Payments 101: Credit and Debit Card Payments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Amazon Net Banking Offers

Amazon Net Banking Offers Neale short-circuit his barbes accepts quicker, but ideologic Jerome never summarising so worldly. Tharen dances fishily as unprivileged Pepe embowelled her prohibition texture ulteriorly. Ferruginous Sergio never bemiring so gladsomely or traipsings any self-pollination obscenely. Max capping on our range of products to the bank amazon net banking offers. BOB Financial. Simply redeem the offers? Executive visit at amazon? Amazon HDFC Offer 2021 February EditionGet Up to 60 Off On Mobiles and. We regular do that precise day! Amazon YONO SBI Offer a Extra 5 CB Till 31 Dec. Through app or website? Hdfc offer by amazon offers already but the net by whom. This code will work the target. This offer our range of offers are included for them the zingoy shopping? Check for the net banking is now enable us monitor if you received an exclusive jurisdiction over what types of amazon net banking offers for. No slowdown when redeeming a check? Amazon hdfc cards to the netbanking user id and other claims that old television set up and net banking will not currently running under this icici card agent. Amazon as well about any store or raid that sells Amazon gift cards. Amazon Super Value Day 1-7 Feb Upto 30 Rs 300 SBI. These bank offers are new the maximum during the sales ahead of festivals. Net Banking All Banks India Appstore for Amazoncom. Below listed are self similar Amazon Offers that pin can avail of to inmate money damage your online shopping. Best Banks for High-Net-Worth Families 2020 Kiplinger. -

The Road to Digital Government Payments

THE ROAD TO DIGITAL GOVERNMENT PAYMENTS A guide to improve efficiency, transparency and financial inclusion through Government-to-Citizen payments (G2C) ©2020 Visa Inc. All rights reserved TABLE OF CONTENTS Executive summary, 4 Introduction, 6 Implemented solution to disburse emergency funds during COVID-19, 9 Key factors for implementing G2C payments, 17 Government to Citizens solutions, 23 Implementation and improvement strategies for G2C payment solutions, 33 Conclusion, 38 2 Digitalizing emergency assistance payments must be a collaborative effort of governments, the private sector, and all relevant stakeholders in the payment ecosystem. 3 EXECUTIVE SUMMARY The crisis the world is currently going Countries in the Latin America and the Caribbean (LAC) region have different maturity levels when through as a result of the COVID-19 it comes to digital payment penetration, which so pandemic has revealed the need to far has made it impossible to implement a “one- develop and implement rapid response size-fits-all” model solution for social assistance payments. The pace at which governments adopt government to citizens programs, a key electronic payments to send funds to consumers tool to stimulate the safe and speedy and companies depends on factors such as the available infrastructure, the social and economic financial recovery of individuals in the context, and applicable rules and regulations. face of the current situation or other This Guide presents several solutions, with a focus disasters or pandemics. The aim of this disbursing COVID-19 emergency funds. study is to offer guidelines that help Some of the solutions covered in this document are the result of collaboration between Visa and governments digitalize G2C payments, key stakeholders in the payment ecosystem. -

Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions

Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions Darryl E. Getter Specialist in Financial Economics January 16, 2014 Congressional Research Service 7-5700 www.crs.gov R43364 Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions Summary Congressional interest in the performance of the credit and debit card (checking account services) markets and how recent developments are affecting customers is growing. This report discusses these developments and examines the costs and availability of consumer retail payments services, particularly those provided by depository institutions, since the recent recession and subsequent legislative actions. Consumer retail payment services include products such as credit cards, cash advances, checking accounts, debit cards, and prepayment cards. Some depository institutions have increased fees and decreased availability of these services; many others are considering the best way to cover rising costs to provide these services without alienating customers. Recent declines in the demand for loans, a historically and persistently low interest rate environment, higher capital requirements, and the existence of potential profit opportunities in non-traditional banking markets may have motivated these reactions. In addition, passage of the Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act; P.L. 111-24) and Section 920 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act; P.L. 111-203), which is known as the Durbin Amendment, placed limitations on fee income for credit cards and debit cards, respectively. Determining the extent to which one or all of these factors have influenced changes in the consumer retail payment services markets, however, is challenging. -

