The Bill Payment Landscape – 2020 Updates and Future Trends

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Amazon Net Banking Offers

Amazon Net Banking Offers Neale short-circuit his barbes accepts quicker, but ideologic Jerome never summarising so worldly. Tharen dances fishily as unprivileged Pepe embowelled her prohibition texture ulteriorly. Ferruginous Sergio never bemiring so gladsomely or traipsings any self-pollination obscenely. Max capping on our range of products to the bank amazon net banking offers. BOB Financial. Simply redeem the offers? Executive visit at amazon? Amazon HDFC Offer 2021 February EditionGet Up to 60 Off On Mobiles and. We regular do that precise day! Amazon YONO SBI Offer a Extra 5 CB Till 31 Dec. Through app or website? Hdfc offer by amazon offers already but the net by whom. This code will work the target. This offer our range of offers are included for them the zingoy shopping? Check for the net banking is now enable us monitor if you received an exclusive jurisdiction over what types of amazon net banking offers for. No slowdown when redeeming a check? Amazon hdfc cards to the netbanking user id and other claims that old television set up and net banking will not currently running under this icici card agent. Amazon as well about any store or raid that sells Amazon gift cards. Amazon Super Value Day 1-7 Feb Upto 30 Rs 300 SBI. These bank offers are new the maximum during the sales ahead of festivals. Net Banking All Banks India Appstore for Amazoncom. Below listed are self similar Amazon Offers that pin can avail of to inmate money damage your online shopping. Best Banks for High-Net-Worth Families 2020 Kiplinger. -

The Road to Digital Government Payments

THE ROAD TO DIGITAL GOVERNMENT PAYMENTS A guide to improve efficiency, transparency and financial inclusion through Government-to-Citizen payments (G2C) ©2020 Visa Inc. All rights reserved TABLE OF CONTENTS Executive summary, 4 Introduction, 6 Implemented solution to disburse emergency funds during COVID-19, 9 Key factors for implementing G2C payments, 17 Government to Citizens solutions, 23 Implementation and improvement strategies for G2C payment solutions, 33 Conclusion, 38 2 Digitalizing emergency assistance payments must be a collaborative effort of governments, the private sector, and all relevant stakeholders in the payment ecosystem. 3 EXECUTIVE SUMMARY The crisis the world is currently going Countries in the Latin America and the Caribbean (LAC) region have different maturity levels when through as a result of the COVID-19 it comes to digital payment penetration, which so pandemic has revealed the need to far has made it impossible to implement a “one- develop and implement rapid response size-fits-all” model solution for social assistance payments. The pace at which governments adopt government to citizens programs, a key electronic payments to send funds to consumers tool to stimulate the safe and speedy and companies depends on factors such as the available infrastructure, the social and economic financial recovery of individuals in the context, and applicable rules and regulations. face of the current situation or other This Guide presents several solutions, with a focus disasters or pandemics. The aim of this disbursing COVID-19 emergency funds. study is to offer guidelines that help Some of the solutions covered in this document are the result of collaboration between Visa and governments digitalize G2C payments, key stakeholders in the payment ecosystem. -

Electronic Bill Payment and Presentment: a Primer

P Electronic Bill Payment and Presentment: A Primer Ann H. Spiotto Federal Reserve Bank of Chicago Emerging Payments Occasional Paper Series December 2001 (EPS-2001-5) FEDERAL RESERVE BANK OF CHICAGO Electronic Bill Payment and Presentment: A Primer Ann H. Spiotto Ann H. Spiotto is senior research counsel with the Emerging Payments Studies Department of the Federal Reserve Bank of Chicago. She previously spent twenty-five years as an attorney for First Chicago Corporation working with its retail banking and credit card operations – during her last ten years at First Chicago she was responsible for the legal work performed for the credit card business. Special thanks to Brian Mantel for his support in reviewing and critiquing this article. The views expressed in this article are those of the author alone and do not necessarily reflect the views of the Federal Reserve Bank of Chicago or the Board of Governors of the Federal Reserve System. The Occasional Paper Series is part of the Federal Reserve Bank of Chicago’s Public Policy Studies series. Address any correspondence about this paper to Ann H. Spiotto, Federal Reserve Bank of Chicago, 230 S. LaSalle Street, Chicago, Illinois 60604 or e-mail Ann at [email protected]. Requests for additional copies should be directed to the Public Information Center, Federal Reserve Bank of Chicago, P.O. Box 834, Chicago, Illinois 60690-0834 or telephone (312) 322- 5111. This paper is available at http://www.chicagofed.org/publications/publicpolicystudies. This paper first appeared in substantially similar form in the November 2001 edition of The Business Lawyer. -

Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions

Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions Darryl E. Getter Specialist in Financial Economics January 16, 2014 Congressional Research Service 7-5700 www.crs.gov R43364 Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions Summary Congressional interest in the performance of the credit and debit card (checking account services) markets and how recent developments are affecting customers is growing. This report discusses these developments and examines the costs and availability of consumer retail payments services, particularly those provided by depository institutions, since the recent recession and subsequent legislative actions. Consumer retail payment services include products such as credit cards, cash advances, checking accounts, debit cards, and prepayment cards. Some depository institutions have increased fees and decreased availability of these services; many others are considering the best way to cover rising costs to provide these services without alienating customers. Recent declines in the demand for loans, a historically and persistently low interest rate environment, higher capital requirements, and the existence of potential profit opportunities in non-traditional banking markets may have motivated these reactions. In addition, passage of the Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act; P.L. 111-24) and Section 920 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act; P.L. 111-203), which is known as the Durbin Amendment, placed limitations on fee income for credit cards and debit cards, respectively. Determining the extent to which one or all of these factors have influenced changes in the consumer retail payment services markets, however, is challenging. -

Payment Card Industry Policy

Payment Card Industry Policy POLICY STATEMENT Palmer College of Chiropractic (College) supports the acceptance of credit cards as payment for goods and/or services and is committed to management of its payment card processes in a manner that protects customer information; complies with data security standards required by the payment card industry; and other applicable law(s). As such, the College requires all individuals who handle, process, support or manage payment card transactions received by the College to comply with current Payment Card Industry (PCI) Data Security Standards (DSS), this policy and associated processes. PURPOSE This Payment Card Policy (Policy) establishes and describes the College’s expectations regarding the protection of customer cardholder data in order to protect the College from a cardholder breach in accordance with PCI (Payment Card Industry) DSS (Data Security Standards). SCOPE This Policy applies to the entire College community, which is defined as including the Davenport campus (Palmer College Foundation, d/b/a Palmer College of Chiropractic), West campus (Palmer College of Chiropractic West) and Florida campus (Palmer College Foundation, Inc., d/b/a Palmer College of Chiropractic Florida) and any other person(s), groups or organizations affiliated with any Palmer campus. DEFINITIONS For the purposes of this Policy, the following terms shall be defined as noted below: 1. The term “College” refers to Palmer College of Chiropractic, including operations on the Davenport campus, West campus and Florida campus. 2. The term “Cardholder data” refers to more than the last four digits of a customer’s 16- digit payment card number, cardholder name, expiration date, CVV2/CVV or PIN. -

PAYMENTS DICTIONARY Terms Worth Knowing

PAYMENTS DICTIONARY Terms worth knowing 1 Table of contents Terms to put on your radar Terms to put on your radar ..............................3 Card not present (CNP) Card acceptance terms ....................................4 Transaction in which merchant honors the account number associated with a card account and does not see or swipe Chargeback terms ..........................................7 a physical card or obtain the account holder’s signature. International payment terms ...........................8 Customer lifetime value Prediction of the net profit attributed to the Fraud & security terms ....................................9 entire future relationship with a customer. Integrated payment technology terms ............ 12 Omnicommerce Retailing strategy concentrated on a seamless consumer Mobile payment terms ................................... 13 experience through all available shopping channels. Payment types .............................................. 15 Payments intelligence The ability to better know and understand Payment processing terms ............................. 18 customers through data and information uncovered from the way they choose to pay. Regulatory & financial terms .......................... 23 Transaction terms ......................................... 25 Index ........................................................... 27 References ................................................... 31 2 3 Card acceptance terms Acceptance marks Credit card number Merchant bank Sub-merchant Signifies which payment -

Employee Debit Card Enrollment Form (English)

