Annual Report 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EQUITY DERIVATIVES Faqs

NATIONAL INSTITUTE OF SECURITIES MARKETS SCHOOL FOR SECURITIES EDUCATION EQUITY DERIVATIVES Frequently Asked Questions (FAQs) Authors: NISM PGDM 2019-21 Batch Students: Abhilash Rathod Akash Sherry Akhilesh Krishnan Devansh Sharma Jyotsna Gupta Malaya Mohapatra Prahlad Arora Rajesh Gouda Rujuta Tamhankar Shreya Iyer Shubham Gurtu Vansh Agarwal Faculty Guide: Ritesh Nandwani, Program Director, PGDM, NISM Table of Contents Sr. Question Topic Page No No. Numbers 1 Introduction to Derivatives 1-16 2 2 Understanding Futures & Forwards 17-42 9 3 Understanding Options 43-66 20 4 Option Properties 66-90 29 5 Options Pricing & Valuation 91-95 39 6 Derivatives Applications 96-125 44 7 Options Trading Strategies 126-271 53 8 Risks involved in Derivatives trading 272-282 86 Trading, Margin requirements & 9 283-329 90 Position Limits in India 10 Clearing & Settlement in India 330-345 105 Annexures : Key Statistics & Trends - 113 1 | P a g e I. INTRODUCTION TO DERIVATIVES 1. What are Derivatives? Ans. A Derivative is a financial instrument whose value is derived from the value of an underlying asset. The underlying asset can be equity shares or index, precious metals, commodities, currencies, interest rates etc. A derivative instrument does not have any independent value. Its value is always dependent on the underlying assets. Derivatives can be used either to minimize risk (hedging) or assume risk with the expectation of some positive pay-off or reward (speculation). 2. What are some common types of Derivatives? Ans. The following are some common types of derivatives: a) Forwards b) Futures c) Options d) Swaps 3. What is Forward? A forward is a contractual agreement between two parties to buy/sell an underlying asset at a future date for a particular price that is pre‐decided on the date of contract. -

Property Derivatives Study Report

Property Derivatives Study Report June 2007 Property Derivatives Study Group Table of Contents Outline of the Study Group workshops..................................................................................................1 Committee members (As of March 31, 2007).........................................................................................2 1. Introduction.........................................................................................................................................3 2 Increasing Potential of Property Derivatives .....................................................................................6 2.1 Financial derivatives from the background of financial liberalization and market competition ..............................................................................................................................................................6 2.1.1 Background of derivatives......................................................................................................6 2.1.2 Current status of the derivatives market..............................................................................8 2.2 Change of Property into risk assets and its background...........................................................10 2.2.1 Change of Land into risk assets due to the bubble collapse ...............................................10 2.2.2 Spread of economic entity with risks ...................................................................................12 2.3 Increasing need for advanced -

Transaction Price Indexes and Derivatives a Revolution in the Real-Estate Investment Industry?

Features Transaction Price Indexes and Derivatives A Revolution in the Real-Estate Investment Industry? David Geltner* Abstract: This article is about two interesting new innovations in the world of real-estate investment that are still flying largely below the radar screen in the U.S., but which I believe have the potential to converge here in this country and revolutionize the industry, and with it, perhaps, even the way many commercial buildings are designed, built and managed. The two innovations are transaction-price-based indexes for tracking commercial-property price movements, and real-estate equity derivatives that allow synthetic trading of investment real estate. Transaction-Price-Based Indexes for Real Estate includes staggered, typically annual, reappraisals of Every major investment asset class needs indexes properties in an index that reports quarterly returns. that accurately track the movements in its market value. The NPI’s relatively narrow property population Stock and bond market indexes of periodic price changes means that it could miss differences between NCREIF abound, and are widely used to study historical risk and member property performance and the broader U.S. return behavior, to understand relative valuations, to commercial-property market. And its appraisal basis help traders predict where they think prices are headed, means that the NPI tends to lag and smooth out to serve as benchmarks or targets for mutual funds and property-market price movements. For example, if the Exchange Traded Funds (ETFs), and even to serve as property market takes a sudden or sharp downturn, the bases for derivatives such as futures contracts that allow NPI may not register such a change for several quarters, synthetic investment in the asset class. -

