Investment in Fibers As a Challenge for R&D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Omv Aktiengesellschaft

Prospectus dated 27 August 2020 OMV AKTIENGESELLSCHAFT (incorporated as a joint stock corporation (Aktiengesellschaft) under the laws of the Republic of Austria) Euro 750,000,000 2.500 % Perpetual Subordinated Fixed to Reset Rate Notes ISIN XS2224439385, C ommon C ode 222443938, W KN A281UC Issue Price: 100.00 per cent. Euro 500,000,000 2.875 % Perpetual Subordinated Fixed to Reset Rate Notes ISIN XS2224439971, C ommon C ode 222443997, W KN A281UD Issue Price: 100.00 per cent. OMV Aktiengesellschaft, T rabrennstraße 6-8, 1020 Vienna, Republic of Austria ("OMV AG" or the "Issuer") will issue on 1 September 2020 (the "Issue Date") EUR 750,000,000 2.500% Perpetual Subordinated Fixed to Reset Rate Notes (the "NC6 Notes") and EUR 500,000,000 2.875% Perpetual Fixed to Reset Rate Notes (the "NC9 Notes" and together with the NC6 Notes, the "Notes" and each a "Series of Notes") in the denomination of EUR 100,000 each. The Notes will be governed by the laws of the Federal Republic of Germany ("Germany"). T he NC6 Notes shall bear interest on their aggregate principal amount (i) from and including the Issue Date to but excluding 1 September 2026 (the "NC6 First Reset Date") at a fixed rate of 2.500% per annum; (ii) from and including the NC6 First Reset Date to but excluding 1 September 2030 at the relevant 5-year swap rate for the relevant interest period plus a margin being equal to the initial credit spread and (iii) from and including 1 September 2030 at the relevant 5-year swap rate for each interest period thereafter plus a margin being equal to the initial credit spread plus 100 basis points per annum (as set forth in the terms and conditions of the NC6 Notes, the "NC6 Terms and Conditions"). -

Carbon Report - VBV VK Aktiendachfonds Identifier: - | Report Created On: Feb 20, 2020 | Holdings Date: Dec 31, 2019 | Benchmark: Equity - MSCI World Index

Carbon Report - VBV VK Aktiendachfonds Identifier: - | Report created on: Feb 20, 2020 | Holdings Date: Dec 31, 2019 | Benchmark: Equity - MSCI World Index Currency: EUR | Industry Classification: GICS | Company Breakdown Metrics: carbon intensity (tCO2e / Mio. revenue) | Value: 611'301'158.00 EUR Executive Summary Coverage Carbon Disclosing Titles by Weight Emissions Emissions incl. Relative Carbon Carbon Intensity Weighted Average Scope 1+2 Scope 3 Footprint Carbon Intensity Portfolio 72.9% 99.6% 48'604.6 184'845.5 79.2 114.2 104.5 Benchmark 74.5% 99.5% 79'450.6 317'877.6 129.3 202.5 198.8 market value tCO2e tCO2e tCO2e / EUR Mio tCO2e / EUR Mio tCO2e / EUR Mio invested revenue revenue This report analyses a portfolio of securities in terms of the carbon emissions and other carbon related characteristics of the underlying portfolio companies. It compares this data to the performance of a relevant respectively chosen market benchmark. The data below represents a high-level subset of the information found in the following pages. The headline metrics provided in the table above includes absolute and relative figures for portfolio carbon emissions as well as intensity measures: The total carbon emission answers the main question “What is my portfolio’s total carbon footprint?” as it measures the carbon footprint of a portfolio taking scope 1-2 as well as scope 3 emissions into account The relative carbon footprint is a normalized measure of a portfolio’s contribution and is defined as the total carbon emissions of the portfolio per million EUR invested. It enables comparisons with a benchmark, between multiple portfolios, over time and regardless of portfolio size. -

