A Bid for Better Transit Improving Service with Contracted Operations Transitcenter Is a Foundation That Works to Improve Urban Mobility

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

71 Fenchurch Street London EC3

71 Fenchurch Street London EC3 73,891 sq ft savills.co.uk Location 71 Fenchurch Street is one of the iconic buildings within the insurance district of the City of London. Accessed via a private courtyard on Fenchurch Street, the building is adjacent to Fenchurch Street mainline station and a few minute walk from Lloyd’s. In addition to Fenchurch Street, numerous other transport hubs are within a short walk; Tower Hill (Docklands Light Railway, District and Circle lines), Aldgate (Circle, Metropolitan and Hammersmith & City lines) and Liverpool Street (mainline, Elizabeth. Central, Circle, Metropolitan and Hammersmith & City lines). Description This landmark 12 storey, Richard Rogers designed building comprises 245,000 sq ft of office space with additional ground floor retail on the Fenchurch Street and Fenchurch Place frontages. The floors are available in a range of conditions from partially fitted-out to full ‘plug-and-play’ options. Specification • Grade A office accommodation VAT • Chilled beam air conditioning • Enhanced raised floors The property has been elected for VAT. • Superb natural light and City skyline views • Cycle spaces, showers and lockers Lease • Reception café • Potential for self-contained entrance off Lloyd’s Avenue A new lease direct from the landlord. • EPC – C (68) Accommodation Quoting rent Floor Area (sq ft) Availability £62.50 per sq ft on Pt 8th floor 11th 4,732 Q3 2021 10th 4,732 Q1 2022 Rates Pt 8th 4,789 Immediate 7th 11,198 Q4 2021 £19.97 per sq ft 6th 11,185 Q3 2021 4th 20,942 Q2 2021 Service Charge LG 16,313 Q3 2021 TBC - strictly by appointment through:- Viewing Josh Lamb Jade Dedman Savills Savills 020 7409 8891 020 7330 8617 [email protected] [email protected] Important Notice: Savills, their clients and any joint agents give notice that: 1.They are not authorised to make or give any representations or warranties in relation to the property either here or elsewhere, either on their own behalf or on behalf of their client or otherwise. -

West Americano Dal 12 Giugno Al 24 Giugno 2019

WEST AMERICANO DAL 12 GIUGNO AL 24 GIUGNO 2019 PROGRAMMA DI VIAGGIO 1 GIORNO Los Angeles SISTEMAZIONE Standard Hilton Los Angeles Airport Solo pernottamento Un incaricato vi accoglierà nella zona bagagli (arrivi nazionali) oppure all'uscita dalla dogana (arrivi internazionali) e vi fornirà tutte le indicazioni necessarie riguardanti il trasferimento al vostro albergo. PUNTI DI INTERESSE Los Angeles Los Angeles è un' importante città della California, la più grande di questo stato e la seconda di tutti gli Stati Uniti d'America. Insieme a New York e Chicago è una delle tre città più importanti del paese ed è un centro economico, culturale, cinematografico e scientifico di rilevanza mondiale. Diventata città il 4 aprile 1850, è il capoluogo dell'omonima contea. L'area costiera dove sarebbe sorta Los Angeles venne abitata per millenni da popolazioni native, come i Tongva, i Chumash e altri gruppi etnici, anche più antichi. L'economia di Los Angeles ha i suoi maggiori punti di forza nel commercio internazionale, nell'industria dell'audiovisivo (film, produzioni televisive, musica), nei settori aeronautico e aerospaziale, nell'agricoltura, nel turismo e nell'industria petrolifera. Los Angeles è divisa in diversi distretti, molti dei quali erano comunità autonome, entrate nel tempo a far parte della città 2 GIORNO Los Angeles SISTEMAZIONE Los Angeles Hilton Airport Prima colazione e pranzo Prima colazione. Partenza per il giro città dove si visiteranno Hollywood, Beverly Hills e Rodeo Drive. Pranzo. Pomeriggio interamente a disposizione. PUNTI DI INTERESSE Beverly Hills Beverly Hills è interamente circondata dalla città di Los Angeles. Pur essendo una città a sè, culturalmente fa ancora largamente parte di Los Angeles. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