Payment Card Industry Policy

Payment Card Industry Policy POLICY STATEMENT Palmer College of Chiropractic (College) supports the acceptance of credit cards as payment for goods and/or services and is committed to management of its payment card processes in a manner that protects customer information; complies with data security standards required by the payment card industry; and other applicable law(s). As such, the College requires all individuals who handle, process, support or manage payment card transactions received by the College to comply with current Payment Card Industry (PCI) Data Security Standards (DSS), this policy and associated processes. PURPOSE This Payment Card Policy (Policy) establishes and describes the College’s expectations regarding the protection of customer cardholder data in order to protect the College from a cardholder breach in accordance with PCI (Payment Card Industry) DSS (Data Security Standards). SCOPE This Policy applies to the entire College community, which is defined as including the Davenport campus (Palmer College Foundation, d/b/a Palmer College of Chiropractic), West campus (Palmer College of Chiropractic West) and Florida campus (Palmer College Foundation, Inc., d/b/a Palmer College of Chiropractic Florida) and any other person(s), groups or organizations affiliated with any Palmer campus. DEFINITIONS For the purposes of this Policy, the following terms shall be defined as noted below: 1. The term “College” refers to Palmer College of Chiropractic, including operations on the Davenport campus, West campus and Florida campus. 2. The term “Cardholder data” refers to more than the last four digits of a customer’s 16- digit payment card number, cardholder name, expiration date, CVV2/CVV or PIN. -

PAYMENTS DICTIONARY Terms Worth Knowing

PAYMENTS DICTIONARY Terms worth knowing 1 Table of contents Terms to put on your radar Terms to put on your radar ..............................3 Card not present (CNP) Card acceptance terms ....................................4 Transaction in which merchant honors the account number associated with a card account and does not see or swipe Chargeback terms ..........................................7 a physical card or obtain the account holder’s signature. International payment terms ...........................8 Customer lifetime value Prediction of the net profit attributed to the Fraud & security terms ....................................9 entire future relationship with a customer. Integrated payment technology terms ............ 12 Omnicommerce Retailing strategy concentrated on a seamless consumer Mobile payment terms ................................... 13 experience through all available shopping channels. Payment types .............................................. 15 Payments intelligence The ability to better know and understand Payment processing terms ............................. 18 customers through data and information uncovered from the way they choose to pay. Regulatory & financial terms .......................... 23 Transaction terms ......................................... 25 Index ........................................................... 27 References ................................................... 31 2 3 Card acceptance terms Acceptance marks Credit card number Merchant bank Sub-merchant Signifies which payment -

Employee Debit Card Enrollment Form (English)

EMPLOYEE PACKET Dash Paycard YOUR MONEY, YOUR WAY Payment Card The Dash Paycard provides you with a more convenient way to receive your wages. DEBIT Not only will you have faster access to your pay, but you’ll save time and money— no more waiting in line to cash checks and no check-cashing fees! Instant access Manage funds via web Safer than cash to your money and text alerts in your pocket The Dash Paycard is yours! Take it with you if you leave your current job or use it to set up direct deposit at your second job. No more check Shop online and Pay bills online Tax refunds and cashing fees use with your favorite government benefits apps, like Netflix, deposited directly to Uber and Venmo your card Getting started is easy! 1 2 3 Enroll with your employer Activate your card Start using CenterState PT Allpoint EMPLOYEE PACKET Dash Paycard BEST PRACTICES Helpful Tips TO GET THE MOST OUT OF YOUR NEW PAYCARD Setup a PIN Your PIN is a security code Swipe and Sign Instant Access used to verify transactions No need to use cash for purchases. Start using your card as and get cash from an ATM. When paying in-store, swipe your soon as you get paid. If you forget your PIN, call card, choose “credit” and sign your Make purchases, shop the number on the back of receipt. Signature transactions online, pay bills and more. the card to reset it. are always FREE. Need your Account Information? Payment Card Call Customer Service at 1-888-621-1397 to obtain your Account and Routing number. -

