Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Carbon Footprint & Energy Transition Report

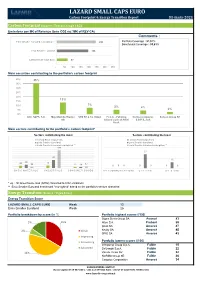

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

Projet De Note En Réponse) Which Was Filed with the French Autorité Des Marchés Financiers on 23 September 2019 and Which Remains Subject to Its Review

This document is an unofficial English-language translation of the draft response document (projet de note en réponse) which was filed with the French Autorité des marchés financiers on 23 September 2019 and which remains subject to its review. In the event of any differences between this unofficial English- language translation and the official French draft response document, the official French draft response document shall prevail. The draft offer and this draft response document remain subject to the French Financial Market's Authority review. DRAFT DOCUMENT PREPARED BY IN RESPONSE TO THE PUBLIC TENDER OFFER FOR THE SHARES OF THE COMPANY ALTRAN TECHNOLOGIES LAUNCHED BY This draft response document (projet de note en réponse) was filed with the French Financial Markets Authority (the "AMF") on 23 September 2019, in accordance with the provisions of Article 231-26 of the AMF's general regulation. It was prepared in accordance with Article 231-19 of the AMF's general regulation. The draft offer and this draft response document remain subject to the review of the AMF. Important notice Pursuant to Articles 231-19 and 261-1 et seq. of the AMF's general regulation, the report of Finexsi, acting in its capacity as independent expert, is included in this draft response document. This draft response document (the "Draft Response Document") is available on the websites of ALTRAN (www.altran.com) and the AMF (www.amf-france.org) and may be obtained free of charge from Altran Technologies' registered office at 96, avenue Charles de Gaulle, 92200 Neuilly-sur-Seine – FRANCE. In accordance with the provisions of Article 231-28 of the AMF's general regulation, information relating to Altran Technologies, in particular legal, financial and accounting information, will be filed with the AMF and made available to the public in the same manner no later than the day before the opening of the tender offer. -

Empresas Adjudicatarias Del Acuerdo Marco Para El Servicio De Desarrollo De Sistemas De Información

Empresas adjudicatarias del acuerdo marco para el servicio de desarrollo de sistemas de información. AM 26/2011. - ALTEN SOLUCIONES PRODUCTOS AUDITORIA E INGENIERIA, S.A.U. ** - ATOS ORIGIN S.A.E. ** - BULL ESPAÑA, S.A. ** - CAPGEMINI ESPAÑA, S.L. ** - EVERIS SPAIN, S.L.U. ** - HEWLETT PACKARD ESPAÑOLA, S.L. ** - IBERMÁTICA, S.A. ** - IBM GLOBAL SERVICES ESPAÑA, S.A) ** - INFORMÁTICA EL CORTE INGLÉS, S.A ** - INGENIERIA DE SOFTWARE AVANZADO, S.A ** - SADIEL TECNOLOGIAS DE LA INFORMACIÓN, S.A. * - SERESCO, S.A. * - SERIKAT, CONSULTORÍA E INFORMÁTICA, S.A. ** - SOPRA GROUP INFÓRMATICA, S.A. ** - TECNOCOM ESPAÑA SOLUTIONS, S.L ** - UTE ACCENTURE, S.L.- ACCENTURE OUTSOURCING SERVICES, S.A.Y CORITEL, S.A. * - UTE ALTIA CONSULTORES,S.A.-KPMG ASESORES S.L. ** - UTE ALTRAN INNOVACION, S.L.-GESEIN, S.L.-NEORIS ESPAÑA, S.L. ** - UTE AVENTIA IBERIA, S.L Y EPTISA SERVICIOS DE INGENIERIA, S.L.. ** - UTE AXPE CONSULTING S.L.-ORACLE IBERICA, S.R.L. ** - UTE B2B (COMERCIO ELECTRÓNICO B2B 2OOO, S.A.-TAISA SYVALUE,S.L.- ALBA TECHNOLOGY, S.L. REALTECH SYSTEM CONSULTING, S.L. -INDENOVA, .-TECNICOS ASOCIADO * - UTE BILBOMATICA, S.A & CIBERNOS & GRUPO EIDOS ** - UTE DELOITTE, S.L.-DELOITTE CONSULTING, S.L.-DXD APLICATIONS, IT SOLUTIONS ** - UTE ENTEL IT CONSULTING, S.A. ENTEL IBAI CONSULTING, S.A. NOVASOFT INGENIERIA, S.L. SYSTEMS MAINTENANCE SERVICES EUROPA, S.A. ** - UTE FUJITSU TECHNOLOGY SOLUTIONS, S.A.-DELAWARE CONSULTORIA, S.L. ** - UTE G9 ( BLOM SISTEMAS GEOESPACIALES, S.L.U. EXIS INVERSIONES EN CONSULTORÍA INFORMÁTICA Y TECNOLOGÍA, S.A.-INTELIGENCIA SISTEMÁTICA 4, S.L., ARISTA * - UTE GMV SOLUCIONES GLOBALES DE INTERNET, S.A. GMV AEROSPACE AND DEFENCE, S.A. -

