Analysis of the Spice Value Chain in Timor-Leste June, 2018 Adam Sendall & Luis Gusmão

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Book 5 Development Partners

República Democrática de Timor-Leste State Budget 2017 Approved Development Partners Book 5 “Be a Good Citizen. Be a New Hero to our Nation” Table of Contents Acronyms ..................................................................................................................................... 3 Part 1: Development Assistance in Combined Sources Budget 2017 ..................... 4 Part 2: National Development Plans .................................................................................. 4 2.1 Strategic Development Plan 20112030 .............................................................................. 4 2.1 Program of the 6th Constitutional Government 20152017 ......................................... 5 2.3 The New Deal for Engagement in Fragile States ............................................................... 6 2.3.1 SDG and SDP Harmonization ........................................................................................................... 7 2.3.2 Timor‐Leste’s Second Fragility Assessment ............................................................................. 8 Part 3: Improved Development Partnership ............................................................... 10 3.1 Development Partnership Management Unit ................................................................. 10 3.2 Aid Transparency Portal (ATP) ........................................................................................... 10 Part 4: Trend of Development Assistance to TimorLeste ..................................... -

República Democrática De Timor-Leste

República Democrática de Timor-Leste Book 3A CONTENTS SUMMARY…………………………………………………………………………………………………………………………………..3 1. INTRODUCTION ............................................................................................................................ 4 1.1. Background of the Infrastructure Fund ............................................................................. 4 1.2. Regulation framework of the Infrastructure Fund............................................................. 6 1.3. IF management and institutional arrangements ............................................................... 7 1.4. IF standards, tools and procedures .................................................................................... 8 1.4.1. Feasibility Study .............................................................................................................. 9 1.4.2. Project Appraisal ............................................................................................................. 9 1.4.3. Ex‐Post Evaluation ........................................................................................................ 10 1.4.4. GIS Database ................................................................................................................. 10 1.5. IF Budget allocation and expenditures ............................................................................ 11 1.6. Results of the IF projects implementation during 2011‐2020 ......................................... 12 2. PORTFOLIO OF THE INFRASTRUCTURE FUND ............................................................................ -

A Journal of Change in Timor-Leste

2019 A Journal of Change in Timor-Leste 2018: A A Journal Journal of Changeof Change in Timor-Leste in Timor-Leste 2019 A Journal of Change in Timor-Leste 2018: A Journal of Change in Timor-Leste A Journal of Change in Timor-Leste is an annual publication of UNICEF Timor-Leste. Data in this report are drawn from the most recent available statistics from UNICEF and other United Nations agencies, and the Government of Timor-Leste. Cover photograph: © UNICEF Timor-Leste/2019/BSoares Girls take part in the ‘Kick for Identity’ junior football match to promote birth registration in Timor-Leste. © UNICEF Timor-Leste/2019/Helin THREE DECADES OF CHILD RIGHTS This has been a significant year for Timor-Leste. The 30th of August 2019 marked 20 years since the Popular Consultation, the countrywide vote that eventually led to the restoration of the country’s independence in 2002. The two decades that followed this momentous day have had their challenges, but have seen Timor- Leste achieve many milestones. The proportion of Timorese living in poverty reduced from 50 per cent in 2007 to 42 per cent in 2014. However, 49 per cent of children between the ages of 0 and 14 live below the national poverty line as of 2014. Undoubtedly, there is much work that still needs to be done. Towards this goal, UNICEF has worked closely with the Government of Timor- Leste, partners and donors to accelerate progress for children in the country: through the provision of technical and policy advice; advocacy; and supporting modeling initiatives or larger nationwide actions that draw attention to issues children face, drive change, and support actions that can catalyze progress. -

