Airport Role and Activity Forecasts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Airline Schedules

Airline Schedules This finding aid was produced using ArchivesSpace on January 08, 2019. English (eng) Describing Archives: A Content Standard Special Collections and Archives Division, History of Aviation Archives. 3020 Waterview Pkwy SP2 Suite 11.206 Richardson, Texas 75080 [email protected]. URL: https://www.utdallas.edu/library/special-collections-and-archives/ Airline Schedules Table of Contents Summary Information .................................................................................................................................... 3 Scope and Content ......................................................................................................................................... 3 Series Description .......................................................................................................................................... 4 Administrative Information ............................................................................................................................ 4 Related Materials ........................................................................................................................................... 5 Controlled Access Headings .......................................................................................................................... 5 Collection Inventory ....................................................................................................................................... 6 - Page 2 - Airline Schedules Summary Information Repository: -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

A Conceptual Design of a Short Takeoff and Landing Regional Jet Airliner

A Conceptual Design of a Short Takeoff and Landing Regional Jet Airliner Andrew S. Hahn 1 NASA Langley Research Center, Hampton, VA, 23681 Most jet airliner conceptual designs adhere to conventional takeoff and landing performance. Given this predominance, takeoff and landing performance has not been critical, since it has not been an active constraint in the design. Given that the demand for air travel is projected to increase dramatically, there is interest in operational concepts, such as Metroplex operations that seek to unload the major hub airports by using underutilized surrounding regional airports, as well as using underutilized runways at the major hub airports. Both of these operations require shorter takeoff and landing performance than is currently available for airliners of approximately 100-passenger capacity. This study examines the issues of modeling performance in this now critical flight regime as well as the impact of progressively reducing takeoff and landing field length requirements on the aircraft’s characteristics. Nomenclature CTOL = conventional takeoff and landing FAA = Federal Aviation Administration FAR = Federal Aviation Regulation RJ = regional jet STOL = short takeoff and landing UCD = three-dimensional Weissinger lifting line aerodynamics program I. Introduction EMAND for air travel over the next fifty to D seventy-five years has been projected to be as high as three times that of today. Given that the major airport hubs are already congested, and that the ability to increase capacity at these airports by building more full- size runways is limited, unconventional solutions are being considered to accommodate the projected increased demand. Two possible solutions being considered are: Metroplex operations, and using existing underutilized runways at the major hub airports. -

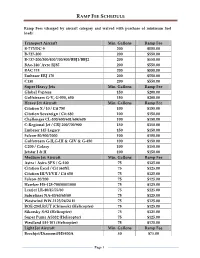

Ramp Fee Schedule

RAMP FEE SCHEDULE Ramp Fees (charged by aircraft category and waived with purchase of minimum fuel load): Transport Aircraft Min. Gallons Ramp Fee B-717/DC-9 200 $550.00 B-727-200 200 $550.00 B-737-200/300/400/700/800/BBJ1/BBJ2 200 $550.00 BAe-146/ Avro RJ85 200 $550.00 BAC 111 200 $550.00 Embraer ERJ 170 200 $550.00 C130 200 $550.00 Super Heavy Jets Min. Gallons Ramp Fee Global Express 150 $200.00 Gulfstream G-V, G-550, 650 150 $200.00 Heavy Jet Aircraft Min. Gallons Ramp Fee Citation X / 10 / Cit 750 100 $150.00 Citation Sovereign / Cit 680 100 $150.00 Challenger CL-300/600/601/604/605 100 $150.00 C-Regional Jet / CRJ 200/700/900 150 $150.00 Embraer 145 Legacy 150 $150.00 Falcon-50/900/2000 100 $150.00 Gulfstream G-II,G-III & GIV & G-450 100 $150.00 G200 / Galaxy 100 $150.00 Jetstar I & II 100 $150.00 Medium Jet Aircraft Min. Gallons Ramp Fee Astra / Astra SPX / G-100 75 $125.00 Citation Excel / Cit 560XL 75 $125.00 Citation III/VI/VII / Cit 650 75 $125.00 Falcon-20/200 75 $125.00 Hawker HS-125-700/800/1000 75 $125.00 Learjet LR-40/45/55/60 75 $125.00 Sabreliner NA-40/60/65/80 75 $125.00 Westwind WW-1123/24/24 II 75 $125.00 BOE-234LR/UT (Chinook) (Helicopter) 75 $125.00 Sikorsky S-92 (Helicopter) 75 $125.00 Super Puma AS332 (Helicopter) 75 $125.00 Westland EH-101 (Helicopter) 75 $125.00 Light Jet Aircraft Min. -

