Final Matbaa 1 Edited.Pub

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Günlük Bülten 12 Ağustos 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,6314 10,1510 1,1744 1.411 485,9 18,27

Günlük Bülten 12 Ağustos 2021 Piyasalarda Son Görünüm* USD/TL EUR/TRY EUR/USD BIST-100 Gram Altın Gösterge Tahvil 8,6314 10,1510 1,1744 1.411 485,9 18,27 Yurt içinde bugün TCMB faiz kararı takip edilecek Haftalık Getiriler (%) 1,5 1,2 ● TCMB’nin politika faizini sabit tutması bekleniyor 1,0 0,7 0,4 ● ABD’de yıllık enflasyon, %5,4 düzeyinde yatay seyretti 0,5 ● ABD Senatosu, 3,5 trilyon $’lık harcama paketini onayladı 0,0 -0,5 Küresel çapta, ABD'de tüketici fiyatları temmuz ayında aylık bazda -1,0 %0,5 artış gösterdi. Haziran ayında aylık enflasyon %0,9 -1,5 -1,5 düzeyinde gerçekleşmiş idi. Bu temmuz ayı gerçekleşmesi ile, yıllık -2,0 -1,7 enflasyon da %5,4 düzeyinde yatay seyretti. Yıllık çekirdek enflasyon Dolar/TL Euro/TL Gram Altın BIST-100 Gösterge Tahvil ise, %4,5'ten %4,3'e geriledi. ABD‘de özellikle enflasyon ve işgücü piyasasına yönelik veriler, Fed'in varlık alımlarında azaltıma Veriler (Bugün) Önceki Beklenti başlayabileceği tarih açısından kritik öneme sahip. TCMB Faiz Kararı (%) 19,0 19,0 Euro Bölgesi Sanayi Bölgesi ABD Senatosu, Başkan Biden'ın ekonomik reform takviminde -1,0 0,2 (Haziran, aylık % değişim, m.a.) bulunan 3,5 trilyon $ tutarındaki bütçe taslağına 50'ye karşı 49 oy ile onay verdi. Tasarının, ABD hükümetinin sosyal ve çevresel konulara yönelik daha fazla harcama yapmasına imkan tanıyacağı Yatırımcı Takvimi için tıklayınız belirtiliyor. Küresel çapta günlük vaka sayıları 7 günlük ortalamalar Devlet Tahvili Getirileri bazında artış eğilimini sürdürürken, ABD'de ve Avrupa'da, aşı (%) 11/08 10/08 2020 olmayanlara yönelik kısmi zorlayıcı tedbirler yürürlüğe giriyor. -

I, No:40 Sayılı Tebliği'nin 8'Nci Maddesi Gereğince, Hisse Senetleri

Sermaye Piyasas Kurulu’nun Seri :I, No:40 say l Teblii’nin 8’nci maddesi gereince, hisse senetleri Borsada i"lem gören ortakl klar n Kurul kayd nda olan ancak Borsada i"lem görmeyen statüde hisse senetlerinin Borsada sat "a konu edilebilmesi amac yla Merkezi Kay t Kurulu"u’na yap lan ba"vurulara ait bilgiler a"a da yer almaktad r. Hisse Kodu S ra Sat "a Konu Hisse Ünvan Grubu Yat r mc n n Ad -Soyad Nominal Tutar Tsp Sat " No Ünvan (TL)* 5"lemi K s t ** ** ADANA 1 ADANA Ç5MENTO E TANER BUGAY SANAY55 A.;. A GRUBU 2.235,720 ALTIN 2 ALTINYILDIZ MENSUCAT E 5SMA5L AYÇ5N VE KONFEKS5YON 0,066 FABR5KALARI A.;. ARCLK 3 ARÇEL5K A.;. E C5HAT YÜKSEKEL 31,344 ARCLK 4 ARÇEL5K A.;. E ERSAN OYMAN 19,736 ARCLK 5 ARÇEL5K A.;. E FER5DE SEZ5K 0,214 ARCLK 6 ARÇEL5K A.;. E F5L5Z EYÜPOHLU 209,141 ARCLK 7 ARÇEL5K A.;. E HANDE YED5DAL 28,180 ARCLK 8 ARÇEL5K A.;. E HAYRETT5N YAVUZ 0,206 ARCLK 9 ARÇEL5K A.;. E 5HSAN ERSEN 1.259,571 ARCLK 10 ARÇEL5K A.;. E 5RFAN ATALAY 195,262 ARCLK 11 ARÇEL5K A.;. E KEZ5BAN ONBE; 984,120 ARCLK 12 ARÇEL5K A.;. E RAFET SALTIK 23,514 ARCLK 13 ARÇEL5K A.;. E SELEN TUNÇKAYA 29,110 ARCLK 14 ARÇEL5K A.;. E YA;AR EMEK 1,142 ARCLK 15 ARÇEL5K A.;. E ZEYNEP ÖZDE GÖRKEY 2,351 ARCLK 16 ARÇEL5K A.;. E ZEYNEP SEDEF ELDEM 2.090,880 ASELS 17 ASELSAN ELEKTRON5K E ALAETT5N ÖZKÜLAHLI SANAY5 VE T5CARET A.;. -

