Integrated Report 2018(10MB)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alma Eikoh Japan Large Cap Equity Fund a Sub-Fund of Alma Capital Investment Funds SICAV

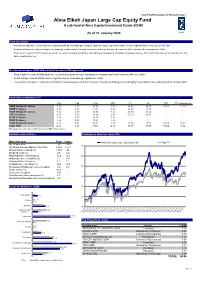

FOR PROFESSIONAL INVESTORS ONLY Alma Eikoh Japan Large Cap Equity Fund A sub-fund of Alma Capital Investment Funds SICAV As of 31 January 2020 Eikoh Fund description • Investment objective: seek long-term capital growth by investing generally in Japanese large cap stocks (with market capitalisation in excess of US$ 1bn) • Investment process: analyse long term company fundamentals through extensive in-house bottom up research with a strong risk management ethos • Portfolio of around 25-30 companies which are well managed, profitable and with good prospects. Portfolio managers believe that Cash Flow Return on Investment and value creation are key Investment manager: ACIM (Alma Capital Investment Management) • Alma Capital Investment Management is a Luxembourg based asset management company and holds a branch office in London • ACIM manages assets of $4bn and is regulated by the Luxembourg regulator the CSSF • The portfolio managers, led by James Pulsford, worked together at Eikoh Research Investment Management managing the portfolio before joining ACIM in January 2020 Cumulative performance (%) 1 M 3 M 6 M YTD 1Y 3Y ITD ITD (annualized) I GBP Hedged C shares -0.29 4.47 12.94 -0.29 24.54 26.44 86.03 11.36 I GBP C shares -0.58 2.63 4.95 -0.58 23.80 24.93 - - I EUR Hedged C shares -0.43 4.29 12.94 -0.43 23.69 23.44 - - I JPY C shares -0.35 4.53 13.85 -0.35 25.10 26.48 - - I EUR C shares 1.36 5.60 14.74 1.36 - - - - I EUR D shares 1.36 5.58 14.67 1.36 - - - - I USD Hedged C shares -0.20 5.06 14.81 -0.20 27.84 33.92 94.05 12.47 Topix (TR) -2.14 1.21 8.88 -2.14 10.17 18.46 53.20 7.86 Fund launched on 12 June 2014 (I USD Hedged C and I GBP Hedged C shares) Portfolio characteristics Performance (Indexed - Base 100) Main indicators Fund Index Alma Eikoh Japan Large Cap Equity Fund Topix TR No. -

List of Certified Facilities (Cooking)

List of certified facilities (Cooking) Prefectures Name of Facility Category Municipalities name Location name Kasumigaseki restaurant Tokyo Chiyoda-ku Second floor,Tokyo-club Building,3-2-6,Kasumigaseki,Chiyoda-ku Second floor,Sakura terrace,Iidabashi Grand Bloom,2-10- ALOHA TABLE iidabashi restaurant Tokyo Chiyoda-ku 2,Fujimi,Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku 1-8-1 Yurakucho, Chiyoda-ku banquet kitchen The Peninsula Tokyo hotel Tokyo Chiyoda-ku 24th floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Peter The Peninsula Tokyo hotel Tokyo Chiyoda-ku Boutique & Café First basement, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku Second floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Hei Fung Terrace The Peninsula Tokyo hotel Tokyo Chiyoda-ku First floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Lobby 1-1-1,Uchisaiwai-cho,Chiyoda-ku TORAYA Imperial Hotel Store restaurant Tokyo Chiyoda-ku (Imperial Hotel of Tokyo,Main Building,Basement floor) mihashi First basement, First Avenu Tokyo Station,1-9-1 marunouchi, restaurant Tokyo Chiyoda-ku (First Avenu Tokyo Station Store) Chiyoda-ku PALACE HOTEL TOKYO(Hot hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku Kitchen,Cold Kitchen) PALACE HOTEL TOKYO(Preparation) hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku LE PORC DE VERSAILLES restaurant Tokyo Chiyoda-ku First~3rd floor, Florence Kudan, 1-2-7, Kudankita, Chiyoda-ku Kudanshita 8th floor, Yodobashi Akiba Building, 1-1, Kanda-hanaoka-cho, Grand Breton Café -

