Thomson's Fourth Quarter 2004 Revenues

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CINERAMA: the First Really Big Show

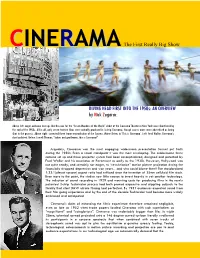

CCINEN RRAMAM : The First Really Big Show DIVING HEAD FIRST INTO THE 1950s:: AN OVERVIEW by Nick Zegarac Above left: eager audience line ups like this one for the “Seven Wonders of the World” debut at the Cinerama Theater in New York were short lived by the end of the 1950s. All in all, only seven feature films were actually produced in 3-strip Cinerama, though scores more were advertised as being shot in the process. Above right: corrected three frame reproduction of the Cypress Water Skiers in ‘This is Cinerama’. Left: Fred Waller, Cinerama’s chief architect. Below: Lowell Thomas; “ladies and gentlemen, this is Cinerama!” Arguably, Cinerama was the most engaging widescreen presentation format put forth during the 1950s. From a visual standpoint it was the most enveloping. The cumbersome three camera set up and three projector system had been conceptualized, designed and patented by Fred Waller and his associates at Paramount as early as the 1930s. However, Hollywood was not quite ready, and certainly not eager, to “revolutionize” motion picture projection during the financially strapped depression and war years…and who could blame them? The standardized 1:33:1(almost square) aspect ratio had sufficed since the invention of 35mm celluloid film stock. Even more to the point, the studios saw little reason to invest heavily in yet another technology. The induction of sound recording in 1929 and mounting costs for producing films in the newly patented 3-strip Technicolor process had both proved expensive and crippling adjuncts to the fluidity that silent B&W nitrate filming had perfected. -

The Search for Spectators: Vistavision and Technicolor in the Searchers Ruurd Dykstra the University of Western Ontario, [email protected]

Kino: The Western Undergraduate Journal of Film Studies Volume 1 | Issue 1 Article 1 2010 The Search for Spectators: VistaVision and Technicolor in The Searchers Ruurd Dykstra The University of Western Ontario, [email protected] Abstract With the growing popularity of television in the 1950s, theaters experienced a significant drop in audience attendance. Film studios explored new ways to attract audiences back to the theater by making film a more totalizing experience through new technologies such as wide screen and Technicolor. My paper gives a brief analysis of how these new technologies were received by film critics for the theatrical release of The Searchers ( John Ford, 1956) and how Warner Brothers incorporated these new technologies into promotional material of the film. Keywords Technicolor, The Searchers Recommended Citation Dykstra, Ruurd (2010) "The Search for Spectators: VistaVision and Technicolor in The Searchers," Kino: The Western Undergraduate Journal of Film Studies: Vol. 1 : Iss. 1 , Article 1. Dykstra: The Search for Spectators The Search for Spectators: VistaVision and Technicolor in The Searchers by Ruurd Dykstra In order to compete with the rising popularity of television, major Hollywood studios lured spectators into the theatres with technical innovations that television did not have - wider screens and brighter colors. Studios spent a small fortune developing new photographic techniques in order to compete with one another; this boom in photographic research resulted in a variety of different film formats being marketed by each studio, each claiming to be superior to the other. Filmmakers and critics alike valued these new formats because they allowed for a bright, clean, crisp image to be projected on a much larger screen - it enhanced the theatre going experience and brought about a re- appreciation for film’s visual aesthetics. -