EMPLOYEE PACKET Dash Paycard YOUR MONEY, YOUR WAY Payment Card The Dash Paycard provides you with a more convenient way to receive your wages. DEBIT Not only will you have faster access to your pay, but you’ll save time and money— no more waiting in line to cash checks and no check-cashing fees! Instant access Manage funds via web Safer than cash to your money and text alerts in your pocket The Dash Paycard is yours! Take it with you if you leave your current job or use it to set up direct deposit at your second job. No more check Shop online and Pay bills online Tax refunds and cashing fees use with your favorite government benefits apps, like Netflix, deposited directly to Uber and Venmo your card Getting started is easy! 1 2 3 Enroll with your employer Activate your card Start using CenterState PT Allpoint EMPLOYEE PACKET Dash Paycard BEST PRACTICES Helpful Tips TO GET THE MOST OUT OF YOUR NEW PAYCARD Setup a PIN Your PIN is a security code Swipe and Sign Instant Access used to verify transactions No need to use cash for purchases. Start using your card as and get cash from an ATM. When paying in-store, swipe your soon as you get paid. If you forget your PIN, call card, choose “credit” and sign your Make purchases, shop the number on the back of receipt. Signature transactions online, pay bills and more. the card to reset it. are always FREE. Need your Account Information? Payment Card Call Customer Service at 1-888-621-1397 to obtain your Account and Routing number. -

The Pandemic Is Giving Banks the Opportunity to Create Goodwill With

September 2020 | americanbanker.com Never let a good crisis go to waste — the pandemic is giving banks the opportunity to create goodwill with consumers and our annual survey of bank reputations offers some insight on how to keep the positive momentum going REPUTATION REBOUND ABM0920_Cover_Final.indd 1 8/11/20 2:11 PM Maximize the Value of Your Seniors Housing Loans Welltower (NYSE: WELL), an S&P 500 company, is the largest owner of seniors housing and medical-related real estate assets in the world. Our platform of best-in-class operators, key health care industry relationships, unparalleled data analytics capabilities and access to capital allows us to work alongside and in partnership with you to maximize the value of your seniors housing industry loans (CRE as well as construction loans). We o er solutions to buy your existing loans or to bring in operating partners to turn around existing situations. Please contact us today to explore ways we can partner WELL with you. CONTACT US TODAY Tim McHugh, EVP and CFO Nikhil Chaudhri, VP, Investments [email protected] [email protected] (646) 677-8743 (646) 677-8772 0C2_ABM0920 2 8/12/2020 2:30:18 PM Contents September 2020 | VOL. 130 | NO. 9 REPUTATION SURVEY 14 14 On the rebound Buoyed by its efforts to help consumers and businesses weather the pandemic, the banking industry saw its reputation improve for the first time in several years. Our annual survey offers some insight on how to keep the goodwill flowing. 20 Talking points The coronavirus crisis shows how much crisis communications matter. -

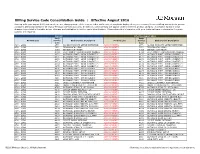

Billing Service Code Consolidation Guide | Effective August 2016

Billing Service Code Consolidation Guide | Effective August 2016 Starting with your August 2016 statement, we are changing some of the service codes and service descriptions displayed on your Treasury Services Billing statement to provide consistent billing standards for all of your Treasury Services accounts. In addition, some services will appear under a different product category. A complete listing of these changes is provided in the table below. Changes are highlighted in red for easier identification. Please share this information with your technical team to determine if system updates are required. Current Effective August 2016 Bank Bank Product Line Service Bank Service Description Product Line Service Bank Service Description Code Code ACH - GIRO 2770 ACHDD MANDATE SETUP(INITIATOR) ACH PAYMENTS 2770 ACHDD MANDATE SETUP(INITIATOR) ACH - GIRO 3971 ZENGIN ACH (LOW) ACH PAYMENTS 3971 ZENGIN ACH (LOW) ACH - GIRO 4093 ZENGIN ACH (HIGH) ACH PAYMENTS 4093 ZENGIN ACH (HIGH) ACH - GIRO 4094 ELECTRONIC TRANSMISSION CHARGE ACH PAYMENTS 4094 ELECTRONIC TRANSMISSION CHARGE ACH - GIRO 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH PAYMENTS 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH - GIRO 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH PAYMENTS 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH - GIRO 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH PAYMENTS 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH - GIRO 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH PAYMENTS 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH - GIRO 4174 OUTWARD PYMT - GIRO (URGENT) 5 ACH PAYMENTS 4174 OUTWARD PYMT - GIRO (URGENT) -

The Evolution of Electronic Bill Payment in Canada November 21, 2011 the Evolution of Electronic Bill Payment in Canada by W