ALARKO HOLDİNG A.Ş. General Assembly Information Document

ALARKO HOLDİNG A.Ş. General Assembly Information Document INFORMATION DOCUMENT FOR ALARKO HOLDİNG A.Ş.’S 2019 ORDINARY GENERAL ASSEMBLY MEETING Dear Shareholders, Our Board of Directors resolved to hold the Annual Ordinary General Assembly Meeting for the year 2019 on 14.07.2020 at 15:00 at the address “Muallim Naci Cad. No.69 Alarko Merkezi Ortaköy/İSTANBUL” Shareholders, as of 1527 no. article 6102 no. Turkish Commercial Code, can participate physically to the General Assembly as well as participate in Electronic platform and vote. Our shareholders willing to participate our company’s Ordinary General Assembly Meeting in Electronic Platform have to register to e-MKK information portal and themselves or their representatives have to hold Electronic Signature Certificate or mobile signature. Persons willing to participate in Electronic Platform or appoint a representative in electronic platform have to register this participation method to e-GKS (Electronic General Assembly System) one day before the day of the general assembly until 21:00 hours. If the person appointed in e-GKS as representative is willing to participate to the meeting in electronic platform, that that person has to register this participation method to e-GKS in the same time period. Our shareholders willing to participate to the meeting in Electronic Platform have to complete the procedures as of the clauses of “Regulations Regarding General Assemblies of Corporations to be Held in Electronic Platform” published in the 28.08.2012 dated and 28395 numbered official gazette and “Communiqué Regarding Electronic General Assembly System to be Applied in General Assemblies of Corporations” published in the 29.08.2012 dated and 28396 numbered official gazette. -

TÜRKİYE İŞ BANKASI A.Ş. U.S.$5,000,000,000 Global Medium

TÜRKİYE İŞ BANKASI A.Ş. U.S.$5,000,000,000 Global Medium Term Note Program Under this U.S.$5,000,000,000 Global Medium Term Note Program (the "Program"), Türkiye İş Bankası A.Ş., a Turkish banking institution organized as a public joint stock company registered with the Istanbul Trade Registry under number 431112 (the "Bank" or the "Issuer"), may from time to time issue notes (the "Notes") denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). Notes may be issued in bearer or registered form (respectively "Bearer Notes" and "Registered Notes"). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Program will not exceed U.S.$5,000,000,000 (or its equivalent in other currencies calculated as described in the Program Agreement described herein), subject to increase as described herein. The Notes may be issued on a continuing basis to: (a) one or more of the Dealers specified under "Overview of the Group and the Program" and any additional Dealer appointed under the Program from time to time by the Issuer (each a "Dealer" and together the "Dealers"), which appointment may be for a specific issue or on an ongoing basis, and/or (b) one or more investors purchasing Notes directly from the Issuer. References in this Base Prospectus to the "relevant Dealer" shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. An investment in Notes issued under the Program involves certain risks. -

Exploring the Impact of Socio-Political Crises on the Operational Performance of the Turkish Airlines

