STRABAG Infrastructure & Safety Solutions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Governance Report

Corporate governance report EVN AG is a listed stock corporation under Austrian law whose Deviations from C-Rules shares are traded on the Vienna Stock Exchange. Corporate gov- EVN does not fully comply with the following C-Rules of the ACGC: ernance is therefore based on Austrian law – in particular stock corporation and capital market laws, legal regulations govern- Rule 16: The Supervisory Board did not appoint a member of the ing co-determination by employees and the company by-laws – Executive Board to serve as chairman because the Executive Board as well as the Austrian Corporate Governance Code (ACGC, see consists of only two members in line with its assigned duties and www.corporate-governance.at – and the rules of procedure for the structure of the company. In cases where the Executive Board the company’s corporate bodies. consists of only two members, voting is based on the following rules: meetings must be announced in the approved manner and both Executive Board members must be present. Resolutions must be passed unanimously and abstention from voting is not permitted. If a unanimous decision is not reached, the Executive Board must Commitment to the Austrian review and vote again on the respective point of the agenda within Corporate Governance Code ten days. The Executive Board must report to the Supervisory Board if the second round of voting does not bring a unanimous decision. Introduction A spokesman is appointed for the Executive Board even when there The Executive Board and the Supervisory Board of EVN are com- are only two members, and the rules for the direction of the meet- mitted to the principles of good corporate governance and, in this ings and the representation also apply in this case. -

STRABAG SE March 28, 2012 Hans Jörg Klingelhöfer STRABAG AG, Vienna Commercial Manager Railway Construction

www.strabag.com STRABAG SE March 28, 2012 Hans Jörg Klingelhöfer STRABAG AG, Vienna Commercial Manager Railway Construction 2 2 © STRABAG SE (2/2012) STRABAG AT A GLANCE Segments Building Construction & Transportation Special Divisions & Civil Engineering Infrastructures Concessions Housing Roads, Railways, Earthworks Tunnelling Hydraulic Engineering, Waterways, Commercial and Industrial Facilities Ground Engineering Dyking and Paving Public Buildings Landscape Architecture and Develop. Real Estate Development Production of Prefabricated Elements Large-Area Works Infrastructure Development Civil Engineering Sports & Recreational Facilities Operation/Maintenance/Marketing Bridges Protective Structures of PPP projects Power Plants Sewer Systems Environmental Technology Production of Construction Materials Property & Facility Services Bridges and Railway Construction Railway Construction International Operations, across Specialty foundation engineering Offshore wind various business units Strong brands 3 © STRABAG SE (2/2012) SUCCESS FACTORS: EXISTING COUNTRY ORGANISATIONS Highlights Overview of STRABAGs key markets Core markets #1 in Austria, Germany, Poland, Czech Republic, Slovakia and Hungary Growth markets More than 70% of group output from regions where STRABAG holds a market position among the top 3 Increased focus on Middle East, India and Asia #1 #1 Intensifying activities in niche markets (e.g. #1 Environmental Technology, etc.) #1 #2 #1 #1 Output volume by region 2010 #3 Re s t of World Re s t of -

Strabag Se Investor Presentation

STRABAG SE INVESTOR PRESENTATION JANUARY 2020 DISCLAIMER This presentation is made by STRABAG SE (the "Company") solely for identified by words such as "believes“, "expects”, "predicts”, "intends”, use at investor meetings and is furnished to you solely for your "projects”, "plans”, "estimates”, "aims”, "foresees”, "anticipates”, "targets”, information. and similar expressions. The forward-looking statements, including but not limited to assumptions, opinions and views of the Company or information This presentation speaks as of January 2020. The facts and information from third party sources, contained in this presentation are based on contained herein might be subject to revision in the future. Neither the current plans, estimates, assumptions and projections and involve delivery of this presentation nor any further discussions of the Company uncertainties and risks. Various factors could cause actual future results, with any of the recipients shall, under any circumstances, create any performance or events to differ materially from those described in these implication that there has been no change in the affairs of the Company statements. The Company does not represent or guarantee that the since such date. None of the Company or any of its parents or subsidiaries assumptions underlying such forward-looking statements are free from or any of such person's directors, officers, employees or advisors nor any errors nor do they accept any responsibility for the future accuracy of the other person (i) accepts any obligation to update any information opinions expressed in this presentation. No obligation is assumed to contained herein or to adjust it to future events or developments or (ii) update any forward-looking statements. -

