Aviation Activity Forecasts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Embraer @ 50 Years of Wonder, Innovation & Success Page 14

MANAGEMENT EMERGING TRENDS DUTIES AND TAXES OF GROWING AIR IN AERO ENGINE ON IMPORT/ PASSENGER TRAFFIC TECHNOLOGIES PURCHASE OF BA P 10 P 18 P 25 AUGUST-SEPTEMBER 2019 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 12 • ISSUE 4 WWW.SPSAIRBUZ.COM ANAIRBUZ EXCLUSIVE MAGAZINE ON CIVIL AVIATION FROM INDIA EMBRAER @ 50 YEARS OF WONDER, INNOVATION & SUCCESS PAGE 14 Embraer Profit Hunter E195-E2 TechLion at PAS 2019 AN SP GUIDE PUBLICATION RNI NUMBER: DELENG/2008/24198 OUT OF SIGHT. INSIGHT. In the air and everywhere. Round-the-clock service representatives, a growing global network, full-flight data, and an app that tracks your orders – solutions have never been more clear. enginewise.com PW_CES_EnginewiseSight_SPs Air Buz.indd 1 3/1/19 11:32 AM Client: Pratt & Whitney Commercial Engines Services Ad Title: Enginewise - OUT OF SIGHT. INSIGHT. Publication: SPs Air Buz - April/May Trim: 210 x 267 mm • Bleed: 220 x 277 mm TABLE OF CONTENTS EMBRAER / 50 YEARS P14 Embraer’s 50 years of MANAGEMENT EMERGING TRENDS DUTIES AND TAXES OF GROWING AIR IN AERO ENGINE ON IMPORT/ PASSENGER TRAFFIC TECHNOLOGIES PURCHASE OF BA WONDER, INNOVATION AND P 10 P 18 P 25 AUGUST-SEPTEMBER 2019 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 12 • ISSUE 4 SUCCESS Cover: WWW.SPSAIRBUZ.COM ANAIRBUZ EXCLUSIVE M A G A ZINE ON C IVIL AVIA TION FROM I NDI A What started as an aircraft EMBRAER @ 50 YEARS OF WONDER, INNOVATION & SUCCESS PAGE 14 Embraer Profit Hunter From turboprop to eVTOL, the five manufacturer to cater to the E195-E2 TechLion at PAS 2019 decades of Embraer’s journey have aviation needs of Brazil 50 years been nothing short of a fascinating ago, is the third-largest aircraft transformation manufacturer in the world today. -

Before the Us Department Of

BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION FEDERAL AVIATION ADMINISTRATION WASHINGTON DC _________________________________________________________ ) ) NOTICE OF PETITION FOR WAIVER ) AND SOLICITATION OF COMMENTS ) Docket No. FAA20100109 GRANT OF PETITION WITH CONDITIONS ) ) ________________________________________________________ ) COMMENTS OF CONSUMER TRAVEL ALLIANCE Communications with respect to this document should be sent to: Charles Leocha, Director Consumer Travel Alliance, Inc. PO Box 15286, Washington, DC 20003 Tel. 202‐713‐9596 Email: [email protected] The Consumer Travel Alliance (CTA) is a nonprofit, nonpartisan organization that works to provide an articulate and reasoned voice in decisions that affect travel consumers across travel’s entire spectrum. CTA’s staff gathers facts, analyzes issues, and disseminates that information to the public, the travel industry, regulators and policy makers. CTA was founded in January 2009 by longtime travel journalists Charles Leocha, former MSNBC travel guru and author of Travel Rights, and Christopher Elliott, ombudsman for National Geographic Traveler and author of travel columns for Tribune Syndicates, MSNBC.com and the Washington Post syndicate. Introduction Delta Air Lines, Inc. (Delta) and US Airways, Inc. (US Airways) have petitioned the Department of Transportation for permission to swap slots between La Guardia Airport (LGA) and Ronald Reagan Washington National Airport (DCA). CTA submits these comments in response to the July 28, 2011 Notice issued by the Department of Transportation (DOT) soliciting comments on a “Petition for Waiver” from Delta Air Lines and US Airways (“Joint Applicants”) to consummate a proposed transfer of a total of 349 slots at New York LaGuardia Airport (LGA) and Ronald Reagan Washington National Airport (DCA) (“Slot Swap # 2”). -

