Form N-CSR Filed 2016-12-06

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CTBUH Journal

About the Council The Council on Tall Buildings and Urban Habitat, based at the Illinois Institute of Technology in CTBUH Journal Chicago and with a China offi ce at Tongji International Journal on Tall Buildings and Urban Habitat University in Shanghai, is an international not-for-profi t organization supported by architecture, engineering, planning, development, and construction professionals. Founded in 1969, the Council’s mission is to disseminate multi- Tall buildings: design, construction, and operation | 2014 Issue IV disciplinary information on tall buildings and sustainable urban environments, to maximize the international interaction of professionals involved Case Study: One Central Park, Sydney in creating the built environment, and to make the latest knowledge available to professionals in High-Rise Housing: The Singapore Experience a useful form. The Emergence of Asian Supertalls The CTBUH disseminates its fi ndings, and facilitates business exchange, through: the Achieving Six Stars in Sydney publication of books, monographs, proceedings, and reports; the organization of world congresses, Ethical Implications of international, regional, and specialty conferences The Skyscraper Race and workshops; the maintaining of an extensive website and tall building databases of built, under Tall Buildings in Numbers: construction, and proposed buildings; the Unfi nished Projects distribution of a monthly international tall building e-newsletter; the maintaining of an Talking Tall: Ben van Berkel international resource center; the bestowing of annual awards for design and construction excellence and individual lifetime achievement; the management of special task forces/working groups; the hosting of technical forums; and the publication of the CTBUH Journal, a professional journal containing refereed papers written by researchers, scholars, and practicing professionals. -

Competing in the Global Truck Industry Emerging Markets Spotlight

KPMG INTERNATIONAL Competing in the Global Truck Industry Emerging Markets Spotlight Challenges and future winning strategies September 2011 kpmg.com ii | Competing in the Global Truck Industry – Emerging Markets Spotlight Acknowledgements We would like to express our special thanks to the Institut für Automobilwirtschaft (Institute for Automotive Research) under the lead of Prof. Dr. Willi Diez for its longstanding cooperation and valuable contribution to this study. Prof. Dr. Willi Diez Director Institut für Automobilwirtschaft (IfA) [Institute for Automotive Research] [email protected] www.ifa-info.de We would also like to thank deeply the following senior executives who participated in in-depth interviews to provide further insight: (Listed alphabetically by organization name) Shen Yang Senior Director of Strategy and Development Beiqi Foton Motor Co., Ltd. (China) Andreas Renschler Member of the Board and Head of Daimler Trucks Division Daimler AG (Germany) Ashot Aroutunyan Director of Marketing and Advertising KAMAZ OAO (Russia) Prof. Dr.-Ing. Heinz Junker Chairman of the Management Board MAHLE Group (Germany) Dee Kapur President of the Truck Group Navistar International Corporation (USA) Jack Allen President of the North American Truck Group Navistar International Corporation (USA) George Kapitelli Vice President SAIC GM Wuling Automobile Co., Ltd. (SGMW) (China) Ravi Pisharody President (Commercial Vehicle Business Unit) Tata Motors Ltd. (India) © 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved. Competing in the Global Truck Industry – Emerging Markets Spotlight | iii Editorial Commercial vehicle sales are spurred by far exceeded the most optimistic on by economic growth going in hand expectations – how can we foresee the with the rising demand for the transport potentials and importance of issues of goods. -

JA Solar Module

JA Solar Overview Protect the one Earth we all share, for this and future generations. Company Profile Headquarters Shanghai, China (with EU, US & Japan Offices) Founded / IPO May 2005 / February 2007 Business c-Si solar module & cell supplier Shipments 1.69GW in 2011 Attributes World class quality, efficiency, and cost structure Capacity (Annual) 3GW Cell, 2.0 GW Module, 1.0 GW Wafer Ticker Symbol JASO (NASDAQ) Employees ~12,000 2 JA Solar Holdings Co., Ltd. (Module) 2012 Optimized Vertical Integration Model SILICON SILICON WAFERS CELL MODULE SYSTEMS Solar Wafers Solar Cells PV Modules EPC • Low-cost, high-quality • One of the world’s largest • High-quality product with • Partnering with top-tier production manufacturers high-quality BOM developers in China • Recognized for top tech at • Additional channel for • Leading the industry in low cost product distribution • Cooperation with global high-efficiency wafer • High-performance mono- • Working with leading leading IPPs on utility research and multi-crystalline solar brands on OEM modules scale projects cells JA Solar Holdings Co., Ltd. (Module) 2012 JA SOLAR Nationwide Production Plant Lianyungang Wafer Facility 500MW Capacity Yanjiao Wafer Facility 500MW Capacity Ningjin Cell Facility 1200MW Capacity Shanghai Head Quarter Yangzhou Cell Facility Hefei Solar Products Facility 1800MW Capacity Fengxian Module Facility 3GW Capacity (Started from Y11) State-of-the-art PV R&D Center 1500MW Capacity Current Module Capacity 500MW Above data will be valid until Q4, 2012. JA Solar Holdings Co., Ltd. (Module) 2012 Featured Projects Partnership with world leading independent power producers for utility scale PV projects Macy’s, New Jersey, USA Lingwu, Ningxia, China Giuliano, Italy 1.1 MW Project 40 MW Project 20.4 MW Project JA Solar Holdings Co., Ltd. -

