Terminal a International Departures Level 1 Floor Layout Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

South African Airways Timetable

102 103 SAA / OUR FLIGHTS OUR FLIGHTS / SAA SOUTH AFRICAN AIRWAYS TIMETABLE As Africa’s most-awarded airline, SAA operates from Johannesburg to 32 destinations in 22 countries across the globe Our extensive domestic schedule has a total Nairobi, Ndola, Victoria Falls and Windhoek. SAA’s international of 284 flights per week between Johannesburg, network creates links to all major continents from our country Cape Town, Durban, East London and Port through eight direct routes and codeshare flights, with daily Elizabeth. We have also extended our codeshare flights from Johannesburg to Frankfurt, Hong Kong, London REGIONAL agreement with Mango, our low-cost operator, (Heathrow), Munich, New York (JFK), Perth, São Paulo and CARRIER FLIGHT FREQUENCY FROM DEPARTS TO ARRIVES to include coastal cities in South Africa (between Washington (Dulles). We have codeshare agreements with SA 144 1234567 Johannesburg 14:20 Maputo 15:20 Johannesburg and Cape Town, Durban, Port Elizabeth and 29 other airlines. SAA is a member of Star Alliance, which offers SA 145 1234567 Maputo 16:05 Johannesburg 17:10 George), as well as Johannesburg-Bloemfontein, Cape Town- more than 18 500 daily flights to 1 321 airports in 193 countries. SA 146 1234567 Johannesburg 20:15 Maputo 21:15 Bloemfontein and Cape Town-Port Elizabeth. Regionally, SAA SAA has won the “Best Airline in Africa” award in the regional SA 147 1234567 Maputo 07:30 Johannesburg 08:35 offers 19 destinations across the African continent, namely Abidjan, category for 15 consecutive years. Mango and SAA hold the SA 160 1.34567 Johannesburg 09:30 Entebbe 14:30 Accra, Blantyre, Dakar, Dar es Salaam, Entebbe, Harare, Kinshasa, number 1 and 2 spots as South Africa’s most on-time airlines. -

Appendix 25 Box 31/3 Airline Codes

March 2021 APPENDIX 25 BOX 31/3 AIRLINE CODES The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 000 ANTONOV DESIGN BUREAU 001 AMERICAN AIRLINES 005 CONTINENTAL AIRLINES 006 DELTA AIR LINES 012 NORTHWEST AIRLINES 014 AIR CANADA 015 TRANS WORLD AIRLINES 016 UNITED AIRLINES 018 CANADIAN AIRLINES INT 020 LUFTHANSA 023 FEDERAL EXPRESS CORP. (CARGO) 027 ALASKA AIRLINES 029 LINEAS AER DEL CARIBE (CARGO) 034 MILLON AIR (CARGO) 037 USAIR 042 VARIG BRAZILIAN AIRLINES 043 DRAGONAIR 044 AEROLINEAS ARGENTINAS 045 LAN-CHILE 046 LAV LINEA AERO VENEZOLANA 047 TAP AIR PORTUGAL 048 CYPRUS AIRWAYS 049 CRUZEIRO DO SUL 050 OLYMPIC AIRWAYS 051 LLOYD AEREO BOLIVIANO 053 AER LINGUS 055 ALITALIA 056 CYPRUS TURKISH AIRLINES 057 AIR FRANCE 058 INDIAN AIRLINES 060 FLIGHT WEST AIRLINES 061 AIR SEYCHELLES 062 DAN-AIR SERVICES 063 AIR CALEDONIE INTERNATIONAL 064 CSA CZECHOSLOVAK AIRLINES 065 SAUDI ARABIAN 066 NORONTAIR 067 AIR MOOREA 068 LAM-LINHAS AEREAS MOCAMBIQUE Page 2 of 19 Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 069 LAPA 070 SYRIAN ARAB AIRLINES 071 ETHIOPIAN AIRLINES 072 GULF AIR 073 IRAQI AIRWAYS 074 KLM ROYAL DUTCH AIRLINES 075 IBERIA 076 MIDDLE EAST AIRLINES 077 EGYPTAIR 078 AERO CALIFORNIA 079 PHILIPPINE AIRLINES 080 LOT POLISH AIRLINES 081 QANTAS AIRWAYS -