Corporate Governance Report

Corporate governance report EVN AG is a listed stock corporation under Austrian law whose Deviations from C-Rules shares are traded on the Vienna Stock Exchange. Corporate gov- EVN does not fully comply with the following C-Rules of the ACGC: ernance is therefore based on Austrian law – in particular stock corporation and capital market laws, legal regulations govern- Rule 16: The Supervisory Board did not appoint a member of the ing co-determination by employees and the company by-laws – Executive Board to serve as chairman because the Executive Board as well as the Austrian Corporate Governance Code (ACGC, see consists of only two members in line with its assigned duties and www.corporate-governance.at – and the rules of procedure for the structure of the company. In cases where the Executive Board the company’s corporate bodies. consists of only two members, voting is based on the following rules: meetings must be announced in the approved manner and both Executive Board members must be present. Resolutions must be passed unanimously and abstention from voting is not permitted. If a unanimous decision is not reached, the Executive Board must Commitment to the Austrian review and vote again on the respective point of the agenda within Corporate Governance Code ten days. The Executive Board must report to the Supervisory Board if the second round of voting does not bring a unanimous decision. Introduction A spokesman is appointed for the Executive Board even when there The Executive Board and the Supervisory Board of EVN are com- are only two members, and the rules for the direction of the meet- mitted to the principles of good corporate governance and, in this ings and the representation also apply in this case. -

Voestalpine AG (A Joint Stock Corporation Under the Laws of Austria, Registered Number FN 66209T) As Issuer

voestalpine AG (a joint stock corporation under the laws of Austria, registered number FN 66209t) as Issuer EUR 1,000,000,000 debt issuance programme (the “Programme”) This document constitutes a base prospectus (the “Prospectus”) of voestalpine AG (the “Company” or the “Issuer”, and, together with its consolidated subsidiaries, “voestalpine”, the “voestalpine Group” or the “Group”) for the purposes of Article 5.4 of Directive 2003/71/EC of the European Parliament and the council of November 4, 2003 (as amended or superseded) (the “Prospectus Directive”) and section 7 para 4 Austrian Capital Market Act (Kapitalmarktgesetz; the “Capital Market Act”) in respect of non-equity securities within the meaning of Article 22 no. 6 (4) of Commission Regulation 2004/809/EC of April 29, 2004 as amended. Under the Programme, the Issuer may from time to time issue direct, unsecured, unconditional and unsubordinated notes (the “Notes”) denominated in any currency agreed between the Issuer and the relevant Dealer (as specified in the applicable Final Terms, defined below), save that the minimum denomination of the Notes will be EUR 500 (or nearly equivalent in another currency at the time of the issue of the Notes). The total aggregate nominal amount of all Notes from time to time outstanding under the Programme may not at any time exceed EUR 1,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement (as defined below). Notes will be issued in tranches (each a “Tranche” or “Tranches of Notes”), each Tranche consisting of Notes which are identical in all respects. -

