The NBN's Impact on Telstra, Iinet And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Court of Australia

FEDERAL COURT OF AUSTRALIA Roadshow Films Pty Ltd v iiNet Limited (No. 3) [2010] FCA 24 SUMMARY Citation: Roadshow Films Pty Ltd v iiNet Limited (No. 3) [2010] FCA 24 Parties: Roadshow Films Pty Ltd (ACN 100 746 870) and the parties in the attached Schedule I v iiNet Limited (ACN 068 628 937) File number: NSD 1802 of 2008 Judge: COWDROY J Date of judgment: 4 February 2010 Roadshow Films Pty Ltd v iiNet Limited (No. 3) [2010] FCA 24 SUMMARY 1 In accordance with the practice of the Federal Court in some cases of public interest, importance or complexity, the following summary has been prepared to accompany the orders made today. This summary is intended to assist in understanding the outcome of this proceeding and is not a complete statement of the conclusions reached by the Court. The only authoritative statement of the Court's reasons is that contained in the published reasons for judgment which will be available on the internet at www.fedcourt.gov.au. 2 The judgment in this proceeding is necessarily complicated both as to fact and law. It is also lengthy, running for 636 paragraphs and almost 200 pages. I have decided to provide short oral reasons for the judgment which I am presently to hand down. These reasons are not intended to be a substitute for reading the judgment itself which will be accessible online this morning. 3 This proceeding raises the question whether an internet service provider or ISP authorises the infringement of copyright of its users or subscribers when they download cinematograph films in a manner which infringes copyright. -

TPG Telecom Limited and Its Controlled Entities ABN 46 093 058 069

TPG Telecom Limited and its controlled entities ABN 46 093 058 069 Annual Report Year ended 31 July 2016 2 TPG Telecom Limited and its controlled entities Annual report For the year ended 31 July 2016 Contents Page Chairman’s letter 3 Directors’ report 5 Lead auditor’s independence declaration 34 Consolidated income statement 35 Consolidated statement of comprehensive income 36 Consolidated statement of financial position 37 Consolidated statement of changes in equity 38 Consolidated statement of cash flows 39 Notes to the consolidated financial statements 40 Directors’ declaration 91 Independent auditor’s report 92 ASX additional information 94 3 TPG Telecom Limited and its controlled entities Chairman’s letter For the year ended 31 July 2016 Dear Shareholders On behalf of the Board of Directors, I am pleased to present to you the TPG Telecom Limited Annual Report for the financial year ended 31 July 2016 (“FY16”). Financial Performance FY16 was another successful year for the Group. Continued organic growth and the integration of iiNet into the business have resulted in further increases in revenue, profits and dividends for shareholders. FY16 represents the eighth consecutive year that this has been the case. A detailed review of the Group’s operating and financial performance for the year is provided in the Operating and Financial Review section of the Directors’ Report starting on page 7 of this Annual Report, and set out below are some of the key financial highlights and earnings attributable to shareholders from the year. FY16 FY15 Movement Revenue ($m) 2,387.8 1,270.6 +88% EBITDA ($m) 849.4 484.5 +75% NPAT ($m) 379.6 224.1 +69% EPS (cents/share) 45.3 28.2 +61% Dividends (cents/share) 14.5 11.5 +26% iiNet Acquisition At the beginning of FY16 we completed the acquisition of iiNet and consequently there has been significant focus during the year on integrating the businesses to improve the efficiency of the combined organisation. -