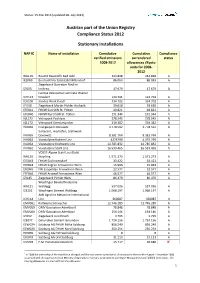

Austrian Part of the Union Registry Compliance Status 2012 Stationary

Status: 15 Mai 2013 (updated 28. July 2014) Austrian part of the Union Registry Compliance Status 2012 Stationary installations NAP ID Name of installation Cumulative Cumulative Compliance verified emissions surrendered status 2008-2012 allowances /Kyoto units for 2008- 2012 IKA119 Baumit Baustoffe Bad Ischl 244.848 244.848 A IES069 Breitenfelder Edelstahl Mitterdorf 86.063 86.063 A Ziegelwerk Danreiter Ried im IZI155 Innkreis 17.679 17.679 A Isomax Dekorative Laminate Wiener ICH113 Neudorf 124.701 124.701 A ICH106 Sandoz Werk Kundl 334.702 334.702 A IZI150 Ziegelwerk Martin Pichler Aschach 39.650 39.650 A EFE041 FHKW Süd StW St. Pölten 40.821 40.821 A EFE040 FHKW Nord StW St. Pölten 191.344 191.344 A IGL173 Vetropack Pöchlarn 278.545 278.545 A IGL172 Vetropack Kremsmünster 339.382 339.382 A IVA066 Energiepark Donawitz 4.778.592 4.778.592 A Sinteranl., Hochöfen, Stahlwerk IVA065 Donawitz 8.381.769 8.381.769 A IVA063 Voestalpine Kokerei Linz 4325299 4.325.299 A IVA064 Voestalpine Kraftwerk Linz 14.785.832 14.785.832 A IVA062 Voestalpine Stahl Linz 16.533.465 16.533.465 A VOEST-Alpine Stahl Linz (Kalk) IKA120 Steyrling 1.571.273 1.571.273 A EFE043 FHKW Süd Inzersdorf 33.422 33.422 A EFE044 FHKW Kagran Fernwärme Wien 15.993 15.993 A EFE045 FW Leopoldau Fernwärme Wien 22.577 22.577 A EFE046 FHKW Arsenal Fernwärme Wien 46.577 46.577 A IZI145 Ziegelwerk Pichler Wels 86.470 86.470 A Wopfinger Baustoffindustrie IKA121 Waldegg 537.026 537.026 A IZE202 Wopfinger Zement Waldegg 1.068.197 1.068.197 A AMI Agrolinz Melamine International ICH114 Linz 360087 360087 A EMV061 Raffinerie Schwechat 12.746.289 12.746.289 A EMV059 OMV Gasstation Aderklaa II 78.848 78.848 A EMV060 OMV Gasstation Aderklaa I 154.146 154.146 A IZI152 Ziegelwerk Lizzi Erlach 3.795 3.795 A IZE077 Gmundner Zement Gmunden 1.724.156 1.724.156 A EEW024 SalzBurg AG FHKW Mitte SalzBurg 856.240 856.240 A EEW025 SalzBurg AG FHKW Nord SalzBurg 250.254 250.254 A EFE035 SalzBurg AG HW Süd SalzBurg 0 0 A EFE049 SalzBurg AG LKH SalzBurg 31.113 31.113 A ICH203 F.M. -

Interim Report January–March 2011 31 MAY 2011 Strabag SE Interim Report January–March 2011 Content S C M Figures Key I Share S CEO Notes