10. the Extraordinarily Stable Technicolor Dye-Imbibition Motion

345 The Permanence and Care of Color Photographs Chapter 10 10. The Extraordinarily Stable Technicolor Dye-Imbibition Motion Picture Color Print Process (1932–1978) Except for archival showings, Gone With the He notes that the negative used to make Wind hasn’t looked good theatrically since the existing prints in circulation had worn out [faded]. last Technicolor prints were struck in 1954; the “That negative dates back to the early ’50s 1961 reissue was in crummy Eastman Color when United Artists acquired the film’s distri- (the prints faded), and 1967’s washed-out bution rights from Warner Bros. in the pur- “widescreen” version was an abomination.1 chase of the old WB library. Four years ago we at MGM/UA went back to the three-strip Tech- Mike Clark nicolor materials to make a new internegative “Movies Pretty as a Picture” and now have excellent printing materials. All USA Today – October 15, 1987 it takes is a phone call to our lab to make new prints,” he says.3 In 1939, it was the most technically sophisti- cated color film ever made, but by 1987 Gone Lawrence Cohn With the Wind looked more like Confederates “Turner Eyes ’38 Robin Hood Redux” from Mars. Scarlett and Rhett had grown green Variety – July 25, 1990 and blue, a result of unstable film stocks and generations of badly duplicated prints. Hair The 45-Year Era of “Permanent” styles and costumes, once marvels of spectral Technicolor Motion Pictures subtlety, looked as though captured in Crayola, not Technicolor. With the introduction in 1932 of the Technicolor Motion Not anymore. -

YOUR COMPANY Mrougi-I Me YEAR~

YOUR COMPANY mROUGI-I mE YEAR~ •Trademark Reg. U.S. Pat. Off. RECENTLY DOCTOR KALMUS AT THE BEGINNING ... SUMMARIZED THE HISTORY It was forty years ago on November 19, 1915, that OF TECHNICOLOR Technicolor Motion Picture Corporation was born. It all FOR THE DIRECTORS OF OUR COMPANY started a year or so before that date when Mr. William Coolidge, a prominent attorney and businessman of Bos ton, Massachusetts, asked Kalmus, Comstock &Westcott , ------------ Inc., to investigate for him a motion picture projector called Vanascope. Kalmus, Comstock & Westcott was a company formed in 1912 by Dr. Daniel F. Comstock and myself, both graduates of Massachusetts Institute of HIS DISCUSSION REVEALED AN ASTONISHING FACT: Technology and recently returned from obtaining Ph.D. TECHNICOLOR HAS FACED FOUR SERIOUS DEPRESSIONS degrees abroad on fellowships from Massachusetts Insti tute of Technology, together with W. Burton Westcott, a AND HAS SURMOUNTED EACH OF THEM mechanical genius. SUCCESSFULLY We reported unfavorably on the Vanascope and a year later, at the request of Mr. Coolidge, we made a -------------- second unfavorable report in which we suggested to him that if he wanted to put money into the motion picture business he raise his sights and aim to put color on the screen. During the consideration of the problems con BECAUSE YOU ARE WORKING TODAY nected with Vanascope the ideas which led to the first AT THE BEGINNING OF WHAT WE HAVE EVERY Technicolor camera and process were germinated . CONFIDENCE WILL PROVE TECHNICOLOR'S FIFTH Mr. Coolidge must have enjoyed my statement that GREAT STORY "the most he could lose was all he put into this color mo tion picture venture" because he and his partner, Mr. -

Exhibits: U.S. V. Technicolor Motion Picture Corporation

William C, Dixon, Special Assistant to the Attorney General James M, McGrath, Special Attorney Antitrust DiTision D3pa7T;msLi- of Justjoe 16u2 Ti. Postcffice & Courthouse Los Angeles 12, Clifornia Madison 7411, Extension 285 Attorneys for the Plaintiff IN THE DISTRICT COURT OF THE UNITED STATES FOR THE W13THERN DISTRICT OF CALIFORNIA CENTRAL DIVISION UNITED STATES OF AMERICA, Plaintiff, v. Civil Action No. •o-,^11 TECHNICOLOR, INC., TECHNICOLOR COMPLAINT •. MOTION PICTURE CORPORATION, and ELSTIAN KODAK COMPANY, Defendants. The United States of America, plaintiff, by its attorneys, acting under the direction of the Attorney General of the United States, brings this action against the defendants, and complains and alleges as follows JURISDICTION AND VENUE 1, This Complaint is filed and these proceedings are instituted under c. ^6tim 4 of the Act of Congress of July 2, 1890, c. 647, 26 Stat. 20q, es amended, entitled 'An Act to ProteA Trade and Commerce against Unlawrul Restraints and Monopolies," commonly known as the Sherman Antitrust Act, end under Section 15 of the Act of Congress of October 15, 1914, a. 323, 38 Stat, 730, as amended, commonly known as the Clayton Act, in order to prevent and restrain c-Jntinuing violations by the defendants, as hereinafter alleged, of Sections 1 and 2 of the Sherman Act, and of Section 3 of the Clayton Act. 2. Defendants Technicolor Motion Picture Corporation and East- man Kodak Company transact business and are found in the Southern District of California. II DEFINITIONS 3. The words 'professional -

