2010 Q2 ECO Quarterly Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JA Solar Module

JA Solar Overview Protect the one Earth we all share, for this and future generations. Company Profile Headquarters Shanghai, China (with EU, US & Japan Offices) Founded / IPO May 2005 / February 2007 Business c-Si solar module & cell supplier Shipments 1.69GW in 2011 Attributes World class quality, efficiency, and cost structure Capacity (Annual) 3GW Cell, 2.0 GW Module, 1.0 GW Wafer Ticker Symbol JASO (NASDAQ) Employees ~12,000 2 JA Solar Holdings Co., Ltd. (Module) 2012 Optimized Vertical Integration Model SILICON SILICON WAFERS CELL MODULE SYSTEMS Solar Wafers Solar Cells PV Modules EPC • Low-cost, high-quality • One of the world’s largest • High-quality product with • Partnering with top-tier production manufacturers high-quality BOM developers in China • Recognized for top tech at • Additional channel for • Leading the industry in low cost product distribution • Cooperation with global high-efficiency wafer • High-performance mono- • Working with leading leading IPPs on utility research and multi-crystalline solar brands on OEM modules scale projects cells JA Solar Holdings Co., Ltd. (Module) 2012 JA SOLAR Nationwide Production Plant Lianyungang Wafer Facility 500MW Capacity Yanjiao Wafer Facility 500MW Capacity Ningjin Cell Facility 1200MW Capacity Shanghai Head Quarter Yangzhou Cell Facility Hefei Solar Products Facility 1800MW Capacity Fengxian Module Facility 3GW Capacity (Started from Y11) State-of-the-art PV R&D Center 1500MW Capacity Current Module Capacity 500MW Above data will be valid until Q4, 2012. JA Solar Holdings Co., Ltd. (Module) 2012 Featured Projects Partnership with world leading independent power producers for utility scale PV projects Macy’s, New Jersey, USA Lingwu, Ningxia, China Giuliano, Italy 1.1 MW Project 40 MW Project 20.4 MW Project JA Solar Holdings Co., Ltd. -

Solar Is Driving a Global Shift in Electricity Markets

SOLAR IS DRIVING A GLOBAL SHIFT IN ELECTRICITY MARKETS Rapid Cost Deflation and Broad Gains in Scale May 2018 Tim Buckley, Director of Energy Finance Studies, Australasia ([email protected]) and Kashish Shah, Research Associate ([email protected]) Table of Contents Executive Summary ......................................................................................................... 2 1. World’s Largest Operational Utility-Scale Solar Projects ........................................... 4 1.1 World’s Largest Utility-Scale Solar Projects Under Construction ............................ 8 1.2 India’s Largest Utility-Scale Solar Projects Under Development .......................... 13 2. World’s Largest Concentrated Solar Power Projects ............................................... 18 3. Floating Solar Projects ................................................................................................ 23 4. Rooftop Solar Projects ................................................................................................ 27 5. Solar PV With Storage ................................................................................................. 31 6. Corporate PPAs .......................................................................................................... 39 7. Top Renewable Energy Utilities ................................................................................. 44 8. Top Solar Module Manufacturers .............................................................................. 49 Conclusion ..................................................................................................................... -

Solar Energy Stock Index Q1 2

Stock Index Solar Energy Q1 2018 Solar Energy About the Solar Energy Stock Index Highlights Similar to the S&P 500 Index, the Solar Stock is set to a base index, in this case, 1000. Next, (1) Index is a market cap weighted composite for each sector, the current period’s total market Overall Solar Index index. The index is prepared by first selecting a cap is calculated, divided by the base period’s increased 2.5% from base period, in this case, Q1 2009, and totaling total market cap and then multiplied by the base last quarter the market caps of the companies in each sector index (1000). The result is the index value used in this period. This period and total market cap for plotting in the graph on the following page. Wafers / Ingots Index decreased 7.2% from Solar Energy Index Outperforms S&P last quarter in Q1 2018 Systems Components Winner’s Circle Sector EBITDA Margins Index increased 22.9% GCL-Poly Energy Holdings Ltd. (26%) W Wafers / Ingots 28% Motech Industries, Inc. 21% S Systems Components 6% from last quarter Canadian Solar Inc. (27%) I Vertically Integrated 8% Azure Power Global Limited 31% D EPC Integrators / Developers 55% Vertically Integrated Worst Performers Sector 3 Year Revenue CAGR Daqo New Energy Corp. (68%) W Wafers / Ingots 5% Index increased 2.0% SolarEdge Technologies, Inc. (59%) S Systems Components 0% from last quarter First Solar, Inc. (60%) I Vertically Integrated 13% BCPG Public Company Limited (52%) D EPC Integrators / Developers 71% Based on quarter-over-quarter share price performance Source: Capital -

