January 20, 2006 TAAG Angola Orders 4

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 25 Box 31/3 Airline Codes

March 2021 APPENDIX 25 BOX 31/3 AIRLINE CODES The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 000 ANTONOV DESIGN BUREAU 001 AMERICAN AIRLINES 005 CONTINENTAL AIRLINES 006 DELTA AIR LINES 012 NORTHWEST AIRLINES 014 AIR CANADA 015 TRANS WORLD AIRLINES 016 UNITED AIRLINES 018 CANADIAN AIRLINES INT 020 LUFTHANSA 023 FEDERAL EXPRESS CORP. (CARGO) 027 ALASKA AIRLINES 029 LINEAS AER DEL CARIBE (CARGO) 034 MILLON AIR (CARGO) 037 USAIR 042 VARIG BRAZILIAN AIRLINES 043 DRAGONAIR 044 AEROLINEAS ARGENTINAS 045 LAN-CHILE 046 LAV LINEA AERO VENEZOLANA 047 TAP AIR PORTUGAL 048 CYPRUS AIRWAYS 049 CRUZEIRO DO SUL 050 OLYMPIC AIRWAYS 051 LLOYD AEREO BOLIVIANO 053 AER LINGUS 055 ALITALIA 056 CYPRUS TURKISH AIRLINES 057 AIR FRANCE 058 INDIAN AIRLINES 060 FLIGHT WEST AIRLINES 061 AIR SEYCHELLES 062 DAN-AIR SERVICES 063 AIR CALEDONIE INTERNATIONAL 064 CSA CZECHOSLOVAK AIRLINES 065 SAUDI ARABIAN 066 NORONTAIR 067 AIR MOOREA 068 LAM-LINHAS AEREAS MOCAMBIQUE Page 2 of 19 Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 069 LAPA 070 SYRIAN ARAB AIRLINES 071 ETHIOPIAN AIRLINES 072 GULF AIR 073 IRAQI AIRWAYS 074 KLM ROYAL DUTCH AIRLINES 075 IBERIA 076 MIDDLE EAST AIRLINES 077 EGYPTAIR 078 AERO CALIFORNIA 079 PHILIPPINE AIRLINES 080 LOT POLISH AIRLINES 081 QANTAS AIRWAYS -

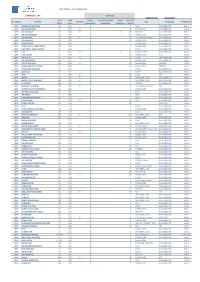

UPDATED ON: 18-03-2019 STATION AIRLINE IATA CODE AWB Prefix ON-LINE CARGO HANDLING FREIGHTER RAMP HANDLING RAMP LINEHAUL IMPORT

WFS CARGO - CUSTOMERS LIST DENMARK - CPH SERVICES UPDATED ON: 18-03-2019 IATA AWB CARGO FREIGHTER RAMP RAMP IMPORT STATION AIRLINE ON-LINE GSA TRUCKING TERMINAL CODE Prefix HANDLING HANDLING LINEHAUL EXPORT CPH AMERICAN AIRLINES AA 001 X E NAL WALLENBORN HAL 1 CPH DELTA AIRLINES DL 006 X X I/E PROACTIVE WALLENBORN HAL1 CPH AIR CANADA AC 014 X X X I/E HWF DK WALLENBORN HAL 1 CPH UNITED AIRLINES UA 016 X I/E NORDIC GSA WALLENBORN HAL1 CPH LUFTHANSA LH 020 X X I/E LUFTHANSA CARGO WALLENBORN HAL1 CPH US AIRWAYS US 037 X I/E NORDIC GSA WALLENBORN HAL1 CPH DRAGON AIR XH 043 X I NORDIC GSA WALLENBORN HAL1 CPH AEROLINEAS ARGENTINAS AR 044 X E CARGOCARE WALLENBORN HAL1 CPH LAN CHILE - LINEA AEREA LA 045 X E KALES WALLENBORN HAL1 CPH TAP TP 047 X X x I/E SCANPARTNER WALLENBORN HAL1 CPH AER LINGUS EI 053 X I/E NORDIC GSA N/A HAL1 CPH AIR France AF 057 X X I/E KL/AF KIM JOHANSEN HAL2 CPH AIR SEYCHELLES HM 061 X E NORDIC GSA WALLENBORN HAL1 CPH CZECH AIRLINES OK 064 X X I/E AviationPlus VARIOUS HAL1 CPH SAUDI AIRLINES CARGO SV 065 X I/E AviationPlus VARIOUS HAL1 CPH ETHIOPIAN AIRLINES ET 071 X E KALES WALLENBORN HAL1 CPH GULF AIR GF 072 X E KALES WALLENBORN HAL1 CPH KLM KL 074 X X I/E KL/AF JDR HAL2 CPH IBERIA IB 075 X X I/E UNIVERSAL GSA WALLENBORN HAL1 CPH MIDDLE EAST AIRLINES ME 076 X X E UNIVERSAL GSA WALLENBORN HAL1 CPH EGYPTAIR MS 077 X E HWF DK WALLENBORN HAL1 CPH BRUSSELS AIRLINES SN 020 X X I/E LUFTHANSA CARGO JDR HAL1 CPH SOUTH AFRICAN AIRWAYS SA 083 X E CARGOCARE WALLENBORN HAL1 CPH AIR NEW ZEALAND NZ 086 X E KALES WALLENBORN HAL1 CPH AIR -