InterIm report January–march 2011 31 MAY 2011 cONTENT KEY FIgURES 3 CEO ´S REVIEW 4 I MPORTANT EVENTS 5 SHARE 6 M ANAgEMENT REPORT JANUARY-MARcH 2011 7 S EgMENT REPORT 10 c ONSOLIDATED INTERIM FINANcIAL STATEMENTS 13 NOTES 18 S TATEMENT OF ALL LEgAL REPRESENTATIVES 26 ARCH 2011 M PORT JANUARY– Re M I R E E INT S STRABAG Key fIgures Key fInancIal fIgures CHANGE € Mln. Q1/2011 Q1/2010 IN % 2010 Output volume 2,309.25 1,837.38 26 % 12,777.00 Revenue 2,210.04 1,788.45 24 % 12,381.54 Order backlog 15,176.99 15,634.71 -3 % 14,738.74 Employees 72,363 68,318 6 % 73,600 Key earnIngs fIgures CHANGE € Mln. Q1/2011 Q1/2010 IN % 2010 EBITDA -59.80 -46.02 -30 % 734.69 EBITDA margin % of revenue -2.7 % -2.6 % 5.9 % EBIT -145.38 -149.89 3 % 298.95 EBIT margin % of revenue -6.6 % -8.4 % 2.4 % Profit before taxes -148.59 -164.40 10 % 279.27 Net income -116.87 -128.65 9 % 188.38 Earnings per share -1.03 -1.03 0 % 1.53 Cash-flow from operating activities -294.12 -117.35 -151 % 690.42 ROCE in % -1.8 % -2.1 % 5.4 % Investments in fixed assets 74.75 102.90 -27 % 553.84 Net income after minorities -117.53 -117.83 0 % 174.86 Net income after minorities margin % of revenue -5.3 % -6.6 % 1.4 % ARCH 2011 M Key balance sheet fIgures PORT JANUARY– Re M CHANGE I R € Mln. -

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik Der ATX Konzerne Mit Stand 2

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik der ATX Konzerne mit Stand 2. April 2020 Ein erster Blick in die Dividendensaison 2020 Im Rahmen dieser Schnelluntersuchung analysiert die Abteilung Betriebswirtschaft der AK-Wien die Dividenden- politik der großen, im Austrian Trade Index notierten, Konzerne. Zum Untersuchungszeitpunkt waren folgende Unternehmen im ATX notiert: Andritz AG, AT&S Austria Technologie & Systemtechnik AG, BAWAG Group AG, CA Immobilien Anlagen AG, DO&CO AG, Erste Group Bank AG, Immofinanz AG, Lenzing AG, Mayr-Melnhof Karton AG, Österreichische Post AG, OMV AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S Immo AG, Telekom Austria AG, Uniqa Insurance Group AG, Verbund AG, Vienna Insurance Group AG, Voestalpine AG und Wiener- berger AG Zum Auswertungszeitpunkt, mit Stand 2. April 2020, lagen von 13 Unternehmen die vollständigen Konzernab- schlüsse (Andritz AG, BAWAG Group AG, Erste Group Bank AG, CA Immobilien Anlagen AG, Lenzing AG, OMV AG, Österreichische Post AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S-Immo AG, Telekom Austria AG, Verbund AG Wienerberger AG) vor. Von weiteren 3 Unternehmen lagen die vorläufigen Zahlen (Mayr-Melnhof Karton AG, Uniqa Insurance Group AG und Vienna Insurance Group AG) vor. Es können daher mit Stand 2. April 2020 verlässliche Aussagen zu 80 % der ATX Konzerne getätigt werden. Rekordgewinne – zwei Drittel der Unternehmen konnten ihre Ergebnisse verbessern Das abgelaufene Wirtschaftsjahr 2019 bescherte den ATX-Unternehmen nach dem Vorjahr erneut Rekordge- winne. Konkret stieg das kumulierte, den AktionärInnen zurechenbare Ergebnis der 16 ATX Konzerne um 3,9 % auf 7,75 Milliarden Euro. Das zweite Jahr in Folge fuhren alle untersuchten Unternehmen einen Konzernüber- schuss ein. -