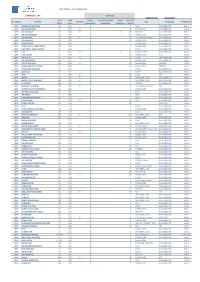

UPDATED ON: 18-03-2019 STATION AIRLINE IATA CODE AWB Prefix ON-LINE CARGO HANDLING FREIGHTER RAMP HANDLING RAMP LINEHAUL IMPORT

WFS CARGO - CUSTOMERS LIST DENMARK - CPH SERVICES UPDATED ON: 18-03-2019 IATA AWB CARGO FREIGHTER RAMP RAMP IMPORT STATION AIRLINE ON-LINE GSA TRUCKING TERMINAL CODE Prefix HANDLING HANDLING LINEHAUL EXPORT CPH AMERICAN AIRLINES AA 001 X E NAL WALLENBORN HAL 1 CPH DELTA AIRLINES DL 006 X X I/E PROACTIVE WALLENBORN HAL1 CPH AIR CANADA AC 014 X X X I/E HWF DK WALLENBORN HAL 1 CPH UNITED AIRLINES UA 016 X I/E NORDIC GSA WALLENBORN HAL1 CPH LUFTHANSA LH 020 X X I/E LUFTHANSA CARGO WALLENBORN HAL1 CPH US AIRWAYS US 037 X I/E NORDIC GSA WALLENBORN HAL1 CPH DRAGON AIR XH 043 X I NORDIC GSA WALLENBORN HAL1 CPH AEROLINEAS ARGENTINAS AR 044 X E CARGOCARE WALLENBORN HAL1 CPH LAN CHILE - LINEA AEREA LA 045 X E KALES WALLENBORN HAL1 CPH TAP TP 047 X X x I/E SCANPARTNER WALLENBORN HAL1 CPH AER LINGUS EI 053 X I/E NORDIC GSA N/A HAL1 CPH AIR France AF 057 X X I/E KL/AF KIM JOHANSEN HAL2 CPH AIR SEYCHELLES HM 061 X E NORDIC GSA WALLENBORN HAL1 CPH CZECH AIRLINES OK 064 X X I/E AviationPlus VARIOUS HAL1 CPH SAUDI AIRLINES CARGO SV 065 X I/E AviationPlus VARIOUS HAL1 CPH ETHIOPIAN AIRLINES ET 071 X E KALES WALLENBORN HAL1 CPH GULF AIR GF 072 X E KALES WALLENBORN HAL1 CPH KLM KL 074 X X I/E KL/AF JDR HAL2 CPH IBERIA IB 075 X X I/E UNIVERSAL GSA WALLENBORN HAL1 CPH MIDDLE EAST AIRLINES ME 076 X X E UNIVERSAL GSA WALLENBORN HAL1 CPH EGYPTAIR MS 077 X E HWF DK WALLENBORN HAL1 CPH BRUSSELS AIRLINES SN 020 X X I/E LUFTHANSA CARGO JDR HAL1 CPH SOUTH AFRICAN AIRWAYS SA 083 X E CARGOCARE WALLENBORN HAL1 CPH AIR NEW ZEALAND NZ 086 X E KALES WALLENBORN HAL1 CPH AIR -

Air Transport Industry Analysis Report

Annual Analyses of the EU Air Transport Market 2016 Final Report March 2017 European Commission Annual Analyses related to the EU Air Transport Market 2016 328131 ITD ITA 1 F Annual Analyses of the EU Air Transport Market 2013 Final Report March 2015 Annual Analyses of the EU Air Transport Market 2013 MarchFinal Report 201 7 European Commission European Commission Disclaimer and copyright: This report has been carried out for the Directorate General for Mobility and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract MOVE/E1/5-2010/SI2.579402. These views have not been adopted or in any way approved by the European Commission and should not be relied upon as a statement of the European Commission's or the Mobility and Transport DG's views. The European Commission does not guarantee the accuracy of the information given in the report, nor does it accept responsibility for any use made thereof. Copyright in this report is held by the European Communities. Persons wishing to use the contents of this report (in whole or in part) for purposes other than their personal use are invited to submit a written request to the following address: European Commission - DG MOVE - Library (DM28, 0/36) - B-1049 Brussels e-mail (http://ec.europa.eu/transport/contact/index_en.htm) Mott MacDonald, Mott MacDonald House, 8-10 Sydenham Road, Croydon CR0 2EE, United Kingdom T +44 (0)20 8774 2000 F +44 (0)20 8681 5706 W www.mottmac.com Issue and revision record StandardSta Revision Date Originator Checker Approver Description ndard A 28.03.17 Various K. -