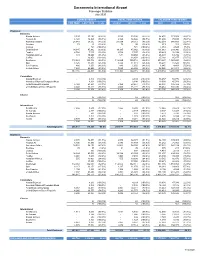

Sacramento International Airport Airline Passenger Statistics July 2011

Sacramento International Airport Airline Passenger Statistics July 2011 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % + / ( - ) 2011/12 2010/11 % + / ( - ) 2011 2010 % + / ( - ) Enplaned Domestic Alaska Airlines 25,451 25,519 (0.3%) 25,451 25,519 (0.3%) 137,442 123,342 11.4% American Airlines 21,359 16,593 28.7% 21,359 16,593 28.7% 125,549 107,297 17.0% Continental Airlines 13,524 14,658 (7.7%) 13,524 14,658 (7.7%) 91,916 94,379 (2.6%) Delta Airlines 34,719 36,317 (4.4%) 34,719 36,317 (4.4%) 165,845 184,669 (10.2%) Frontier Airlines 14,565 15,931 (8.6%) 14,565 15,931 (8.6%) 75,597 84,949 (11.0%) Hawaiian Airlines 7,573 7,536 0.5% 7,573 7,536 0.5% 50,427 49,307 2.3% Horizon Air 11,316 13,753 (17.7%) 11,316 13,753 (17.7%) 69,346 81,296 (14.7%) Jet Blue 11,909 10,453 13.9% 11,909 10,453 13.9% 67,313 64,002 5.2% Mesa/US Airways Express/YV - 753 (100.0%) - 753 (100.0%) 3,472 2,821 23.1% Skywest/Delta Connection 11,149 5,818 91.6% 11,149 5,818 91.6% 57,907 31,982 81.1% Skywest/United Express 13,461 15,635 (13.9%) 13,461 15,635 (13.9%) 97,706 107,786 (9.4%) Southwest 192,922 205,786 (6.3%) 192,922 205,786 (6.3%) 1,328,959 1,380,693 (3.7%) United Airlines 28,903 29,249 (1.2%) 28,903 29,249 (1.2%) 171,877 173,518 (0.9%) US Airways 25,959 25,755 0.8% 25,959 25,755 0.8% 129,707 129,309 0.3% CHARTER - - - - - - 412,810 423,756 (2.6%) 412,810 423,756 (2.6%) 2,573,063 2,615,350 (1.6%) International AeroMexico 1,583 - 1,583 - 1,583 - Alaska Airlines 1,665 - 1,665 - 12,220 - Mexicana - 5,303 (100.0%) - 5,303 (100.0%) - -

Federal Register/Vol. 72, No. 223/Tuesday, November 20, 2007

Federal Register / Vol. 72, No. 223 / Tuesday, November 20, 2007 / Proposed Rules 65237 with Indian Tribal Governments’’). F. Unfunded Mandates Reform Act • Fax: (202) 493–2251. Because none of the options on which The Department has determined that Instructions: You must include the we are seeking comment would the requirements of Title II of the agency name and docket number DOT– significantly or uniquely affect the Unfunded Mandates Reform Act of 1995 OST–01–9325 or the Regulatory communities of the Indian tribal do not apply to this notice. Identification Number (RIN) for the governments or impose substantial rulemaking at the beginning of your direct compliance costs on them, the Issued this 15th day of November, 2007, at comment. All comments received will Washington, DC. funding and consultation requirements be posted without change to http:// of Executive Order 13084 do not apply. Michael W. Reynolds, www.regulations.gov, including any Deputy Assistant Secretary for Aviation and personal information provided. D. Regulatory Flexibility Act International Affairs. Privacy Act: Anyone is able to search [FR Doc. 07–5760 Filed 11–15–07; 4:15 pm] The Regulatory Flexibility Act (5 the electronic form of all comments BILLING CODE 4910–13–P U.S.C. 601 et seq.) requires an agency to received in any of our dockets by the review regulations to assess their impact name of the individual submitting the comment (or signing the comment, if on small entities unless the agency DEPARTMENT OF TRANSPORTATION submitted on behalf of an association, determines that a rule is not expected to business, labor union, etc.). -