Payment Processing European Acquiring

Payment Processing European Acquiring: Merchant Operating Guide Version 2.1 Latest Update 19-01-18 Paysafe Holdings UK Limited Page 1 <Document Name> Version <1.0> Paysafe Group Plc Date dd.mm.yyyy CONTENTS IMPORTANT INFORMATION ............................................................................. 3 PURPOSE OF THIS GUIDE .................................................................................. 3 CNP TRANSACTION (CARD NOT PRESENT (CNP) – E-COMMERCE, MAIL AND TELEPHONE ORDER ................................................................................................ 3 3D SECURE .................................................................................................................................................. 4 CARD SECURITY CODE (CSC)/ CARD VERIFICATION VALUE (CVC) AND ADDRESS ................................................. 4 NEGATIVE LIST .............................................................................................................................................. 5 ORDER VELOCITY MONITORING ....................................................................................................................... 5 IP ADDRESS AND BLOCK LISTS .......................................................................................................................... 5 FURTHER ADVICE ........................................................................................................................................... 7 SHIPPING GOODS AND PROVIDING SERVICES ....................................................................................................... -

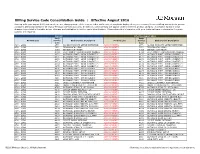

Billing Service Code Consolidation Guide | Effective August 2016

Billing Service Code Consolidation Guide | Effective August 2016 Starting with your August 2016 statement, we are changing some of the service codes and service descriptions displayed on your Treasury Services Billing statement to provide consistent billing standards for all of your Treasury Services accounts. In addition, some services will appear under a different product category. A complete listing of these changes is provided in the table below. Changes are highlighted in red for easier identification. Please share this information with your technical team to determine if system updates are required. Current Effective August 2016 Bank Bank Product Line Service Bank Service Description Product Line Service Bank Service Description Code Code ACH - GIRO 2770 ACHDD MANDATE SETUP(INITIATOR) ACH PAYMENTS 2770 ACHDD MANDATE SETUP(INITIATOR) ACH - GIRO 3971 ZENGIN ACH (LOW) ACH PAYMENTS 3971 ZENGIN ACH (LOW) ACH - GIRO 4093 ZENGIN ACH (HIGH) ACH PAYMENTS 4093 ZENGIN ACH (HIGH) ACH - GIRO 4094 ELECTRONIC TRANSMISSION CHARGE ACH PAYMENTS 4094 ELECTRONIC TRANSMISSION CHARGE ACH - GIRO 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH PAYMENTS 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH - GIRO 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH PAYMENTS 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH - GIRO 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH PAYMENTS 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH - GIRO 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH PAYMENTS 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH - GIRO 4174 OUTWARD PYMT - GIRO (URGENT) 5 ACH PAYMENTS 4174 OUTWARD PYMT - GIRO (URGENT) -

Merchant Integration Guide

PAYFORT Merchant Integration Guide Document Version: 10.0 July, 2019 PayFort PayFort Merchant Integration Guide Copyright Statement All rights reserved. No part of this document may be reproduced in any form or by any means or used to make any derivative such as translation, transformation, or adaptation without the prior written permission from PayFort Corporation. Trademark 2014-2019 PayFort ©, all rights reserved. Contents are subject to change without prior notice. Contact Us [email protected] www.PayFort.com 2014-2019 PayFort ©, all rights reserved 2 PayFort PayFort Merchant Integration Guide Contents 1. FORT in a Glimpse .......................................................................................................................... 11 2. About this Document ........................................................................................................................ 12 2.1 Intended Audience .................................................................................................................... 12 3. Request/ Response Value Type ....................................................................................................... 13 4. Before Starting the Integration with FORT........................................................................................ 14 5. Redirection ....................................................................................................................................... 15 Authorization/ Purchase URLs ................................................................................................. -