IBN HALDUN UNIVERSITY SCHOOL OF GRADUATE STUDIES MASTER OF SCIENCE IN AIR TRANSPORT MANAGEMENT MASTER THESIS EXPLORING THE IMPACT OF SOCIO-POLITICAL CRISES ON THE OPERATIONAL PERFORMANCE OF THE TURKISH AIRLINES VİLDAN HAVVA KESİCİ THESIS SUPERVISOR: PROF. MUSTAFA KEMAL YILMAZ ISTANBUL, 2020 IBN HALDUN UNIVERSITY SCHOOL OF GRADUATE STUDIES MASTER OF SCIENCE IN AIR TRANSPORT MANAGEMENT MASTER THESIS EXPLORING THE IMPACT OF SOCIO-POLITICAL CRISES ON THE OPERATIONAL PERFORMANCE OF THE TURKISH AIRLINES by VİLDAN HAVVA KESİCİ A thesis submitted to the School of Graduate Studies in partial fulfillment of the requirements for the degree of Master of Science in Management THESIS SUPERVISOR: PROF. MUSTAFA KEMAL YILMAZ ISTANBUL, 2020 ÖZ SOSYO-POLİTİK KRİZLERİN TÜRK HAVA YOLLARI’NIN FAALİYET PERFORMANSINA ETKİLERİ Kesici, Vildan Havva Hava Taşımacılığı Yönetimi Yüksek Lisans Programı Tez Danışmanı: Prof. Dr. Mustafa Kemal Yılmaz Ocak 2020, 90 sayfa Çalışmada, 2010-2018 döneminde Türkiye’de yaşanan sosyo-politik birtakım krizlerin, Türk Hava Yolları’nın faaliyet peformansı üzerindeki etkisi, arz edilen koltuk kilometre (ASK), ücretli yolcu kilometre (RPK), yolcu doluluk oranı (PLF) ve taşınan yolcu sayıları gibi parametreler değerlendirilerek araştırılmıştır. Bu olaylar kronolojik sıra itibari ile; Gezi Parkı, Rus askeri jetinin vurulması, 15 Temmuz askeri darbe girişimi ve elektronik cihazların yasaklanmasıdır. Söz konusu olayların etkileri bölgesel bazda dört farklı algoritma kullanılarak analiz edilmiştir: (1) nedensel etki analizi, (2) aykırı değer algoritması (ODA), (3) kırılma noktası algoritması (BDA) ve (4) değişim noktası algoritması (CPA). Çalışma bulguları, sosyo-politik krizlerin Türk Hava Yolları'nın faaliyet performansı üzerinde bölgesel olarak sınırlı ölçüde etkileri olduğunu göstermiştir. CPA, Gezi Park döneminde yurtiçi, Afrika ve Kuzey Amerika bölgelerinde RPK’da; Avrupa, Uzak Doğu ve Kuzey Amerika bölgelerinde ASK değerlerinde değişim tespit etmiştir. -

En-Isbank2009.Pdf

Contents Presentation 1 İşbank at the onset of 2010 2 Turkey’s Bank 4 İşbank since 1924 5 İşbank’s Vision, Objectives, and Strategy 6 Pioneering Activities 7 İşbank’s Financial Indicators and Shareholder Structure 8 Chairman’s Message 12 CEO’s Message 18 İşbank’s transformation journey: Customer Centric Transformation (MOD) 20 The Economic Outlook in 2009 26 İşbank in 2009 49 Subsidiaries 54 Corporate Social Responsibility at İşbank 60 Annual Report Compliance Opinion Management and Corporate Governance at İşbank 62 Board of Directors & Auditors 64 Executive Committee 66 Organization Chart 68 Managers of Internal Systems 68 Information About the Meetings of the Board of Directors 69 İşbank Committees 71 Human Resources Functions at İşbank 72 Information on the Transactions Carried out with İşbank’s Risk Group 72 Activities for which Support Services are Received in Accordance with the Regulation on Procurement of Support Services for Banks and Authorization of Organizations Providing this Service 73 İşbank’s Dividend Distribution Policy 74 Agenda of the Annual General Meeting 75 Report of the Board of Directors 76 Auditors’ Report 77 Dividend Distribution Proposal 78 Corporate Governance Principles Compliance Report Financial Information and Assessment on Risk Management 89 Audit Committee’s Assessments on the Operation of Internal Control, Internal Audit and Risk Management Systems, and Their Activities in the Reported Period 91 Independent Auditors’ Report 92 Unconsolidated Financial Statements 102 Financial Highlights and Key Ratios -