Reshuffling of the Market

PHOTOVOLTAICS SILICON AND WAFER MANUFACTURERS Reshuffling of the market Japan. “In 2010, the region arrived at a market share of 11 %. That share will increase to 16 % by the end of 2011 and reach the 26 % mark by 2015.” Profit warning in Europe Meanwhile, the first solar companies in the wafer segment are reacting to the new trend. In particular, the manufacturers with production locations in Europe have been attracting attention with their an- nouncements. One example is the UK-based PV Crystalox Solar, a silicon and wafer manufacturer, which recently published a profit warning for the sec- ond half of 2011. PV Crystalox Solar warned that op- erative losses could occur as a result of the meagre supply situation in the second half of the year, which had been considerable lower than expected in May. On the level of the end consumer, the demand has In the wafer segment, the companies meanwhile greatly decreased, says the company. tend to pair the expansion of their When compared to the previous year, the installed PV capacities with an increased level of capacities in Germany alone have dropped by 50 % vertical integration. Photo: REC Group between March and May. Shortly after the profit warn- ing was published, the price for PV Crystalox Solar shares took a sharp tumble. Similar news arrived from Norway. Towards the end of the second quarter, The global PV market is finding a new balance. While the REC Group announced that it would curb its produc- tion on a temporary basis. According to REC’s Inves- traditional European core markets are faced with a tor Relations Analyst Peder Poulsson, the reason for tumbling demand, other parts of the world such as Asia the measure must be seen in the weak sales situation in Europe and the falling wafer and module prices. -

China Solar Sector Research Analysts INITIATION Gary Zhou, CFA 852 2101 6648 [email protected] the Two New Trends

30 June 2017 Asia Pacific/China Equity Research Utilities China Solar Sector Research Analysts INITIATION Gary Zhou, CFA 852 2101 6648 [email protected] The two new trends Dave Dai, CFA 852 2101 7358 [email protected] Figure 1: Expanding market share of distributed solar and rising Gloria Yan demand for mono-Si solar components 852 2101 7369 80% 71% 74% [email protected] 60% 50% 50% Distributed solar as % of 40% 45% 32% 40% 25% 30% China's annual solar 18% installations 20% 9% 12% 0% Market share of mono-Si 2015 2016 2017E 2018E 2019E 2020E Source: NDRC, Credit Suisse estimates ■ Mono-Si gaining share on the upstream. Despite global solar market likely growing by single digits in the next few years, we expect demand for Mono-Silicon (mono-Si) solar components to more than double during 2016-20, driven by market share expansion (from 25% to 50%) due to its superior cost efficiency over competing multi-silicon (multi-Si) technology. Such a trend should benefit mono-Si wafer manufacturers (led by LONGi) with strong volume and earnings growth, while multi-Si rivals (such as GCL Poly) may suffer from shrinking demand. ■ Rising distributed solar in China. For China's solar operator market, another major change we expect is the shift from ground-mounted solar farms to distributed solar (largely rooftops). Such a trend is warranted by a lower land requirement, limited power curtailment and lucrative returns for distributed solar (an equity IRR of >15% vs 10% for solar farms). We believe that the forecasted 55% capacity CAGR (60GW target by 2020) during 2016-20 for distributed solar should help to drive up demand for mono-Si products (extra 100-200 bp IRR gains). -