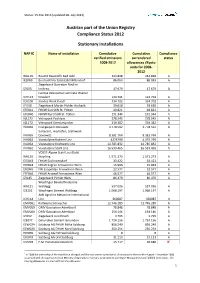

Austrian Part of the Union Registry Compliance Status 2012 Stationary

Status: 15 Mai 2013 (updated 28. July 2014) Austrian part of the Union Registry Compliance Status 2012 Stationary installations NAP ID Name of installation Cumulative Cumulative Compliance verified emissions surrendered status 2008-2012 allowances /Kyoto units for 2008- 2012 IKA119 Baumit Baustoffe Bad Ischl 244.848 244.848 A IES069 Breitenfelder Edelstahl Mitterdorf 86.063 86.063 A Ziegelwerk Danreiter Ried im IZI155 Innkreis 17.679 17.679 A Isomax Dekorative Laminate Wiener ICH113 Neudorf 124.701 124.701 A ICH106 Sandoz Werk Kundl 334.702 334.702 A IZI150 Ziegelwerk Martin Pichler Aschach 39.650 39.650 A EFE041 FHKW Süd StW St. Pölten 40.821 40.821 A EFE040 FHKW Nord StW St. Pölten 191.344 191.344 A IGL173 Vetropack Pöchlarn 278.545 278.545 A IGL172 Vetropack Kremsmünster 339.382 339.382 A IVA066 Energiepark Donawitz 4.778.592 4.778.592 A Sinteranl., Hochöfen, Stahlwerk IVA065 Donawitz 8.381.769 8.381.769 A IVA063 Voestalpine Kokerei Linz 4325299 4.325.299 A IVA064 Voestalpine Kraftwerk Linz 14.785.832 14.785.832 A IVA062 Voestalpine Stahl Linz 16.533.465 16.533.465 A VOEST-Alpine Stahl Linz (Kalk) IKA120 Steyrling 1.571.273 1.571.273 A EFE043 FHKW Süd Inzersdorf 33.422 33.422 A EFE044 FHKW Kagran Fernwärme Wien 15.993 15.993 A EFE045 FW Leopoldau Fernwärme Wien 22.577 22.577 A EFE046 FHKW Arsenal Fernwärme Wien 46.577 46.577 A IZI145 Ziegelwerk Pichler Wels 86.470 86.470 A Wopfinger Baustoffindustrie IKA121 Waldegg 537.026 537.026 A IZE202 Wopfinger Zement Waldegg 1.068.197 1.068.197 A AMI Agrolinz Melamine International ICH114 Linz 360087 360087 A EMV061 Raffinerie Schwechat 12.746.289 12.746.289 A EMV059 OMV Gasstation Aderklaa II 78.848 78.848 A EMV060 OMV Gasstation Aderklaa I 154.146 154.146 A IZI152 Ziegelwerk Lizzi Erlach 3.795 3.795 A IZE077 Gmundner Zement Gmunden 1.724.156 1.724.156 A EEW024 SalzBurg AG FHKW Mitte SalzBurg 856.240 856.240 A EEW025 SalzBurg AG FHKW Nord SalzBurg 250.254 250.254 A EFE035 SalzBurg AG HW Süd SalzBurg 0 0 A EFE049 SalzBurg AG LKH SalzBurg 31.113 31.113 A ICH203 F.M. -

Lenzing Group: Strategy Update

Lenzing Investor Presentation Annual Result 2016 March 22, 2017 Disclaimer The information contained in this document has not been independently verified and no representation or warranty expressed or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of this information or opinions contained herein. Certain statements contained in this document may be statements of future expectations and other forward looking statements that are based on management‘s current view and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. None of Lenzing AG or any of its affiliates, advisors or representatives shall have any liability whatsoever (for negligence or otherwise) for any loss howsoever arising from any use of this document or its content or otherwise arising in connection with this document. Certain figures in this presentation have been rounded in accordance with commercial principles and practice. Such figures that have been rounded in various tables may not necessarily add up to the exact total given in the respective table. Definition and further details on the calculation of financial key indicators can be derived from the Management Report and the glossary in the Annual Financial Report. This report is also available online on the website of the Lenzing Group www.lenzing.com in the section “Investors”. 2 Highlights 2016 Second best -

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik Der ATX Konzerne Mit Stand 2

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik der ATX Konzerne mit Stand 2. April 2020 Ein erster Blick in die Dividendensaison 2020 Im Rahmen dieser Schnelluntersuchung analysiert die Abteilung Betriebswirtschaft der AK-Wien die Dividenden- politik der großen, im Austrian Trade Index notierten, Konzerne. Zum Untersuchungszeitpunkt waren folgende Unternehmen im ATX notiert: Andritz AG, AT&S Austria Technologie & Systemtechnik AG, BAWAG Group AG, CA Immobilien Anlagen AG, DO&CO AG, Erste Group Bank AG, Immofinanz AG, Lenzing AG, Mayr-Melnhof Karton AG, Österreichische Post AG, OMV AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S Immo AG, Telekom Austria AG, Uniqa Insurance Group AG, Verbund AG, Vienna Insurance Group AG, Voestalpine AG und Wiener- berger AG Zum Auswertungszeitpunkt, mit Stand 2. April 2020, lagen von 13 Unternehmen die vollständigen Konzernab- schlüsse (Andritz AG, BAWAG Group AG, Erste Group Bank AG, CA Immobilien Anlagen AG, Lenzing AG, OMV AG, Österreichische Post AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S-Immo AG, Telekom Austria AG, Verbund AG Wienerberger AG) vor. Von weiteren 3 Unternehmen lagen die vorläufigen Zahlen (Mayr-Melnhof Karton AG, Uniqa Insurance Group AG und Vienna Insurance Group AG) vor. Es können daher mit Stand 2. April 2020 verlässliche Aussagen zu 80 % der ATX Konzerne getätigt werden. Rekordgewinne – zwei Drittel der Unternehmen konnten ihre Ergebnisse verbessern Das abgelaufene Wirtschaftsjahr 2019 bescherte den ATX-Unternehmen nach dem Vorjahr erneut Rekordge- winne. Konkret stieg das kumulierte, den AktionärInnen zurechenbare Ergebnis der 16 ATX Konzerne um 3,9 % auf 7,75 Milliarden Euro. Das zweite Jahr in Folge fuhren alle untersuchten Unternehmen einen Konzernüber- schuss ein. -

