Securities Suits Ease Back to Normal Following a Frantic Two Years an Advisen Quarterly Report – Q1 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lesson Guide Princess Bodice Draping: Beginner Module 1 – Prepare the Dress Form

Lesson Guide Princess Bodice Draping: Beginner Module 1 – Prepare the Dress Form Step 1 Apply style tape to your dress form to establish the bust level. Tape from the left apex to the side seam on the right side of the dress form. 1 Module 1 – Prepare the Dress Form Step 2 Place style tape along the front princess line from shoulder line to waistline. 2 Module 1 – Prepare the Dress Form Step 3A On the back, measure the neck to the waist and divide that by 4. The top fourth is the shoulder blade level. 3 Module 1 – Prepare the Dress Form Step 3B Style tape the shoulder blade level from center back to the armhole ridge. Be sure that your guidelines lines are parallel to the floor. 4 Module 1 – Prepare the Dress Form Step 4 Place style tape along the back princess line from shoulder to waist. 5 Lesson Guide Princess Bodice Draping: Beginner Module 2 – Extract Measurements Step 1 To find the width of your center front block, measure the widest part of the cross chest, from princess line to centerfront and add 4”. Record that measurement. 6 Module 2 – Extract Measurements Step 2 For your side front block, measure the widest part from apex to side seam and add 4”. 7 Module 2 – Extract Measurements Step 3 For the length of both blocks, measure from the neckband to the middle of the waist tape and add 4”. 8 Module 2 – Extract Measurements Step 4 On the back, measure at the widest part of the center back to princess style line and add 4”. -

Knitting Teacher | Designer | Author Construction Basics: When It Comes to Fit, Every Sweater Construction Has Different Needs

knitting teacher | designer | author Construction Basics: When it comes to fit, every sweater construction has different needs. When getting the fit we want we must consider not only required ease for that construction, but also how each sweater works with bust, armhole and shoulder. The armhole fit can be the most confusing when looking at sweaters other than the set-in sleeve. So how do the chest, armholes and shoulder size connect? If you have a large bust and narrow shoulders, you’ll need to consider how you narrow your sweater as you move to your shoulders, in your armhole shaping of course! Let’s take a look at your six basic sweater shapes: 1) Drop Shoulder: Cabled Coat by Patty Lyons Armhole: General Properties: - Top of sleeve must be very wide in a traditional drop - Easiest to knit, unshaped. shoulder for it to fit you right. - Perfect backdrop for complex stitch patterns, cables, and - In a traditional drop shoulder, the armhole depth is half of color work. the upper arm; the arm folds in half and seams into the side - No armhole shaping. of the sweater. This will create an armhole depth at least 1” – 2” deeper than a set-in sleeve. Fit considerations: - In the more modern drop shoulder style, the sleeve is - Size will be based on your full chest measurement. narrower. To fit the body without bunching under the arm, - Must be knit with a lot of ease, usually 6” – 8”. This is the body must be wide enough for the sleeve to hit farther because part of the body “drops down” to become the top down on the upper arm. -

Undergarments : Extension Circular 4-12-2

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln Nebraska 4-H Clubs: Historical Materials and Publications 4-H Youth Development 1951 Undergarments : Extension Circular 4-12-2 Allegra Wilkens Follow this and additional works at: https://digitalcommons.unl.edu/a4hhistory Part of the Service Learning Commons Wilkens, Allegra, "Undergarments : Extension Circular 4-12-2" (1951). Nebraska 4-H Clubs: Historical Materials and Publications. 124. https://digitalcommons.unl.edu/a4hhistory/124 This Article is brought to you for free and open access by the 4-H Youth Development at DigitalCommons@University of Nebraska - Lincoln. It has been accepted for inclusion in Nebraska 4-H Clubs: Historical Materials and Publications by an authorized administrator of DigitalCommons@University of Nebraska - Lincoln. Jan. 1951 E.G. 4-12-2 o PREPARED FOR 4-H CLOTHrNG ClUB GIRLS EXTENSION SERVICE UNIVERSITY OF NEBRASKA COLLEGE OF AGRICULTURE AND U. S. DEPARTMENT OF AGRICULTURE COOPERATING A W. V. LAMBERT, DIRECTOR C i ( Undergarments for the Well Dressed 4-H Girl Allegra Wilkens The choosing or designing of the undergarments that will make a suitable foundation for her costume is a challenge to any girl's good taste. She may have attractive under- wear if she is wise in the selection of materials and careful in making it or in choosing ready-made garments. It is not the amount of money that one spends so much as it is good judgment in the choice of styles, materials and trimmings. No matter how beautiful or appropriate a girl's outer garments may be, she is not well dressed unless she has used good judgment in making or selecting her under - wear. -