Analyzing the Case of Kenya Airways by Anette Mogaka

GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SPRING 2018 GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA A THESIS SUBMITTED TO THE SCHOOL OF HUMANITIES AND SOCIAL STUDIES (SHSS) IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF MASTER OF ARTS DEGREE IN INTERNATIONAL RELATIONS UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SUMMER 2018 STUDENT DECLARATION I declare that this is my original work and has not been presented to any other college, university or other institution of higher learning other than United States International University Africa Signature: ……………………… Date: ………………………… Anette Mogaka (651006) This thesis has been submitted for examination with my approval as the appointed supervisor Signature: …………………. Date: ……………………… Maurice Mashiwa Signature: …………………. Date: ……………………… Prof. Angelina Kioko Dean, School of Humanities and Social Sciences Signature: …………………. Date: ……………………… Amb. Prof. Ruthie C. Rono, HSC Deputy Vice Chancellor Academic and Student Affairs. ii COPYRIGHT This thesis is protected by copyright. Reproduction, reprinting or photocopying in physical or electronic form are prohibited without permission from the author © Anette Mogaka, 2018 iii ABSTRACT The main objective of this study was to examine how globalization had affected the development of the airline industry by using Kenya Airways as a case study. The specific objectives included the following: To examine the positive impact of globalization on the development of Kenya Airways; To examine the negative impact of globalization on the development of Kenya Airways; To examine the effect of globalization on Kenya Airways market expansion strategies. -

Competitive Strategies and Entry Strategies of Low Cost Airline Incumbent 1Time Airline

Competitive Strategies and Entry Strategies of Low Cost Airline Incumbent 1time Airline A dissertation submitted in partial fulfilment of the requirements for the degree of Masters in Business Administration of Rhodes University by Diane Potgieter January 2007 Abstract This dissertation reports on the factors that contributed to the successful entry strategy of 1time Airline, a low cost carrier, into the South African airline industry as well as its competitive strategies within this context. Research interviews were conducted in November 2005 and research material gathered until end January 2006. Key issues include an evaluation of 1time's business model in relation to other low cost entrants as well as against material sourced through interviews with 1time Airline management, employees and consumers of the airline's product. Porter's Generic Strategies and Five Forces model are used as a framework in evaluating the airline. It is found that Nohria, Joyce and Robertson's "4+2 Formula" is effectively implemented at the airline, but that further implementation of Game Theory in terms of alliances should be investigated for continued success and sustainability. " \ I Contents Chapter 1 Context ...... ... ....................... ............................. ... .. .................................. 1 1.1 Introduction ................................................. .. .... .................. .. ................ .............. .. ... 1 1.2 The global airline industry ......................................... .. .. ...... .. .. .. ................... -