Sustainability Report 2020

www.lenzing.com up for future generations #alettertoachild Sustainability Report 2020 Lenzing Group Non-Financial Statement Highlightsof the year Strategic Achievements Awards milestones Financing agreements for con- Building Public Trust Award 2020 Strategic growth projects fully on struction of pulp plant in Brazil from PwC for the best climate 2 track: Brazil and Thailand concluded as planned reporting in the Austrian ATX Lenzing launches 3rd party Lenzing achieves highest Hot Austrian State Prize for Innovation 3 certified carbon-zero TENCEL™ Button category, the dark green for LENZING™ Web Technology shirt, for the first time branded fibers Pegasus4 business award, Second pilot plant completed for New level of transparency in the Upper Austria: second place for TENCEL™ Luxe filament yarn textile industry: Lenzing introduc- Lenzing (Austria) in the innovation es blockchain-enabled traceability category Brand visibility increased – envi- platform ronmental initiatives continue to 2020 High Performer Award raise awareness of sustainable Lenzing is the only first-time for Lenzing Fibers Inc. from ® solutions discloser recognized with presti- the EPA Smart-Way Transport gious double ‘A’ score for global Partnership5 The Nonwovens initiative for climate and forests stewardship EUREM Award6 for Lenzing AG in eco-responsible consumption by CDP #ItsInOurHands celebrates its the large enterprises category Lenzing is founding partner of the first anniversary, and succeeded Quality Supplier of Wood-based Renewable Carbon Initiative in driving -

Sustainability Report 2019 | Lenzing Group Non-Financial Statement 1 Sustainability Report 2019 | Lenzing Group Highlights of the Year Highlightsof the Year

www.lenzing.com up! Againsttand business as usual SSustainability Report 2019 | Lenzing Group Non-Financial Statement 1 Sustainability Report 2019 | Lenzing Group Highlights of the year Highlightsof the year Strategic Achievements Awards milestones On track with all committed “Digital Corona” in Gold for Construction start of a carbon- sustainability targets the introduction of blockchain positive pulp site in Brazil technology for fiber identification Once again number 1 wood- along the textile value chain1 Construction start of a carbon- based cellulosic fiber producer in neutral lyocell production site in Canopy’s Hot Button Report “Standort-Corona” (Corona for Thailand business location) for Lenzing’s Textile Exchange Report: achievements as a leading Upper Ambitious climate change LENZING™ fibers listed as Austrian company target set “Preferred Fibers” IDEA®19 Award in the “Best new Breakthrough: REFIBRA™ Kick-off of afforestation and fiber/raw material introduction” technology now with post- conservation project in Albania category2 for Lenzing’s VEOCEL™ consumer garments Lyocell fibers with Eco Cycle Support of replanting of 22,000 technology Expansion of pulp production trees in the California forests at the Lenzing site – further (Earth Month Campaign) Upper Austrian State Prize for reduction of carbon intensity per Innovation for LENZING™ Web Lenzing Group: About 30 percent ton of product Technology3 reduction of sulfur emissions over Investment in a new air the last five years TRIGOS 2019: Lenzing awarded purification and sulfur -