18-Daagse Familiereis

NOORD AMERIKA, WEST KUST The Best of The West Tijdens deze reis worden natuurgebieden afgewisseld met kleurrijke wereldsteden zoals Los Angeles met de beroemde wijken Santa Monica, Hollywood en Beverly Hills, San Fransisco met de Golden Gate Bridge en cable cars en de 'gokstad Las Vegas met haar vele casino's en themahotels. Een populaire route onder Amerika-reizigers is de California State Route 1, ook wel Highway Number 1 genoemd die van San Francisco naar Los Angeles loopt met een lengte van ca. 650-700 kilometer. Je passeert onderweg de juweeltjes van de Pacific Coast zoals Santa Barbara en de kustlijn is verbluffend fraai met uitgestrekte vergezichten over de Stille Oceaan. In Arizona ligt Sedona, prachtig gelegen tussen de Red Rock Canyons waar een bezoek aan de Montezuma Castle vanwege de Indianen cultuur niet mag ontbreken. Page 2 REIS SCHEMA DAG 1 Amsterdam – San Francisco DAG 2 San Francisco DAG 3 San Francisco DAG 4 San Francisco - Monterey DAG 5 Monterey DAG 6 Monterey - Santa Barbara DAG 7 Santa Barbara DAG 8 Santa Barbara – Santa Monica DAG 9 Santa Monica DAG 10 Santa Monica DAG 11 Santa Monica – Las Vegas DAG 12 Las Vegas DAG 13 Las Vegas – Grand Canyon DAG 14 Grand Canyon DAG 15 Grand Canyon - Sedona DAG 16 Sedona DAG 17 Sedona DAG 18 Sedona – Phoenix - Amsterdam Page 3 DAG TOT DAG PROGRAMMA DAG 1 Amsterdam San - Francisco Vertrek Amsterdam om 09.50 en aankomst in San Franciso om11.45 per KLM De auto kan op de luchthaven worden opgehaald. Overnachting San Francisco DAG 2 en 3 San Francisco Voldoende tijd om deze heerlijke stad te verkennen. -

2018 Financial and CSR Report Attestation of the Persons Responsible for the Annual Report

2018 Financial and CSR Report Attestation of the persons responsible for the annual report We, the undersigned, hereby attest that to the best of our knowledge the financial statements have been prepared in accordance with generally-accepted accounting principles and give a true and fair view of the assets, liabilities, financial position and results of the company and of all consolidated companies, and that the management report attached presents a true and fair picture of the results and financial position of the consolidated companies and of all uncertainties facing them. Paris, 29 March 2019 Chairwoman and CEO Catherine Guillouard Chief Financial Officer Jean-Yves Leclercq Management Corporate report governance Editorial 4 report Profile 6 The Board of Directors 89 RATP Group organisation chart 14 Compensation of corporate officers 91 Financial results 16 Diversity policy 91 Extra-financial performance Appendix – List of directors declaration 28 and their terms of office at 31 December 2018 91 International control and risk management 69 Consolidated Financial fi nancial statements statements Statutory Auditors’ report on the financial statements 156 Statutory Auditors’ report on the consolidated financial statements 96 EPIC balance sheet 159 Consolidated statements EPIC income statement 160 of comprehensive income 100 Notes to the financial statements 161 Consolidated balance sheets 102 Consolidated statements of cash flows 103 Consolidated statements of changes in equity 104 Notes to the consolidated financial statements 105 RATP Group — 2018 Financial and CSR Report 3 Editorial 2018 – a year of strong growth momentum and commitment to the territories served 2018 was marked by an acceleration in RATP Capital Innovation continues to invest the Group’s development in Île-de-France, in new shared mobility solutions and smart cities, in France and internationally. -