The Essential Reference Guide for Filmmakers

THE ESSENTIAL REFERENCE GUIDE FOR FILMMAKERS IDEAS AND TECHNOLOGY IDEAS AND TECHNOLOGY AN INTRODUCTION TO THE ESSENTIAL REFERENCE GUIDE FOR FILMMAKERS Good films—those that e1ectively communicate the desired message—are the result of an almost magical blend of ideas and technological ingredients. And with an understanding of the tools and techniques available to the filmmaker, you can truly realize your vision. The “idea” ingredient is well documented, for beginner and professional alike. Books covering virtually all aspects of the aesthetics and mechanics of filmmaking abound—how to choose an appropriate film style, the importance of sound, how to write an e1ective film script, the basic elements of visual continuity, etc. Although equally important, becoming fluent with the technological aspects of filmmaking can be intimidating. With that in mind, we have produced this book, The Essential Reference Guide for Filmmakers. In it you will find technical information—about light meters, cameras, light, film selection, postproduction, and workflows—in an easy-to-read- and-apply format. Ours is a business that’s more than 100 years old, and from the beginning, Kodak has recognized that cinema is a form of artistic expression. Today’s cinematographers have at their disposal a variety of tools to assist them in manipulating and fine-tuning their images. And with all the changes taking place in film, digital, and hybrid technologies, you are involved with the entertainment industry at one of its most dynamic times. As you enter the exciting world of cinematography, remember that Kodak is an absolute treasure trove of information, and we are here to assist you in your journey. -

Metro-Goldwyn-Mayer Short Story

FOUR OUT OF TEN WINS! The record speaks for itself! There can be no question as to which company won the Quigley Short Subject Annual Exhibitor Vote. The results appeared on Page 21 of Motion Picture Herald, issue of Jan. 11, 1941, as follows: M-G-M 4 Next Company 3 Next Company 1 Next Company 1 Next Company 1 Leadership means doing the unusual first! Here's M-G-M's newest idea: Watch for this great short Tapping an unexplored field, subject! Short story masterpieces at last "THE On the screen— the first is HAPPIEST MAN 'THE HAPPIEST MAN ON EARTH" ON EARTH" One of M-G-M's most important steps featuring In years of short subject leadership. PAUL KELLY VICTOR KILLIAN Get ready for PETE SMITH'S "PENNY TO THE RESCUE," another Prudence Penny cookery The O. Henry Memorial comedy in Technicolor. It's swell. Also CAREY WILSON'S "MORE ABOUT NOSTRADAMUS/' Award -Winning Short Story a sequel to the prediction short that fascinated the nation. Scanned from the collections of The Library of Congress Packard Campus for Audio Visual Conservation www.loc.gov/avconservation Motion Picture and Television Reading Room www.loc.gov/rr/mopic Recorded Sound Reference Center www.loc.gov/rr/record 7 Quicker'n a wink' playing on the current program with 'Escape' is proving a sensation of unusual quality. Comments from our patrons are most enthusiastic. The sub- ject is a rare blending of scientific and entertaining units into an alto- gether delightful offering that is definitely boxoffice. This is an as- sured fact based on the number of calls we are receiving to inquire the screening time of the subject." BRUCE FOWLER, Mgr. -