United Japan Growth Fund

United Japan Growth Fund Semi Annual Report for the half year ended 30 June 2021 United Japan Growth Fund (Constituted under a Trust Deed in the Republic of Singapore) MANAGER UOB Asset Management Ltd Registered Address: 80 Raffles Place UOB Plaza Singapore 048624 Company Registration No. : 198600120Z Tel: 1800 22 22 228 DIRECTORS OF UOB ASSET MANAGEMENT LTD Lee Wai Fai Eric Tham Kah Jin PehKianHeng Thio Boon Kiat TRUSTEE State Street Trust (SG) Limited 168 Robinson Road #33-01, Capital Tower Singapore 068912 CUSTODIAN / ADMINISTRATOR / REGISTRAR State Street Bank and Trust Company, acting through its Singapore Branch 168 Robinson Road #33-01, Capital Tower Singapore 068912 AUDITOR PricewaterhouseCoopers LLP 7 Straits View, Marina One East Tower, Level 12 Singapore 018936 SUB-MANAGER Fukoku Capital Management, Inc. 1-3-1 Uchisaiwaicho Chiyoda-Ku Saiwai Building 3rd Floor Tokyo 100-0011, Japan -1- United Japan Growth Fund (Constituted under a Trust Deed in the Republic of Singapore) A) Fund Performance Since Inception 18 August 3yr 5yr 10 yr 1995 3mth 6mth 1yr Ann Ann Ann Ann Fund Performance/ % % % Comp Comp Comp Comp Benchmark Returns Growth Growth Growth Ret Ret Ret Ret United Japan Growth Fund -2.42 -2.27 16.23 3.68 5.17 4.75 2.57 Benchmark -0.24 3.01 20.29 6.73 10.16 8.13 0.60 Source: Morningstar. Note: The performance returns of the Fund are in Singapore Dollar based on a NAV-to-NAV basis with dividends and distributions reinvested, if any. The benchmark of the Fund: Aug 95 – Dec 04: Nikkei 225 Stock Average; Jan 05 – Dec 10: Topix; Jan 11 to Present: MSCI Japan Index. -

Tokyo GB Eng.Pdf

http://www.kankyo.metro.tokyo.jp/en/index.html Introduction In the year 2000, the Tokyo Metropolitan Government (TMG) replaced the Tokyo Metropolitan Pollution Prevention Ordinance with the Tokyo Metropolitan Environmental Security Ordinance, which covers countermeasures for vehicle pollution, chemical substances and climate change. The reason for the replacement was a shift in Tokyo’s environmental problems from industrial pollution mainly attributable to factories to urban and domestic pollution due to vehicle emissions and chemical substances, which may sometimes be related to climate change problems. In 2002, we started two programmes on which Tokyo’s present climate change strategy has been based: Tokyo Green Building Program for new buildings and Tokyo Carbon Reduction Reporting Program for existing large facilities. Since 2005, we have been promoting environmentally superior developments by introducing a mechanism to evaluate and disclose facilities’ efforts made in the programmes. In Tokyo’s Big Change - The 10-Year Plan developed in 2006, we set a goal of reducing citywide greenhouse gas emissions by 25% below 2000 levels by 2020 to make Tokyo a city with the least environmental impact in the world. Then in 2007, we announced the Tokyo Climate Change Strategy, which clarified our basic attitude toward tackling climate change for the next 10 years. Following a revision of the Tokyo Metropolitan Environmental Security Ordinance in 2008, we launched the Tokyo Cap-and-Trade Program for large facilities, the world’s first urban cap- and-trade scheme that covers office buildings as well, and the Carbon Reduction Reporting Program for small and medium facilities, committed to advancing our climate change strategy ever since then. -