News Release

Contacts: SJC - Rosemary Barnes 408-392-1199 / [email protected] Alaska Airlines – Media Relations 206-304-0008 / [email protected] April 4, 2018 NEWS RELEASE New Daytime, Nonstop Service to New York’s JFK on Alaska Airlines from Silicon Valley’s Airport -- No. 1 Requested Domestic Market by Silicon Valley Travelers; Daily, Daytime Nonstop Flight Begins July 6, 2018 -- San José, Calif. – Alaska Airlines today announced plans to begin daily, nonstop service to New York’s John F. Kennedy Airport (JFK) from Mineta San José International Airport (SJC) beginning July 6, 2018. The new service is significant as it marks the first daytime nonstop flight from SJC to JFK, the No. 1 requested domestic market by Silicon Valley travelers. Tickets are on sale now at www.alaskaair.com. Silicon Valley business and leisure travelers will love the addition of a direct, daytime flight to New York,” said San José Mayor Sam Liccardo. “I thank CEO Brad Tilden and his team at Alaska Airlines for launching this new nonstop service to New York-JFK, and for continuing to invest in destinations that are a high priority for our travelers.” Alaska will operate the daily service using modern Airbus A320 aircraft as follows: City Pair Departs Arrives San José – New York/JFK 7:05 a.m. 3:43 p.m. New York/JFK – San José 4:45 p.m. 8:23 p.m. Times are local. Average flight time is 6 hours. “We continue to add exciting new destinations from San Jose, providing our valued guests more nonstop options to meet their business and leisure needs,” said John Kirby, Alaska’s vice president of capacity planning. -

Adaptive Connected.Xlsx

Sacramento International Airport Passenger Statistics July 2020 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % +/(-) 2020/21 2019/20 % +/(-) 2020 2019 % +/(-) Enplaned Domestic Alaska Airlines 3,593 33,186 (89.2%) 3,593 33,186 (89.2%) 54,432 173,858 (68.7%) Horizon Air 6,120 14,826 (58.7%) 6,120 14,826 (58.7%) 31,298 75,723 (58.7%) American Airlines 28,089 54,512 (48.5%) 28,089 54,512 (48.5%) 162,319 348,689 (53.4%) Boutique 79 95 (16.8%) 79 95 (16.8%) 613 201 205.0% Contour - 721 (100.0%) - 721 (100.0%) 4,461 2,528 76.5% Delta Airlines 14,185 45,962 (69.1%) 14,185 45,962 (69.1%) 111,063 233,946 (52.5%) Frontier 4,768 7,107 (32.9%) 4,768 7,107 (32.9%) 25,423 38,194 (33.4%) Hawaiian Airlines 531 10,660 (95.0%) 531 10,660 (95.0%) 26,393 64,786 (59.3%) Jet Blue - 16,858 (100.0%) - 16,858 (100.0%) 25,168 85,877 (70.7%) Southwest 112,869 300,716 (62.5%) 112,869 300,716 (62.5%) 899,647 1,963,253 (54.2%) Spirit 8,425 11,318 (25.6%) 8,425 11,318 (25.6%) 38,294 15,526 146.6% Sun Country 886 1,650 (46.3%) 886 1,650 (46.3%) 1,945 4,401 (55.8%) United Airlines 7,620 46,405 (83.6%) 7,620 46,405 (83.6%) 98,028 281,911 (65.2%) 187,165 544,016 (65.6%) 187,165 544,016 (65.6%) 1,479,084 3,288,893 (55.0%) Commuters Alaska/Skywest - 4,304 (100.0%) - 4,304 (100.0%) 36,457 50,776 (28.2%) American/Skywest/Compass/Mesa - 8,198 (100.0%) - 8,198 (100.0%) 18,030 45,781 (60.6%) Delta/Skywest/Compass 5,168 23,651 (78.1%) 5,168 23,651 (78.1%) 62,894 146,422 (57.0%) United/Skywest/GoJet/Republic 4,040 16,221 (75.1%) 4,040 16,221 (75.1%) -

Air Travel Consumer Report

Air Travel Consumer Report A Product Of THE OFFICE OF AVIATION CONSUMER PROTECTION Issued: August 2021 Flight Delays1 June 2021 January - June 2021 Mishandled Baggage, Wheelchairs, and Scooters 1 June 2021 January -June 2021 Oversales1 2nd Quarter 2021 Consumer Complaints2 June 2021 (Includes Disability and January - June 2021 Discrimination Complaints) Airline Animal Incident Reports4 June 2021 Customer Service Reports to 3 the Dept. of Homeland Security June 2021 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov 2 Data compiled by the Office of Aviation Consumer Protection. Website: http://www.transportation.gov/airconsumer 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Office of Aviation Consumer Protection. TABLE OF CONTENTS Section Page Section Page Flight Delays Flight Delays (continued) Introduction 3 Table 8 35 Explanation 4 List of Regularly Scheduled Domestic Flights with Tarmac Delays Over 3 Hours, By Marketing/Operating Carrier Branded Codeshare Partners 5 Table 8A Table 1 6 List of Regularly Scheduled International Flights with 36 Overall Percentage of Reported Flight Tarmac Delays Over 4 Hours, By Marketing/Operating Carrier Operations Arriving On-Time, by Reporting Marketing Carrier Appendix 37 Table 1A 7 Mishandled Baggage Overall Percentage of Reported Flight Ranking- by Marketing Carrier (Monthly) 39 Operations Arriving On-Time, by Reporting Operating Carrier Ranking- by Marketing Carrier (YTD) 40 Table 1B 8 -