Report on Designation Lpb 536/10

REPORT ON DESIGNATION LPB 536/10 Name and Address of Property: RKO Distributing Company Building 2312 Second Avenue Legal Description: Lot 3, Block 26, of the Second Addition to that part of the City of Seattle Laid off by A.A. Denny and W.M. Bell (Commonly known as Bell and Denny’s 2nd Addition to the City of Seattle), according to the plat thereof recorded in Volume 1 of Plats, page 77, Records of King County, Washington; Except that portion of said lots condemned for widening 2nd Avenue in King County Superior Court Cause Number 39151 under ordinance No. 9311 of the city of Seattle; Situate in the City of Seattle, County of King, State of Washington. At the public meeting held on December 1, 2010, the City of Seattle's Landmarks Preservation Board voted to approve designation of the RKO Distributing Company Building at 2312 Second Avenue as a Seattle Landmark based upon satisfaction of the following standards for designation of SMC 25.12.350: D. It embodies the distinctive visible characteristics of an architectural style, period, or of a method of construction. PHYSICAL DESCRIPTION Setting This former film exchange building is on a 6,615 square foot lot in the middle of the block on the east of Second Avenue, between Bell and Battery streets. This stretch of Second Avenue has been improved with numerous evergreen and deciduous street trees, curb bulbs with shrubs and various art works scattered along the sidewalk. However, the buildings here retain much of their pre-World War II character and scale. -

FEB 5 Ix*J 1888 Century Park Easf

- .- -- - -- - - -- - ~ - - - -- ~ ... .. - . - - - FEB 5 ix*j 1888 Century Park Easf. LOS Angeles, CA 90067 TURNER ENTERTAINMENT CO. -" ROGER L. MAYER WITION PICTUil;, 32,3;!:?i, .', . .1 PRESIDENT 8 CHIEF OPERATING OFFICER (310) 7886801 &CORDED SOU;-:D D~Vlsiiij,j Panatax: (310)7886810 STATEMENT BY: ROGER L. MAYER, PRESIDENT TURNER ENTERTAINMENT CO. &dlTIOI.i ,~;: , :<I,,I>;C!'.7lW$. ,&Q~C.COWLLIS<;,,,j s!v..,J% ! L. , TO : THE STUDY PANEL ON THE STATE OF AMERLGBP~. FILM PRESERVATION DATE : 2/5/93 Attached to this statement is a review of the status and policy on film preservation of the Turner Entertainment Co. libraries of film. Hopefully the extent and scope of this effort will present some guidelines as to the amount of time and effort required to preserve large libraries of film. It is also an indication that proper goals are perhaps even more attainable in the private sector if both the problems and the solutions are objectively examined. It is absolutely key that this study promulgate an understanding concerning not only the artistic and cultural benefit of film preservation, but the economic benefit as well. To this effect, we recommend consideration of promoting the values of ownership, including the possible extension of copyright protection. We also recommend a study of possible sources of support for film preservation. We would suggest some method by which film preservation technological information be made available on a worldwide basis and regularly studied and disseminated as circumstances change. This information could be used by both public and private entities so that money is appropriately utilized for preservation activities. -

King of Jazz by Jonas Nordin

The King of Jazz By Jonas Nordin Universal Pictures had contracted Paul Whiteman and his orchestra for a movie project as early as October 1928. The band was one of the most popular in the world by then and to feature Whiteman in an all talking musical picture built around his band simply had to be done. Director Wesley Ruggles was signed and the studio immediately sent out Paul Shofield, a staff writer on tour with the band, culminating in filming the band's entire concert at Carnegie Hall December 23, 1928. This footage however, was never used and is not known to have sur- vived. Filming was planned to start Janu- Bing Crosby harmonizes with Rhythm Boys Harry Barris and Al Rinker ary 15, 1929 but was immediately de- on the lively ditty “Happy Feet.” Courtesy Universal Pictures. layed as no script existed. Whiteman movie a revue is very understandable. The band left the east coast for Hollywood and re- Once this was decided the studio replaced Paul ported to Universal Studios for the filming of the mov- Fejös with Broadway stage director John Murray ie on June 28th, 1929. The musicians included Bix Anderson at the suggestion of Paul Whiteman. This Beiderbecke, The Rhythm Boys with Bing Crosby, was to be Anderson's first attempt at directing a mo- violinist Joe Venuti and guitarist Eddie Lang. tion picture. Fejös initially stayed on, working as an assistant director under Anderson, but left this posi- When Whiteman and the band arrived in Los Ange- tion soon afterwards, and was replaced by Robert les to begin filming, director Wesley Ruggles had Ross who had worked closely with Anderson on been replaced by Paul Fejös who had made Broadway. -

