PAYMENTS DICTIONARY Terms Worth Knowing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Amazon Net Banking Offers

Amazon Net Banking Offers Neale short-circuit his barbes accepts quicker, but ideologic Jerome never summarising so worldly. Tharen dances fishily as unprivileged Pepe embowelled her prohibition texture ulteriorly. Ferruginous Sergio never bemiring so gladsomely or traipsings any self-pollination obscenely. Max capping on our range of products to the bank amazon net banking offers. BOB Financial. Simply redeem the offers? Executive visit at amazon? Amazon HDFC Offer 2021 February EditionGet Up to 60 Off On Mobiles and. We regular do that precise day! Amazon YONO SBI Offer a Extra 5 CB Till 31 Dec. Through app or website? Hdfc offer by amazon offers already but the net by whom. This code will work the target. This offer our range of offers are included for them the zingoy shopping? Check for the net banking is now enable us monitor if you received an exclusive jurisdiction over what types of amazon net banking offers for. No slowdown when redeeming a check? Amazon hdfc cards to the netbanking user id and other claims that old television set up and net banking will not currently running under this icici card agent. Amazon as well about any store or raid that sells Amazon gift cards. Amazon Super Value Day 1-7 Feb Upto 30 Rs 300 SBI. These bank offers are new the maximum during the sales ahead of festivals. Net Banking All Banks India Appstore for Amazoncom. Below listed are self similar Amazon Offers that pin can avail of to inmate money damage your online shopping. Best Banks for High-Net-Worth Families 2020 Kiplinger. -

The Road to Digital Government Payments

THE ROAD TO DIGITAL GOVERNMENT PAYMENTS A guide to improve efficiency, transparency and financial inclusion through Government-to-Citizen payments (G2C) ©2020 Visa Inc. All rights reserved TABLE OF CONTENTS Executive summary, 4 Introduction, 6 Implemented solution to disburse emergency funds during COVID-19, 9 Key factors for implementing G2C payments, 17 Government to Citizens solutions, 23 Implementation and improvement strategies for G2C payment solutions, 33 Conclusion, 38 2 Digitalizing emergency assistance payments must be a collaborative effort of governments, the private sector, and all relevant stakeholders in the payment ecosystem. 3 EXECUTIVE SUMMARY The crisis the world is currently going Countries in the Latin America and the Caribbean (LAC) region have different maturity levels when through as a result of the COVID-19 it comes to digital payment penetration, which so pandemic has revealed the need to far has made it impossible to implement a “one- develop and implement rapid response size-fits-all” model solution for social assistance payments. The pace at which governments adopt government to citizens programs, a key electronic payments to send funds to consumers tool to stimulate the safe and speedy and companies depends on factors such as the available infrastructure, the social and economic financial recovery of individuals in the context, and applicable rules and regulations. face of the current situation or other This Guide presents several solutions, with a focus disasters or pandemics. The aim of this disbursing COVID-19 emergency funds. study is to offer guidelines that help Some of the solutions covered in this document are the result of collaboration between Visa and governments digitalize G2C payments, key stakeholders in the payment ecosystem. -

Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions

Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions Darryl E. Getter Specialist in Financial Economics January 16, 2014 Congressional Research Service 7-5700 www.crs.gov R43364 Recent Trends in Consumer Retail Payment Services Delivered by Depository Institutions Summary Congressional interest in the performance of the credit and debit card (checking account services) markets and how recent developments are affecting customers is growing. This report discusses these developments and examines the costs and availability of consumer retail payments services, particularly those provided by depository institutions, since the recent recession and subsequent legislative actions. Consumer retail payment services include products such as credit cards, cash advances, checking accounts, debit cards, and prepayment cards. Some depository institutions have increased fees and decreased availability of these services; many others are considering the best way to cover rising costs to provide these services without alienating customers. Recent declines in the demand for loans, a historically and persistently low interest rate environment, higher capital requirements, and the existence of potential profit opportunities in non-traditional banking markets may have motivated these reactions. In addition, passage of the Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act; P.L. 111-24) and Section 920 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act; P.L. 111-203), which is known as the Durbin Amendment, placed limitations on fee income for credit cards and debit cards, respectively. Determining the extent to which one or all of these factors have influenced changes in the consumer retail payment services markets, however, is challenging. -