A Discursive Project of Low-Carbon City in Shenzhen, China

Anti-Carbonism or Carbon Exceptionalism: A Discursive Project of Low-Carbon City in Shenzhen, China Yunjing Li Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy under the Executive Committee of the Graduate School of Arts and Sciences COLUMBIA UNIVERSITY 2019 2019 Yunjing Li All rights reserved ABSTRACT Anti-Carbonism or Carbon Exceptionalism: A Discursive Project of Low-Carbon City in Shenzhen, China Yunjing Li As the role of cities in addressing climate change has been increasingly recognized over the past two decades, the idea of a low-carbon city becomes a dominant framework to organize urban governance and envision a sustainable urban future. It also becomes a development discourse in the less developed world to guide the ongoing urbanization process. China’s efforts toward building low-carbon cities have been inspiring at first and then obscured by the halt or total failure of famous mega-projects, leading to a conclusion that Chinese low-carbon cities compose merely a strategy of green branding for promoting local economy. This conclusion, however, largely neglects the profound implications of the decarbonization discourse for the dynamics between the central and local governments, which together determine the rules and resources for development practices. The conclusion also hinders the progressive potentials of the decarbonization discourse in terms of introducing new values and norms to urban governance. This dissertation approaches “low-carbon cities” as a part of the decarbonization -

Final Report

25 June 2015 Final Report Assessment of the normative and policy framework governing the Chinese economy and its impact on international competition For: AEGIS EUROPE Brussels Belgium THINK!DESK China Research & Consulting Prof. Dr. Markus Taube & Dr. Christian Schmidkonz GbR Merzstrasse 18 81679 München Tel.: +49 - (0)89 - 26 21 27 82 [email protected] www.thinkdesk.de 1 This report has been prepared by: Prof. Dr. Markus Taube Peter Thomas in der Heiden 2 Contents Executive Summary ························································································· 11 1. Introduction ······························································································ 27 Part I: The Management of the Chinese Economy: Institutional Set-up and Policy Instruments 2. Centralised Planning and Market Forces in the Chinese Economy ··················· 32 2.1 The Role of Planning in the Chinese Economy ············································ 32 2.1.1 Types of Plans ··············································································· 32 2.1.2 Plans and Complementary Documents················································ 41 2.2 Dedicated Government Programmes for Industry Guidance ··························· 45 2.2.1 Subsidies – An Overview ································································· 45 2.2.1.1 Examples for Preferential Policies and Grant Giving Operations by Local Governments ································································ 51 2.2.1.2 Recent Initiatives by the Central Government -

China Autos Asia China Automobiles & Components

Deutsche Bank Markets Research Industry Date 18 May 2016 China Autos Asia China Automobiles & Components Vincent Ha, CFA Fei Sun, CFA Research Analyst Research Analyst (+852 ) 2203 6247 (+852 ) 2203 6130 [email protected] [email protected] F.I.T.T. for investors What you should know about China's new energy vehicle (NEV) market Many players, but only a few are making meaningful earnings contributions One can question China’s target to put 5m New Energy Vehicles on the road by 2020, or its ambition to prove itself a technology leader in the field, but the surge in demand with 171k vehicles sold in 4Q15 cannot be denied. Policy imperatives and government support could ensure three-fold volume growth by 2020, which would make China half of this developing global market. New entrants are proliferating, with few clear winners as yet, but we conclude that Yutong and BYD have the scale of NEV sales today to support Buy ratings. ________________________________________________________________________________________________________________ Deutsche Bank AG/Hong Kong Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 057/04/2016. Deutsche Bank Markets Research Asia Industry Date China 18 May 2016 Automobiles & China -

