Daily Wrap-Up

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annualreport11-12.Pdf

THE GLOBAL AGROCHEMICAL INDUSTRY GREW AT A 4% CAGR BETWEEN 2005 AND 2011. UNITED PHOSPHORUS GREW 26%.* * As one of the many spin-offs of this consistent reality, United Phosphorus grew revenues 31.6% in 2011-12 over the previous year, even as the rest of the industry complained of various unexpected realities UNITED PHOSPHORUS 22 Number of LIMITED. nationalities in Team UPL THE WORLD’S THIRD- 106% LARGEST GENERIC Revenue growth between AGROCHEMICAL 2006 and 2011 COMPANY. 24 Acquisitions in the THE WORLD’S last ten years SEVENTH-LARGEST AGROCHEMICAL 10 UPL products with COMPANY. global leadership AND ONE OF THE 110 Chemistries with in- MOST PROFITABLE house expertise GLOBAL AGROCHEMICAL COMPANIES. TRULY TRANS-NATIONAL. 2 United Phosphorus Limited Lineage Indian manufacturing location in herbicides, rodenticides, fumigants, Part of a US$ 1.6 bn group Vapi, Ankaleshwar, Jhagadia, Halol, plant growth regulators, agrochemicals Jammu and Haldia. Captive power as well as industrial and speciality Established in 1969 by Mr. Rajju plant (48.5 MW) in Jhagadia (Gujarat) chemicals. Shroff (Chairman) Global sales presence across 120 Presence countries (through subsidiaries and Registrations The Company has more than 1,000 Headquartered in Mumbai, India associates) product registrations which, represent Manufacturing presence across 23 88 subsidiaries globally marketing permissions by statutory international locations (nine in India, authorities to market agrochemicals in three in France, three in Argentina, and Products respective geographies. -

MARKET LENS 11537 Intraday Pic MARICO Resistance 11878 Intraday Pick SIEMENS 12026 Intraday Pick UPL

Institutional Equity Research NIFTY 11730 IN FOCUS October 29, 2020 Support 11633 Stock in Focus Aarti Industries MARKET LENS 11537 Intraday Pic MARICO Resistance 11878 Intraday Pick SIEMENS 12026 Intraday Pick UPL EQUITY INDICES Indices Absolute Change Percentage Change Domestic Last Trade Change 1-D 1-Mth YTD BSE Sensex 39,922 (600) (1.5%) 4.9% (3.2%) CNX Nifty 11,730 (160) (1.3%) 4.3% (3.6%) S&P CNX 500 9,632 (116) (1.2%) 3.1% (2.4%) SENSEX 50 12,285 (174) (1.4%) 3.9% (3.6%) International Last Trade Change 1-D 1-Mth YTD DJIA 26,520 (943) (3.4%) (4.5%) (7.1%) NASDAQ 11,005 (426) (3.7%) (1.5%) 22.7% NIKKEI 23,242 (177) (0.8%) 0.2% (1.8%) HANGSENG 24,354 (355) (1.4%) 3.9% (13.6%)) ADRs / GDRs Last Trade Change 1-D 1-Mth YTD Dr. Reddy’s Lab (ADR) 64.9 (3.1) (4.6%) (6.7%) 59.9% Tata Motors (ADR) 8.9 (0.6) (6.7%) (2.6%) (31.6%) STOCK IN FOCUS Infosys (ADR) 14.4 (0.5) (3.2%) 4.1% 39.3% f Aarti Industries’ revenue is likely to increase by ~8% YoY due to ICICI Bank (ADR) 10.6 (0.6) (5.4%) 7.4% (30.0%) demand revival and higher capacity utilization in Q2FY21. Its operating HDFC Bank (ADR) 58.6 (1.3) (2.2%) 17.2% (7.6%) capacity is expected to be >80%. Within the specialty chemicals Axis Bank (GDR) 33.2 (1.4) (3.9%) 12.9% (37.5%) segment, higher demand from the automobile sector is expected to Reliance Ind (GDR) 54.4 (0.8) (1.5%) (10.5%) 27.9% boost its volume. -

