The Information on the Capital Market Calendar 2020 Included in This Annual Financial Report 2019 Has Been Revised

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Governance Report

Corporate governance report EVN AG is a listed stock corporation under Austrian law whose Deviations from C-Rules shares are traded on the Vienna Stock Exchange. Corporate gov- EVN does not fully comply with the following C-Rules of the ACGC: ernance is therefore based on Austrian law – in particular stock corporation and capital market laws, legal regulations govern- Rule 16: The Supervisory Board did not appoint a member of the ing co-determination by employees and the company by-laws – Executive Board to serve as chairman because the Executive Board as well as the Austrian Corporate Governance Code (ACGC, see consists of only two members in line with its assigned duties and www.corporate-governance.at – and the rules of procedure for the structure of the company. In cases where the Executive Board the company’s corporate bodies. consists of only two members, voting is based on the following rules: meetings must be announced in the approved manner and both Executive Board members must be present. Resolutions must be passed unanimously and abstention from voting is not permitted. If a unanimous decision is not reached, the Executive Board must Commitment to the Austrian review and vote again on the respective point of the agenda within Corporate Governance Code ten days. The Executive Board must report to the Supervisory Board if the second round of voting does not bring a unanimous decision. Introduction A spokesman is appointed for the Executive Board even when there The Executive Board and the Supervisory Board of EVN are com- are only two members, and the rules for the direction of the meet- mitted to the principles of good corporate governance and, in this ings and the representation also apply in this case. -

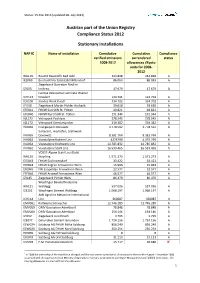

Austrian Part of the Union Registry Compliance Status 2012 Stationary

Status: 15 Mai 2013 (updated 28. July 2014) Austrian part of the Union Registry Compliance Status 2012 Stationary installations NAP ID Name of installation Cumulative Cumulative Compliance verified emissions surrendered status 2008-2012 allowances /Kyoto units for 2008- 2012 IKA119 Baumit Baustoffe Bad Ischl 244.848 244.848 A IES069 Breitenfelder Edelstahl Mitterdorf 86.063 86.063 A Ziegelwerk Danreiter Ried im IZI155 Innkreis 17.679 17.679 A Isomax Dekorative Laminate Wiener ICH113 Neudorf 124.701 124.701 A ICH106 Sandoz Werk Kundl 334.702 334.702 A IZI150 Ziegelwerk Martin Pichler Aschach 39.650 39.650 A EFE041 FHKW Süd StW St. Pölten 40.821 40.821 A EFE040 FHKW Nord StW St. Pölten 191.344 191.344 A IGL173 Vetropack Pöchlarn 278.545 278.545 A IGL172 Vetropack Kremsmünster 339.382 339.382 A IVA066 Energiepark Donawitz 4.778.592 4.778.592 A Sinteranl., Hochöfen, Stahlwerk IVA065 Donawitz 8.381.769 8.381.769 A IVA063 Voestalpine Kokerei Linz 4325299 4.325.299 A IVA064 Voestalpine Kraftwerk Linz 14.785.832 14.785.832 A IVA062 Voestalpine Stahl Linz 16.533.465 16.533.465 A VOEST-Alpine Stahl Linz (Kalk) IKA120 Steyrling 1.571.273 1.571.273 A EFE043 FHKW Süd Inzersdorf 33.422 33.422 A EFE044 FHKW Kagran Fernwärme Wien 15.993 15.993 A EFE045 FW Leopoldau Fernwärme Wien 22.577 22.577 A EFE046 FHKW Arsenal Fernwärme Wien 46.577 46.577 A IZI145 Ziegelwerk Pichler Wels 86.470 86.470 A Wopfinger Baustoffindustrie IKA121 Waldegg 537.026 537.026 A IZE202 Wopfinger Zement Waldegg 1.068.197 1.068.197 A AMI Agrolinz Melamine International ICH114 Linz 360087 360087 A EMV061 Raffinerie Schwechat 12.746.289 12.746.289 A EMV059 OMV Gasstation Aderklaa II 78.848 78.848 A EMV060 OMV Gasstation Aderklaa I 154.146 154.146 A IZI152 Ziegelwerk Lizzi Erlach 3.795 3.795 A IZE077 Gmundner Zement Gmunden 1.724.156 1.724.156 A EEW024 SalzBurg AG FHKW Mitte SalzBurg 856.240 856.240 A EEW025 SalzBurg AG FHKW Nord SalzBurg 250.254 250.254 A EFE035 SalzBurg AG HW Süd SalzBurg 0 0 A EFE049 SalzBurg AG LKH SalzBurg 31.113 31.113 A ICH203 F.M. -