Approved Securities List

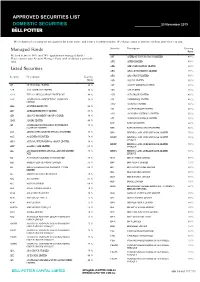

APPROVED SECURITIES LIST DOMESTIC SECURITIES 23 November 2019 The inclusion of a security on our approval list is not advice and is not a recommendation. We change ratios at any time without prior notice to you. Security Description Gearing Managed Funds Ratio We lend between 50% and 70% against most managed funds. APT AFTERPAY TOUCH GROUP LIMITED 40 % Please contact your Account Manager if you wish to discuss a particular fund. APX APPEN LIMITED 40 % Listed Securities ARB ARB CORPORATION LIMITED. 60 % ARG ARGO INVESTMENTS LIMITED 75 % Security Description Gearing ARQ ARQ GROUP LIMITED 50 % Ratio ASB AUSTAL LIMITED 50 % 3PL 3P LEARNING LIMITED.. 40 % AST AUSNET SERVICES LIMITED 65 % A2B A2B AUSTRALIA LIMITED 50 % ASX ASX LIMITED 70 % A2M THE A2 MILK COMPANY LIMITED NZ 40 % AUB AUB GROUP LIMITED 40 % AAC AUSTRALIAN AGRICULTURAL COMPANY 50 % AVJ AVJENNINGS LIMITED 40 % LIMITED. AWC ALUMINA LIMITED 70 % ABA AUSWIDE BANK LTD 40 % AX1 ACCENT GROUP LIMITED 50 % ABC ADELAIDE BRIGHTON LIMITED 65 % AYS AMAYSIM AUSTRALIA LIMITED 50 % ABP ABACUS PROPERTY GROUP STAPLED 50 % AZJ AURIZON HOLDINGS LIMITED 70 % ADH ADAIRS LIMITED 40 % BAP BAPCOR LIMITED 60 % AFI AUSTRALIAN FOUNDATION INVESTMENT 75 % COMPANY LIMITED BBN BABY BUNTING GROUP LIMITED 50 % AGI AINSWORTH GAME TECHNOLOGY LIMITED 55 % BEN BENDIGO AND ADELAIDE BANK LIMITED 70 % AGL AGL ENERGY LIMITED. 70 % BENPE BENDIGO AND ADELAIDE BANK LIMITED 70 % LPYR6UT AHG AUTOMOTIVE HOLDINGS GROUP LIMITED. 50 % BENPF BENDIGO AND ADELAIDE BANK LIMITED 70 % AHY ASALEO CARE LIMITED 65 % LPYR6UT AIA AUCKLAND INTERNATIONAL AIRPORT LIMITED 70 % BENPG BENDIGO AND ADELAIDE BANK LIMITED 70 % NZX LPYR3UT ALF AUSTRALIAN LEADERS FUND LIMITED 50 % BGA BEGA CHEESE LIMITED 60 % ALG ARDENT LEISURE GROUP LIMITED 55 % BHP BHP GROUP LIMITED 75 % ALI ARGO GLOBAL LISTED INFRASTRUCTURE 60 % BIN BINGO INDUSTRIES LIMITED 50 % LIMITED BKL BLACKMORES LIMITED 60 % ALL ARISTOCRAT LEISURE LIMITED 70 % BKW BRICKWORKS LIMITED 60 % ALQ ALS LIMITED 65 % BLD BORAL LIMITED. -

Quarterly Investment Update Antares High Growth Shares Fund – June 2021

Quarterly Investment Update Antares High Growth Shares Fund – June 2021 For adviser use only Highlights for the quarter Performance: The Fund returned 9.6% (net of fees) for the June quarter, outperforming its benchmark by 1.3%. Contributors to performance: Positive contributors – Aristocrat Leisure, Telix Pharmaceuticals, Megaport, Boral, Woodside (not owned); Negative contributors – Incitec Pivot, Qantas, ANZ, Resmed (not owned) and Altium (not owned). Stock activity: Buys/additions – Ansell, Downer and TPG Telecom ; Sells/reductions – BlueScope Steel, Boral, Endeavour Group and Worley Fund snapshot Inception date 7 December 1999 Benchmark S&P/ASX 200 Total Return Index To outperform the benchmark (after fees) over rolling Investment objective 5-year periods Investment returns as at 30 June 20211 Period 3 months 1 year 3 years pa 5 years pa 10 years pa Since inception pa Net return2 % 9.6 39.9 9.2 12.6 10.0 11.0 Gross return3 % 9.9 41.9 10.5 13.9 11.2 12.5 Benchmark return % 8.3 27.8 9.6 11.2 9.3 8.5 Net excess return % 1.3 12.1 -0.4 1.4 0.7 2.5 Gross excess return % 1.6 14.1 0.9 2.7 1.9 4.0 1 Past performance is not a reliable indicator of future performance. Returns are not guaranteed and actual returns may vary from any target returns described in this document. 2 Investment returns are based on exit prices, and are net of management fees and assume reinvestment of all distributions. Contributors to performance Pleasingly the Fund enjoyed another strong quarter, returning 9.6% (net of fees) vs the benchmark return of 8.3%. -