A Review of Interest Rate Hedging in Real Estate

2011–2015 2011–2015 SHORT PAPER 22 A Review of Interest Rate Hedging in Real Estate This research was commissioned by the IPF Research Programme 2011–2015 JANUARY 2015 A Review of Interest Rate Hedging in Real Estate This research was funded and commissioned through the IPF Research Programme 2011–2015. This Programme supports the IPF’s wider goals of enhancing the understanding and efficiency of property as an investment. The initiative provides the UK property investment market with the ability to deliver substantial, objective and high-quality analysis on a structured basis. It encourages the whole industry to engage with other financial markets, the wider business community and government on a range of complementary issues. The Programme is funded by a cross-section of businesses, representing key market participants. The IPF gratefully acknowledges the support of these contributing organisations: A Review of Interest Rate Hedging in Real Estate IPF Research Programme Short Papers Series A Review of Interest Rate Hedging in Real Estate IPF Research Programme 2011–2015 January 2015 The IPF Short Papers Series addresses current issues facing the property investment market in a timely but robust format. The aims of the series are: to provide topical and relevant information in a short format on specific issues; to generate and inform debate amongst the IPF membership, the wider property industry and related sectors; to publish on current issues in a shorter time-scale than we would normally expect for a more detailed research project, but with equally stringent standards for quality and robustness; and to support the IPF objectives of enhancing the understanding and efficiency of property as an investment asset class. -

Copyrighted Material

Index ABN Amro, 51–52 Bahrain, 18 Africa, 17, 116 Bank for International Settlements (BIS), Agent-principal argument, xxiii 32–34 Agricultural commodities, 117–118 Bank-issued infl ation-linked notes, 109–110 AIG, macroprudential regulation and, 53 Bank of America, 46–47 Algeria, 19 Bank of England, 56, 106 Alpha, as myth, 82 Banks: ARCH/GARCH models, 78–80 concentration of derivatives in, 28–29 Argentina, 7 deleveraging of, xxv Asia: initiatives to address systemic risk in, central banks, 22 30–36 currency crisis of 1997–1998, 5, 24, 38 moral hazard and, 37–42 gross savings versus net lending in Barclays Bank, 48–49, 120 percentage of gross domestic product Barings bank, 27 of, 17 Basel Committee on Banking and Asset-backed commercial paper vehicles Supervision (BCBS): (ABCPs), in shadow banking system, limit on leverage ratios, 162 xxiv proposals for revamping rules, 173–175 Asset-liability committee (ALCO), 124 Basel II, 45 policies, 134–137 Basel III, 123 reporting, 136, 137–142 Bear Stearns: reporting, proposed, 174–175 fi nancial accelerator and, 68 Asset-liability management (ALM), systemic risk and, 52, 53–54 123–157 http://www.pbookshop.comBelgium: ALCO policy, 134–137 gross domestic product of, 51 ALCO reporting, 137–142 sovereign debt and, 100 basic concepts, 123–134 Bernanke, Ben, 14–15, 43 internal funding rate policy, 151–157 Best practices, internal funding rate policy liquidity risk management metrics, and, 154 145–151 COPYRIGHTEDBlackstone, MATERIAL 64 liquidity risk management principles, Blundell-Wignall, Adrian, 153 142–145 BNP Paribus: mismanaged, 86 effi cient market hypothesis and, 80–81 Assets: leverage and total assets, 46–47 internal funding rate policy and, 155–156 Boards of Directors: rotation of, 95–97 current regulations and bank strategy, strategy and review of, 161 160 Atkinson, Paul, 153 risk behavior and remuneration, 66 Australia, 68, 108 structure of, 167 191 192 INDEX Bonds, infl ation risks and, 110–112 debt as percentage of gross domestic Bonuses. -