Darts - a Reverse Approach By: Linda74sews

Darts - A Reverse Approach By: Linda74Sews http://www.burdastyle.com/techniques/darts-a-reverse-approach The subject is darts – one of the mostly commonly performed and easily done techniques for any experienced garment sewer. As we all know, darts play an important role in creating curves and shaping a garments silhouette. And, when executed well help create a professional look in clothing. In contrast, poorly executed darts can make a garment look “homemade.” So, what’s the big deal? Yes, for most sewers we don’t give them much thought. Within a matter of minutes they’re done. But, as I have learned teaching many new sewists, this simple technique can be a daunting one. Sewing darts for the first time can consume an inordinate amount of time to accomplish when conventional methods are employed. But, it doesn’t have to be that way. I have painfully watched new sewers struggle sewing darts for the first time. Where they (and let’s face it a lot of us, too) go wrong is sewing beyond the dart’s end point or short ending the points that produce the dreaded pucker. Or, simply not being able to follow the dart leg properly. A task most sewists can perform with relative ease and precision can take 3-4 times as long for the beginner. This simple sewing basic should be, for all practical purposes, a cinch to master. The objective of sewing the perfect dart is pretty straightforward. Follow a properly marked, and pinned, dart leg to a precise end point without overshooting, backstitching or short ending it. -

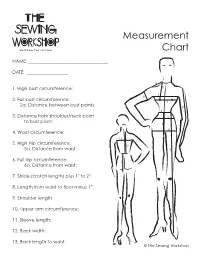

Measurement Chart

Measurement Chart NAME: ___________________________________ DATE: __________________ 1. High bust circumference: 2. Full bust circumference: 2a. Distance between bust points: 3. Distance from shoulder/neck point to bust point: 4. Waist circumference: 5. High Hip circumference: 5a. Distance from waist: 6. Full hip circumference: 6a. Distance from waist: 7. Stride (crotch length) plus 1" to 2": 8. Length from waist to floor minus 1": 9. Shoulder length: 10. Upper arm circumference: 11. Sleeve length: 12. Back width: 13. Back length to waist: © The Sewing Workshop Fitting the Bust: Ease Chart Garment Minimum Bust Ease Blouse, Dress 2½" to 3" Unlined jacket 3" to 4" Lined jacket 3½" to 4½" Coat 4" to 5" Fitting the Bust: Ease Chart © The Sewing Workshop Fitting the Back: Ease Chart Garment Minimum Back Ease Blouse, Dress ½" to 1" Jacket 1" Coat 1" to 2" Fitting the Back: Ease Chart © The Sewing Workshop Fitting Sleeves: Ease Chart Garment Minimum Upper Arm Ease Blouse 1" to 1½" Dress 1½" to 2" Unlined jacket 3" to 4" Lined jacket 3" to 4½" Coat 4" to 5½" Fitting Sleeves: Ease Chart © The Sewing Workshop Fitting Pants: Ease Chart Minimum Pants Ease Waist 1" to 2" Hip 2" - Fitted Pants 4" - Elastic Waist Pants Crotch Length 1" - If hips are less than 37" 1½" - If hips are 37"-40" 2" - If hips are 40" or more Fitting Pants: Ease Chart © The Sewing Workshop How to Measure For Successful Fitting by Linda Lee Tips! Tips! Tips! Gather Your Tools Know Your Notions Two very specific tools are recommended: Elastic - Use 1”-wide Stretchrite woven polyester flat non-roll elastic. -

Methods to Master

Methods to Master: Five Patternmaking Skills Learn five key skills for { by Sarah Veblen } adjusting and correcting your garment patterns. Employ these techniques to streamline the fitting process and create more flattering, comfortable garments. 38 sew NEWS AUGUST/SEPTEMBER 2014 Pattern Precision In garment sewing, the pattern plays A transparent 2”x18” plastic ruler 1 a key role: It allows you to repeatedly marked with an ⁄8” grid allows you to 1 achieve consistent and predictable re- see the pattern markings through the 1 sults. A well-executed pattern makes it ruler as you work. The ⁄8” interval easier to sew the garment because all of works well for patternmaking because the puzzle pieces fit together perfectly. garment seam allowances are usually 1 3 1 5 In addition, subtle pattern changes, ⁄4”, ⁄8”, ⁄2” or ⁄8”. such as slightly adjusting the hip curve A transparent curved fashion ruler, to fit you more precisely, make the sometimes called a Styling Design finished garment look more flattering. Ruler, aids in measuring and Incorporating just a few skills into drawing curves. your patternmaking arsenal gives you more control. For example, if you #1: Focusing on Seamlines notice that two side seams are not the When making pattern alterations, 2 same length, rather than wondering concentrate on the seamlines (stitch- what you did incorrectly, you’ll know ing lines) and ignore the cutting lines. how to check—and more importantly, Many patterns, especially multi-sized correct—the pattern. Having this patterns, don’t have any seamlines knowledge puts you in charge of the marked on the pattern. -

A Compendium of Seams by Austin Coody What Are Seams?