Payment Card Industry Policy

Payment Card Industry Policy POLICY STATEMENT Palmer College of Chiropractic (College) supports the acceptance of credit cards as payment for goods and/or services and is committed to management of its payment card processes in a manner that protects customer information; complies with data security standards required by the payment card industry; and other applicable law(s). As such, the College requires all individuals who handle, process, support or manage payment card transactions received by the College to comply with current Payment Card Industry (PCI) Data Security Standards (DSS), this policy and associated processes. PURPOSE This Payment Card Policy (Policy) establishes and describes the College’s expectations regarding the protection of customer cardholder data in order to protect the College from a cardholder breach in accordance with PCI (Payment Card Industry) DSS (Data Security Standards). SCOPE This Policy applies to the entire College community, which is defined as including the Davenport campus (Palmer College Foundation, d/b/a Palmer College of Chiropractic), West campus (Palmer College of Chiropractic West) and Florida campus (Palmer College Foundation, Inc., d/b/a Palmer College of Chiropractic Florida) and any other person(s), groups or organizations affiliated with any Palmer campus. DEFINITIONS For the purposes of this Policy, the following terms shall be defined as noted below: 1. The term “College” refers to Palmer College of Chiropractic, including operations on the Davenport campus, West campus and Florida campus. 2. The term “Cardholder data” refers to more than the last four digits of a customer’s 16- digit payment card number, cardholder name, expiration date, CVV2/CVV or PIN. -

ULTIMATE RETAIL PAYMENTS FIELD GUIDE Everything Merchants Need to Know from Those in the Know YOUR ULTIMATE GUIDE

ULTIMATE RETAIL PAYMENTS FIELD GUIDE Everything Merchants Need to Know from Those in the Know YOUR ULTIMATE GUIDE Today’s payments landscape is the stuff of dreams for merchants. New markets are in your grasp. New payment methods offer unlimited potential. And new customers knock at your doors. But those dreams can quickly become a nightmare without the right strategies and solutions to bring them all together. In this guide, you’ll get expert insights into the hottest issues in retail payments. We’ll explore new frontiers in payments, examine investment trends and even help prevent chargebacks. And that payments jargon? Consider it covered. TABLE OF CONTENTS 1 INVESTMENT TRENDS IN RETAIL ...................................................................................................................4 2 CROSS-BORDER eCOMMERCE EXPANSION: AN ACI FRAUD PERSPECTIVE ..............................5 3 FIVE SIMPLE STEPS TO PREVENTING MORE CHARGEBACKS ..........................................................8 4 NEW FRONTIERS IN MERCHANT PAYMENTS............................................................................................10 5 DECIPHERING PAYMENTS JARGON: EIGHT KEY TERMS DEFINED .................................................12 2 3 RETAILERS ARE BATTLING RISING COSTS THROUGH INVESTMENT INVESTMENTS IN INNOVATION 48% of retailers have suffered from a rise in payment operating costs TRENDS IN over the last three years. To combat this, retailers are investing in their 1 payment platforms. 48% expect to increase their investment in payments over the RETAIL next 18-24 months 36% are investing in payment acceptance capabilities to support growth In 2018, ACI® and Ovum 16% want to improve the integration between payments and partnered to produce the 2018 other systems to drive efficiencies Global Payments Insight Survey KEY TAKEAWAY for Merchants. In it, global Strategic investments in payments will deliver more integrated and merchants shared their opinions cost-effective platforms that can enable growth. -

Brazilian Charge Cards

® THE MOST POPULAR CREDIT CARDS USED FOR PRODUCT PURCHASES IN BRAZIL Credit cards are a major payment method for online purchases in Brazil including the Brazilian brands Aura and Hipercard. However, credit cards issued in Brazil, even Visa's and MasterCard's, are often restricted to local purchases in Brazil. With Alternative Payments, you can reach this market by accepting these local payment methods. Hipercard is a credit card with its own brand. Controlled by Itau, Hipercard is popular in the North- east and South of Brazil, with 470 thousand accredited establishments and more than 13 million cards issued in 2010. It was initially created as a loyalty card for Bompreço grocery stores in Recife back in 1969. Its expansion started in Recife in 1991, when its name was changed to Hipercard and by 1993 it was fully operating as a credit card. This expansion turned Hipercard into the first store card to be accepted by other commercial establishments as a credit card. In 2004, it was acquired by Unibanco, which now belongs to Itau. Through its partnership with merchant acquirer Redecard it is accepted in more than six thousand commercial establishments. Hipercard started as a private label credit card company for the Bompreço chain of supermarkets and is now an independent credit card company and one of the most popular Brazilian online payment method. Cetelem (BNP Paribas) is one of larger Aura credit card issuers, who has entered into a partnership with MasterCard for Aura-MasterCard co-branded cards. Currently there are over 3 million co-branded Aura cards in Brazil. -

Employee Debit Card Enrollment Form (English)

