Hamilton-Niagara Peninsula.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

When the Mountain Became the Escarpment.FH11

Looking back... with Alun Hughes WHEN THE MOUNTAIN BECAME THE ESCARPMENT The Niagara Escarpment hasnt always been But Coronelli was not the first to put Niagara known by that name. Early in the 19th century it on the map. That distinction belongs to Father Louis was often referred to as the Mountain, and of course Hennepin, the Recollect priest who was the first it is still called that in Hamilton and Grimsby today. European to describe Niagara Falls from personal We in eastern Niagara have largely forgotten the observation. In his Description de la Louisiane, name, though it survives in the City of Thorolds published in 1683, five years after his visit, he speaks motto Where the Ships Climb the Mountain. of le grand Sault de Niagara, and labels it thus on the accompanying map. This is the form that So when did the name Niagara Escarpment first prevails thereafter, and it is the spelling used for Fort come into use? And what about the areas other de Niagara, established by the French at the mouth Niagara names, like Niagara Falls, Niagara River of the river in 1726. The English followed suit, and Niagara Peninsula? When did these first appear? though on many early maps (e.g. Moll 1715, I dont pretend to have definitive answers there Mitchell 1782) they use the name Great Fall of are too many sources I have not seen but I can Niagara rather than Niagara Falls. suggest some preliminary conclusions. In his Description Hennepin also refers to la The name Niagara is definitely of native origin, belle Riviere de Niagara, so the name Niagara though there is no agreement about its meaning. -

SPECIAL GENERAL ISSUES COMMITTEE LIGHT RAIL TRANSIT (LRT) MINUTES 16-026 10:30 A.M

SPECIAL GENERAL ISSUES COMMITTEE LIGHT RAIL TRANSIT (LRT) MINUTES 16-026 10:30 a.m. Tuesday, October 25, 2016 Council Chambers Hamilton City Hall 71 Main Street West ______________________________________________________________________ Present: Mayor F. Eisenberger, Deputy Mayor D. Skelly (Chair) Councillors T. Whitehead, T. Jackson, C. Collins, S. Merulla, M. Green, J. Farr, A. Johnson, D. Conley, M. Pearson, B. Johnson, L. Ferguson, R. Pasuta, J. Partridge Absent with Regrets: Councillor A. VanderBeek – Personal _____________________________________________________________________ THE FOLLOWING ITEMS WERE REFERRED TO COUNCIL FOR CONSIDERATION: 1. Light Rail Transit (LRT) Project Update (PED16199) (City Wide) (Item 5.1) (Conley/Pearson) That Report PED16199, respecting the Light Rail Transit (LRT) Project Update, be received. CARRIED 2. Hamilton Street Railway (HSR) Fare Integration (PW16066) (City Wide) (Item 6.1) (Eisenberger/Ferguson) That Report PW16066, respecting Hamilton Street Railway (HSR) Fare Integration, be received. CARRIED 3. Possibility of adding the LRT A-Line at the same time as building the B- Line (7.2) (Merulla/Whitehead) That staff be directed to communicate with Metrolinx to determine the possibility of adding the LRT A-Line at the same time as building the B-Line and report back to the LRT Sub-Committee. CARRIED General Issues Committee October 25, 2016 Minutes 16-026 Page 2 of 26 4. LRT Project Not to Negatively Affect Hamilton’s Allocation of Provincial Gas Tax Revenue or Future Federal Infrastructure Public Transit Funding (Item 7.3) (Collins/Merulla) That the Province of Ontario be requested to commit that the Hamilton Light Rail Transit (LRT) Project will not negatively affect Hamilton’s allocation of Provincial Gas Tax Funding or Future Federal Infrastructure Public Transit Funding. -

