Integrated Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Günlük Bülten 12 Ağustos 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,6314 10,1510 1,1744 1.411 485,9 18,27

Günlük Bülten 12 Ağustos 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,6314 10,1510 1,1744 1.411 485,9 18,27 Yurt içinde bugün TCMB faiz kararı takip edilecek Haftalık Getiriler (%) 1,5 1,2 ● TCMB’nin politika faizini sabit tutması bekleniyor 1,0 0,7 0,4 ● ABD’de yıllık enflasyon, %5,4 düzeyinde yatay seyretti 0,5 ● ABD Senatosu, 3,5 trilyon $’lık harcama paketini onayladı 0,0 -0,5 Küresel çapta, ABD'de tüketici fiyatları temmuz ayında aylık bazda -1,0 %0,5 artış gösterdi. Haziran ayında aylık enflasyon %0,9 -1,5 -1,5 düzeyinde gerçekleşmiş idi. Bu temmuz ayı gerçekleşmesi ile, yıllık -2,0 -1,7 enflasyon da %5,4 düzeyinde yatay seyretti. Yıllık çekirdek enflasyon Dolar/TL Euro/TL Gram Altın BIST-100 Gösterge Tahvil ise, %4,5'ten %4,3'e geriledi. ABD‘de özellikle enflasyon ve işgücü piyasasına yönelik veriler, Fed'in varlık alımlarında azaltıma Veriler (Bugün) Önceki Beklenti başlayabileceği tarih açısından kritik öneme sahip. TCMB Faiz Kararı (%) 19,0 19,0 Euro Bölgesi Sanayi Bölgesi ABD Senatosu, Başkan Biden'ın ekonomik reform takviminde -1,0 0,2 (Haziran, aylık % değişim, m.a.) bulunan 3,5 trilyon $ tutarındaki bütçe taslağına 50'ye karşı 49 oy ile onay verdi. Tasarının, ABD hükümetinin sosyal ve çevresel konulara yönelik daha fazla harcama yapmasına imkan tanıyacağı Yatırımcı Takvimi için tıklayınız belirtiliyor. Küresel çapta günlük vaka sayıları 7 günlük ortalamalar Devlet Tahvili Getirileri bazında artış eğilimini sürdürürken, ABD'de ve Avrupa'da, aşı (%) 11/08 10/08 2020 olmayanlara yönelik kısmi zorlayıcı tedbirler yürürlüğe giriyor. -

En-Isbank2009.Pdf

Contents Presentation 1 İşbank at the onset of 2010 2 Turkey’s Bank 4 İşbank since 1924 5 İşbank’s Vision, Objectives, and Strategy 6 Pioneering Activities 7 İşbank’s Financial Indicators and Shareholder Structure 8 Chairman’s Message 12 CEO’s Message 18 İşbank’s transformation journey: Customer Centric Transformation (MOD) 20 The Economic Outlook in 2009 26 İşbank in 2009 49 Subsidiaries 54 Corporate Social Responsibility at İşbank 60 Annual Report Compliance Opinion Management and Corporate Governance at İşbank 62 Board of Directors & Auditors 64 Executive Committee 66 Organization Chart 68 Managers of Internal Systems 68 Information About the Meetings of the Board of Directors 69 İşbank Committees 71 Human Resources Functions at İşbank 72 Information on the Transactions Carried out with İşbank’s Risk Group 72 Activities for which Support Services are Received in Accordance with the Regulation on Procurement of Support Services for Banks and Authorization of Organizations Providing this Service 73 İşbank’s Dividend Distribution Policy 74 Agenda of the Annual General Meeting 75 Report of the Board of Directors 76 Auditors’ Report 77 Dividend Distribution Proposal 78 Corporate Governance Principles Compliance Report Financial Information and Assessment on Risk Management 89 Audit Committee’s Assessments on the Operation of Internal Control, Internal Audit and Risk Management Systems, and Their Activities in the Reported Period 91 Independent Auditors’ Report 92 Unconsolidated Financial Statements 102 Financial Highlights and Key Ratios -