Tel.03-3246-3236 時代を動かすランドマーク̶̶ 汐留シティセンター。

Specifications 物件概要 Building Profile 名 称 汐留シティセンター Name Shiodome City Center 所在地 東京都港区東新橋1丁目5番2号 Location Higashi-Shimbashi 1-Chome 5-2, Minato-ku, Tokyo 交 通 都営大江戸線「汐留」駅、新交通ゆりかもめ「新橋」駅:徒歩1分 Access 1-minute walk : Oedo Line-Shiodome Station, Yurikamome Line-Shimbashi Station 都営浅草線「新橋」駅:徒歩2分 2-minute walk : Asakusa line-Shimbashi Station JR線、東京メトロ「新橋」駅:徒歩3分 3-minute walk : JR, Ginza Line-Shimbashi Station 主要用途 事務所、店舗 Primary uses Office and retail 構 造 鉄骨造、鉄骨鉄筋コンクリート造 Primary structure type Steel, steel framed reinforced concrete 敷地面積 19,708.33㎡(B街区全体) Site area 19,708.33㎡ (Block B) 延床面積 210,154.24 ㎡(63,571.66坪) Building area 210,154.24㎡ (63,571.66 tsubo) 総貸付面積(事務所) 106,219.57 ㎡(32,131.42坪)[コア内3,132.12㎡(947.46坪)] Rentable area (offices) 106,219.57㎡(32,131.42 tsubo) [within core 3,132.12㎡(947.46 tsubo)] 階 数 地上43階、地下4階、塔屋1階 No. of stories 43 above-ground floors, 4 underground, 1 penthouse 最高高さ GL+215.75 m Max. height GL+215.75m 竣 工 2003年1月 Completion January, 2003 設 計 ケビンローシュ・ジョンディンカルー・アンド・アソシエイツ Architects Kevin Roche, John Dinkeloo and Associates 共同設計 日本設計 Co-Architect Nihon Sekkei Inc. 施 工 竹中工務店 Main contractor Takenaka Corporation プロジェクト・マネジメント 三井不動産 Project management Mitsui Fudosan Co., Ltd. Developers Alderney Investments Pte Ltd., Mitsui Fudosan Co., Ltd. 貸 主 アルダニー・インベストメンツ、三井不動産 Parking capacity 443 vehicles (for Shiodome City Center) 駐車台数 443台(汐留シティセンター分) Elevators (for passengers) Low-rise bank (1F, 4F-12F): Seven elevators (24 persons each) エレベーター設備(乗用) 低 層:24人乗×7基(1F・ 4F-12F) Mid-rise bank (1F, 13F-22F): Eight elevators (24 persons each) -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

The Demonstra#On of Smart City and Expansion to the Urban Disaster

1 The demonstraon of smart city and expansion to the urban disaster recovery promo-on area in Japan Toshiba corporaon Community Solu-on Div. Yoshimasa Kudo 2 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 3 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 4 Roadmap of smart city project 2009 2010 2011 2012 2013 2014 2015 - Miyako island smart grid project Energy stabilization Demand response project Effects & evaluaon of large PV/ many PV Distribution network system of next generations Energy management of Realiza<on of electric and thermal control smart city Energy conservaon project (BEMS/HEMS) Demonstration Smart EV project of basic technology (EV charging) New Mexico smart grid project (Overseas project) & others Demonstration The four-location smart city operational experiments (Japanese project) & others of smart city Business model project Earthquake (DR, Aggregator) 5 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 6 Miyako island smart grid system 7 Major smart city project in Japan 4 areas were selected as the smart city of first pilot -