A Conceptual Design of a Short Takeoff and Landing Regional Jet Airliner

A Conceptual Design of a Short Takeoff and Landing Regional Jet Airliner Andrew S. Hahn 1 NASA Langley Research Center, Hampton, VA, 23681 Most jet airliner conceptual designs adhere to conventional takeoff and landing performance. Given this predominance, takeoff and landing performance has not been critical, since it has not been an active constraint in the design. Given that the demand for air travel is projected to increase dramatically, there is interest in operational concepts, such as Metroplex operations that seek to unload the major hub airports by using underutilized surrounding regional airports, as well as using underutilized runways at the major hub airports. Both of these operations require shorter takeoff and landing performance than is currently available for airliners of approximately 100-passenger capacity. This study examines the issues of modeling performance in this now critical flight regime as well as the impact of progressively reducing takeoff and landing field length requirements on the aircraft’s characteristics. Nomenclature CTOL = conventional takeoff and landing FAA = Federal Aviation Administration FAR = Federal Aviation Regulation RJ = regional jet STOL = short takeoff and landing UCD = three-dimensional Weissinger lifting line aerodynamics program I. Introduction EMAND for air travel over the next fifty to D seventy-five years has been projected to be as high as three times that of today. Given that the major airport hubs are already congested, and that the ability to increase capacity at these airports by building more full- size runways is limited, unconventional solutions are being considered to accommodate the projected increased demand. Two possible solutions being considered are: Metroplex operations, and using existing underutilized runways at the major hub airports. -

Airline Service Abandonment and Consolidation - a Chapter in the Battle Ga Ainst Subsidization Ronald D

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Southern Methodist University Journal of Air Law and Commerce Volume 32 | Issue 4 Article 2 1966 Airline Service Abandonment and Consolidation - A Chapter in the Battle ga ainst Subsidization Ronald D. Dockser Follow this and additional works at: https://scholar.smu.edu/jalc Recommended Citation Ronald D. Dockser, Airline Service Abandonment and Consolidation - A Chapter in the Battle against Subsidization, 32 J. Air L. & Com. 496 (1966) https://scholar.smu.edu/jalc/vol32/iss4/2 This Article is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in Journal of Air Law and Commerce by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. AIRLINE SERVICE ABANDONMENT AND CONSOLIDATION - A CHAPTER IN THE BATTLE AGAINST SUBSIDIZATIONt By RONALD D. DOCKSERtt CONTENTS I. INTRODUCTION II. THE CASE FOR ELIMINATING SUBSIDY A. Subsidy Cost B. Misallocation Results Of Subsidy C. CAB Present And Future Subsidy Goals III. PROPOSALS FOR FURTHER SUBSIDY REDUCTION A. Federal TransportationBill B. The Locals' Proposal C. The Competitive Solution 1. Third Level Carriers D. Summary Of Proposals IV. TRUNKLINE ROUTE ABANDONMENT A. Passenger Convenience And Community Welfare B. Elimination Of Losses C. Equipment Modernization Program D. Effect On Competing Carriers E. Transfer Of Certificate Approach F. Evaluation Of Trunkline Abandonment V. LOCAL AIRLINE ROUTE ABANDONMENT A. Use-It-Or-Lose-It 1. Unusual and Compelling Circumstances a. Isolation and Poor Surface Transportation b. -

