0.7745 Cash and 0.4516 DEXUS Securities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

2021 Annual Report Dexus Releases Its 2021 Annual Report, Which Will Be Mailed to Security Holders Who Have Elected to Receive a Hard Copy in Mid-September 2021

Dexus (ASX: DXS) ASX release 17 August 2021 2021 Annual Report Dexus releases its 2021 Annual Report, which will be mailed to Security holders who have elected to receive a hard copy in mid-September 2021. Authorised by the Board of Dexus Funds Management Limited For further information please contact: Investors Media Rowena Causley Louise Murray Senior Manager, Investor Relations Senior Manager, Corporate Communications +61 2 9017 1390 +61 2 9017 1446 +61 416 122 383 +61 403 260 754 [email protected] [email protected] About Dexus Dexus (ASX: DXS) is one of Australia’s leading fully integrated real estate groups, managing a high-quality Australian property portfolio valued at $42.5 billion. We believe that the strength and quality of our relationships will always be central to our success and are deeply committed to working with our customers to provide spaces that engage and inspire. We invest only in Australia, and directly own $17.5 billion of office, industrial and healthcare properties, and investments. We manage a further $25.0 billion of office, retail, industrial and healthcare properties for third party clients. The group’s $14.6 billion development pipeline provides the opportunity to grow both portfolios and enhance future returns. Sustainability is integrated across our business, and our sustainability approach is the lens we use to manage emerging ESG risks and opportunities for all our stakeholders. Dexus is a Top 50 entity by market capitalisation listed on the Australian Securities Exchange and is supported by more than 30,000 investors from 23 countries. With over 35 years of expertise in property investment, funds management, asset management and development, we have a proven track record in capital and risk management and delivering superior risk-adjusted returns for investors. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

2012 DEXUS ANNUAL Report

2012 DEXUS ANNUAL REPORT DEXUS DIVERSIFIED TRUST (ARSN 089 324 541) Letter frOM THE CHAir 1 FIVE YEAR FINANCIAL SUMMAry 3 BOArd OF DirectOrs 4 CORPORAte GOvernAnce stAteMent 6 FinAnciAL REPORT DIRECTORS’ REPORT 14 AUDITOr’S IndePendenCE DEClaRATIOn 38 CONSOLIDATED STATEMenT OF COMPREHensIVE InCOME 39 CONSOLIDATED STATEMenT OF FInanCIal POSITIOn 40 CONSOLIDATED STATEMenT OF CHanGes IN EQUITY 41 CONSOLIDATED STATEMenT OF CasH FlOWS 42 NOTes TO THE FInanCIal STATEMenTs 43 DIRECTORS’ DEClaRATIOn 89 IndePendenT AUDITOr’S RePORT 90 AdditiONAL InfORMATION 92 InvestOR InfORMAtiON 94 DirectOry 96 2012 Annual Reporting suite DEXUS Property Group (DXS) presents our 2012 annual reporting suite and supporting material for the year ending 30 June 2012: 1. The 2012 DEXUS Annual Review – an integrated report summarising our financial, operational and Corporate Responsibility and Sustainability (CR&S) performance. 2. This 2012 DEXUS Annual Report – DXS’s consolidated financial statements, Corporate Governance Statement and information about our Board of Directors. This document should be read in conjunction with the 2012 DEXUS Annual Review. 3. The 2012 DEXUS Combined Financial Statements – the Financial Statements of DEXUS Industrial Trust, DEXUS Office Trust and DEXUS Operations Trust. This document should be read in conjunction with the 2012 DEXUS Annual Report and Annual Review. It is available in hard copy on request by email at [email protected], phone on 1800 819 675 or online in our annual reporting suite at www.dexus.com/dxs/reports 4. The 2012 DEXUS Performance Pack – the data and information supporting the results outlined in the 2012 DEXUS Annual Review will be available in our online annual reporting suite from mid-October 2012. -