Bringing the Future Faster

6mm hinge Bringing the future faster. Annual Report 2019 WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Bringing the future faster Spark New Zealand Annual Report 2019 Bringing the future faster Contents Build customer intimacy We need to understand BRINGING THE FUTURE FASTER and anticipate the needs of New Zealanders, and Spark performance snapshot 4 technology enables us Chair and CEO review 6 to apply these insights Our purpose and strategy 10 to every interaction, Our performance 12 helping us serve our Our customers 14 customers better. Our products and technology 18 Read more pages 7 and 14. Our people 20 Our environmental impact 22 Our community involvement 24 Our Board 26 Our Leadership Squad 30 Our governance and risk management 32 Our suppliers 33 Leadership and Board remuneration 34 FINANCIAL STATEMENTS Financial statements 38 Notes to the financial statements 44 Independent auditor’s report 90 OTHER INFORMATION Corporate governance disclosures 95 Managing risk framework roles and 106 responsibilities Materiality assessment 107 Stakeholder engagement 108 Global Reporting Initiative (GRI) content 109 index Glossary 112 Contact details 113 This report is dated 21 August 2019 and is signed on behalf of the Board of Spark New Zealand Limited by Justine Smyth, Chair and Charles Sitch, Chair, Audit and Risk Management Committee. Justine Smyth Key Dates Annual Meeting 7 November 2019 Chair FY20 half-year results announcement 19 February 2020 FY20 year-end results announcement 26 August 2020 Charles Sitch Chair Audit and Risk Management Committee WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Create New Zealand’s premier sports streaming business Spark Sport is revolutionising how New Zealanders watch their favourite sports events. -

Australian Equity Microcap Insights

UBS Asset Management For professional / qualified / institutional investors only. May 2020 Australian Equity Microcap Insights Opportunities abound in Microcap space As the economy moves into the post COVID-19 recovery phase, UBS Microcap Fund Portfolio Manager Joel Fleming expects microcap companies to be an important contributor to the recovery, Joel Fleming with many smaller firms driving high levels Portfolio Manager Yarra Capital Management of growth as they take advantage of the lasting changes caused by the pandemic. There are a large number of common misconceptions Microcap recap about the contribution made by Australia’s smaller firms to Microcaps offer the largest investable universe by number the domestic economy. Some of Joels’s favourites include: on the ASX. With no ETF or passive products, a more constrained liquidity profile compared to large caps, and a • “Micro companies are largely in retail and service vast investable universe, Microcap investing is all about sectors and employ relatively few people in active management. comparison to larger firms” The index represents opportunity, with many examples of • “Micro and small companies tend to not be profitable. companies that have delivered on an idea and transitioned Profits in Australia are driven by large firms in the into the sphere of Australia’s Top 100 listed companies. mining, banks, supermarket and health care sectors” Think Afterpay, A2 Milk, Domino’s Pizza or TPG Telecom. • “Micro companies pay small dividends and have low While much of the universe will deliver poor returns, operating margins. Investing in the space is all about despite the hype and promise, the success stories can capital growth” deliver many multiples of an initial investment. -

Ci Australian Equities Fund

CI AUSTRALIAN EQUITIES FUND QUARTERLY COMMENTARY REPORT Cooper Investors Pty Limited AFS Licence Number 221794 ABN 26 100 409 890 For current performance information please refer to the Monthly Performance Report. JUNE 2021 “Wise men speak because they have something to say: fools because they have to say something.” Plato “Faced with the choice between changing one’s mind and proving that there is no need to do so, almost everyone gets busy on the proof.” John Kenneth Galbraith **PORTFOLIO #BENCHMARK VALUE ADDED ROLLING 3 MONTH 9.13% 8.29% 0.84% ROLLING 1 YEAR 28.02% 27.80% 0.22% ROLLING 3 YEAR 10.82% 9.58% 1.24% ROLLING 5 YEAR 11.76% 11.16% 0.60% ROLLING 7 YEAR 11.32% 8.79% 2.53% ROLLING 10 YEAR 12.59% 9.26% 3.33% SINCE INCEPTION* 12.55% 8.98% 3.57% SINCE INCEPTION^ 844.84% 411.66% 433.18% *Annualised ^Cumulative (4 July 2002) **Before fees and expenses #S&P ASX 200 Accumulation Index Past performance is not necessarily a reliable indicator of future performance CI Australian Equities Fund - Gross of Fees $1,000 Invested Since Inception $9,800 $8,800 $7,800 $6,800 $5,800 $4,800 $3,800 $2,800 $1,800 $800 CI Australian Equities Fund S&P ASX 200 Accumulation Index Source: NAB Asset Servicing 1 CI AUSTRALIAN EQUITIES FUND QUARTERLY COMMENTARY REPORT Cooper Investors Pty Limited AFS Licence Number 221794 ABN 26 100 409 890 For current performance information please refer to the Monthly Performance Report. JUNE 2021 CI Australian Equities vs ASX200 (since inception to 30-Jun 2021) 16% CI Australian Equities 12% S&P 500 ASX 200 Acc. -