Networked Thinking Renewable Energy and Supply Security

EVN Full Report 2013/14 EVN Full Networked thinking Renewable energy and supply security EVN Full Report 2013/14 58122P_EVN.GB_E.14_Umschlag_einzelseiten.indd 1 01.12.14 17:29 When you think of renewable energy Renewable energy will shape the energy future. But to use it efficiently and effectively, we need intelligent networks that can meet the added technical challenges. EVN has addressed these challenges for many years with massive investments in renewable energy generation plants and the expansion of its smart grids. 58122P_EVN.GB_E.14_Umschlag_einzelseiten.indd 2 27.11.14 22:3401.12.14 17:29 Key figures Change 1) 2013/14 2012/13 nominal in % Employees Sales volumes Number of employees Electricity generation volumes GWh 4,395 3,701 694 18.7 thereof Austria thereof from renewable energy GWh 1,868 1,954 –86 –4.4 thereof abroad Electricity sales volumes to end customers GWh 19,317 20,209 –891 –4.4 Employee fluctuation Natural gas sales volumes to end customers GWh 5,383 6,333 –950 –15.0 Proportion of women Heat sales volumes to end customers GWh 1,991 2,062 –71 –3.4 Training hours per employee Consolidated statement of operations Number of occupational accidents Revenue EURm 1,974.8 2,105.9 –131.0 –6.2 EBITDA EURm 184.1 540.0 –356.0 –65.9 Environment EBITDA margin2) % 9.3 25.6 –16.3 – Quantity of CO Results from operating activities (EBIT) EURm –341.4 242.2 –583.6 – NOX EBIT margin2) % –17.3 11.5 –28.8 – Hazardous waste Result before income tax EURm –373.3 170.7 –544.0 – Water consumption (drinking and process water) EURm Group net result -

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik Der ATX Konzerne Mit Stand 2

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik der ATX Konzerne mit Stand 2. April 2020 Ein erster Blick in die Dividendensaison 2020 Im Rahmen dieser Schnelluntersuchung analysiert die Abteilung Betriebswirtschaft der AK-Wien die Dividenden- politik der großen, im Austrian Trade Index notierten, Konzerne. Zum Untersuchungszeitpunkt waren folgende Unternehmen im ATX notiert: Andritz AG, AT&S Austria Technologie & Systemtechnik AG, BAWAG Group AG, CA Immobilien Anlagen AG, DO&CO AG, Erste Group Bank AG, Immofinanz AG, Lenzing AG, Mayr-Melnhof Karton AG, Österreichische Post AG, OMV AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S Immo AG, Telekom Austria AG, Uniqa Insurance Group AG, Verbund AG, Vienna Insurance Group AG, Voestalpine AG und Wiener- berger AG Zum Auswertungszeitpunkt, mit Stand 2. April 2020, lagen von 13 Unternehmen die vollständigen Konzernab- schlüsse (Andritz AG, BAWAG Group AG, Erste Group Bank AG, CA Immobilien Anlagen AG, Lenzing AG, OMV AG, Österreichische Post AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S-Immo AG, Telekom Austria AG, Verbund AG Wienerberger AG) vor. Von weiteren 3 Unternehmen lagen die vorläufigen Zahlen (Mayr-Melnhof Karton AG, Uniqa Insurance Group AG und Vienna Insurance Group AG) vor. Es können daher mit Stand 2. April 2020 verlässliche Aussagen zu 80 % der ATX Konzerne getätigt werden. Rekordgewinne – zwei Drittel der Unternehmen konnten ihre Ergebnisse verbessern Das abgelaufene Wirtschaftsjahr 2019 bescherte den ATX-Unternehmen nach dem Vorjahr erneut Rekordge- winne. Konkret stieg das kumulierte, den AktionärInnen zurechenbare Ergebnis der 16 ATX Konzerne um 3,9 % auf 7,75 Milliarden Euro. Das zweite Jahr in Folge fuhren alle untersuchten Unternehmen einen Konzernüber- schuss ein. -

