Press Release Jorabat Shillong Expressway Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EIA Report Iv Surface Water Quality of Nearby River (60M Upstream and Refer Section 3.7 on Page No

ENVIRONMENTAL IMPACT ASSESSMENT AND EMP REPORT FOR PROPOSED CEMENT PLANT (500 TPD CLINKER & 500 TPD CEMENT) LOCATED AT DAG NO.: 141 to 146 & 151 of K. P. PATTA NO.: 3, 19, 21, & 9, VILLAGE AMBHER, 12TH MILE, JORABAT, MOUZA SONAPUR, DISTRICT KAMRUP, ASSAM. PROJECT PROPONENT: M/S. K R ASSOCIATES PREPARED BY: en-VISIzn ENVIRO TECHNOLOGIES PVT. LTD. 2nd FLOOR, SHRI RAM COMPLEX, ABOVE BANK OF INDIA, NEAR KARGIL CHOWK, SURAT-DUMAS ROAD, PIPLOD, SURAT-395007 GUJARAT. M/S. K R ASSOCIATES Phone No.: (0261) 2223003, 2224004, Email Add.: [email protected] Website: www.en-vision.in Accreditation by QCI / NABET SEPT, 2015 151005_315032_100915 PREFACE M/s. K R Associates is proposing to set up Cement Plant (500 TPD Clinker & 500 TPD Cement) at Dag No.: 141 to 146 & 151 of K. P. Patta No.: 3, 19, 21, & 9, Village Ambher, 12th Mile, Jorabat, Mouza Sonapur, District Kamrup, Assam. In order to assess the likely impacts arising out of the proposed project, M/s. K R Associates had appointed M/s. En-vision Enviro Technologies Pvt. Ltd., Surat (Gujarat), to undertake the Rapid Environmental Impact Assessment (REIA) study for the various environmental components which may be affected, to assess the impact arising out of the proposed project and to prepare a detailed Environmental Management Plan (EMP) to minimize those adverse impacts. The cooperation and assistance rendered by M/s. K R Associates in the preparation of this report is gratefully acknowledged. M/s. En-vision Enviro Technologies Pvt. Ltd. M/S. K R ASSOCIATES, KAMRUP, ASSAM. EXECUTIVE SUMMARY OF DRAFT EIA EMP REPORT 1.0 INTRODUCTION M/s. -

International Livestock Research Institute Training Course

International Livestock Research Institute Training course report Training on hygienic milk production and handling in Guwahati, Assam, India December 2013 © 2013 International Livestock Research Institute (ILRI) This publication is copyrighted by the International Livestock Research Institute (ILRI). It is licensed for use under the Creative Commons Attribution-Noncommercial-Share Alike 3.0 Unported License. To view this license, visit http://creativecommons.org/licenses/by-nc-sa/3.0/. Unless otherwise noted, you are free to copy, duplicate, or reproduce, and distribute, display, or transmit any part of this publication or portions thereof without permission, and to make translations, adaptations, or other derivative works under the following conditions: ATTRIBUTION. The work must be attributed, but not in any way that suggests endorsement by ILRI or the author(s) NON-COMMERCIAL. This work may not be used for commercial purposes. SHARE ALIKE. If this work is altered, transformed, or built upon, the resulting work must be distributed only under the same or similar license to this one. NOTICE For any reuse or distribution, the license terms of this work must be made clear to others. Any of the above conditions can be waived if permission is obtained from the copyright holder. Nothing in this license impairs or restricts the author’s moral rights. Fair dealing and other rights are in no way affected by the above. The parts used must not misrepresent the meaning of the publication. ILRI would appreciate being sent a copy of any materials in which text, photos etc. have been used. Written by Ram Pratim Deka and Delia Grace Edited and formatted by Tezira Lore Citation ILRI (International Livestock Research Institute). -

Impact on Dairy Farmers of Kamrup District, Assam, India Pinky Barua Department of Sociology Assam Down Town University Guwahati, Assam Email:Pinky .Baruag@Gmail .Com

