Corporate Governance Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

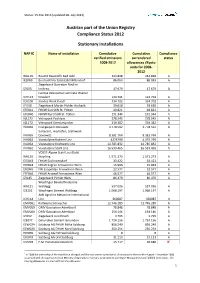

Austrian Part of the Union Registry Compliance Status 2012 Stationary

Status: 15 Mai 2013 (updated 28. July 2014) Austrian part of the Union Registry Compliance Status 2012 Stationary installations NAP ID Name of installation Cumulative Cumulative Compliance verified emissions surrendered status 2008-2012 allowances /Kyoto units for 2008- 2012 IKA119 Baumit Baustoffe Bad Ischl 244.848 244.848 A IES069 Breitenfelder Edelstahl Mitterdorf 86.063 86.063 A Ziegelwerk Danreiter Ried im IZI155 Innkreis 17.679 17.679 A Isomax Dekorative Laminate Wiener ICH113 Neudorf 124.701 124.701 A ICH106 Sandoz Werk Kundl 334.702 334.702 A IZI150 Ziegelwerk Martin Pichler Aschach 39.650 39.650 A EFE041 FHKW Süd StW St. Pölten 40.821 40.821 A EFE040 FHKW Nord StW St. Pölten 191.344 191.344 A IGL173 Vetropack Pöchlarn 278.545 278.545 A IGL172 Vetropack Kremsmünster 339.382 339.382 A IVA066 Energiepark Donawitz 4.778.592 4.778.592 A Sinteranl., Hochöfen, Stahlwerk IVA065 Donawitz 8.381.769 8.381.769 A IVA063 Voestalpine Kokerei Linz 4325299 4.325.299 A IVA064 Voestalpine Kraftwerk Linz 14.785.832 14.785.832 A IVA062 Voestalpine Stahl Linz 16.533.465 16.533.465 A VOEST-Alpine Stahl Linz (Kalk) IKA120 Steyrling 1.571.273 1.571.273 A EFE043 FHKW Süd Inzersdorf 33.422 33.422 A EFE044 FHKW Kagran Fernwärme Wien 15.993 15.993 A EFE045 FW Leopoldau Fernwärme Wien 22.577 22.577 A EFE046 FHKW Arsenal Fernwärme Wien 46.577 46.577 A IZI145 Ziegelwerk Pichler Wels 86.470 86.470 A Wopfinger Baustoffindustrie IKA121 Waldegg 537.026 537.026 A IZE202 Wopfinger Zement Waldegg 1.068.197 1.068.197 A AMI Agrolinz Melamine International ICH114 Linz 360087 360087 A EMV061 Raffinerie Schwechat 12.746.289 12.746.289 A EMV059 OMV Gasstation Aderklaa II 78.848 78.848 A EMV060 OMV Gasstation Aderklaa I 154.146 154.146 A IZI152 Ziegelwerk Lizzi Erlach 3.795 3.795 A IZE077 Gmundner Zement Gmunden 1.724.156 1.724.156 A EEW024 SalzBurg AG FHKW Mitte SalzBurg 856.240 856.240 A EEW025 SalzBurg AG FHKW Nord SalzBurg 250.254 250.254 A EFE035 SalzBurg AG HW Süd SalzBurg 0 0 A EFE049 SalzBurg AG LKH SalzBurg 31.113 31.113 A ICH203 F.M. -

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik Der ATX Konzerne Mit Stand 2