Analyzing the Case of Kenya Airways by Anette Mogaka

GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SPRING 2018 GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA A THESIS SUBMITTED TO THE SCHOOL OF HUMANITIES AND SOCIAL STUDIES (SHSS) IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF MASTER OF ARTS DEGREE IN INTERNATIONAL RELATIONS UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SUMMER 2018 STUDENT DECLARATION I declare that this is my original work and has not been presented to any other college, university or other institution of higher learning other than United States International University Africa Signature: ……………………… Date: ………………………… Anette Mogaka (651006) This thesis has been submitted for examination with my approval as the appointed supervisor Signature: …………………. Date: ……………………… Maurice Mashiwa Signature: …………………. Date: ……………………… Prof. Angelina Kioko Dean, School of Humanities and Social Sciences Signature: …………………. Date: ……………………… Amb. Prof. Ruthie C. Rono, HSC Deputy Vice Chancellor Academic and Student Affairs. ii COPYRIGHT This thesis is protected by copyright. Reproduction, reprinting or photocopying in physical or electronic form are prohibited without permission from the author © Anette Mogaka, 2018 iii ABSTRACT The main objective of this study was to examine how globalization had affected the development of the airline industry by using Kenya Airways as a case study. The specific objectives included the following: To examine the positive impact of globalization on the development of Kenya Airways; To examine the negative impact of globalization on the development of Kenya Airways; To examine the effect of globalization on Kenya Airways market expansion strategies. -

The Best of Air France-KLM in Africa December 2014

The best of Air France-KLM in Africa December 2014 1 Libreville AIRF_1310357 • MASTER Presse Mag UK AF/KLM Afrique • PP • 210 x 297 mm • Visuel : Réseau Afrique ILG • BAG ENJOY THE ENTIRE WORLD DEPARTING FROM AFRICA Thanks to the partnership between AIR FRANCE and KLM along with our SkyTeam partners, we offer one of the largest networks giving you access to over 1000 destinations. AIRF_1310357_AF_KLM_Afrique_UK_210x297_PM_CS3.indd 1 20/11/13 14:14 In Africa, the Air France-KLM Group aims to meet its customers’ expectations by offering them the best of its products and services. NEW TRAVEL CABINS ON BOARD On 4 December 2014, Air France unveils all its new long-haul cabins in Africa for the first time during a special flight from Paris-Charles de Gaulle to Libreville (Gabon). African customers will be able to enjoy a designer suite in La Première or make themselves comfortable in a private cocoon in the sky in Business class. They will also discover the new Premium Economy class, offering 40% more space and the new Economy class, offering optimum travel comfort. As from spring 2015, Libreville as well as Douala (Cameroon) and Malabo (Equatorial Guinea) will be regularly served by Boeing 777 equipped with the Company’s new cabins. Moreover, KLM now offers its new World Business Class to Africa, on flights operated by Boeing 747- 400 between Amsterdam-Schiphol and Nairobi (Kenya). NEW ON THE AIR FRANCE-KLM NETWORK IN AFRICA Since 26 October 2014, Air France has been serving Abidjan by A380, the largest superjumbo in its fleet, with three weekly frequencies. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Terminal a International Departures Level 1 Floor Layout Plan