ISSN. 0972 - 8406 The NEHU Journal Vol . XIX, No . 1 (January –June), 2021, pp .65-72 Corona virus Disease (COVID-19) and livelihood: Impact on Dairy Farmers of Kamrup District, Assam, India Pinky Barua Department of Sociology Assam Down Town University Guwahati, Assam Email:pinky .baruag@gmail .com Abstract In the lockdown period, the dairy industry in Assam as in other parts faced lots of dif- ficulty which impacted the livelihood of several dairy farmers. As per reports, the dairy farmers had to throw away their milk in the river and pond due to loss of supply provision . This article presents the scenario of milk farming uplifting living condition and economic status of the Dairy farmers . Field report reveals that covid19 virus had a severe impact on dairy farmers livelihood . Coronavirus had negative impact on their daily activities and even milkmen could neither sell milk nor could buy fodder for the cattle . The present study was conducted in Gorkha population concentrated in the 10th mile area of Guwa- hati (Kamrup), Assam . Basically, this area has the community engaged in rearing cow and goat and with milk business they supply milk to the greater Guwahati area . The study was based on qualitative research using in-depth interview and telephonic interview to collect information . The study has used both primary data and secondary data . The study was conducted in the rural area in order to find out the basic challenges encountered by the dairy farmers during first part of lockdown days due toCOVID 19 . Key Words: COVID-19, Dairy Farmer, Livelihood, Challenges. -

LIST of POST GST COMMISSIONERATE, DIVISION and RANGE USER DETAILS ZONE NAME ZONE CODE Search

LIST OF POST GST COMMISSIONERATE, DIVISION AND RANGE USER DETAILS ZONE NAME GUW ZONE CODE 70 Search: Commission Commissionerate Code Commissionerate Jurisdiction Division Code Division Name Division Jurisdiction Range Code Range Name Range Jurisdiction erate Name Districts of Kamrup (Metro), Kamrup (Rural), Baksa, Kokrajhar, Bongaigon, Chirang, Barapeta, Dhubri, South Salmara- Entire District of Barpeta, Baksa, Nalbari, Mankachar, Nalbari, Goalpara, Morigaon, Kamrup (Rural) and part of Kamrup (Metro) Nagoan, Hojai, East KarbiAnglong, West [Areas under Paltan Bazar PS, Latasil PS, Karbi Anglong, Dima Hasao, Cachar, Panbazar PS, Fatasil Ambari PS, Areas under Panbazar PS, Paltanbazar PS & Hailakandi and Karimganj in the state of Bharalumukh PS, Jalukbari PS, Azara PS & Latasil PS of Kamrup (Metro) District of UQ Guwahati Assam. UQ01 Guwahati-I Gorchuk PS] in the State of Assam UQ0101 I-A Assam Areas under Fatasil Ambari PS, UQ0102 I-B Bharalumukh PS of Kamrup (Metro) District Areas under Gorchuk, Jalukbari & Azara PS UQ0103 I-C of Kamrup (Metro) District Areas under Nagarbera PS, Boko PS, Palashbari PS & Chaygaon PS of Kamrup UQ0104 I-D District Areas under Hajo PS, Kaya PS & Sualkuchi UQ0105 I-E PS of Kamrup District Areas under Baihata PS, Kamalpur PS and UQ0106 I-F Rangiya PS of Kamrup District Areas under entire Nalbari District & Baksa UQ0107 Nalbari District UQ0108 Barpeta Areas under Barpeta District Part of Kamrup (Metro) [other than the areas covered under Guwahati-I Division], Morigaon, Nagaon, Hojai, East Karbi Anglong, West Karbi Anglong District in the Areas under Chandmari & Bhangagarh PS of UQ02 Guwahati-II State of Assam UQ0201 II-A Kamrup (Metro) District Areas under Noonmati & Geetanagar PS of UQ0202 II-B Kamrup (Metro) District Areas under Pragjyotishpur PS, Satgaon PS UQ0203 II-C & Sasal PS of Kamrup (Metro) District Areas under Dispur PS & Hatigaon PS of UQ0204 II-D Kamrup (Metro) District Areas under Basistha PS, Sonapur PS & UQ0205 II-E Khetri PS of Kamrup (Metropolitan) District. -