Delivering the Performance We Promised

Delivering the Performance We Promised Solid progress under our long-term plan, backed by a strong focus on our core businesses of holding, trading and management, has positioned Mitsui Fudosan to drive sustainable growth as a leader at every stage of Japan’s real estate value chain. Annual Report 2006 Year ended March 31, 2006 High-potential developments and… Contents 1 Delivering the Performance We Promised 18 Management Business 24 Six-Year Summary 4 To Our Stakeholders 20 Corporate Social Responsibility 25 Management’s Discussion and Analysis 10 Holding Business 22 Corporate Governance 36 Consolidated Financial Statements 14 Trading Business 23 Management Team 59 Corporate Information Capturing opportunities in new growth segments of the real estate market will lay the groundwork for the next generation of expansion. Nihonbashi Mitsui Tower Exemplifying our commitment to enhancing the richness of Nihonbashi’s past with modern amenities, this 39-story high-rise complex complements the historically significant Mitsui Main Building with leading-edge office space and the Mandarin Oriental Hotel. 1 ...solid financial structure... An improved debt/equity ratio and a heightened emphasis on cash flow and less capital-intensive businesses give Mitsui Fudosan the flexibility to invest for growth. Tokyo Midtown Set to open in spring 2007, Tokyo Midtown will offer office, retail and residential facilities. A Ritz-Carlton Hotel and the Suntory Museum of Art will add further appeal to this innovative urban development. 2 Shibaura Island Project This impressive urban housing development will feature 4,000 condominium units, including both units for sale and rental apartments, on a 60,000 square-meter site. -

CSR Report 2005

CSR Report 2005 ANA Group Corporate outline (as of April 1, 2005) CONTENTS Company name Message from the President 1 All Nippon Airways Co., Ltd. ANA CSR Message 2 President Mineo Yamamoto 2004 Highlights 6 Date of establishment December 27, 1952 ANA’s CSR Address As a company trusted by society Shiodome City Center,1-5-2 Higashi-Shimbashi, Minato-ku, Tokyo 105-7133, Japan ANA’s CSR 12 Website URL ANA’s Management Style 14 http:// www.ana.co.jp Paid-in capital ¥107,292 million Approach to Safety Number of employees Aiming for the world’s highest levels of safety 12,091 Approach to Safety 18 Number of routes and flights Domestic service : 132 routes, 865 flights per day International service : 35 routes, 488 flights per week Engagement with Stakeholders As a good corporate citizen Customers 24 Outline Communities and Society 28 Editorial Policy Next Generation 32 We published the CSR Report as a new tool for communication. This Report presents plain and simple Business Partners 35 descriptions of our CSR activities to a wide range of stakeholders. Employees 36 * For more details about our environmental activities, please refer to the ANA Group Together with Our Stakeholders 40 Environmental White Paper. Activities and data not included in the Report will be available on a CSR information page on our website – ANA Sky Web. Organizations Covered Approach to the Environment In principle, the ANA Group as a whole. For contribution to a sustainable society (Some activities are distinct to All Nippon Airways Co., Ltd. or its group companies.) -

MITSUI FUDOSAN Co., Ltd

Case Study LCM Service Mitsui Fudosan Co., Ltd. The rapid growth of the shared office business, driven by the government-promoted work style reform sustained by a PC deployment and management support service Mitsui Fudosan Co., Ltd., one of Japan’s leading real estate companies, has recently launched a new shared office business called “Work Styling,” aimed at companies promoting “work style reform.” The new business offers some 30 office locations in major cities all over Japan, used by a fast-growing list of corporate clients. When the business was initially launched, however, there were difficulties with the installation and management of PCs for use by the “concierges” of the shared office spaces. Fujitsu’s LCM Service not only resolved the issue, but it also helped to accelerate expansion of office sites. Challenges Results PCs for reception and networking needed to be installed Rapid PC installation and support for work sites using Help Desk, at at locations around Japan in a short time pace with rapid expansion in office sites With more and more sites, the people in charge of Lower PC installation work load enabled a shift in resources to the installation faced a growing work load planning of new office sites and enhanced services An increasingly heavy work load to deal with PC-related Using Help Desk to respond to inquiries from concierges reduced the inquiries from the concierges at each office site management work load of people in charge LCM Service (PC installation and management at growing number sites across Japan) / PCs, Products and Services printers, Office 365, IT Policy N@vi Aim Installation, management, and support of PCs for reception Reason To deal with national expansion and use Help Desk Key point Support for installation/management to enable shared office setup in a short time With increasing shared office sites, been focused on work style reform. -

Non-Existing Governmental Bodies)