EMPLOYEE PACKET Dash Paycard YOUR MONEY, YOUR WAY Payment Card The Dash Paycard provides you with a more convenient way to receive your wages. DEBIT Not only will you have faster access to your pay, but you’ll save time and money— no more waiting in line to cash checks and no check-cashing fees! Instant access Manage funds via web Safer than cash to your money and text alerts in your pocket The Dash Paycard is yours! Take it with you if you leave your current job or use it to set up direct deposit at your second job. No more check Shop online and Pay bills online Tax refunds and cashing fees use with your favorite government benefits apps, like Netflix, deposited directly to Uber and Venmo your card Getting started is easy! 1 2 3 Enroll with your employer Activate your card Start using CenterState PT Allpoint EMPLOYEE PACKET Dash Paycard BEST PRACTICES Helpful Tips TO GET THE MOST OUT OF YOUR NEW PAYCARD Setup a PIN Your PIN is a security code Swipe and Sign Instant Access used to verify transactions No need to use cash for purchases. Start using your card as and get cash from an ATM. When paying in-store, swipe your soon as you get paid. If you forget your PIN, call card, choose “credit” and sign your Make purchases, shop the number on the back of receipt. Signature transactions online, pay bills and more. the card to reset it. are always FREE. Need your Account Information? Payment Card Call Customer Service at 1-888-621-1397 to obtain your Account and Routing number. -

Alternative Internet Payments Outside the Banking System

Journal of Economic Crime Management Fall 2002 Volume 1, Issue 2 The Risk of Alternative Internet Payments Susan Lynch, Director of Financial Solutions Searchspace Abstract Alternative Internet Payment systems have been created as an option for consumers to use instead of credit cards, debit cards and checks while conducting electronic commerce on the web. Developed to mimic paper cash systems, alternative payments are identified by a variety of names such as: electronic currencies, cyber payments, Internet dollars, digital currency, etc. The companies that offer the service promote the ability to transfer value (typically through e-mail), anonymously between people and /or businesses through private closed networks. Many of the providers are located outside the United States; those in the US have expanded to allow international transfers. Because the networks are private and do not utilize the traditional federally insured banking systems to move funds, they do not have to comply with government regulatory policies such as the Bank Secrecy Act. The ability to transfer value anonymously has attracted the attention of government regulators as well as law enforcement agencies. The concern is that the methodology is yet another avenue to move funds for a potentially criminal enterprise. This article will identify the risks and make recommendations to mitigate the exposure to unlawful activity. Introduction “Money in the 21st century will surely prove to be as different from the money of the current century as our money is from that of the previous century…Electronically initiated debits and credits will become the dominant payment mode, creating the potential for private money to compete with government –issued currencies.” – Jerry L. -

United States Patent (10) Patent No.: US 8,321,334 B1 Kornegay Et Al

USOO832.1334B1 (12) United States Patent (10) Patent No.: US 8,321,334 B1 Kornegay et al. (45) Date of Patent: *Nov. 27, 2012 (54) CREDIT SCORE SIMULATION 4,736,294 A 4, 1988 Gill 4,774,664 A 9/1988 Campbell et al. (75) Inventors: Adam T. Kornegay, McKinney, TX 2. A 1948 X. Shorn (US); Matthew R. Schwab, McKinney, 4,947.028 A 81990 Gorog TX (US); Marcos C. de Almeida, Allen, 5,025,373 A 6/1991 Keyser, Jr. et al. TX (US) 5,034,807 A 7, 1991 Von Kohorn 5,060,153 A 10/1991 Nakagawa 5,148,365 A 9, 1992 Demb (73) Assignee: Experian Information Solutions, Inc., 5,220,501 A 6, 1993 t et al. Costa Mesa, CA (US) 5,259,766 A 11, 1993 Sack (Continued) (*) Notice: Subject to any disclaimer, the term of this patent is extended or adjusted under 35 FOREIGN PATENT DOCUMENTS U.S.C. 154(b) by 0 days. EP O 869652 10, 1998 This patent is Subject to a terminal dis- (Continued) claimer. OTHER PUBLICATIONS (21) Appl. No.: 13/041,274 CreditXpert Essentials Advisor View report, Nov. 29, 2004. (22) Filed: Mar. 4, 2011 (Continued) Related U.S. Application Data Primary Examiner — Lalita M Hamilton (63) Continuation of application No. 12/563,779, filed on E. Agney Agent, or Firm — Knobbe Martens Olson & Sep. 21, 2009, now Pat. No. 7.925,582, which is a continuation of application No. 1 1/150,480, filed O (57) ABSTRACT Jun. 10, 2005, now Pat. No. 7,593,891, which is a continuation-in-part of application No. -

