Stairstops Using Magee’S Basing Points to Ratchet Stops in Trends

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Testing the Profitability of Technical Analysis in Singapore And

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by ScholarBank@NUS Testing the Profitability of Technical Analysis in Singapore and Malaysian Stock Markets Department of Electrical and Computer Engineering Zoheb Jamal HT080461R In partial fulfillment of the requirements for the Degree of Master of Engineering National University of Singapore 2010 1 Abstract Technical Analysis is a graphical method of looking at the history of price of a stock to deduce the probable future trend in its return. Being primarily visual, this technique of analysis is difficult to quantify as there are numerous definitions mentioned in the literature. Choosing one over the other might lead to data- snooping bias. This thesis attempts to create a universe of technical rules, which are then tested on historical data of Straits Times Index and Kuala Lumpur Composite Index. The technical indicators tested are Filter Rules, Moving Averages, Channel Breakouts, Support and Resistance and Momentum Strategies in Price. The technical chart patterns tested are Head and Shoulders, Inverse Head and Shoulders, Broadening Tops and Bottoms, Triangle Tops and Bottoms, Rectangle Tops and Bottoms, Double Tops and Bottoms. This thesis also outlines a pattern recognition algorithm based on local polynomial regression to identify technical chart patterns that is an improvement over the kernel regression approach developed by Lo, Mamaysky and Wang [4]. 2 Acknowledgements I would like to thank my supervisor Dr Shuzhi Sam Ge whose invaluable advice and support made this research possible. His mentoring and encouragement motivated me to attempt a project in Financial Engineering, even though I did not have a background in Finance. -

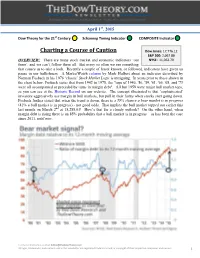

Dow Theory for the 21St Century Schannep Timing Indicator COMPOSITE Indicator

st April 1 , 2015 Dow Theory for the 21st Century Schannep Timing Indicator COMPOSITE Indicator Charting a Course of Caution Dow Jones: 17,776.12 S&P 500: 2,067.88 OVERVIEW: There are many stock market and economic indicators ‘out NYSE: 11,062.79 there’, and we can’t follow them all. But every so often we see something that causes us to take a look. Recently a couple of lesser known, or followed, indicators have given us pause in our bullishness. A MarketWatch column by Mark Hulbert about an indicator described by Norman Fosback in his 1976 ‘classic’ Stock Market Logic is intriguing. In years prior to those shown in the chart below, Fosback states that from 1942 to 1975, the "tops of 1946, '56, '59, '61, '66, '68, and '73 were all accompanied or preceded by turns in margin debt". All but 1959 were major bull market tops, as you can see at the Historic Record on our website. The concept illustrated is that ‘sophisticated’ investors aggressively use margin in bull markets, but pull in their horns when stocks start going down. Fosback further stated that when the trend is down, there is a 59% chance a bear market is in progress (41% a bull market is in progress) - not good odds. That implies the bull market topped out earlier this last month on March 2nd at 18,288.63! How’s that for a cloudy outlook? On the other hand, when margin debt is rising there is an 85% probability that a bull market is in progress – as has been the case since 2011, until now. -

Pattern Recognition User Guide.Book

Chart Pattern Recognition Module User Guide CPRM User Guide April 2011 Edition PF-09-01-05 Support Worldwide Technical Support and Product Information www.nirvanasystems.com Nirvana Systems Corporate Headquarters 7000 N. MoPac, Suite 425, Austin, Texas 78731 USA Tel: 512 345 2545 Fax: 512 345 4225 Sales Information For product information or to place an order, please contact 800 880 0338 or 512 345 2566. You may also fax 512 345 4225 or send email to [email protected]. Technical Support Information For assistance in installing or using Nirvana products, please contact 512 345 2592. You may also fax 512 345 4225 or send email to [email protected]. To comment on the documentation, send email to [email protected]. © 2011 Nirvana Systems Inc. All rights reserved. Important Information Copyright Under the copyright laws, this publication may not be reproduced or transmitted in any form, electronic or mechanical, including photocopying, recording, storing in an information retrieval system, or translating, in whole or in part, without the prior written consent of Nirvana Systems, Inc. Trademarks OmniTrader™, VisualTrader™, Adaptive Reasoning Model™, ARM™, ARM Knowledge Base™, Easy Data™, The Trading Game™, Focus List™, The Power to Trade with Confidence™, The Path to Trading Success™, The Trader’s Advantage™, Pattern Tutor ™, and Chart Pattern Recognition Module™ are trademarks of Nirvana Systems, Inc. Product and company names mentioned herein are trademarks or trade names of their respective companies. DISCLAIMER REGARDING USE OF NIRVANA SYSTEMS PRODUCTS Trading stocks, mutual funds, futures, and options involves high risk including possible loss of principal and other losses. Neither the software nor any demonstration of its operation should be construed as a recommendation or an offer to buy or sell securities or security derivative products of any kind. -