ADA-ES, Inc. a D

Clean Technology and Renewables Conference Company Fact Sheet Headquarters ADA-ES, Inc.Third Annual Clean Technology and RenewablesADES Conference 8100 SouthPark Way February 20, 2008 Littleton, CO 80120 303 34-12 Company Description Analysts www.adaes.com ADA-ESADA-ES, Inc. Inc.provides air pollution control systems, ADES Charles J. Fishman Senior Research Analyst specialty chemicals and consulting services to utility and Management industrial customers. The air pollution control business 314 963-9702 Company Description CEO:[email protected] Michael D. Durham focuses on mercury emissions control for coal-fired ADA-ES Inc. provides air pollution control systems, specialty CFO: Mark H. McKinnies boilerschemicals, while and the consulting specialty servicchemicalses to utilitysegment and industrialaddresses Elaine S. Kwei fluecustomers. gas conditioning, The air pollution problems control with business coal switching focuses on and mercury Research Analyst fluxing additives. The company offers consulting services 415 277-1511 emissions control for coal-fired boilers while the specialty to improve baghouse and electrostatic precipitator [email protected] chemicals segment addresses flue gas conditioning, problems performance.with coal switching, The mercury and fluxin controlsg additives. business The company accounts offers for roughlyconsulting 90% services of revenues to improve with baghouseflue gas andconditioning electrostatic and otherprecipitator activities performance. contributing The to mercury the balance. controls business accounts Headquarters for roughly 90% of revenues with flue gas conditioning and other 8100 SouthPark Way Source:activities Company contributing reports, to the Piper balance. Jaffray Littleton, CO 80120 303 734-1727 Source: Company reports, Piper Jaffray www.adaes.com Management CEO: Michael D. Durham CFO: Mark H. -

COMPANY PROFILE SCUBE Technologies Ltd

COMPANY PROFILE SCUBE Technologies Ltd. www.scube.com.bd Flat # 4B (4th Floor), House # 67/B, Road # 15/A (Old 26), Dhanmondi, Dhaka-1209, Bangladesh S C U B E INTRODUCTION Initiated by two passionate engineers in 2015 to create mark on mitigating the country’s energy need through nature friendly renewable energy, with a fantastic team effort SCUBE Technologies Limited has become the foremost player of industrial clean energy providers by taking part in around 6.1 MW capacity of renewable energy in different industries and mini- grids. This leadership was gained through a fantastic teamwork of our business, engineering and support teams coming from different streams with diverse industry experiences. In less than 3 years of operations SCUBE gained the trust of world leading renewable energy equipment producers like SMA, JA Solar, Joymeter, Schneider Electric, ABB, Span Pumps Pvt Limited etc. For its extensive organizational knowledge in solar energy design and implementation and maintenance, SCUBE is awarded with a country service agency from SMA Solar Technology AG, Germany, for SMA Inverter which is the most reliable inverter for solar electricity throughout the world. SCUBE has also awarded the local sales and service agency from JA Solar, producer of the third most used solar panels in the world according to Bloomberg New Energy Finance (BNEF) reports. In a pretty short lifetime, SCUBE has acquired experiences as a low cost environment friendly industrial power provider in various industries including Textiles, RMG, Poultry, Cold Storages, Armed Forces, NGO, etc. With the trust of the clients SCUBE has installed a number of industrial solar power plants up to 723KWp capacity and gained the experience of working in every region of Bangladesh. -

Market Shifting

PHOTOVOLTAICS CELL AND MODULE MANUFACTURERS Market shifting Large-scale systems are After years of oversupply and artificially low module pricing, market becoming a growing market segment. The system in the analysts believe that the solar industry will begin to stabilize by 2017. picture has been installed in While the market activities are shifting from Europe to the Asia Pacific the Japanese prefecture of Yamanashi and uses Solar region and the United States, the solar shakeout continues to be in full Frontier modules. Photo: Solar Frontier swing including solar cell and module manufacturing. ccording to a recent report by the market ana play the role as global leader are over. “It is clear from lysts at Navigant Research, the annual world the results of 2012 and the forecast for the coming Awide revenues made from solar PV installa years that Europe’s leading role in the PV market is tions will surpass the mark of US$ 134 billion by coming to an end,” says Craig Winneker, Head of Po 2020. “Financial incentives, government renewable litical Communications at EPIA. In 2011, 70 % of glo energy deployment targets, and technology cost re bal new installations were connected to the grid in duction are still the most important drivers of the so Europe, says Winneker. In 2012, the share dropped lar PV market,” says Dexter Gauntlett, a research ana to 55 % and the majority of new installations will no lyst with Navigant Research. In view of such outlooks, doubt be found outside Europe in 2013. The global many companies in the industry have come to believe module and solar cell manufacturers are already re that 2017 will be the year in which solar power will fi acting to this trend. -

