Euromonitor Igest

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Herbal Cosmetics, Ayurvedic Cosmetics, Herbal Beauty Products, Makeup Products, Herbs, Skin Care Cosmetics, Body Care, Hair Care

Herbal Cosmetics Ayurvedic Cosmetics, Herbal Beauty Products, Makeup Products, Herbs, Skin Care Cosmetics, Body Care, Hair Care, Skin Care, Herbal Hair Oil, Herbal Shampoo, Herbal Creams Manufacturing Plant, Formulation, Detailed Project Report, Profile, Business Plan, Industry Trends, Market Research, Survey, Manufacturing Process, Machinery, Raw Materials, Formula, Feasibility Study, Investment Opportunities, Cost and Revenue, Plant Economics, Production Schedule, Working Capital Requirement, Plant Layout, Process Flow Sheet, Cost of Project, Projected Balance Sheets, Profitability Ratios, Break Even Analysis, Formulae, Indian Herbal Cosmetic Industry Introduction Cosmetics are substances used to enhance the appearance or odor of the human body. Cosmetics include skin-care creams, lotions, powders, perfumes, lipsticks, fingernail and toe nail polish, eye and facial makeup, permanent waves, colored contact lenses, hair colors, hair sprays and gels, deodorants, baby products, bath oils, bubble baths, bath salts, butters and many other types of products. www.entrepreneurindia.co Herbal cosmetics have growing demand in the world market and are an invaluable gift of nature. There are a wide range of herbal cosmetic products to satisfy beauty regime. Adding herbs in cosmetics is very safe for our skin. Herbal cosmetics are in high demand due to the increasing interest of mankind towards them because they are more effective with nil or less side effects, easily available ingredients etc. www.entrepreneurindia.co The herbal cosmetics market has enormous potential for further growth. “The market for Herbal cosmetics products in India is expected to grow at a rapid pace over the coming decades. The market is only beginning to get populated with ayurvedic brands and it will be a while until it gets too crowded. -

Market Research Report Herbal Beauty Care Industry

MARKET RESEARCH REPORT HERBAL BEAUTY CARE INDUSTRY 1 REPORT OVERVIEW Industry Discussed – Herbal health care Focused Market– Indian affluent class Analysis focused -- Determine the industry & market potential. -- Identify prominent existence player. -- Analyze their market, product , profitability & weaknesses. -- Understand their sales, marketing & distribution strategy. Client’s objective The report was to be used to assess the market potential and viability of the high end product among the elite segments of India. MARKET RESEARCH| CONFIDENTIAL 2 CONTENTS Industry Overview 3 Industry Trends 4 Porter’s Five Forces Model 6 Market Overview 9 Growth Drivers 10 Competitive Analysis 11 Profit Margin Analysis 15 • Shahnaz Husain 15 • Kaya 16 • Kama Ayurveda 17 Competitor’s Weaknesses 19 Category-Wise Price Comparison 22 • Body care Products 22 • Facial Care Products 23 • Hair Care Products 24 Our Opportunities & Recommendation 25 Mistakes to Avoid 26 MARKET RESEARCH| CONFIDENTIAL 3 ₹XXX-₹XXXB Industry Size XX%-XX% Annual Growth INDUSTRY OVERVIEW With a growing economy that plans to see annual income triple by 20XX, the cosmetics market of India is full of opportunities and is a potential gold mine for many beauty and personal care companies. Experts tend to agree that the Indian market is bound to explode in a very good way. The beauty industry in India is “Cosmetics market in India growing at a break-neck is growing faster than many pace, almost twice as fast as other developing countries. that of the markets in the Though organic skincare United States and Europe. market is still at a nascent stage in India, the growth According to the recent and penetration in this report by FCCI, the overall segment is very Indian beauty market is remarkable.” currently pegged at ₹XXX- -Aditi Vyas, ₹XXX billion and is growing at Founder & Director, the rate of XX%-XX% per Azafran Innovacion Ltd. -