Group Annual Report 2017 Incl. Group

VALUES. GROWTH. POTENTIAL. 2017 ANNUAL REPORT KEY GROUP FIGURES ACCORDING TO IFRS Unit 01/01/2017– 01/01/2016– Change 31/12/2017 31/12/2016 in % Earnings indicators Rental income in EUR k 168,310 140,464 19.8 Net operating income from letting activities (NOI) in EUR k 153,548 125,588 22.3 Disposal profits in EUR k 2,561 6,391 – 59.9 Net income in EUR k 284,373 94,109 202.2 Funds from operations (FFO) in EUR k 102,673 76,877 33.6 FFO per share1 in EUR 1.29 1.14 13.2 Unit 31/12/2017 31/12/2016 Change in % Balance sheet matrix Investment property in EUR k 3,383,259 2,215,228 52.7 Cash and cash equivalents in EUR k 201,476 68,415 194.5 Total assets in EUR k 3,835,748 2,344,763 63.6 Equity in EUR k 1,936,560 1,009,503 91.8 Equity ratio in % 50.5 43.1 7.4 pp Interest-bearing liabilities in EUR k 1,541,692 1,040,412 48.2 Net debt in EUR k 1,340,216 971,997 37.9 Net LTV2 in % 39.2 43.4 – 4.2 pp EPRA NAV3 in EUR k 2,228,512 1,252,131 78.0 EPRA NAV per share1, 3 in EUR 21.84 18.57 17.6 Unit 31/12/2017 31/12/2016 Change in % Key portfolio performance indicators Property value4 in EUR k 3,400,582 2,241,615 51.7 Properties Number 426 404 22 units Annualised in-place rent5 in EUR k 214,057 155,276 37.9 In-place rental yield in % 6.3 6.9 – 0.6 pp EPRA Vacancy Rate in % 3.6 3.8 – 0.2 pp WALT in years 6.3 6.1 0.2 years Average rent EUR/sqm 10.05 9.67 3.9 1 Total number of shares as at 31 December 2016: 67.4 m, as at 31 December 2017: 102.0 m. -

Real Estate Derivatives Market

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by DSpace@MIT Barriers to Growth in the US Real Estate Derivatives Market By Jani Venter Bachelor of Architecture, 2000 Bachelor of Building Arts, 1998 University of Port Elizabeth Submitted to the Department of Urban Studies and Planning in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development at the Massachusetts Institute of Technology September, 2007 ©2007 Jani Venter All rights reserved The author hereby grants MIT permission to reproduce and publicly distribute both paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created. Signature of author___________________________________________________ Jani Venter Department of Urban Studies and Planning July 27, 2007 Certified by_________________________________________________________ Gloria Schuck Lecturer, Department of Urban Studies and Planning Thesis Supervisor Accepted by________________________________________________________ David Geltner Chairman, Interdepartmental Degree Program in Real Estate Development Barriers to Growth in the US Real Estate Derivatives Market By Jani Venter Bachelor of Architecture, 2000 Bachelor of Building Arts, 1998 University of Port Elizabeth Submitted to the Department of Urban Studies and Planning in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development Abstract Commercial real estate is an important asset class but it does not yet have a well-developed derivatives market in the United States. A derivative is a contract that derives its value from an underlying index or asset. Examples of the most well-known derivatives that have been widely used and traded for years are stock options, commodity futures and interest rate swaps. -