Mise En Page 1

40, avenue André Morizet 92514 Boulogne-Billancourt Cedex www.alten.fr Technology Consulting and Engineering Business Report 2008 This document and the corresponding business report constitute the ALTEN reference document for the 2008 fiscal year. It was submitted to France’s financial market authority (Autorité des Marchés Financiers) on 3 June 2009 in accordance with Article 212-13 of the Autorité des Marchés Financiers’ general regulations. This Reference Document may be used in connection with a financial transaction if it is accompanied by a prospectus approved by the Autorité des Marchés Financiers. Furthermore, pursuant to Article 28 of Directive No. 809/2004 of the European Commission, the following information is incorporated by reference in this Reference Document: - The company and consolidated financial statements at 31 December 2007, along with the related reports prepared by the Statutory Auditors and presented on pages 137 through 194 of reference document no. D.08-0297 filed with the Autorité des Marchés Financiers on 25 April 2008. - The company and consolidated financial statements at 31 December 2006, along with the related reports prepared by the Statutory Auditors, presented on pages 88 through 149 of reference document no. D.07-0593 filed with the Autorité des Marchés Financiers on 14 June 2007. It was prepared by the issuer under the responsibility of the persons who signed it. Rapport d’activité ALTEN 2007 Sommaire BUSINESS REPORT I - GROUP GOVERNANCE Page Message from the Chairman 5 The Board of Directors and -

Engineering Services Top 50 2019

20192019 WHAT IS THE EVEREST GROUP ENGINEERING SERVICES TOP 50™? Engineering services include all activities (across software, embedded, mechanical, and process engineering functions) that support the design, development, testing, and management of products, both hardware and software1. The Everest Group Engineering Services Top 50™ is a global list of the 50 largest third-party providers, based on their Engineering Services (ES) revenues and year-on-year growth for CY 2018. This is the inaugural edition of the list; we are launching it to help ES stakeholders understand the broad dynamics of growth and success in the industry. WHY THE EVEREST GROUP ENGINEERING SERVICES TOP 50™? The global third-party ES industry is valued at more than US$40 billion. Enterprises have traditionally kept the design-to-development process in-house, but the need for scalability and rapid innovation has compelled them to consider third-party providers. As a result, ES providers have grown, through both more and larger deals, expanding the industry breadth, solution breadth, and global footprint. They are developing domain expertise and gaining scale through IP engagements and acquisitions. And, the market is becoming more favorable to engineering services providers as more high-end engineering services opportunities are being outsourced. Engineering services providers are diverse. Some are pure-play engineering services providers, while others offer engineering services as part of a broader portfolio (IT and/or business process services, consulting, technology products, etc.). Some are focused on a particular domain or geography, while others are broad- based. Some are listed, while others are privately held. This list helps enterprises to identify the largest providers and their functional coverage. -

