Australian Broadband Regulation Reviewed

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Court of Australia

FEDERAL COURT OF AUSTRALIA Roadshow Films Pty Ltd v iiNet Limited (No. 3) [2010] FCA 24 SUMMARY Citation: Roadshow Films Pty Ltd v iiNet Limited (No. 3) [2010] FCA 24 Parties: Roadshow Films Pty Ltd (ACN 100 746 870) and the parties in the attached Schedule I v iiNet Limited (ACN 068 628 937) File number: NSD 1802 of 2008 Judge: COWDROY J Date of judgment: 4 February 2010 Roadshow Films Pty Ltd v iiNet Limited (No. 3) [2010] FCA 24 SUMMARY 1 In accordance with the practice of the Federal Court in some cases of public interest, importance or complexity, the following summary has been prepared to accompany the orders made today. This summary is intended to assist in understanding the outcome of this proceeding and is not a complete statement of the conclusions reached by the Court. The only authoritative statement of the Court's reasons is that contained in the published reasons for judgment which will be available on the internet at www.fedcourt.gov.au. 2 The judgment in this proceeding is necessarily complicated both as to fact and law. It is also lengthy, running for 636 paragraphs and almost 200 pages. I have decided to provide short oral reasons for the judgment which I am presently to hand down. These reasons are not intended to be a substitute for reading the judgment itself which will be accessible online this morning. 3 This proceeding raises the question whether an internet service provider or ISP authorises the infringement of copyright of its users or subscribers when they download cinematograph films in a manner which infringes copyright. -

TPG Telecom Limited and Its Controlled Entities ABN 46 093 058 069

TPG Telecom Limited and its controlled entities ABN 46 093 058 069 Annual Report Year ended 31 July 2016 2 TPG Telecom Limited and its controlled entities Annual report For the year ended 31 July 2016 Contents Page Chairman’s letter 3 Directors’ report 5 Lead auditor’s independence declaration 34 Consolidated income statement 35 Consolidated statement of comprehensive income 36 Consolidated statement of financial position 37 Consolidated statement of changes in equity 38 Consolidated statement of cash flows 39 Notes to the consolidated financial statements 40 Directors’ declaration 91 Independent auditor’s report 92 ASX additional information 94 3 TPG Telecom Limited and its controlled entities Chairman’s letter For the year ended 31 July 2016 Dear Shareholders On behalf of the Board of Directors, I am pleased to present to you the TPG Telecom Limited Annual Report for the financial year ended 31 July 2016 (“FY16”). Financial Performance FY16 was another successful year for the Group. Continued organic growth and the integration of iiNet into the business have resulted in further increases in revenue, profits and dividends for shareholders. FY16 represents the eighth consecutive year that this has been the case. A detailed review of the Group’s operating and financial performance for the year is provided in the Operating and Financial Review section of the Directors’ Report starting on page 7 of this Annual Report, and set out below are some of the key financial highlights and earnings attributable to shareholders from the year. FY16 FY15 Movement Revenue ($m) 2,387.8 1,270.6 +88% EBITDA ($m) 849.4 484.5 +75% NPAT ($m) 379.6 224.1 +69% EPS (cents/share) 45.3 28.2 +61% Dividends (cents/share) 14.5 11.5 +26% iiNet Acquisition At the beginning of FY16 we completed the acquisition of iiNet and consequently there has been significant focus during the year on integrating the businesses to improve the efficiency of the combined organisation. -

Extreme Weather Events Impact Service in the South West District of Western Australia Iinet Group Reference ID: 2529877

CUSTOMER SERVICE NOTICE FROM IINET GROUP (IINET LTD, WESTNET PTY LTD, NETSPACE PTY LTD, AAPT CONSUMER DIVISION, INTERNODE PTY LTD, TRANSACT CAPITAL COMMUNICATIONS PTY LTD) Extreme Weather events impact service in the South West district of Western Australia iiNet Group reference ID: 2529877 The iiNet Group (iiNet Ltd, Westnet Pty Ltd, Netspace Pty Ltd, Internode Pty Ltd, AAPT Consumer Division and TransACT Capital Communications Pty Ltd) is currently working to manage the impact to its network that has occurred as a result of a series of lightning strikes and some heavy rain in the South West district of Western Australia on or about Wednesday 17 April. Lightning strikes and heavy rain have caused notable damage to the network, rendering some services faulty, as referred to in Telstra Wholesales Mass Service Disruption Notification which can be found at http://telstra.com. au/abouttelstra/commitments/mass-service-disruption/. A copy of this notice will also be published in the West Australian on 26 April 2013. The iiNet Group is working closely with suppliers and wholesalers to assess and repair the damage to affected services in a timely manner. Customers in these regions may experience service disruptions and delays to normal connection times and fault restoration. Because these events are outside the iiNet Group’s control, iiNet is claiming an exemption under Section 21 of the Telecommunications (Customer Service Guarantee) Standard 2011 from the normal performance standards. The exemption shall apply from 18 April 2013 to 3 May 2013 inclusive. This date is indicative only; customers should anticipate that some further delays may occur. -

PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED (Exact Name of Registrant As Specified in Its Charter)

Table of Contents SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File No. 0-29092 PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED (Exact name of registrant as specified in its charter) Delaware 54-1708481 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 7901 Jones Branch Drive, Suite 900, McLean, VA 22102 (Address of principal executive offices) (Zip Code) (703) 902-2800 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered None N/A Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share Contingent Value Rights Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Iv. Other Matters Relevant to the Commercial Viability of NBN, the Commonwealth's Accounting Treatment of Government Debt/Inve

iv. other matters relevant to the commercial viability of NBN, the Commonwealth’s accounting treatment of government debt/investment in NBN, and the prospect of future sale, in whole or part, of NBN. Issue: A typical way to try and deal with this problem. It will only fail and eventually be written off as a bad debt anyway. Solution: Try a different approach. Try to actually make the NBN thrive by standing behind it now, let someone else take over and do it properly. Rather than trying to recover costs from a terrible plan by both governments. If you go down the usual path, the only people who win are the accountants, the lawyers and the report writing companies like the one’s you have engaged to run this inquiry. Spend money on tangible infrastructure and systems to automate that process as much as possible. Move on, write-off the bad decisions and the bad debt and focus on making Australian internet great! Just like the US .com boom in the late 90’s was over-funded by mostly venture capitalists and share traders. Many lost money, but the US gained an online super highway and have never looked back as far as internet infrastructure goes. On a positive note, we now have fibre in the ground. Added Information: A good analogy what is happening with the NBN currently is to compare it to what Coles and Woolies tried to do with fuel. They have previously tried subsidising fuel (still they get away with it a little with the 4c or 8c back offers), but they blatantly tried to drop pricing below what they knew the smaller operators couldn’t offer. -

For Personal Use Only

22nd May 2013 The Manager Company Announcements Office Australian Stock Exchange Exchange Plaza, 2 The Esplanade, Perth WA 6000 Dear Sir/Madam, iiNet reaches agreement with NBN Co for sale of TransACT FTTP network 22 May 2013: iiNet Limited (ASX:IIN) has reached an agreement with NBN Co for the sale of TransACT’s fibre- to-the-premises (FTTP) network in the ACT region. The TransACT FTTP network covers approximately 8,500 premises with a further 4,500 premises planned or already under construction. Under the agreement, iiNet will receive $9 million cash for the existing premises passed. Additional equivalent per premise consideration will be received as the remaining premises are passed or connected. The transaction is not expected to result in a material net impact to the iiNet Limited income statement in FY13 or FY14. TransACT will complete construction of pit-and pipe infrastructure in some new estates where agreements are in place until 2017, and transfer ownership to NBN Co for no additional charge. The agreement also provides NBN Co with long term access to additional underground duct infrastructure within the ACT. iiNet Chief Executive Officer, Michael Malone, said the deal is a positive one for iiNet and for TransACT’s customers. “This agreement means that TransACT’s FTTP customers will soon be able to experience the benefits that come from being on the NBN. We’ll be communicating with our FTTP customers throughout the process to ensure a smooth transition over the next twelve months,” he said. The execution of the deal is subject to a number of conditions precedent, including ACCC clearance, and is expected to complete in the next two months. -