EVN Ganzheitsbericht 2009-10

Ganzheits/ bericht Will/ 2009/10 kommen beim Klima/ wandel Neue Herausforderungen. Neue Perspektiven. Das Klima wandelt sich. wird’s wärmer. Ökono Willkommen beim Kli die EVN nimmt die Her Das Klima wandelt sich. wird’s wärmer. Ökono Willkommen beim Kli die EVN nimmt die Her h. Meteorologisch o misch ist’s stürmisch. li mawandel? Ja! Denn r ausforderungen an. / Inhalt EVN in Kürze. Verwurzelt in Niederösterreich, erfolgreich in Europa – 06 die aktuellen Projekte und Zahlen der EVN im Überblick. Gerüstet für die Zukunft. Die Mitglieder des EVN Vorstands, Dr. Burkhard Hofer, Dipl.-Ing. Dr. Peter Layr und Dipl.-Ing. Herbert Pöttschacher, im Gespräch über aktuelle Herausforderungen und 10 die neue EVN Strategie 2020. EVN am Kapitalmarkt. Die wichtigsten Daten, Fakten und Entwicklungen 18 rund um die EVN Aktie. Zahlen & Fakten. Die EVN inszeniert Zahlen & Fakten 20 erstmals als Foto-Stillleben. Der Wandel ist gewaltig. Prof. Nebojsa Nakicenovic, einer der weltweit führenden 24 Energieökonomen, über Wandel und Herausforderungen. Vorzeigeprojekt Dürnrohr. Im Kraftwerk Dürnrohr wird Strom erzeugt, Abfall ökologisch verwertet, und zudem werden zahlreiche Haushalte mit Fernwärme versorgt. Ein Investment im EVN Kernmarkt, 28 das sich für alle lohnt! Klimaschutz im Dilemma. Prof. Mojib Latif über die Klimaerwärmung, Lösungswege 38 und Szenarien, falls keine Auswege gefunden werden. Wasserkraft für Südosteuropa. An den albanischen Flüssen Devoll und Drin sowie am Fluss Gorna Arda in Bulgarien entstehen drei Projekte der EVN, die ein Ziel gemeinsam haben: die nachhaltige Verbesserung der Versorgung ganzer Regionen mit 42 erneuerbarer Energie. Wandel als Chance. Die EVN wird immer internationaler: Der Group HR-Day 48 zeigt Chancen für die Mitarbeitenden der EVN auf. -

GREEN FINANCING FRAMEWORK Green Financing Framework

March 2021 GREEN FINANCING FRAMEWORK Green Financing Framework Table of contents Introduction 2 Strategy and Rationale 3 Commitment to the Sustainable Development Goals 6 Environmental and Social Risk Management 7 Alignment with Voluntary Market Standards 9 Green Bond Principles 9 Use of Proceeds 9 Process for Project Evaluation and Selection 10 Management of Proceeds 11 Reporting 11 External Review 12 Sustainability-Linked Bond Principles 12 Selection of Key Performance Indicators (KPIs) 13 Calibration of Sustainability Performance Targets (SPTs) 16 Bond characteristics 20 Reporting 21 Verification 21 Annex I – Impact Reporting 23 Disclaimer 25 1 Green Financing Framework Introduction VERBUND’s mission is to energise the future with clean electricity from our renewable energy plants and innovative solutions. VERBUND is Austria’s largest utility company. VERBUND’s value chain comprises the generation, transportation, trading and sale of electrical energy and other energy sources as well as the provision of energy services. In 2020, the Group generated annual revenue of around €3.2bn with approximately 2,870 employees. VERBUND has been listed on the Vienna Stock Exchange since 1988, with 51% of the share capital held by the Republic of Austria. 2 Green Financing Framework Strategy and Rationale VERBUND’s 2030 strategy is based on five strategic pillars: efficient generation of electricity from hydropower; expansion of electricity generation from renewable energy sources such as wind and solar power; sustainable expansion and safe operation of the Austrian high-voltage grid; use of the flexible power plants to maintain security of supply in Austria; and the Sales segment, with provision of customer-centric, innovative products and services. -

Mergers & Acquisitions

Mergers & Acquisitions 2020 Ninth Edition Editors: Lorenzo Corte & Scott C. Hopkins Global Legal Insights Mergers & Acquisitions 2020, Ninth Edition Editors: Lorenzo Corte & Scott C. Hopkins Published by Global Legal Group GLOBAL LEGAL INSIGHTS – MERGERS & ACQUISITIONS 2020, NINTH EDITION Editors Lorenzo Corte & Scott C. Hopkins, Skadden, Arps, Slate, Meagher & Flom (UK) LLP Head of Production Suzie Levy Senior Editor Sam Friend Sub Editor Megan Hylton Group Publisher Rory Smith Chief Media Officer Fraser Allan We are extremely grateful for all contributions to this edition. Special thanks are reserved for Lorenzo Corte & Scott C. Hopkins of Skadden, Arps, Slate, Meagher & Flom (UK) LLP for all of their assistance. Published by Global Legal Group Ltd. 59 Tanner Street, London SE1 3PL, United Kingdom Tel: +44 207 367 0720 / URL: www.glgroup.co.uk Copyright © 2020 Global Legal Group Ltd. All rights reserved No photocopying ISBN 978-1-83918-053-8 ISSN 2048-6839 This publication is for general information purposes only. It does not purport to provide comprehensive full legal or other advice. Global Legal Group Ltd. and the contributors accept no responsibility for losses that may arise from reliance upon information contained in this publication. This publication is intended to give an indication of legal issues upon which you may need advice. Full legal advice should be taken from a qualified professional when dealing with specific situations. The information contained herein is accurate as of the date of publication. CONTENTS Austria Horst -