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik der ATX Konzerne mit Stand 2. April 2020 Ein erster Blick in die Dividendensaison 2020 Im Rahmen dieser Schnelluntersuchung analysiert die Abteilung Betriebswirtschaft der AK-Wien die Dividenden- politik der großen, im Austrian Trade Index notierten, Konzerne. Zum Untersuchungszeitpunkt waren folgende Unternehmen im ATX notiert: Andritz AG, AT&S Austria Technologie & Systemtechnik AG, BAWAG Group AG, CA Immobilien Anlagen AG, DO&CO AG, Erste Group Bank AG, Immofinanz AG, Lenzing AG, Mayr-Melnhof Karton AG, Österreichische Post AG, OMV AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S Immo AG, Telekom Austria AG, Uniqa Insurance Group AG, Verbund AG, Vienna Insurance Group AG, Voestalpine AG und Wiener- berger AG Zum Auswertungszeitpunkt, mit Stand 2. April 2020, lagen von 13 Unternehmen die vollständigen Konzernab- schlüsse (Andritz AG, BAWAG Group AG, Erste Group Bank AG, CA Immobilien Anlagen AG, Lenzing AG, OMV AG, Österreichische Post AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S-Immo AG, Telekom Austria AG, Verbund AG Wienerberger AG) vor. Von weiteren 3 Unternehmen lagen die vorläufigen Zahlen (Mayr-Melnhof Karton AG, Uniqa Insurance Group AG und Vienna Insurance Group AG) vor. Es können daher mit Stand 2. April 2020 verlässliche Aussagen zu 80 % der ATX Konzerne getätigt werden. Rekordgewinne – zwei Drittel der Unternehmen konnten ihre Ergebnisse verbessern Das abgelaufene Wirtschaftsjahr 2019 bescherte den ATX-Unternehmen nach dem Vorjahr erneut Rekordge- winne. Konkret stieg das kumulierte, den AktionärInnen zurechenbare Ergebnis der 16 ATX Konzerne um 3,9 % auf 7,75 Milliarden Euro. Das zweite Jahr in Folge fuhren alle untersuchten Unternehmen einen Konzernüber- schuss ein. -

GREEN FINANCING FRAMEWORK Green Financing Framework

March 2021 GREEN FINANCING FRAMEWORK Green Financing Framework Table of contents Introduction 2 Strategy and Rationale 3 Commitment to the Sustainable Development Goals 6 Environmental and Social Risk Management 7 Alignment with Voluntary Market Standards 9 Green Bond Principles 9 Use of Proceeds 9 Process for Project Evaluation and Selection 10 Management of Proceeds 11 Reporting 11 External Review 12 Sustainability-Linked Bond Principles 12 Selection of Key Performance Indicators (KPIs) 13 Calibration of Sustainability Performance Targets (SPTs) 16 Bond characteristics 20 Reporting 21 Verification 21 Annex I – Impact Reporting 23 Disclaimer 25 1 Green Financing Framework Introduction VERBUND’s mission is to energise the future with clean electricity from our renewable energy plants and innovative solutions. VERBUND is Austria’s largest utility company. VERBUND’s value chain comprises the generation, transportation, trading and sale of electrical energy and other energy sources as well as the provision of energy services. In 2020, the Group generated annual revenue of around €3.2bn with approximately 2,870 employees. VERBUND has been listed on the Vienna Stock Exchange since 1988, with 51% of the share capital held by the Republic of Austria. 2 Green Financing Framework Strategy and Rationale VERBUND’s 2030 strategy is based on five strategic pillars: efficient generation of electricity from hydropower; expansion of electricity generation from renewable energy sources such as wind and solar power; sustainable expansion and safe operation of the Austrian high-voltage grid; use of the flexible power plants to maintain security of supply in Austria; and the Sales segment, with provision of customer-centric, innovative products and services. -