Investing with Volume Analysis

Praise for Investing with Volume Analysis “Investing with Volume Analysis is a compelling read on the critical role that changing volume patterns play on predicting stock price movement. As buyers and sellers vie for dominance over price, volume analysis is a divining rod of profitable insight, helping to focus the serious investor on where profit can be realized and risk avoided.” —Walter A. Row, III, CFA, Vice President, Portfolio Manager, Eaton Vance Management “In Investing with Volume Analysis, Buff builds a strong case for giving more attention to volume. This book gives a broad overview of volume diagnostic measures and includes several references to academic studies underpinning the importance of volume analysis. Maybe most importantly, it gives insight into the Volume Price Confirmation Indicator (VPCI), an indicator Buff developed to more accurately gauge investor participation when moving averages reveal price trends. The reader will find out how to calculate the VPCI and how to use it to evaluate the health of existing trends.” —Dr. John Zietlow, D.B.A., CTP, Professor of Finance, Malone University (Canton, OH) “In Investing with Volume Analysis, the reader … should be prepared to discover a trove of new ground-breaking innovations and ideas for revolutionizing volume analysis. Whether it is his new Capital Weighted Volume, Trend Trust Indicator, or Anti-Volume Stop Loss method, Buff offers the reader new ideas and tools unavailable anywhere else.” —From the Foreword by Jerry E. Blythe, Market Analyst, President of Winthrop Associates, and Founder of Blythe Investment Counsel “Over the years, with all the advancements in computing power and analysis tools, one of the most important tools of analysis, volume, has been sadly neglected. -

Chapter 8 Stock Price Behavior and Market Efficiency Questions and Problems

CHAPTER 8 Stock Price Behavior and Market Efficiency “One of the funny things about the stock market is that every time one man buys, another sells, and both think they are astute.” William Feather “There are two times in a man’s life when he shouldn’t speculate: When he can’t afford it, and when he can.” Mark Twain Our discussion of investments in this chapter ranges from the most controversial issues, to the most intriguing, to the most baffling. We begin with bull markets, bear markets, and market psychology. We then move into the question of whether you, or indeed anyone, can consistently “beat the market.” Finally, we close the chapter by describing market phenomena that sound more like carnival side shows, such as “the amazing January effect.” (marg. def. technical analysis Techniques for predicting market direction based on (1) historical price and volume behavior, and (2) investor sentiment.) 8.1 Technical Analysis In our previous two chapters, we discussed fundamental analysis. We saw that fundamental analysis focuses mostly on company financial information. There is a completely different, and controversial, approach to stock market analysis called technical analysis. Technical analysis boils down to an attempt to predict the direction of future stock price movements based on two major types of information: (1) historical price and volume behavior and (2) investor sentiment. 2 Chapter 8 Technical analysis techniques are centuries old, and their number is enormous. Many, many books on the subject have been written. For this reason, we will only touch on the subject and introduce some of its key ideas in the next few sections. -

The Dow Theory and the Management of Investments

THE DOW THEORY AND THE MANAGEMENT OF INVESTMENTS By BURTON M. WOODWARD A DISSERTATION PRESENTED TO THE GRADUATE COUNCIL OF THE UNIVERSITY OF FLORIDA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PHILOSOPHY UNIVERSITY OF FLORIDA 1968 COPYRIGHT 1968 BY BURTON M . WOODWARD 11 ACKNOWLEDGMENTS The writer wishes to express his appreciation for the assistance given him by Dr. William V. Wilmot, chairman of the supervisory committee. Appreciation is also expressed to Dr. Harvey Deinzer, Dr. John James, Dr. Alan Sievers, and Dr. Ralph Blodgett, who served on the committee. Special thanks go to Dr. A. E. Brandt for equal measures of advice and enthusiasm that made the research seem exciting. Special appreciation is expressed to my wife, Joanne, whose devotion and encouragement contributed immeasurably. iii . TABLE OF CONTENTS Page Acknowledgments iii Chapter I Introduction 1 Chapter II History of the Dow Theory 13 Chapter III Technical and Logical Problems 26 Chapter IV Analysis of the Dow Theory 35 Chapter V Other Methods of Trend Following 71 Chapter VI A New Technical Strategy 83 1 Chapter VII Summary and Conclusions 92 Appendix A Major Bull Movements and Dow Trades 1932-1967 99 Appendix B Lines 100 Appendix C Volume Action Between Turning Points 102 Appendix D Volume Correlation 103 Appendix E Trades on the Dow Theory 1932-1939 104 Appendix F Trades on the Dow Theory 1940-1947 105 Appendix G Trades on the Dow Theory 1948-1955 106 Appendix H Trades on the Dow Theory 1956-1963 107 Appendix I Trades on the Dow Theory 1964-1967 -