Inner 29 Equity Savings Fund

Tata Equity Savings Fund (An open-ended scheme investing in equity, arbitrage and debt) As on 30th September 2020 PORTFOLIO % to % to % to NAV Company name Company name INVESTMENT STYLE NAV NAV Derivative Predominantly investing in equity and equity related instruments, Equity & Equity Related Total 70.00 Tata Consultancy Services Ltd. 3.82 equity arbitrage opportunities and debt and money market instruments. Unhedge Positions 36.36 Tata Consultancy Services Ltd.Future -3.80 Auto Axis Bank Ltd. 3.15 INVESTMENT OBJECTIVE Mahindra & Mahindra Ltd. 1.49 Axis Bank Ltd.Future -3.16 The investment objective of the scheme is to provide long term capital Maruti Suzuki India Ltd. 0.59 Sbi Life Insurance Company Ltd. 2.58 appreciation and income distribution to the investors by predominantly Banks Sbi Life Insurance Company Ltd.Future -2.58 investing in equity and equity related instruments, equity arbitrage HDFC Bank Ltd. 4.09 Reliance Industries Ltd. 2.45 opportunities and investments in debt and money market instruments. ICICI Bank Ltd. 3.10 Reliance Industries Ltd.Future -2.46 However, there is no assurance or guarantee that the investment State Bank Of India 1.39 ICICI Bank Ltd. 2.38 objective of the Scheme will be achieved. The scheme does not assure Kotak Mahindra Bank Ltd. 0.69 ICICI Bank Ltd.Future -2.39 or guarantee any returns. Cement Hindalco Industries Ltd. 1.96 Ultratech Cement Ltd. 1.06 Hindalco Industries Ltd.Future -1.97 DATE OF ALLOTMENT ACC Ltd. 0.38 Maruti Suzuki India Ltd. 1.03 April 27, 2000 Construction Project Maruti Suzuki India Ltd.Future -1.03 Larsen & Toubro Ltd. -

Ultratech Cement (UTCEM: IN)

Equity Research INDIA August 18, 2020 Virtual Conference 2020 ICICI Securities Limited is the author and Day 2 Highlights distributor of this report We hosted 15 large cap corporates at I-Sec Virtual Conference 2020 on August 18, 2020. Infosys (INFO: IN) ITC (ITC: IN) Sun Pharma (SUNP: IN) Ultratech Cement (UTCEM: IN) Godrej Consumer Products (GCPL: IN) Aurobindo Pharma (ARBP: IN) United Spirits (UNSP: IN) Lupin (LPC: IN) Hindalco (HNDL: IN) UPL (UPLL: IN) United Breweries (UBBL: IN) ACC (ACC: IN) Voltas (VOLT: IN) Dr Lal Path (DLPL: IN) Kajaria Ceramics (KJC: IN) Research Analysts: I-Sec Equity Research [email protected] Please refer to important disclosures at the end of this report Virtual Conference August 18, 2020 ICICI Securities TABLE OF CONTENT Infosys (HOLD, CMP: Rs968) ......................................................................................... 3 Sun Pharma (BUY, CMP: Rs526) ................................................................................... 4 Ultratech Cement (BUY, CMP: Rs4,169) ....................................................................... 6 Godrej Consumer Products (ADD, CMP: Rs691) ......................................................... 7 Aurobindo Pharma (ADD, CMP: Rs872) ....................................................................... 8 United Spirits (ADD, CMP: Rs589) ................................................................................ 9 Lupin (HOLD, CMP: Rs981) ......................................................................................... -

UPL-31-03-2021-Icici.Pdf

March 31, 2021 Derivatives Strategy Underlying Action Quant Pick – UPL Duration : 1-2 months Click here to• see PRODUCTopen calls 1 Quant Pick Stock Action Initiation Range Target Stop loss Time Frame Quant (Derivatives) Pick UPL Buy 625-635 735 570 3 Months Underlying Action Sun Pharma Buy Tata Consumer Buy United Breweries Buy Duration : 1-3 months Click here to see open calls • PRODUCT 2 Retail Equity Research Equity Retail – Research Analysts RajResearch Deepak Singh Analysts Securities ICICI Raj Deepak Singh Nandish Patel [email protected] Dipesh Dedhia [email protected] [email protected] [email protected] Nandish Patel Dipesh Dedhia [email protected] [email protected] Buy UPL in range of | 625-635; Target: | 735; Stop Loss: | 570; Time frame: Three months Spot Price 640 Beta 1.11 Snapshot 12M Avg Price (|) 470 3M Avg Roll (%) 96% Pick Quant HV 30 Day (% Annualised) 53.1 Low leverage likely to help in further momentum 700 30000000 Price Open Interest 650 25000000 600 550 20000000 Price vs. 500 open interest 450 15000000 400 pattern Research Equity Retail 10000000 – 350 300 5000000 250 200 0 May-20 Nov-19 Dec-19 Dec-19 Jan-20 Jan-20 Feb-20 Feb-20 Mar-20 Apr-20 Apr-20 Jun-20 Jun-20 Jul-20 Jul-20 Aug-20 Aug-20 Sep-20 Sep-20 Oct-20 Oct-20 Nov-20 Dec-20 Dec-20 Jan-21 Jan-21 Feb-21 Mar-21 Mar-21 ICICI Securities Securities ICICI Source: NSE, Seediff, ICICI Direct Research March 31, 2021 ICICI Securities Ltd. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Newspaper Publication- Intimation of Board Meeting Q2- 2019-20