Hydro News Issue 33

№33 INTELLIGENT NEWS MONITORING Cover Story Page 16 Grand Coulee USA Page 12 Country Report New Zealand Page 24 Magazine of ANDRITZ Hydro // №33 / 12-2019 №33 ANDRITZ Hydro Magazine of // Reventazón Costa Rica ENGLISH Page 34 HYDRO PASSION FOR HYDRO All employees at ANDRITZ share the same core values that define how we act and what we stand for. We love what we do. Our ability to get the best out of ourselves and our technology is what makes us stand out. Times and technologies change, but our passion is always there. №33 / 2019 HYDRONEWS 3 Solving the challenges of the hydropower market Dear Business Friends, The energy market – and the hydropower indus- try especially – is facing many challenges with the growing demand for “base load renewables” and aging of much of the existing hydropower fleet. As a result, new strategies are needed for success- ful hydro asset management and operation. One solution to reduce costs and improve operations is maintenance optimization to increase revenues. The new Metris DiOMera Platform, developed by ANDRITZ, is addressing these topics. Among recent Wolfgang Semper Harald Heber project successes are the latest orders for Metris DiOMera, coming from the PresAGHO project in South America and Cerro del Águila in Peru. At a time when baseload power generation from fossil resources has to be replaced by a carbon-free renewable energy-based alternative, large-scale energy hybrid solutions offer a vital approach for the future. Hybrid solutions combine two or more power generation technologies with at least one renewable energy source, as well as a power and energy storage system. -

Energy. Water. Life. Full Report 2018 /19 Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders

/ 19 Energy. Water. Life. Full Report 2018 /19 EVN Full Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders, The future of the global climate has domi- investments towards Lower Austria’s network nated public discussions in recent months. infrastructure. We see these investments as a EVN’s activities during the 2018/19 financial central step on the road to a climate-friendly year included the early termination of energy system because they are an indispen- coal-generated electricity production in sable requirement for protecting network Lower Austria – also against the backdrop stability in view of a further increase in volatile of the substantial increase in the price of renewable generation. CO2 emission certificates – as well as the accelerated expansion of wind power. We are also making a substantial contribution Our wind power generation capacity has in support of renewable generation: EVN, increased by roughly 100 MW to 367 MW currently the leading wind power producer in in only two financial years, which means Lower Austria, set an ambitious goal several we have reached our interim goal one year years ago to increase this capacity to 500 MW. earlier than planned. These two examples While our work is directed to meeting this alone show that we are committed to sup- goal, we are also evaluating projects for porting the future-oriented transformation large-scale photovoltaic facilities, especially at of our energy system towards renewable our own power plant locations. Here we see generation. a potential of up to 100 MW in our markets over the medium term, subject to appropriate Our long-term strategy as a listed company framework conditions. -

Annual Report Key Figures

Annual Report Key Figures Wiener Städtische (Individual Accounts) 1999/in AT S 1998/in AT S Gross Premiums Earned (in millions) 18,456 17,709 e 1,341.2 – Property & Casualty Insurance (in millions) 8,154 8,406 e 592.6 – Health Insurance (in millions) 3,260 3,201 e 236.9 – Life Insurance (in millions) 7,043 6,102 e 511.8 Combined Ratio (Property & Casualty) (in %) 105.2 102.9 Financial Results (in millions) 4,875 5,051 e 354.3 Earnings from Ordinary Activities (in millions) 435 784 e 31.6 Investments (in millions) 83,981 80,124 e 6,103.1 Underwriting Provisions (in millions) 71,806 67,305 e 5,218.3 Capital and Reserves (in millions) 10,270 10,084 e 746.3 Number of Employees 4,030 4,096 – Office Staff 1,997 2,045 – Field Staff 2,033 2,051 Number of Branch Offices 171 171 Contents Introduction 2 Wiener Städtische AG Annual Financial Statements Company Bodies 4 Balance Sheet 6 6 P rofit & Loss Account 7 2 Wiener Städtische AG Status Report Separate Income Statement for Economic Situation in 1999 9 Auto Third Party Liability Insurance 7 9 Wiener Städtische in 1999 1 2 A p p e n d i x 8 0 P ro p e rty & Casualty Insurance 1 7 A u d i t o r’s Cert i f i c a t e 9 2 Health Insurance 2 0 L i f e / P e n s i o n s 2 2 Consolidated Annual Financial Statements I n v e s t m e n t s 2 4 Balance Sheet 9 8 S t a ff/Socio-economic Issues 2 8 P rofit & Loss Account 1 0 2 C u rrent Situation and Outlook 3 1 A p p e n d i x 1 0 7 A u d i t o r’s Cert i f i c a t e 1 2 1 Supervisory Board Report 35 Contact Information 128 Group Status Report G roup Status Report 3 8 Investor Relations 131 The Group (Diagram) 4 2 Donau Ve r s i c h e ru n g 4 4 About this Publication 132 Vo l k s f ü r s o rge Jupiter 4 6 Union Ve r s i c h e ru n g 4 7 M o n t a n v e r s i c h e ru n g 4 8 CA Ve r s i c h e ru n g 5 1 K a p i t a l &We rt Ve rm ö g e n s v e rwaltung AG 5 2 Kooperativa Praha 5 4 Kooperativa Bratislava 5 5 InterRisk Wi e s b a d e n 5 6 H e ros S.A. -