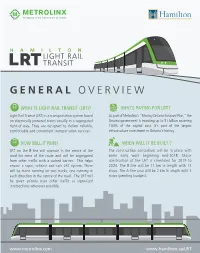

General Overview

HAMILTON LIGHT RAIL LRT TRANSIT GENERAL OVERVIEW WHAT IS LIGHT RAIL TRANSIT (LRT)? WHO’S PAYING FOR LRT? Light Rail Transit (LRT) is a transportation system based As part of Metrolinx’s “Moving Ontario Forward Plan,” the on electrically powered trains usually in a segregated Ontario government is investing up to $1 billion covering right-of-way. They are designed to deliver reliable, 100% of the capital cost. It’s part of the largest comfortable and convenient transportation services. infrastructure investment in Ontario's history. HOW WILL IT RUN? WHEN WILL IT BE BUILT ? LRT on the B-line will operate in the centre of the The construction consortium will be in place with road for most of the route and will be segregated some early work beginning mid-2018. Major from other traffic with a curbed barrier. This helps construction of the LRT is scheduled for 2019 to ensure a rapid, reliable and safe LRT system. There 2024. The B-line will be 11 km in length with 13 will be trains running on two tracks; one running in stops. The A-line spur will be 2 km in length with 5 each direction in the centre of the road. The LRT will stops (pending budget). be given priority over other traffic at signalized intersections wherever possible. www.metrolinx.com www.hamilton.ca/LRT WHERE WILL THE LRT RUN? WHAT ARE THE BENEFITS OF LRT? HOW OFTEN WILL IT RUN? LRT will provide Hamilton with fast, reliable, convenient The trains will run approximately every five minutes and integrated transit, including connections to the during peak hours. -

Please Sign in So We Can Provide Updates and Information on Future Events

HURONTARIO LIGHT RAIL TRANSIT PROJECT Welcome Please sign in so we can provide updates and information on future events. metrolinx.com/HurontarioLRT [email protected] @HurontarioLRT WHAT IS THE HURONTARIO LRT PROJECT? The Hurontario Light Rail Transit (LRT) Project will bring 20 kilometres of fast, reliable, rapid transit to the cities of Mississauga and Brampton along the Hurontario corridor. New, modern light rail vehicles will travel in a dedicated right-of-way and serve 22 stops with connections to GO Transit’s Milton and Lakeshore West rail lines, Mississauga MiWay, Brampton Züm, and the Mississauga Transitway. Metrolinx is working in coordination with the cities of Mississauga and Brampton and the Region of Peel to advance the Hurontario LRT project. Preparatory construction is underway. The project is expected to be completed at the end of 2022. The Hurontario LRT project is funded through a $1.4 billion commitment from the Province of Ontario as part of the Moving Ontario Forward plan. Allandale LAKE SIMCOE Waterfront OUR RAPID TRANSIT NETWORK Barrie South Innisfil SIMCOE Bradford East Gwillimbury Newmarket NewmarketSouthlakeHuron Heights Leslie TODAY AND TOMORROW GO Bus Terminal Hwy 404 Eagle LEGEND Mulock Main Mulock Savage Longford Aurora Lincolnville Every train, subway and bus helps to keep us moving, connecting us to the people and places Bloomington King City Stouffville GO Rail that matter most. As our region grows, our transit system is growing too. Working with 19th- Gamble Bernard Gormley municipalities across the Greater Toronto and Hamilton Area, and beyond, we’re delivering Kirby Elgin Mills Mount Joy Crosby Centennial new transit projects,making it easier, better, and faster for you to get around. -

