Moxa Oncell G2100 Series Quad-Band Industrial GSM/GPRS Modem World’S GPRS APN List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Code of Ethical Business Conduct Leading with Integrity

Global Code of Ethical Business Conduct Leading with Integrity be certain. Contents A Letter from our CEO 3 Serving Our Customers 10 MTS Values 4 Antitrust Compliance 10 Using the Global Code 5 Fair Dealing and Competition 10 Introduction 5 Accurate Business Records, Financial Following the Code 5 Records and Record Management 10 Waivers 5 Product Quality and Safety 11 Ethical Decision Making 5 Protecting Our Stockholders and Our Company 12 Our Role and Responsibility 6 Conflicts of Interest 12 A Letter from our CRCO 6 Insider Trading Is Prohibited 13 Our Responsibilities 6 Appropriate Technology Use 14 Supervisor Responsibilities 6 Protection of Company Assets 14 Company Resources 6 Protecting the Company’s Reputation 14 Asking Questions and Reporting Concerns 7 Supporting Our Global Communities 15 Protection Against Retaliation 7 Anti-Corruption Measures 15 Working Together 8 Gifts, Business Courtesies and Sponsorships 15 Respectful Work Environment 8 International Trade 16 Preventing Workplace Violence and Harassment 8 Environmental Compliance 16 Employment Laws 8 Engaging in Lobbying Activities 17 We Respect Diversity and Provide Making Political Contributions 17 Equal Employment Opportunity 8 Making Charitable Contributions 17 Safe Workplace 9 Working with Third Parties 17 Data Privacy 9 Closing Note 18 Security 9 Addendum A: AlertLine Phone Numbers 19 Addendum B: AlertLine Privacy Notice 20 PAGE 2 A Letter from Our CEO At MTS, we hold ourselves to a set of MTS Values that guide our actions. These values include acting with integrity, respect, and accountability, among other things. To achieve our strategies and be the best in our industry requires not only superior performance but also a commitment from all of us to uphold the core values that have always made MTS so special. -

Vodacom Annual Results Presentation

Vodacom Group Annual Results For the year ended 31 March 2020 The future is exciting. Ready? Disclaimer The following presentation is being made only to, and is only directed at, persons to whom such presentations may lawfully be communicated (‘relevant persons’). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Information in the following presentation relating to the price at which relevant investments have been bought or sold in the past or the yield on such investments cannot be relied upon as a guide to the future performance of such investments. This presentation does not constitute an offering of securities or otherwise constitute an invitation or inducement to any person to underwrite, subscribe for or otherwise acquire securities in any company within the Group. Promotional material used in this presentation that is based on pricing or service offering may no longer be applicable. This presentation contains certain non-GAAP financial information which has not been reviewed or reported on by the Group’s auditors. The Group’s management believes these measures provide valuable additional information in understanding the performance of the Group or the Group’s businesses because they provide measures used by the Group to assess performance. However, this additional information presented is not uniformly defined by all companies, including those in the Group’s industry. Accordingly, it may not be comparable with similarly titled measures and disclosures by other companies. Additionally, although these measures are important in the management of the business, they should not be viewed in isolation or as replacements for or alternatives to, but rather as complementary to, the comparable GAAP measures. -

State of Mobile Networks: Australia (November 2018)

State of Mobile Networks: Australia (November 2018) Australia's level of 4G access and its mobile broadband speeds continue to climb steadily upwards. In our fourth examination of the country's mobile market, we found a new leader in both our 4G speed and availability metrics. Analyzing more than 425 million measurements, OpenSignal parsed the 3G and 4G metrics of Australia's three biggest operators Optus, Telstra and Vodafone. Report Facts 425,811,023 31,735 Jul 1 - Sep Australia Measurements Test Devices 28, 2018 Report Sample Period Location Highlights Telstra swings into the lead in our download Optus's 4G availability tops 90% speed metrics Optus's 4G availability score increased by 2 percentage points in the A sizable bump in Telstra's 4G download speed results propelled last six months, which allowed it to reach two milestones. It became the the operator to the top of our 4G download speed and overall first Australian operator in our measurements to pass the 90% threshold download speed rankings. Telstra also became the first in LTE availability, and it pulled ahead of Vodafone to become the sole Australian operator to cross the 40 Mbps barrier in our 4G winner of our 4G availability award. download analysis. Vodafone wins our 4G latency award, but Telstra maintains its commanding lead in 4G Optus is hot on its heels upload Vodafone maintained its impressive 4G latency score at 30 While the 4G download speed race is close among the three operators milliseconds for the second report in row, holding onto its award in Australia, there's not much of a contest in 4G upload speed. -