Solar Is Driving a Global Shift in Electricity Markets

SOLAR IS DRIVING A GLOBAL SHIFT IN ELECTRICITY MARKETS Rapid Cost Deflation and Broad Gains in Scale May 2018 Tim Buckley, Director of Energy Finance Studies, Australasia ([email protected]) and Kashish Shah, Research Associate ([email protected]) Table of Contents Executive Summary ......................................................................................................... 2 1. World’s Largest Operational Utility-Scale Solar Projects ........................................... 4 1.1 World’s Largest Utility-Scale Solar Projects Under Construction ............................ 8 1.2 India’s Largest Utility-Scale Solar Projects Under Development .......................... 13 2. World’s Largest Concentrated Solar Power Projects ............................................... 18 3. Floating Solar Projects ................................................................................................ 23 4. Rooftop Solar Projects ................................................................................................ 27 5. Solar PV With Storage ................................................................................................. 31 6. Corporate PPAs .......................................................................................................... 39 7. Top Renewable Energy Utilities ................................................................................. 44 8. Top Solar Module Manufacturers .............................................................................. 49 Conclusion ..................................................................................................................... -

Anchor Channel Typical Product Catalogue Contents Advantage and Application

Anchor Channel Typical Product Catalogue Contents Advantage and Application 1. Advantage and A lication ··································································································· 01 pp Good Anti-corrosion Performance Wide Application Low Construction Cost Stainless Steel ---Austenitic Architectural Facade/ Public Facility Simple Tools 2. Product Performance Testing ······························································································ 02 Stainless Steel / Rail Transportation Less Installation Time Structural Steel---Hot Dip / Indoor Decoration Easy Installation 3. Order Instruction ····················································································································· 04 Galvanization 4. Material and Process ···············································································································06 5. Anchor Channel Calculation ································································································ 08 Simple Installation Strong Reliability High Construction Safety . Minimum dge istance and n 6 E D Mi imum Bolt Spacing ····················································09 Bolted Connection without Welding No Impact on Main Structure No Welding Sparks Adjustable Installation Position Force Bearing No Noise or Vibration 7.Welded Anchor Channel ········································································································· 10 No Damage on the Steel Bars 8. Casted Anchor Channel •········································································································ -

A-Share Research Highlights (CMS Research Center) HSI 22,915.28 -38.44 -0.17 1

本报告仅限被授权人内参 RICH资讯-发布最快的最新股票研究报告 请勿外传扩散,发现立停且不退费且追责,请知悉 www.181818.info Hong Kong Morning Daily Sep 16, 2013 (Monday) 晨会报告 HK Indices Last price chg % chg A-share Research Highlights (CMS Research Center) HSI 22,915.28 -38.44 -0.17 1. Automobile industry – comment on new air pollution control policy Finance 31,872.59 -27.79 -0.09 Properties 29,752.90 -234.2 -0.78 [Fang Xiaojian, Sept. 13, 2013] The State Council officially issued the Air Utilities 50,280.41 224.0 0.45 Pollution Prevention and Treatment Initiative, which includes six measures 13,407.88 -24.51 -0.18 to tackle automobile-related air pollution such as strengthening traffic Commerce&Industry HSCEI 10,538.94 -98.59 -0.93 management, upgrading fuel quality and accelerating the elimination of HSCCI 4,418.32 -0.02 0.00 “yellow label” vehicles (those that fail to meet the rudimentary emission HKSPGEM 428.67 3.00 0.70 standard). We believe the Initiative will have a huge impact on the automotive industry. Commercial vehicles will benefit from higher emission World Indices Last price chg % chg standards and the priority on public transport. New energy vehicles will be FTSE 100 6,583.80 -5.18 -0.08 further promoted. Automobile dismantling and inspection will also benefit. DAX 30 8,509.42 15.42 0.18 But the control on ownership volume and increased costs for usage would CAC 40 4,114.50 7.87 0.19 hurt consumption. Companies that benefit from the policy include: Weifu DJIA 15,376.06 75.42 0.49 High-Technology Group (000581), BYD (002594), Anhui Jianghuai S&P500 1,687.99 4.57 0.27 Nasdaq Automobile (600418), Zhengzhou Yutong Bus (600066), Anhui Ankai Composite 3,722.18 6.22 0.17 Automobile (000868), Miracle Automation Engineering (002009), China Nikkei 225 14,404.67 17.40 0.12 Automotive Engineering Research Institute (601965), etc. -

