Official Record of Proceedings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OFFICIAL RECORD of PROCEEDINGS Monday, 13 July 2015 the Council Continued to Meet at Nine O'clock

LEGISLATIVE COUNCIL ─ 13 July 2015 14421 OFFICIAL RECORD OF PROCEEDINGS Monday, 13 July 2015 The Council continued to meet at Nine o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.M., G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN THE HONOURABLE LEE CHEUK-YAN THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, G.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE WONG KWOK-HING, B.B.S., M.H. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P., Ph.D., R.N. 14422 LEGISLATIVE COUNCIL ─ 13 July 2015 THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, S.B.S., J.P. THE HONOURABLE RONNY TONG KA-WAH, S.C. THE HONOURABLE CYD HO SAU-LAN, J.P. THE HONOURABLE STARRY LEE WAI-KING, J.P. DR THE HONOURABLE LAM TAI-FAI, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, J.P. THE HONOURABLE CHAN KIN-POR, B.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. DR THE HONOURABLE LEUNG KA-LAU THE HONOURABLE CHEUNG KWOK-CHE THE HONOURABLE WONG KWOK-KIN, S.B.S. -

Progress on Reading to Learn in Hong Kong Primary Schools

“The basis of their reading experience”: Progress on Reading to Learn in Hong Kong Primary Schools Po Shan Susana Lau Teacher Librarian HKIED Jockey Club Primary School Hong Kong Peter Warning Lecturer University of Hong Kong Hong Kong A key government education policy in Hong Kong is Reading to Learn, introduced in 2000. Cultivating an independent reading habit is identified as one of the “Seven Learning Goals” to be achieved by 2014. This paper reports the results of a small-scale pilot study designed to inform a more comprehensive future survey implemented jointly by the Education and Manpower Bureau and the Hong Kong Teacher Librarians Association to measure the effectiveness of Reading to Learn. Introduction “Were we to choose our leaders on the basis of their reading experience and not their political programs, there would be much less grief on earth.” Joseph Brodsky (Nobel Prize acceptance speech, 1987) A key government education policy – one of the “Four Key Tasks” – in Hong Kong is Reading to Learn , introduced in 2000. Cultivating an independent reading habit is identified as one of the “Seven Learning Goals” to be achieved by 2014 (EMB Education & Manpower Bureau, 2004). To provide support for Reading to Learn , government-funded primary schools in Hong Kong have been encouraged to appoint teacher librarians (TLs). The duties of the TLs are to manage their schools’ libraries and promote Reading to Learn . This paper reports the results of a small-scale pilot study designed to inform a more comprehensive future survey implemented jointly by the Education and Manpower Bureau (EMB) and the Hong Kong Teacher Librarians Association (HKTLA) to measure the effectiveness of Reading to Learn . -

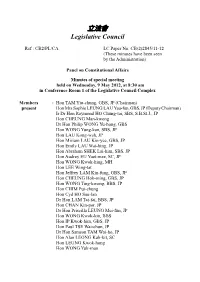

Minutes Have Been Seen by the Administration)

立法會 Legislative Council Ref : CB2/PL/MP/1 LC Paper No. CB(2)357/05-06 (These minutes have been seen by the Administration) Panel on Manpower Minutes of meeting held on Thursday, 20 October 2005 at 2:30 pm in Conference Room A of the Legislative Council Building Members : Hon LAU Chin-shek, JP (Chairman) present Hon KWONG Chi-kin (Deputy Chairman) Hon LEE Cheuk-yan Hon CHAN Yuen-han, JP Hon LEUNG Yiu-chung Hon Jasper TSANG Yok-sing, GBS, JP Hon Andrew CHENG Kar-foo Hon Tommy CHEUNG Yu-yan, JP Hon Frederick FUNG Kin-kee, JP Hon WONG Kwok-hing, MH Hon Andrew LEUNG Kwan-yuen, SBS, JP Hon LEUNG Kwok-hung Member : Hon LI Fung-ying, BBS, JP absent Public Officers : Item I attending Mr Stephen IP Secretary for Economic Development and Labour Mr Matthew CHEUNG Kin-chung Permanent Secretary for Economic Development and Labour (Labour) Mrs Jennie CHOR Deputy Commissioner for Labour (Labour Administration) - 2 - Mrs DO PANG Wai-yee Assistant Commissioner for Labour (Policy Support and Strategic Planning) Mr Byron NG Assistant Commissioner for Labour (Employment Services) (Acting) Item II Prof Arthur K C LI, GBS, JP Secretary for Education and Manpower Mrs Fanny LAW, GBS, JP Permanent Secretary for Education and Manpower Mr Edward YAU, JP Deputy Secretary for Education and Manpower 1 Clerk in : Mrs Sharon TONG attendance Chief Council Secretary (2) 1 Staff in : Mr Raymond LAM attendance Senior Council Secretary (2) 5 Ms Alice CHEUNG Legislative Assistant (2)1 Action I. Briefing by Secretary for Economic Development and Labour on the Chief Executive's 2005-2006 Policy Address relating to labour portfolio (LC Paper No. -