Global Fleet & Mro Market Forecast Summary

GLOBAL FLEET & MRO MARKET FORECAST SUMMARY 2017-2027 AUTHORS Tom Cooper, Vice President John Smiley, Senior Manager Chad Porter, Technical Specialist Chris Precourt, Technical Analyst For over a decade, Oliver Wyman has surveyed aviation and aerospace senior executives and industry influencers about key trends and challenges across the Maintenance, Repair, and Overhaul market. If you are responsible for maintenance and engineering activities at a carrier, aftermarket activities at an OEM, business operations at an MRO, or a lessor, you may want to participate in our survey. For more information, please contact our survey team at: [email protected]. To read last year’s survey, please see: http://www.oliverwyman.com/our-expertise/insights/2016/apr/mro-survey-2016.html . CONTENTS 1. EXECUTIVE SUMMARY 1 2. STATE OF THE INDUSTRY 5 Global Economic Outlook 7 Economic Drivers 11 3. FLEET FORECAST 17 In-Service Fleet Forecast 18 4. MRO MARKET FORECAST 31 Copyright © Oliver Wyman 1 EXECUTIVE SUMMARY EXECUTIVE SUMMARY Oliver Wyman’s 2017 assessment and 10-year outlook for the commercial airline transport fleet and the associated maintenance, repair, and overhaul (MRO) market marks the 17th year of supporting the industry with informed, validated industry data. This has become the most credible go-to forecast for many executives in the airline and MRO industry as well as for those with financial interests in the sector, such as private equity firms, investment banks and investment analysts. The global airline industry has made radical changes in the last few years and is producing strong financial results. While the degree of success varies among the world regions, favorable fuel prices and widespread capacity discipline are regarded as key elements in the 2016 record high in global profitability ($35.6 billion). -

Airplus Company Account: Airline Acceptance

AirPlus Company Account: Airline Acceptance IATA ICAO Country GDS ONLINE (Web) Comments Code Code Acceptance DBI Acceptance DBI Aegean Airlines A3 AEE GR a a a online acceptance: web & mobile Aer Arann RE REA IE a a Aer Lingus P.L.C. EI EIN IE a a a * Aeroflot Russian Intl. Airlines SU AFL RU a a a Aerogal 2K GLG EC a a Aeromar VW TAO MX a a a Aeroméxico AM AMX MX a a a Air Algérie AH DAH DZ a a Air Alps A6 LPV AT a a Air Astana KC KZR KZ a a Air Austral UU REU RE a a Air Baltic BT BTI LV a a Air Busan BX ABL KR a a Air Canada AC ACA CA a a a * Air Caraibes TX FWI FR a a a Air China CA CCA CN a a a a online acceptance in China only Air Corsica XK CCM FR a a Air Dolomiti EN DLA IT a a a Air Europa UX AEA ES a a Air France AF AFR FR a a a * Air Greenland GL GRL GL a a a Air India AI AIC IN a a Air Macau NX AMU MO a a Air Malta KM AMC MT a a a Air Mauritius MK MAU MU a a Air New Zealand NZ ANZ NZ a a a Air Niugini PX ANG PG a a a Air One AP ADH IT a a a Air Serbia JU ASL RS a a a Air Seychelles HM SEY SC a a Air Tahiti Nui VT VTA PF a a Air Vanuatu NF AVN VU a a Air Wisconsin ZW WSN US a a a Aircalin (Air Calédonie Intl.) SB ACI FR a a Air-Taxi Europe - TWG DE a a * AirTran Airways FL TRS US a a a * Alaska Airlines AS ASA US a a a Alitalia AZ AZA IT a a a * All Nippon Airways (ANA) NH ANA JP a a a American Airlines AA AAL US a a a * APG Airlines GP - FR a a a Arik Air W3 ARA NG a a Asiana Airlines OZ AAR KR a a a * Austrian Airlines OS AUA AT a a a a Avianca AV AVA CO a a Azul Linhas Aéreas Brasileiras AD AZU BR a a a Bahamasair UP BHS BS a a Bangkok Airways PG BKP TH a a Bearskin Airlines JV BLS US a a Beijing Capital Airlines JD CBJ CN a a Biman Bangladesh BG BBC BD a a BizCharters (BizAir Shuttle) - - US a a Blue Panorama BV BPA IT a a * Boliviana de Aviación OB BOV BO a a a British Airways BA BAW UK a a a a only one DBI field for online bookings available Brussels Airlines SN BEL BE a a a a Canadian North Inc. -

Chapter Iv Regionals/Commuters

CHAPTER IV REGIONALS/COMMUTERS For purposes of the Federal Aviation REVIEW OF 20032 Administration (FAA) forecasts, air carriers that are included as part of the regional/commuter airline industry meet three criteria. First, a The results for the regional/commuter industry for regional/commuter carrier flies a majority of their 2003 reflect the continuation of a trend that started available seat miles (ASMs) using aircraft having with the events of September 11th and have been 70 seats or less. Secondly, the service provided by drawn out by the Iraq War and Severe Acute these carriers is primarily regularly scheduled Respiratory Syndrome (SARS). These “shocks” to passenger service. Thirdly, the primary mission of the system have led to the large air carriers posting the carrier is to provide connecting service for its losses in passengers for 3 years running. The code-share partners. losses often reflect diversions in traffic to the regional/commuter carriers. These carriers During 2003, 75 reporting regional/commuter recorded double-digit growth in both capacity and airlines met this definition. Monthly traffic data for traffic for the second time in as many years. History 10 of these carriers was compiled from the has demonstrated that the regional/commuter Department of Transportation’s (DOT) Form 41 industry endures periods of uncertainty better than and T-100 filings. Traffic for the remaining the larger air carriers. During the oil embargo of 65 carriers was compiled solely from T-100 filings. 1 1973, the recession in 1990, and the Gulf War in Prior to fiscal year 2003, 10 regionals/commuters 1991, the regional/commuter industry consistently reported on DOT Form 41 while 65 smaller outperformed the larger air carriers. -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