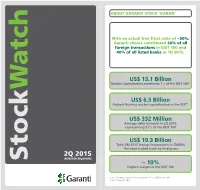

2Q 2015, Representing 21% of the BIST 100

ABOUT GARANTI STOCK ‘GARAN’ With an actual free float ratio of ~50%, Garanti shares constituted 20% of all foreign transactions in BIST 100 and 40% of all listed banks in 1H 2015. US$ 13.1 Billion Market Capitalization constitutes 7% of the BIST 100* Watch US$ 6.5 Billion Highest floating market capitalization in the BIST* US$ 332 Million Average daily turnover in 2Q 2015, representing 21% of the BIST 100 US$ 19.3 Billion Total 6M 2015 foreign transactions in GARAN The most traded stock by foreigners 2Q 2015 INVESTOR RELATIONS Stock ~ 10% Highest weight in the BIST 100 Note: Currency conversion is based on US$/TL CBRT ask rate. * As of June 30, 2015 GARANTI FINANCIAL HIGHLIGHTS Garanti Market Shares* Jun-15 QoQ ∆ In the first half of 2015, Garanti Total Performing Loans 11.8% reached consolidated total TL Loans 10.8% asset of US$ 99.9 billion and FC Loans 14.1% Credit Cards - Issuing (Cumulative) 19.1% consolidated net profit of Credit Cards - Acquiring (Cumulative) 20.4% US$ 777.7 million. Consumer Loans** 14.0% Total Customer Deposits 11.4% TL Customer Deposits 9.3% FC Customer Deposits 14.1% SELECTED FINANCIALS* Customer Demand Deposits 13.5% Mutual Funds 11.0% Total Assets Total Performing Loans * Figures are based on bank-only financials for fair comparison with sector. Sector US$ 99.9 Billion US$ 60.0 Billion figures are based on BRSA weekly data for commercial banks only. ** Including consumer credit cards and other Total Deposits Shareholders’ Equity Garanti with Numbers* US$ 54.7 Billion US$ 10.5 Billion Dec-14 Mar-15 Jun-15 -

Istanbul Jewelry School Spreads to the World Behold the Jewels, from the Ancient Lands, Where Civilisations Flourished, Gifts Crafted by the Artisanship of Ages

YOUR COMPLIMENTARY COPY BRIEFING Turkey aims to export $190B in 2020 INDEPT Turkish Jewelry all over the Word INTERVIEW Deva CEO TheTurkish Philipp Haas PerspectiveFEBRUARY 2020 ISSUE 79 ECONOMY I BUSINESS I FOREIGN TRADE I ANALYSIS Istanbul Jewelry School Spreads to the World Behold the jewels, from the ancient lands, where civilisations flourished, gifts crafted by the artisanship of ages. It is the historical and cultural heritage that these rare accesories bear, that makes you feel special when you touch, put them on or wear them, rather than their monetary value. The Turkish Perspective TheTurkish Perspective Contents FEBRUARY 2020 ISSUE 79 Snow Globe of the World: 42Turkey Mckinsey: Artificial Intelligence The Power Symbol Turkey’s innovation ecosystem 14 to create 3.1 million jobs in 28 of Turkey: Jewelry 46 grows above the EU average Turkey 2019 exports reach to record Kamar: Our exports totaled 7.2 16 level of 180.5 billion dollars 30 billion dollars in 2019 THY awarded as Turkey’s A Master of Murassa: 20 top service exporter 35 Hrac Aslanyan Franchise sector to create an FDI Spotlight in Turkey Turkey’s Car Introduced 48 ecosystem of 50 billion dollars 22 38 in 2020 Foreign investors generated 64 Turkey eyes 120 billion USD Gastronomical reflection of 26 percent of Turkish M&A market 40 from tourism 54 Turkish Culture deal volume Mediterranean Cuisine FEBRUARY 2020 ISSUE 79 3 TheTurkish Perspective FEBRUARY 2020 ISSUE 79 THE TURKISH PERSPECTIVE RENEWED Management Publisher On Behalf Of Turkish Exporters Assembly Chairman Of The Turkish Exporters Assembly The Turkish Perspective continues publishing İsmail GÜLLE Strategic Partner with its renewed content in 2020. -