Classic Patterns

CLASSIC PATTERNS TABLE OF CONTENTS Classic Patterns . Bullish Patterns: …………………………………………………………………………………………………………. 1 Ascending Continuation Triangle…………………………………………………………………….. 2 Bottom Triangle – Bottom Wedge…………………………………………………………………… 5 Continuation Diamond (Bullish) ……………………………………………………………………… 9 Continuation Wedge (Bullish) …………………………………………………………………………. 11 . Diamond Bottom…………………………………………………………………………………………….. 13 Double Bottom……………………………………………………………………………………………….. 15 Flag (Bullish) …………………………………………………………………………………………………… 19 . Head and Shoulders Bottom……………………………………………………………………………. 22 Megaphone Bottom………………………………………………………………………………………… 27 Pennant (Bullish) ……………………………………………………………………………………………. 28 Symmetrical Continuation Triangle (Bullish) …………………………………………………… 31 Triple Bottom………………………………………………………………………………………………….. 35 Upside Breakout……………………………………………………………………………………………… 39 Rounded Bottom…………………………………………………………………………………………….. 42 . Bearish Patterns…………………………………………………………………………………………………………. 45 Continuation Diamond (Bearish) …………………………………………………………………….. 46 Continuation Wedge (Bearish) ……………………………………………………………………….. 48 Descending Continuation Triangle…………………………………………………………………… 50 Diamond top…………………………………………………………………………………………………… 53 Double Top (Bearish) ……………………………………………………………………………………… 55 Downside Breakout…………………………………………………………………………………………. 60 Flag (Bearish) ………………………………………………………………………………………………….. 62 . Head and Shoulders top (Bearish) ………………………………………………………………….. 65 Megaphone Top……………………………………………………………………………………………… 71 Pennant -

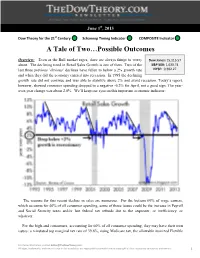

Dow Theory for the 21St Century Schannep Timing Indicator COMPOSITE Indicator a Tale of Two…Possible Outcomes

st June 1 , 2013 Dow Theory for the 21st Century Schannep Timing Indicator COMPOSITE Indicator A Tale of Two…Possible Outcomes Overview: Even as the Bull market rages, there are always things to worry Dow Jones: 15,115.57 about. The declining trend in Retail Sales Growth is one of them. Two of the S&P 500: 1,630.74 last three previous ‘obvious’ declines have fallen to below a 2% growth rate NYSE: 9,302.27 and when they did the economy entered into recession. In 1995 the declining growth rate did not continue and was able to stabilize above 2% and avoid recession. Today’s report, however, showed consumer spending dropped to a negative -0.2% for April, not a good sign. The year- over-year change was about 2.8%. We’ll keep our eyes on this important economic indicator: The reasons for this recent decline in sales are numerous. For the bottom 60% of wage earners, which accounts for 40% of all consumer spending, some of those issues could be the increase in Payroll and Social Security taxes and/or late federal tax refunds due to the sequester, or inefficiency, or whatever. For the high-end consumers, accounting for 60% of all consumer spending, they may have their own issues: a reinstated top marginal tax rate of 39.6%, rising Medicare tax, the allowable itemized Flexible For more information, contact [email protected]. All logos, trademarks, and content used in this newsletter are registered trademarks and/or copyright of their respective companies and owners. 1 st June 1 , 2013 spending health-care accounts reduced by half, and the top rate on long-term capital gains and dividends rose from 15% to 20%. -

Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation

THE JOURNAL OF FINANCE • VOL. LV, NO. 4 • AUGUST 2000 Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation ANDREW W. LO, HARRY MAMAYSKY, AND JIANG WANG* ABSTRACT Technical analysis, also known as “charting,” has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analy- sis. One of the main obstacles is the highly subjective nature of technical analy- sis—the presence of geometric shapes in historical price charts is often in the eyes of the beholder. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regression, and we apply this method to a large number of U.S. stocks from 1962 to 1996 to evaluate the effectiveness of technical analysis. By comparing the unconditional empirical dis- tribution of daily stock returns to the conditional distribution—conditioned on spe- cific technical indicators such as head-and-shoulders or double-bottoms—we find that over the 31-year sample period, several technical indicators do provide incre- mental information and may have some practical value. ONE OF THE GREATEST GULFS between academic finance and industry practice is the separation that exists between technical analysts and their academic critics. In contrast to fundamental analysis, which was quick to be adopted by the scholars of modern quantitative finance, technical analysis has been an orphan from the very start. It has been argued that the difference be- tween fundamental analysis and technical analysis is not unlike the differ- ence between astronomy and astrology. -