La Classifica Delle TOP100 Software E Servizi IT Coglie Con Uno Sguardo

La Classifica delle TOP100 Software e Servizi IT coglie con uno sguardo complessivo le tensioni dinamiche che scuotono il settore IT in Italia, attraverso l’aggregazione dei risultati dei principali attori sul mercato. IDC stima che i dati aggregati della Classifica vadano sostanzialmente a intercettare circa i due terzi del valore complessivo del settore in Italia. Sebbene sia opportuno ricordare che la Classifica rappresenta una parte importante del comparto Software e Servizi IT in Italia, di fatto copre in misura prevalente la componente Grandi Imprese, presentando un minore grado di risoluzione sullo scenario PMI. Il fatturato prodotto dall’aggregato delle società presenti in Classifica si concentra in un numero ristretto di grandi attori multinazionali (Tab.1, Fig.1). Le società con un fatturato superiore ai 500 milioni di euro, le prime cinque posizioni nella Classifica, rappresentano il 39,2% dei ricavi complessivi nella Top100 (circa 4,9 miliardi di euro), mentre le imprese con un fatturato inferiore ai 500 milioni (le restanti 95 posizioni) totalizzano complessivamente il 60,8% (circa 7,69 miliardi di euro). Come già rilevato lo scorso anno, rispetto al 2012 prosegue e accelera la tendenza a uno spostamento dei risultati dal vertice del mercato verso la restante parte degli operatori, con una riduzione di quasi un punto e mezzo percentuale del valore complessivo riconducibile alle prime cinque posizioni. Nel corso dell’ultimo anno, l’indice di Herfindahl (HHI), calcolato sullo spazio competitivo rappresentato dalla Classifica Top100, è andato incontro a una progressiva riduzione, passando dal HHITOP100, 2011=0,047 al HHITOP100, 2012=0,045 a HHITOP100, 2013=0,043: i dati dell’ultimo triennio mettono in evidenza un processo di trasformazione della struttura competitiva del settore che prosegue in modo irriducibile senza dare segni di inversione. -

Andreas Blancke Grad

BRIEF PROFILE Andreas Blancke Grad. Eng. in Food Technology Food Resource Management GmbH Grad. Eng. in Industrial Engineering Andreas Blancke Managing Partner Business Psychology (M.Sc.) Heinrich-Zille-Straße 7A · 01219 Dresden, Germany Interim Expert Telephone: +49 351 485 24 801 Mobile: +49 176 782 772 95 Operations / Food Email: [email protected] Internet: www.food-resource.de Competencies Notable projects and experiences Ability to supply Business assessment Significant improvement in efficiency and productivity through sustainable change Change management Continuous improvement processes management coupled with coaching, mediation and moderation Cost optimisation at a manufacturer of Trend products Lean management / lean production Equipment planning Relocation of production processes in the international arena with subsequent Factory planning plant closure as part of a strategic repositioning of a renowned sugar producer Increasing productivity Kaizen Interim Management of an insolvent frozen food producer with transfer process Key figure systems to the investor Leadership Development Mediation Introduction of Lean Management at renowned manufacturers Production planning of dairy and frozen products Project controlling Project management Introduction of TPM and OEE at international starch producers in 3 locations Process analysis Construction of a meat production facility with a project volume of €100 m Raw materials use Systems planning Restructuring of a commercial kitchens with 5000 meals per day Succession management -

Press Release

PRESS RELEASE Paris, February 23rd 2021 5:40 pm 2020 FULL‐YEAR RESULTS . BUSINESS AND OPERATING MARGIN ON ACTIVITY IMPACTED BY THE HEALTH CRISIS . 10 ACQUISITIONS IN FRANCE AND ABROAD IN 2020 & 2021 Y‐o‐y € Million 2019 2020 change Revenue 2,624.0 2,331.9 ‐11.1% . of which France 1,134.5 907.5 ‐20.0% . of which International 1,489.5 1,424.4 ‐4.4% Operation Profit on Activity 260.8 142.4 ‐45.4% As % of revenue 9.9% 6.1% Operating Profit 238.2 119.2 ‐49.9% As % of revenue 9.1% 5.1% Net profit, Groupe share 164.2 98.0 ‐40.3% As % of revenue 6.3% 4.2% Free Cash flow 160.3 246.8 +54.0% As % of revenue 6.1% 10.6% Net cash position 74.9 195.6 +161.0% Headcount 37,200 33,800 ‐9.1% Audit in progress BUSINESS IN 2020 IMPACTED BY THE HEALTH CRISIS: ‐11.1% Revenue reaches €2,331.9 M decreasing by 11.1% as compared to 2019. On a like‐for‐like basis, business decreases by 12.9% (‐19.5% in France and ‐7.9% outside France) as it is strongly impacted by the health crisis. The crisis has mainly impacted the Automotive and Civil aeronautics whereas Rail/Naval, Life Sciences and Energy (Oil & Gas excepted) are strong and still growing. Therefore business has significantly decreased in 2020 in the countries where the Automotive and Civil aeronautics are predominant – such as France, Germany, Sweden, the US and the UK. -