• •••• •••• • • • •• • • • wip' ro•ifi: . ·. ....•. •: . • • •• •••• • • •••• ••••••• October 3, 2019 The Manager - Listing BSE Limited (BSE: 507685) The Manager - Listing National Stock Exchange of India Limited. (NSE : WIPRO) Dear Sir/Madam , Sub: Newspaper Advertisement- Regulation 47 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Pursuant to Regulation 47 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are enclosing a copy of newspaper advertisement published in the Newspaper of Business Standard and Kannada Prabha. The same has been made available on the Company's Website www.wipro.com . Thanking You, For WIPRO LIMITED ·N/CY/ A~ M San~~I~ ~ Company Secretary Re gistered Office: Wipro Limited T : +91 (80) 2844 0011 Doddakannelli F : +91 (80) 2844 0054 Sarjapur Road E : [email protected] Bengaluru 560 035 W: wipro.com India C : L32102KA1945PLC020800 Business Standard MUMBAI I wrn•EsoAv, 2 oaoBER 2019 ECONOMY & PUBLIC AFFAIRS 5 W B Govt Tender Abrid g<" d t-~ .I.T. !'io.:- WB IW/Sfl:\JBQ'l'IT·0lfr)f) 9·2 0 PHILLIPS CARBON BLACK LIM ITED I) ~pc-"1al rC'p:11r t<J l)1~mbutary oo .1 of Mahan:inda M:un Can.al In September, UPI bucks CIN l23109WB1960f>LC024602 from ch 00010 10 I~ km \.i1Tl()l"2ofDy 3 from ch 000 10 I b R99(1 Qt!';c. 31.tkta)Sul>llasRoao.KoluUl-700001 l..i11.~1mor .lofDy~ lrom0001u I Jll l.rn.M1nor~ufDy) from T•I• •913366251-461-5'1 F1~•'.U 1322~01•0/22436681 Corporal• Qfriee RPSG HouM, 2Ja .1uOQes Court Roao, 4ltl Floof 000 to I 71 l,;m along wnh siructuro of Dy 3 of \ 1!abJ11anda Kot,,alll -700027. -

Today's Top Research Idea Market Snapshot UPL: Adding Rynaxypyr

9 March 2021 ASIAMONEY Brokers Poll 2020 (India) Today’s top research idea UPL: Adding Rynaxypyr ahead of time in the kitty ❖ UPL has announced a long-term strategic collaboration with FMC Corporation for Rynaxypyr, which allows UPL access to key markets prior to the patent expiry and to commercialize Rynaxypyr Active: FMC's leading insecticide. In CY19, the global Rynaxypyr market was valued at USD1.6b (v/s the global Crop Protection market of USD59.8b). The market is expected to expand at a Market snapshot moderate CAGR (4.4%) over CY18-25 and reach USD2.1b by CY25-end. ❖ The pact also allows UPL to launch Rynaxypyr formulations with its own Equities - India Close Chg .% CYTD.% Sensex 50,441 0.1 5.6 trademark and combination molecule in key markets, thereby enabling the Nifty-50 14,956 0.1 7.0 company to add a new core molecule to its portfolio. Rynaxypyr has a 2.7% Nifty-M 100 24,149 0.3 15.9 market share in the global Crop Protection market. Equities-Global Close Chg .% CYTD.% ❖ As per an industry source, toll manufacturing and supply of Rynaxypyr to FMC S&P 500 3,821 -0.5 1.7 Nasdaq 12,609 -2.4 -2.2 in India will provide UPL with a INR7-8b - a long-term growth opportunity. We FTSE 100 6,719 1.3 4.0 maintain our Neutral view with a TP of INR631/share. DAX 14,381 3.3 4.8 Hang Seng 11,015 -2.5 2.6 Nikkei 225 28,743 -0.4 4.7 Research covered Commodities Close Chg .% CYTD.% Brent (US$/Bbl) 68 -2.2 32.6 Cos/Sector Key Highlights Gold ($/OZ) 1,684 -1.0 -11.3 UPL Adding Rynaxypyr ahead of time in the kitty Cu (US$/MT) 9,019 1.2 16.4 Almn -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

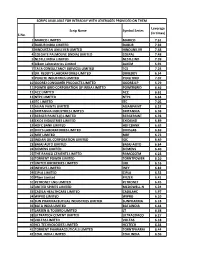

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues. -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd.