Mediacom LLC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the United States Bankruptcy Court for the Eastern District of Virginia Richmond Division

Case 20-32299-KLP Doc 304 Filed 06/09/20 Entered 06/09/20 21:09:06 Desc Main Document Page 1 of 128 Steven J. Reisman (pro hac vice admission pending) Donald C. Schultz (VSB No. 30531) Marc B. Roitman (pro hac vice admission pending) W. Ryan Snow (VSB No. 47423) KATTEN MUCHIN ROSENMAN LLP CRENSHAW, WARE & MARTIN, PLC 575 Madison Avenue 150 West Main Street, Suite 1500 New York, New York 10022 Norfolk, Virginia 23510 Telephone: (212) 940-8800 Telephone: (757) 623-3000 Facsimile: (212) 940-8776 Facsimile: (757) 623-5735 Geoffrey M. King (pro hac vice admission pending) KATTEN MUCHIN ROSENMAN LLP 525 West Monroe Street Chicago, Illinois 60661 Telephone: (312) 902-5200 Facsimile: (312) 902-1061 Proposed Co-Counsel to the Special Committee of the Board of Intelsat Envision Holdings LLC IN THE UNITED STATES BANKRUPTCY COURT FOR THE EASTERN DISTRICT OF VIRGINIA RICHMOND DIVISION ) In re: ) Chapter 11 ) INTELSAT S.A., et al.,1 ) Case No. 20-32299 (KLP) ) Debtors. ) (Jointly Administered) ) APPLICATION OF INTELSAT ENVISION HOLDINGS LLC FOR ENTRY OF AN ORDER AUTHORIZING THE EMPLOYMENT AND RETENTION OF KATTEN MUCHIN ROSENMAN LLP AS SPECIAL COUNSEL PURSUANT TO SECTIONS 327(e), 328(a), AND 1107(b) OF THE BANKRUPTCY CODE EFFECTIVE AS OF MAY 13, 2020 Intelsat Envision Holdings LLC (“Intelsat Envision” or the “Debtor”), one of the above- captioned debtors and debtors in possession (the “Debtors”), respectfully states as follows in support of this application (this “Application”):2 1 Due to the large number of Debtors in these chapter 11 cases, for which joint administration has been granted, a complete list of the Debtor entities and the last four digits of their federal tax identification numbers is not provided herein. -

Mediacom Channel Lineup

768 HLN HD tve ** 248 FOX uine Network tve * 770 Paramount Network HD tve ** 769 truTV HD tve ** 253 VICLAND tve * 771 Comed Central HD tve ** 771 Comed Central HD tve ** 271 Invetigation Dicover tve * 772 MTV HD tve ** 772 MTV HD tve ** 273 National Geographic Channel 773 VH1 HD tve ** Channel 775 CMT HD tve ** tve * 774 T HD tve ** 777 Nickelodeon HD tve ** 277 Newmax* 775 CMT HD tve ** 778 Dine Channel HD tve ** 292 Hallmark Movie & Mterie* 776 Freeform HD tve ** Lineup 296 DIY Network tve * 777 Nickelodeon HD tve ** Variet TV 401 FXX tve * 778 Dine Channel HD tve ** Duuque, IA (include Local TV) 408 F1 tve * 779 Hallmark Channel HD tve ** 24 Lifetime tve † 503 IFC tve * 25 PN tve † 504 Lifetime Movie tve * port & Information Digital 26 PN2 tve † 506 FX Movie Channel tve * Pak^ tve † 641 undance TV tve * 27 NC port Chicago 128 loomerg tve tve † 659 Tenni Channel HD** 28 A& 167 RID TV tve † 660 FXX HD tve ** 29 ravo 172 FOX College port Atlantic tve tve † 662 C port Network HD tve ** 30 AMC 173 FOX College port Central tve tve † 665 F2 HD tve ** 31 TLC 174 FOX College port Pacific tve ffective Januar 27, 2021 tve † 668 Marquee port Network HD** 32 Hitor 175 Olmpic Channel tve tve † 671 VICLAND HD tve ** 33 CNN 177 portman Channel 34 HLN tve † 672 Invetigation Dicover HD † 178 PNU tve Local TV 119 KIIN-DT3 (IPTV P) WORLD 35 MNC tve † tve ** † 181 PN Claic (include Digital Muic) 123 Mediacom Main treet 36 FOX New tve † 675 FOX uine Network HD † 182 MG Network 1 Mediacom On Demand^ 124 KCRG-DT6 Circle 37 CNC tve † tve ** † 185 Y Network -

Pwc”) to Serve As Independent Auditor and Tax Compliance Services Provider for the Debtors, Effective As of February 18, 2020

Case 20-10343-LSS Doc 796 Filed 06/05/20 Page 1 of 16 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: Chapter 11 BOY SCOUTS OF AMERICA AND Case No. 20-10343 (LSS) DELAWARE BSA, LLC,1 (Jointly Administered) Debtors. Hearing Date: July 9, 2020 at 10:00 a.m. (ET) Objection Deadline: June 19, 2020 at 4:00 p.m. (ET) DEBTORS’ APPLICATION FOR ENTRY OF AN ORDER AUTHORIZING THE RETENTION AND EMPLOYMENT OF PRICEWATERHOUSECOOPERS LLP AS INDEPENDENT AUDITOR AND TAX COMPLIANCE SERVICES PROVIDER FOR THE DEBTORS AND DEBTORS IN POSSESSION, EFFECTIVE AS OF FEBRUARY 18, 2020 The Boy Scouts of America (the “BSA”) and Delaware BSA, LLC, the non-profit corporations that are debtors and debtors in possession in the above-captioned chapter 11 cases (together, the “Debtors”), submit this application (this “Application”), pursuant to section 327(a) of title 11 of the United States Code (the “Bankruptcy Code”), rules 2014(a) and 2016 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”), and rules 2014-1 and 2016-2 of the Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the District of Delaware (the “Local Rules”), for entry of an order, substantially in the form attached hereto as Exhibit A (the “Proposed Order”), (i) authorizing the Debtors to retain and employ PricewaterhouseCoopers LLP (“PwC”) to serve as independent auditor and tax compliance services provider for the Debtors, effective as of February 18, 2020 (the “Petition Date”), pursuant to the terms and conditions of the Engagement Letters (as defined 1 The Debtors in these chapter 11 cases, together with the last four digits of each Debtor’s federal tax identification number, are as follows: Boy Scouts of America (6300) and Delaware BSA, LLC (4311). -

Charter Business White Paper Social Media Marketing for the Small Business Environment

Charter Business White Paper Social Media Marketing for the Small Business Environment Special Report from “ThisisCable” for Business “ThisIsCable” for Business Reports are designed to demonstrate how new technologies enabled by cable providers help small business owners and managers address key challenges, solve problems and achieve mission critical objectives. More resources can be found at thisiscable.com/business. In the Web 2.0 era, first generation e-commerce tactics are no longer enough to deliver the winning edge. Today, organizations of all sizes are looking for new ways to unleash the power of the Internet. and the next new frontier is the realm of social media. Social media runs the gamut from social networking sites like Facebook and MySpace to microblogging forums like Twitter, to including collaboration, low barriers to entry (in cost as well as usability), and the ability to edit and revise content in real time. At this early stage in the social media marketing lifecycle, there are few wellmarked routes and even fewer rules of the road. Even next level. A new survey conducted by email marketing provider StrongMail found that half of all businesses plan to increase their email and social media marketing budgets in 2011, while 43 percent plan to maintain current levels. “As marketers head into 2011, they are focused on increasing subscriber engagement through increased relevancy and automat- ing lifecycle communications,” says Ryan Deutsch, vice president of strategic services at StrongMail. “While it’s clear that mar- The “2011 Marketing Trends” survey reveals that email marketing (65 percent) and social media (57 percent) will be the top areas of marketing investment in 2011. -