Turkish Outbound M&A Review 2014-2015

Turkish Outbound M&A Review 2014-2015 May 2016 2 Foreword Despite volatile financial markets and local political tension in the last two years, Turkish companies were keen on expanding their global footprint via acquisitions in new geographies. Although the number of deals was lower as compared to the previous periods, the deal volume was remarkable. Turkish corporates’ appetite to expand in global markets translated into a record-breaking level in 2014 in terms of deal value, especially through a couple of mega deals; and last year Turkish investors remained eager but cautious in investing abroad, due to the ascending political uncertainty and weakened financial performance of the companies. Looking ahead, cross border acquisitions of Turkish companies will increase at a strong pace as part of their operational strategies towards becoming regional players and benefiting from the growth potential in the new markets. On behalf of our corporate finance team in Deloitte Turkey, we are delighted to share our Turkish Outbound M&A Review, featuring our analyses regarding the cross-border investments of Turkish corporates over the past two years. Başak Vardar Financial Advisory Leader Partner Turkish Outbound M&A Review 2014-2015 1 Basis of Presentation Transaction data presented in this report are based on information that is readily available in the public domain and include transactions with closing procedures still ongoing at the year end. This study does not include capital market transactions or intra-group share transfers but covers real estate acquisitions, infrastructure projects and concessions. We do not accept any responsibility as to the accuracy or completeness of the data or as to whether all transactions listed herein will necessarily close. -

The Mineral Industry of Turkey in 2016

2016 Minerals Yearbook TURKEY [ADVANCE RELEASE] U.S. Department of the Interior January 2020 U.S. Geological Survey The Mineral Industry of Turkey By Sinan Hastorun Turkey’s mineral industry produced primarily metals and decreases for illite, 72%; refined copper (secondary) and nickel industrial minerals; mineral fuel production consisted mainly (mine production, Ni content), 50% each; bentonite, 44%; of coal and refined petroleum products. In 2016, Turkey was refined copper (primary), 36%; manganese (mine production, the world’s leading producer of boron, accounting for 74% Mn content), 35%; kaolin and nitrogen, 32% each; diatomite, of world production (excluding that of the United States), 29%; bituminous coal and crushed stone, 28% each; chromite pumice and pumicite (39%), and feldspar (23%). It was also the (mine production), 27%; dolomite, 18%; leonardite, 16%; salt, 2d-ranked producer of magnesium compounds (10% excluding 15%; gold (mine production, Au content), 14%; silica, 13%; and U.S. production), 3d-ranked producer of perlite (19%) and lead (mine production, Pb content) and talc, 12% each (table 1; bentonite (17%), 4th-ranked producer of chromite ore (9%), Maden İşleri Genel Müdürlüğü, 2018b). 5th-ranked producer of antimony (3%) and cement (2%), 7th-ranked producer of kaolin (5%), 8th-ranked producer of raw Structure of the Mineral Industry steel (2%), and 10th-ranked producer of barite (2%) (table 1; Turkey’s industrial minerals and metals production was World Steel Association, 2017, p. 9; Bennett, 2018; Bray, 2018; undertaken mainly by privately owned companies. The Crangle, 2018a, b; Fenton, 2018; Klochko, 2018; McRae, 2018; Government’s involvement in the mineral industry was Singerling, 2018; Tanner, 2018; van Oss, 2018; West, 2018). -

