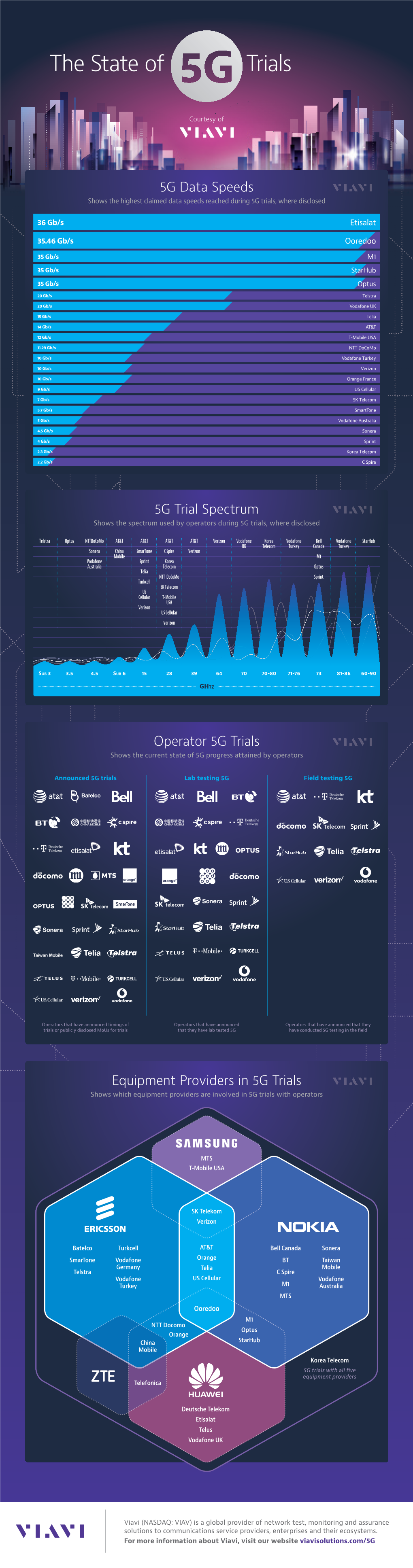

The State of 5G Trials

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Code of Ethical Business Conduct Leading with Integrity

Global Code of Ethical Business Conduct Leading with Integrity be certain. Contents A Letter from our CEO 3 Serving Our Customers 10 MTS Values 4 Antitrust Compliance 10 Using the Global Code 5 Fair Dealing and Competition 10 Introduction 5 Accurate Business Records, Financial Following the Code 5 Records and Record Management 10 Waivers 5 Product Quality and Safety 11 Ethical Decision Making 5 Protecting Our Stockholders and Our Company 12 Our Role and Responsibility 6 Conflicts of Interest 12 A Letter from our CRCO 6 Insider Trading Is Prohibited 13 Our Responsibilities 6 Appropriate Technology Use 14 Supervisor Responsibilities 6 Protection of Company Assets 14 Company Resources 6 Protecting the Company’s Reputation 14 Asking Questions and Reporting Concerns 7 Supporting Our Global Communities 15 Protection Against Retaliation 7 Anti-Corruption Measures 15 Working Together 8 Gifts, Business Courtesies and Sponsorships 15 Respectful Work Environment 8 International Trade 16 Preventing Workplace Violence and Harassment 8 Environmental Compliance 16 Employment Laws 8 Engaging in Lobbying Activities 17 We Respect Diversity and Provide Making Political Contributions 17 Equal Employment Opportunity 8 Making Charitable Contributions 17 Safe Workplace 9 Working with Third Parties 17 Data Privacy 9 Closing Note 18 Security 9 Addendum A: AlertLine Phone Numbers 19 Addendum B: AlertLine Privacy Notice 20 PAGE 2 A Letter from Our CEO At MTS, we hold ourselves to a set of MTS Values that guide our actions. These values include acting with integrity, respect, and accountability, among other things. To achieve our strategies and be the best in our industry requires not only superior performance but also a commitment from all of us to uphold the core values that have always made MTS so special. -