AECOM Top Projects 2017

AECOM Top Projects 2017 #13 Turcot Interchange #6 Romaine Complex #59 Region of Waterloo ION LRT #53 Giant Mine Remediation #65 Lions Gate Secondary Wastewater Treatment Plant #82 Wilson Facility Enhancement and Yard Expansion AECOM Top Projects 2017 With $186.4 billion invested in Canada’s Top100 Projects of 2017, the country is experiencing record investment in creating AECOM Top Projects 2017 and improving public sector infrastructure from coast-to-coast. Those investments are creating tens of thousands of jobs and providing a foundation for the country’s growing economy. EDITOR In 2017, AECOM again showed why it is a leader in Canada’s Andrew Macklin infrastructure industry. In this year’s edition of the ReNew Canada Top100 projects report, AECOM was involved in PUBLISHER 29 of the 100 largest public sector infrastructure projects, Todd Latham one of just a handful of businesses to reach our Platinum Elite status. Those 29 projects represented just under $61.5 billion, close to one-third of the $186.4 billion list. ART DIRECTOR & DESIGN Donna Endacott AECOM’s involvement on the Top100 stretches across multiple sectors, working on big infrastructure projects in the transit, ASSOCIATE EDITOR energy, transportation, health care and water/wastewater Katherine Balpatasky sectors. That speaks to the strength of the team that the company has built in Canada to deliver transformational assets across a multitude of industries. Through these projects, AECOM has also shown its leadership in both putting together teams, and working as a member of a team, to help produce the best project possible for the client. As a company that prides itself on its ability “to develop and implement innovative solutions to the world’s most complex challenges,” they have shown they are willing to work with AECOM is built to deliver a better all involved stakeholders to create the greatest possible world. -

Underground Railroad in Western New York

Underground Railroad on The Niagara Frontier: Selected Sources in the Grosvenor Room Key Grosvenor Room Buffalo and Erie County Public Library 1 Lafayette Square * = Oversized book Buffalo, New York 14203-1887 Buffalo = Buffalo Collection (716) 858-8900 Stacks = Closed Stacks, ask for retrieval www.buffalolib.org GRO = Grosvenor Collection Revised June 2020 MEDIA = Media Room Non-Fiction = General Collection Ref. = Reference book, cannot be borrowed 1 Table of Contents Introduction ..................................................................................................................... 2 Books .............................................................................................................................. 2 Newspaper Articles ........................................................................................................ 4 Journal & Magazine Articles .......................................................................................... 5 Slavery Collection in the Rare Book Room ................................................................... 6 Vertical File ..................................................................................................................... 6 Videos ............................................................................................................................. 6 Websites ......................................................................................................................... 7 Further resources at BECPL ......................................................................................... -

The Student Residence of Columbia International College

The Student Residence of Columbia International College Planning Justification Report Plaza Imports Limited & Columbia International College 105 Main Street East Hamilton, ON L8N 1G6 urbansolutions.info Table of Contents 1. Introduction ......................................................................................................... 6 1.1 Location................................................................................................. 7 1.2 Site Description ..................................................................................... 9 2. Proposed Development ........................................................................................ 11 2.1 Planning Applications ........................................................................... 13 3. Supporting Studies ................................................................................................ 14 3.1 Urban Design Report ............................................................................. 14 3.2 Site Slope Reconstruction ..................................................................... 14 3.3 Hydraulic Assessment ........................................................................... 15 3.4 Natural Heritage Constraints................................................................. 16 3.5 Parking Analysis/Study .......................................................................... 16 3.6 Environmental Noise Assessment ......................................................... 16 3.7 Wind Study ........................................................................................... -

Imagine Niagara

This page has been intentionally left blank. Chapter 1 1 - 2 1. Imagine Niagara Physical and Economic Background The Regional Municipality of Niagara is located in Southern Ontario between Lake Erie and Lake Ontario. It corresponds approximately to the area commonly referred to as the "Niagara Peninsula" and will be referred to here as simply "the Region". It is bounded on the east by the Niagara River and the State of New York, and on the west by the City of Hamilton and Haldimand County. The Region is at one end of the band of urban development around the western end of Lake Ontario. Chapter 1 1 - 3 The Region was formed in 1970 and includes all of the areas within the boundaries of the former Counties of Lincoln and Welland. There are twelve local municipalities within the Region; these were formed by the rearrangement and amalgamation of the twenty-six municipalities which existed before 1970. The Queen Elizabeth Way and other provincial highways place most of the Region within ninety minutes' travel time of Toronto. Hamilton-Wentworth, with a population of over 400,000, is about thirty minutes away from the centre of the Region. Four road and two rail bridges connect the Region to the western part of New York State. About 2,500,000 people live along the United States' side of the Niagara River. The developing industrial complex at Nanticoke, on the shore of Lake Erie to the southwest, is about an hour's travel time from the centre of the Region. Physical Characteristics The "Niagara Peninsula" area is not a true peninsula but is a narrow neck of land stretching between Lakes Erie and Ontario. -