1. Shareholdings in Public and Private Companies (Including Holding

Form A 3 March 2020 Surname: Mclachlan Other names: Andrew State/Territory: SA Date: 3/03/2020 1. Shareholdings in public and private companies (including holding companies) indicating the name of the company or companies (Note: It is NOT necessary to declare the size or value of the shareholding) Name of company – (including holding and subsidiary companies if applicable) OATMILL HOLDINGS PTY LTD AUSTOFIX GROUP LTD VITRO SOFTWARE HOLDINGS (Designated Activity Company) ALUMINA LIMITED ANTIPODES GLOBAL INVESTMENT COMPANY LTD ANZ BANKING GROUP LIMITED AP EAGERS LIMITED ARISTOCRAT LEISURE LIMITED BHP GROUP LIMITED BORAL LIMITED CLEANAWAY WASTE MANAGEMENT LTD COMMONWEALTH BANK OF AUSTRALIA CORPORATE TRAVEL MANAGEMENT LIMITED COSTA GROUP HOLDINGS LIMITED GRAINCORP LIMITED ILUKA RESOURCES LIMITED LI LONG SHORT FUND LIMITED MACQUARIE GROUP LIMITED MINERAL RESOURCES LIMITED Form A NAOS EMERG OPP CO LTD NINE ENTERTAINMENT co HLDGS LTD OOH!MEDIA LIMITED ORIGIN ENERGY LIMITED ORORA LIMITED QBE INSURANCE GROUP LIMITED QUBE HOLDINGS LIMITED RELIANCE WORLDWIDE CORPORATION LIMITED SIMS LIMITED SONIC HEALTHCARE LIMITED SOUTH32 LIMITED S32 THE STAR ENTERTAINMENT GROUP LTD TPG TELECOM LIMITED TPM WAM LEADERS LIMITED WAM MICROCAP LIMITED WESFARMERS LIMITED WESTPAC BANKING CORPORATION WOODSIDE PETROLEUM LIMITED WORLEY LIMITED NATIONAL STORAGE REIT STPLD SEC AMCOR PLC JANUS HENDERSON GROUP PLC SPARK NEW ZEALAND LIMITED VIRGIN MONEY UK PLC ANZ BANK UNSEC NON-CUM PARADICE GLOBAL SMALL CAP FUND PLATINUM EUROPEAN FUND WESTPAC CAPITAL NOTES 2. Family and business -

Ausbil Australian Emerging Leaders Fund (ARSN 089 995 442) (Fund)

Contactus@ ausbil.com.au Ausbil Investment Ausbil Australian Emerging Management Limited ABN 26 076 316 473 AFSL 229722 Leaders Fund Level 27 225 George Street Sydney NSW 2000 Monthly performance update GPO Box 2525 Sydney NSW 2001 July 2020 Phone 61 2 9259 0200 Fax 61 2 9259 0222 ‘We have now entered the FY 2020 reporting Fund Characteristics season in which companies will reveal the full Returns1 as at 31 July 2020 impact, so far, of Covid-19 on this year’s financial Period Fund Bench- Out/Under Return1 mark2 performance performance and balance sheets’ % % % 1 month 3.44 1.85 1.59 Performance Review 3 months 13.77 13.14 0.64 Fund performance for July 2020 was +3.44% (net of fees), versus the 6 months -9.97 -8.32 -1.65 benchmark return of +1.85%. The benchmark is represented by a FYTD 3.44 1.85 1.59 composite, 70% of the S&P/ASX MidCap 50 Accumulation Index, and CYTD -6.89 -4.39 -2.49 30% of the S&P/ASX Small Ordinaries Accumulation Index. 1 year -8.26 -4.05 -4.21 At a sector level, the overweight positions in the Materials, Financials 3 years pa 3.96 7.14 -3.18 and Information Technology sectors added to relative performance. The underweight positions in Industrials, Health Care and Real Estate also 5 years pa 6.03 9.36 -3.32 added to relative performance. Conversely, the overweight positions in 7 years pa 8.14 10.26 -2.13 the Consumer Staples and Communication Services sectors detracted 10 years pa 7.44 7.94 -0.51 from relative performance. -