A Compendium of Seams By Austin Coody What are seams? • A seam is the join between two or more layers of fabric, leather, or other sheeted material, held together with stitches. The Plain Seam There are The Flat/Abutted Seam many types of seam, such as… The Lapped Seam The French Seam The Plain Seam • A plain seam is made by attaching your material together, usually right sides together. This seam does not take care of your hems, which will need to be finished separately. The Flat/ Abutted Seam • A flat seam is sewn by attaching the layers of fabric together, then rolling and tucking the hems and topstitching them down. The Lapped Seam • A lapped seam is achieved by folding the right side to the wrong side of the fabric and folding the seam allowance underneath to prevent raveling. The French Seam A French seam is made by attaching the layers of fabric, right sides together, and then folding them in an S-shape so that both right sides face outward, and the seam allowances are beneath the fabric layers. Center Back/ Front Seam Inseam/ Outseam There are also many Sideseam positions for seams, such Shoulder Seam as… Armscye Seam Princess Seam/ Darting /Tucking The Center Front and Back Seams • Goes down the front of a • Goes down the back of a garment, in the center. garment, in the center. The Inseam and Outseam • The inseam refers to the vertical line that travels down the interior of the pant. The inseam goes up to the crotch, on the inside of the leg. -

Raleigh Haberdasher

-RALEIGH HABERDASHER- Arrow "Dart" White Shirt of fine broodcloth with America's most popular collar the regular point non-wilt. San- forized for less than 1 % shrink- age and mitoga cut for comfort. Sizes 14 to 17, sleeves 30 to 36.-..3.65 Top to bottom: White All-Silk Muffler with a jacquard design. Idea! for dress or daytime wear. Fringed edge, generously sized_7.50 Hand-Printed Silk Foulard Muf- fler, hand-blocked in Italy. Smart and luxurious in a rich paisley pattern on red grounds, $10 Initial Buckle and Belt Set by Hickok. Belt is stitchless East India brown buffalo calf. Buckle is rolled gold with ribbon initial. Both in an attractive plastic cigarette gift box. Sizes 32 to 44 -6.70* ’Price* Include Federal Tax. Top to bottom: Genuine Pigskin Wallet by Swank. Removable billfold, com- partments with lots of room for Above: business cords and identifico- tiortr Hazel shade. "Strod-O-Gab" Leisure Shirt by -$9* Stradivari. Fine washable rayon Bobardine tailored in the custom man- Easy Selector Key Case in genu- ner. Rich tones of wine, grey, tan, ine pigskin. Inner pocket for sandune, green and blue. Sizes small driver's license. Styled by Swank to large. Ours Exclusively-8.95 with zip closure. Hazel shade, 4.20* ’Prices Include Pedersl Til. If the old problem of what to get him Christmas has you look at these from Colorful Royon Pajamas in nov- perplexed just suggestions elty patterns. Coat style with his favorite men's store. They're all tops for quality cuffed trousers and drawstring waistband. -

A Quantification of the Preferred Ease Allowance for the Men's Formal

Kim et al. Fash Text (2019) 6:5 https://doi.org/10.1186/s40691-018-0165-x RESEARCH Open Access A quantifcation of the preferred ease allowance for the men’s formal jacket patterns In Hwa Kim1* , Yun Ja Nam2 and Hyunsook Han3 *Correspondence: inhwa‑[email protected] Abstract 1 Visiting Professor, The purpose of this study is to provide a quantitative reference required for the deci- Department of Fashion Design, The University sion of ease allowance to draft men’s formal jacket patterns by quantifying the cus- of Suwon, Suwon, Republic tomers’ actual tendency regarding the preferred ft. The ease allowances of 62 male of Korea customers were investigated through the sensory evaluations, once in the initial ftting Full list of author information is available at the end of the jackets which were designed using the graded sizing chart of ready-to-wear, and once article again in the custom-made jacket customers ordered. The 5-point Likert scale was used for the sensory evaluation and the preferred ease allowance was defned as the ease allowance of respondents who responded “3_Suitable”. The regression equations were developed to estimate preferred ease allowance by inputting body size measurements which showed the highest correlation with the preferred ease allowances. The esti- mated ease allowance ranges by inputting the 5th to 95th percentile of the body sizes were 5.17–8.25 cm for the chest circumference, 6.90–2.09 cm for chest–waist circumfer- ence on the jacket, 3.82 to 1.34 cm for the chest–hip circumference on the jacket, 1.58–5.86 cm for the− upper arm circumference, 1.80 to 1.95 cm for the bi-shoulder length, and 0.406–0.425 for the ratio of jacket length− to stature. -

