(A) Self-Insurers -- General Provisions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Illinois Rules of the Road 2021 DSD a 112.35 ROR.Qxp Layout 1 5/5/21 9:45 AM Page 1

DSD A 112.32 Cover 2021.qxp_Layout 1 1/6/21 10:58 AM Page 1 DSD A 112.32 Cover 2021.qxp_Layout 1 5/11/21 2:06 PM Page 3 Illinois continues to be a national leader in traffic safety. Over the last decade, traffic fatalities in our state have declined significantly. This is due in large part to innovative efforts to combat drunk and distracted driving, as well as stronger guidelines for new teen drivers. The driving public’s increased awareness and avoidance of hazardous driving behaviors are critical for Illinois to see a further decline in traffic fatalities. Beginning May 3, 2023, the federal government will require your driver’s license or ID card (DL/ID) to be REAL ID compliant for use as identification to board domestic flights. Not every person needs a REAL ID card, which is why we offer you a choice. You decide if you need a REAL ID or standard DL/ID. More information is available on the following pages. The application process for a REAL ID-compliant DL/ID requires enhanced security measures that meet mandated federal guidelines. As a result, you must provide documentation confirming your identity, Social Security number, residency and signature. Please note there is no immediate need to apply for a REAL ID- compliant DL/ID. Current Illinois DL/IDs will be accepted to board domestic flights until May 3, 2023. For more information about the REAL ID program, visit REALID.ilsos.gov or call 833-503-4074. As Secretary of State, I will continue to maintain the highest standards when it comes to traffic safety and public service in Illinois. -

LOST the Official Show Auction

LOST | The Auction 156 1-310-859-7701 Profiles in History | August 21 & 22, 2010 572. JACK’S COSTUME FROM THE EPISODE, “THERE’S NO 574. JACK’S COSTUME FROM PLACE LIKE HOME, PARTS 2 THE EPISODE, “EGGTOWN.” & 3.” Jack’s distressed beige Jack’s black leather jack- linen shirt and brown pants et, gray check-pattern worn in the episode, “There’s long-sleeve shirt and blue No Place Like Home, Parts 2 jeans worn in the episode, & 3.” Seen on the raft when “Eggtown.” $200 – $300 the Oceanic Six are rescued. $200 – $300 573. JACK’S SUIT FROM THE EPISODE, “THERE’S NO PLACE 575. JACK’S SEASON FOUR LIKE HOME, PART 1.” Jack’s COSTUME. Jack’s gray pants, black suit (jacket and pants), striped blue button down shirt white dress shirt and black and gray sport jacket worn in tie from the episode, “There’s Season Four. $200 – $300 No Place Like Home, Part 1.” $200 – $300 157 www.liveauctioneers.com LOST | The Auction 578. KATE’S COSTUME FROM THE EPISODE, “THERE’S NO PLACE LIKE HOME, PART 1.” Kate’s jeans and green but- ton down shirt worn at the press conference in the episode, “There’s No Place Like Home, Part 1.” $200 – $300 576. JACK’S SEASON FOUR DOCTOR’S COSTUME. Jack’s white lab coat embroidered “J. Shephard M.D.,” Yves St. Laurent suit (jacket and pants), white striped shirt, gray tie, black shoes and belt. Includes medical stetho- scope and pair of knee reflex hammers used by Jack Shephard throughout the series. -

Trademark / Service Mark Database Subscription Form

South Dakota Secretary of State Trademark/Service Mark Database Terms and Conditions South Dakota Secretary of State’s (SOS) office provides a download of all Trademark/Service mark Registration records. The download is made available in 3 ways: a Full Database download (Updated Quarterly), a download of all Quarterly Updates, and a download of all images done Quarterly. Subscribers wishing to use the service made available by the South Dakota Secretary of State will need to complete this form. Trademark/Service mark Registration Database downloads are available in Excel (.xlsx) format and will be emailed to the subscriber. The Subscriber and The Office of Secretary of State (SOS) agree to contract for the Trademark/Service mark Registration database provided by the SOS as per the Terms and Conditions stated below. 1. This agreement sets forth the terms and conditions under which SOS will provide services to the subscriber. 2. Term: SOS reserves the right to withdraw any service without consulting Subscriber prior to withdrawing such service and shall have no liability whatsoever to Subscriber in connection with deletion of any service. Subscriber may terminate this agreement at any time by written notice to the SOS. 3. Subscriber acknowledges that he/she has read the Agreement and agrees that it is the complete and exclusive statement between the parties, superseding all other communications, oral or written. This agreement and other notices provided to the Subscriber by SOS constitute the entire agreement between the parties. This agreement may be modified only by written amendment signed by the parties except as otherwise provided in this paragraph. -