2019 Annual Report

Discover more Annual Report 2019 Join us as we discover Inside how Vicinity Centres creates market-leading 01 Highlights 42 Our Board 02 Our Value Chain 45 Our Executive Committee destinations. 04 Market-Leading Destinations 48 Tax Transparency 06 Chairman’s Review 52 Sustainability Assurance Destinations that 08 CEO and Managing Statement enhance communities Director’s Review 53 Financial Report 12 Our Operating and 54 Director’s Report and offer so much more Financial Review 58 Remuneration Report than an exceptional 29 Our Portfolio 80 Financial Statements 34 Integrated Energy Platform 122 Independent Auditor’s retail experience. 36 Our Communities Report 38 Our Data and Analytics 128 Summary of Securityholders 40 Our People 129 Corporate Directory About this report This annual report discloses Vicinity’s financial and non- environmentally responsible paper manufactured under This annual report is a summary of Vicinity Centres’ operations, financial performance for FY19 and has been prepared using IAO 14001 environmental standards. activities and financial position as at 30 June 2019. In this elements of the International Integrated Reporting Council The following symbols are used in this report to cross-refer report references to ‘Vicinity’, ‘Group’, ‘we’, ‘us’ and ‘our’ refer (IIRC) Integrated Reporting <IR> framework. More information, to more information on a topic: to Vicinity Centres unless otherwise stated. particularly latest company announcements and detailed sustainability reporting, can be found on Vicinity’s website. References in this report to a ‘year’ and ‘FY19’ refer to the References additional information within financial year ended 30 June 2019 unless otherwise stated. Vicinity is committed to reducing the environmental footprint this Annual Report All dollar figures are expressed in Australian dollars (AUD) associated with the production of the annual report and unless otherwise stated. -

Printmgr File

CBRE CLARION GLOBAL REAL ESTATE INCOME FUND Semi-Annual Report for the Six Months Ended June 30, 2019 CBRE Clarion Global Real Estate Income Fund (the “Trust”), acting in accordance with an exemptive order received from the Securities and Exchange Commission (“SEC”) and with approval of its Board of Trustees (the “Board”), has adopted a managed distribution policy (the “Policy”) with the purpose of distributing over the course of each year, through periodic distributions as nearly equal as practicable and any required special distributions, an amount closely approximating the total taxable income of the Trust during such year and all of the returns of capital paid by portfolio companies to the Trust during such year. In accordance with its Policy, the Trust distributes a fixed amount per common share, currently $0.05, each month to its common shareholders. This amount is subject to change from time to time in the discretion of the Board. Although the level of distributions is independent of fund performance, the Trust expects such distributions to correlate with its performance over time. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential increases or decreases in the final dividend periods for each year in light of the Trust’s performance for the entire calendar year and to enable the Trust to comply with the distribution requirements imposed by the Internal Revenue Code. Over time, the Trust expects that the distribution rate in relation to the Trust’s Net Asset Value (“NAV”) will approximately equal the Trust’s total return on NAV. -

Net Zero Momentum Tracker Property Sector (September 2019)

NET ZERO MOMENTUM TRACKER PROPERTY SECTOR SEPTEMBER 2019 WWW.NETZEROTRACKER.ORG SEPTEMBER 2019 1 WWW.NETZEROTRACKER.ORG The Property Sector report is the first in a series of Net Zero Momentum Tracker assessments that Australia’s focus on key sectors of the Australian economy. The Net Zero Momentum Tracker is an initiative that demonstrates progress towards net zero property sector greenhouse gas emissions in Australia. It brings together and evaluates climate action commitments made by Australian businesses, governments and is moving other organisations. Achieving net zero emissions prior to 2050 is a key element of the Paris Climate Agreement to limit global towards net temperature rise to well below 2 degrees Celsius above pre-industrial levels and to strive for 1.5 degrees1. zero emissions This report examines influential companies within the Australian property sector and those with the highest reported emissions. It includes the property companies listed in the ASX200 and those required to report their emissions under the National Greenhouse and Energy Reporting Act 2007 (NGER Act)i. Our analysis finds 43% of these companies have a net zero target or aspiration, of which: + 29% have pledged to achieve net zero emissions by 2050 for their owned and managed assets. These companies represent 36% of total ASX200 property sector market capitalisationii. + 14% have made climate commitments that align with a pathway to achieve net zero emissions by 2050 but have not yet explicitly pledged to achieve this goal. There remains significant opportunity in the property sector for companies to strengthen their commitments to align with net zero emissions by 2050. -

EXCHANGE TRADED BOND UNITS (“Xtbs”)