BW Confidential Team At

www.bwconfidential.com The inside view on the international beauty industry October 20 - November 2, 2016 #137 CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL Comment Inside The buzz 2 The price of growth News roundup his week saw Coty make another acquisition, with the Netwatch 6 Tproposed purchase of hairstyling appliance brand ghd for $510m. The move was somewhat surprising, as it came just a Social media monitor few weeks after Coty closed the deal to take over P&G’s beauty brands. It was thought that Coty would take time to digest this Interview 7 deal (and also the acquisition of Brazil-based Hypermarcas, which Shiseido EMEA chief brand officer it made at the end of 2015) before moving on to its next target. for fragrance & president of The fact that the acquisition was in the professional haircare Fragrance Center of Excellence arena also raised some eyebrows. Ghd may sit well with Wella, Nathalie Helloin-Kamel which Coty took over as part of the P&G deal, but analysts insist that the US-based group has much to learn when it comes to the professional haircare Insight 9 segment, which is very different to fragrance and cosmetics. India What isn’t surprising, however, is that M&A continues apace. More M&A is set to be driven by an active start-up market, major groups looking to pick up the hottest new Show review 12 brand before their competitors do, the need for global groups to reinforce their presence Luxe Pack Monaco in key areas such as digital and among the millennials and also because some of the multinationals’ brands are not seeing the growth that they used to. -

Inception Report

To Study the Cultivation /Collection Practices and Market Analysis of Ashwagandha, Aloe-vera and Aonla in the State of Telangana @2020 Research Team Dr. Sattram Singh, Principal Investigator Ms. Dyuti De, Consultant July, 2020 Printed at: Tituprint F-58, Malviya Industrial Area, Jaipur, Rajasthan-302017. Prepared By: CCS NATIONAL INSTITUTE OF AGRICULTURAL MARKETING (An Autonomous Organization of Ministry of Agriculture and Farmers’ Welfare, Government of India) Kota Raod, Bambala, Pratap Nagar, Jaipur-302033, Rajasthan www.ccsniam.gov.in ACKNOWLEDGEMENTS The idea of conducting the present study entitled “To Study the Cultivation /Collection Practices and Market Analysis of Ashwagandha, Aloe-vera and Aonla in the State of Telangana” coined in the Annual Board Meeting held in the NMPB office at New Delhi in the month of August, 2017. The meeting chaired by Ms. Shomita Biswas, IFS, the then Chief Executive Officer, NMPB and Ms. Irina Garg, IRS, the then Director General, CCS NIAM and undersigned attended the meeting to explore the opportunity for consultancy project. The representative of others states were also attended the meeting. In consequence of the discussion in the meeting the proposal for conducting the present study coined by Ms. Sonibala Akoijam, IFS, CEO Telangana Medicinal Plants Board. After that a research outline emerged through a discussion with respective state. On behalf of CCS NIAM, I would like to thank Dr. P. Chandra Shekara, Director General, CCS NIAM for constant help and encouragement time to time during the study and also provide all kind of freedom in conducting the study and continuous support to bring the study to a logical conclusion. -