OFFICIAL RECORD of PROCEEDINGS Wednesday, 17

LEGISLATIVE COUNCIL ─ 17 November 2010 2033 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 17 November 2010 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN IR DR THE HONOURABLE RAYMOND HO CHUNG-TAI, S.B.S., S.B.ST.J., J.P. THE HONOURABLE LEE CHEUK-YAN DR THE HONOURABLE DAVID LI KWOK-PO, G.B.M., G.B.S., J.P. THE HONOURABLE FRED LI WAH-MING, S.B.S., J.P. DR THE HONOURABLE MARGARET NG THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHEUNG MAN-KWONG THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE MRS SOPHIE LEUNG LAU YAU-FUN, G.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE PHILIP WONG YU-HONG, G.B.S. 2034 LEGISLATIVE COUNCIL ─ 17 November 2010 THE HONOURABLE LAU KONG-WAH, J.P. THE HONOURABLE LAU WONG-FAT, G.B.M., G.B.S., J.P. THE HONOURABLE MIRIAM LAU KIN-YEE, G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE ANDREW CHENG KAR-FOO THE HONOURABLE TIMOTHY FOK TSUN-TING, G.B.S., J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, S.B.S., J.P. THE HONOURABLE LI FUNG-YING, S.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE AUDREY EU YUET-MEE, S.C., J.P. -

Permanent Secretary, Chief Executive's Office Session No

Index Page Replies to supplementary questions raised by Finance Committee Members in examining the Estimates of Expenditure 2014-15 Controlling Officer : Permanent Secretary, Chief Executive's Office Session No. : 10 File Name : CEO-2S-e1.docx Reply Serial Question No. Serial No. Name of Member Head Programme S-CEO01 S0089 CHAN Ka-lok, Kenneth 21 (2) Executive Council S-CEO02 SV020 FAN Kwok-wai, Gary 21 (1) Chief Executive's Office S-CEO03 S0096 HO Sau-lan, Cyd 21 (1) Chief Executive's Office (2) Executive Council Examination of Estimates of Expenditure 2014-15 Reply Serial No. S-CEO01 CONTROLLING OFFICER’S REPLY (Question Serial No. S0089) Head: (21) Chief Executive’s Office Subhead (No. & title): (-) Not Specified Programme: (2) Executive Council Controlling Officer: Permanent Secretary, Chief Executive’s Office (Ms Alice LAU) Director of Bureau: Director of the Chief Executive’s Office This question originates from: Question: Would the Administration inform this Committee of the attendance rates of Non-official Members at the meetings of the Executive Council in each of the past 3 years using the following table? Name Total no. of No. of meetings No. of meetings No. of withdrawals meetings held attended not attended from discussions Asked by: Hon CHAN Ka-lok, Kenneth Reply: The Executive Council (ExCo) Secretariat keeps minutes of every ExCo meeting, which record, among other things, Members’ attendance and withdrawals from discussions. Since Non-official Members may need to withdraw from the discussion of individual items due to conflict of interest, and the conflict of interest involved may vary from one discussion item to another, the attendance rates of Members alone cannot accurately reflect their participation. -

