Global Fleet & Mro Market Forecast Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The A320's Success Continues to Accelerate and Its Customer Base Is

38 I MAINTENANCE & ENGINEERING The A320’s success continues to accelerate and its customer base is widening. The oldest aircraft in the fleet have reached maturity. The aircraft has a well-earned reputation for low maintenance requirements, although its schedule still requires operators to compromise. A320 maintenance cost analysis ith the oldest A320s prevention and control programme out in the aircraft’s maintenance completing their first nine- (CPCP) is an integral part of its airframe planning document (MPD), are at each year structural checks, checks. So far, there have not been any FC, every 24 hours and every seven days. A320 family aircraft being ageing aircraft service bulletins (SBs) or The intervals for the daily and weekly Woperated by the majority of the world’s Airworthiness Directives (ADs). checks have been extended by some major carriers, and aircraft having been Apart from airframe checks operators operators to between 36 and 48 hours involved in used aircraft transactions, an only have to consider line maintenance and eight days. These three checks can all analysis of the A320 family’s and the usual removal of heavy be performed on the ramp and incur maintenance costs is essential. components, line replaceable unit (LRU) minimal downtime. All elements of the A320’s components and interior work. Work included in the transit or pre- maintenance, apart from engine-related The A320 differs to older types of flight check includes a review of the items, are examined here. The A320 is similar size, such as the 737 and MD-80, aircraft’s technical log, inspection of the oldest member of the family. -

N 8900.570 NOTICE FEDERAL AVIATION ADMINISTRATION Effective Date: National Policy 11/18/20 Cancellation Date: 11/18/21

U.S. DEPARTMENT OF TRANSPORTATION N 8900.570 NOTICE FEDERAL AVIATION ADMINISTRATION Effective Date: National Policy 11/18/20 Cancellation Date: 11/18/21 SUBJ: Boeing 737-8 and 737-9 Airplanes: Return to Service 1. Purpose of This Notice. This notice provides policy, information, and direction to certain Federal Aviation Administration (FAA) employees regarding the maintenance actions required for operators to complete prior to returning the Boeing Company Model 737-8 and 737-9 (referred to collectively as the 737 MAX) airplanes to service. The FAA has identified the required return-to-service activities for operators of the 737 MAX and heightened surveillance and tracking of those related activities for aviation safety inspectors (ASI). 2. Audience. The primary audience for this notice is principal inspectors (PI), ASIs, and other Flight Standards (FS) personnel who are responsible for the oversight of certificate holders operating or maintaining 737 MAX airplanes under Title 14 of the Code of Federal Regulations (14 CFR) parts 91, 121, 125, and 129. The secondary audience includes the FS Safety Standards and Foundational Business offices. 3. Where You Can Find This Notice. You can find this notice on the MyFAA employee website at https://employees.faa.gov/tools_resources/orders_notices. Inspectors can access this notice through the Flight Standards Information Management System (FSIMS) at https://fsims.avs.faa.gov. Operators can find this notice on the FAA’s website at https://fsims.faa.gov. This notice is available to the public at https://www.faa.gov/regulations_policies/orders_notices. 4. Applicability. This notice applies only to 737 MAX airplanes that received FAA Airworthiness Certificates and export Certificates of Airworthiness prior to the date of issuance of the Rescission of Emergency Order of Prohibition (November 18, 2020). -