EXCHANGE TRADED BOND UNITS (“XTBs”) Supplementary Product Disclosure Statement SERIES 010 6 JUNE 2019 Trust: Australian Corporate Bond Trust (ARSN 603 010 779) Responsible Entity: Theta Asset Management Limited (ABN 37 071 807 684; AFSL No. 230920) Securities Manager: Australian Corporate Bond Company Limited (ABN 34 169 442 657; Authorised Representative No. 469037) Underlying Bonds: Ausnet Services Holdings Pty Limited 16 August 2027 Senior Unsecured Notes Dexus Finance Pty Limited 11 May 2027 Senior Unsecured Notes Telstra Corporation Limited 19 April 2027 Senior Unsecured Notes Vicinity Centres RE Limited as RE for the Vicinity Centres Trust April 2024 Senior Unsecured Notes Vicinity Centres RE Limited as RE for the Vicinity Centres Trust April 2027 Senior Unsecured Notes AUSTRALIAN CORPORATE BOND COMPANY Supplementary Product Disclosure Statement This Supplementary Product Disclosure Statement (“SPDS”) updates the information in the Product Disclosure Statement 7 September 2018 Series 010 (the “PDS”) for the Classes of exchange traded bond units (“XTBs”) specified in Table 1.1 of this SPDS. Only the Classes of XTBs described in Table 1.1 of this SPDS are the subject matter of this SPDS. Other Classes of XTB may be the subject matter of separate Supplementary Product Disclosure Statements. Information relating to classes of XTBs that exist as at the time of this SPDS can be found on the Security Manager’s website at www.xtbs.com.au. The PDS and this SPDS should be read together. A copy of this SPDS has been lodged with the Australian Securities and Investments Commission (“ASIC”) on 6 June 2019. Neither ASIC or ASX Limited takes any responsibility for the contents of this SPDS. -

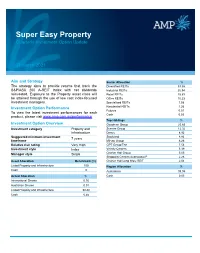

Super Easy Property Quarterly Investment Option Update

Super Easy Property Quarterly Investment Option Update 31 March 2021 Aim and Strategy Sector Allocation % The strategy aims to provide returns that track the Diversified REITs 33.55 S&P/ASX 200 A-REIT Index with net dividends Industrial REITs 26.94 reinvested. Exposure to the Property asset class will Retail REITs 25.89 be attained through the use of low cost index-focused Office REITs 10.23 investment managers. Specialised REITs 1.58 Investment Option Performance Residential REITs 1.26 Futures 0.51 To view the latest investment performances for each Cash 0.05 product, please visit www.amp.com.au/performance Top Holdings % Investment Option Overview Goodman Group 25.65 Investment category Property and Scentre Group 12.32 infrastructure Dexus 8.93 Suggested minimum investment Stockland 8.84 7 years timeframe Mirvac Group 8.28 Relative risk rating Very High GPT Group/The 7.54 Investment style Index Vicinity Centres 5.39 Manager style Single Charter Hall Group 5.05 Shopping Centres Australasia P 2.28 Asset Allocation Benchmark (%) Charter Hall Long Wale REIT 2.04 Listed Property and Infrastructure 100 Region Allocation % Cash 0 Australasia 99.95 Actual Allocation % Cash 0.05 International Shares 0.95 Australian Shares 0.01 Listed Property and Infrastructure 98.48 Cash 0.55 Market Review The Australian listed real estate market lost ground slightly in the March quarter, underperforming the broader Australian share market. The S&P/ASX 200 A-REIT index finished down by 0.47%, on a total return basis. The REIT market was particularly challenged earlier in the period, as optimism about further economic stimulus in the US and robust Australian economic data set a bullish tone, dampening the more defensive listed real estate market. -