Come to Climate Change

2009/10 Full Report / climate change / to / Welcome Full Report 2009/10 Wel/ come to climate change New challenges. New perspectives. The climate is changing. Meteorologically speak- ing, it is getting warmer. Economically, it is quite stormy. Welcome to cli mate change? Well, yes! EVN is accepting these challenges. The climate is changing. Meteorologically speak- ing, it is getting warmer. Economically, it is quite stormy. Welcome to cli mate change? Well, yes! EVN is accepting these challenges. / Contents EVN in short. Rooted in Lower Austria, successful in Europe – 06 an overview of the latest EVN projects and figures. Equipped for the future. The members of the EVN Executive Board, Burkhard Hofer, Peter Layr and Herbert Pöttschacher speak about current challenges and the 10 new EVN Strategy 2020. EVN on the capital market. The most important data, facts and 18 developments pertaining to the EVN share. Facts and figures. For the first time, EVN presents facts 20 and figures as still life photography. The change is enormous. Prof. Nebojsa Nakicenovic, one of the world’s leading 24 energy economists, on change and challenges. The showcase project Dürnrohr. Electricity is generated, waste ecologically treated and numerous households also supplied with district heat. An investment in EVN’s core 28 market, which pays off for everyone! The climate protection dilemma. Prof. Mojib Latif on global warming, solutions 38 and scenarios if no way out can be found. Hydropower for South East Europe. Three EVN projects on the Devoll and Drin rivers in Albania and the Gorna Arda River in Bulgaria are arising, all with a common goal: the sustainable improvement in supplying 42 entire regions with renewable energy. -

Hydro News Issue 33

№33 INTELLIGENT NEWS MONITORING Cover Story Page 16 Grand Coulee USA Page 12 Country Report New Zealand Page 24 Magazine of ANDRITZ Hydro // №33 / 12-2019 №33 ANDRITZ Hydro Magazine of // Reventazón Costa Rica ENGLISH Page 34 HYDRO PASSION FOR HYDRO All employees at ANDRITZ share the same core values that define how we act and what we stand for. We love what we do. Our ability to get the best out of ourselves and our technology is what makes us stand out. Times and technologies change, but our passion is always there. №33 / 2019 HYDRONEWS 3 Solving the challenges of the hydropower market Dear Business Friends, The energy market – and the hydropower indus- try especially – is facing many challenges with the growing demand for “base load renewables” and aging of much of the existing hydropower fleet. As a result, new strategies are needed for success- ful hydro asset management and operation. One solution to reduce costs and improve operations is maintenance optimization to increase revenues. The new Metris DiOMera Platform, developed by ANDRITZ, is addressing these topics. Among recent Wolfgang Semper Harald Heber project successes are the latest orders for Metris DiOMera, coming from the PresAGHO project in South America and Cerro del Águila in Peru. At a time when baseload power generation from fossil resources has to be replaced by a carbon-free renewable energy-based alternative, large-scale energy hybrid solutions offer a vital approach for the future. Hybrid solutions combine two or more power generation technologies with at least one renewable energy source, as well as a power and energy storage system. -

Energy. Water. Life. Full Report 2018 /19 Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders

/ 19 Energy. Water. Life. Full Report 2018 /19 EVN Full Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders, The future of the global climate has domi- investments towards Lower Austria’s network nated public discussions in recent months. infrastructure. We see these investments as a EVN’s activities during the 2018/19 financial central step on the road to a climate-friendly year included the early termination of energy system because they are an indispen- coal-generated electricity production in sable requirement for protecting network Lower Austria – also against the backdrop stability in view of a further increase in volatile of the substantial increase in the price of renewable generation. CO2 emission certificates – as well as the accelerated expansion of wind power. We are also making a substantial contribution Our wind power generation capacity has in support of renewable generation: EVN, increased by roughly 100 MW to 367 MW currently the leading wind power producer in in only two financial years, which means Lower Austria, set an ambitious goal several we have reached our interim goal one year years ago to increase this capacity to 500 MW. earlier than planned. These two examples While our work is directed to meeting this alone show that we are committed to sup- goal, we are also evaluating projects for porting the future-oriented transformation large-scale photovoltaic facilities, especially at of our energy system towards renewable our own power plant locations. Here we see generation. a potential of up to 100 MW in our markets over the medium term, subject to appropriate Our long-term strategy as a listed company framework conditions. -

The World of Tomorrow?