Time Travel and Free Will in the Television Show Lost

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Directory of Open Access Journals Praxes of popular culture No. 1 - Year 9 12/2018 - LC.1 Kevin Drzakowski, University of Wisconsin-Stout, USA Paradox Lost: Time Travel and Free Will in the Television Show Lost Abstract The television series Lost uses the motif of time travel to consider the problem of human free will, following the tradition of Humean compatibilism in asserting that human beings possess free will in a deterministic universe. This paper reexamines Lost’s final mystery, the “Flash Sideways” world, presenting a revisionist view of the show’s conclusion that figures the Flash Sideways as an outcome of time travel. By considering the perspectives of observers who exist both within time and outside of it, the paper argues that the characters of Lost changed their destinies, even though the rules of time travel in Lost’s narrative assert that history cannot be changed. Keywords: Lost, time travel, Hume, free will, compatibilism My purpose in this paper is twofold. First, I intend to argue that ABC’s Lost follows a tradition of science fiction in using time travel to consider the problem of human free will, making an original contribution to the debate by invoking a narrative structure previously unseen in time travel stories. I hope to show that Lost, a television show that became increasingly invested in questions over free will and fate as the series progressed, makes a case for free will in the tradition of Humean compatibilism, asserting that human beings possess free will even in a deterministic world. -

The Ultimate and Philosophy

PHILOSOPHY/POP CULTURE IRWIN SERIES EDITOR: WILLIAM IRWIN What are the metaphysics of time travel? EDITED BY SHARON KAYE How can Hurley exist in two places at the same time? THE ULTIMATE What does it mean for something to be possibly true in the fl ash-sideways universe? Does Jack have a moral obligation to his father? THE ULTIMATE What is the Tao of John Locke? Dude. So there’s, like, this island? And a bunch of us were on Oceanic fl ight 815 and we crashed on it. I kinda thought it was my fault, because of those numbers. I thought they were bad luck. We’ve seen the craziest things here, like a polar bear and a Smoke Monster, and we traveled through time back to the 1970s. And we met the Dharma dudes. Arzt even blew himself up. For a long time, I thought I was crazy. But now, I think it might have been destiny. The island’s made me question a lot of things. Like, why is it that Locke and Desmond have the same names as real philosophers? Why do so many of us have AND PHILOSOPHY trouble with our dads? Did Jack have a choice in becoming our leader? And what’s up Think Together, Die Alone with Vincent? I mean, he’s gotta be more than just a dog, right? I dunno. We’ve all felt pretty lost. I just hope we can trust Jacob, otherwise . whoa. With its sixth-season series fi nale, Lost did more than end its run as one of the most AND PHILOSOPHY talked-about TV programs of all time; it left in its wake a complex labyrinth of philosophical questions and issues to be explored. -

The Exodus, Then and Now

Seton Hall University eRepository @ Seton Hall The Bridge: A Yearbook of Judaeo-Christian Studies, Vol. I The Institute of Judaeo-Christian Studies 1955 The Exodus, Then and Now Barnabas M. Ahern Follow this and additional works at: https://scholarship.shu.edu/jcs-bridge-I Part of the Biblical Studies Commons, Christianity Commons, and the Jewish Studies Commons Recommended Citation Barnabas M. Ahern, "The Exodus, Then and Now." In The Bridge: A Yearbook of Judaeo-Christian Studies, Vol. 1, edited by John M. Oesterreicher and Barry Ulanov, 53-74. New York: Pantheon Books, 1955. ! of moral I but made nt on, and Barnabas M. Ahern, c.P. THE EXODUS, THEN AND NOW UPHEAVAL stirred the world of Abraham. Dynastic changes at Ur and vast migrations over the Fertile Crescent clogged the stagnant pool of a world that had died. Babylon in the early second millennium vaunted the boast, "I am rich and have grown wealthy and have need of nothing"; and all the while the bragging corpse failed to see how "wretched and miserable and poor and blind and naked" it really was (Apoc 3:17) . All flesh had corrupted its way; God's clean sun shone on a pool full of death. But life still throbbed at Haran in northern Mesopotamia, for Abraham lived there, a newcomer from Ur in the south. All future history would flow from him; he was to become "the father of us all ... our father in the sight of God" (Rom 4 : 17). For one day at Haran, in the middle of the nineteenth century, a merciful God spoke to the heart of this tribal chief (Gen 12: 1-3) and broke it wide open with a freshet of mercy, gushing forth and bubbling over to cleanse all heartS by faith. -