Government Pension Fund Global Holding of Equities at 31 December

Government Pension Fund Global Holding of equities at 31 December 2011 et value K) K) arket value arket ark wnership wnership ector ector oting oting NO NO S M ( V O S M ( V O AUSTRALIA David Jones Ltd Consumer Services 51 018 951 0.67% 0.67% Abacus Property Group Financials 22 995 524 0.51% 0.51% Deep Yellow Ltd Basic Materials 2 644 029 0.29% 0.29% ABC Learning Centres Ltd Consumer Services 1 672 0.50% 0.50% Dexus Property Group Financials 158 816 463 0.65% 0.65% Acrux Ltd Health Care 16 824 771 0.58% 0.58% Discovery Metals Ltd Basic Materials 25 004 853 0.71% 0.71% Adelaide Brighton Ltd Industrials 54 271 215 0.48% 0.48% Downer EDI Ltd Industrials 55 616 672 0.66% 0.66% AED Oil Ltd Oil & Gas 642 658 0.30% 0.30% DuluxGroup Ltd Industrials 104 835 466 1.61% 1.61% AGL Energy Ltd Utilities 259 696 118 0.64% 0.64% Echo Entertainment Group Ltd Consumer Services 97 268 039 0.64% 0.64% AJ Lucas Group Ltd Industrials 1 743 778 0.24% 0.24% Elders Ltd Consumer Goods 3 899 317 0.55% 0.55% Alesco Corp Ltd Industrials 3 440 168 0.52% 0.52% Emeco Holdings Ltd Industrials 24 130 089 0.65% 0.65% Alliance Resources Ltd Basic Materials 762 474 0.17% 0.17% Energy Resources of Australia Ltd Basic Materials 10 573 558 0.27% 0.27% Alumina Ltd Basic Materials 110 036 341 0.66% 0.66% Energy World Corp Ltd Utilities 35 210 692 0.48% 0.48% Amcor Ltd/Australia Industrials 474 366 213 0.89% 0.89% Envestra Ltd Utilities 31 301 292 0.46% 0.46% AMP Ltd Financials 444 770 671 0.63% 0.63% Equatorial Resources Ltd Basic Materials 6 626 114 0.57% 0.57% Ampella Mining -

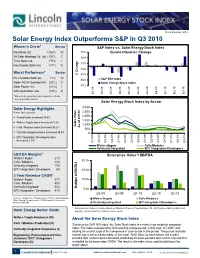

Solar Energy Index Outperforms S&P in Q3 2010

Third Quarter 2010 Solar Energy Index Outperforms S&P in Q3 2010 Winner’s Circle* Sector S&P Index vs. Solar Energy Stock Index ReneSola Ltd. +102% W 50% Quarter/Quarter Change JA Solar Holdings Co. Ltd. +101% C 30% Trina Solar Ltd. +75% I e 10% Real Goods Solar, Inc. +17% D -10% Worst Performers* Sector % Chang -30% PV Crystalox Solar plc +1% W -50% S&P 500 Index Solon AG für Solartechnik (22%) C Solar Energy Stock Index Solar Power Inc. (57%) I -70% SAG Solarstrom AG (15%) D Q1-08 Q2-08 Q3-08 Q4-08 Q1-09 Q2-09 Q3-09 Q4-09 Q1-10 Q2-10 Q3-10 * Based on quarter-over-quarter share price performance Solar Energy Stock Index by Sector Solar Energy Highlights 3,000 From last quarter: 2,500 2,000 Overall Index increased 34.0% 1,500 Wafers / Ingots Index increased 78.3% 1,000 Index Value Value Index Cells / Modules Index increased 30.2% 3/31/07 As of 500 Vertically Integrated Index increased 39.4% 0 EPC Integrators / Developers Index decreased 3.9% Q1-07 Q2-07 Q3-07 Q4-07 Q1-08 Q2-08 Q3-08 Q4-08 Q1-09 Q2-09 Q3-09 Q4-09 Q1-10 Q2-10 Q3-10 Wafers/Ingots Cells/Modules Vertically Integrated EPC Integrators/Developers EBITDA Margins* Enterprise Value*/ EBITDA Wafers / Ingots 21% 30.0x Cells / Modules 13% A Vertically Integrated 19% EPC Integrators / Developers 8% 20.0x 3 Year Revenue CAGR* Wafers / Ingots 37% 10.0x Cells / Modules 50% Vertically Integrated 55% Multiple of EBITD 0.0x EPC Integrators / Developers 41% Q3-09 Q4-09 Q1-10 Q2-10 Q3-10 *Source: Capital IQ as of September 30, 2010 or latest available Wafers/Ingots Cells/Modules Note: Average for each sector; CAGR stands for compound annual growth rate Vertically Integrated EPC Integrators/Developers * Enterprise Value is calculated as Market Cap on September 30, 2010 plus debt, preferred Solar Energy Sector Guide equity and minority interest less cash Wafers / Ingots Producers (W) About the Solar Energy Stock Index Cells / Modules Production (C) Similar to the S&P 500 Index, the Solar Stock Index is a market cap weighted composite Vertically Integrated Companies (I) index. -