STRABAG PFS 2018 with Business Remaining Stable at Previous Record Level

Press release STRABAG PFS 2018 with business remaining stable at previous record level Revenue stable at € 1.1 billion in 2018 Contact New market segments entered and customer portfolio expanded STRABAG Property and Facility Non-organic growth in Germany and abroad Services GmbH Corporate Communications Tel. +49 69 13029-1122 Frankfurt, 28 May 2019 STRABAG Property and Facility [email protected] Services GmbH (STRABAG PFS), together with its subsidiaries and international companies, closed the 2018 financial year with total revenue of € 1.12 billion and unchanged from the record level of the previous year. € 1.00 billion of this was generated in Germany (2017: € 994 million). Technical facility management and building management accounted for € 625 million of this (2017: € 596 million), infrastructural facility services and industrial services for € 303 million (2017: € 309 million) and real estate management/property management for € 75 million (2017: € 84 million). Outside Germany, STRABAG PFS increased its revenue to € 115 million (2017: € 112 million). A total of 12,781 people/headcounts (2017: 13,748) worked for the industrial and property service provider in Germany and abroad as at 31 December 2018. In Germany alone, there were 10,298 employees as at the end of the reporting period (2017: 11,704). Stable business with new and existing customers With the UniCredit deal, STRABAG PFS obtained the biggest property portfolio tendered on the German market in 2018. The property and industrial service provider also expanded contracts with existing customers (e.g. DFS Deutsche Flugsicherung, Airbus) and gained new customers (e.g. DEMIRE, IMMOFINANZ, Nordex Energy) in 2018. -

Informissue 17 May 2009

informissue 17 may 2009 STRABAG CONSTRUCTION LOGISTICS IN THE LIMELIGHT BLT LICENCE TO LEAD PERSONNEL DEVELOPMENT BASEWORK PAR EXCELLENCE GOTTHARD TUNNEL THE MAGAZINE OF STRABAG SE Editorial inform 17 EDITORIAL DEAR EMPLOYEES, LADIES AND GENTLEMEN, Hans Peter Haselsteiner CEO of STRABAG SE The reason for the ongoing economic crisis being so frightening markets in all geographical directions. Secondly, our equity capital is that we – magniloquent finance ministers, confident central bank resources will enable us, even under the self-imposed strategy of governors and professors of the economy included – still don’t have cautious investment, to focus on certain areas, like for example the any good and reliable ideas on how to overcome it or to at least promotion of the off-shore wind sector. Construction logistics and soften its blow. All that has been done so far and most of what is transport, i.e. the BLT Division, which features in our cover story, is going to be initiated are the well-meant attempts at putting up some another such focus. Alfred Zimmermann and his experienced team resistance without knowing the direction in which the “crisis monster” of experts are in a position to achieve considerable cost savings by will move. And, there is no proof at all that it will show even the means of applying well thought out logistics concepts – provided slightest reaction to the defensive measures taken by the three that the operating colleagues want and support this. Thirdly, we can strongest “knights” we have, namely the state, the central bank bank on our efficient organizational structure, in the form of an ideal and international institutions. -

GREEN FINANCING FRAMEWORK Green Financing Framework

March 2021 GREEN FINANCING FRAMEWORK Green Financing Framework Table of contents Introduction 2 Strategy and Rationale 3 Commitment to the Sustainable Development Goals 6 Environmental and Social Risk Management 7 Alignment with Voluntary Market Standards 9 Green Bond Principles 9 Use of Proceeds 9 Process for Project Evaluation and Selection 10 Management of Proceeds 11 Reporting 11 External Review 12 Sustainability-Linked Bond Principles 12 Selection of Key Performance Indicators (KPIs) 13 Calibration of Sustainability Performance Targets (SPTs) 16 Bond characteristics 20 Reporting 21 Verification 21 Annex I – Impact Reporting 23 Disclaimer 25 1 Green Financing Framework Introduction VERBUND’s mission is to energise the future with clean electricity from our renewable energy plants and innovative solutions. VERBUND is Austria’s largest utility company. VERBUND’s value chain comprises the generation, transportation, trading and sale of electrical energy and other energy sources as well as the provision of energy services. In 2020, the Group generated annual revenue of around €3.2bn with approximately 2,870 employees. VERBUND has been listed on the Vienna Stock Exchange since 1988, with 51% of the share capital held by the Republic of Austria. 2 Green Financing Framework Strategy and Rationale VERBUND’s 2030 strategy is based on five strategic pillars: efficient generation of electricity from hydropower; expansion of electricity generation from renewable energy sources such as wind and solar power; sustainable expansion and safe operation of the Austrian high-voltage grid; use of the flexible power plants to maintain security of supply in Austria; and the Sales segment, with provision of customer-centric, innovative products and services. -