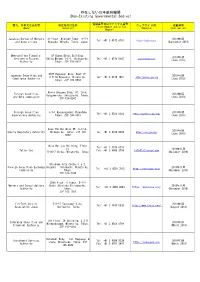

存在しない日本政府機関 (Non-Existing Governmental Bodies) 電話番号又はファックス番号 商号、名称又は氏名等 所在地又は住所 ウェブサイトURL 掲載時期 (Phone Number and/or Fax (Name) (Location) (Website) (Publication) Number) Japanese Bureau of Mergers 31 floor, Midtown Tower, 9-7-1 2019年9月 Tel: +81 3 4572 0701 https://japbma.org/ and Acquisitions Akasaka, Minato, Tokyo, Japan (September 2019) Metropolitan Financial 8F Humax Ebisu Building, 2019年6月 Services & Futures Ebisu Minami 1-1-1, Shibuya-ku, Tel: +81 3 4579 5647 www.mfinsfa.com (June 2019) Authority Tokyo, ZIP 150-0022 STEP Roppongi Bldg. West 1F, Japanese Securities and 2019年6月 6-8-10 Roppongi, Minato-ku, Tel: +81 3 4510 7897 http://jaseca-gov.org Compliance Authority (June 2019) Tokyo, ZIP 106-0032 World Udagawa Bldg. 6F, 36-6, Foreign Securities 2019年6月 Udagawa-cho, Shibuya-ku, Tokyo, and Bond commission (June 2019) ZIP 150-0042 Foreign Securities 3-7-1 Kasumigaseki,Chiyodaku 2019年6月 Tel: +81 3 4520 8922 https://www.fssa-gov.org/ Supervisory Authority Tokyo, ZIP 100-0013 (June 2019) Axes 7th Building 6F, 3-17-4, 2019年6月 Equity Regulatory Authority Shibuya-ku, Tokyo, ZIP 150- Tel: +81 3 4520 8934 https://era-gov.org/ (June 2019) 0002 Mita Belljyu Building, Floor Tel: +81 3 4579 0731 24, 2018年11月 Tatler Cox Fax: +81 3 6800 2769 [email protected] 5-36-7 Shiba, Minato-ku, Tokyo (November 2018) Shiodome City Center 1-5-2, Foreign Securities Exchange Higashi - Shinbashi, Minato-ku, 2018年11月 Tel: +81 3 4510 7815 http://fsec-gov.org/ Commission Tokyo, (November 2018) ZIP 105-7140 29th floor, C tower, 3-7-1 Mergers and Consolidations Nishi -

Mitsui Fudosan and LINK-J to Participate in the BRAVE

Press Release December 7, 2016 Beyond Next Ventures Life Science Innovation Network Japan, Inc. (LINK-J) Mitsui Fudosan Co. Ltd. Mitsui Fudosan and LINK-J to Participate in the BRAVE Acceleration Program as Partners to Support Business Startups of University-originated Technology Business Ventures Life Sciences Award established at the Final Examination to invite the winner to a U.S. event organized by Biocom, with approximately 800 members around the world Tokyo, Japan, December 7, 2016 - Life Science Innovation Network Japan Inc. (LINK-J), an incorporated association founded by Mitsui Fudosan Co., Ltd. (Mitsui Fudosan) and a group of volunteers from academia, and Mitsui Fudosan are pleased to announce that they will take part in the BRAVE Acceleration Program operated by Beyond Next Ventures Inc. (Beyond Next Ventures), a company making incubation investments in university-originated technology business ventures, as corporate partners. Beyond Next Ventures is a venture capital firm with strength in incubation investments in university-originated technology business ventures at the seed level in the fields of medical and health care, robots, artificial intelligence (AI), Internet of Things (IoT), big data and other advanced technologies. In November 2016, it moved its head office from Chiyoda-ku to Nihonbashi in Chuo-ku in Tokyo, where life sciences firms are clustered. Its president and representative director Tsuyoshi Ito serves as a LINK-J Supporter*. Outline of the BRAVE Acceleration Program The BRAVE Acceleration Program is a platform that helps researchers and entrepreneurs in universities and research institutes and those aiming for commercialization to launch business based on innovative technologies. It is intended to offer knowledge, expertise and a network for achieving commercialization.