Australian Equity Strategy

8 May 2020 Australia EQUITIES Australian Equity Strategy On average companies who presented at the Australia 2020 Conference Wrap 2020 conference outperformed Key points 57 companies presented at the 22nd Macquarie Australia Conference. On average, companies that presented outperformed 1.3ppt on the day. Technology companies were the clear winner during the Covid-19 crisis, and among the biggest outperformers after their presentations. Event Source: FactSet, Macquarie Research, May 2020 • We review key takeaways from the 22nd Macquarie Australia Conference. With the strongest return in Technology Key Takeaways 1. Worth it. A total of 57 companies presented at the virtual conference. Like many economic variables, this is down on last year due to Covid-19. But we still heard from large and small companies from a range of industries. The stocks of presenting companies outperformed by 1.3ppt on the day. 2. Technology is the clear winner in the Covid-19 crisis, as the disruption has accelerated the digitisation of the economy that had already been occurring for years. Given few companies have guidance, NXT, BVS and Source: FactSet, Macquarie Research, May 2020 RDY stand out for guiding to double-digit earnings growth in a contracting The 22st Macquarie Conference had a broad economy. Technology stocks were among the best relative performers with representation of market caps NEA +10%, APX +9.3% and Z1P +9% vs the ASX 200. 3. Covid-19 impacts material and widespread. Before the virus, we would not have expected to see traffic on TCL’s domestic toll roads fall over 50%, that jet fuel demand would fall 80-90%, that Spotless Hospitality could see a temporary period of zero revenue or that private health insurer MPL would commit to return any extra profits to policyholders (not shareholders). -

DEXUS Property Group (ASX: DXS) ASX Release

DEXUS Property Group (ASX: DXS) ASX release 31 August 2016 DEXUS Property Group (DEXUS) today released its 2016 Annual Report, which is attached, as part of its 2016 Annual Reporting suite. The 2016 Annual Reporting suite which includes the 2016 Performance Pack is available online at www.dexus.com. Printed copies of the 2016 Annual Report will be mailed to Security holders who have elected to receive them today. For further information please contact: Investor relations Media relations Rowena Causley T: +61 2 9017 1390 Louise Murray T: +61 2 9017 1446 M: +61 416 122 383 M:+61 403 260 754 E: [email protected] E: [email protected] About DEXUS DEXUS Property Group is one of Australia’s leading real estate groups, investing directly in high quality Australian office and industrial properties. With $22.2 billion of assets under management, the Group also actively manages office, industrial and retail properties located in key Australian markets on behalf of third party capital partners. The Group manages an office portfolio of 1.8 million square metres located predominantly across Sydney, Melbourne, Brisbane and Perth and is the largest owner of office buildings in the Sydney CBD, Australia’s largest office market. DEXUS is a Top 50 entity by market capitalisation listed on the Australian Securities Exchange under the stock market trading code ‘DXS’ and is supported by more than 31,000 investors from 20 countries. With more than 30 years of expertise in property investment, development and asset management, the Group has a proven track record in capital and risk management, providing service excellence to tenants and delivering superior risk-adjusted returns for its investors. -

Essential to Our Communities

Essential to our communities Annual Report 2020 Inside 2020 Integrated Annual Report 01 Highlights Our vision is to reimagine destinations 02 Our Value Chain of the future, where people love to connect. 04 Chairman’s Review 06 CEO and Managing Director’s Review 10 Our Operating and Financial Review 30 Our Data and Analytics 32 Our Communities 34 Our People 36 Our Board 39 Our Executive Committee 42 Tax Transparency 46 Sustainability Assurance Statement 49 Financial Report 50 Director’s Report 54 Remuneration Report 76 Financial Statements 129 Independent Auditor’s Report 136 Summary of Securityholders 137 Corporate Directory About this report This Annual Report discloses Vicinity’s financial and non-financial This report is printed on environmentally responsible paper This annual report is a summary of Vicinity Centres’ operations, performance for FY20 and has been prepared using elements manufactured under IAO 14001 environmental standards. activities and financial position as at 30 June 2020. In this of the International Integrated Reporting Council (IIRC) Integrated The following symbols are used in this report to cross-refer report references to ‘Vicinity’, ‘Group’, ‘Company’, ‘we’, ‘us’ Reporting <IR> framework. More information, particularly latest to more information on a topic: and ‘our’ refer to Vicinity Centres unless otherwise stated. company announcements and detailed sustainability reporting, can be found on Vicinity’s website. References in this report to a ‘year’ and ‘FY20’ refer to the References additional information within financial year ended 30 June 2020 unless otherwise stated. Vicinity is committed to reducing the environmental footprint this Annual Report All dollar figures are expressed in Australian dollars (AUD) associated with the production of the annual report and printed unless otherwise stated.