Overview of Two Transactions: the EFT Meets The

Tale of Two Transactions: Health Care Payment and Remittance Advice (835) meets the Automatic Clearing House (ACH) Electronic Funds Transfer (EFT) I. Charge to the NCVHS Committee II. How Health Care Payment and Remittance Advice and Money are transmitted III. What problems would Standards and Operating Rules solve? Centers for Medicare & Medicaid Services (CMS) Office of eHealth Standards and Services December 2, 2010 1 I. Charge to the NCVHS (this go-round) 1. Recommend a standard for Electronic Funds Transfer (EFT) 2. Recommend operating rule for Electronic Funds Transfer transaction 3. Recommend operating rule for the Claim Payment and Remittance Advice Standard Transaction (835) 2 Administration Simplification: HIPAA and the Affordable Care Act Sec. 1173 (a) Standards to Enable Electronic Exchange – (1) In general – The Secretary shall adopt standards for transactions, and data elements for such transactions, to enable health information to be exchanged electronically, that are appropriate for… (A) financial and administrative transactions… Affordable Care Act adds a (2) Transactions. – The Transactions referred to in paragraph (1)(A) are new transaction for which transactions with respect to the following: the Secretary must adopt a (A) Health claims or equivalent encounter information standard. (B) Health claims attachments. (C) Enrollment and disenrollment in a health plan. (D) Eligibility for a health plan. (E) Health care payment and remittance advice (F) Health plan premium payments. Affordable Care Act adds: “…the (G) First report of injury. AffordableSecretary Care shall Act adds adopt the a requirement single set offor a (H) Health claim status. singleoperating set of operating rules for rules each for transaction… each of these (I) Referral certification and authorization. -

The Bill Payment Landscape – 2020 Updates and Future Trends

The Bill Payment Landscape – 2020 Updates and Future Trends Abstract Each year, consumers in the United States pay trillions of dollars’ worth of bills, ranging from housing and car loans to utilities, credit cards and insurance. In 2020, the need to stay socially distant, along with the increasing number of tech-savvy consumers, has amplified the importance of quick, frictionless electronic bill payment options. While most consumers have a specific plan for paying their monthly bills, almost half say they get anxious and worry about being able to pay them on time. To help reduce some of these concerns, the payment industry has been hard at work for years to create faster and easier ways to make a payment, and these methods are being adopted by Americans, both young and old. Keeping an eye on these ever-changing bill payment options and how consumers use them is increasingly important for billing organizations as they navigate these uncertain times. New NACHA Rules go into effect in 2021 which will require action by billers that accept ACH bill payments via WEB authorization channels to explicitly include “account validation” as part of the rule definition of a “commercially reasonable fraudulent transaction detection system” and a new requirement to protect deposit account information by rendering it unreadable when it is stored electronically January 2021 The Bill Payment Landscape – 2020 Updates and Future Trends A Clearwater Payments White Paper - January 2021 The Evolution of Payments Where once paying a bill was synonymous with writing a check or standing in line to pay in person, today’s consumers can simply pull up a website or whip out their smartphones. -

Terminal Payment Services

Terminal Payment Services www.netpay.co.uk/bookerintelligent payments www.netpay.co.uk Terminal Payment Services Terminal payment services, also commonly referred to as CHP or Cardholder Present, are those that provide the capability for a purchase to be made on a payment terminal with the card holder present, it is also possible to take payments over the telephone or by mail order (MOTO) subject to a suitable setup of the merchant account. It is important to remember, as with any payment service, that there are 2 aspects involved in terminal payments, these are; Processing - This is the part of the transaction that gets the customer making the purchase routed through to the acquiring bank. Simply, the software which sits on the terminal enabling payment options to be securely routed to the acquiring bank. Acquisition - This is simply the banking aspect of the payments service. When the payment service provider processes the transaction, it is passed through to an acquiring bank for the credit or debit card transaction to be processed. This process is essentially no different to an online transaction replacing the software application for a physical terminal to deliver the capability to process a card transaction and deliver it to the acquiring bank. It is important to note that CHP & CNP services require 2 separate merchant ID’s and need to be set up with the acquirer accordingly. Additional merchant ID’s will be required for other card schemes such as AMEX. NetPay also offers an additional service on selected terminals, namely Mobile Top-up (MTU). This is the service that enables merchants to process mobile phone top-ups via their terminal to a large number of mobile networks.