2015 Annual Report on Form 10-K for the Fiscal Year Ended January 3, 2016 (The “2015 Annual Report”) Online and Vote Online

CORPORATE HEADQUARTERS SunPower Corporation 77 Rio Robles, San Jose California 95134 USA 408.240.5500 sunpower.com Annual Report 2015 ©2016 SunPower Corporation. All Rights Reserved. SUNPOWER and the SUNPOWER logo are registered trademarks of SunPower Corporation in the U.S. and other countries as well. sp_annual_report_2015_cover_print.indd 1 3/8/16 4:34 PM EXECUTIVE OFFICERS Thomas H. Werner Changing the Way Our World is Powered President, CEO and Chairman of the Board As one of the world’s most innovative and sustainable energy Lisa Bodensteiner Executive Vice President companies, SunPower provides residential, commercial and and General Counsel Charles D. Boynton utility customers with complete solar solutions, services and Executive Vice President and Chief Financial Officer Smart Energy choices. Our global customers rely on our Eric Branderiz Senior Vice President, more than 30 years of proven experience. From the first flip Corporate Controller and Chief Accounting Officer of the switch, SunPower delivers maximum value and superb Marty T. Neese Chief Operating Officer performance throughout the long life of every solar system. SunPower provides clean energy through residential, Douglas J. Richards Executive Vice President commercial and power plant Administration Headquartered in Silicon Valley, SunPower has about 8,000 installations worldwide. Howard Wenger President dedicated, customer-focused employees in Africa, Asia, Business Units Australia, Europe, North and South America. Since 2011, BOARD OF DIRECTORS we’ve been majority-owned by Total, the fourth largest Thomas H. Werner publicly-traded energy company. Chairman of the Board Arnaud Chaperon Director We passionately believe that our company’s achievements and Bernard Clément Director our individual contributions are making the world a better place. -

Form N-CSR Filed 2016-12-06

SECURITIES AND EXCHANGE COMMISSION FORM N-CSR Certified annual shareholder report of registered management investment companies filed on Form N-CSR Filing Date: 2016-12-06 | Period of Report: 2016-09-30 SEC Accession No. 0001193125-16-786448 (HTML Version on secdatabase.com) FILER SPDR INDEX SHARES FUNDS (Formerly streetTRACKS Mailing Address Business Address ONE LINCOLN STREET ONE LINCOLN STREET Index Shares Funds) CPH0326 CPH0326 BOSTON MA 02111 BOSTON MA 02111 CIK:1168164| IRS No.: 421537593 | State of Incorp.:MA | Fiscal Year End: 0930 866-787-2257 Type: N-CSR | Act: 40 | File No.: 811-21145 | Film No.: 162036995 Copyright © 2016 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number: 811-21145 SPDR® INDEX SHARES FUNDS (Exact name of registrant as specified in charter) One Lincoln Street, Boston, Massachusetts 02111 (Address of principal executive offices) (zip code) Joshua A. Weinberg, Esq. Vice President and Managing Counsel SSGA Funds Management, Inc. One Lincoln Street Boston, Massachusetts 02111 (Name and address of agent for service) Copy to: W. John McGuire, Esq. Morgan, Lewis & Bockius LLP 1111 Pennsylvania Avenue, NW Washington, DC 20004 Registrants telephone number, including area code: (617) 664-7037 Date of fiscal year end: September 30 Date of reporting period: September 30, 2016 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Table of Contents Item 1. Reports to Shareholders.