A Sectorial Analysis of Possible Information Leakages Prior to Merger and Acquisition Deals in Istanbul Stock Exchange

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Sönmezer, Sıtkı Article — Published Version A Sectorial Analysis of Possible Information leakages prior to Merger and Acquisition Deals in Istanbul Stock Exchange Journal of Economics and Political Economy Suggested Citation: Sönmezer, Sıtkı (2014) : A Sectorial Analysis of Possible Information leakages prior to Merger and Acquisition Deals in Istanbul Stock Exchange, Journal of Economics and Political Economy, ISSN 2148-8347, KSP Journals, Istanbul, Vol. 1, Iss. 2, pp. 186-194, http://dx.doi.org/10.1453/jepe.v1i2.63 , http://kspjournals.org/index.php/JEPE/article/view/63 This Version is available at: http://hdl.handle.net/10419/105848 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. -

Market Watch Monday, March 01, 2021 Agenda

Market Watch Monday, March 01, 2021 www.sekeryatirim.com.tr Agenda 01 M onday 02 Tuesday 03 Wednesday 04 Thursday 05 Friday Turkstat, 4Q20 GDP Growth Germany, January TurkStat, February inflation CBRT, February Germany, Janu- retail sales inflation assess- ary factory orders China, February Caixin non-mfg. China, February Caixin mfg. PMI ment Germany, February PMI U.S., February Germany and Eurozone, Febru- unemployment data U.S., jobless non-farm payrolls ary Markit mfg. PMI Germany and Eurozone, Febru- ary Markit non-mfg. PMI claims and unemploy- Eurozone, February ment rate Germany, February CPI CPI Eurozone, February PPI U.S., January factory orders U.S., February U.S., February Markit mfg. PMI U.S., February ADP employment average hourly change earnings U.S., February ISM manufactur- ing index U.S., February Markit non-mfg. PMI U.S., January construction U.S., February ISM non- spending manufacturing index Outlook Major global stock markets closed lower on Friday, amid the rise in US Treasury yields, which has increased concerns over rising inflation and the Fed derailing its currently accommodative policy. Global risk appetite has Volume (mn TRY) BIST 100 relatively weakened, despite Fed Chair Powell’s statements suggesting that inflation was likely to remain below the targeted value, and that the 1.551 major central bank would maintain its current policy. Having moved in 1.518 1.488 parallel to the course of major international stock markets, the BIST100 48.000 1.483 1.471 1.600 also shed 1.13% to close at 1,471.39 on Friday, after a volatile day in 40.000 1.500 trading. -