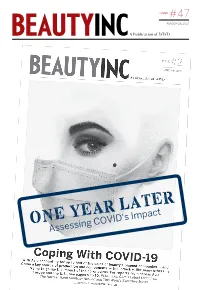

Assessing COVID's Impact

ISSUE #47 MARCH 26, 2021 A Publication of WWD ONEAssessing YEAR COVID's LATER Impact THE BUZZ 2 MARCH 26, 2021 Beauty Bulletin SK-II will release as “leftover” in Chinese culture. eight original The company's #ChangeDestiny films through its newly formed campaigns over the years also include By the SK-II Studio. “The Expiry Date,” “Meet Me Halfway” and its “Timelines” docuseries, Numbers: created in partnership with Katie Couric. Trendalytics' “All of these stories have been about the limitations that society has placed Top 10 on women, forcing them to make choices that they don't necessarily Beauty want to make,” Seth said. “We felt the need to make this brand purpose Trends much more integral. Over the last year, Data from Trendalytics across the world, a lot of unfortunate points to a return to things have been said and done. We normalcy by summer. felt that SK-II needs to take a stronger stance and have a point of view and be BY JAMES MANSO that force for good.” CONSUMERS ARE getting ready Along with its studio, SK-II has set to show their faces to the outside up a #ChangeDestiny fund, to which it world — masked or otherwise. will contribute $1 per view of its films. Trendalytics' top March trends Total contributions will be capped at point to the masses anticipating $500,000, with proceeds benefiting a return to normalcy, perhaps organizations with which SK-II has a by this summer. relationship. “People are trying to prepare Asked for the company's stance themselves for the fact that on the rise in global anti-Asian hate they’ll have to be appropriate for SK-II to Release Original Films crimes since the onset of COVID-19, human consumption sometime YoeGin Chang, SK-II Global's senior soon,” said Cece Lee Arnold, chief executive officer of Trendalytics. -

Frequently Asked Questions

Frequently Asked Questions What Types of Companies Are on the "Don't Test" List? This list includes companies that make cosmetics, personal-care products, household-cleaning products, and other common household products. All companies that are included on PETA's "don't test" list have signed our statement of assurance verifying that they and their ingredient suppliers don't conduct, commission, pay for, or allow any tests on animals for ingredients, formulations, or finished products anywhere in the world and will not do so in the future. We encourage consumers to support the companies on this list, since we know that they're committed to making products without harming animals. Companies on the "Do Test" list should be shunned until they implement a policy that prohibits animal testing. The "do test" list doesn't include companies that manufacture only products that are required by law to be tested on animals (e.g., pharmaceuticals and garden chemicals). Although PETA is opposed to all animal testing, our focus in those instances is less on the individual companies and more on the regulatory agencies that require animal testing. How Does a Company Get on PETA's Global Animal Test–Free List? In order to be listed as animal test–free by PETA's Beauty Without Bunnies program, a company or brand must submit a legally binding statement of assurance signed by its CEO verifying that it and its ingredient suppliers don't conduct, commission, pay for, or allow any tests on animals for ingredients, formulations, or finished products anywhere in the world and won't do so in the future. -

1 Kaya Limited Q2 FY21 Earnings Conference Call

Kaya Limited Q2 FY21 Earnings Conference Call - Moderator - During the conference, please signal an operator by pressing ‘*’ and then ‘0’ on your touchtone telephone. Please note that this conference is being recorded. I now hand the conference over to Mr. Jinesh Joshi from Prabhudas Lilladher. Thank you and over to you sir. - Mr. Jinesh Joshi – Prabhudas Lilladher Private Limited - Good morning everyone. On behalf of Prabhudas Lilladher, I welcome you all to the Q2 FY 21 Earnings Call of Kaya Limited. We have with us the management represented by Mr. Rajiv Nair – CEO, Kaya Group, Mr. Vikas Agarwal – CEO, Kaya Middle East and Mr. Saurabh Shah – CFO. I would now like to handover the call to management for opening remarks and after that we can open the floor for Q&A. Thank you and over to you sir. Mr. Saurabh Shah – CFO, Kaya Group - Hi, good morning everybody. I welcome you all to the conference call on our company’s behalf. Let me begin the conference call with a very short update on the Q2 performance of Kaya Limited which is already in public domain and uploaded on our website www.kaya.in. Kaya Limited posted consolidated revenue from operation of Rs. 74 crores for the quarter ended 30th September 2020, a decline of 27% over the corresponding quarter ended 30th September 2019. Consolidated EBITDA is Rs. 14.6 crore as compared to Rs. 14.6 crores in Q2 FY20 which is same. Loss after tax and minority interest for the quarter 30th September 2020 is Rs. 4.3 crores compared to loss of Rs. -