List of Foreign EASA Part-145 Approved Organisations

EASA-IFP - List of Valid Foreign Part 145 organisations (WEB) List of valid Foreign Part-145 organisations This list contains valid approvals, including limited and partially suspended ones. Approved organisations EASA approval number Certificate address Country - Status of Approval: Patially Suspended (3) EASA.145.0469 NW TECHNIC LLC RUSSIA EASA.145.0547 ONUR AIR TASIMACILIK A.S. D/B/A ONUR AIR TURKEY EASA.145.0660 LIMITED LIABILITY COMPANY ''UTG DOMODEDOVO'' T/A UTG AVIATION SERVICES RUSSIA - Status of Approval: Valid (334) EASA.145.0003 GOODRICH AEROSTRUCTURES SERVICE (CENTER-ASIA) PTE Ltd. SINGAPORE EASA.145.0005 CHROMALLOY (THAILAND) LTD. THAILAND EASA.145.0007 ''UZBEKISTAN AIRWAYS TECHNICS'' LIMITED LIABILITY COMPANY UZBEKISTAN EASA.145.0008 KUWAIT AIRWAYS COMPANY KUWAIT EASA.145.0010 ABU DHABI AVIATION UNITED ARAB EMIRATES EASA.145.0012 AEROFLOT RUSSIAN AIRLINES RUSSIA EASA.145.0015 AIR ASTANA JSC KAZAKHSTAN EASA.145.0016 AI ENGINEERING SERVICES LIMITED t/a AIESL INDIA EASA.145.0017 AIR MAURITIUS Ltd. MAURITIUS EASA.145.0018 AIRFOIL SERVICES SDN. BHD. MALAYSIA EASA.145.0019 GE AVIATION, ENGINE SERVICES - SING PTE. LTD. SINGAPORE EASA.145.0020 ALIA - THE ROYAL JORDANIAN AIRLINES PLC CO (ROYAL JORDANIAN) JORDAN EASA.145.0021 AIRCRAFT MAINTENANCE AND ENGINEERING CORPORATION, BEIJING (AMECO) CHINA EASA.145.0022 AMSAFE AVIATION (CHONGQING) Ltd. CHINA EASA.145.0024 ASIA PACIFIC AEROSPACE Pty. Ltd. AUSTRALIA EASA.145.0025 ASIAN COMPRESSOR TECHNOLOGY SERVICES CO. LTD. TAIWAN EASA.145.0026 ASIAN SURFACE TECHNOLOGIES PTE LTD SINGAPORE EASA.145.0027 AEROVIAS DEL CONTINENTE AMERICANO S AVIANCA S.A. COLOMBIA EASA.145.0028 BAHRAIN AIRPORT SERVICES BAHRAIN EASA.145.0029 ISRAEL AEROSPACE INDUSTRIES, Ltd. -

Preventive Maintenance

Maintenance Aspects of Owning Your Own Aircraft Introduction According to 14 CFR Part 43, Maintenance, Preventive Maintenance, Rebuilding, and Alteration, the holder of a pilot certificate issued under 14 CFR Part 61 may perform specified preventive maintenance on any aircraft owned or operated by that pilot, as long as the aircraft is not used under 14 CFR Part 121, 127, 129, or 135. This pamphlet provides information on authorized preventive maintenance. How To Begin Here are several important points to understand before you attempt to perform your own preventive maintenance: First, you need to understand that authorized preventive maintenance cannot involve complex assembly operations. Second, you should carefully review 14 CFR Part 43, Appendix A, Subpart C (Preventive Maintenance), which provides a list of the authorized preventive maintenance work that an owner pilot may perform. Third, you should conduct a self-analysis as to whether you have the ability to perform the work satisfactorily and safely. Fourth, if you do any of the preventive maintenance authorized in 14 CFR Part 43, you will need to make an entry in the appropriate logbook or record system in order to document the work done. The entry must include the following information: • A description of the work performed, or references to data that are acceptable to the Administrator. • The date of completion. • The signature, certificate number, and kind of certificate held by the person performing the work. Note that the signature constitutes approval for return to service only for work performed. Examples of Preventive Maintenance Items The following is a partial list of what a certificated pilot who meets the conditions in 14 CFR Part 43 can do: • Remove, install, and repair landing gear tires. -

A Conceptual Design of a Short Takeoff and Landing Regional Jet Airliner

A Conceptual Design of a Short Takeoff and Landing Regional Jet Airliner Andrew S. Hahn 1 NASA Langley Research Center, Hampton, VA, 23681 Most jet airliner conceptual designs adhere to conventional takeoff and landing performance. Given this predominance, takeoff and landing performance has not been critical, since it has not been an active constraint in the design. Given that the demand for air travel is projected to increase dramatically, there is interest in operational concepts, such as Metroplex operations that seek to unload the major hub airports by using underutilized surrounding regional airports, as well as using underutilized runways at the major hub airports. Both of these operations require shorter takeoff and landing performance than is currently available for airliners of approximately 100-passenger capacity. This study examines the issues of modeling performance in this now critical flight regime as well as the impact of progressively reducing takeoff and landing field length requirements on the aircraft’s characteristics. Nomenclature CTOL = conventional takeoff and landing FAA = Federal Aviation Administration FAR = Federal Aviation Regulation RJ = regional jet STOL = short takeoff and landing UCD = three-dimensional Weissinger lifting line aerodynamics program I. Introduction EMAND for air travel over the next fifty to D seventy-five years has been projected to be as high as three times that of today. Given that the major airport hubs are already congested, and that the ability to increase capacity at these airports by building more full- size runways is limited, unconventional solutions are being considered to accommodate the projected increased demand. Two possible solutions being considered are: Metroplex operations, and using existing underutilized runways at the major hub airports. -