Hydro News 30

SANTO ANTÔNIO An Amazonian Example of Sustainable Hydropower (page 22) 02-2017 ENGLISH HYDRONEWS No.30 MAGAZINE OF ANDRITZ HYDRO page 10 MEGATRENDS Scenarios of the Future 2 Editorial HYDRONEWS No. 30 Dear Business Friends, © iStock.com/YiuCheung Global demographic, technological and activities of ANDRITZ HYDRO world- economic megatrends – such as urbani- wide. A special highlight is the com- zation, climate change, and the rising pletion of the hydropower plant Santo de mand for electricity – will bring about Antônio in the Amazon region of Brazil, major social and political changes which has the world’s most power- over the coming decades to 2050. At ful bulb turbines installed to date. The ANDRITZ HYDRO we consider this successful commissioning of this pro- “Scenario 2050” a motivating vision – ject, which went ahead on schedule, yet finding tomorrow’s solutions today. again underscores ANDRITZ HYDRO’s high level of technical competence So far, the enormous potential of hydro - when it comes to low-head hydraulic power has not been fully exploited. In power plants. Other examples include fact, it can still make a significant con- the new contracts for electro-mechan- tribution to the redesign of global energy ical equipment and hydraulic steelwork supply on the road to sustainability. engineering for the Gouvães pumped At the moment the general conditions storage power plant in Portugal, as well in the hydropower market are very chal- as for Nam Theun I in Lao PDR, Yusufeli lenging indeed. With investment level- in Turkey, and the John Day refurbish- ling off, the market appears to be rather ment project in the USA. -

ATX Komitee Entscheidungen

ÄNDERUNGEN ÖSTERREICHISCHER INDIZES Mitteilung vom: 2.September 2020 Wirksam am: 21.September 2020 Die neuen Gewichtungsfaktoren (Repräsentationsfaktoren und Fundamentalfaktoren) wurden am 17. September 2020 nach Handelsschluss bekanntgegeben. ATX, ATX NTR, ATX TR, ATX DSTB Name ISIN Neue Aktienanzahl Neuer FFF Neuer RF Änderung IMMOFINANZ AG AT0000A21KS2 0,70 ATX Prime Name ISIN Neue Aktienanzahl Neuer FFF Neuer RF Änderung EVN AG AT0000741053 0,30 Änderung IMMOFINANZ AG AT0000A21KS2 0,70 ATX PC8, ATX PC8 NTR, ATX PC8 TR Name ISIN Neue Aktienanzahl Neuer FFF Neuer RF Änderung EVN AG AT0000741053 0,30 Änderung IMMOFINANZ AG AT0000A21KS2 0,70 Änderung ERSTE GROUP BANK AG AT0000652011 0,44 Änderung OMV AG AT0000743059 0,61 Änderung RAIFFEISEN BANK INTERNATIONAL AG AT0000606306 1,00 Änderung VERBUND AG KAT. A AT0000746409 0,87 Änderung VOESTALPINE AG AT0000937503 0,98 ATX five, ATX five NTR, ATX five TR Name ISIN Neue Aktienanzahl Neuer FFF Neuer RF Aufnahme WIENERBERGER AG AT0000831706 115.187.982 1,00 1,00 Streichung BAWAG GROUP AG AT0000BAWAG2 Änderung ERSTE GROUP BANK AG AT0000652011 1,00 Änderung OMV AG AT0000743059 0,80 ATX GP Name ISIN Neue Aktienanzahl Neuer FFF Neuer RF Aufnahme AGRANA BETEILIGUNGS-AG AT000AGRANA3 62.488.976 0,20 1,00 Änderung ANDRITZ AG AT0000730007 0,47 Änderung VOESTALPINE AG AT0000937503 0,34 1/2 ATX FND Name ISIN Neue Aktienanzahl Neuer FFF Neuer FUF Änderung IMMOFINANZ AG AT0000A21KS2 0,70 1,9327 Änderung ANDRITZ AG AT0000730007 0,6343 Änderung AT&S AUSTRIA TECH.&SYSTEMTECH. AT0000969985 3,2650 Änderung BAWAG GROUP AG AT0000BAWAG2 0,5136 Änderung CA IMMOBILIEN ANLAGEN AG AT0000641352 1,2620 Änderung DO & CO AKTIENGESELLSCHAFT AT0000818802 2,9699 Änderung ERSTE GROUP BANK AG AT0000652011 0,2706 Änderung LENZING AG AT0000644505 4,3159 Änderung MAYR-MELNHOF KARTON AG AT0000938204 1,5976 Änderung OESTERR. -