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

Investor Presentation – July 2017

Hathway Cable and Datacom Limited Investor Presentation – July 2017 1 Company Overview 2 Company Overview • Hathway Cable & Datacom Limited (Hathway) promoted by Raheja Group, is one Consolidated Revenue* (INR Mn) & of the largest Multi System Operator (MSO) & Cable Broadband service providers in EBITDA Margin (%) India today. 14,000 16.2% 20.0% 13,000 15.0% • The company’s vision is to be a single point access provider, bringing into the home and work place a converged world of information, entertainment and services. 12,000 12.1% 13,682 10.0% 11,000 11,550 5.0% • Hathway is listed on both the BSE and NSE exchanges and has a current market 10,000 0.0% th capitalisation of approximately INR 28 Bn as on 30 June, 2017. FY16 FY17 Broadband Cable Television FY17 Operational - Revenue Break-up • Hathway holds a PAN India ISP license • One of India’s largest Multi System Activation Other and is the first cable television services Operator (MSO), across various regions 6% 2% Cable Subscription provider to offer broadband Internet of the country and transmitting the 34% services same to LCOs or directly to subscribers. • Approximately 4.4 Mn two-way • Extensive network connecting 7.5 Mn Placement broadband homes passed CATV households and 7.2 Mn digital 21% cable subscriber • Total broadband Subscribers – 0.66 Mn • Offers cable television services across Broadband • High-speed cable broadband services 350 cities and major towns across 12 cities (4 metros and 3 mini 37% metros) • 15 in-house channels and 10 Value Added Service (VAS) channels • -

Latin America: Mobile Deals Spur M&A Activity

4 Global Media and Communications Quarterly Autumn Issue 2012 Latin America: Mobile Deals Spur M&A Activity The Latin American telecommunications market In December 2011, Sky Brasil (a Brazil-based has witnessed several substantial developments subsidiary of DirecTV), announced the purchase of in the past twelve months, particularly in the areas Acom Comunicações, a Brazilian television and of wireless and 4G. In particular, rising demand for internet company, for US$55 million. Completion of more widespread access to 4G and other wireless the acquisition is still pending, subject to antitrust and services has driven consolidation activity in the Latin communications regulatory approvals. This deal is part telecoms market. This article briefly describes some of Sky Brasil’s overall strategy to enhance its new 4G developments and representative transactions of the operations and to expand its services to other parts of past 12 months in Brazil, Columbia, Mexico, and Haiti. Brazil. By acquiring Acom Comunicações, Sky Brasil will acquire new 4G wireless spectrum in ten states As the economy of Brazil continues to expand, internet covering fifty major municipalities, to complement use and access continues to be a significant focus the airwaves it acquired in the June auction. of activity. Online commerce in Brazil has increased 21% since 2011 (to approximately US$18.7 billion), Outside of Brazil, other recent investments have and the forecast is for internet penetration to increase demonstrated a trend towards greater industry by the end of 2012 to over 86 million people, or 42% consolidation. In Mexico, Televisa recently completed of the population. As the demand for internet access a deal to acquire a 50% stake in Grupo Iusacell, a grows, the government is focusing increasing efforts Mexican mobile operator. -

LIST of ISP LICENSEES AS on 30.06.2015* Sl No Name of Company CAT Service Area

LIST OF ISP LICENSEES AS ON 30.06.2015* Sl No Name of Company CAT Service Area 1 Reliance Communications Infrastructure Ltd. A All India 2 Dishnet Wireless Ltd. A All India 3 Tata Communications Limited A All India 4 RPG Infotech Ltd. A All India 5 Value Healthcare Ltd B Mumbai 6 Hughes Communications India Limited A All India 7 Karuturi Telecom Private Limited A All India 8 Micky Online Pvt. Ltd. C Moradabad 9 Seven Star Dot Com Private Limited B Mumbai 10 Gujarat Narmada Valley Fertilizers Company Ltd. A All India 11 Kerala Communication Network Pvt. Ltd. B Kerala 12 North East Online Services Pvt. Ltd. C Guwahati 13 The Tata Power Company Ltd A All India 14 Asianet Satellite Communications Ltd. B Kerala 15 M/s Reliance Ports and Terminals Limited [Earlier M/s Reliance Engineering A All India Associates Pvt. Ltd.] 16 Hathway Bhawani Cabeltel & Datacom Ltd. B Mumbai 17 Millennium Telecom. Ltd. A All India 18 Amber Online Services Ltd. B Andhra Pradesh 19 Tata Teleservices Ltd. A All India 20 Web Cable TV Ltd C Nagercoil 21 Netkracker Ltd. A All India 22 Karuturi Global Limited B Karnataka 23 SAB Infotech Ltd. C Dharamshala 24 SAB Infotech Ltd. C Karnal 25 Sujan Engineering Pvt. Ltd. C Vadodara 26 Space Online Ltd. B Gujarat 27 World Phone Internet Services Pvt. Ltd. A All India 28 C-DAC, Noida C Ghaziabad 29 Essel Shyam Communications Ltd. A All India 30 Forum Infotech Pvt. Ltd. C Srinagar 31 Micky Online Pvt. Ltd. C Nainintal 32 Reach Network India Pvt. -