Set-In Sleeves- Tips Beyond the Guidesheet

Set-In Sleeves- Tips Beyond the Guidesheet Prepared by Beatrice Kalka, Ed.D. Virginia Cooperative Extension Service Extension Specialist Virginia Tech and Virginia State Clothing and Textiles Virginia's Land-grant Universities Publication 346-122 March 1985 Sleeves, and the way they are shaped Determine the pattern ease allowance and set in, are one of the focal points in the by aligning and pinning the shoulder changes of fashion. They are in a strategic seam of the front and back bodice pattern location-near the face-and thus are a pieces. Placed on edge, walk a tape noticed feature of the blouses, dresses, measure or a flexible ruler around the shirts, and jackets that you sew. A well armhole seam line from underarm seam to made sleeve is a credit to your sewing underarm seam (Figure A). Make a note of ability. Since the most common sleeve th is measurement. problems exist with set-in sleeves, the tips pertain to this style. The tips provide information that may not be given in the pattern guidesheet. Always depend on the guidesheet for basic instructions and information no matter what your sewing skill level is. Sleeve-Cap Ease Puckers and unsightly tucks or ripples in the sleeve resu It when the fashion fabric is not supple enough to handle the allowed ease, or the ease allowance has not been properly controlled by the FRONT seamstress. The recommended amount of sleeve-cap ease is 1 %" ease for supple fabrics and 1" ease for knits, firm wovens, and real or imitation leather. You should check the sleeve-cap ease on the paper pattern before you cut the fashion fabric. -

Singer Main Site Index

Home of the Sewalot Site By Alex I Askaroff For antique and vintage sewing machines Sewing Machine Fault Finder Sewing Machine Tension Problems Isaac Merritt Singer Main Site Index Alex has spent a lifetime in the sewing industry and is considered one of the foremost experts of pioneering machines and their inventors. He has written extensively for trade magazines, radio, television, books and publications worldwide. Alex I Askaroff style="font-family:Garamond;mso-bidi-font-family:Arial; " lang="en-gb"Isaac Singer A brief history of a giant By Alex Askaroff style="font-family: Garamond; mso-bidi-font-family: Arial" Isaac Merritt Singer 27th October 1811 - 23rd July 1875 Touched by Fire What a man! When I first started, as a child, to hear stories about Isaac Merritt Singer I was enthralled. He had lived the American dream. A true rags to riches story. They say a fewlang="en-gb" men are touched by fire in their lives, Isaac was one of these men. Other books will blind you with facts, figures and endless dates. Let me tell you about the man who became a household name and his invention that changed the world. lang="en-gb"Over a lifetime I have collected every snippet on the great man and put it all here. I hope that many others will follow in my footsteps and take his story further. Please forgive any mistakes. Isaac Merritt Singer was the youngest of eight children. His father, Adam, was possibly of German-Jewish origin as there was a Jewish family in his hometown of Frankfurt, Germany, known as the Rei- singers. -

Ease” and Finished Garment Measures, Helps Perfect Your Fit

How understanding “ease” and finished garment measures, helps perfect your fit Making clothes fit well can be tricky if you’re not one of 20 % of the population that fits a pattern straight out of the packet! It’s a hot topic in both the home sewing world and in the fashion industry. During my MA research I discovered that: “Customers return an estimated 40% of what they buy online, mostly because of sizing issues. Clearly, modern fashion has a fit problem.” Dockterman, E. (2016) Many believe that poor fit is a modern problem, a symptom of fast fashion, yet here’s a quote from a 1961 survey about garment fit. “47.5 per cent of respondents were searching for a better fit with home sewing” So, in 2017 how can the DIY dressmaker expect to achieve a good fit? There’s so many fitting books and tutorials online, that it’s easy to become overwhelmed and confused. I like to approach choosing pattern sizes in 2 stages. Step 1: Deciding what size to use as a starting point. I do this by taking body measurements and comparing them to the body measurement chart on the pattern. So many of my students, assume that they are the same in pattern sizes as they are in high street sizing, and this is just not the case. I do this each and every time I use a new book, or a new pattern company. Just because I may be a 12 in a McCalls pattern doesn’t mean I’m a 12 in By Hand London, or a Collette pattern! Step 2: Now I’ve worked out my rough pattern size, I'll use it the finished garment measures to really fine tune the fit.