Raiffeisen Bank International AG EUR 500,000,000 Fixed to Reset Rate Additional Tier 1 Notes of 2020 with a First Reset Date On

Prospectus dated 27 July 2020 Raiffeisen Bank International AG (Vienna, Republic of Austria) EUR 500,000,000 Fixed to Reset Rate Additional Tier 1 Notes of 2020 with a First Reset Date on 15 December 2026 ISIN XS2207857421, Common Code 220785742, WKN A280C0 Issue price: 100.00 per cent. Raiffeisen Bank International AG (the "Issuer" or "RBI") will issue on 29 July 2020 (the "Issue Date") EUR 500,000,000 Fixed to Reset Rate Additional Tier 1 Notes of 2020 with a First Reset Date on 15 December 2026 (the "Notes") in the denomination of EUR 200,000 each. The Notes will bear distributions on the Current Principal Amount (as defined below) at the rate of 6.00 per cent. per annum (the "First Rate of Distributions") from and including 29 July 2020 (the "Distribution Commencement Date") to but excluding 15 December 2026 (the "First Reset Date") and thereafter at the relevant Reset Rate of Distributions from and including each Reset Date to but excluding the next following Reset Date. "Reset Date" means the First Reset Date and each 5th anniversary thereof for as long as the Notes remain outstanding. The "Reset Rate of Distributions" for each reset period will be the sum of the Reference Rate and the Margin, such sum converted from an annual basis to a semi-annual basis in accordance with market convention (both as defined in the terms and conditions of the Notes (the "Terms and Conditions")). Distributions will be scheduled to be paid semi-annually in arrear on 15 December and 15 June in each year, commencing on 15 December 2020 (first short coupon). -

STRABAG Infrastructure & Safety Solutions

Control Centre Technology STRABAG Infrastructure & Safety Solutions 02_16_STRABAG_Leitstellentechnik_ENG_r12.indd 1 11.03.16 09:21 2 STRABAG Infrastructure & Safety Solutions Control Centre Technology We set standards STRABAG Infrastructure & Safety Solutions, or SISS for short, is a 100% subsidiary of STRABAG AG that offers communication and safety solutions for public institutions, public and private transport, industry and companies in a variety of sectors. Our range of services includes everything from highly available products and systems to the installation and operation of end-to-end solutions as general contractor. Within the STRABAG Group, SISS is responsible for electro-technical infrastructure and safety solutions worldwide. In its field, the company is among the leading in Europe. Everything from a single source As general contractor for transport and tunnel technology as well as communication and safety systems, SISS goes through every step of a project hand in hand with its clients – from the needs analysis to planning and systems development all the way to installation, service and maintenance. SISS offers solutions for the control, optimisation and evaluation of the efficiency and quality of all communication and safety equipment. In every area of business, we place great importance on perfect implementation of the individual solution – from analysis of the infrastructure to on-site development, construction and systems planning up to the definition of the software. Top quality, on-time delivery, effectiveness and teamwork – these values have priority not only at SISS but also for the entire group. It is because of this that SISS counts among the leading European companies in the field of communication and safety technology. -