EASA Part 145 Approved Organization Egyptair Maintenance

Code of Federal Regulation (CFR) Air TitleShow 14: Aeronauticsand and Space PART 145 – Repair Stations Aviation Expo EgyptAir Maintenance & Engineering Training Course Code of Federal Regulation (CFR) Title 14: Aeronautics and Space PART 145 – Repair Stations (Ref.14CFR ch.1 (1-1-09 Edition) Training Course Ref. QA/FAR 145/Inspectors/0111 EASA Part 145 Approved Organization Ref. QA /FAR 145/ inspectors / 0111 1 Code of Federal Regulation (CFR) Air TitleShow 14: Aeronauticsand and Space PART 145 – Repair Stations Aviation Expo Content • Introduction • Part 145 – Repair Stations. • Part 43 – Rules Governing Maintenance, Preventive Maintenance, Rebuilding, and Alteration • Repair station manual • Training program manual Ref. QA /FAR 145/ inspectors / 0111 2 Code of Federal Regulation (CFR) Air TitleShow 14: Aeronauticsand and Space PART 145 – Repair Stations Aviation Expo Introduction • The management of change CAA AMO Organization structure Applicable regulation Facilities M.O.E. Quality documents Personnel Ref. QA /FAR 145/ inspectors / 0111 3 Code of Federal Regulation (CFR) Air TitleShow 14: Aeronauticsand and Space PART 145 – Repair Stations Aviation Expo Introduction (cont.) AMO product and product features. AMM Record Ref. QA /FAR 145/ inspectors / 0111 4 Code of Federal Regulation (CFR) Air TitleShow 14: Aeronauticsand and Space PART 145 – Repair Stations Aviation Expo Introduction (cont.) Managing Quality Functions Quality Management Quality System Quality Quality Control Assurance ECAA - FAA EASA Inspection Audit Ref. QA /FAR 145/ inspectors / 0111 5 .. Code of Federal Regulation (CFR) Air TitleShow 14: Aeronauticsand and Space PART 145 – Repair Stations Aviation Expo Introduction (cont.) Definitions Inspection: A critical examination of an event or object for conformance with a standard. -

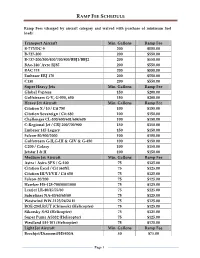

Ramp Fee Schedule

RAMP FEE SCHEDULE Ramp Fees (charged by aircraft category and waived with purchase of minimum fuel load): Transport Aircraft Min. Gallons Ramp Fee B-717/DC-9 200 $550.00 B-727-200 200 $550.00 B-737-200/300/400/700/800/BBJ1/BBJ2 200 $550.00 BAe-146/ Avro RJ85 200 $550.00 BAC 111 200 $550.00 Embraer ERJ 170 200 $550.00 C130 200 $550.00 Super Heavy Jets Min. Gallons Ramp Fee Global Express 150 $200.00 Gulfstream G-V, G-550, 650 150 $200.00 Heavy Jet Aircraft Min. Gallons Ramp Fee Citation X / 10 / Cit 750 100 $150.00 Citation Sovereign / Cit 680 100 $150.00 Challenger CL-300/600/601/604/605 100 $150.00 C-Regional Jet / CRJ 200/700/900 150 $150.00 Embraer 145 Legacy 150 $150.00 Falcon-50/900/2000 100 $150.00 Gulfstream G-II,G-III & GIV & G-450 100 $150.00 G200 / Galaxy 100 $150.00 Jetstar I & II 100 $150.00 Medium Jet Aircraft Min. Gallons Ramp Fee Astra / Astra SPX / G-100 75 $125.00 Citation Excel / Cit 560XL 75 $125.00 Citation III/VI/VII / Cit 650 75 $125.00 Falcon-20/200 75 $125.00 Hawker HS-125-700/800/1000 75 $125.00 Learjet LR-40/45/55/60 75 $125.00 Sabreliner NA-40/60/65/80 75 $125.00 Westwind WW-1123/24/24 II 75 $125.00 BOE-234LR/UT (Chinook) (Helicopter) 75 $125.00 Sikorsky S-92 (Helicopter) 75 $125.00 Super Puma AS332 (Helicopter) 75 $125.00 Westland EH-101 (Helicopter) 75 $125.00 Light Jet Aircraft Min. -