Historic P U B Lic W Ork S P Roje Cts on the Ce N Tra L

SHTOIRICHISTORIC SHTOIRIC P U B LIC W ORK S P ROJE TSCP ROJE CTS P ROJE TSC ON THE CE N TRA L OCA STCOA ST OCA ST Compiled by Douglas Pike, P.E. Printing Contributed by: Table of Contents Significant Transportation P rojects......2 El Camino Real................................................... 2 US Route 101...................................................... 3 California State Route 1...................................... 6 The Stone Arch Bridge ..................................... 11 Cold Spring Canyon Arch Bridge..................... 12 Significant W ater P rojects...................14 First Dams and Reservoirs................................ 14 First Water Company........................................ 14 Cold Spring Tunnel........................................... 15 Mission Tunnel ................................................. 16 Gibraltar Dam ................................................... 16 Central Coast Conduit....................................... 18 Water Reclamation In Santa Maria Valley....... 23 Twitchell Dam & Reservoir.............................. 24 Santa Maria Levee ............................................ 26 Nacimiento Water Project................................. 28 M iscellaneous P rojects of Interest.......30 Avila Pier .......................................................... 30 Stearns Wharf.................................................... 32 San Luis Obispo (Port Harford) Lighthouse..... 34 Point Conception Lighthouse............................ 35 Piedras Blancas Light ...................................... -

Orgnr Orgnr Bedrift Juridisk Navn Avdeling Besøksadresse Landsforening Forbund Avtale 912899535 914579899 Agder Buss AS Avd

Orgnr Orgnr bedrift Juridisk navn Avdeling Besøksadresse Landsforening Forbund Avtale 912899535 914579899 Agder Buss AS avd. Tvedestrand Grendstølveien 40 NHO Transport YTF Bussbransjeavtale-YS 912899535 913057597 Agder Buss AS hovedkontor Bjoråvegen 72 NHO Transport YTF Bussbransjeavtale-YS 945968915 973132784 AS Jotunheimen og Valdresruten Bilselskap Avd. Fagernes Jernbanevegen 7 NHO Transport YTF Bussbransjeavtale-YS 816061652 971769726 AS Snertingdal Auto Snertingdalveien 1741 NHO Transport YTF Bussbransjeavtale-YS 954653137 972229881 Boreal Bane AS Avd Gråkallbanen Vognhallveien 1B NHO Transport YTF Bussbransjeavtale-YS 979437218 919388382 Boreal Buss AS Avd Mo I Rana Midtre gate 13 NHO Transport YTF Bussbransjeavtale-YS 979437218 974886243 Boreal Buss AS Avd Alta Bjørn Wirkolasvei 11 NHO Transport YTF Bussbransjeavtale-YS 979437218 999093590 Boreal Buss AS Avd Andøy Industriveien 5 NHO Transport YTF Bussbransjeavtale-YS 979437218 974330814 Boreal Buss AS Avd Buss Bolleveien 3 NHO Transport YTF Bussbransjeavtale-YS 979437218 918157182 Boreal Buss AS Avd Elnesvågen Tornesvegen 108 NHO Transport YTF Bussbransjeavtale-YS 979437218 874170542 Boreal Buss AS Avd Finnsnes Ringveien 5 NHO Transport YTF Bussbransjeavtale-YS 979437218 974309254 Boreal Buss AS Avd Hafrsfjord Treskevieen 5 NHO Transport YTF Bussbransjeavtale-YS 979437218 974064022 Boreal Buss AS Avd Hammerfest Rossmollgata 86 NHO Transport YTF Bussbransjeavtale-YS 979437218 973187163 Boreal Buss AS Avd Harstad Fjordgata 8 NHO Transport YTF Bussbransjeavtale-YS 979437218 974886332 -