53395-001: Water Supply and Sanitation Investment Project

Initial Environmental Examination March 2021 Timor-Leste: Water Supply and Sanitation Investment Project – Viqueque City Subproject (Part 1 of 5) Prepared by the Directorate General for Water and Sanitation, Ministry of Public Works for the Asian Development Bank. (page left Intentionally blank) i ABBREVIATIONS WSSIP - Water Supply and Sanitation Investment Project ACMs - Asbestos Containing Materials ADB - Asian Development Bank DED - Detailed Engineering Design DGAS - Directorate General for Water and Sanitation DNAP - National Directorate for Protected Areas DNCP - National Directorate for Pollution Control DNSA - National Directorate for Water Services EARF - Environmental Assessment and Review Framework EHS - Environment, Health and Safety EIA - Environmental Impact Assessment EIS - Environmental Impact Statement EMP - Environmental Management Plan EMR - Environmental Monitoring Report ESS - Environmental Safeguard Specialist ESA - Environmental Safeguard Assistant FSTP - Faecal Sludge Treatment Plant GRM - Grievance Redress Mechanism IEE - Initial Environmental Examination IFC - International Finance Corporation MPW - Ministry of Public Works PA - Protected Area PD - Project Document PDC - Project Design Consultant PSC - Project Supervision Consultant PMU - Project Management Unit SEA - Superior Environmental Authority SEIS - Simplified Environmental Impact Statement CEMP - Site-specific Construction EMP SMASA - Municipal Water, Sanitation and Environment Services SPS - Safeguard Policy Statement TOR - Terms of Reference WDZ - Water -

National Coastal Vulnerability Assessment and Designing of Integrated Coastal Management and Adaptation Strategic Plan for Timor-Leste

National Coastal Vulnerability Assessment and Designing of Integrated Coastal Management and Adaptation Strategic Plan for Timor-Leste Coastal Vulnerability Assessment Report February 2018 © UNDP 2018 The report is contracted by United Nations Development Programme, UNDP and Ministry of Agriculture and Fisheries, MAF and prepared by Global CAD, 2018. The Copyright of the report is the property of UNDP and the Government of Democratic Republic of Timor-Leste, 2018 1-2 List of Abbreviations ADB Asian Development Bank AL-GIS Agriculture and Land Use Geographic Information System ATSEA Arafura and Timor Seas Ecosystem Action AUSAID Australian Agency for International Development CC Climate Change CCCBTL Centre for Climate Change and Biodiversity Timor-Leste CBA Cost Benefit Analysis CEA Cost-Effectiveness Analysis CHW Coastal Hazard Wheel CI Conservation International CIVAT Coastal Integrity Vulnerability Assessment Tool cm centimetres CO2 Carbon Dioxide COP Conference of Parties CTC Coral Triangle Center CVA Coastal Vulnerability Assessment CVI Coastal Vulnerability Index DED Detailed Engineering Design DEM Digital Elevation Model DRR Disaster Risk Reduction EBA Ecosystem-Based Adaptation ECMWF European Center for Medium Range Weather Forecasting ENSO El Niño Southern Oscillation EU European Union EWS Early Warning System FAO Food and Agriculture Organization FGD Focus Group Discussion GDP Gross Domestic Product GIS Geographical Information System GIZ German Corporation for International Cooperation GoTL Government of Timor-Leste GPS Global -