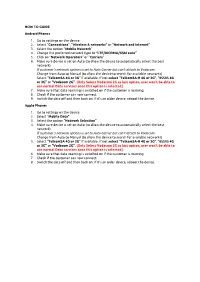

HOW to GUIDE Android Phones 1. Go to Settings on the Device. 2. Select “ Connections”, “Wireless & Networks” Or “N

HOW TO GUIDE Android Phones 1. Go to settings on the device. 2. Select “Connections”, “Wireless & networks” or “Network and Internet” 3. Select the option “Mobile Network” 4. Change the preferred network type to “LTE/WCDMA/GSM auto” 5. Click on “Network Operators” or “Carriers” 6. Make sure device is set on Auto (to allow the device to automatically select the best network) If customer’s network options is set to Auto Carrier but can’t attach to Vodacom: Change from Auto to Manual (to allow the device to search for available networks) Select “TelkomSA 4G or 3G” if available. If not select “TelkomSA-R 4G or 3G”, “65505 4G or 3G” or “Vodacom 2G”. (Only Select Vodacom 2G as last option, user won’t be able to use normal Data services once this option is selected.) 7. Make sure that data roaming is switched on if the customer is roaming. 8. Check if the customer can now connect. 9. Switch the data off and then back on. If it’s an older device, reboot the device. Apple Phones 1. Go to settings on the device. 2. Select “Mobile Data” 3. Select the option “Network Selection” 4. Make sure device is set on Auto (to allow the device to automatically select the best network) If customer’s network options is set to Auto Carrier but can’t attach to Vodacom: Change from Auto to Manual (to allow the device to search for available networks) 5. Select “TelkomSA 4G or 3G” if available. If not select “TelkomSA-R 4G or 3G”, “65505 4G or 3G” or “Vodacom 2G”. -

Download Europe Pop

EUROPE LEGEND As built: March 2021. Maps are not to scale. Learn more about our network: teliacarrier.com Point of presence (PoP) Multiple PoPs Telia Carrier fiber Leased network OUR PoPs IN EUROPE Amsterdam Copenhagen Helsinki Milan Prague Tallinn Cessnalaan 50, Interxion 3000 Industriparken 20A, Interxion Iso-Roobertinkatu 21–25, Telia Via Caldera 21, Irideos Nad Elektrarnou 411, CECOLO Söle 14, Telia Johan Huizingalaan 759, Global Switch Horskaetten 3, Global Connect Kansakoulukuja 3, Telia 25 Viale Lombardia, Supernap Kuuse 4, Telia J.W Lucasweg 35, Iron Mountain Metrovej 1, Telia Kiviadankatu 2H, Nebula Via Monzoro 101–105, Data4 Riga 12 Koolhovenlaan, EdgeConnex Sydvestvej 100, Telia Parrukatu 2, Equinix Lielvardes Str. 8a, Telia Timisoara Kuiperbergweg 13, Equinix Sahamyllyntie 4b, Equinix Moscow Zakusalas krastmala 1, Riga TV Tower Calea Torontalului 94, Orange Luttenbergweg 4, Equinix Dresden Sinimäentie 12, Equinix Altufevskaya Shosse 33G, IXcellerate Schepenbergweg 42, Equinix Overbeckstr. 41a, Telia Valimotie 3–5, Telia Butlerova Str. 7, MMTS-9 JSC Rome Udomlya Science Park 120a, Digital Realty Oktyabrskaya Str. 1, Telia Via del Tizii, NAMEX CONSYST-Communication Provider Science Park 121, Interxion Dublin Kiev Viamotornaya Str. 69, DataPro Science Park 610, Equinix Kilcarbery Park, Equinix Gaydara Str. 50, New Telco Ukraine Rotterdam Valencia Science Park 105, NIKHEF Citywest Campus, Equinix Leontovicha Str. B. 9/3, Farlep-Invest Munich Van Nelleweg Rotterdam, 1, Smart DC Calle Villa de Madrid 44, Nixval Tupolevlaan 101, Interxion -