Trading Property Derivatives © Investment Property Forum, March 2010

Trading Property Derivatives © Investment Property Forum, March 2010 All rights reserved by the Investment Property Forum (IPF). No part of this publication may be reproduced, stored or transmitted in any form or by any means whether graphic, electronic or mechanical; including photocopying, recording or any other information storage system, without the prior consent from the IPF. Trading Property Derivatives has been produced by the IPF and the PDIG Technical Sub-Group solely for information purposes and is not an invitation or an offer to buy or sell any properties, securities, options, futures or derivative-related products. It does not purport to be a complete description of the markets, developments or securities referred to in this material. The information on which this publication is based has been obtained from sources which the IPF and the contributors believe to be reliable, but we have not independently verified such information and we do not guarantee that it is accurate or complete. This material is provided to recipients on the understanding that it will not be relied upon in making any investment decision. The IPF and the contributors to this publication accept no liability whatsoever for any direct or consequential loss of any kind arising out of the use of this document or any part of its contents. Introduction The Trading Property Derivatives handbook picks up where Getting into Property Derivatives, published by the IPF Property Derivatives Interest Group (PDIG) in November 2008, left off. The earlier publication sought to tackle some of the hurdles encountered by many property investors wanting to participate in the property derivatives market. -

Basis Risk and Property Derivative Hedging in the UK

Basis Risk and Property Derivative Hedging in the UK: Implications of the 2007 IPF Study of Tracking Error By Jia Ma Master of Architecture, 2004, Tsinghua University Bachelor of Architecture, 2001, Tsinghua University Submitted to the Center for Real Estate in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development at the Massachusetts Institute of Technology September 2009 © 2009 Jia Ma All rights reserved The author hereby grants to MIT permission to reproduce and distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created Signature of Author______________________________________________________________ Center for Real Estate July 24, 2009 Certified by____________________________________________________________________ David M. Geltner Professor of Real Estate Finance Thesis Supervisor Accepted by___________________________________________________________________ Brian A. Ciochetti Chairman, Interdepartmental Degree Program in Real Estate Development Basis Risk and Property Derivative Hedging in the UK: Implications of the 2007 IPF Study of Tracking Error by Jia Ma Master of Architecture, 2004, Tsinghua University Bachelor of Architecture, 2001, Tsinghua University Submitted to the Center for Real Estate on July 24, 2009 in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development Abstract This thesis examines how the basis risk affects property derivative hedging in the UK market, based on the tracking error (basis risk) report from the Investment Property Forum study in 2007 (the IPF Study). The thesis first analyzes the risks relevant to hedging and defines the basis risk. Considering hedgers with different objectives measure hedging efficiency differently, this thesis divides the hedging users into two major categories: β-Avoidance hedgers and α-Usage hedgers. -

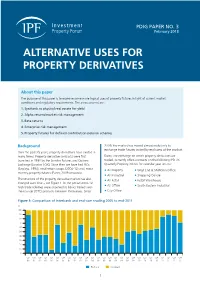

Alternative Uses for Property Derivatives’ Is the Third Paper in the Series Published by PDIG

PDIG PAPER NO. 3 February 2018 ALTERNATIVE USES FOR PR OPER TY DERI VATIVES About this paper The purpose of this paper is to examine some more topical uses of property futures in light of current market conditions and regulatory requirements. The areas covered are: 1. Synthetic vs physical real estate for yield 2. Alpha returns/market risk management 3. Beta returns 4. Enterprise risk management 5. Property futures for defined contribution pension schemes Background 2009, the market has moved almost exclusively to exchange trade futures traded by end users of the product. Over the past 25 years, property derivatives have existed in many forms. Property derivative contracts were first Eurex, the exchange on which property derivatives are launched in 1991 by the London Futures and Options traded, currently offers contracts on the following IPD UK Exchange (London FOX). Since then we have had PICs Quarterly Property indices for calendar year returns: (Barclays, 1994), total return swaps (200 4-12) and, most • All Property • West End & Midtown Office recently, property futures (Eurex, 2009 onwards). • All Industrial • Shopping Centre The structure of the property derivative market has also • All Retail • Retail Warehouse changed over time – see Figure 1. In the period 2004-12 All Office South Eastern Industrial high trade volumes were observed as banks traded over- • • the-counter (OTC) products between themselves. Since • City Office Figure 1: Comparison of Interbank and end-user trading 2005 to end-2011 % 100 90 80 70 60 50 40 30 20 10 0 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 05 05 05 06 06 06 06 07 07 07 07 08 08 08 08 09 09 09 09 10 10 10 10 11 11 11 11 End user Interbank 1 Compared to transactions in physical property, the costs of A property future, of course, only offers a beta return. -