The Best of Air France-KLM in Africa December 2014

The best of Air France-KLM in Africa December 2014 1 Libreville AIRF_1310357 • MASTER Presse Mag UK AF/KLM Afrique • PP • 210 x 297 mm • Visuel : Réseau Afrique ILG • BAG ENJOY THE ENTIRE WORLD DEPARTING FROM AFRICA Thanks to the partnership between AIR FRANCE and KLM along with our SkyTeam partners, we offer one of the largest networks giving you access to over 1000 destinations. AIRF_1310357_AF_KLM_Afrique_UK_210x297_PM_CS3.indd 1 20/11/13 14:14 In Africa, the Air France-KLM Group aims to meet its customers’ expectations by offering them the best of its products and services. NEW TRAVEL CABINS ON BOARD On 4 December 2014, Air France unveils all its new long-haul cabins in Africa for the first time during a special flight from Paris-Charles de Gaulle to Libreville (Gabon). African customers will be able to enjoy a designer suite in La Première or make themselves comfortable in a private cocoon in the sky in Business class. They will also discover the new Premium Economy class, offering 40% more space and the new Economy class, offering optimum travel comfort. As from spring 2015, Libreville as well as Douala (Cameroon) and Malabo (Equatorial Guinea) will be regularly served by Boeing 777 equipped with the Company’s new cabins. Moreover, KLM now offers its new World Business Class to Africa, on flights operated by Boeing 747- 400 between Amsterdam-Schiphol and Nairobi (Kenya). NEW ON THE AIR FRANCE-KLM NETWORK IN AFRICA Since 26 October 2014, Air France has been serving Abidjan by A380, the largest superjumbo in its fleet, with three weekly frequencies. -

Overview of the Developments in the Domestic Airline Industry in South Africa Since Market Deregulation

Page 1 of 11 Original Research Overview of the developments in the domestic airline industry in South Africa since market deregulation Authors: Deregulation or liberalisation of air transport has had major global impacts on the domestic 1 Rose Luke air transport markets, with effects ranging from stimulation to changes in the structure and Jackie Walters1 functioning of these markets. In South Africa, deregulation has had wide-reaching effects on Affiliations: the domestic market. The purpose of this article was to investigate the current domestic air 1Institute of Transport and transport market. A literature review was performed to examine the effects of deregulation in Logistics Studies (Africa), other domestic air transport markets around the world. This was followed by a review of the University of Johannesburg, South Africa South African domestic air transport market prior to deregulation in order to determine the changes that were made following deregulation. The ten-year period immediately following Correspondence to: deregulation was also examined; this period was characterised by relatively large numbers of Rose Luke market entries and exits. A database was obtained from the Airports Company South Africa; Email: air traffic movements, passenger numbers and load factors were evaluated. The study showed [email protected] that the market is still characterised by regular market entries and exits. Also that the entry of the low-cost carriers has stimulated the market, resulting in increased air traffic movements, Postal address: higher passenger numbers, higher load factors in general and the opening of a secondary PO Box 524, Auckland Park, Johannesburg 2006, airport in Gauteng, Lanseria International. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Media Release

MEDIA RELEASE CELEBRATE THE THANKSGIVING HOLIDAY WITH SOUTH AFRICAN AIRWAYS’ SALE OF THE SEASON TO AFRICA Our lowest fares of the year from $699* roundtrip from New York and Washington, DC to Africa for Winter and Spring travel Fort Lauderdale, FL (November 20, 2018) – South African Airways (SAA), the national flag carrier of South Africa, is offering tremendous savings with special fares from the U.S. to destinations in Africa for 7-days only over the Thanksgiving holiday. Low fares are offered from Washington, DC-Dulles International Airport and New York-JFK International Airport to Johannesburg, South Africa starting from $699.00* roundtrip (restrictions apply). Additionally, fares from Washington Dulles to Accra, Ghana start at just $729.00* roundtrip (restrictions apply) and Washington Dulles to Dakar, Senegal from $725.00* (restrictions apply) roundtrip. Great low fares are also available to Cape Town and Durban, South Africa. Travel on these sale fares is applicable between January 10 and March 31, 2019, with tickets purchased by Tuesday, November 27, 2018. “SAA is offering its lowest fares of the year for travel in early 2019, so now is a great time book that dream getaway to Africa” said Todd Neuman, executive vice president - North America for South African Airways. “These low fares, combined with very favorable currency exchange rates in Africa, make the perfect holiday present for everyone. These great fares coupled with Africa’s majestic beauty, world-class cities, spectacular wildlife and rich culture will provide travellers with a lifetime of memories.” Directors JB Magwaza* (Chairperson), V Jarana (Group Chief Executive Officer), DJ Fredericks (Interim Chief Financial Officer), AI Bassa*, ML Kingston*1, HP Maluleka*, TN Mgoduso*, T Mhlari*, AH Moosa*, G Rothschild*, MP Tshisevhe* *Non-Executive Director 1 British Citizen Company Secretary – RN Kibuuka South African Airways SOC Ltd Reg. -