Frequently Asked Questions

Frequently Asked Questions What types of companies are on the "Don't Test" list? The list includes companies that make cosmetics, personal-care products, household-cleaning products, and other common household products. In the U.S., no law requires that these types of products be tested on animals, and companies can choose not to sell their products in countries such as China, where tests on animals are required for cosmetics and other products. Companies on this list should be supported for their commitment to manufacturing products without harming any animals. Companies that aren't on this list should be boycotted until they implement a policy that prohibits animal testing. The list does not include companies that manufacture only products that are required by law to be tested on animals (e.g., pharmaceuticals and garden chemicals). Although PETA is opposed to all animal testing, our quarrel in those instances is less with the individual companies and more with the regulatory agencies that require animal testing. Nonetheless, it is important to let companies know that it is their responsibility to convince the regulatory agencies that there are better ways to determine product safety. All companies that are included on PETA's cruelty-free list have signed PETA's statement of assurance or submitted a statement verifying that neither they nor their ingredient suppliers conduct, commission, or pay for any tests on animals for ingredients, formulations, or finished products. How does a company get on the list? Company representatives interested in having their company's name added to our cruelty-free list(s) must complete a short questionnaire and sign a statement of assurance verifying that they do not conduct, commission, or pay for any tests on animals for ingredients, formulations, or finished products and that they pledge not to do so in the future. -

BW Confidential Will Be Taking a Break for the Summer

www.bwconfidential.com The inside view on the international beauty industry July 10-August 27, 2014 #96 CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL Comment Inside The buzz 2 Retail on fire News roundup obile shopping strategies are likely to get a little Netwatch 6 Mmore serious now that Amazon has launched its own smartphone. The e-commerce giant’s Fire Beauty blogger review Phone is described as more of a shopping tool than a communication device, as it can recognize thousands Interview 7 of products and enable users to immediately buy them Givaudan fragrance division from Amazon’s website. The phone’s dedicated button president Michael Carlos for making a purchase means that shoppers have more opportunities to shop and shop more easily and Insight 9 can compare prices and buy an item that costs less India on Amazon. This is likely to send shivers down the spine of most competing retailers, but could be a major opportunity for brands to sell more if they agree to Show review cooperate with Amazon. World Perfumery Congress 12 Amazon practically invented e-commerce, transforming (and in some cases MakeUp in Paris 14 destroying) a string of industries from book selling to electronics retail in the process. Its new phone could very well usher in another new chapter in retailing. Store visit 16 It’s unlikely that beauty will remain untouched by the online retailer’s ever- ArtDeco, Paris growing influence for long. Industry players may have to decide sooner than they thought whether they can beat Amazon with their own strategies or whether they will end up having to join them. -

Secret Sources of Hundreds of Vegan, Vegetarian, and Cruelty-Free Products

Secret Sources of Hundreds of Vegan, Vegetarian, and Cruelty-Free Products Editor: Chad Kimball Secret Sources of Vegetarian, Vegan, and Cruelty-Free Products Table Of Contents Table of Contents ……………………………………2 Introduction: Finding 100% Vegan, Vegetarian, …………………………………….3 and Cruelty-Free Products Chapter 1: 196 Vegan and Vegetarian Food Manufacturers ………….…………………………4 Chapter 2: 511 Companies that Don't Test on Animals …………………………………..32 Chapter 3: 44 Companies that Test on Animals …………………………………..52 Chapter 4: Password Protected Resource: Online Vegan and …………………………………..55 Vegetarian Databases Copyright 2004 Chad Kimball 2 Secret Sources of Vegetarian, Vegan, and Cruelty-Free Products Introduction: Finding 100% Vegan, Vegetarian, and Cruelty-Free Products In a recent survey that we completed of vegetarians and vegans, 38% said their biggest frustration as a vegetarian or vegan was finding vegetarian and vegan foods, restaurants, and products. We have devoted much energy to helping vegetarians and vegans solve this problem in our various books. We've compiled glossaries of animal-derived additives and hidden ingredients. We've created lists of vegan products and alcoholic drinks. We've published reports on how to distinguish vegetarian and vegan products from non-vegetarian or non-vegan products. However, many vegans and vegetarians have found that hidden animal ingredients inevitably sneak in to the "animal-free" diet, despite their painstaking efforts. How can a vegetarian or vegan successfully eliminate animal products and animal cruelty from their shopping? It sometimes seems impossible, given the complexities of food and cosmetics manufacturing, the cryptic nature of ingredient labels, and the numerous ways that animal ingredients have infiltrated our world. There is a way! The simplest, surest way to pursue a 100% vegan or vegetarian lifestyle is to purchase products from companies and distributors that cater specifically to vegan and vegetarian interests. -