Political Economy of Conflict: Evidence from Turkey

Markets, Conflict, and Incumbent Tenure: Evidence From Turkey's Kurdish Insurgency Emine Deniz ∗ February 3, 2020 ∗Harris School of Publicy Policy, The University of Chicago ([email protected]). I am grateful to Shanker Satyanath for his unwavering support throughout this project. I would like to thank Micha¨elAklin, Eric Arias, Antonella Bandiera, Kara Ross Camarena, Maria Carreri, Oeindrila Dube, Anna Getmansky, Michael Gilligan, Luis Martinez, Erzen Oncel,¨ Pablo Querebin, Cyrus Sami, Edoardo Teso, and Austin Wright for helpful discussions and insightful comments. The author thanks the discussants and seminar participants at the Workshop on the Political Economy of Turkey at LSE, Ozye˘ginUniversity,¨ Sabancı University and Bo˘gazi¸ciUniversity. Finally, Deniz Akku¸sand the analysts at the Kare Investment and Securities, Inc., were very generous with their time and resources providing the financial markets data. Alyssa Eldridge provided incredible editorial assistance.All errors belong to the author. Abstract Unexpected outbreaks of civil conflict may either strengthen or weaken the like- lihood of an incumbent remaining in office. In the absence of an actual turnover in office, or immediate public opinion surveys, scholars of conflict are at a loss to tell whether such episodes of conflict strengthen or weaken an incumbent's hold on power. In this paper, I address this question with a novel approach: studying the stock market performances of the firms inside and outside of the incumbent's network to infer the effect of an exogenous conflict episode on the incumbent's survival probability. I hypothesize that the abnormal returns of firms connected with the incumbent provide valuable information about the incumbent's hold on power: positive abnormal returns indicate stronger incumbent power, while neg- ative abnormal returns indicate weaker incumbent power. -

Turkish OFDI Continues to Grow Report Dated March 24, 2014

Turkish OFDI Continues to Grow Report dated March 24, 2014 Istanbul and New York, March 24, 2014 Kadir Has University (KHU) and the Foreign Economic Relations Board (DEİK), both based in Istanbul, Turkey, and the Vale Columbia Center on Sustainable International Investment (VCC), a joint initiative of the Columbia Law School and The Earth Institute at Columbia University in New York, are releasing today the results of their third annual survey of Turkish multinational enterprises (MNEs).1 Conducted in 2013, the survey is part of a long-term study of the rapid global expansion of MNEs from emerging markets and covers the period from 2010 to 2012. Highlights In 2012, the 29 largest Turkish MNEs had foreign assets totaling US$ 36.7 billion (Table 1), foreign sales of US$ 23.4 billion, and 115,539 foreign employees (Annex I, Table 1). The top five companies together controlled 58% or a total of US$ 21.4 billion. The top ten companies controlled slightly more than 70% of total foreign assets, amounting to US$ 26.4 billion. Five out of these ten are conglomerates2; the remaining five are active in the infrastructure, glass, oil and gas, food and beverage, and energy sectors. Nineteen of the 29 MNEs are listed on the Istanbul Stock Exchange, with two of those companies also being listed on a foreign stock exchange. These 29 MNEs have 426 subsidiaries overseas, 326 of which are located primarily in Europe and Central Asia, followed by Middle East and Africa (53), East Asia, South Asia and the developed Asia-Pacific3 (31), and the Americas (16). -

Günlük Bülten 27 Temmuz 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,5599 10,1079 1,1803 1.349 494,0 18,41