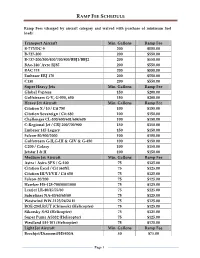

Ramp Fee Schedule

RAMP FEE SCHEDULE Ramp Fees (charged by aircraft category and waived with purchase of minimum fuel load): Transport Aircraft Min. Gallons Ramp Fee B-717/DC-9 200 $550.00 B-727-200 200 $550.00 B-737-200/300/400/700/800/BBJ1/BBJ2 200 $550.00 BAe-146/ Avro RJ85 200 $550.00 BAC 111 200 $550.00 Embraer ERJ 170 200 $550.00 C130 200 $550.00 Super Heavy Jets Min. Gallons Ramp Fee Global Express 150 $200.00 Gulfstream G-V, G-550, 650 150 $200.00 Heavy Jet Aircraft Min. Gallons Ramp Fee Citation X / 10 / Cit 750 100 $150.00 Citation Sovereign / Cit 680 100 $150.00 Challenger CL-300/600/601/604/605 100 $150.00 C-Regional Jet / CRJ 200/700/900 150 $150.00 Embraer 145 Legacy 150 $150.00 Falcon-50/900/2000 100 $150.00 Gulfstream G-II,G-III & GIV & G-450 100 $150.00 G200 / Galaxy 100 $150.00 Jetstar I & II 100 $150.00 Medium Jet Aircraft Min. Gallons Ramp Fee Astra / Astra SPX / G-100 75 $125.00 Citation Excel / Cit 560XL 75 $125.00 Citation III/VI/VII / Cit 650 75 $125.00 Falcon-20/200 75 $125.00 Hawker HS-125-700/800/1000 75 $125.00 Learjet LR-40/45/55/60 75 $125.00 Sabreliner NA-40/60/65/80 75 $125.00 Westwind WW-1123/24/24 II 75 $125.00 BOE-234LR/UT (Chinook) (Helicopter) 75 $125.00 Sikorsky S-92 (Helicopter) 75 $125.00 Super Puma AS332 (Helicopter) 75 $125.00 Westland EH-101 (Helicopter) 75 $125.00 Light Jet Aircraft Min. -

Air America in South Vietnam I – from the Days of CAT to 1969

Air America in South Vietnam I From the days of CAT to 1969 by Dr. Joe F. Leeker First published on 11 August 2008, last updated on 24 August 2015 I) At the times of CAT Since early 1951, a CAT C-47, mostly flown by James B. McGovern, was permanently based at Saigon1 to transport supplies within Vietnam for the US Special Technical and Economic Mission, and during the early fifties, American military and economic assistance to Indochina even increased. “In the fall of 1951, CAT did obtain a contract to fly in support of the Economic Aid Mission in FIC [= French Indochina]. McGovern was assigned to this duty from September 1951 to April 1953. He flew a C-47 (B-813 in the beginning) throughout FIC: Saigon, Hanoi, Phnom Penh, Vientiane, Nhatrang, Haiphong, etc., averaging about 75 hours a month. This was almost entirely overt flying.”2 CAT’s next operations in Vietnam were Squaw I and Squaw II, the missions flown out of Hanoi in support of the French garrison at Dien Bien Phu in 1953/4, using USAF C-119s painted in the colors of the French Air Force; but they are described in the file “Working in Remote Countries: CAT in New Zealand, Thailand-Burma, French Indochina, Guatemala, and Indonesia”. Between mid-May and mid-August 54, the CAT C-119s continued dropping supplies to isolated French outposts and landed loads throughout Vietnam. When the Communists incited riots throughout the country, CAT flew ammunition and other supplies from Hanoi to Saigon, and brought in tear gas from Okinawa in August.3 Between 12 and 14 June 54, CAT captain -

Global Fleet & Mro Market Forecast Summary

GLOBAL FLEET & MRO MARKET FORECAST SUMMARY 2017-2027 AUTHORS Tom Cooper, Vice President John Smiley, Senior Manager Chad Porter, Technical Specialist Chris Precourt, Technical Analyst For over a decade, Oliver Wyman has surveyed aviation and aerospace senior executives and industry influencers about key trends and challenges across the Maintenance, Repair, and Overhaul market. If you are responsible for maintenance and engineering activities at a carrier, aftermarket activities at an OEM, business operations at an MRO, or a lessor, you may want to participate in our survey. For more information, please contact our survey team at: [email protected]. To read last year’s survey, please see: http://www.oliverwyman.com/our-expertise/insights/2016/apr/mro-survey-2016.html . CONTENTS 1. EXECUTIVE SUMMARY 1 2. STATE OF THE INDUSTRY 5 Global Economic Outlook 7 Economic Drivers 11 3. FLEET FORECAST 17 In-Service Fleet Forecast 18 4. MRO MARKET FORECAST 31 Copyright © Oliver Wyman 1 EXECUTIVE SUMMARY EXECUTIVE SUMMARY Oliver Wyman’s 2017 assessment and 10-year outlook for the commercial airline transport fleet and the associated maintenance, repair, and overhaul (MRO) market marks the 17th year of supporting the industry with informed, validated industry data. This has become the most credible go-to forecast for many executives in the airline and MRO industry as well as for those with financial interests in the sector, such as private equity firms, investment banks and investment analysts. The global airline industry has made radical changes in the last few years and is producing strong financial results. While the degree of success varies among the world regions, favorable fuel prices and widespread capacity discipline are regarded as key elements in the 2016 record high in global profitability ($35.6 billion).