SERVICES ID20 Wheelchair Area ID56 BIDAir Ticket Sales: JetAirways, ID71 South African Revenue Services: Customs ID28 Immigration Office Iberia, hewabora airways & ID72 Air Nambia Ticket Sales ID29 South African Revenue Services Singapore Airlines ID73 British Airways Ticket Sales ID30 South African Police Service ID57 Kenya Ticket Sales ID74 Self Service Check In Kiosk ID36 Tax Refund ID58 Air France & KLM Ticket Sales ID75 Delta Ticket Sales ID37 MTN ID60 Emirates Ticket Sales ID76 Holiday Aviation Ticket Sales ID40 Master Currency (Forex) ID61 TAP Portugal Ticket Sales ID77 Menzies Aviation Ticket Sales ID44 Vodacom ID62 Air Botswana Ticket Sales ID78 SAA Voyager Lifetime/Platinum ID48 Bureau de Change (Forex) ID63 IATA Ticket Sales Check In ID49 Tax Refund ID64 Swissport Ticket Sales ID79 Drop off SAA Voyager ID51 Turkish Airlines Ticket Sales ID65 Federal Air Ticket Sales Lifetime/Platinum Check In N ID52 Star Alliance Ticket Sales: ID66 Linhas Aéras de Mocambique ID80 SAA Voyager Lifetime/Platinum Lufthansa & Swiss Int. Airlines Ticket Sales Check In ID05 ID53 TAAG Angola Airlines Ticket Sales ID01 ID67 Air Malawi Ticket Sales ID81 Self Service Check In Kiosk ID54 TAC Trans Air Congo Ticket Sales ID69 Virgin Atlantic Ticket Sales ID82 Self Service Check In Kiosk ID55 InterAir & Airo Benin Ticket Sales ID70 Gabon Airlines Ticket Sales ID83 Self Service Check In Kiosk ID04 ID06 Gate ID02 ID03 Gate Gate ID08 Gate A6 A5 A4 ID07 A3 Boarding Gates A1 - A2 ID18 ID13 ID28 ID29 ID16 ID19 ID21 ID22 ID23 ID09 ID10 ID11 ID12 ID14 ID20 ID26 -

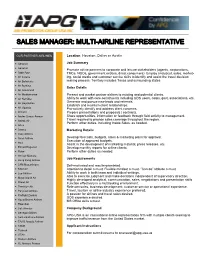

Sales Manager: Multi-Airline Representative

SALES MANAGER: MULTI-AIRLINE REPRESENTATIVE OUR PARTNER AIRLINES Location: Houston, Dallas or Austin Aerocon Job Summary Aeromar Promote airline partners to corporate and leisure stakeholders (agents, corporations, Aigle Azur TMCs, NGOs, government entities, direct consumers). Employ analytical, sales, market- Air Astana ing, social media and customer service skills to identify and assist the travel decision Air Botswana making process. Territory includes Texas and surrounding states. Air Burkina Sales Details Air Greenland Air Mediterranee Present and market partner airlines to existing and potential clients. Air Namibia Ability to work with core constituents including GDS users, corps, govt, associations, etc. Generate and pursue new leads and referrals. Air Seychelles Establish and maintain client relationships. Air Uganda Pro-actively identify and address client concerns. Aircalin Prepare presentations and proposals | contracts. Andes Lineas Aereas Share opportunities, information or feedback through field activity to management. Antrak Air Travel required to provide sales coverage throughout the region. Perform other duties, including Inside Sales, as needed. Arkia Aserca Marketing Details Asky Airlines Avior Airlines Develop forecasts, budgets, sales & marketing plans for approval. Execution of approved budgets. Azul Assist in the development of marketing material, press releases, etc. Etihad Regional Develop monthly reports for airline clients. Flybe Perform other duties as needed. Heli Air Monaco Job Requirements Hong Kong Airlines LAM Mozambique Self-motivated and results-orientated. KAM Air Attention to detail a must. Flexible mindset a must. “Can do” attitude a must. Lao Airlines Ability to work in both team and individual settings. Able to exercise judgment and make decisions independent of supervisory direction. Maya Island Air Highly developed analytical, communication, sales, negotiations and presentation skills Oman Air Function effectively in a multitasking environment. -

Download the Key Figures In

KEY DATA AFRICA FROM ABOVE FIGURES mproving access, creating jobs, boosting trade – air transport is a crucial local and international develop- ment factor. Yet the African continent remains on the margins of the global air traffic scene. Fares are expensive and intra-African flights are limited. Although a few countries stand out, with successful airpo- I rts and airlines, air transport in Africa still has considerable unrealised potential. Air traffic – A global overview EUROPE NORTH 26.2 % AMERICA + 5.5 % 27.1 % + 3.3 % ASIA & PACIFIC 31.8 % + 8.2 % 4.8 % 2.3 % + 12.1 % + 0.6 % MIDDLE AFRICA EAST 7.6 % + 7.9 % LATIN AMERICA & CARIBBEAN Main air routes worldwide % share of passenger traffic, 2014 % growth of passenger traffic on scheduled services, 2015 Sources: ICAO, 2015; ATAG, 2014 Projected annual growth High airport rate for international traffic taxes in Africa by region, 2012–2032 Djibouti Latin Africa Asia- Europe Middle North World Pacific America & East America 85.9 Caribbean Nairobi Johannesburg Dakar Paris CDG Addis Ababa Frankfurt Singapore 6.3 Cairo Dubai 5.5 5.4 5.1 4.7 32.1 31.2 3.8 23.9 3.0 21 20.1 12 4,4 10.9 8.9 Airport taxes and fees by airport, in euros in % Source: Special edition Africa, Le Monde, 2014 Source: ATAG, 2014 6 PRIVATE SECTOR & DEVELOPMENT Overview of air transport in Africa To and AFRICA FROM ABOVE Alger from Europe Casablanca Tunis FIGURES Enfida 140 Cairo Oran Monastir + 4.9 % Djerba MOROCCO To and from Borg North El-Arab Agadir ALGERIA America Marrakech Charm El-Cheik Hurghada 12 EGYPT + 6.1 % To -

An Analysis of African Airlines Efficiency with Two-Stage TOPSIS

Journal of Air Transport Management 44-45 (2015) 90e102 Contents lists available at ScienceDirect Journal of Air Transport Management journal homepage: www.elsevier.com/locate/jairtraman An analysis of African airlines efficiency with two-stage TOPSIS and neural networks * Carlos Pestana Barros a, Peter Wanke b, a Instituto Superior de Economia e Gestao,~ University of Lisbon, Rua Miguel Lupi, 20, 1249-078 Lisbon, Portugal b COPPEAD Graduate Business School, Federal University of Rio de Janeiro, Rua Paschoal Lemme, 355, 21949-900 Rio de Janeiro, Brazil article info abstract Article history: This paper presents an efficiency assessment of African airlines, using the TOPSIS e Technique for Order Received 8 August 2014 Preference by Similarity to the Ideal Solution. TOPSIS is a multi-criteria decision making technique, which Received in revised form similar to DEA (Data Envelopment Analysis), ranks a finite set of units based on the minimisation of 27 February 2015 distance from an ideal point, and the maximisation of distance from an anti-ideal point. In this research, Accepted 5 March 2015 TOPSIS is used first in a two-stage approach, in order to assess the relative efficiency of African airlines Available online 16 March 2015 using the most frequent indicators adopted by the literature on airlines. During the second stage, neural networks are combined with TOPSIS results, as part of an attempt to produce a model for airline per- Keywords: e Airlines formance which has effective predictive ability. The results reveal that network size-related variables fi Africa economies of scope, are the most important variables for explaining levels of ef ciency in the African TOPSIS airline industry, although the impact of fleet mix and public ownership cannot be neglected. -

Hy Kodu Havayolu Hy Kodu Havayolu Aa American

HY KODU HAVAYOLU HY KODU HAVAYOLU AA AMERICAN AIRLINES CX CATHAY PACIFIC DL DELTA AIRLINES JP ADRIA AIRWAYS AC AIR CANADA HR HAHN AIR UZ UNITED AIRLINES HA HAWAIIAN AIRLINES PW PRECISION AIR EK EMIRATES AR AEROLINEAS ARGENTINA KE KOREAN AIRLINES TP TAP - AIR PORTUGAL Z6 DNIEPROAVIA AVIATION OA OLYMPIC AIR S.A. SW AIR NAMIBIA(PTY) LTD AZ ALITALIA S.P.A IG MERIDIANA FLY SPA AF AIR FRANCE TU TUNIS AIR OK CZECH AIRLINES NH ALL NIPPON AIRWAYS SV SAUDIA YE YANAIR 8Q ONUR AIR TG THAI AIRWAYS INTL. TM LAM - LINHAS AEREAW LH LUFTHANSA ET ETHIOPIAN AIRLINES 2J AIR BURKINA GF GULFAIR KU KUWAIT AIRWAYS KL K L M MH MALAYSIA AIRLINES IB IBERIA LAE, S.A.O.SU TK THY A.O. ME M E A IZ ARKIA ISRAELI AIRLINES MS EGYPTAIR MK AIR MAURITIUS PR PHILIPPINE AIRINES ST GERMANIA FLUGGESELLS LO L O T O6 OCEANAIR LINHAS AERE QF QANTAS AIRWAYS LTD HY UZBEKISTAN AIRWAYS SN SN BRUSSELS AIRLINES OS AUSTRIAN AIRLINES SA SOUTH AFRICAN AIRWAYS MD AIR MADAGASCAR AI AIR INDIA LTD U6 JSC URAL AIRLINES AY FINNAIR BE FLYBE FI ICELANDAIR EQ TAME LINEA AEREA LY ELAL ISRAEL AIRLINES GP APG AIRLINES JU AIR SERBIA RO TAROM SK SAS SCANDINAVIAN AIR OM MIAT MONGOLIAN AIRLINE DT TAAG ANGOLA AIRLINES CI CHINA AIRLINES LTD AH AIR ALGERIE UT UTAIR AVIATION JSC BA BRITISH AIRWAYS NP NILE AIR GA GARUDA INDONESIA 7R JOINTSTCK AV.RUSLINE G3 VRG LINHAS AEREAS W2 FLEXFLIGHT APS JL JAPAN AIRLINES CO.LT A3 AEGEAN AIRLINES AM AEROMEXICO YM MONTENEGRO AIRLINES FZ FLYDUBAI SZ SOMON AIR AT|BR| ROYAL AIR MAROC S7 SIBERIA AIRLINES PJS QR QATAR AIRWAYS ZI AIGLE AZUR HY KODU HAVAYOLU 3O AIR ARABIA MAROC -