Thèse Drouhin Pierre-Arnaud

UNIVERSITÉ PARIS-DAUPHINE ÉCOLE DOCTORALE EDOGEST Numéro attribué par la bibliothèque Caractéristiques statistiques et dynamique de prix des produits dérivés immobiliers Document de soutenance de thèse Pour l’obtention du titre de DOCTEUR EN SCIENCES DE GESTION (Arrêté du 7 août 2006) Soutenue publiquement le 16 novembre 2012 par Pierre-Arnaud DROUHIN COMPOSITION DU JURY Directeur de thèse : Monsieur Laurent BATSCH Professeur, Université Paris-Dauphine Rapporteurs : Monsieur Michel BARONI Professeur, ESSEC Business School Monsieur Alain COEN Professeur, Université du Québec à Montréal Suffragants : Madame Delphine LAUTIER Professeur, Université Paris-Dauphine Monsieur Christophe PINEAU Docteur, MRICS, Directeur de la recherche à BNP Paribas Real Estate Monsieur Arnaud SIMON Maître de conférences, Université Paris-Dauphine Thèse de doctorat 2 | P a g e L’université n’entend donner aucune approbation ni improbation aux opinions émises dans les thèses : ces opinions doivent être considérées comme propres à leurs auteurs Thèse de doctorat 3 | P a g e Thèse de doctorat 4 | P a g e REMERCIEMENTS Mes premières pensées s’adressent à mon directeur de thèse, Monsieur le Professeur Laurent Batsch, ainsi qu’à Monsieur Arnaud Simon Maître de conférences à l’Université Paris-Dauphine. Je les remercie pour la confiance qu’ils m’ont accordée tout au long de ce travail doctoral. Ces années m’ont été agréables par l’atmosphère intellectuelle stimulante dans laquelle ils ont supervisé mes travaux. Leurs disponibilités, leurs conseils toujours judicieux et leurs encouragements permanents m’ont été des plus précieux dans la conduite de mes recherches et je leur en suis très reconnaissant. Je remercie Monsieur le Professeur Michel Baroni, ESSEC Business School, et Monsieur le Professeur Alain Coen, Université du Québec à Montréal, d’avoir accepté d’être les rapporteurs de cette thèse. -

Risk-Neutral Valuation of Real Estate Derivatives

David van Bragt Marc Francke Bert Kramer Antoon Pelsser Risk-Neutral Valuation of Real Estate Derivatives Discussion Paper 10/2009 - 048 October, 2009 OFRC WORKING PAPER SERIES RISK-NEUTRAL VALUATION OF REAL ESTATE DERIVATIVES David van Bragt∗, Marc Francke†‡, Bert Kramer†, Antoon Pelsser§¶ Technical Paper No. 2009-02 October 2009 Ortec Finance Research Center P.O. Box 4074, 3006 AB Rotterdam Max Euwelaan 78, The Netherlands, www.ortec-finance.com ABSTRACT We propose a novel and intuitive risk-neutral valuation model for real estate derivatives. We first model the under- lying efficient market price of real estate and then construct the observed index value with an adaptation of the price update rule by Blundell and Ward (1987). The resulting index behavior can easily be analyzed and closed-form pric- ing solutions are derived for forwards, swaps and European put and call options. We demonstrate the application of the model by valuing a put option on a house price index. Autocorrelation in the index returns appears to have a large impact on the option value. We also study the effect of an over- or undervalued real estate market. The observed effects are significant and as expected. Keywords: Real estate derivatives; Option pricing; Incomplete markets; Price discovery; Autoregressive models; Seasonality, Stochastic volatility. JEL Classification: C51/D52/G13 ∗Ortec Finance Insurance Risk Management. Please e-mail comments and questions to David.vanBragt@ortec-finance.com. We would like to thank Diederik van Eck of Ortec Finance and participants of the Real Estate Finance seminar at the University of Amsterdam for useful suggestions and comments.