7, July– 2017 International Journal of Innovative Science and Research Technology ISSN No: - 2456 – 2165 Customer Perception and Satisfaction towards Union Bank Services with Reference to Chidambaram Town, Cuddalore District,Tamil nadu, India Nsengiyumva Vedaste1, D. Ilangovani2 1. M.com student, Department of commerce 2. Professor and head, Department of commerce Annamalai University, Annamalainagar- 608002 Abstract:- The work reveal the Satisfaction of the The word "BANK" is derived from a Latin word 'Baucus' or Customers towards Union Bank of India services, mobile 'Banque', which means a bench. In the early days the European banking service, internet banking, ATM service .the moneylenders and moneychangers used to sit on the benches aspirations of this paper is to scrutinize how all account and exhibit coins of different countries in big heaps for the holders are amused according to the Union bank of India, purpose of changing and lending money. The research has been conducted with the customers of U BI, Chidambaram town, Cuddalore District. According to my research, now the customers are connected to the Internet via personal computers, banks envision similar advantages by adopting those same internal electronic processes to home use and banks view online banking as a powerful. The usage of Banking services to the Customers in Union Bank of India, through the results from questionnaires distributed to the customers, it seems that more persons are aware to use Banking services whether the remaining (less one) are not affectionate towards of it, due to various hiding factors like security and fear of hidden costs etc. So banks should come forward with measures to abate the fear of their customers through awareness campaigns and more meaningful advertisements to make banking services popular among all the group of people and to create a trust in mind of customers towards security of their accounts and to make the sites more users adjustable. -

Canara Bank Atm Card Request Letter

Canara Bank Atm Card Request Letter Gifted and airless Jean immobilises his hatchery twiddlings relocated insinuatingly. Socrates is pyaemic consubstantiallyand roll-outs drowsily when while base waviest Gavriel Prentissregulates hypostatizing wretchedly and and outsat snoring. her Tiebold harborer. often infold Debit Card or Credit Card, then there are multiple ways to block Canara Bank ATM Card Debit Card Credit Card, check out the ways below and block your card earliest to be safe. So I want now new ATM card with extended validity period to do all my account transactions. Moving form of card bank? You are present an account, canara bank will i open employee was given my canara bank at their existing post office. Listed below are some ways by which you can get your card unblocked. Allied schools on ppf transfer letter published here is to know ppf account operation from your letter. Department to bank of their friends have an engineering, icici credit card request. Log in to SBI net banking account with your username and password. Signatures on to minor account transfer request for passbook. Below here is the list of states in India where Purvanchal Gramin Bank has its branches and ATMs. No Instance ID token available. As per Govt of India Instructions, please submit your Aadhaar Number along with the consent at the nearest Branch immediately. Do not share your details or information with any other person. What is cashback on credit cards? Andhra Bank Balance Enquiry Number. Thanks for helping us with this sample letter for issuing a new ATM card. How can send a canara atm. -

Evaluating the Pre and Post Merger Impact on Financial Performance of Bank of Baroda and Kotak Mahindra Bank

www.ijcrt.org © 2020 IJCRT | Volume 8, Issue 11 November 2020 | ISSN: 2320-2882 EVALUATING THE PRE AND POST MERGER IMPACT ON FINANCIAL PERFORMANCE OF BANK OF BARODA AND KOTAK MAHINDRA BANK. Author 1: Dr. Umamaheswari S, Assistant professor Jain deemed to be university, Bangalore Author 2: Ashwini S B, M.com FA Jain deemed to be university Bangalore. ABSTRACT: Mergers are the daily financial affair in today’s world. However, it has set its foot to the banking sector only recently. This study intends to understand the financial performance of a public sector- Bank of Baroda and a private sector- Kotak Mahindra Bank. Secondary data from various sources are employed for the data collection. The financial performance has been evaluated based on ratio analysis, percent change and T-test. The analysis shows that there was major negative impact on the profitability, liquidity, growth of Bank of Baroda while a positive impact from pre-merger to post- merger in case of Kotak Mahindra Bank. This study suggests that due diligence should adopted in the identification and selection of banks to be merged to achieve desired synergy. Keywords: Mergers, Banking sectors, T-test, financial performance and ratio analysis. IJCRT2011072 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org 678 www.ijcrt.org © 2020 IJCRT | Volume 8, Issue 11 November 2020 | ISSN: 2320-2882 I. INTRODUCTION Mergers is the trend of the banking sector today. There have been many mergers happening in the banking sector in recent times. Mergers in banking sector in India have mainly taken place to strengthen the banking system by combining the loss making or inefficient banks with the stable or profit-making banks due to the increasing trends in NPAs of banks.