Federal Communications Commission WASHINGTON, D.C

BEFORE THE Federal Communications Commission WASHINGTON, D.C. 20554 In the Matter of ) ) Windstream Holdings, Inc., ) WC Docket No. 20-__ Debtor-in-Possession. ) Transferor ) ITC-T/C-2020____-_____ ) and ) ) Windstream Holdings, Inc., ) Transferee ) ) Application or Consent to Transfer of Control ) of Domestic and International Section 214 ) Authorizations to Emerge from Federal Bankruptcy Protection To: Chief, Wireline Competition Bureau Chief, International Bureau CONSOLIDATED APPLICATION FOR CONSENT TO TRANSFER OF CONTROL Windstream Holdings, Inc., Debtor-in-Possession (“Holdings” or “Transferor”) and Windstream Holdings, Inc. (“New Windstream” or “Transferee”) (together the “Applicants”) hereby seek, pursuant to Section 214 of the Communications Act, as amended (the “Act”), and Sections 63.04 and 63.24 of the Rules of the Federal Communications Commission (the “Commission”), Commission approval for transfer of control of each of the subsidiaries of Holdings, identified below, that holds either a domestic or international Section 214 telecommunications license (collectively, “Windstream” or the “Windstream Companies”) for the purpose of emerging from federal bankruptcy protection. I. DESCRIPTION OF THE PARTIES See Section I of Attachment 1, “Description of Proposed Transaction and Public Interest Statement.” - 2 - II. DESCRIPTION OF THE TRANSACTION See Section I.E. of Attachment 1, “Description of Proposed Transaction and Public Interest Statement.” As described therein, the Applicants seek FCC permission to accomplish this transaction in two steps, allowing the Windstream Companies to emerge more quickly from bankruptcy protection at Step One, and deferring consideration of the proposed final ownership structure to Step Two. III. APPROVAL OF THE REQUESTED TRANSFER OF CONTROL WILL PROVIDE SUBSTANTIAL PUBLIC INTEREST BENEFITS WITH NO COMPETITIVE OR OTHER HARMS See Section II of Attachment 1, “Description of Proposed Transaction and Public Interest Statement.” IV. -

Before the Federal Communications Commission Washington, D.C. 20554

Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Advanced Methods to Target and Eliminate ) CG Docket No. 17-59 Unlawful Robocalls ) ) Call Authentication Trust Anchor ) WC Docket No. 17-97 COMMENTS OF NCTA – THE INTERNET & TELEVISION ASSOCIATION NCTA – The Internet & Television Association (“NCTA”) submits these comments in response to the Public Notice in the above-captioned dockets seeking input for a Commission staff report on call blocking measures.1 NCTA applauds the Commission’s recent efforts to promote the deployment of call authentication and call blocking technologies and is pleased to report on the considerable action its members have taken to protect consumers. To further empower voice providers to combat illegal and unwanted robocalls, the Commission should also (i) adopt a broad call blocking safe harbor and (ii) establish a centrally compiled and maintained Critical Calls List. I. Cable Operators Work Diligently to Protect Their Customers from Illegal and Unwanted Robocalls As leading providers of state-of-the-art competitive voice service, cable operators share the Commission’s and the public’s deep concern about harmful and illegal robocalls. NCTA’s members understand that these calls are more than just a nuisance, and they have devoted significant time and resources to developing and implementing solutions to combat them. 1 Consumer and Governmental Affairs Bureau Seeks Input for Report on Call Blocking, Public Notice, CG Docket No. 17-59, WC Docket No. 17-97, DA 19-1312 (rel. Dec. 20, 2019) (“Public Notice”). NCTA’s larger members, for instance, have taken a leading role in developing and deploying robocall solutions. -

Verizon-And-Disney+Press-Release-FINAL-10.21.19-Final.Pdf

News Release FOR IMMEDIATE RELEASE October 22, 2019 9am ET Disney+ on us: Verizon to give customers 12 months of Disney+ Exclusive wireless carrier partner to offer customers a year of Disney+. ● On November 12, Verizon will begin offering 12 months of Disney+ to all new and existing 4G LTE and 5G unlimited wireless customers ● New Verizon Fios Home Internet and 5G Home Internet customers can also enjoy 12 months of Disney+ on us ● Verizon customers can enjoy everything Disney+ has to offer, including high-quality and commercial- free viewing, up to four concurrent streams, downloads for offline viewing, personalized recommendations, and the ability to set up to seven different profiles NEW YORK and BURBANK (October 22, 2019) – Verizon and The Walt Disney Company’s Direct-to-Consumer and International segment announced a wide-ranging agreement that will offer all Verizon wireless unlimited customers, new Fios Home Internet and 5G Home Internet customers 12 months of Disney+. Set to launch on November 12, Disney+ will be the dedicated streaming home for movies and shows from Disney, Pixar, Marvel, Star Wars, National Geographic, and more. The agreement will allow Verizon Wireless customers to stream Disney+ on the largest, most reliable network1 and provide yet another reason for customers to choose Verizon for the best content choices available. Eligible Verizon customers will have access to the highly anticipated streaming service where they can experience everything Disney+ has to offer: never-before-seen original programming including feature-length films, series, documentaries, and short-form content made exclusively for Disney+, along with unprecedented access to Disney’s vast collection of films and television shows. -