Public Notice No. 03/2016

आयुक्त कायाालय(लेखा परीक्षा) OFFICE OF THE COMMISSIONER (AUDIT) के न्द्रीय उ配पाद शु쥍क, सीमा शु쥍क औरसेवा कर, गुवाहाटी CUSTOMS ,CENTRAL EXCISE & SERVICE TAX, GUWAHATI रॉयल रीजᴂसी, एम. आर. डी रोड, बामनू िमदै ाम, गवु ाहाटी- ७८१ ०२१ भारत सरकार Royal Regency, MRD Road, Bamunimaidam:: GUWAHATI – 781 021 Public Notice No.03/2016 Dated, Guwahati, the 22nd December, 2016 ADDENDUM TO PUBLIC NOTICE No. 02/2015 Dated Guwahati, the 21st of May 2015 In partial modification to the Public Notice No. 02/2015, dated 21.05.2015 in the matter of Designation of Central Public Information Officers (CPIOs) under Section 5 of Right to Information Act 2005, the names and addresses of Central Public Information Officer ( CPIO’s) and also the address of the First Appellate Authority (FAA) is amended and may be read as under: Sl. Name and Designation Address and Jurisdiction No. Designation under the RTI Telephone No. Act, 2005 1. Ms M.Rahman, Central Public Office of the Entire North Eastern Region comprising Assistant Information Commissioner of the states of Assam, Meghalaya, Commissioner Officer (CPIO) (Audit), Customs, Mizoram, Nagaland, Tripura and Central Excise & Arunachal Pradesh. Service Tax Audit Commissionerate, 2ndFloor, Royal Regency, MRD Road, Bamunimaidam, Guwahati- 781021 2. Shri D. R. Saha, Central Public Office of the All Central Excise Assessees in the Assistant Information Commissioner jurisdiction of south of A.T. Road- starting Commissioner Officer (CPIO) (Audit), Customs, from railway gate 6 at Bharalumukh, West Central Excise & of Fatasil Road upto junction of Bharalu Service Tax, 1st River, West of Mora Bharalu River, Floor, Royal Betkuchi, Gorchuk, Pub Boragaon Area, Regency, MRD Both side of H.B. -

44508-001: Strengthening Urban Transport Subsector Under ADB

Technical Assistance Consultant’s Report Technical Assistance 7750-IND September 2013 India: Strengthening Urban Transport Subsector under ADB-supported Urban Development Projects − Urban Transport Component Prepared by Gordon Neilson, Subhajit Lahiri and Prasant Sahu, Study Team Members For the Ministry of Urban Development This consultant’s report does not necessarily reflect the views of ADB or the Government concerned, and ADB and the Government cannot be held liable for its contents. ASSAM URBAN INFRASTRUCTURE PROJECT URBAN TRANSPORT COMPONENT ADB Contract S71818 TA- 7750(IND) FINAL REPORT October 2011 Contract S71818; TA – 7750 (IND) Final Report TABLE OF CONTENTS 1. INTRODUCTION ....................................................................................................... 1 1.1 Background ............................................................................................................... 1 1.2 Objectives of Study and Tasks .................................................................................. 1 1.3 Organisation of Report .............................................................................................. 2 2. PUBLIC TRANSPORT SECTOR ASSESSMENT ..................................................... 3 2.1 Introduction ............................................................................................................... 3 2.2 Current Situation ....................................................................................................... 4 2.3 Road Map for the Future .......................................................................................... -