![Sectorwatch: IT Services - Western Europe January 2020 IT Services - Western Europe January 2020 Sector Dashboard [4]](https://docslib.b-cdn.net/cover/8019/sectorwatch-it-services-western-europe-january-2020-it-services-western-europe-january-2020-sector-dashboard-4-2578019.webp)

Sectorwatch: IT Services - Western Europe January 2020 IT Services - Western Europe January 2020 Sector Dashboard [4]

Sectorwatch: IT Services - Western Europe January 2020 IT Services - Western Europe January 2020 Sector Dashboard [4] Public Basket Performance [5] Operational Metrics [7] Valuation Comparison [10] Recent Deals [13] Appendix [14] 7 Mile Advisors appreciates the opportunity to present this confidential information to the Company. This document is meant to be delivered only in conjunction with a verbal presentation, and is not authorized for distribution. Please see the Confidentiality Notice & Disclaimer at the end of the document. All data cited in this document was believed to be accurate at the time of authorship and came from publicly available sources. Neither 7 Mile Advisors nor 7M Securities make warranties or representations as to the accuracy or completeness of third-party data contained herein. This document should be treated as confidential and for the use of the intended recipient only. Please notify 7 Mile Advisors if it was distributed in error. 2 Overview 7MA provides Investment Banking & Advisory Services to the Business Services and Technology Industries globally. We advise on M&A and private capital transactions, and provide market assessments and benchmarking. As a close knit team with a long history together and a laser focus on our target markets, we help our clients sell their companies, raise capital, grow through acquisitions, and evaluate new markets. We publish our sectorwatch, a review of M&A and operational trends in the industries we focus. Dashboard Valuation Comparison • Summary metrics on the sector • Graphical, detailed comparison of • Commentary on market momentum by valuation multiples for the public basket comparing the most recent 12-month performance against the last 3-year averages. -

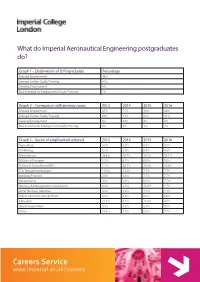

Aeronautical Engineering Postgraduates Do?

What do Imperial Aeronautical Engineering postgraduates do? Graph 1 – Destinations of 2016 graduates Percentage Entered Employment 48% Entered Further Study/Training 41% Seeking Employment 4% Not Available for Employment/Study/Training 7% Graph 2 – Comparison with previous years 2013 2014 2015 2016 Entered Employment 67% 71% 38% 48% Entered Further Study/Training 29% 14% 53% 41% Seeking Employment 5% 10% 6% 4% Not Available for Employment/Study/Training 0% 5% 3% 7% Graph 3 – Sector of employment entered 2013 2014 2015 2016 Agriculture 0.0% 0.0% 0.0% 0.0% Oil/Mining 7.1% 0.0% 0.0% 0.0% Manufacture 28.6% 46.7% 15.4% 23.1% Utilities & Transport 7.1% 6.7% 0.0% 0.0% Technical Consultancy/R&D 7.1% 26.7% 30.8% 30.8% IT & Telecommunications 14.3% 13.3% 7.7% 7.7% Banking/Financial 0.0% 0.0% 7.7% 7.7% Accountancy 0.0% 0.0% 0.0% 7.7% Business & Management Consultancy 0.0% 0.0% 15.4% 7.7% Other Business Activities 0.0% 0.0% 7.7% 7.7% Public Administration/Defence 0.0% 0.0% 0.0% 0.0% Education 21.4% 6.7% 15.4% 0.0% Health/Social Work 0.0% 0.0% 0.0% 0.0% Others 14.3% 0.0% 0.0% 7.7% Careers Service www.imperial.ac.uk/careers Postgraduate Taught Courses Examples of employers and occupations for Aeronautical Engineering taught course postgraduates who entered employment Examples of Employers Examples of Occupations • Accenture • Aeronautical Engineer • Alten Sud Ouest • Analyst • Atkins • Assistant Manager (Analytics and Modelling) • Blue Origin • Control and Systems Engineer • Caterpillar • Emulation and Modelling Engineer • Curtis Machine Tools • Engineer -