GAO-19-160, MILITARY PERSONNEL: Strategy Needed to Improve

United States Government Accountability Office Report to Congressional Committees February 2019 MILITARY PERSONNEL Strategy Needed to Improve Retention of Experienced Air Force Aircraft Maintainers GAO-19-160 February 2019 MILITARY PERSONNEL Strategy Needed to Improve Retention of Experienced Air Force Aircraft Maintainers Highlights of GAO-19-160, a report to congressional committees Why GAO Did This Study What GAO Found Air Force aircraft maintainers are The Air Force has reduced overall aircraft maintainer staffing gaps, but continues responsible for ensuring that the Air to have a gap of experienced maintainers. The Air Force reduced the overall gap Force’s aircraft are operationally ready between actual maintainer staffing levels and authorized levels from 4,016 and safe for its aviators—duties critical maintainers (out of 66,439 authorized active component positions) in fiscal year to successfully executing its national 2015, to 745 in fiscal year 2017 (out of 66,559 positions). However, in 7 of the security mission. With more than last 8 fiscal years, the Air Force had staffing gaps of experienced maintainers— 100,000 maintainers across the Air those who are most qualified to meet mission needs and are needed to train new Force’s active and reserve maintainers. Maintainers complete technical school as 3-levels and initially lack components, according to Air Force the experience and proficiency needed to meet mission needs. Following years officials, aircraft maintenance is the Air of on-the-job training, among other things, maintainers upgrade to the 5- and 7- Force’s largest enlisted career field— accounting for about a quarter of its levels. -

Military Aircraft and International Law: Chicago Opus 3'

Journal of Air Law and Commerce Volume 66 | Issue 3 Article 2 2001 Military Aircraft nda International Law: Chicago Opus 3 Michel Bourbonniere Louis Haeck Follow this and additional works at: https://scholar.smu.edu/jalc Recommended Citation Michel Bourbonniere et al., Military Aircraft na d International Law: Chicago Opus 3, 66 J. Air L. & Com. 885 (2001) https://scholar.smu.edu/jalc/vol66/iss3/2 This Article is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in Journal of Air Law and Commerce by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. MILITARY AIRCRAFT AND INTERNATIONAL LAW: CHICAGO OPUS 3' MICHEL BOURBONNIERE Louis HAECK TABLE OF CONTENTS I. CIVIL AND MILITARY INTERFACE ............... 886 II. TREATY OF PARIS ................................ 889 III. CHICAGO CONVENTION AND MILITARY AIRCRAFT ......................................... 893 A. ARTICLE 3(B) ................................... 896 B. ARTICLE 3(D) ................................... 912 1. Content of Due Regard ....................... 912 a. Exegetical Analysis ..................... 914 b. Analysis of the Annexes to the Chicago Convention ............................ 916 c. Analysis of the ICAO Resolutions ...... 922 2. Application of Due Regard ................... 926 a. How is Due Regard Applied? .......... 926 b. Where is Due Regard Applied? ........ 927 c. Methods of Application of Due Regard ................................. 928 IV. CAA-CANADA LITIGATION ....................... 931 A. CAA ARGUMENTS ............................... 932 B. DEFENSE BY CANADA ............................ 934 C. COMMENTS ON THE ARGUMENTS OF CAA ....... 935 D. COMMENTS ON THE CANADIAN ARGUMENTS ..... 941 V. UNAUTHORIZED OVERFLIGHT ................. 946 VI. U.S. DOMESTIC LAW ............................. 948 1 The authors express their appreciation to the following individuals for sharing their thoughts on the subject of this note: ICAO Legal Bureau, Col. -