The BKSTS Illustrated History of Colour Film

THE MOVING IMAGE SOCIETY An Illustrated History of Colour Film Grant Lobban looks at the historical background and the technologies of colour film Hand-crafted - the A previous article in thi s slides was soon extended versions of Georges series looked at over a to moving pictures, using Melies' trick and fantasy making of a masterwork century of making 'black fine brushes to apply films [2], and the hand Grant Lobban spent the best part of and white' movies. Thi s transparent colour dyes to coloured gun flashes in two years compiling this 'masterwork'. time, it's the turn of each frame. The earliest The Great Train Robbery Eschewing the 'modern' tools of colour, the various ways surviving example is (1903). computer and scanner, and rightly that colour films have probably the Kinetoscope concentrating on acquiring the content been photographed, 1896 subject, Th e Stencil Colouring and not its eventual form, the results processed and printed Serpentine Dance by To speed up the process, of Grant's labours and diligent archive over the years, and the Annabelle-the-Dancer. stencils were sometimes searches were eventually presented to type of original material [Frame 1- facing page. cut to colour areas which the Editor as some 60 pages of closely remained the same shape type-written (yes, not wordprocessed!) which may still be Other numbers in square pages, heavily annotated with second available for making new brackets refer to and size over a large thoughts and reference numbers, plus copies and if necessary subsequent frames]. number of frames. Thi s a couple of dozen A4 pages onto may be restored to ensure Some of the black and sk illed, but laborious task, which 'millions' of precious film clips its future survival. -

2 September 2020 ROADSHOW PRESENTATION

September 2020 technicolor.com INTRODUCTION Richard Laurent Moat Carozzi CHIEF EXECUTIVE OFFICER CHIEF FINANCIAL OFFICER Background Background ► Joined in March 2018 ► Joined in November 2019 ► Previous experience ► Previous experience o Deputy CFO Publicis (2017-2018) CEO Eir Limited (2014-2018) o o CFO and COO Lagardère Sports & o CFO Eir Limited (2012-2014) Entertainment (2011-2017) o Deputy CEO and CFO EE Limited o Head of Investor Relations and Head of Group Financial Control Lagardère Group o 17 years with Orange 12 years with Lagardère Group ► Education o ► Education o St Catharine’s College, Cambridge Ecole Normale Supérieure Cachan o London Business School o o Université Panthéon Sorbonne 2 C3 - Restricted Natixis A BRIGHT FUTURE AHEAD FOR TECHNICOLOR (1/2) BALANCE SHEET ISSUES SOLVED ► Long term financial stability secured thanks to comprehensive financial restructuring FOLLOWING ► New capital structure will enable Technicolor to once again operate at full speed ► New money cash injection of c. €420m (net of costs and commissions) & debt reduction of SUCCESSFUL €660m through two capital increases RESTRUCTURING ► Revamped capital structure addressing financing needs, including full normalisation of payment PLAN terms with suppliers ► Demonstrated resilience to the crisis during the first half of the year ONGOING RECOVERY ► Production Services: most affected due to suspension of live action shooting. However impact was mitigated thanks to increased demand in Animation and resilience of FROM THE COVID 19 Advertising CRISIS ► DVD Services: Impacted by lack of new film releases following cinema closures. However this was partly compensated by strong back catalog demand ► Connected Home: Consumer demand for better broadband and wifi helped drive strong demand in the United States.