DOCOMO's 5G Network Deployment Strategy

DOCOMO’s 5G Network Deployment Strategy Copyright ©2020 NTT DOCOMO, INC. All Rights Reserved. Contents Chapter 1: 5G delivers high speed and large capacity using new spectrum Chapter 2: 5G deployment in 4G bands Chapter 3: To realize low latency Chapter 4: DOCOMO’s 5G network deployment strategy Copyright ©2020 NTT DOCOMO, INC. All Rights Reserved. 1 Chapter 1: 5G delivers high speed and large capacity using new spectrum Copyright ©2020 NTT DOCOMO, INC. All Rights Reserved. What is 5G? The 5th generation mobile communication system: Offers 3 key properties High speed, large capacity Max. transmission bit rate: 20Gbps 5G 1.7Gbps 4G/4GeLTE 10ms 105 Low latency Massive device connectivity Transmission latency in radio interface: No. of simultaneously connectible devices: 1ms 106 devices/km2 * The numbers above are the target performance defined in technical standard Copyright ©2020 NTT DOCOMO, INC. All Rights Reserved. and do not represent the performance delivered at the time of 5G launch. 3 New Spectrum Allocation New 5G spectrum allocated to Japanese carriers <3.7GHz band> <4.5GHz band> Bandwidth: 100MHz /slot Bandwidth: 100MHz /slot Rakuten KDDI SoftBank KDDI DOCOMO Mobile DOCOMO 3600 3700 4100 4500 4600[MHz] <28GHz band> Bandwidth: 400MHz/slot Rakuten Mobile DOCOMO KDDI Local 5G SoftBank 27.0 27.4 27.8 28.2 29.1 29.5 [GHz] Copyright ©2020 NTT DOCOMO, INC. All Rights Reserved. 4 Why 5G Can Deliver High Speed & Large Capacity? 5G can deliver high speed and large capacity because a wider channel bandwidth is allocated in the new frequency bands. Channel bandwidth 28G 400MHz bandwidth 4.5G 100MHz bandwidth 3.7G 100MHz bandwidth 3.5GHz 5G uses frequency bands that can secure 3.4GHz a wider channel bandwidth compared to the 2GHz frequency bands assigned for 4G, which enables 1.7GHz faster speeds and larger capacity! 1.5GHz 800MHz New frequency bands 700MHz 4G bands Copyright ©2020 NTT DOCOMO, INC. -

Vodacom Annual Results Presentation

Vodacom Group Annual Results For the year ended 31 March 2020 The future is exciting. Ready? Disclaimer The following presentation is being made only to, and is only directed at, persons to whom such presentations may lawfully be communicated (‘relevant persons’). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Information in the following presentation relating to the price at which relevant investments have been bought or sold in the past or the yield on such investments cannot be relied upon as a guide to the future performance of such investments. This presentation does not constitute an offering of securities or otherwise constitute an invitation or inducement to any person to underwrite, subscribe for or otherwise acquire securities in any company within the Group. Promotional material used in this presentation that is based on pricing or service offering may no longer be applicable. This presentation contains certain non-GAAP financial information which has not been reviewed or reported on by the Group’s auditors. The Group’s management believes these measures provide valuable additional information in understanding the performance of the Group or the Group’s businesses because they provide measures used by the Group to assess performance. However, this additional information presented is not uniformly defined by all companies, including those in the Group’s industry. Accordingly, it may not be comparable with similarly titled measures and disclosures by other companies. Additionally, although these measures are important in the management of the business, they should not be viewed in isolation or as replacements for or alternatives to, but rather as complementary to, the comparable GAAP measures. -

State of Mobile Networks: Australia (November 2018)

State of Mobile Networks: Australia (November 2018) Australia's level of 4G access and its mobile broadband speeds continue to climb steadily upwards. In our fourth examination of the country's mobile market, we found a new leader in both our 4G speed and availability metrics. Analyzing more than 425 million measurements, OpenSignal parsed the 3G and 4G metrics of Australia's three biggest operators Optus, Telstra and Vodafone. Report Facts 425,811,023 31,735 Jul 1 - Sep Australia Measurements Test Devices 28, 2018 Report Sample Period Location Highlights Telstra swings into the lead in our download Optus's 4G availability tops 90% speed metrics Optus's 4G availability score increased by 2 percentage points in the A sizable bump in Telstra's 4G download speed results propelled last six months, which allowed it to reach two milestones. It became the the operator to the top of our 4G download speed and overall first Australian operator in our measurements to pass the 90% threshold download speed rankings. Telstra also became the first in LTE availability, and it pulled ahead of Vodafone to become the sole Australian operator to cross the 40 Mbps barrier in our 4G winner of our 4G availability award. download analysis. Vodafone wins our 4G latency award, but Telstra maintains its commanding lead in 4G Optus is hot on its heels upload Vodafone maintained its impressive 4G latency score at 30 While the 4G download speed race is close among the three operators milliseconds for the second report in row, holding onto its award in Australia, there's not much of a contest in 4G upload speed. -