Office of the Chief Commissioner, Goods and Services Tax & Customs

Office of the Chief Commissioner, Goods and Services Tax & Customs, Guwahati Zone 5th Floor, GST Bhavan, Kedar Road, Machkhowa, Guwahati Assam. Pincode-781001 Phone no.0361-2735999 / 0364-2500131 Fax No.0361-2735979 / 0364-2224747 E-mail: [email protected] For the Quarter ending June 2019 Chief Commissioner S. No. Office/Location of CPIO(Sh/Smt.) Appellate Authority Jurisdiction Notified officer Commissionerate (Sh/Smt.) for payment of fees 1. Office of the Shri A.K. Shri Suven Das Office of the Chief The Assistant Chief Biswas, Gupta, Commissioner, Chief Accounts Commissioner, Assistant Joint Commissioner, Shillong in the Officer, Office GST & Commissioner, Crescens Building, matters of GST, of the CGST Customs, GST Bhavan, M.G. Road, shilling- Central Excise, Commissioner Guwahati Zone, Kedar Road, 793001, Customs and Cadre ate, Shillong, Machkhowa, Tel. No. (0364)- Controlling Authority Morellow Guwahati- 2502052; functions except Compound, 781001, Fax No.(0364)- those of the M.G. Road, Tel. No. (0361)- 2502047 recruitment and Shillong- 2735999; vigilance in the 793001. Fax No.(0361)- states of Assam, 2735979 Meghalaya, Tripura, Nagaland, Manipur, Mizoram and Arunachal Pradesh . 2. Office of the Shri. Sanjeet Shri Mahendra Pal, All seven States of ACAO Commissioner Kumar, Commissioner(Appe Assam, Meghalaya, CGST & (Appeals), GST Assistant als), Customs House Tripura, Nagaland, Cx,Guwahati & Customs, Commissioner, Complex, 5th Fllor, Manipur, Mizoram Guwahati Zone, Customs House Nilomani Phukan and Arunachal Complex, 5th Path, -

Avifaunal Diversity and Abundance of Jalikhara and Etila Beel (Wetland) of Kamrup (Metro) District, Assam, India

International Journal of Science and Research (IJSR) ISSN (Online): 2319-7064 Index Copernicus Value (2015): 78.96 | Impact Factor (2015): 6.391 Avifaunal Diversity and Abundance of Jalikhara and Etila Beel (wetland) of Kamrup (metro) District, Assam, India Trishna Medhi1, Suraj Sharma2 1 Department of Eco-Restoration, Dimoria College, Khetri (under Life Science Department, Dibrugarh University, Dibrugarh, Assam, India) 2Department of Ecology and Environmental Science, Assam Univerty, Silchar, India Abstract: Avifaunal diversity is very common in wetland ecosystem. Wetlands like river, beels, marshes provide a significant habitat for incalculable species of birds. The purpose of this study was to find out the diversity and abundance of avifauna in two selected wetlands of Dimoria region namely Jalikhara and Etila. The study was conducted between March 2016 to April 2017. The line transect method was used to collect data on bird diversity and abundance. And to determine the species diversity Shannon-Weiner diversity index (Hꞌ) was used. A total of 45 bird species belonging to 23 families were recorded. Both the Jalikhara and Etila beel are rich in avifaunal diversity. But the diversity of Etila is found to be comparatively lower (3.17) than the Jalikhara (3.68). And the family Ardeidae is found abundantly in Jalikhara beel while Sturnidae is the most abundant family in Etila beel. The main reason behind it is the avoidance of Etila beel by water birds is due to high effluent discharge by Hindustan Paper Corporation (Nogoan Paper Mill). Keywords: Abundance, Avifauna, Diversity, Line-transect, Shannon-weiner index, Wetland 1. Introduction Jalikhara and Etila beel (wetland), (ii) To calculate the Diversity and Abundance of the avifauna recorded in the A wetland is an any kind of land area that is submerged by study, (iii) To make a comparative analysis of the diversity water. -

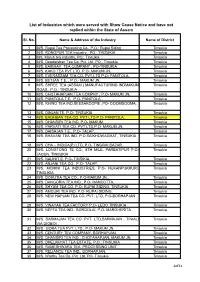

List of Industries Which Were Served with Show Cause Notice and Have Not Replied Within the State of Assam