The Wonder Years Episode & Music Guide

The Wonder Years Episode & Music Guide “What would you do if I sang out of tune … would you stand up and walk out on me?" 6 seasons, 115 episodes and hundreds of great songs – this is “The Wonder Years”. This Episode & Music Guide offers a comprehensive overview of all the episodes and all the songs played during the show. The episode guide is based on the first complete TWY episode guide which was originally posted in the newsgroup rec.arts.tv in 1993. It was compiled by Kirk Golding with contributions by Kit Kimes. It was in turn based on the first TWY episode guide ever put together by Jerry Boyajian and posted in the newsgroup rec.arts.tv in September 1991. Both are used with permission. The music guide is the work of many people. Shane Hill and Dawayne Melancon corrected and inserted several songs. Kyle Gittins revised the list; Matt Wilson and Arno Hautala provided several corrections. It is close to complete but there are still a few blank spots. Used with permission. Main Title & Score "With a little help from my friends" -- Joe Cocker (originally by Lennon/McCartney) Original score composed by Stewart Levin (episodes 1-6), W.G. Snuffy Walden (episodes 1-46 and 63-114), Joel McNelly (episodes 20,21) and J. Peter Robinson (episodes 47-62). Season 1 (1988) 001 1.01 The Wonder Years (Pilot) (original air date: January 31, 1988) We are first introduced to Kevin. They begin Junior High, Winnie starts wearing contacts. Wayne keeps saying Winnie is Kevin's girlfriend - he goes off in the cafe and Winnie's brother, Brian, dies in Vietnam. -

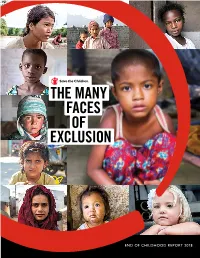

The Many Faces of Exclusion: 2018 End of Childhood Report

THE MANY FACES OF EXCLUSION END OF CHILDHOOD REPORT 2018 Six-year-old Arwa* and her family were displaced from their home by armed conflict in Iraq. CONTENTS 1 Introduction 3 End of Childhood Index Results 2017 vs. 2018 7 THREAT #1: Poverty 15 THREAT #2: Armed Conflict 21 THREAT #3: Discrimination Against Girls 27 Recommendations 31 End of Childhood Index Rankings 32 Complete End of Childhood Index 2018 36 Methodology and Research Notes 41 Endnotes 45 Acknowledgements * after a name indicates the name has been changed to protect identity. Published by Save the Children 501 Kings Highway East, Suite 400 Fairfield, Connecticut 06825 United States (800) 728-3843 www.SavetheChildren.org © Save the Children Federation, Inc. ISBN: 1-888393-34-3 Photo:## SAVE CJ ClarkeTHE CHILDREN / Save the Children INTRODUCTION The Many Faces of Exclusion Poverty, conflict and discrimination against girls are putting more than 1.2 billion children – over half of children worldwide – at risk for an early end to their childhood. Many of these at-risk children live in countries facing two or three of these grave threats at the same time. In fact, 153 million children are at extreme risk of missing out on childhood because they live in countries characterized by all three threats.1 In commemoration of International Children’s Day, Save the Children releases its second annual End of Childhood Index, taking a hard look at the events that rob children of their childhoods and prevent them from reaching their full potential. WHO ARE THE 1.2 BILLION Compared to last year, the index finds the overall situation CHILDREN AT RISK? for children appears more favorable in 95 of 175 countries. -

The End of Absence Reclaiming What Weve Lost in a World of Constant Connection 1St Edition Pdf, Epub, Ebook

THE END OF ABSENCE RECLAIMING WHAT WEVE LOST IN A WORLD OF CONSTANT CONNECTION 1ST EDITION PDF, EPUB, EBOOK Michael Harris | 9781591847922 | | | | | The End of Absence Reclaiming What Weve Lost in a World of Constant Connection 1st edition PDF Book Brain Computation as Hierarchical Abstraction. How do relationships I am part of the last generation that will remember life without personal computing devices. I fear our children will lose lack, lose absence, and never comprehend its quiet, immeasurable value. For exam An exploration of the effects of the Internet and related mobile devices on our society and psyches, this book is at once interesting and frustrating. Michael Harris is an award-winning journalist and a contributing editor at Western Living and Vancouvermagazines. His perspective throughout is sweetly personal and sweetly queer, which is refreshing for a book on the subject of human-technology interaction. Approximately 12, years ago, early humans in western Asia and Europe who had been itinerant foragers, subsisting on what food they could find, slowly began settling in one place. Jan van Toorn and Wim Crouwel. It's a very breezy read and best considered a kind of light, course opener on the subject. And is it that experience of everyday information miracles, perhaps, that makes us all feel as though our own opinions are so worth sharing? Aquaman Vol. I've talked about, recommended and pulled parts of this book away to think more about since finishing it only a couple days ago - why? A Goodreads review says it's like a too long blog post and that's not a bad summary. -