Skyus™ DS2 LTE Modem for High-Speed Primary and Failover

TECHNOLOGY: Global Cat-6 LTE Skyus™ DS2 LTE modem for high-speed primary and failover connectivity Why Inseego? As a U.S.-based company, we design and develop all of our products in the USA and hold them to the highest security standards. Our products and solutions are trusted by top tier carriers, government entities, and fortune 500 enterprise customers. Purpose built design With the Skyus’ DS2 compact and versatile design, you can use it for a wide array of connectivity applications. 4G LTE speeds Thanks to the 4G LTE CAT-6 capability, The Skyus DS2 supports an incredible network speed of up to 300/50Mbps. Industrial rated Rated for extreme thermal environments -40⁰F to 185⁰F (-40⁰C to 85⁰C) and continuous 24/7 use. Secure and encrypted Skyus DS2 safeguards your data with enterprise-grade security and 3rd party penetration testing. Skyus DS2 LTE gateway product specifications Network connectivity1 Mounting North America, EMEA • Mounting bracket accessory is available, contact • LTE: B1-B5, B7, B12, B13, B20, B25, B26, B29, B30, sales for more information B41 • 3G (HSPA+, UMTS): B1, B2, B3, B4, B5, B8 Dimensions & weight APAC • 82mm x 60mm x 11mm (3.22” x 2.375” x 0.42”) • LTE: B1, B3, B5, B7, B8, B18, B19, B21, B28, B38-B41 • 50 g (1.7 oz) • 3G (HSPA+, UMTS): B1, B5, B6, B8, B9, B19, B39 Operating temperature Carrier approval • Normal operation: -40°C to 80°C (-40 to 176°F) • Verizon, AT&T, Sprint, Telus, USCC, Telstra, Optus, Generic EU & APAC SD-WAN partners • Riverbed Chipset • VMmare • Qualcomm® MDM9230 • Dell Data rates Systems -

An Introduction to Network Slicing

AN INTRODUCTION TO NETWORK SLICING An Introduction to Network Slicing Copyright © 2017 GSM Association AN INTRODUCTION TO NETWORK SLICING About the GSMA Future Networks Programme The GSMA represents the interests of mobile operators The GSMA’s Future Networks is designed to help operators worldwide, uniting nearly 800 operators with almost 300 and the wider mobile industry to deliver All-IP networks so companies in the broader mobile ecosystem, including handset that everyone benefits regardless of where their starting point and device makers, software companies, equipment providers might be on the journey. and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces industry-leading The programme has three key work-streams focused on: events such as Mobile World Congress, Mobile World Congress The development and deployment of IP services, The Shanghai, Mobile World Congress Americas and the Mobile 360 evolution of the 4G networks in widespread use today, Series of conferences. The 5G Journey developing the next generation of mobile technologies and service. For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA. For more information, please visit the Future Networks website at: www.gsma.com/futurenetworks With thanks to contributors: AT&T Mobility BlackBerry Limited British Telecommunications PLC China Mobile Limited China Telecommunications Corporation China Unicom Cisco Systems, Inc Deutsche Telekom AG Emirates Telecommunications Corporation (ETISALAT) Ericsson Gemalto NV Hong Kong Telecommunications (HKT) Limited Huawei Technologies Co Ltd Hutchison 3G UK Limited Intel Corporation Jibe Mobile, Inc KDDI Corporation KT Corporation Kuwait Telecom Company (K.S.C.) Nokia NTT DOCOMO, Inc. -

Cradlepoint IBR900 Series Router

PRODUCT BRIEF IBR900 SERIES ROUTER Cradlepoint IBR900 Series Router Compact, ruggedized Gigabit-Class LTE router for advanced Mobile and IoT connectivity Firewall Throughput: WAN Connectivity: LAN Connectivity: NetCloud Solution: 940 Mbps 4G Cat 11 or Cat 18, Wi-Fi 5, GbE Mobile or IoT GbE The Cradlepoint IBR900 Series router is a ruggedized Gigabit-Class LTE Key Benefits: networking platform that was designed for persistent connectivity across a wide range of in-vehicle and mobile applications as well as portable or — Deploy a robust, dependable Gigabit- fixed IoT installations. The IBR900 Series accommodates environmentally Class LTE network platform for first harsh environments while delivering enterprise-class standards of reliability, responders and commercial fleets scalability, comprehensive management, and security. — Add a second cellular modem, with For organizations that depend on field forces and mobile networks, the an Extensibility Dock, for multi-link Cradlepoint IBR900 Series mobile router with the NetCloud Mobile solution dependability package provides ruggedized and GPS-enabled in-vehicle network solutions — View cellular health with an LTE signal that are SD-WAN and SD-Perimeter-capable. With an available Gigabit-Class strength map displaying all areas a fleet LTE modem, Gigabit Wi-Fi, and advanced security features, the IBR900 delivers has driven enterprise networking capabilities for mobile applications that require secure, always-on connectivity. — Implement WiFi-as-WAN for data- intensive tasks such as video offloading The IBR900 Series with NetCloud IoT Solutions Package provides a compact ruggedized 4G LTE router solution for connecting and protecting IoT devices — Install in harsh environments where at scale. With an extensive list of safety and hardening certifications, it can connectivity must be reliable be confidently deployed in the field, in buildings, or in embedded systems to deliver complete visibility, security, and control of connected devices anywhere. -