Introduction: the Uniqueness of Hong Kong Democracy

Notes Introduction: The Uniqueness of Hong Kong Democracy 1 . Charles Tilly, Democracy (New York: Cambridge University Press, 2007), p. 7. 2 . Ibid . 3 . Ibid ., p. 9. 4 . Ibid . 5 . Ibid ., p. xi. 6 . Ibid . 7 . Ibid ., p. 13. 8 . Charles Tilly, Trust and Rule (New York: Cambridge University Press, 2005), p. 12. 9 . Ibid. 10 . Ibid ., p. 104. 11 . Tilly, Democracy , p. 135. 12 . Ibid ., p. 136. 13 . Ibid ., p. 146. 14 . Ibid ., pp. 110–111. 15 . Ibid ., p. 110. 16 . Ibid ., p. 135. 17 . David Potter, “Explaining Democratization,” in David Potter, David Goldblatt, Margaret Kiloh and Paul Lewis, eds., Democratization (Cambridge: Polity Press, 1997), pp. 3–5. 18 . See, for example, Seymour Martin Lipset, Political Man (London: Heinemann, 1983). 19 . Ibid ., p. 21. 20 . Ibid . 21 . Ibid . 22 . Ibid ., p. 15. 23 . Guillermo O’Donnell and Philippe C. Schmitter, Transition from Authoritarian Rule: Tentative Conclusions about Uncertain Democracies (Baltimore, Maryland: Johns Hopkins University Press, 1986). 24 . Potter, “Explaining Democratization,” p. 29. 25 . Samuel P. Huntington, The Third Wave: Democratization in the Late Twentieth Century (Norman: University of Oklahoma Press, 1993), p. 7. 26 . Ibid ., p. 38. 27 . Ibid ., pp. 65–66. 28 . Ibid ., p. 73. 29 . Ibid ., p. 86. 30 . Ibid ., pp. 93–94. 31 . Ibid ., p. 100. 32 . Ibid ., p. 122. 33 . Ibid ., p. 123. 34 . Ibid ., p. 142. 160 Notes 161 35 . Ibid ., p. 151. 36 . Ibid ., pp. 152–153. 37 . Ibid ., p. 159. 38 . Ibid ., p. 159. 39 . Ibid ., p. 171. 40 . Ibid ., p. 192. 41 . Ibid ., p. 199. 42 . Ibid ., p. 202. 43 . Ibid ., p. -

Ourhkfoundation Art Book We

About the Authors Introduction: Our Museums the Hidden Gems of Hong Kong 3 CHANG HSIN-KANG (H. K. CHANG) Professor H.K. Chang received and holds one Canadian patent. In his B.S. in Civil Engineering from addition, he has authored 11 books National Taiwan University (1962), in Chinese and 1 book in English, M.S. in Structural Engineering from mainly on education, cultures and Stanford University (1964) and Ph.D. civilizations. His academic interests in Biomedical Engineering from now focus on cultural exchanges Northwestern University (1969). across the Eurasian landmass, particularly along the Silk Road. Having taught at State University of New York at Buffalo (1969-76), McGill Professor Chang is a Foreign Member University (1976-84) and the University of Royal Academy of Engineering of of Southern California (1984-90), he the United Kingdom and a Member of became Founding Dean of School of the International Eurasian Academy Engineering at Hong Kong University of Sciences. of Science and Technology (1990- 94) and then Dean of School of He was named by the Government Engineering at the University of of France to be Chévalier dans l’Ordre Pittsburgh (1994-96). Professor Chang National de la Légion d’Honneur in served as President and University 2000, decorated as Commandeur Professor of City University of Hong dans l’Ordre des Palmes Académiques Kong from 1996 to 2007. in 2009, and was awarded a Gold Bauhinia Star by the Hong Kong SAR In recent years, Professor Chang has Government in 2002. taught general education courses at Tsinghua University, Peking University, Professor Chang served as Chairman China-Europe International Business of the Culture and Heritage School and Bogazici University in Commission of Hong Kong (2000- Istanbul. -

Minutes Have Been Seen by the Administration)

立法會 Legislative Council Ref : CB2/PL/CA LC Paper No. CB(2)2845/11-12 (These minutes have been seen by the Administration) Panel on Constitutional Affairs Minutes of special meeting held on Wednesday, 9 May 2012, at 8:30 am in Conference Room 1 of the Legislative Council Complex Members : Hon TAM Yiu-chung, GBS, JP (Chairman) present Hon Mrs Sophie LEUNG LAU Yau-fun, GBS, JP (Deputy Chairman) Ir Dr Hon Raymond HO Chung-tai, SBS, S.B.St.J., JP Hon CHEUNG Man-kwong Dr Hon Philip WONG Yu-hong, GBS Hon WONG Yung-kan, SBS, JP Hon LAU Kong-wah, JP Hon Miriam LAU Kin-yee, GBS, JP Hon Emily LAU Wai-hing, JP Hon Abraham SHEK Lai-him, SBS, JP Hon Audrey EU Yuet-mee, SC, JP Hon WONG Kwok-hing, MH Hon LEE Wing-tat Hon Jeffrey LAM Kin-fung, GBS, JP Hon CHEUNG Hok-ming, GBS, JP Hon WONG Ting-kwong, BBS, JP Hon CHIM Pui-chung Hon Cyd HO Sau-lan Dr Hon LAM Tai-fai, BBS, JP Hon CHAN Kin-por, JP Dr Hon Priscilla LEUNG Mei-fun, JP Hon WONG Kwok-kin, BBS Hon IP Kwok-him, GBS, JP Hon Paul TSE Wai-chun, JP Dr Hon Samson TAM Wai-ho, JP Hon Alan LEONG Kah-kit, SC Hon LEUNG Kwok-hung Hon WONG Yuk-man - 2 - Members : Hon LEE Cheuk-yan attending Prof Hon Patrick LAU Sau-shing, SBS, JP Hon KAM Nai-wai, MH Hon Starry LEE Wai-king, JP Hon Paul CHAN Mo-po, MH, JP Hon Albert CHAN Wai-yip Members : Hon Albert HO Chun-yan absent Dr Hon Margaret NG Hon LAU Wong-fat, GBM, GBS, JP Hon Timothy FOK Tsun-ting, GBS, JP Hon Ronny TONG Ka-wah, SC Hon Mrs Regina IP LAU Suk-yee, GBS, JP Public Officers : Office of the Chief Executive-elect attending Mrs Fanny LAW FAN Chiu-fun Head -