Şirketlerin/Fonların Listesi

Şirket ACIBADEM SAĞLIK HİZMETLERİ VE TİCARET A.Ş. ADANA ÇİMENTO SANAYİİ A.Ş. A GRUBU ADANA ÇİMENTO SANAYİİ A.Ş. B GRUBU ADANA ÇİMENTO SANAYİİ A.Ş. C GRUBU ADEL KALEMCİLİK TİCARET VE SANAYİ A.Ş. AFM ULUSLARARASI FİLM PRODÜKSİYON TİCARET VE SANAYİ A.Ş. AFYON ÇİMENTO SANAYİ T.A.Ş. AK ENERJİ ELEKTRİK ÜRETİM A.Ş. AK PORTFÖY A.Ş. BORÇLANMA ARAÇLARI ŞEMSİYE FONUNA BAĞLI UZUN VADELİ BORÇLANMA ARAÇLARI FONU AK PORTFÖY A.Ş. HİSSE SENEDİ ŞEMSİYE FONUNA BAĞLI HİSSE SENEDİ FONU (HİSSE SENEDİ YOĞUN FON) AKBANK T.A.Ş. AKÇANSA ÇİMENTO SANAYİ VE TİCARET A.Ş. AKIN TEKSTİL A.Ş. AKİŞ GAYRİMENKUL YATIRIM ORTAKLIĞI A.Ş. AKMERKEZ GAYRİMENKUL YATIRIM ORTAKLIĞI A.Ş. AKMERKEZ GAYRİMENKUL YATIRIM ORTAKLIĞI A.Ş. B GRUBU İMTİYAZLI AKSA AKRİLİK KİMYA SANAYİİ A.Ş. AKSİGORTA A.Ş. AKSU ENERJİ VE TİCARET A.Ş. AKSU ENERJİ VE TİCARET A.Ş.İMTİYAZLI ALARKO CARRIER SANAYİİ VE TİCARET A.Ş. ALARKO GAYRİMENKUL YATIRIM ORTAKLIĞI A.Ş. ALARKO HOLDİNG A.Ş. ALCATEL LUCENT TELETAŞ TELEKOMÜNİKASYON A.Ş. ALKİM ALKALİ KİMYA A.Ş. ALKİM KAĞIT SANAYİ VE TİCARET A.Ş. ALTERNATİFBANK A.Ş. ALTIN YUNUS ÇEŞME TURİSTİK TESİSLER A.Ş. ALTIN YUNUS ÇEŞME TURİSTİK TESİSLER A.Ş. A GRUBU İMTİYAZLI ALTIN YUNUS ÇEŞME TURİSTİK TESİSLER A.Ş. B GRUBU İMTİYAZLI ALTIN YUNUS ÇEŞME TURİSTİK TESİSLER A.Ş. E GRUBU İMTİYAZLI ALTINYAĞ KOMBİNALARI A.Ş. ALTINYAĞ KOMBİNALARI A.Ş. İMTİYAZLI ANADOLU ANONİM TÜRK SİGORTA ŞİRKETİ ANADOLU ANONİM TÜRK SİGORTA ŞİRKETİ İMTİYAZLI ANADOLU CAM SANAYİ A.Ş. ANADOLU CAM SANAYİ A.Ş. İMTİYAZLI ANADOLU EFES BİRACILIK VE MALT SANAYİİ A.Ş. ANADOLU HAYAT EMEKLİLİK A.Ş. -

Araştırma 08/11/201908/11/19

GÜNLÜKGÜNLÜK BÜLTEN BÜLTEN [email protected] [email protected] Araştırma 08/11/201908/11/19 GÜNLÜK YATIRIM BÜLTENİ BIST-100 endeksinde 106,000 seviyesini güçlü direnç bölgesi olarak izliyoruz Sermaye Piyasası Küresel piyasalarda büyüme eğilimi, ABD - Çin ticaret konusu ve Brexit BIST-100 (TL) 103,544 BIST-100 (US$) 18,050 süreci takip edilen ana konu başlıkları olmaya devam ediyor. ABD ve Çin Günlük Değişim (TL) 2.4% ticaret anlaşması umutları ve ABD’den gelen ılımlı makro veriler eşliğinde Günlük Hacim (BIST-100) US$1,663 mn Günlük Hacim (BIST-TÜM) US$2,015 mn küresel hisse senetlerinde yükseliş eğilimi korunuyor. ABD-Çin ticaret anlaşmasının imzalanması için ABD Başkanı Donald Trump ve Çin Devlet Toplam Piyasa Değeri US$176.2 mlr Başkanı Xi Jinping'in bir araya gelmelerinin Aralık ayına ertelenebileceğine Halka Açıklık Oranı 26.2% 3 Aylık Günlük İşlem Hacmi US$1,511 mn dair haberler soru işareti yaratırken dün zamanlaması belli olmasa da tarifelerin geri alınması konusunda ABD, Çin’in ortak noktada birleştiklerine BIST-100 Getirisi (TL) dair haberler riskli varlıklara destek oldu. ABD-Çin haberleri eşliğinde hisse 1 haftalık / 1 aylık 5.2% / 0.5% 3 aylık / 12 aylık 5.6% / 8.4% senetlerinde yeni rekor seviyeler test edilirken, güvenli liman altın, Japon yeni ve bonoların baskı altında kaldığını takip ediyoruz. Küresel risk En çok artan TL/hisse Değişim barometresi olarak da izlenen S&P 500 endeksi 2 Ekim diplerinden bu yana THYAO 12.66 6.0% EKGYO 1.29 4.9% %6.8, MSCI EM %8.5 civarı yükselmiş durumda. Ayı dönmede ABD 10 KARTN 337.00 4.8% yıllık tahvil faizi 40 baz puan civarı yükselirken, altın %3 civarı geri çekildi. -