Downtown Hamilton Development Opportunity

71 REBECCA STREET APPROVED DOWNTOWN HAMILTON DEVELOPMENT OPPORTUNITY 1 CONTACT INFORMATION BRETT TAGGART* Sales Representative 416 495 6269 [email protected] BRAD WALFORD* Vice President 416 495 6241 [email protected] SEAN COMISKEY* Vice President 416 495 6215 [email protected] CASEY GALLAGHER* Executive Vice President 416 815 2398 [email protected] TRISTAN CHART* Senior Financial Analyst 416 815 2343 [email protected] 2 *Sales Representative TABLE OF CONTENTS 1. EXECUTIVE SUMMARY 2. PROPERTY PROFILE 3. DEVELOPMENT OVERVIEW 4. LOCATION OVERVIEW 5. MARKET OVERVIEW 6. OFFERING PROCESS 3 EXECUTIVE SUMMARY 4 01 5 THE OFFERING // EXECUTIVE SUMMARY CBRE Limited (“CBRE “or “Advisor”) is pleased to offer for sale 71 Rebecca Street (the “Property” or “Site”), an approved mixed-use development opportunity with a total Gross Floor Area (GFA) of 327,632 sq. ft. The development opportunity includes a maximum building height of 318 ft. (30 storeys) containing 313 dwelling units, with 13,240 sq. ft. of commercial floor area on the ground floor on 0.78 ac. of land along the north side of Rebecca Street, between John Street North to the west and Catharine Street North to the east in the heart of Downtown Hamilton. Positioned within close proximity to both the Hamilton GO Centre Transit Station and the West Harbour GO Transit Station, this offering presents a rare opportunity to acquire a major development land parcel that is ideally positioned to address the significant demand for both new housing and mixed-use space in Hamilton. 71 Rebecca Street is currently improved with a single storey building that was originally built as a bus terminal and operated by Grey Coach and Canada Coach Bus Lines until 1996. -

Proposed Rapid Transit Systems

HAMILTON THE IMPACT OF TRANSPORTATION IMPROVEMENTS ON HOUSING VALUES IN THE HAMILTON AREA Don R Campbell, Senior Analyst Melanie Reuter, Director of Research Allyssa Epp, Research Analyst WWW.REINCANADA.COM AUTHORS Don R. Campbell, President Melanie Reuter, Manager of Research Allyssa Epp, Research Analyst © 2011 Real Estate Investment Network TM Cutting Edge Research Inc. #87 - 5855 Mt. Lehman Road Abbotsford, BC V4X 2P7 2nd Edition - May 2011 BC Tel #: (604) 852-2825 AB Tel #: (403) 208-2722 Toll Free: 1-888-824-7346 Fax (403) 241-6685 E-Mail: [email protected] Web Page: www.realestateinvestingincanada.com Important Disclaimer: This report, or any seminars or updates given in relation thereto, is sold, or otherwise provided, on the understanding that the authors – Don R. Campbell, Melanie Reuter, Allyssa Epp, Cutting Edge Research Inc and Real Estate Investment Network™ and their instructors, are not responsible for any results or results of any actions taken in reliance upon any information contained in this report, or conveyed by way of the said seminars, nor for any errors contained therein or presented thereat or omissions in relation thereto. It is further understood that the said authors and instructors do not purport to render legal, accounting, tax, investment, financial planning or other professional advice. The said authors and instructors hereby disclaim all and any liability to any person, whether a purchaser of this Report, a student of the said seminars, or otherwise, arising in respect of this Report, or the said seminars, and of the consequences of anything done or purported to be done by any such person in reliance, whether in whole or part, upon the whole or any part of the contents of this report or the said seminars. -