List of Industries which were served with Show Cause Notice and have not replied within the State of Assam Sl. No. Name & Address of the Industry Name of District 1 M/S. Rupai Tea Processing Co., P.O.: Rupai Siding Tinsukia 2 M/S. RONGPUR TEA Industry., PO.: TINSUKIA Tinsukia 3 M/s. Maruti tea industry, PO.: Tinsukia Tinsukia 4 M/S. Deodarshan Tea Co. Pvt. Ltd ,PO.: Tinsukia Tinsukia 5 M/S. BAIBHAV TEA COMPANY , PO-TINSUKIA Tinsukia 6 M/S. KAKO TEA PVT LTD. P.O- MAKUM JN, Tinsukia 7 M/S. EVERASSAM TEA CO. PVT.LTD P.O- PANITOLA, Tinsukia 8 M/S. BETJAN T.E. , P.O.- MAKUM JN, Tinsukia 9 M/S. SHREE TEA (ASSAM ) MANUFACTURING INDMAKUM Tinsukia ROAD., P.O.: TINSUKIA 10 M/S. CHOTAHAPJAN TEA COMPNY , P.O- MAKUM JN, Tinsukia 11 M/S. PANITOLA T.E. ,P.O- PANITOLA , Tinsukia 12 M/S. RHINO TEA IND.BEESAKOOPIE ,PO- DOOMDOOMA, Tinsukia 13 M/S. DINJAN TE, P.O- TINSUKIA Tinsukia 14 M/S. BAGHBAN TEA CO. PVT LTD P.O- PANITOLA, Tinsukia 15 M/S. DHANSIRI TEA IND. P.O- MAKUM, Tinsukia 16 M/S. PARVATI TEA CO. PVT LTD,P.O- MAKUM JN, Tinsukia 17 M/S. DAISAJAN T.E., P.O- TALAP, Tinsukia 18 M/S. BHAVANI TEA IND. P.O.SAIKHOWAGHAT, TINSUKIA Tinsukia 19 M/S. CHA – INDICA(P) LTD, P.O- TINGRAI BAZAR, Tinsukia 20 M/S. LONGTONG TE CO., 8TH MILE, PARBATIPUR P.O- Tinsukia JAGUN, TINSUKIA 21 M/S. NALINIT.E. P.O- TINSIKIA, Tinsukia 22 M/S. -

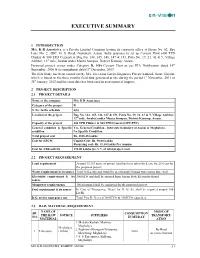

Executive Summary

e n - V I S I z n EXECUTIVE SUMMARY 1 INTRODUCTION M/s. K R Associates, is a Private Limited Company having its corporate office at House No. 62, Bye Lane No. 2, ABC, G. S. Road, Guwahati, Assam, lndia proposes to set up Cement Plant (400 TPD Clinker & 500 TPD Cement) at Dag No. 144, 145, 146, 147 & 151, Patta No. 19, 21, 42 & 9, Village Ambher, 12th mile, Jorabat under Mauza Sonapur, District Kamrup, Assam. Proposed project comes under Category B, 3(b) Cement Plant as per EIA Notification dated 14th September, 2006 & its amendment dated 1st December, 2009. The EIA Study has been carried out by M/s. En-vision Enviro Engineers Private Limited, Surat, Gujarat, which is based on the three months field data generated at site during the period 1st November, 2011 to 31st January, 2012 and the same data has been used in assessment of impacts. 2 PROJECT DESCRIPTION 2.1 PROJECT DETAILS Name of the company M/s. K R Associates Category of the project B S. No. In the schedule 3(b) Location of the project Dag No. 144, 145, 146, 147 & 151, Patta No. 19, 21, 42 & 9, Village Ambher, 12th mile, Jorabat under Mauza Sonapur, District Kamrup, Assam. Capacity of the project 400 TPD Clinker & 500 TPD Cement (OPC/PPC) General condition & Specific Yes, General Condition - Interstate boundary of Assam & Meghalaya. condition No Specific Condition. Total project cost Rs. 3818.25 Lakhs Cost for EPCM Capital Cost: Rs. 98.00 Lakhs Recurring cost: Rs. 11.50 Lakhs Per Annum Cost for CSR activity 191.00 Lakhs (i.e. -