TELUS WISE Smartphone Contract for Parents/Guardians and Children

TELUS Wise® smartphone contract for parents/guardians and children Empowering Canadians to stay safe safe in a digital world. At TELUS, we believe smartphone ownership is a privilege and there are rules and responsibilities that everyone should follow to help have a positive experience with technology. This contract outlines some basic rules and responsibilities of smartphone ownership. It’s designed to keep the lines of communication open between parents/guardians and children, and establish safe and healthy smartphone usage and boundaries. Child Parent • I will always ask for permission first before giving out any personal • I will ensure my child activates the smartphone’s lock function information online. This includes my name, phone number, home • I will ensure my child sets a strong password (for the smartphone or email address, school name, parent/guardian’s names, work and any apps or social networking sites) address, photos of myself and my family, etc. • I will ensure my child installs and/or activates the remote locate/lock/ • I will not share my passwords with anyone, except for my parents/ wipe software (for example, Find My iPhone), and keeps all software guardians up to date • I will not participate in cyberbullying, and I will always report • I will ensure my child has geo-tagging turned off to avoid revealing cyberbullying to a trusted adult if I experience it or see it happening their exact location in photos • I will not share photos of others or tag them in photos without their • I will keep an eye on privacy and permission settings and know what permission. -

Comment Operators at Crossroads: Market Protection Or Innovation?

Comment Operators at crossroads: Market protection or innovation? Arnd Webera*, Daniel Scukab Published in: Telecommunications Policy, Volume 40, Issue 4, April 2016, Pages 368–377, doi:10.1016/j.telpol.2015.11.009. Permission to publish an authors’ version has kindly been granted by Elsevier B.V. a KIT (ITAS), Kaiserstraße 12, 76131 Karlsruhe, Germany b Mobikyo K.K., Level 32, Shinjuku Nomura Building, 1‐26‐2 Nishi‐Shinjuku, Shinjuku‐ku, Tokyo 163‐0532, Japan Abstract Many today believe that the mobile Internet was invented by Apple in the USA with their iPhone, enabling a data‐driven Internet ecosystem to disrupt the staid voice and SMS busi‐ ness models of the telecom carriers. History, however, shows that the mobile Internet was first successfully commercialised in Japan, in 1999. Some authors such as Richard Feasey in Telecommunications Policy (Issue 6, 2015) argue that operators had been confused and un‐ prepared when the Internet emerged and introduced “walled gardens”, without Internet access. This comment article reviews in detail how the operators reacted when the fixed, and later the mobile Internet spread; some introduced walled gardens, some opened it for the “unofficial” content on the Internet. The article concludes that most large European tel‐ ecom and information technology companies and their investors have a tradition of risk avoidance and pursued high‐price strategies that led them to regularly fail against better and cheaper foreign products and services, not only when the wireless Internet was introduced, but also when PCs and the fixed Internet were introduced. Consequences, such as the need to enable future disruptions and boost the skills needed to master them, are presented. -

Competitiveness of the Internet Industry in Korea and Japan: Case Studies of Korea Telecom Freetel and NTT Docomo*