List of Government-Owned and Privatized Airlines (Unofficial Preliminary Compilation)

List of Government-owned and Privatized Airlines (unofficial preliminary compilation) Governmental Governmental Governmental Total Governmental Ceased shares shares shares Area Country/Region Airline governmental Governmental shareholders Formed shares operations decreased decreased increased shares decreased (=0) (below 50%) (=/above 50%) or added AF Angola Angola Air Charter 100.00% 100% TAAG Angola Airlines 1987 AF Angola Sonair 100.00% 100% Sonangol State Corporation 1998 AF Angola TAAG Angola Airlines 100.00% 100% Government 1938 AF Botswana Air Botswana 100.00% 100% Government 1969 AF Burkina Faso Air Burkina 10.00% 10% Government 1967 2001 AF Burundi Air Burundi 100.00% 100% Government 1971 AF Cameroon Cameroon Airlines 96.43% 96.4% Government 1971 AF Cape Verde TACV Cabo Verde 100.00% 100% Government 1958 AF Chad Air Tchad 98.00% 98% Government 1966 2002 AF Chad Toumai Air Tchad 25.00% 25% Government 2004 AF Comoros Air Comores 100.00% 100% Government 1975 1998 AF Comoros Air Comores International 60.00% 60% Government 2004 AF Congo Lina Congo 66.00% 66% Government 1965 1999 AF Congo, Democratic Republic Air Zaire 80.00% 80% Government 1961 1995 AF Cofôte d'Ivoire Air Afrique 70.40% 70.4% 11 States (Cote d'Ivoire, Togo, Benin, Mali, Niger, 1961 2002 1994 Mauritania, Senegal, Central African Republic, Burkino Faso, Chad and Congo) AF Côte d'Ivoire Air Ivoire 23.60% 23.6% Government 1960 2001 2000 AF Djibouti Air Djibouti 62.50% 62.5% Government 1971 1991 AF Eritrea Eritrean Airlines 100.00% 100% Government 1991 AF Ethiopia Ethiopian -

Download Annual Report 2005/06

ANNUAL REPORT 2005 - 06 CONTENTS 2 Management Board of Ethiopian Airlines 3 CEO’s Message 4 Management Team 5 News Highlights 11 Finance 23 Glossary 24 Auditors Report & Financial Statements 44 Ethiopian Airlines Domestic Offices 45 Ethiopian Airlines Offices 46 International Route Map 48 Ethiopian Airlines General Sales Agents BOARD OF MANAGEMENT CEO’s MESSAGE t is my great pleasure to report yet another year of record revenue During this period, the number of our frequent flyers increased to a and operating profits at Ethiopian Airlines. Operating revenue total of 99,920 members of which 28,736 represent new membership H.E. Mr. Seyom Mesfin. .............................................................................................................................................Chairman Isurpassed the 5 billion mark for the first time ever reaching Birr 5.4 enrollments; this translates into an increase of 40% compared to the billion, a 25% increase as compared to the previous budget year. previous year. Operating profit for the period is Birr 237 million. The growth in revenue In response to our customers’ demands, we have introduced new flight H.E. Mr. Haile Assegidie .............................................................................................................................................. Member and operating profits was a result of a 14% increase in the number of services to three destinations – Dakar, Libreville, and Brussels – while a passengers and a 28 % rise in freight carried during the period. significant number of frequencies have been added to many routes of the Airline. Mr. Aberra Mekonnen ................................................................................................................................................. Member As always revenue from services provided to other airlines, particularly those from aircraft maintenance and training, contributed significantly The same year marked Ethiopian’s 60 years of successful operations in to the bottom line.