Vaccine Storage and Handling Toolkit-March 2021

Vaccine Storage and Handling Toolkit Updated with COVID-19 Vaccine Storage and Handling Information Addendum added September 29, 2021 September 2021 CS296544-B Table of Contents The Vaccine Storage and Handling Toolkit has been updated with an addendum to address proper storage, handling, transport, and emergency handling of COVID-19 vaccines. The addendum will be updated as new COVID-19 vaccine products are approved. Please check the CDC Vaccine Storage and Handling Toolkit website (www.cdc.gov/vaccines/hcp/admin/storage/toolkit/index.html) regularly for the most current version of the toolkit during the COVID-19 response. The addendum can be found on page 49. Introduction .........................................................................................................................................................................................................2 SECTION ONE: Vaccine Cold Chain ..............................................................................................................................................................4 SECTION TWO: Staff and Training .................................................................................................................................................................6 SECTION THREE: Vaccine Storage and Temperature Monitoring Equipment ......................................................................................8 SECTION FOUR: Vaccine Inventory Management ....................................................................................................................................16 -

Jack's Costume from the Episode, "There's No Place Like - 850 H

Jack's costume from "There's No Place Like Home" 200 572 Jack's costume from the episode, "There's No Place Like - 850 H... 300 Jack's suit from "There's No Place Like Home, Part 1" 200 573 Jack's suit from the episode, "There's No Place Like - 950 Home... 300 200 Jack's costume from the episode, "Eggtown" 574 - 800 Jack's costume from the episode, "Eggtown." Jack's bl... 300 200 Jack's Season Four costume 575 - 850 Jack's Season Four costume. Jack's gray pants, stripe... 300 200 Jack's Season Four doctor's costume 576 - 1,400 Jack's Season Four doctor's costume. Jack's white lab... 300 Jack's Season Four DHARMA scrubs 200 577 Jack's Season Four DHARMA scrubs. Jack's DHARMA - 1,300 scrub... 300 Kate's costume from "There's No Place Like Home" 200 578 Kate's costume from the episode, "There's No Place Like - 1,100 H... 300 Kate's costume from "There's No Place Like Home" 200 579 Kate's costume from the episode, "There's No Place Like - 900 H... 300 Kate's black dress from "There's No Place Like Home" 200 580 Kate's black dress from the episode, "There's No Place - 950 Li... 300 200 Kate's Season Four costume 581 - 950 Kate's Season Four costume. Kate's dark gray pants, d... 300 200 Kate's prison jumpsuit from the episode, "Eggtown" 582 - 900 Kate's prison jumpsuit from the episode, "Eggtown." K... 300 200 Kate's costume from the episode, "The Economist 583 - 5,000 Kate's costume from the episode, "The Economist." Kat.. -

LOST Fandom and Everyday Philosophy

"Accidental Intellectuals": LOST Fandom and Everyday Philosophy Author: Abigail Letak Persistent link: http://hdl.handle.net/2345/2615 This work is posted on eScholarship@BC, Boston College University Libraries. Boston College Electronic Thesis or Dissertation, 2012 Copyright is held by the author, with all rights reserved, unless otherwise noted. ! ! ! ! ! ! ! ! ! ! This thesis is dedicated to everyone who has ever been obsessed with a television show. Everyone who knows that adrenaline rush you get when you just can’t stop watching. Here’s to finding yourself laughing and crying along with the characters. But most importantly, here’s to shows that give us a break from the day-to-day milieu and allow us to think about the profound, important questions of life. May many shows give us this opportunity as Lost has. Acknowledgements First and foremost I would like to thank my parents, Steve and Jody, for their love and support as I pursued my area of interest. Without them, I would not find myself where I am now. I would like to thank my advisor, Juliet Schor, for her immense help and patience as I embarked on combining my personal interests with my academic pursuits. Her guidance in methodology, searching the literature, and general theory proved invaluable to the completion of my project. I would like to thank everyone else who has provided support for me throughout the process of this project—my friends, my professors, and the Presidential Scholars Program. I’d like to thank Professor Susan Michalczyk for her unending support and for believing in me even before I embarked on my four years at Boston College, and for being the one to initially point me in the direction of sociology.