JOURNAL OF INTERNATIONAL AND AREA STUDIES 37 Volume 7, Number 2, 2000, pp. 37-52 Competitiveness of the Internet Industry in Korea and Japan: Case Studies of Korea Telecom Freetel and NTT DoCoMo* Hwy-Chang Moon Korea’ s well-developed mobile telephony network infrastructure makes it a globally competitive country in the field of wireless Internet. Korea Telecom Freetel has enjoyed the ‘ early-mover’ advantage in the wireless Internet industry in Korea, although it was a ‘ late-comer’ in the mobile telephony industry. The competition, however, is becoming harsher than ever, and the company is now seeking a breakthrough. For benchmarking, Japan’ s NTT DoCoMo was chosen for its tremendous success in the world’ s first commercialization of the wireless Internet. Using the diamond model (Porter 1990; Moon, Rugman and Verbeke 1998), the variables are analyzed and strategic recommendations are provided. One important conclusion is that Korea Telecom Freetel is taking advantage of its E-business implementation, but can be more competitive if its business environment is less restrictive. The results of this research will help policymakers as well as business people in making decisions to enhance the competitiveness of the Internet industry. 1. INTRODUCTION Recently, the Internet has been expanding its territory from wired network into wireless network. Some analysts firmly believe that the use of the wireless Internet will surpass that of the wired Internet by the year 2003. Although both Korea and Japan are the early movers in the wireless Internet industry in the global market, Korea is not yet as competitive as Japan. The main purpose of this research is to compare and contrast the Internet industries of Korea and Japan, and to suggest some strategic guidelines for Korea to enhance its international competitiveness in the Internet industry. -

(MTS) Converges Fixed and Mobile Telephony

Customer Case Study Mobile TeleSystems (MTS) Converges Fixed and Mobile Telephony MTS creates new revenue opportunities with new services. Business Challenge EXECUTIVE SUMMARY Wireless applications for voice and data are Mobile TeleSystems (MTS) Industry: Telecommunications becoming as essential to today’s businesses as their BUSINESS CHALLENGE fixed, or wired, counterparts. Although many Increase revenue opportunities and market enterprises have sophisticated IP data networks in share by offering fixed-mobile converged voice services. place, and many have implemented IP NETWORK SOLUTION Communications applications over those networks, A Cisco gateway and softswitch solution that they must still rely on a separate mobile voice delivers enhanced signaling and call control. network. In Europe, many operators of Global BUSINESS RESULTS Systems for Mobile Communications (GSM) Delivered new fixed-mobile converged voice solution to customers in multiple regions. networks are monitoring technology advances that Reduced capital and operating expenses in purchasing, maintaining, and supporting new will enable them to build an open, IP-based service infrastructure. infrastructure that can provide a reliable foundation Gained competitive advantage by presenting customers with a unified bill. from which to deploy rich multimedia communication services – including mixed telecom and data services and combined fixed and mobile services. The emerging IP Multimedia Subsystem (IMS) approach to deploying IP infrastructure promises to help operators achieve this goal. Mobile TeleSystems (MTS), with multiple networks and more than 50 million existing customers in Eastern Europe and Russia, saw an opportunity to increase its revenue opportunities and market share in large enterprises by offering a fixed-mobile converged voice service. If successful, the service could advance MTS well ahead of its competitors and allow it to capture a significantly large share of the enterprise telecom revenue. -

Separation of Telstra: Economic Considerations, International Experience

WIK-Consult Report Study for the Competitive Carriers‟ Coalition Separation of Telstra: Economic considerations, international experience Authors: J. Scott Marcus Dr. Christian Wernick Kenneth R. Carter WIK-Consult GmbH Rhöndorfer Str. 68 53604 Bad Honnef Germany Bad Honnef, 2 June 2009 Functional Separation of Telstra I Contents 1 Introduction 1 2 Economic and policy background on various forms of separation 4 3 Case studies on different separation regimes 8 3.1 The Establishment of Openreach in the UK 8 3.2 Functional separation in the context of the European Framework for Electronic Communication 12 3.3 Experiences in the U.S. 15 3.3.1 The Computer Inquiries 15 3.3.2 Separate affiliate requirements under Section 272 17 3.3.3 Cellular separation 18 3.3.4 Observations 20 4 Concentration and cross-ownership in the Australian marketplace 21 4.1 Characteristics of the Australian telecommunications market 22 4.2 Cross-ownership of fixed, mobile, and cable television networks 27 4.3 The dominant position of Telstra on the Australian market 28 5 An assessment of Australian market and regulatory characteristics based on Three Criteria Test 32 5.1 High barriers to entry 33 5.2 Likely persistence of those barriers 35 5.3 Inability of other procompetitive instruments to address the likely harm 38 5.4 Conclusion 38 6 The way forward 39 6.1 Regulation or separation? 40 6.2 Structural separation, or functional separation? 42 6.3 What kind of functional separation? 44 6.3.1 Overview of the functional separation 44 6.3.2 What services and assets should be assigned to the separated entity? 47 6.3.3 How should the separation be implemented? 49 Bibliography 52 II Functional Separation of Telstra Recommendations Recommendation 1.