ANNUAL REPORT 2019 Rev2 FIINAL ENGLISH.Cdr

ANNUAL REPORT ALOLA Foundation 20192019 FUNDASAUN ALOLA VISION: “Strong Women Strong Nation- Feto Forte Nasaun Forte” WOMEN OF TIMOR-LESTE HAVE EQUAL STATUS IN ALL ASPECT OF LIFE (Access, participation, role in decision making, enjoyment of benefits) THROUGH EDUCATION, ECONOMIC EMPOWERMENT HEALTH AND COMMUNITY LEADERSHIP MISSION : To Promote Women's Rights And Increase Women's Leadership Capacity, Improve Health Status Of Women And Children, Increase Access & Quality Of Education For Women And Children, Strengthen Women's Small Enterprise At The Grassroots Level. Equality Justice Participation Respect Economic Advocacy Maternal & Child Education Management Health Empowerment Promote Women's Improve Women's And Improve Quality And Strengthen Women's Effective and Efficient Human Rights Children Health Status Access To Education Economic Participation Management & HR system Ÿ Campaign for women's Ÿ Reduction of IMR, MMR, MMBR Ÿ Promote the importance of Ÿ Improve the status of Ÿ Establish responsive system. human rights. and Under 5 child malnutrition education with whole women in enterprise from program management and Ÿ Strengthen women's rate. community involvement. Ÿ Increase income generating evaluation. leadership. Ÿ Promotion of exclusive Ÿ Provide training to improve opportunities Ÿ Ensure transparency and Ÿ Strengthen networks with all breastfeeding and comple- teachers teaching ability. Ÿ Promote economic accountability in financial partners. mentary feeding (through Ÿ Resource development in independence for women management. Ÿ Empower women in all community-based groups at the Tetun and Portuguese and Ÿ Ensure quality facilities areas in municipalities. village level). using local resources. management and process Ÿ Assist women to access Ÿ Empower community-based Ÿ Work collaboratively with Ÿ Maintain endowment funds for information and understand groups to support MCH at the MOE and other education future programs. -

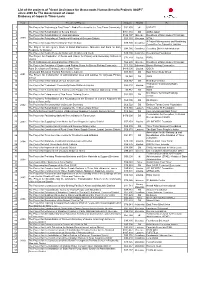

20190521List of GGP Projects 2000-2018 UPDATED

List of the projects of "Grant Assistance for Grass-roots Human Security Projects (GGP)" since 2000 by The Government of Japan Embassy of Japan in Timor-Leste Revised 2019.05.21 Year The title of Project Amount District By The Project for "Listening to East Timor" - Radio Receivers for the East Timor 1 $91,850 all UNTAET Community 2 The Project for Rehabilitation of Becora School $151,934 Dili ADRA Japan 3 The Project for Rehabilitation of Laga Orphanage $146,107 Baucau Daughters of Mary Help of Christians 2000 4 The Project for Rebuilding of Traditional Weaving of Oecusse District $23,135 Oecusse IKTALI A Project Management and 5 The Project for Carpentry Training for Youth in Suai $89,700 Covalima Monitoring Committee for Carpentry Training The Project for Emergency Stock of Road Maintenance Materials and Fund for 6 $94,786 Covalima Covalima District Administration Early Response for Disaster 7 The Project for Build a Peaceful Nation with Children and Youth $80,200 6 districts Deo Gratias Foundation The Project for Production of Desks and Chairs for Primary and Secondary 8 $72,118 Liquica PARC Schools in Liquica 9 The Rehabilitation of Laga Orphanage (Phase II) $66,295 Baucau Daughters of Mary Help of Christians The Project for Provision of Engines and Fishing Gears for Biacou Fishing 10 $15,192 Bobonaro Biacou Fishing Cooperative Cooperative 11 Rural Development Training Center in East Timor $410,000 Liquica OISCA 12 2001 Library and Education Training Facility Development $88,588 Dili East Timor Study Group The Project for Construction -

Agriculture Assessment Oxfam in Timor-Leste

AGRICULTURE ASSESSMENT OXFAM IN TIMOR-LESTE CONTENTS Introduction ........................................................................................................................................................3 Research Approach & Methodology .................................................................................................................5 Case Study Sites ................................................................................................................................................7 Perceptions of Farming ...................................................................................................................................12 Inclusive Growth ...............................................................................................................................................14 Basic Infrastructure: Roads and Water ..........................................................................................................17 Inputs & Technical Support .............................................................................................................................20 Market Engagement .........................................................................................................................................22 Conclusion: Building an Enabling Environment .............................................................................................27 Recommendations ...........................................................................................................................................32 -