CEE Equity Strategy | Equity | CEE 2Q 2021

Erste Group Research CEE Equity Strategy | Equity | CEE 2Q 2021 CEE Equity Strategy Recovery tangible - question not if, but when Henning Eßkuchen Earnings growth needed as answer to most pressing issues – both rising +43 (0)50 100 19634 yields and the hope of a continued recovery have to find their justification in [email protected] further rising earnings growth. Inflation and rising yields – for now, inflation has a temporary touch, rising long-term yields can well be read as confirmation of the growth outlook. Not an individual issue – spreads to Bunds are not rising, with the exception of Turkey and partially Czechia. Impact via steepening slope of yield curves – would confirm the outlook for equities, qualifying this asset class as an inflation hedge. Financials might gain in outlook, sector rotation towards cyclical exposure is finding further support. Continued recovery out of pandemic situation – vaccination progress as a prerequisite for recovery remains slow, with Serbia and Hungary taking the lead. Containment measures remain at stable, burdening levels. Economic and corporate earnings growth – the recovery outlook is stabilizing, but some postponement into 2022 is becoming visible. CEE is leading in earnings growth momentum, with EPS in a strong trend. Poland has the Contents strongest momentum in CEE. Earnings growth needed as answer to most Valuation – a sound recovery is highly priced in. Vulnerability comes via the pressing issues 3 Continued recovery out of pandemic risk recovery continuing quickly enough; any delay/postponement creates situation 7 vulnerability. Valuation 11 Sentiment 13 Sentiment – the positive mood should generally remain intact, but fragile Sector view 14 market conditions will allow for consolidation episodes. -

Hydro News Issue 33

№33 INTELLIGENT NEWS MONITORING Cover Story Page 16 Grand Coulee USA Page 12 Country Report New Zealand Page 24 Magazine of ANDRITZ Hydro // №33 / 12-2019 №33 ANDRITZ Hydro Magazine of // Reventazón Costa Rica ENGLISH Page 34 HYDRO PASSION FOR HYDRO All employees at ANDRITZ share the same core values that define how we act and what we stand for. We love what we do. Our ability to get the best out of ourselves and our technology is what makes us stand out. Times and technologies change, but our passion is always there. №33 / 2019 HYDRONEWS 3 Solving the challenges of the hydropower market Dear Business Friends, The energy market – and the hydropower indus- try especially – is facing many challenges with the growing demand for “base load renewables” and aging of much of the existing hydropower fleet. As a result, new strategies are needed for success- ful hydro asset management and operation. One solution to reduce costs and improve operations is maintenance optimization to increase revenues. The new Metris DiOMera Platform, developed by ANDRITZ, is addressing these topics. Among recent Wolfgang Semper Harald Heber project successes are the latest orders for Metris DiOMera, coming from the PresAGHO project in South America and Cerro del Águila in Peru. At a time when baseload power generation from fossil resources has to be replaced by a carbon-free renewable energy-based alternative, large-scale energy hybrid solutions offer a vital approach for the future. Hybrid solutions combine two or more power generation technologies with at least one renewable energy source, as well as a power and energy storage system. -

Energy. Water. Life. Full Report 2018 /19 Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders

/ 19 Energy. Water. Life. Full Report 2018 /19 EVN Full Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders, The future of the global climate has domi- investments towards Lower Austria’s network nated public discussions in recent months. infrastructure. We see these investments as a EVN’s activities during the 2018/19 financial central step on the road to a climate-friendly year included the early termination of energy system because they are an indispen- coal-generated electricity production in sable requirement for protecting network Lower Austria – also against the backdrop stability in view of a further increase in volatile of the substantial increase in the price of renewable generation. CO2 emission certificates – as well as the accelerated expansion of wind power. We are also making a substantial contribution Our wind power generation capacity has in support of renewable generation: EVN, increased by roughly 100 MW to 367 MW currently the leading wind power producer in in only two financial years, which means Lower Austria, set an ambitious goal several we have reached our interim goal one year years ago to increase this capacity to 500 MW. earlier than planned. These two examples While our work is directed to meeting this alone show that we are committed to sup- goal, we are also evaluating projects for porting the future-oriented transformation large-scale photovoltaic facilities, especially at of our energy system towards renewable our own power plant locations. Here we see generation. a potential of up to 100 MW in our markets over the medium term, subject to appropriate Our long-term strategy as a listed company framework conditions.