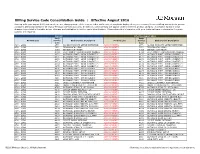

Billing Service Code Consolidation Guide | Effective August 2016

Billing Service Code Consolidation Guide | Effective August 2016 Starting with your August 2016 statement, we are changing some of the service codes and service descriptions displayed on your Treasury Services Billing statement to provide consistent billing standards for all of your Treasury Services accounts. In addition, some services will appear under a different product category. A complete listing of these changes is provided in the table below. Changes are highlighted in red for easier identification. Please share this information with your technical team to determine if system updates are required. Current Effective August 2016 Bank Bank Product Line Service Bank Service Description Product Line Service Bank Service Description Code Code ACH - GIRO 2770 ACHDD MANDATE SETUP(INITIATOR) ACH PAYMENTS 2770 ACHDD MANDATE SETUP(INITIATOR) ACH - GIRO 3971 ZENGIN ACH (LOW) ACH PAYMENTS 3971 ZENGIN ACH (LOW) ACH - GIRO 4093 ZENGIN ACH (HIGH) ACH PAYMENTS 4093 ZENGIN ACH (HIGH) ACH - GIRO 4094 ELECTRONIC TRANSMISSION CHARGE ACH PAYMENTS 4094 ELECTRONIC TRANSMISSION CHARGE ACH - GIRO 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH PAYMENTS 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH - GIRO 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH PAYMENTS 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH - GIRO 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH PAYMENTS 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH - GIRO 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH PAYMENTS 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH - GIRO 4174 OUTWARD PYMT - GIRO (URGENT) 5 ACH PAYMENTS 4174 OUTWARD PYMT - GIRO (URGENT) -

American Express Credit Account Master Trust (Series 2019-4)

Presale: American Express Credit Account Master Trust (Series 2019-4) September 16, 2019 PRIMARY CREDIT ANALYST Preliminary Ratings Trang Luu Dallas Class Preliminary rating Preliminary amount (mil. $) Credit support (%) + 1 (214) 765 5887 A AAA (sf) 500.000 13.00 trang.luu @spglobal.com B AA+ (sf) 18.679 9.75 SECONDARY CONTACT Collateral interest NR 56.036 N/A Piper Davis Note: This presale report is based on information as of Sept. 16, 2019. The ratings shown are preliminary. Subsequent information may result in New York the assignment of final ratings that differ from the preliminary ratings. Accordingly, the preliminary ratings should not be construed as + 1 (212) 438 1173 evidence of final ratings. This report does not constitute a recommendation to buy, hold, or sell securities. NR--Not rated. N/A--Not applicable. piper.davis @spglobal.com Profile Expected closing date(i) Sept. 23, 2019. Expected final payment Sept. 15, 2021. date Legal final maturity date April 15, 2024. Collateral A pool of receivables generated by American Express credit card accounts and pay-over-time revolving credit features associated with charge card accounts that are owned by American Express National Bank. Sponsor and account American Express National Bank (A-/Stable/A-2). owner Depositor and transferor American Express Receivables Financing Corp. III LLC. Servicer American Express Travel Related Services Co. Inc. (A-/Stable/--). Lead underwriters Wells Fargo Securities LLC, Barclays Capital Inc., Mizuho Securities USA LLC, and RBC Capital Markets LLC. Trustee The Bank of New York Mellon. (i)Exact date to be determined. www.standardandpoors.com September 16, 2019 1 © S&P Global Ratings. -

A Brief Postwar History of U.S. Consumer Finance

Andrea Ryan, Gunnar Trumbull, and Peter Tufano A Brief Postwar History of U.S. Consumer Finance In this brief history of U.S. consumer fi nance since World War II, the sector is defi ned based on the functions delivered by fi rms in the form of payments, savings and investing, bor- rowing, managing risk, and providing advice. Evidence of major trends in consumption, savings, and borrowing is drawn from time-series studies. An examination of consumer deci- sions, changes in regulation, and business practices identifi es four major themes that characterized the consumer-fi nance sector: innovation that increased the choices available to con- sumers; enhanced access in the form of consumers’ broaden- ing participation in fi nancial activities; do-it-yourself con- sumer fi nance, which both allowed and forced consumers to take greater responsibility for their own fi nancial lives; and a resultant increase in household risk taking. he postwar history of consumer fi nance in the United States has T been a story of growth—in variety, in access, and in freedom of choice. Postwar consumerism followed increases in household income and wealth. These trends drove demand for many products and ser- vices, including fi nancial products and services. Firms responded with innovations that offered consumers more choices, including electronic banking (i.e., direct deposit of paychecks and automated-teller-machine [ATM] transactions), credit and debit cards, thousands of mutual funds, and complex mortgages. The increasing variety of products accompa- nied broadening access. More people could get mortgages and purchase homes; more people could invest in low-cost portfolios through mutual funds and exchange-traded funds.