861 Sq Ft Headquarters Office Building Your Own Front Door

861 SQ FT HEADQUARTERS OFFICE BUILDING YOUR OWN FRONT DOOR This quite unique property forms part of the building known as Rotherwick House. The Curve comprises a self-contained building, part of which is Grade II Listed, which has been comprehensively refurbished to provide bright contemporary Grade A office space. The property — located immediately to the east of St Katharine’s Dock and adjoining Thomas More Square — benefits from the immediate area which boasts a wide variety of retail and restaurant facilities. SPECIFICATION • Self-contained building • Generous floor to ceiling heights • New fashionable refurbishment • Full-height windows • New air conditioning • Two entrances • Floor boxes • Grade II Listed building • LG7 lighting with indirect LED up-lighting • Fire and security system G R E A ET T THE TEA TRE E D S A BUILDING OL S T E R SHOREDITCH N S HOUSE OLD STREET T R E E T BOX PARK AD L RO NWEL SHOREDITCH CLERKE C I HIGH STREET T Y R G O O A S D W S F H A O E R L U A L R T AD T H I O R T R N A S STEPNEY D’ O O M AL G B N A GREEN P O D E D T H G O T O WHITECHAPEL A N N R R R O D BARBICAN W O CHANCERY E A FARRINGDON T N O LANE D T T E N H A E M C T N O C LBOR A D O HO M A IGH MOORGATE G B O H S R R U TOTTENHAM M L R LIVERPOOL P IC PE T LO E COURT ROAD NDON WA O K A LL R N R H STREET H C L C E E O S A I SPITALFIELDS I IT A A W B N H D L E W STE S R PNEY WAY T O J R U SALESFORCE A E HOLBORN B T D REE TOWER E ST N I D L XFOR E G T O W R E K G ES H ALDGATE I A H E N TE A O M LONDON MET. -

INTRODUCTION the GREENEST CITY? Jonathan Metzger and Amy Rader Olsson

CHAPTER 1 INTRODUCTION THE GREENEST CITY? Jonathan Metzger and Amy Rader Olsson THE EUROPEAN UNION inaugurated the European Green Capital Award in 2010. The annual prize recognizes the consistent record of high envi- ronmental standards and commitment to ongoing and ambitious goals for further environmental improvement of one city within the European Union, which can then function as a role model to inspire and “promote best practice experiences in all other European cities” (European Green Capital, 2009). The first city to receive this award was Stockholm, the capital of Sweden. Positioned on the Baltic rim, on the northern outskirts of Europe, Stockholm has long been renowned for its distinctive waterfront and exten- sive foliage, truly making this “Venice of the North” worthy of the moniker Green (and blue!) Capital in the literal sense of the term. But of course, in relation to urban development the adjective “green” also implies so much more, functioning as a synonym for sustainability, or sustainable develop- ment. The classic definition of sustainable development, as formulated in the Brundtland Report (World Commission on Environment and Development, 1987), states that sustainable development is development that “meets the needs of the present without compromising the ability of future generations to meet their own needs.” In many contexts, the term is also used in a broad sense to denote action toward securing, sustaining, and developing the global preconditions for human life across multiple generations, while simultaneously paying attention to human well-being and prosperity, as well as safeguarding sensitive ecosystems and finite natural resources (for a more detailed discussion, see Chapter 3). -

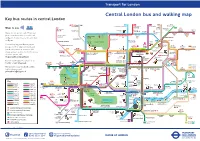

Central London Bus and Walking Map Key Bus Routes in Central London

General A3 Leaflet v2 23/07/2015 10:49 Page 1 Transport for London Central London bus and walking map Key bus routes in central London Stoke West 139 24 C2 390 43 Hampstead to Hampstead Heath to Parliament to Archway to Newington Ways to pay 23 Hill Fields Friern 73 Westbourne Barnet Newington Kentish Green Dalston Clapton Park Abbey Road Camden Lock Pond Market Town York Way Junction The Zoo Agar Grove Caledonian Buses do not accept cash. Please use Road Mildmay Hackney 38 Camden Park Central your contactless debit or credit card Ladbroke Grove ZSL Camden Town Road SainsburyÕs LordÕs Cricket London Ground Zoo Essex Road or Oyster. Contactless is the same fare Lisson Grove Albany Street for The Zoo Mornington 274 Islington Angel as Oyster. Ladbroke Grove Sherlock London Holmes RegentÕs Park Crescent Canal Museum Museum You can top up your Oyster pay as Westbourne Grove Madame St John KingÕs TussaudÕs Street Bethnal 8 to Bow you go credit or buy Travelcards and Euston Cross SadlerÕs Wells Old Street Church 205 Telecom Theatre Green bus & tram passes at around 4,000 Marylebone Tower 14 Charles Dickens Old Ford Paddington Museum shops across London. For the locations Great Warren Street 10 Barbican Shoreditch 453 74 Baker Street and and Euston Square St Pancras Portland International 59 Centre High Street of these, please visit Gloucester Place Street Edgware Road Moorgate 11 PollockÕs 188 TheobaldÕs 23 tfl.gov.uk/ticketstopfinder Toy Museum 159 Russell Road Marble Museum Goodge Street Square For live travel updates, follow us on Arch British -