Airline Maintenance Cost Executive Commentary - January 2011

Airline Maintenance Cost Executive Commentary - January 2011 Airline Maintenance Cost Executive Commentary An exclusive benchmark analysis (FY2009 data) by IATA’s Maintenance Cost Task Force Executive Summary In 2009, global aviation faced the worst decline to date. Economies Overhead accounted for an average of 24% of the total maintenance cost. As worldwide have been shaken by the global crisis and demand for aviation not all airlines reported the overhead cost, for the purpose of this analysis we plunged. The air cargo industry has been extremely hardly hit, as demand for mostly focus on the direct maintenance cost (DMC). air freight is very elastic and demand for consumer goods dropped to record The 20 airlines continuously reporting to the MCTF for 4+ years flew 2% less lows. The financial consequences for the aviation industry have resulted in a flight hours and 6% less flight cycles, resulting in a 3% lower annual aircraft “permanent” loss of 2.5 years of growth in passenger business and 3.5 years utilization (down to 8.82 hours/day). The stage length increased by 4% of growth in air cargo*. compared to the year before. The 40 MCTF participating airlines in 2009 reported a total fleet of 3,312 Engine cost remained by far the largest single expenditure, amounting to aircraft. Boeing aircraft represented the majority (63%), followed by Airbus about 43% of the maintenance spending. Almost three quarters of engine with 32%. Narrow body aircraft represented over 60% of the fleet, while wide maintenance was outsourced; this excludes materials purchased for the body aircraft accounted for 32% of the fleet. -

Chapter Iv Regionals/Commuters

CHAPTER IV REGIONALS/COMMUTERS For purposes of the Federal Aviation REVIEW OF 20032 Administration (FAA) forecasts, air carriers that are included as part of the regional/commuter airline industry meet three criteria. First, a The results for the regional/commuter industry for regional/commuter carrier flies a majority of their 2003 reflect the continuation of a trend that started available seat miles (ASMs) using aircraft having with the events of September 11th and have been 70 seats or less. Secondly, the service provided by drawn out by the Iraq War and Severe Acute these carriers is primarily regularly scheduled Respiratory Syndrome (SARS). These “shocks” to passenger service. Thirdly, the primary mission of the system have led to the large air carriers posting the carrier is to provide connecting service for its losses in passengers for 3 years running. The code-share partners. losses often reflect diversions in traffic to the regional/commuter carriers. These carriers During 2003, 75 reporting regional/commuter recorded double-digit growth in both capacity and airlines met this definition. Monthly traffic data for traffic for the second time in as many years. History 10 of these carriers was compiled from the has demonstrated that the regional/commuter Department of Transportation’s (DOT) Form 41 industry endures periods of uncertainty better than and T-100 filings. Traffic for the remaining the larger air carriers. During the oil embargo of 65 carriers was compiled solely from T-100 filings. 1 1973, the recession in 1990, and the Gulf War in Prior to fiscal year 2003, 10 regionals/commuters 1991, the regional/commuter industry consistently reported on DOT Form 41 while 65 smaller outperformed the larger air carriers. -

Technological Innovation in the Airline Industry: the Impact of Regional Jets

Technological Innovation in the Airline Industry: The Impact of Regional Jets by Jan K. Brueckner Department of Economics University of California, Irvine 3151 Social Science Plaza Irvine, CA 92697 e-mail: [email protected] and Vivek Pai Department of Economics University of California, Irvine 3151 Social Science Plaza Irvine, CA 92697 e-mail: [email protected] February 2007 Abstract This paper explores the impact of the regional jet (RJ), an important new technological inno- vation in the airline industry, on service patterns and service quality. The evidence shows that RJs were used to provide service on a large number of new hub-and-spoke (HS) and point-to- point (PP) routes. In addition, they replaced discontinued jet and turboprop service on many HS routes, as well as supplementing continuing jet service on such routes. When replace- ment or supplementation by RJs occurred, passengers benefited from better service quality via higher flight frequencies. The paper’s theoretical analysis predicts that the frequency ad- vantage of RJs over jets, a consequence of their small size, should have led to the emergence of PP service in thin markets where such service was previously uneconomical. However, the evidence contradicts this prediction, showing that markets attracting new PP service by RJs had demographic characteristics similar to those of markets that already had jet PP service or attracted it after 1996. Technological Innovation in the Airline Industry: The Impact of Regional Jets by Jan K. Brueckner and Vivek Pai 1. Introduction While the airline industry has experienced a number of significant institutional innovations over the years, including the adoption of hub-and-spoke networks and frequent flier programs and the use of yield management techniques, true technological innovations have been less fre- quent.