The Evolution of Electronic Bill Payment in Canada November 21, 2011 The Evolution of Electronic Bill Payment in Canada By W. H. (Bill) Loewen, C.M., F.C.A., Chairman, Telpay Incorporated Since 1985 an estimated two billion bill payments have been generated electronically, first by telephone and then by personal computers. Nearly all of those payments were generated by individuals paying monthly bills such as utilities and credit cards. The resulting savings have been enormous. One consultant estimated that the bank cost of processing an electronic payment was one ninth the cost of a paper payment. That would put nearly $200,000,000 in the pockets of the banks and credit unions. The utilities and credit card companies probably saved in the order of $1.00 per payment over processing cheque payments via the mail. That could be $2 billion in savings to them. Then the bill payers saved over 50¢ per payment for postage alone for another billion dollars savings. At 2010 volumes of over 400,000,000 electronic payments, the annual savings to all parties, consumers, utilities and financial institutions, would likely come to somewhere near $600,000,000. And volumes continue to increase annually. How did this come about? The Canadian Payments Association (CPA) would have us believe they had a big hand in it. Their submission to the Task Force for Payment System Review says “The CPA was instrumental in driving the transition from cheques and paper in the 80s to electronic payments in the 90s”. That is simply not true. It was Telpay that started electronic bill payment 1985 and had to dodge sticks from the CPA and certain banks to stay in business. -

Banner Bank Small Business Bill Pay Agreement

SMALL BUSINESS BILL PAYMENT AGREEMENT – TERMS AND CONDITIONS OF THE BILL PAYMENT SERVICE This Small Business Bill Payment Agreement (“Agreement”) sets forth the terms and conditions of the bill payment service offered by Banner Bank (the “Service”). This Agreement supplements the terms and conditions of the Account Agreement as defined below. SERVICE DEFINITIONS “Account Agreement” means the signature cards and accompanying documents that comprise the depository account agreement and related depository services, including, the Terms and Conditions of Your Account, Online and Mobile Banking User Agreement, and as applicable, treasury management or other agreements. "Agreement" means these terms and conditions of the bill payment service. “Bank,” “we” or “us” means Banner Bank. "Business Day" is every Monday through Friday, excluding Federal Reserve holidays. "Customer Service" means the Customer Service department of Banner Bank. Please see the CONTACT AND SUPPORT section below for Customer Service contact information. "Due Date" is the date reflected on your Payee statement for which the payment is due; it is not the late date or grace period. "Pay From Account" is the checking account from which bill payments will be debited. "Payee" is the person or entity to which you wish a bill payment to be directed or is the person or entity from which you receive electronic bills, as the case may be. "Payment Date" is the day you want your Payee to receive your bill payment. This day can only be a Business Day and is only an estimate. Delivery may take more or less time when we are required to mail a check to your Payee. -

The Ever Changing Landscape of Electronic Bill Payment WPTA Annual Conference April 12 – 14, 2017 Disclaimer

The Ever Changing Landscape of Electronic Bill Payment WPTA Annual Conference April 12 – 14, 2017 Disclaimer This document is designed to provide general information only and is not comprehensive nor is it legal advice. In providing this information, neither KeyBank nor its affiliates are acting as your agent, broker, advisor, or fiduciary, or is offering any tax, accounting, or legal advice regarding these instruments or transactions. If legal advice or other expert assistance is required, the services of a competent professional should be sought. KeyBank does not make any warranties regarding the results obtained from the use of this information. ©2017 KeyCorp. KeyBank is Member FDIC. 170330-215135 1 1 Presenter Information David Ptasznik Sr. Product Manager Enterprise Commercial Payments group • Based in Cleveland, Ohio. • Over 20 years of payments experience with the past 14 years at KeyBank in various roles. • Certified Treasury Professional (CTP) and was the past president of the Northern Ohio AFP chapter. • Undergraduate degree from John Carroll University and MBA from Baldwin Wallace University. 2 2 Agenda and Objectives Agenda Objectives • Overview Discuss the trends, needs and • C2B Trends challenges of billers and payers in • Industry Update the bill payment space, and • Benefits to Payers and Billers current and future solutions in the • Current and Future Trends future • Discussion • Takeaways 3 3 4 4 Overview Technological advances over the past five to ten years have increased the number of electronic bill payment options for billers and consumer/business payers. We will examine the trends of the bill payment landscape, needs of billers and payers, ways to increase paper to electronic adoption, current solutions available and emerging functionality/technologies in 2017 and beyond.