CITYWIDE SPECIAL EVENTS CD Estimated Cost 1 Central

CITYWIDE SPECIAL EVENTS CD Estimated Cost 1 Central American Parade & Festival $ 15,300 1 Chinese New Year Golden Dragon Parade $ 3,000 1 Chinese New Year’s Festival $ 1,000 1 Dia De Los Muertos $ 10,000 1 Dia del Salvadoreno $ 14,000 1 Echo Park Holiday Parade $ 5,000 1 Feria Augustina $ 13,800 1 Firecracker Run $ 15,000 1 Glassell Park Tree Lighting Ceremony $ 2,000 1 Greek Festival $ 6,000 1 HP Car Show $ 5,000 1 HP Christmas Parade $ 5,000 1 LA Dodgers Opening Day $ 30,000 1 La Guelaguetza $ 5,000 1 LGBTQ Event $ 5,000 1 Lincoln Heights Fireworks Show $ 2,000 1 Lincoln Heights Holiday Parade $ 2,000 1 Lotus Festival $ 2,500 1 Lummis Day $ 800 1 MacArthur Park Fireworks Show $ 2,000 1 Northeast Jazz Festival $ 5,000 1 Philippine Festival/Independence Day $ 5,000 1 Sharing Festival $ 5,000 . SUBTOTAL CD 1 $ 159,400 2 Lit Crawl $ 2,500 2 NoHo Summer Nights $ 2,500 2 Songkran Festival $ 8,000 2 Studio City Winter Festival $ 6,752 2 St. Anne Annual Community Festival $ 7,000 2 Valley Village Family Festival $ 7,000 2 Vegan Fair $ 5,000 2 NoHo Cinifest $ 2,000 . SUBTOTAL CD 2 $ 40,752 . 3 4th of July $ 20,000 3 Councilmember Blumenfield’s Regional . Community Event $ 5,000 3 Dia De Los Muertos $ 8,404 CITYWIDE SPECIAL EVENTS CD Estimated Cost 3 Grateful Hearts $ 1,826 3 JHA Walk of Ages $ 4,775 3 Light the Night Walk for Leukemia $ 4,500 3 Memorial Day Parade $ 14,989 3 Motor4Toys Charity Car Show $ 2,500 3 Reseda Art Walk $ 15,000 3 Still Saving Lives Car Show $ 2,000 3 Walk of Hearts $ 2,200 . -

Shanghai, China Overview Introduction

Shanghai, China Overview Introduction The name Shanghai still conjures images of romance, mystery and adventure, but for decades it was an austere backwater. After the success of Mao Zedong's communist revolution in 1949, the authorities clamped down hard on Shanghai, castigating China's second city for its prewar status as a playground of gangsters and colonial adventurers. And so it was. In its heyday, the 1920s and '30s, cosmopolitan Shanghai was a dynamic melting pot for people, ideas and money from all over the planet. Business boomed, fortunes were made, and everything seemed possible. It was a time of breakneck industrial progress, swaggering confidence and smoky jazz venues. Thanks to economic reforms implemented in the 1980s by Deng Xiaoping, Shanghai's commercial potential has reemerged and is flourishing again. Stand today on the historic Bund and look across the Huangpu River. The soaring 1,614-ft/492-m Shanghai World Financial Center tower looms over the ambitious skyline of the Pudong financial district. Alongside it are other key landmarks: the glittering, 88- story Jinmao Building; the rocket-shaped Oriental Pearl TV Tower; and the Shanghai Stock Exchange. The 128-story Shanghai Tower is the tallest building in China (and, after the Burj Khalifa in Dubai, the second-tallest in the world). Glass-and-steel skyscrapers reach for the clouds, Mercedes sedans cruise the neon-lit streets, luxury- brand boutiques stock all the stylish trappings available in New York, and the restaurant, bar and clubbing scene pulsates with an energy all its own. Perhaps more than any other city in Asia, Shanghai has the confidence and sheer determination to forge a glittering future as one of the world's most important commercial centers.