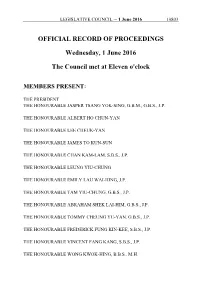

Official Record of Proceedings

LEGISLATIVE COUNCIL ─ 1 June 2016 10803 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 1 June 2016 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.M., G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN THE HONOURABLE LEE CHEUK-YAN THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, G.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE VINCENT FANG KANG, S.B.S., J.P. THE HONOURABLE WONG KWOK-HING, B.B.S., M.H. 10804 LEGISLATIVE COUNCIL ─ 1 June 2016 PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P., Ph.D., R.N. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, S.B.S., J.P. THE HONOURABLE CYD HO SAU-LAN, J.P. THE HONOURABLE STARRY LEE WAI-KING, J.P. DR THE HONOURABLE LAM TAI-FAI, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, J.P. THE HONOURABLE CHAN KIN-POR, B.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. DR THE HONOURABLE LEUNG KA-LAU THE HONOURABLE CHEUNG KWOK-CHE THE HONOURABLE WONG KWOK-KIN, S.B.S. -

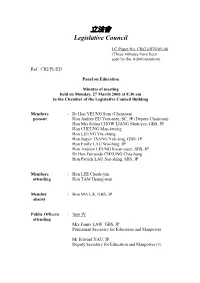

Minutes Have Been Seen by the Administration)

立法會 Legislative Council LC Paper No. CB(1)2469/11-12 (These minutes have been seen by the Administration) Ref : CB1/PL/ITB/1 Panel on Information Technology and Broadcasting Minutes of special meeting held on Monday, 28 May 2012, at 4:30 pm in Conference Room 2A of the Legislative Council Complex Members present : Hon WONG Yuk-man (Chairman) Dr Hon Samson TAM Wai-ho, JP (Deputy Chairman) Hon LAU Kong-wah, JP Hon Emily LAU Wai-hing, JP Hon Timothy FOK Tsun-ting, GBS, JP Hon LEE Wing-tat Hon Andrew LEUNG Kwan-yuen, GBS, JP Hon WONG Ting-kwong, BBS, JP Hon Ronny TONG Ka-wah, SC Hon Cyd HO Sau-lan Hon IP Kwok-him, GBS, JP Hon Mrs Regina IP LAU Suk-yee, GBS, JP Member absent : Hon CHAN Kam-lam, SBS, JP Public officers : Agenda item I attending Mrs Fanny LAW FAN Chiu-fun Head of the Chief Executive-elect's Office - 2 - Ms Alice LAU Yim Secretary-General of the Chief Executive-elect's Office Mr Joe WONG, JP Deputy Secretary for Commerce and Economic Development (Communications and Technology) Miss Joey LAM, JP Deputy Government Chief Information Officer (Policy and Customer Service) Mr Johann WONG Deputy Commissioner for Innovation & Technology Clerk in attendance : Ms YUE Tin-po Chief Council Secretary (1)3 Staff in attendance : Mr Andy LAU Assistant Secretary General 1 Mr Joey LO Senior Council Secretary (1)3 Ms May LEUNG Legislative Assistant (1)3 Action I. Proposal to set up a Technology and Communications Bureau under the proposed re-organization of the Government Secretariat (LC Paper No. -

Minutes Have Been Seen by the Administration)