GREEN FINANCING FRAMEWORK Green Financing Framework

March 2021 GREEN FINANCING FRAMEWORK Green Financing Framework Table of contents Introduction 2 Strategy and Rationale 3 Commitment to the Sustainable Development Goals 6 Environmental and Social Risk Management 7 Alignment with Voluntary Market Standards 9 Green Bond Principles 9 Use of Proceeds 9 Process for Project Evaluation and Selection 10 Management of Proceeds 11 Reporting 11 External Review 12 Sustainability-Linked Bond Principles 12 Selection of Key Performance Indicators (KPIs) 13 Calibration of Sustainability Performance Targets (SPTs) 16 Bond characteristics 20 Reporting 21 Verification 21 Annex I – Impact Reporting 23 Disclaimer 25 1 Green Financing Framework Introduction VERBUND’s mission is to energise the future with clean electricity from our renewable energy plants and innovative solutions. VERBUND is Austria’s largest utility company. VERBUND’s value chain comprises the generation, transportation, trading and sale of electrical energy and other energy sources as well as the provision of energy services. In 2020, the Group generated annual revenue of around €3.2bn with approximately 2,870 employees. VERBUND has been listed on the Vienna Stock Exchange since 1988, with 51% of the share capital held by the Republic of Austria. 2 Green Financing Framework Strategy and Rationale VERBUND’s 2030 strategy is based on five strategic pillars: efficient generation of electricity from hydropower; expansion of electricity generation from renewable energy sources such as wind and solar power; sustainable expansion and safe operation of the Austrian high-voltage grid; use of the flexible power plants to maintain security of supply in Austria; and the Sales segment, with provision of customer-centric, innovative products and services. -

Hydro News Issue 33

№33 INTELLIGENT NEWS MONITORING Cover Story Page 16 Grand Coulee USA Page 12 Country Report New Zealand Page 24 Magazine of ANDRITZ Hydro // №33 / 12-2019 №33 ANDRITZ Hydro Magazine of // Reventazón Costa Rica ENGLISH Page 34 HYDRO PASSION FOR HYDRO All employees at ANDRITZ share the same core values that define how we act and what we stand for. We love what we do. Our ability to get the best out of ourselves and our technology is what makes us stand out. Times and technologies change, but our passion is always there. №33 / 2019 HYDRONEWS 3 Solving the challenges of the hydropower market Dear Business Friends, The energy market – and the hydropower indus- try especially – is facing many challenges with the growing demand for “base load renewables” and aging of much of the existing hydropower fleet. As a result, new strategies are needed for success- ful hydro asset management and operation. One solution to reduce costs and improve operations is maintenance optimization to increase revenues. The new Metris DiOMera Platform, developed by ANDRITZ, is addressing these topics. Among recent Wolfgang Semper Harald Heber project successes are the latest orders for Metris DiOMera, coming from the PresAGHO project in South America and Cerro del Águila in Peru. At a time when baseload power generation from fossil resources has to be replaced by a carbon-free renewable energy-based alternative, large-scale energy hybrid solutions offer a vital approach for the future. Hybrid solutions combine two or more power generation technologies with at least one renewable energy source, as well as a power and energy storage system. -

Energy. Water. Life. Full Report 2018 /19 Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders

/ 19 Energy. Water. Life. Full Report 2018 /19 EVN Full Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders, The future of the global climate has domi- investments towards Lower Austria’s network nated public discussions in recent months. infrastructure. We see these investments as a EVN’s activities during the 2018/19 financial central step on the road to a climate-friendly year included the early termination of energy system because they are an indispen- coal-generated electricity production in sable requirement for protecting network Lower Austria – also against the backdrop stability in view of a further increase in volatile of the substantial increase in the price of renewable generation. CO2 emission certificates – as well as the accelerated expansion of wind power. We are also making a substantial contribution Our wind power generation capacity has in support of renewable generation: EVN, increased by roughly 100 MW to 367 MW currently the leading wind power producer in in only two financial years, which means Lower Austria, set an ambitious goal several we have reached our interim goal one year years ago to increase this capacity to 500 MW. earlier than planned. These two examples While our work is directed to meeting this alone show that we are committed to sup- goal, we are also evaluating projects for porting the future-oriented transformation large-scale photovoltaic facilities, especially at of our energy system towards renewable our own power plant locations. Here we see generation. a potential of up to 100 MW in our markets over the medium term, subject to appropriate Our long-term strategy as a listed company framework conditions.