SOUTH AFRICAN AIRWAYS TIMETABLE As Africa’S Most-Awarded Airline, SAA Operates from Johannesburg to 32 Destinations in 22 Countries Across the Globe

100 101 SAA / OUR FLIGHTS OUR FLIGHTS / SAA SOUTH AFRICAN AIRWAYS TIMETABLE As Africa’s most-awarded airline, SAA operates from Johannesburg to 32 destinations in 22 countries across the globe Our extensive domestic schedule has a total of Maputo, Mauritius, Nairobi, Ndola, Victoria Falls and 284 flights per week between Johannesburg, Windhoek. SAA’s international network creates links to all Cape Town, Durban, East London and Port major continents from our country through eight direct routes Elizabeth. We have also extended our code- and codeshare flights, with daily flights from Johannesburg to share agreement with Mango, our low-cost Frankfurt, Hong Kong, London (Heathrow), Munich, New operator, to include coastal cities in South York (JFK), Perth, São Paulo and Washington (Dulles). We have Africa (between Johannesburg and Cape Town, Durban, Port codeshare agreements with 29 other airlines. SAA is a member Elizabeth and George), as well as Cape Town to Bloemfontein of Star Alliance, which offers more than 19 000 daily flights to REGIONAL and Johannesburg to Zanzibar, Tanzania. Regionally, SAA offers more than 1 250 airports in 195 countries. SAA has won the CARRIER FLIGHT FREQUENCY FROM DEPARTS TO ARRIVES SA 144 1234567 Johannesburg 14:20 Maputo 15:20 19 destinations across the African continent, namely Abidjan, “Best Airline in Africa” award in the regional category for 15 SA 145 1234567 Maputo 16:05 Johannesburg 17:10 Accra, Blantyre, Dakar, Dar es Salaam, Entebbe, Harare, consecutive years. Mango and SAA hold the number 1 and 2 SA 146 1234567 Johannesburg 20:15 Maputo 21:15 Kinshasa, Lagos, Lilongwe, Livingstone, Luanda, Lusaka, spots as South Africa’s most on-time airlines. -

Sales Manager: Multi-Airline Representative

SALES MANAGER: MULTI-AIRLINE REPRESENTATIVE OUR PARTNER AIRLINES Location: Houston, Dallas or Austin Aerocon Job Summary Aeromar Promote airline partners to corporate and leisure stakeholders (agents, corporations, Aigle Azur TMCs, NGOs, government entities, direct consumers). Employ analytical, sales, market- Air Astana ing, social media and customer service skills to identify and assist the travel decision Air Botswana making process. Territory includes Texas and surrounding states. Air Burkina Sales Details Air Greenland Air Mediterranee Present and market partner airlines to existing and potential clients. Air Namibia Ability to work with core constituents including GDS users, corps, govt, associations, etc. Generate and pursue new leads and referrals. Air Seychelles Establish and maintain client relationships. Air Uganda Pro-actively identify and address client concerns. Aircalin Prepare presentations and proposals | contracts. Andes Lineas Aereas Share opportunities, information or feedback through field activity to management. Antrak Air Travel required to provide sales coverage throughout the region. Perform other duties, including Inside Sales, as needed. Arkia Aserca Marketing Details Asky Airlines Avior Airlines Develop forecasts, budgets, sales & marketing plans for approval. Execution of approved budgets. Azul Assist in the development of marketing material, press releases, etc. Etihad Regional Develop monthly reports for airline clients. Flybe Perform other duties as needed. Heli Air Monaco Job Requirements Hong Kong Airlines LAM Mozambique Self-motivated and results-orientated. KAM Air Attention to detail a must. Flexible mindset a must. “Can do” attitude a must. Lao Airlines Ability to work in both team and individual settings. Able to exercise judgment and make decisions independent of supervisory direction. Maya Island Air Highly developed analytical, communication, sales, negotiations and presentation skills Oman Air Function effectively in a multitasking environment.