立法會 Legislative Council LC Paper No. CB(2)1879/05-06 (These minutes have been seen by the Administration) Ref : CB2/PL/ED Panel on Education Minutes of meeting held on Monday, 27 March 2006 at 8:30 am in the Chamber of the Legislative Council Building Members : Dr Hon YEUNG Sum (Chairman) present Hon Audrey EU Yuet-mee, SC, JP (Deputy Chairman) Hon Mrs Selina CHOW LIANG Shuk-yee, GBS, JP Hon CHEUNG Man-kwong Hon LEUNG Yiu-chung Hon Jasper TSANG Yok-sing, GBS, JP Hon Emily LAU Wai-hing, JP Hon Andrew LEUNG Kwan-yuen, SBS, JP Dr Hon Fernando CHEUNG Chiu-hung Hon Patrick LAU Sau-shing, SBS, JP Members : Hon LEE Cheuk-yan attending Hon TAM Heung-man Member : Hon MA Lik, GBS, JP absent Public Officers : Item IV attending Mrs Fanny LAW, GBS, JP Permanent Secretary for Education and Manpower Mr Edward YAU, JP Deputy Secretary for Education and Manpower (1) - 2 - Miss Vivian LAU Deputy Secretary for Education and Manpower (6) Mr Michael V STONE, JP Secretary-General, University Grants Committee Mr Peter CHEUNG Executive Director Hong Kong Council for Academic Accreditation Mr LI Wing Controller, Student Financial Assistance Agency Miss Charmaine LEE Principal Assistant Secretary for Education and Manpower (Higher Education) Resource Person Joint Quality Review Committee Prof Philip YEUNG Chairman City University of Hong Kong Ms Jennifer NG Principal, Community College Ms Wanda LAU Vice Principal (Academic), Community College Hong Kong Baptist University Dr Simon WONG Dean of School of Continuing Education Dr Ella CHAN Associate Dean and Head -

香港特別行政區排名名單 the Precedence List of the Hong Kong Special Administrative Region

二零二一年九月 September 2021 香港特別行政區排名名單 THE PRECEDENCE LIST OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION 1. 行政長官 林鄭月娥女士,大紫荊勳賢,GBS The Chief Executive The Hon Mrs Carrie LAM CHENG Yuet-ngor, GBM, GBS 2. 終審法院首席法官 張舉能首席法官,大紫荊勳賢 The Chief Justice of the Court of Final The Hon Andrew CHEUNG Kui-nung, Appeal GBM 3. 香港特別行政區前任行政長官(見註一) Former Chief Executives of the HKSAR (See Note 1) 董建華先生,大紫荊勳賢 The Hon TUNG Chee Hwa, GBM 曾蔭權先生,大紫荊勳賢 The Hon Donald TSANG, GBM 梁振英先生,大紫荊勳賢,GBS, JP The Hon C Y LEUNG, GBM, GBS, JP 4. 政務司司長 李家超先生,SBS, PDSM, JP The Chief Secretary for Administration The Hon John LEE Ka-chiu, SBS, PDSM, JP 5. 財政司司長 陳茂波先生,大紫荊勳賢,GBS, MH, JP The Financial Secretary The Hon Paul CHAN Mo-po, GBM, GBS, MH, JP 6. 律政司司長 鄭若驊女士,大紫荊勳賢,GBS, SC, JP The Secretary for Justice The Hon Teresa CHENG Yeuk-wah, GBM, GBS, SC, JP 7. 立法會主席 梁君彥議員,大紫荊勳賢,GBS, JP The President of the Legislative Council The Hon Andrew LEUNG Kwan-yuen, GBM, GBS, JP - 2 - 行政會議非官守議員召集人 陳智思議員,大紫荊勳賢,GBS, JP The Convenor of the Non-official The Hon Bernard Charnwut CHAN, Members of the Executive Council GBM, GBS, JP 其他行政會議成員 Other Members of the Executive Council 史美倫議員,大紫荊勳賢,GBS, JP The Hon Mrs Laura CHA SHIH May-lung, GBM, GBS, JP 李國章議員,大紫荊勳賢,GBS, JP Prof the Hon Arthur LI Kwok-cheung, GBM, GBS, JP 周松崗議員,大紫荊勳賢,GBS, JP The Hon CHOW Chung-kong, GBM, GBS, JP 羅范椒芬議員,大紫荊勳賢,GBS, JP The Hon Mrs Fanny LAW FAN Chiu-fun, GBM, GBS, JP 黃錦星議員,GBS, JP 環境局局長 The Hon WONG Kam-sing, GBS, JP Secretary for the Environment # 林健鋒議員,GBS, JP The Hon Jeffrey LAM Kin-fung, GBS, JP 葉國謙議員,大紫荊勳賢,GBS, JP The Hon