(MTS) Converges Fixed and Mobile Telephony

Customer Case Study Mobile TeleSystems (MTS) Converges Fixed and Mobile Telephony MTS creates new revenue opportunities with new services. Business Challenge EXECUTIVE SUMMARY Wireless applications for voice and data are Mobile TeleSystems (MTS) Industry: Telecommunications becoming as essential to today’s businesses as their BUSINESS CHALLENGE fixed, or wired, counterparts. Although many Increase revenue opportunities and market enterprises have sophisticated IP data networks in share by offering fixed-mobile converged voice services. place, and many have implemented IP NETWORK SOLUTION Communications applications over those networks, A Cisco gateway and softswitch solution that they must still rely on a separate mobile voice delivers enhanced signaling and call control. network. In Europe, many operators of Global BUSINESS RESULTS Systems for Mobile Communications (GSM) Delivered new fixed-mobile converged voice solution to customers in multiple regions. networks are monitoring technology advances that Reduced capital and operating expenses in purchasing, maintaining, and supporting new will enable them to build an open, IP-based service infrastructure. infrastructure that can provide a reliable foundation Gained competitive advantage by presenting customers with a unified bill. from which to deploy rich multimedia communication services – including mixed telecom and data services and combined fixed and mobile services. The emerging IP Multimedia Subsystem (IMS) approach to deploying IP infrastructure promises to help operators achieve this goal. Mobile TeleSystems (MTS), with multiple networks and more than 50 million existing customers in Eastern Europe and Russia, saw an opportunity to increase its revenue opportunities and market share in large enterprises by offering a fixed-mobile converged voice service. If successful, the service could advance MTS well ahead of its competitors and allow it to capture a significantly large share of the enterprise telecom revenue. -

Separation of Telstra: Economic Considerations, International Experience

WIK-Consult Report Study for the Competitive Carriers‟ Coalition Separation of Telstra: Economic considerations, international experience Authors: J. Scott Marcus Dr. Christian Wernick Kenneth R. Carter WIK-Consult GmbH Rhöndorfer Str. 68 53604 Bad Honnef Germany Bad Honnef, 2 June 2009 Functional Separation of Telstra I Contents 1 Introduction 1 2 Economic and policy background on various forms of separation 4 3 Case studies on different separation regimes 8 3.1 The Establishment of Openreach in the UK 8 3.2 Functional separation in the context of the European Framework for Electronic Communication 12 3.3 Experiences in the U.S. 15 3.3.1 The Computer Inquiries 15 3.3.2 Separate affiliate requirements under Section 272 17 3.3.3 Cellular separation 18 3.3.4 Observations 20 4 Concentration and cross-ownership in the Australian marketplace 21 4.1 Characteristics of the Australian telecommunications market 22 4.2 Cross-ownership of fixed, mobile, and cable television networks 27 4.3 The dominant position of Telstra on the Australian market 28 5 An assessment of Australian market and regulatory characteristics based on Three Criteria Test 32 5.1 High barriers to entry 33 5.2 Likely persistence of those barriers 35 5.3 Inability of other procompetitive instruments to address the likely harm 38 5.4 Conclusion 38 6 The way forward 39 6.1 Regulation or separation? 40 6.2 Structural separation, or functional separation? 42 6.3 What kind of functional separation? 44 6.3.1 Overview of the functional separation 44 6.3.2 What services and assets should be assigned to the separated entity? 47 6.3.3 How should the separation be implemented? 49 Bibliography 52 II Functional Separation of Telstra Recommendations Recommendation 1. -

Termination Rates at European Level January 2021

BoR (21) 71 Termination rates at European level January 2021 10 June 2021 BoR (21) 71 Table of contents 1. Executive Summary ........................................................................................................ 2 2. Fixed networks – voice interconnection ..................................................................... 6 2.1. Assumptions made for the benchmarking ................................................................ 6 2.2. FTR benchmark .......................................................................................................... 6 2.3. Short term evolution of fixed incumbents’ FTRs (from July 2020 to January 2021) ................................................................................................................................... 9 2.4. FTR regulatory model implemented and symmetry overview ............................... 12 2.5. Number of lines and market shares ........................................................................ 13 3. Mobile networks – voice interconnection ................................................................. 14 3.1. Assumptions made for the benchmarking .............................................................. 14 3.2. Average MTR per country: rates per voice minute (as of January 2021) ............ 15 3.3. Average MTR per operator ...................................................................................... 18 3.4. Average MTR: Time series of simple average and weighted average at European level .................................................................................................................