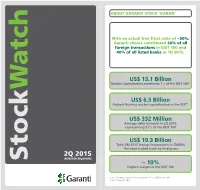

2Q 2015, Representing 21% of the BIST 100

ABOUT GARANTI STOCK ‘GARAN’ With an actual free float ratio of ~50%, Garanti shares constituted 20% of all foreign transactions in BIST 100 and 40% of all listed banks in 1H 2015. US$ 13.1 Billion Market Capitalization constitutes 7% of the BIST 100* Watch US$ 6.5 Billion Highest floating market capitalization in the BIST* US$ 332 Million Average daily turnover in 2Q 2015, representing 21% of the BIST 100 US$ 19.3 Billion Total 6M 2015 foreign transactions in GARAN The most traded stock by foreigners 2Q 2015 INVESTOR RELATIONS Stock ~ 10% Highest weight in the BIST 100 Note: Currency conversion is based on US$/TL CBRT ask rate. * As of June 30, 2015 GARANTI FINANCIAL HIGHLIGHTS Garanti Market Shares* Jun-15 QoQ ∆ In the first half of 2015, Garanti Total Performing Loans 11.8% reached consolidated total TL Loans 10.8% asset of US$ 99.9 billion and FC Loans 14.1% Credit Cards - Issuing (Cumulative) 19.1% consolidated net profit of Credit Cards - Acquiring (Cumulative) 20.4% US$ 777.7 million. Consumer Loans** 14.0% Total Customer Deposits 11.4% TL Customer Deposits 9.3% FC Customer Deposits 14.1% SELECTED FINANCIALS* Customer Demand Deposits 13.5% Mutual Funds 11.0% Total Assets Total Performing Loans * Figures are based on bank-only financials for fair comparison with sector. Sector US$ 99.9 Billion US$ 60.0 Billion figures are based on BRSA weekly data for commercial banks only. ** Including consumer credit cards and other Total Deposits Shareholders’ Equity Garanti with Numbers* US$ 54.7 Billion US$ 10.5 Billion Dec-14 Mar-15 Jun-15 -

Mergers and Acquisitions Report Turkey 2013

Mergers and Acquisitions Report Turkey 2013 January 2014 Foreword In 2013, many countries continued to be impacted by the global economic crisis and political and economic troubles still dominated agendas. Yet, Turkey, with its economy still growing, albeit to a lesser extent than in previous years, continued to distinguish itself as a successful, important and attractive country to invest in, not only in its region but in the world. In a year when global mergers and acquisitions volume slowed down, Turkey also experienced a slight decrease in transaction volume but reached a record high in terms of the number of deals. After such a year, we are delighted to share the twelfth “EY Mergers and Acquisitions Report”, a widely respected and much used reference material by all market players. The EY Mergers and Acquisitions Report 2013 is a thorough compilation of the facts and trends in mergers and acquisitions that were realized in Turkey in 2013, including comparisons with previous years. The Report also presents the results of our traditional “Mergers and Acquisitions in Turkey Survey” whose participants comprised shareholders and upper management of prominent public companies and private sector establishments in Turkey. We thank the survey participants for their contributions and support, as well as the EY Corporate Finance Team who prepared the EY Mergers and Acquisitions Report 2013. Mustafa Çamlıca Müşfik Cantekinler EY Turkey EY Turkey Country Leader Head of Corporate Finance Services 15 January 2014 Content General evaluation 5 Investor profile 8 Sectoral breakdown 12 Public sector deals 14 Transaction volumes 15 2014 overview 16 The overlook of the Turkish Business World towards the M&A Market 18 List of M&A transactions in 2013 25 Basis of preparation of the study 32 Mergers and Acquisitions Report Turkey 2013 General evaluation In a year when developed countries, many of them European, achieved limited growth, Turkey stood out by meeting growth expectations and exceeding the previous year’s growth rate.