Günlük Bülten 27 Temmuz 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,5599 10,1079 1,1803 1.349 494,0 18,41 Asya hisse senedi piyasalarında toparlanma çabaları gözleniyor Haftalık Getiriler (%) 0,1 0,0 0,0 ● Ancak Çinli teknoloji şirket hisselerinde satış baskısı sürüyor 0,0 -0,1 ● Yurt içinde Hazine borçlanma ihaleleri takip ediliyor -0,2 ● Yurt içinde ayrıca vaka sayılarında artış eğilimi devam ediyor -0,3 -0,2 -0,2 -0,4 -0,5 Reuters’in ekonomistler arasında küresel çapta gerçekleştirdiği bir -0,6 -0,7 ankete göre; küresel ekonomide, bu yıl büyümenin göreli güçlü -0,8 seyredeceği ancak salgına bağlı risklerin de takip edilmeye devam -0,9 -0,8 edeceği değerlendiriliyor. Dolar/TL Euro/TL Gram Altın BIST-100 Gösterge Tahvil ABD’de yeni konut satışları Haziran ayında aylık bazda %6,6 düşüş Veriler (Bugün) Önceki Beklenti gösterdi. Sektörde yüksek konut fiyatlarının ve arz kısıtlarının ABD Dayanıklı Mal Siparişleri 2,3 2,0 satışlarda ivme kaybına neden olduğu belirtiliyor. (Haziran, aylık % değişim, öncü) ABD Conference Board Tüketici 127,3 124,0 Küresel piyasalarda dün ABD’de S&P500 hisse senedi endeksinin Güven Endeksi (Temmuz) %0,24 yükselmesinin ardından Asya hisse senedi piyasaların çoğunda sınırlı toparlanma eğilimi gözleniyor. Ancak Çin teknoloji Yatırımcı Takvimi için tıklayınız şirketlerinde satış baskısı devam ediyor. Çin’de, teknoloji Devlet Tahvili Getirileri şirketlerine yönelik ek regülasyon adımlarının gelip gelmeyeceğine (%) 26/07 23/07 2020 yönelik belirsizliklerin satışlarda etkili olduğu belirtiliyor. Yarın TLREF 19,13 18,95 17,97 açıklanacak Fed para politikası kararı öncesinde ABD 10 yıl vadeli TR 10 yıllık 17,66 17,49 12,90 devlet tahvili getirileri %1,28 ile düşük seyrini sürdürürken, dolar ABD 10 yıllık 1,29 1,28 0,91 endeksi 92,6’ya geriledi. -

Sustainability Report 2015 Sustainability Report 2015

SUSTAINABILITY REPORT 2015 SUSTAINABILITY REPORT 2015 Garanti Sustainability 2015 Report 3 CONTENTS 7 8-9 10-11 12-15 16-19 20-31 32-35 38-45 About this Vision, Mission Key Sustainability Sustainability Message from Garanti in Brief Milestones Focusing on Report and Values Highlights Strategy and the CEO Stakeholders -Key Facts -Garanti’s Sustainability- Policy - Key Stakeholder -Our Vision -Garanti Bank in Numbers Related Indicators -Sustainability Strategy Groups and Engagement -Our Mission -Group Structure -Sustainability Policy Platforms -Our Strategy -Corporate Profile -Sustainability Principles -National and International -Our Core Values -Garanti’s Products and Memberships Services -Approach to Materiality -Garanti’s Integrated Subsidiaries 46-65 66-97 98-113 114-130 131-135 136-137 138-163 165-208 Focusing on Focusing on Focusing on Focusing on Focusing on Assurance Appendix GRI G4 Corporate Customers Managing Human Resources Communities Report Content Index Sustainability through Environmental -Appendıx 1: Key -Human Resources and the -Garanti Bank’s Corporate Stakeholder Groups And Governance Sustainable Impact of Business Environment Social Responsibility Engagement Platforms -Equality of Opportunity and Policy -Board of Directors and Finance Operations -Appendıx 2: Environmental Diversity -Education And Social Impact Senior Management -Importance of Customer -Environmental Policy -Occupational Health and -Supporting the Assessment Model (Esiam) -Committees Experience and Satisfaction -Garanti Bank’s Environmental Safety (OHS) -

Günlük Bülten 30 Temmuz 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,4719 10,0682 1,1880 1.392 497,0 18,41