15 / EVN Full Report 2014 EVN Full Full Report 2014 /15 EVN Future Lab @ EVN_Future_Lab The world of tomorrow? # We_have_answers Full Report 2014 /15 Future Lab Designing the future with its many different facets is the central subject of this full report. EVN is actively and consciously addressing the accom panying challenges. In order to identify and systematically examine the many different future scenarios, EVN founded the future lab – an internal think tank – in 2014/15. The objectives of its analyses were to pinpoint possible development trends, determine the company’s current position and develop futureoriented business models. This full report provides an overview of the processes used by the EVN Future Lab and the results achieved to date. At this point, we would like to thank all the contributors to the future lab for their dedication and commitment! Key figures +/– 2014/15 2013/14 in % 2012/131) Sales volumes Electricity generation volumes GWh 4,882 4,395 11.1 3,332 thereof from renewable energy GWh 2,106 1,868 12.8 1,181 Electricity sales volumes to end customers GWh 19,263 19,317 –0.3 20,403 Natural gas sales volumes to end customers GWh 5,241 5,383 –2.6 6,475 Heat sales volumes to end customers GWh 2,038 1,991 2.4 1,911 Consolidated statement of operations Revenue EURm 2,135.8 1,974.8 8.2 2,105.9 EBITDA EURm 583.2 184.1 – 540.0 EBITDA margin2) % 27.3 9.3 – 25.6 Results from operating activities (EBIT) EURm 268.2 –341.4 – 242.2 EBIT margin2) % 12.6 –17.3 – 11.5 Result before income tax EURm 207.9 –373.3 – 170.7 Group net -

Annual Report Key Figures

Annual Report Key Figures Wiener Städtische (Individual Accounts) 1999/in AT S 1998/in AT S Gross Premiums Earned (in millions) 18,456 17,709 e 1,341.2 – Property & Casualty Insurance (in millions) 8,154 8,406 e 592.6 – Health Insurance (in millions) 3,260 3,201 e 236.9 – Life Insurance (in millions) 7,043 6,102 e 511.8 Combined Ratio (Property & Casualty) (in %) 105.2 102.9 Financial Results (in millions) 4,875 5,051 e 354.3 Earnings from Ordinary Activities (in millions) 435 784 e 31.6 Investments (in millions) 83,981 80,124 e 6,103.1 Underwriting Provisions (in millions) 71,806 67,305 e 5,218.3 Capital and Reserves (in millions) 10,270 10,084 e 746.3 Number of Employees 4,030 4,096 – Office Staff 1,997 2,045 – Field Staff 2,033 2,051 Number of Branch Offices 171 171 Contents Introduction 2 Wiener Städtische AG Annual Financial Statements Company Bodies 4 Balance Sheet 6 6 P rofit & Loss Account 7 2 Wiener Städtische AG Status Report Separate Income Statement for Economic Situation in 1999 9 Auto Third Party Liability Insurance 7 9 Wiener Städtische in 1999 1 2 A p p e n d i x 8 0 P ro p e rty & Casualty Insurance 1 7 A u d i t o r’s Cert i f i c a t e 9 2 Health Insurance 2 0 L i f e / P e n s i o n s 2 2 Consolidated Annual Financial Statements I n v e s t m e n t s 2 4 Balance Sheet 9 8 S t a ff/Socio-economic Issues 2 8 P rofit & Loss Account 1 0 2 C u rrent Situation and Outlook 3 1 A p p e n d i x 1 0 7 A u d i t o r’s Cert i f i c a t e 1 2 1 Supervisory Board Report 35 Contact Information 128 Group Status Report G roup Status Report 3 8 Investor Relations 131 The Group (Diagram) 4 2 Donau Ve r s i c h e ru n g 4 4 About this Publication 132 Vo l k s f ü r s o rge Jupiter 4 6 Union Ve r s i c h e ru n g 4 7 M o n t a n v e r s i c h e ru n g 4 8 CA Ve r s i c h e ru n g 5 1 K a p i t a l &We rt Ve rm ö g e n s v e rwaltung AG 5 2 Kooperativa Praha 5 4 Kooperativa Bratislava 5 5 InterRisk Wi e s b a d e n 5 6 H e ros S.A.