Ciel-2 Satellite Now Operational

CIEL-2 SATELLITE NOW OPERATIONAL Satellite Completes all Testing and Begins Commercial Service at 129 Degrees West February 5th, 2009 – Ottawa, Canada – The Ciel Satellite Group today announced that its first communications satellite, Ciel-2, has completed all in-orbit testing and has now entered commercial service at the 129 degrees West Longitude orbital position. The new satellite was launched last December 10 from the Baikonur Cosmodrome in Kazakhstan, and will be providing high-definition (HD) television services to the North American market, primarily for anchor customer DISH Network Corporation. “We are very pleased that Ciel-2 has successfully completed all of its initial testing, and are excited about its entry into commercial operations,” said Brian Neill, Executive Chairman of Ciel. “The support of many parties, particularly our shareholders and Industry Canada, has been central to our success, and we look forward to a bright future of serving customers for many years to come throughout North America.” About Ciel-2 Built by Thales Alenia Space, Ciel-2 is the largest Spacebus class spacecraft ever built, weighing 5,592 kg at launch; Ciel-2 is expected to operate for at least 15 years. The new BSS spacecraft is capable of serving all regions of Canada visible from 129 degrees West, as well as the larger North American market. The Ciel Satellite Group was awarded the license for 129 degrees West by Industry Canada in October 2004. Ciel-2 will be operated from the new Satellite Operations Centre at SED Systems located in Saskatoon, Saskatchewan, Canada. The Ciel-2 satellite is designed to provide 10.6 kilowatts of power to the communications payload at end of life, which consists of 32 Ku-band transponders. -

In the Matter of ) ) Expanding Flexible Use of the ) WT Docket No

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554 _______________________________________ ) In the Matter of ) ) Expanding Flexible Use of the ) WT Docket No. 20-443 12.-12.7 GHz Band ) ) Expanding Flexible Use in Mid-Band Spectrum ) GN Docket No. 17-183 Between 3.7-24 GHz ) ) ) REPLY COMMENTS OF DISH NETWORK CORPORATION Jeff Blum, Executive Vice President, Pantelis Michalopoulos External & Legislative Affairs Christopher Bjornson Alison Minea, Director & Senior Counsel Andrew M. Golodny Hadass Kogan, Director & Senior Counsel Travis West DISH NETWORK CORPORATION STEPTOE & JOHNSON LLP 1110 Vermont Avenue, N.W., Suite 450 1330 Connecticut Avenue, N.W. Washington, D.C. 20005 Washington, D.C. 20036 (202) 463-3702 (202) 429-3000 Counsel for DISH Network Corporation July 7, 2021 Table of Contents I. INTRODUCTION AND SUMMARY .............................................................................. 1 II. A BROAD SPECTRUM OF PUBLIC INTEREST AND BUSINESS ENTITIES, INCLUDING DISINTERESTED ENTITIES, SUPPORTS 5G IN THE BAND ............. 7 III. THE PROPOSAL’S FEW OPPONENTS DO NOT CLOSE THE DOOR TO 5G IN THE BAND .................................................................................................................. 9 IV. SHARING IS EMINENTLY FEASIBLE ....................................................................... 10 A. Sharing Is Possible Between Higher-Power Two-Way Terrestrial Services and DBS ............................................................................................................... 10 -