A Study of Skin Care Cosmetic Products

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 23, Issue 6. Ser. VII (June 2021), PP 37-43 www.iosrjournals.org Brand Journey from Awareness To Loyalty –A Study Of Skin Care Cosmetic Products BRAND JOURNEY FROM AWARENESS TO LOYALTY – A STUDY OF SKIN CARE COSMETIC PRODUCTS M.JYOTHI Research scholar and Asst Prof in Vasavi college of Engineering Prof. H.VENKATESWARLU (Retd), Research supervisor Dept. of Commerce, Osmania University, Hyderabad. Abstract: The present research paper attempts to analyze the journey of a product from brand awareness to brand loyalty in the cosmetic industry. Cosmetic industry is one of the fastest growing industries in the Indian market and is valued at around 6.5 billion USD in 2018-19. The cosmetic industry is racing with enormous growth potential. The projected growth of the industry by the year 2025 is expected as 22 percent. It is of relevance to note that almost 22 percent of the consumer packaged goods is from the beauty industry and the growth of the industry is almost double than the gowth in US and Europe. Awareness about the existence of a brand in the market is a prerequisite for the brand to move into the purchase decision making process. The brand selected as per the considerations of each individual will be purchased and if the brand meets the expectations of the individuals, they continue to buy the brand contributing to the loyal base. Brand awareness and brand loyalty in skin care are considered for the study as and skin care segment is the leader in the cosmetic industry. -

Forest Essentials

Forest Essentials https://www.indiamart.com/forest-essentials/ Manufacturer of hotel supplies like soaps, massage oils and all kinds of natural beauty products. About Us We have emerged as one of the leading exporters of an extensive range of herbal body care products. The products we offer are ideal for skin care as well as for veterinary and anti-bacterial purposes. These are formulated using natural ingredients, which are procured from leading vendors of the country. We further ensure that the products are processed under hygienic conditions as per the specifications of our clients. For more information, please visit https://www.indiamart.com/forest-essentials/aboutus.html VATA FACIAL CARE P r o d u c t s & S e r v i c e s Sandalwood & Saffron Night Facial Toner Panchpushp Treatment Cream Madhulika Nourishing Honey Facial Treatment Masque Lep VATA BODY CARE P r o d u c t s & S e r v i c e s Ayurvedic Body Massage Oil Body Polisher Cane Sugar & Narayana Tamarind Velvet Silk Body Cream Velvet Silk Body Cream Vitamin E CONCERN BODY CARE MOISTURE & REPLENISHING P r o d u c t s & S e r v i c e s Moisture Replenishing Bath & Moisture Drenching Hand & Shower Oil Body Lotion Saffron Infused Milk Butter Body Polisher Hydrating Sea Soap Salt Crystal Rose PITTA BODY CARE P r o d u c t s & S e r v i c e s Velvet Silk Body Cream Velvet Silk Body Cream Luxury Sugar Soap Green Tea & Oudh Body Mist PITTA FACIAL CARE P r o d u c t s & S e r v i c e s Soundarya Facial Ubtan Madhulika Nourishing Honey Lep Facial Toner Pure Rosewater Facial Tonic Mist