NIAGARA ROCKS, BUILDING STONE, HISTORY and WINE

NIAGARA ROCKS, BUILDING STONE, HISTORY and WINE Gerard V. Middleton, Nick Eyles, Nina Chapple, and Robert Watson American Geophysical Union and Geological Association of Canada Field Trip A3: Guidebook May 23, 2009 Cover: The Battle of Queenston Heights, 13 October, 1812 (Library and Archives Canada, C-000276). The cover engraving made in 1836, is based on a sketch by James Dennis (1796-1855) who was the senior British officer of the small force at Queenston when the Americans first landed. The war of 1812 between Great Britain and the United States offers several examples of the effects of geology and landscape on military strategy in Southern Ontario. In short, Canada’s survival hinged on keeping high ground in the face of invading American forces. The mouth of the Niagara Gorge was of strategic value during the war to both the British and Americans as it was the start of overland portages from the Niagara River southwards around Niagara Falls to Lake Erie. Whoever controlled this part of the Niagara River could dictate events along the entire Niagara Peninsula. With Britain distracted by the war against Napoleon in Europe, the Americans thought they could take Canada by a series of cross-border strikes aimed at Montreal, Kingston and the Niagara River. At Queenston Heights, the Niagara Escarpment is about 100 m high and looks north over the flat floor of glacial Lake Iroquois. To the east it commands a fine view over the Niagara Gorge and river. Queenston is a small community perched just below the crest of the escarpment on a small bench created by the outcrop of the Whirlpool Sandstone. -

REPORT 16-026 10:30 A.M

SPECIAL GENERAL ISSUES COMMITTEE REPORT 16-026 10:30 a.m. Tuesday, October 25, 2016 Council Chambers Hamilton City Hall 71 Main Street West _________________________________________________________________________ Present: Mayor F. Eisenberger, Deputy Mayor D. Skelly (Chair) Councillors T. Whitehead, T. Jackson, C. Collins, S. Merulla, M. Green, J. Farr, A. Johnson, D. Conley, M. Pearson, B. Johnson, L. Ferguson, R. Pasuta, J. Partridge Absent with Regrets: Councillor A. VanderBeek – Personal _________________________________________________________________________ THE GENERAL ISSUES COMMITTEE PRESENTS REPORT 16-026 AND RESPECFULLY RECOMMENDS: 1. Light Rail Transit (LRT) Project Update (PED16199) (City Wide) (Item 5.1) That Report PED16199, respecting the Light Rail Transit (LRT) Project Update, be received. 2. Hamilton Street Railway (HSR) Fare Integration (PW16066) (City Wide) (Item 6.1) That Report PW16066, respecting Hamilton Street Railway (HSR) Fare Integration, be received. 3. Possibility of adding the LRT A-Line at the same time as building the B-Line (7.2) That staff be directed to communicate with Metrolinx to determine the possibility of adding the LRT A-Line at the same time as building the B-Line and report back to the LRT Sub-Committee. Council – November 9, 2016 General Issues Committee October 25, 2016 Report 16-026 Page 2 of 26 . 4. LRT Project Not to Negatively Affect Hamilton’s Allocation of Provincial Gas Tax Revenue or Future Federal Infrastructure Public Transit Funding (Item 7.3) That the Province of Ontario be requested to commit that the Hamilton Light Rail Transit (LRT) Project will not negatively affect Hamilton’s allocation of Provincial Gas Tax Funding or Future Federal Infrastructure Public Transit Funding 5.