Extreme Weather Events Impact Service in the South West District of Western Australia Iinet Group Reference ID: 2529877

CUSTOMER SERVICE NOTICE FROM IINET GROUP (IINET LTD, WESTNET PTY LTD, NETSPACE PTY LTD, AAPT CONSUMER DIVISION, INTERNODE PTY LTD, TRANSACT CAPITAL COMMUNICATIONS PTY LTD) Extreme Weather events impact service in the South West district of Western Australia iiNet Group reference ID: 2529877 The iiNet Group (iiNet Ltd, Westnet Pty Ltd, Netspace Pty Ltd, Internode Pty Ltd, AAPT Consumer Division and TransACT Capital Communications Pty Ltd) is currently working to manage the impact to its network that has occurred as a result of a series of lightning strikes and some heavy rain in the South West district of Western Australia on or about Wednesday 17 April. Lightning strikes and heavy rain have caused notable damage to the network, rendering some services faulty, as referred to in Telstra Wholesales Mass Service Disruption Notification which can be found at http://telstra.com. au/abouttelstra/commitments/mass-service-disruption/. A copy of this notice will also be published in the West Australian on 26 April 2013. The iiNet Group is working closely with suppliers and wholesalers to assess and repair the damage to affected services in a timely manner. Customers in these regions may experience service disruptions and delays to normal connection times and fault restoration. Because these events are outside the iiNet Group’s control, iiNet is claiming an exemption under Section 21 of the Telecommunications (Customer Service Guarantee) Standard 2011 from the normal performance standards. The exemption shall apply from 18 April 2013 to 3 May 2013 inclusive. This date is indicative only; customers should anticipate that some further delays may occur. -

Study of Mobile Telecommunications Markets in NZ Submission

Study of mobile telecommunications markets in NZ Submission | Commerce Commission 26 October 2018 Public Version Contents Executive Summary .............................................................................................................. 1 Introduction ........................................................................................................................... 4 1. Current market outcomes .................................................................................................. 5 Assessing competition and market outcomes .................................................................... 5 Price, quality and innovation .............................................................................................. 6 Data the paper seeks further information on ...................................................................... 7 2. Looking forward .............................................................................................................. 13 5G network deployment ................................................................................................... 15 Emerging trends .............................................................................................................. 17 Promoting 5G deployment ............................................................................................... 23 3. Industry structure ............................................................................................................ 24 MVNOs ........................................................................................................................... -

Australian Broadband Regulation Reviewed

Australian Journal of Telecommunications and the Digital Economy Australian Broadband Regulation Reviewed Troy S Barry The University of Western Australia Abstract: This article establishes the relationship between the condition of Australian broadband services and Australia’s history of broadband regulation. It briefly surveys the history of the industry in terms of government action and firms’ responses. It reviews research on the effects of regulation and industry concentration internationally, which indicates that the effects of widely deployed policies are often small or undetectable. The article uses these findings to build models of national broadband prices, penetration and quality. The models are verified using recent statistics from developed economies, confirming that outcomes are little affected by access regulation, and also not by market concentration. Penetration and quality are strongly affected by technology factors. The models and the regulatory history are used to explain the condition of Australian broadband services, and to extract lessons applicable to future policy development. Keywords: Broadband, Australia, Regulation, Market power, Network technology. Introduction Australian regulation of fixed broadband networks was broadly consistent with other developed economies until 2009, when NBN Co was established as a government-owned monopoly. Australian consumers are currently less satisfied with Internet services than with mobile phone or fixed line telephone services, and are particularly dissatisfied with Internet data speeds, service costs and the speed of fault repairs (ACMA_2017, pp. 60-61). Successive government policies are regularly criticised as contributing to poor Australian outcomes, but how much impact does policy actually have, compared to the impact of other economic and demographic factors? This article explores this question through an international comparison.