PIF) PROJECT TYPE: Full-Sized Project TYPE of TRUST FUND:GEF Trust Fund for More Information About GEF, Visit Thegef.Org

GEF-6 PROJECT IDENTIFICATION FORM (PIF) PROJECT TYPE: Full-sized Project TYPE OF TRUST FUND:GEF Trust Fund For more information about GEF, visit TheGEF.org PART I: PROJECT INFORMATION Project Title: Securing the long-term conservation of Timor-Leste’s biodiversity and ecosystem services through the establishment of a functioning National Protected Area Network and the improvement of natural resource management in priority catchment corridor Country(ies): Timor-Leste GEF Project ID:1 9434 GEF Agency(ies): CI (select) (select) GEF Agency Project ID: Other Executing Partner(s): Ministry of Agriculture and Fisheries (MAF), Submission Date: 04/08/2016 Ministry of Commerce, Industry & Environment (MCIE), and CI Timor-Leste GEF Focal Area(s): Multi-focal Areas Project Duration (Months) 48 Integrated Approach Pilot IAP-Cities IAP-Commodities IAP-Food Security Corporate Program: SGP Name of parent program: [if applicable] Agency Fee ($) 300,633 A. INDICATIVE FOCAL AREA STRATEGY FRAMEWORK AND OTHER PROGRAM STRATEGIES2 (in $) Objectives/Programs (Focal Areas, Integrated Approach Pilot, Corporate Trust Fund Programs) GEF Project Co- Financing financing (select) (select) SFM-1 GEFTF 556,728 2,350,000 (select) (select) SFM-2 GEFTF 556,728 2,350,000 BD-1 Program 1 (select) (select) GEFTF 890,765 3,760,000 LD-1 Program 1 (select) (select) GEFTF 668,073 2,820,000 LD-1 Program 2 (select) (select) GEFTF 668,073 2,820,000 (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) (select) -

List of the Project of GGP 2000-2020

List of the projects of "Grant Assistance for Grass-roots Human Security Projects (GGP)" since 2000 by The Government of Japan Embassy of Japan in Timor-Leste Year The title of Project Amount District By 1 The Project for "Listening to East Timor" - Radio Receivers for the East Timor Community $91,850 all UNTAET 2 The Project for Rehabilitation of Becora School $151,934 Dili ADRA Japan 3 The Project for Rehabilitation of Laga Orphanage $146,107 Baucau Daughters of Mary Help of Christians 4 2000 The Project for Rebuilding of Traditional Weaving of Oecusse District $23,135 Oecusse IKTALI A Project Management and Monitoring 5 The Project for Carpentry Training for Youth in Suai $89,700 Covalima Committee for Carpentry Training The Project for Emergency Stock of Road Maintenance Materials and Fund for Early 6 $94,786 Covalima Covalima District Administration Response for Disaster 7 The Project for Build a Peaceful Nation with Children and Youth $80,200 6 districts Deo Gratias Foundation The Project for Production of Desks and Chairs for Primary and Secondary Schools in 8 $72,118 Liquica PARC Liquica 9 The Rehabilitation of Laga Orphanage (Phase II) $66,295 Baucau Daughters of Mary Help of Christians 10 The Project for Provision of Engines and Fishing Gears for Biacou Fishing Cooperative $15,192 Bobonaro Biacou Fishing Cooperative 11 Rural Development Training Center in East Timor $410,000 Liquica OISCA 12 Library and Education Training Facility Development $88,588 Dili East Timor Study Group 2001 The Project for Construction of Administration -