Bear Market Investing Strategies WILEY TRADING SERIES

Y L F M A E T Team-Fly® Bear Market Investing Strategies WILEY TRADING SERIES The Psychology of Finance, revised edition Lars Tvede The Elliott Wave Principle: Key to Market Behavior Robert R. Prechter International Commodity Trading Ephraim Clark, Jean-Baptiste Lesourd and Rene´Thie´blemont Dynamic Technical Analysis Philippe Cahen Encyclopedia of Chart Patterns Thomas N. Bulkowski Integrated Technical Analysis Ian Copsey Financial Markets Tick by Tick: Insights in Financial Markets Microstructure Pierre Lequeux Technical Market Indicators: Analysis and Performance Richard J. Bauer and Julie R. Dahlquist Trading to Win: The Psychology of Mastering the Markets Ari Kiev Pricing Convertible Bonds Kevin Connolly At the Crest of the Tidal Wave: A Forecast for the Great Bear Market Robert R. Prechter BEAR MARKET INVESTING STRATEGIES Harry D. Schultz Copyright # 2002 by John Wiley & Sons Ltd Baffins Lane, Chichester, West Sussex PO19 1UD, England National 01243 779777 International (þ44) 1243 779777 e-mail (for orders and customer service enquiries): [email protected] Visit our Home Page on http://www.wiley.co.uk or http://www.wiley.com All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except under the terms of the Copyright, Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, 90 Tottenham Court Road, London W1P 9HE, UK without -

September 2015 the Dow Jones Industrial Average (DJIA), S&P 500

On Our Radar – September 2015 The Dow Jones Industrial Average (DJIA), S&P 500 and NASDAQ Composite fell 6.56 percent, 6.25 percent, and 6.85 percent, respectively, in August, which was highlighted by a dramatic 1089.42 point decline in the DJIA in the first ten minutes of trading on Monday August 24, 2015. That extreme selloff was shortly followed by a two-day rally of 988.33 points, the largest in history. Although last month we stated that trading in August “can subject the markets to large swings,” and that “it is not unusual for periods of low volatility to be followed by periods of high volatility,” we did not anticipate a decline of 1692.28 DJIA points in four days. The catalyst for the decline seems to have been a combination of factors including the devaluation of the Chinese renminbi (yuan), which surprised the markets. On or about August 11, 2015, the International Monetary Fund (IMF) decided that the yuan would not be part of a reserve currency basket, at least for another year. Soon thereafter, China officially devalued their currency. As the U.S. plays a dominant role in the IMF, China’s response may have been a way to retaliate against the U.S. In addition, a deceleration in China’s economic growth along with a strong U.S. dollar have caused a massive bear market in commodities, led by the near 60 percent decline in the price of oil. This is putting further economic pressure on oil producing countries including Russia and Saudi Arabia. -

A Technical Analysis-Based Method for Share Price Forecasting

A TECHNICAL ANALYSIS-BASED METHOD FOR SHARE PRICE FORECASTING C.A. Mahesh Kumar1, S.Naseeruddin2, B.Narendra3, A.Venugopal Reddy4 1Assistant Professor, 2,3,4P.G Student, Department of Management Studies, Gates Institute of Technology, Gooty, A.P (India) ABSTRACT Technical analysis attempts to explain and forecast changes in security prices by studying only the market data. In other words a study of past share prices behavior to predict the future trend is termed as technical analysis. The main objective of this paper is to identify or predict the share price in stock market by using Dow theory, moving average method(MAM), relative strength index(RSI). Dow Theory, moving average method and relative strength index these are all tools of technical analysis. Dow theory is a market indicator and MAM,RSI are market and individual stock indicators. Here we find out primary movements , secondary reactions and minor movements and also to know the bullish trend and bearish trend. Keywords: Technical analysis, Dow theory, Moving average method(MAM),Bullish & Bearish trend and also Relative strength index(RSI). I. INTRODUCTION The methods used to analyze securities and make investment decisions fall into two very broad categories: fundamental analysis and technical analysis. Fundamental analysis involves analyzing the characteristics of a company in order to estimate its value. Technical analysis takes a completely different approach; it doesn't care one bit about the "value" of a company or a commodity. Technicians (sometimes called chartists) are only interested in the price movements inthemarket. Despite all the fancy and exotic tools it employs, technical analysis really just studies supply and demand in a market in an attempt to determine what direction, or trend, will continue in the future.