The Foundation for a Successful Future

The foundation for a successful Annual Report 2015 Report Annual future. Europaplatz 1a, 4020 Linz Tel. +43 (0) 732/6596-0 Fax +43 (0) 732/6596-22739 Annual Report 2015 E-Mail: [email protected] Raiffeisen Landesbank Raiffeisen Landesbank Oberösterreich Oberösterreich www.rlbooe.at www.rlbooe.at Annual Report 2015 2 Annual Report 2015 Raiffeisen Banking Group Upper Austria Raiffeisenlandesbank Oberösterreich Group General information 3 Contents General information Foreword by Heinrich Schaller _____________________________________________________________________________ 5 The Managing Board of Raiffeisenlandesbank Oberösterreich Aktiengesellschaft _________________________________ 8 Foreword by Jakob Auer __________________________________________________________________________________ 10 The Supervisory Board of Raiffeisenlandesbank Oberösterreich Aktiengesellschaft ________________________________ 12 2015 in retrospect ________________________________________________________________________________________ 26 Sustainability management and corporate social responsibility _________________________________________________ 28 Raiffeisenlandesbank Oberösterreich Aktiengesellschaft Group Group management report ________________________________________________________________________________ 44 IFRS consolidated financial statements 2015 _________________________________________________________________ 62 Raiffeisenlandesbank Oberösterreich Aktiengesellschaft Management Report 2015 of Raiffeisenlandesbank Oberösterreich Aktiengesellschaft ____________________________ -

Base Prospectus RAIFFEISEN BANK INTERNATIONAL AG EUR

This document constitutes two base prospectuses of Raiffeisen Bank International AG: (i) the base prospectus in respect of non-equity securities within the meaning of Art. 22 No. 6 (4) of the Commission Regulation (EC) No 809/2004 of 29 April 2004 (the "Commission Regulation") and (ii) the base prospectus in respect of Covered Bank Bonds (together, the "Base Prospectus" or the "Prospectus"). Base Prospectus RAIFFEISEN BANK INTERNATIONAL AG EUR 25,000,000,000 Debt Issuance Programme for the issue of Notes (as defined herein) Under the EUR 25,000,000,000 Debt Issuance Programme described in this Base Prospectus (the "Programme"), Raiffeisen Bank International AG may from time to time issue notes in bearer form (the "Bearer Notes") and Covered Bank Bonds (Fundierte Bankschuldverschreibungen) in bearer form ("Covered Bank Bonds" and together with the Bearer Notes, the "Notes"). The aggregate principal amount of Notes (issued under the Programme) outstanding will not at any time exceed EUR 25,000,000,000 (or the equivalent in other currencies). This Prospectus constitutes a prospectus as defined in Article 5.4 of Directive 2003/71/EC, as amended (the "Prospectus Directive"). Application has been made to list Notes issued under the Programme on the official list of the Luxembourg Stock Exchange, to admit Notes to trading on the Regulated Market of the Luxembourg Stock Exchange and application may be made to admit Notes on the Second Regulated Market (Geregelter Freiverkehr) of the Vienna Stock Exchange or on any other stock exchange. The Regulated Market of the Luxembourg Stock Exchange and the Second Regulated Market (Geregelter Freiverkehr) of the Vienna Stock Exchange are regulated markets for the purposes of the Markets in Financial Instruments Directive 2004/39/EEC (a "Regulated Market").