Draft Guwahati City Disaster Management & Response Plan

DRAFT GUWAHATI CITY DISASTER MANAGEMENT & RESPONSE PLAN KAMRUP METROPOLITAN DISTRICT www.kamrupmetro.nic.in www.idrn.gov.in 1 CHAPTER-1 CITY AT A GLANCE Introduction: The City Disaster Management Plan focuses on the Guwahati Metropolitan Development Authority jurisdiction, comprising of Guwahati Municipality Corporation area (GMCA), North Guwahati Town Committee area, Amingaon and some revenue villages. The area is known as the Guwahati Metropolitan area(GMA) and covers an area of 264 sq.kms. 1.1 HISTORY Situated on the bank of the mighty river Brahmaputra, Guwahati is said to be the legendary Pragjyotishpur or City of Eastern Light. Guwahati is the gateway to northeastern India. The name is a combination of two words - Guwa meaning areca nut and Hat meaning market. Guwahati is the commercial nerve centre of the Northeast. 1.2 LOCATION Geographical extension of Guwahati city is 91°33'18.141" E and 91°10'41.005 "E Longitude and 25° 59' 33.183" N and 26° 15' 50.945" N Latitudes.. It is located towards the South-Eastern side of Kamrup district, which is surrounded by Nalbari District in the north, Darang and Marigaon districts in the East, Meghalaya State in the South and Goalpara and Barpeta districts at the west. The city is situated on an undulating plain with varying altitudes of 49.5 m to 55.5 m above Mean sea Level(MSL). The Southern and Eastern sides of the city are surrounded by hillocks. Apart from the hilly tracts, swamps, marshes, water bodies like Deepor Bill, Silpukhuri, Dighali Pukhuri, Borsola Beel and silsakoo Beel etc also cover the city. -

Factory List.Xlsx

Estimated Licence/ Bureau's Sector District Industry LIST OF REGISTERED FACTORIES FOR THE YEAR 2016 Description of main economic activity of the Enterprises Average daily Employ- H.P Remarks Employment. ment. Registration Sl. No. Pro- code Code as Number. vision. Per NIC2008 1 2 3 4 5 6 9 10 11 12 BNG/64 *05525 3 2 3 *01118 Tirupati Soya Udyog,Shed No.6, I/E,New Bongaigaon 6 70 KAM/1037 1 2 14 *01118 Raj Industries. Khanamukh, West Jalukbari,Ghy-14 10 - KAM/1081 *06061 1 2 14 *01118 Vinita Food Products. Lalunggaon. Lokhra,Ghy-34 10 142 KAM/1412 *07159 1 2 14 *01118 Shree Shyam Commercial Co, National Board Complex.Panikhaiti, 18 197 KAM/1455 *07202 1 2 14 *01118 Vinaak Industries. National Board Complex.Panikhaiti, Ghy-26 10 47 KAM/1697 *07444 1 2 14 *01118 M/sSharma Soya Products. Old Glass Factory Comples,Ghy-9 12 178.2 NAL/27 1 2 21 *01118 Assam Food Products. B.P.Road, Nalbari. 10 - DHU/93 *06001 1 2 8 *01118 M/s R.K.Soya Udyog.al Mill Compound. No.3, Baluchar 15 160 TSK/667 *06885 1 2 25 *01118 Rasi Industries. Makum Road. Behind Steel worth. 10 80.4 SON/427 *06996 1 2 24 *01118 M/s J.K.Food Products. Vill-Gotonga. P.O.B.P.Tinali 10 90 GLT/360 *06892 1 2 11 *01118 M/s Crest India. Ward No. 10 A.T.Road, P.O.Dergaon. 10 105 JOR/395 *06909 1 2 13 *01118 Soni Industries.