Infrastructure Fund Portfolio 4 1

República Democrática de Timor-Leste Infrastructure Fund Book 3A “Be a Good Cizen. Be a New Hero to our Naon” TABLE OF CONTENTS INTRODUCTION 3 I. INFRASTRUCTURE FUND PORTFOLIO 4 1. AGRICULTURE PROGRAM 5 2. WATER AND SANITATION PROGRAM 5 3. URBAN AND RURAL DEVELOPMENT PROGRAM 6 4. ELECTRICITY PROGRAM 6 5. PORT PROGRAM 7 6. AIRPORT PROGRAM 7 7. MILLENNIUM DEVELOPMENT GOALS PROGRAM (MDG) 8 8. TASI MANE PROGRAM 8 9. EXTERNAL LOANS PROGRAM 9 10. FINANCIAL SYSTEM AND SUPPORTING INFRASTRUCTURE PROGRAM 9 11. INFORMATICS PROGRAM 10 12. YOUTH AND SPORTS PROGRAM 10 13. HEALTH PROGRAM 11 14. TOURISM PROGRAM 11 15. EDUCATION PROGRAM 12 16. SOCIAL SOLIDARITY PROGRAM 12 17. BRIDGES PROGRAM 12 18. SECURITY AND DEFENCE PROGRAM 13 19. ROAD PROGRAM 13 20. PUBLIC BUILDINGS PROGRAM 14 21. PREPARATION OF DESIGNS AND PROVISION OF SUPERVISION SERVICES 14 22. MAINTENANCE AND REHABILITATION PROGRAM 14 II. IF BUDGET SUMMARY 15 III. ANNEXES 17 2 | P a g e Rectification Budget Book 3A – Infrastructure Fund 2017 INTRODUCTION The infrastructure development is one of the key national priorities for strategic investment in Timor- Leste. According to the Strategic Development Plan 2011 – 2030, a central pillar of the long-term development is the building and maintenance of core and productive infrastructure that will be able to support and enhance social and economic growth that leads to a better quality of life. The main objective of the Infrastructure Fund is to support strategic projects for further growth of Timor- Leste’s economy. The Infrastructure Fund is the main governmental instrument which was established in 2011 in order to facilitate infrastructure development and provide financial sources for roads and bridges, airports and seaports, power and water supply, education and health, tourism and other major projects with budget over than $1 million which have significant impact to the country. -

Infrastructure Fund

República Democrática de Timor-Leste Infrastructure Fund Book 3A TABLE OF CONTENTS Foreword …………………………………..........…………………..…………………………………………… 3 1. IF POLICY, STANDARDS AND REGULATION 4 1.1. IF Objective and Priorities ………..……………………………………………….…………….…… 4 1.2. IF Budget Allocation and Execution ……………………………………………….………..…… 7 1.3. Legal Regulation Framework …………………………………………………………..…………… 8 1.4. Institutional Arrangements ……………………………………….……………………………..…. 9 1.5. Project Implementation and IF Workflow ……………………………………………………. 10 1.6. Project Standards …………………………………………………………….……………………..…… 12 Feasibility Study ……………………………………………………………………………..…………… 12 Project Appraisal …………………………………………………………………………………….…… 12 Ex‐post Evaluation …………………………………………………………………………….………… 14 2. INFRASTRUCTURE FUND PORTFOLIO 15 2.1. Agriculture Program ……………………………………………………………..………………… 16 2.2. Water and Sanitation Program …………………………………………..…………………… 16 2.3. Urban and Rural Development Program …………………………………………….…… 17 2.4. Electricity Program …………………………………………………………………………….…… 17 2.5. Ports Program ………………………………………………………………………………………… 18 2.6. Airports Program ……………………………………………………………………………………. 18 2.7. Tasi Mane Program ………………………………………………………………………………… 19 2.8. Financial System and Supporting Infrastructure ……………………………………… 19 2.9. Information System Program …………………………………………………………………. 20 2.10. Youth and Sports Program ……………………………………………………………………… 20 2.11. Health Program ………………………………………………………………………………….…… 21 2.12. Tourism Program ……………………………………………………………………………….…… 21 2.13. Education Program ………………………………………………………………………………….