Günlük Bülten 30 Temmuz 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,4719 10,0682 1,1880 1.392 497,0 18,41 Asya hisse senedi piyasalarının çoğunda satıcılı seyir gözleniyor Haftalık Getiriler (%) 3,5 3,0 ● ABD Başkanı Biden, yeni aşılananlar için teşvik çağrısı yaptı 3,0 2,5 ● TCMB, 2021 enflasyon tahminini %12,2’den %14,1’e yükseltti 2,0 ● Ekonomik güven endeksi, Temmuz’da 100,1’e yükseldi 1,5 1,0 0,4 0,5 0,0 ABD’de Başkan Biden’ın yeni aşılananlar için 100$ tutarında teşvik 0,0 -0,5 0,0 çağrısı yaptığı belirtiliyor. ABD Hazine Bakanlığı, Mart ayında hayata -1,0 geçen 1,9 trilyon $ tutarındaki kurtarma paketinde, eyalet ve yerel -1,5 -0,9 yönetimlere 350 milyar $’lık kaynak ayrıldığını belirtti. Diğer taraftan, Dolar/TL Euro/TL Gram Altın BIST-100 Gösterge Tahvil 1 trilyon $ düzeyinde öngörülen alt yapı paketine ilişkin çalışmalarda da ABD Senatosu’nda ilerleme kaydedildiği Veriler (Bugün) Önceki Beklenti Türkiye Dış Denge (Haziran, milyar belirtiliyor. -4,10 -2,90 $) ABD Çekirdek Kişisel Tük. Har. Enf. Küresel piyasalarda ise, dün ABD temel hisse senedi endekslerinin 3,4 3,7 (Haziran, yıllık % değişim) olumlu ekonomik veri akışının verdiği destekle %0,1 ilâ % %0,4 primli kapatmasının ardından bu sabah Asya hisse senedi piyasalarında satıcılı bir seyir söz konusu. ABD 10 yıl vadeli devlet Yatırımcı Takvimi için tıklayınız tahvili getirileri %1,25 ile düşük seyrini sürdürürken, dolar endeksi Devlet Tahvili Getirileri 92’nin hemen altına ılımlı geriledi. (%) 29/07 28/07 2020 TLREF 19,00 18,98 17,97 ● Yurt içinde TCMB, dün açıkladığı yılın üçüncü Enflasyon TR 10 yıllık 17,61 17,71 12,90 Raporu’nda, 2021 yılı enflasyon tahminini %12,2’den %14,1’e, ABD 10 yıllık 1,27 1,23 0,91 2022 enflasyon tahminini %7,5’ten %7,8’e yükseltti. -

Turkey Trade & Export Finance Conference 2016

Turkey Trade & Export Finance Conference 2016 March 22-23, 2016 | Shangri-La Istanbul Istanbul, Turkey EVENT OVERVIEW WWW.GTREVIEW.COM CORPORATES & TRADERS 59% BANKS & FINANCIERS 17 % Turkey Trade & INSURERS & RISK MANAGERS 5% Export Finance GOVT ORGS & PUBLIC BODIES 5% Conference 2016 NON-BANK FINANCIERS 3% ECAS & MULTILATERALS 2% SOLUTION PROVIDERS 2% GTR’s Turkey Trade & Export Finance Conference 2016 Sectors attended in 2016 returned to Istanbul on March 22-23, 2016, bringing together CONSULTANTS 1% senior officials from some of Turkey’s key corporate players MEDIA 1% and financial institutions, who each gave their insight into the COMPANIES DELEGATES COUNTRIES uncertainty surrounding the trade and export market and the LAWYERS 1% REPRESENTED ATTENDED REPRESENTED effects on businesses operating out of Turkey. OTHER 4% 260 344 15 Bader Arslan, Secretary-General, Turkish Exporters’ Association (TIM) opened the conference with an assessment 2016’s vital statistics of the Turkish market and the various factors affecting external trade. The session assessed the impact of rising interest rates, Percentage of attendees by region in 2016 how realistic the 2023 export targets are and the next steps to further establish Turkey’s strategic role in the region. Further participation was seen from the likes of Koc Holding, OMV % % Petrol Ofisi, Sem Plastik, Yildirim Holding, Natixis, UniCredit, 8 92 Siemens and many more. As always attendees, were able to benefit from the extensive networking on offer, by way of numerous breaks and receptions, providing