Oreba-Xiaoyu ZHANG

Status of LFP industry and market in China & its readiness to support the transport electrification Xiaoyu ZHANG, SynPLi Consulting Email: [email protected] Agenda Up-stream: LFP in China Mid-stream: LIB in China • LIB market: LIB for xEV application • Key LIB players assessment Down-stream: transport electrification • xEV market • Policy and strategy trend of main OEMs Conclusions and outlook Up-stream: LFP in China 54,000 ton in 2013 Pylon Hangsheng LFP in 2013: 3500 ton Up-stream: LFP in China China 17% More optimistic Less optimistic Cathode active materials in 2025: > 330 000 Tons ASSUMPTIONS : Portable devices: 2010-2025: +11% per year in volume World HEV 4,8 M HEV/year in 2020 - 35% LIB 6,8 M HEV in 2025 90% LIB P-HEV 0,4 M P-HEV/year in 2020, 0,7 M in 2025 100% LIB EV 1M EV/year in 2020, 1,5M/year in 2025 100% LIB Courtesy of Avicenne Energy LIB business revenues (10 8 RMB) 90 Mid-stream: LIB in China 80 70 Lishen 60 World: LIB demand @13CY ( 51,500 MWh) 50 ATL 40 BAK Others 30 BYD Nalon 20 Coslight Wisewod 10 Mcnair 0 Great power 2008 2009 2010 2011 2012 2013 TCL Optimum China LIB supply @13CY ( 17,650 MWh) Veken Lishen Gxgk Po B&K ATL Oceansun Pr BYD UTL BAK HYB Cy AEE Coslight Tianmao 0,00 200,00 400,00 600,00 800,00 1000,00 First First Coslight BAK China LIB export BYD 4,0% @13CY: 7% ATL Japan Lishen Korea LEJ 25,9% 27,2% AESC Cy Pr Po&La China Hitachi Others Sony 42,9% Panasonic LG Chem SDI Courtesy of RealLi Research China LIB demand @13CY: 14000MWh Mid-stream: LIB in China China LIB production @13CY (unit: -

Download Automotive Patent Trends 2019 – Technologies

A U T O M O T I V E P A T E N T T R E N D S 2 0 1 9 Cipher Automotive is the only patent intelligence software that includes a taxonomy of over 200 technologies critical to the future of the car AU T O M O T I V E @ C I P H E R . A I Cipher Automotive Patent Trends 2019 provides a strategic overview of patented technologies in Foreword the sector. Patent intelligence is critical at a time when there is an accelerating shifrom conventional technologies to connectivity, autonomy, shared services and electrification. It is not only the OEMs and their suppliers who are investing billions in automotive R&D, but an entire network of technology companies and a vast swathe of start-ups that are now able to participate at a time when barriers to entry have been lowered. These dynamics are placing increasing pressure on legal, intellectual property and R&D teams alike. We have now reached the point where there are over two million new patents published a year, and it is harder than ever to understand whether the patents you own are the ones that truly serve your business objectives. Advances in AI have made it possible to access information about who owns patented technology. The analysis of technologies and companies in the pages that follow were generated in less than 4 hours - by a machine that does not tire, drink coffee or take holidays. Nigel Swycher, CEO and Steve Harris, CTO This section covers nine technology areas within the automotive industry, identifies the top patent Section 1: owners, shows the growth of patenting, highlights a few important technologies within each area, and includes league tables across the major geographies. -

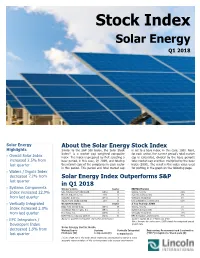

Solar Energy Stock Index Q1 2

Stock Index Solar Energy Q1 2018 Solar Energy About the Solar Energy Stock Index Highlights Similar to the S&P 500 Index, the Solar Stock is set to a base index, in this case, 1000. Next, (1) Index is a market cap weighted composite for each sector, the current period’s total market Overall Solar Index index. The index is prepared by first selecting a cap is calculated, divided by the base period’s increased 2.5% from base period, in this case, Q1 2009, and totaling total market cap and then multiplied by the base last quarter the market caps of the companies in each sector index (1000). The result is the index value used in this period. This period and total market cap for plotting in the graph on the following page. Wafers / Ingots Index decreased 7.2% from Solar Energy Index Outperforms S&P last quarter in Q1 2018 Systems Components Winner’s Circle Sector EBITDA Margins Index increased 22.9% GCL-Poly Energy Holdings Ltd. (26%) W Wafers / Ingots 28% Motech Industries, Inc. 21% S Systems Components 6% from last quarter Canadian Solar Inc. (27%) I Vertically Integrated 8% Azure Power Global Limited 31% D EPC Integrators / Developers 55% Vertically Integrated Worst Performers Sector 3 Year Revenue CAGR Daqo New Energy Corp. (68%) W Wafers / Ingots 5% Index increased 2.0% SolarEdge Technologies, Inc. (59%) S Systems Components 0% from last quarter First Solar, Inc. (60%) I Vertically Integrated 13% BCPG Public Company Limited (52%) D EPC Integrators / Developers 71% Based on quarter-over-quarter share price performance Source: Capital