Business Delegation to the USA

Ministry for Economics, Labor and Transport of Niedersachsen Oslo Stockholm Dublin Berlin Warsaw London Hannover Paris Business DelegationRome Madrid to the USA Athens Chicago, Detroit, San Francisco 12 – 18 March 2017 Business Delegation to the USA Chicago, Detroit, San Francisco 12 – 18 March 2017 4 5 Business Delegation to the USA I am very pleased to be visiting the USA with a delegation of around fifty representatives of Niedersachsen’s trade and industry, professional associations and state parliament. On this trip we are Olaf Lies looking to build on and extend the traditionally good business Minister for Economics, Labor relations between Niedersachsen and the USA, and especially to and Transport of Niedersachsen exchange information and views on current developments in the fields of digitalization and mobility. [email protected] Niedersachsen is home to such global players as Volkswagen, www.nds.de Continental and Airbus, leaders in the automobile and aerospace industries, but also to many innovative and visionary medium-sized enterprises that play a shaping role in the Niedersachsen economy. Currently, I am conducting numerous discussions with enterprises and professional associations on how digitalization will change our economy and society. In the digitalization process I perceive many opportunities; delivery and value added chains have been established in all sorts of sectors that, being well equipped for future demands and open to cutting-edge innovation, are already living in the age of ‘Industry 4.0’ production. Our specialized providers of automation and IT solutions are making their contribution to this standard; facilities such as Hannover Centre for Production Technology (PZH) and the OFFIS Institute for Information Technology in Oldenburg are driving forces of ‘intelligent production’. -

Sector Report

INDEPENDENT RESEARCH Software and IT Services 21st September 2017 Adoption of a multi-dimensional prospective beta Software and IT Services ALTEN BUY vs. NEUTRAL FV EUR85 vs.74 Over the years, IT players have substantially reduced their earnings Last Price EUR72,82 Market Cap. EUR2,457m volatility: 1) maintenance on their installed bases and the emergence of ALTRAN TECHNOLOGIES BUY FV EUR19 vs. 17 Last Price EUR15,335 Market Cap. EUR2,696m the cloud have boosted recurring software sales; 2) IT services ATOS BUY vs. NEUTRAL FV EUR153 vs. 133 companies have curbed their dependency on cycles via industrialisation. Last Price EUR130,45 Market Cap. EUR13,724m In view of this, a more precise DCF valuation method seems necessary AXWAY SOFTWARE SELL FV EUR21 vs. 23 and for this reason, we have improved our current method by adopting Last Price EUR22,27 Market Cap. EUR463m multi-dimensional prospective betas. CAPGEMINI BUY FV EUR113 vs.105 Last Price EUR100 Market Cap. EUR16,915m A purely quantitative "flat rate" beta has its limits. In a DCF model, CAST NEUTRAL FV EUR3.6 vs.3,4 Last Price EUR3,54 Market Cap. EUR57m the beta reflects a company’s specific risk relative to the market as a whole. DASSAULT SYSTEMES NEUTRAL vs. SELL FV EUR86 vs. 65 The methodology we had used to date for the IT sector is based on a Last Price EUR85,54 Market Cap. EUR22,171m quantitative "flat rate" beta which did not reflect qualitative factors INDRA SISTEMAS BUY FV EUR16 (leadership, ability to beat expectations, acquisitions, economic Last Price EUR13,52 Market Cap.