Federal Communications Commission DA 12-1334

Federal Communications Commission DA 12-1334 Appendix B: Fixed Broadband Price Dataset, IBDR 2012, FCC comp_sta downspe upspeed_ Local country company plan tech tus ed_adv adv Currency Australia iiNet entrant ADSL1 Home-1 ADSL 1.5 0.256 AD Australia iiNet entrant ADSL1 Home-1 Plus ADSL 20 1 AD Australia iiNet entrant ADSL1 Home-2 ADSL 1.5 0.256 AD Australia iiNet entrant ADSL1 Home-3 ADSL 1.5 0.256 AD Australia iiNet entrant ADSL Home-4 ADSL 20 1 AD Australia iiNet entrant ADSL Home-5 ADSL 20 1 AD Australia iiNet entrant ADSL Home-6 ADSL 20 1 AD Australia iiNet entrant ADSL2+ Home-1 ADSL2+ 24 NA AD Australia iiNet entrant ADSL2+ Home-2 ADSL2+ 24 NA AD Australia iiNet entrant ADSL2+ Home-3 ADSL2+ 24 NA AD Australia iiNet entrant ADSL2+ Home-4 ADSL2+ 24 NA AD Australia iiNet entrant Fibre 1 Fiber 25 5 AD Australia iiNet entrant Fibre 2 Fiber 25 5 AD Australia iiNet entrant Fibre 3 Fiber 25 5 AD Australia iiNet entrant Fibre 4 Fiber 50 20 AD Australia iiNet entrant Fibre 5 Fiber 50 20 AD Australia iiNet entrant Fibre 6 Fiber 100 40 AD Australia iiNet entrant Fibre 7 Fiber 100 40 AD Australia iiNet entrant NBN-1 standard FTTH 12 1 AD Australia iiNet entrant NBN-1 fast FTTH 25 5 AD Australia iiNet entrant NBN-1 faster FTTH 50 20 AD Australia iiNet entrant NBN-1 fastest FTTH 100 40 AD Australia iiNet entrant NBN-2 standard FTTH 12 1 AD Australia iiNet entrant NBN-2 fast FTTH 25 5 AD Australia iiNet entrant NBN-2 faster FTTH 50 20 AD Australia iiNet entrant NBN-2 fastest FTTH 100 40 AD Australia iiNet entrant NBN-3 standard FTTH 12 1 AD Australia -

Quick Setup Guide

Quick Setup Guide Thanks for getting mobile with MobiiConnect 4G! With the supplied AC and car charger adapters, you can truly get online on the go with the MobiiConnect 4G. This guide will show you how to get online with your new MobiiConnect 4G. MobiiConnect 4G Overview 1. USB plug for computer, AC adapter or car charger adapter 2. Reset button 3. microSD™ memory card slot 4. SIM card slot (Standard size only) 5. LED status lights 1. Open the back cover using the thumb notch 2. Insert your Standard size SIM card into the SIM card slot The side with the gold panel should face down, with the cut-off corner facing out as shown below: 3. OPTIONAL: Insert a memory card To use your device for portable USB storage, insert your own microSD™ card as shown. microSD(HC)™ memory cards up to 32GB are supported. 4. Write down the default SSID and password (case sensitive) for the Wi-Fi You’ll find these below the barcode on the sticker next to the SIM card slot. mobii 5. Replace the back cover 6. Plug in to a USB slot on a PC tower or laptop and then wait for the Status light to turn blue or green. Alternatively, plug in to the supplied AC adapter or car charger adapter. 7. Connect to the Wi-Fi Use the SSID (network name) and password (case sensitive) printed on your device and on the security sticker. You can customise your SSID and password through the Web Management Page mentioned later in this guide. -

The End of Australia's National Broadband Network?

The End of Australia’s National Broadband Network? June 2016 Lucia Gamboa Sorensen and Andrew Medina 1099 NEW YORK AVE, NW SUITE 520 WASHINGTON, DC 20001 PHONE: 202.828.4405 E-MAIL: [email protected] WEB: www.techpolicyinstitute.org THE END OF AUSTRALIA’S NATIONAL BROADBAND NETWORK?* Lucia Gamboa Sorensen† Andrew Medina‡ July 12, 2016 * The views in this paper are the authors’ only and do not necessarily reflect those of the authors’ fellowship sponsor, TPI, its staff, or its board. † Lucia Gamboa is an MPP student at the LBJ School of Public Policy and a 2016 Google Policy Fellow at the Technology Policy Institute. Contact: [email protected] ‡ Andrew Medina recently received his BA from Harvard University and was a 2015 Google Policy Fellow at the Technology Policy Institute. ABSTRACT Australia’s National Broadband Network (NBN) is the largest public sector investment in broadband to replace existing copper infrastructure with fiber. Government decided to build and operate a wholesale network to encourage competition on that retail fixed broadband and achieve faster infrastructure buildout with higher quality and lower retail prices. The NBN aimed to connect 93 percent of Australian households and businesses (13 million premises) to a wholesale fiber-to-the-premises (FTTP) but downgraded to fiber-to-the-node (FTTN) as a result of escalating costs and political change. In further attempts to bring down the cost and adopt a more deliverable strategy, the current administration is considering a gradual sell-off of the NBN network. Six years after its start the overall outcome has not been positive. -