Scalability of the Air Transportation System and Development of Multi-Airport Systems: a Worldwide Perspective

Scalability of the Air Transportation System and Development of Multi-Airport Systems: A Worldwide Perspective by Philippe A. Bonnefoy B. Ing., Mechanical Engineering, École Polytechnique de Montréal, Canada, 2002 S.M., Aeronautics & Astronautics, Massachusetts Institute of Technology, 2005 Submitted to the engineering systems division in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY at the MASSACHUSETTS INSTITUTE OF TECHNOLOGY June 2008 2008 Philippe A. Bonnefoy, All rights reserved. The author hereby grants to MIT the permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part. Signature of Author: ______________________________________________________ Philippe A. Bonnefoy Engineering Systems Division May 30th 2008 Certified by: _____________________________________________________________ R. John Hansman, Professor Department of Aeronautics and Astronautics and Engineering Systems Thesis Supervisor Certified by: _____________________________________________________________ Cynthia Barnhart, Professor Department of Civil and Environmental Engineering and Engineering Systems Certified by: _____________________________________________________________ Richard de Neufville, Professor Department of Civil and Environmental Engineering and Engineering Systems Certified by: _____________________________________________________________ Amedeo Odoni, Professor Department of Aeronautics and Astronautics and Civil and Environmental Engineering Accepted -

Technological Innovation in the Airline Industry: the Impact of Regional Jets

Technological Innovation in the Airline Industry: The Impact of Regional Jets by Jan K. Brueckner Department of Economics University of California, Irvine 3151 Social Science Plaza Irvine, CA 92697 e-mail: [email protected] and Vivek Pai Department of Economics University of California, Irvine 3151 Social Science Plaza Irvine, CA 92697 e-mail: [email protected] February 2007 Abstract This paper explores the impact of the regional jet (RJ), an important new technological inno- vation in the airline industry, on service patterns and service quality. The evidence shows that RJs were used to provide service on a large number of new hub-and-spoke (HS) and point-to- point (PP) routes. In addition, they replaced discontinued jet and turboprop service on many HS routes, as well as supplementing continuing jet service on such routes. When replace- ment or supplementation by RJs occurred, passengers benefited from better service quality via higher flight frequencies. The paper’s theoretical analysis predicts that the frequency ad- vantage of RJs over jets, a consequence of their small size, should have led to the emergence of PP service in thin markets where such service was previously uneconomical. However, the evidence contradicts this prediction, showing that markets attracting new PP service by RJs had demographic characteristics similar to those of markets that already had jet PP service or attracted it after 1996. Technological Innovation in the Airline Industry: The Impact of Regional Jets by Jan K. Brueckner and Vivek Pai 1. Introduction While the airline industry has experienced a number of significant institutional innovations over the years, including the adoption of hub-and-spoke networks and frequent flier programs and the use of yield management techniques, true technological innovations have been less fre- quent. -

Aviation Activity Forecasts

2 Aviation Activity Forecasts INTRODUCTION The Charles M. Schulz–Sonoma County Airport (STS) is one of six public use airports in Sonoma County. It is the only commercial service airport1 between the San Francisco Bay Area to the south, Sacramento to the east and Arcata-Eureka to the north. The Airport’s primary service area has a population of over 1 million people2 and includes Sonoma, Lake, and Mendocino counties, and parts of Marin and Napa counties. Airport Role The Sonoma County Airport, as the region’s principal Airport, serves many roles, including providing facilities for scheduled commuter and air carrier airline services. The California Aviation System Plan (CASP) designates the Airport as a Primary Commercial Service Non-Hub Airport. There are no Primary Commercial Service Hub airports in the region. The closest Primary Commercial Service Hub airports are the San Francisco, Oakland, and San Jose International Airports. The Sacramento International Airport is slightly more distant, but at times it can be more convenient for highway travel. The Sonoma County Airport also serves a growing population of general aviation (GA) activities including corporate and business flying. For this reason, the Federal Aviation Administration’s (FAA) National Plan of Integrated Airport Systems (NPIAS) currently classifies the Airport as a General Aviation facility, but in the future the Airport is expected to be reclassified as a Commercial Service Non-Primary Airport. A strong potential exists for additional scheduled airline and commuter air carrier service, particularly in the form of new, quiet technology jet aircraft with up to 135 passenger seats.3 The Airport also serves as a base of operations for local pilots, a place to conduct business, and a point of emergency access for the region.