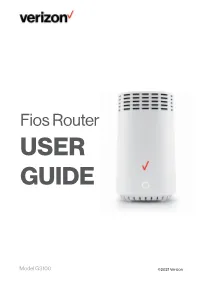

Fios Router 2.0 User Guide

Fios Router USER GUIDE Model G3100 ©2021 Verizon CONTENTS 01 / 03 / INTRODUCTION WI-FI SETTINGS 1.0 Package Contents 6 3.0 Overview 41 1.1 System Requirements 6 3.1 Basic Settings 42 1.2 Features 6 3.2 Advanced Settings 52 1.3 Getting to Know Your Fios Router 9 04 / CONNECTED DEVICES 02 / 4.0 Overview 59 CONNECTING YOUR FIOS 4.1 Device Settings 59 ROUTER 2.0 Setting up Your Fios Router 19 05 / 2.1 Expanding Wi-Fi SETTING PARENTAL coverage 26 CONTROLS 2.2 Computer Network 5.0 Activating Parental Configuration 28 Controls 65 2.3 Main Screen 35 5.1 Active Rules 68 TABLE OF CONTENTS 3 06 / 08 / CONFIGURING ADVANCED SPECIFICATIONS SETTINGS 8.0 General 6.0 Firewall 73 Specifications 182 6.1 Utilities 86 8.1 LED Indicators 183 6.2 Network Settings 98 8.2 Environmental Parameters 183 6.3 Date & Time 149 6.4 DNS Settings 152 6.5 Monitoring 156 09 / NOTICES 6.6 System Settings 162 9.0 Regulatory Compliance Notices 187 07 / TROUBLESHOOTING 7.0 Troubleshooting Tips 168 7.1 Frequently Asked Questions 175 verizon.com/fios | ©2021 Verizon. All Rights Reserved 01 / INTRODUCTION 1.0 Package Contents 1.1 System Requirements 1.2 Features 1.3 Getting to Know Your Fios Router 01 / INTRODUCTION 5 Verizon Fios Router lets you transmit and distribute digital entertainment and information to multiple devices in your home/office. Your Fios Router supports networking using coaxial cables, Ethernet, or Wi-Fi, making it one of the most versatile and powerful routers available. -

FOR PUBLIC INSPECTION December 22

Stephanie A. Roy 202 429 6278 [email protected] 1330 Connecticut Avenue, NW Washington, DC 20036-1795 202 429 3000 main www.steptoe.com REDACTED – FOR PUBLIC INSPECTION December 22, 2014 VIA ELECTRONIC FILING Marlene H. Dortch Secretary Federal Communications Commission 445 Twelfth Street, S.W. Washington, DC 20554 Re: Applications of Comcast Corp. and Time Warner Cable Inc. for Consent to Assign or Transfer Control of Licenses and Authorizations, MB Docket No. 14-57 Dear Ms. Dortch: Pursuant to the Second Amended Modified Joint Protective Order1 (“Modified Joint Protective Order”) in the above-captioned proceeding, DISH Network Corporation (“DISH”) herby submits a public, redacted version of its December 22, 2014 Reply. The {{ }} symbols denote where Highly Confidential Information has been redacted, and the [[ ]] symbols denote where Confidential Information has been redacted. The Highly Confidential and Confidential versions of this filing are being simultaneously filed with the Commission and will be made available pursuant to the terms of the Modified Joint Protective Order. 1 Applications of Comcast Corp. and Time Warner Cable Inc. for Consent to Assign or Transfer Control of Licenses and Authorizations, Docket No. 14-57, Second Amended Modified Joint Protective Order, DA 14-1639 (Nov. 12, 2014) (“Modified Joint Protective Order”). Ms. Marlene Dortch December 22, 2014 Page 2 of 2 Please contact me with any questions. Respectfully submitted, Sincerely, Pantelis Michalopoulos Stephanie A. Roy Counsel for DISH Network Corporation Enclosure REDACTED - FOR PUBLIC INSPECTION Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554 In the Matter of ) ) Applications of ) ) Comcast Corporation and Time Warner ) MB Docket No. -

Verizon Communications Inc. 2020 Form 10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark one) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 1-8606 Verizon Communications Inc. (Exact name of registrant as specified in its charter) Delaware 23-2259884 (State or other jurisdiction (I.R.S. Employer Identification No.) of incorporation or organization) 1095 Avenue of the Americas New York, New York 10036 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (212) 395-1000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol(s) Name of Each Exchange on Which Registered Common Stock, par value $0.10 VZ New York Stock Exchange Common Stock, par value $0.10 VZ The NASDAQ Global Select Market 1.625% Notes due 2024 VZ24B New York Stock Exchange 4.073% Notes due 2024 VZ24C New York Stock Exchange 0.875% Notes due 2025 VZ25 New York Stock Exchange 3.250% Notes due 2026 VZ26 New York Stock Exchange 1.375% Notes due 2026 VZ26B New York Stock Exchange 0.875% Notes due 2027 VZ27E New York Stock Exchange 1.375% Notes due 2028 VZ28 New York Stock Exchange 1.125% Notes due 2028 VZ28A New York Stock Exchange 1.875% Notes due 2029 VZ29B New York Stock Exchange 1.250% Notes due 2030 VZ30 New York Stock Exchange 1.875% Notes due 2030 VZ30A