The NBN's Impact on Telstra, Iinet And

The NBN’s impact on Telstra, iiNet and TPG 15/09/2014 3:40 pm Roger Montgomery Switzer Expert The NBN’s impact on Telstra, iiNet and TPG 28/08/2014 by Roger Montgomery ADSL has for many years been the staple of what retail service providers (RSPs) utilise to offer internet services. This is largely based off of the existing Telstra copper network, one originally designed for telephony services and not the internet. Technology has since developed and more advanced ways of delivering internet capacity are now available, particularly in fibre-based networks, the backbone of the National Broadband Network (NBN). An NBN had been debated by various private institutions such as Telstra since the early 2000’s yet were never able to obtain approval by the ACCC. In April 2009, the Labor government announced plans for a new NBN project that would provide a wholesale open-access network to RSPs and deliver internet connectivity at 100Mbps to 90% of Australian households via fibre to the premise technology (FTTP). This project was estimated to cost $43 billion and would be designed, built and operated by a newly created government business enterprise: NBN Co. Part of the process would involve the decommissioning of telephone network assets owned by Telstra and Optus, allowing for NBN Co to hold a monopoly in the provision of wholesale internet capacity. Soon after the Coalition’s victory in 2013, an independent review of NBN Co was conducted with several key conclusions found: 1. Progress of NBN deployment (as measured by the metric; premises passed) was 55% behind corporate plan as of September 2013. -

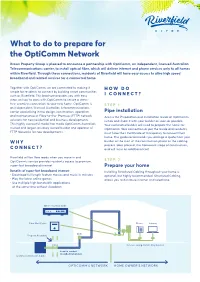

Opticomm Network

What to do to prepare for the OptiComm Network Brown Property Group is pleased to announce a partnership with OptiComm, an independent, licensed Australian Telecommunications carrier, to install optical fibre, which will deliver internet and phone services only to all homes within Riverfield. Through these connections, residents of Riverfield will have easy access to ultra high speed broadband and related services for a connected home. Together with OptiComm, we are committed to making it HOW DO simple for residents to connect by building smart communities such as Riverfield. This brochure provides you with easy I CONNECT? steps on how to work with OptiComm to secure a stress- free, seamless connection to your new home. OptiComm is STEP 1: an independent, licensed Australian Telecommunications carrier specialising in the design, construction, operation Pipe installation and maintenance of Fibre-to-the- Premises (FTTP) network Access the Preparation and Installation Guide at OptiComm. solutions for new residential and business developments. net.au and share it with your builder as soon as possible. This highly successful model has made OptiComm Australia’s Your nominated builder will need to prepare the home for trusted and largest privately owned builder and operator of OptiComm fibre connection as per the Guide and residents FTTP Networks for new developments. must have their Certificate of Occupancy to connect their home. The guide recommends you arrange a quote from your WHY builder at the start of the construction phase as the cabling process takes place at the framework stage of construction, CONNECT? and will incur an additional cost. Riverfield will be fibre ready when you move in and OptiComm’s service provides residents access to premium, STEP 2: super-fast broadband internet. -

ECONOMUSE Will the TPG-Iinet Merger Kill Competition? Will TPG Drive Down Prices Or Will We See a Cosy Oligopoly Emerge in Broadband?

ECONOMUSE Will the TPG-iiNet merger kill competition? Will TPG drive down prices or will we see a cosy oligopoly emerge in broadband? If iiNet’s shareholders accept the TPG offer and the ACCC approves this take-over (neither of which is certain), the prospect of vigorous retail competition in the fixed network is dim. The extent of price competition currently is debateable and increased industry concentration is irrefutable. The ACCC’s recent report on the prices paid for telecommunications seems very sanguine about price trends. It reports that “The average real price paid for all types of internet services fell by 2.2 per cent during 2013−14. This is significantly greater than the 0.9 per cent reduction in 2012−13.” In nominal terms (before CPI increases of 3% pa), these are increases of 0.8 and 2.1 per cent. On my estimates, the cost of broadband fell by more than 9% in 2014 after increasing by more than 25% the previous year. That’s a bit different. The ACCC constructs five types of customer based on bill samples and then finds the best plan for each; which is then tracked by year. As it says, increases in data allowances are not reflected in the indices when the price points for the plans do not change. My alternative estimates are based on my annual survey of ADSL2+ and NBN plans for each of the give major ISPs (Big Pond, Optus, iinet, TPG and Internode). Plot the monthly cost against the data cap on a scattergram and put a best-fit (regression) line through this to get a single plan that describes the whole market.