Finance, Corporations and Society Fall 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Value, Caution and Accountability in an Era of Large Banks and Complex Finance*

2011-2012 BETTING BIG 765 BETTING BIG: VALUE, CAUTION AND ACCOUNTABILITY IN AN ERA OF LARGE BANKS AND COMPLEX FINANCE* LAWRENCE G. BAXTER** Abstract Big banks are controversial. Their supporters maintain that they offer products, services and infrastructure that smaller banks simply cannot match and enjoy unprecedented economies of scale and scope. Detractors worry about the risks generated by big banks, their threats to financial stability, and the way they externalize costs of operation to the public. This article explains why there is no conclusive argument one way or the other and why simple measures for restricting the danger of big banks are neither plausible nor effective. The complex ecology of modern finance and the management and regulatory challenges generated by ultra-large banking, however, cast serious doubt on the proposition that the benefits of big banking outweigh its risks. Consequently, two general principles are proposed for further consideration. First, big banks should bear a greater degree of public accountability by reforming certain principles of corporate governance to require greater representation of public interests at the board and executive levels of big banks. Second, given the unproven promises of performance by big banks, their unimpressive actual record of performance, and the many hazards they inevitably generate or encounter, financial regulators should consciously adopt a strict cautionary approach. Under this approach, big banks would bear a very heavy onus to demonstrate in concrete terms that their continued growth – and even the maintenance of their current scale – can be adequately managed and supervised. * © Lawrence G. Baxter. ** Professor of the Practice of Law, Duke Law School. -

Notes and Sources for Evil Geniuses: the Unmaking of America: a Recent History

Notes and Sources for Evil Geniuses: The Unmaking of America: A Recent History Introduction xiv “If infectious greed is the virus” Kurt Andersen, “City of Schemes,” The New York Times, Oct. 6, 2002. xvi “run of pedal-to-the-medal hypercapitalism” Kurt Andersen, “American Roulette,” New York, December 22, 2006. xx “People of the same trade” Adam Smith, The Wealth of Nations, ed. Andrew Skinner, 1776 (London: Penguin, 1999) Book I, Chapter X. Chapter 1 4 “The discovery of America offered” Alexis de Tocqueville, Democracy In America, trans. Arthur Goldhammer (New York: Library of America, 2012), Book One, Introductory Chapter. 4 “A new science of politics” Tocqueville, Democracy In America, Book One, Introductory Chapter. 4 “The inhabitants of the United States” Tocqueville, Democracy In America, Book One, Chapter XVIII. 5 “there was virtually no economic growth” Robert J Gordon. “Is US economic growth over? Faltering innovation confronts the six headwinds.” Policy Insight No. 63. Centre for Economic Policy Research, September, 2012. --Thomas Piketty, “World Growth from the Antiquity (growth rate per period),” Quandl. 6 each citizen’s share of the economy Richard H. Steckel, “A History of the Standard of Living in the United States,” in EH.net (Economic History Association, 2020). --Andrew McAfee and Erik Brynjolfsson, The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies (New York: W.W. Norton, 2016), p. 98. 6 “Constant revolutionizing of production” Friedrich Engels and Karl Marx, Manifesto of the Communist Party (Moscow: Progress Publishers, 1969), Chapter I. 7 from the early 1840s to 1860 Tomas Nonnenmacher, “History of the U.S. -

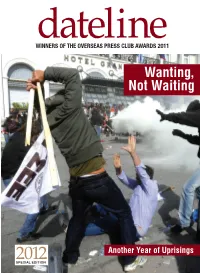

Wanting, Not Waiting

WINNERSdateline OF THE OVERSEAS PRESS CLUB AWARDS 2011 Wanting, Not Waiting 2012 Another Year of Uprisings SPECIAL EDITION dateline 2012 1 letter from the president ne year ago, at our last OPC Awards gala, paying tribute to two of our most courageous fallen heroes, I hardly imagined that I would be standing in the same position again with the identical burden. While last year, we faced the sad task of recognizing the lives and careers of two Oincomparable photographers, Tim Hetherington and Chris Hondros, this year our attention turns to two writers — The New York Times’ Anthony Shadid and Marie Colvin of The Sunday Times of London. While our focus then was on the horrors of Gadhafi’s Libya, it is now the Syria of Bashar al- Assad. All four of these giants of our profession gave their lives in the service of an ideal and a mission that we consider so vital to our way of life — a full, complete and objective understanding of a world that is so all too often contemptuous or ignorant of these values. Theirs are the same talents and accomplishments to which we pay tribute in each of our awards tonight — and that the Overseas Press Club represents every day throughout the year. For our mission, like theirs, does not stop as we file from this room. The OPC has moved resolutely into the digital age but our winners and their skills remain grounded in the most fundamental tenets expressed through words and pictures — unwavering objectivity, unceasing curiosity, vivid story- telling, thought-provoking commentary. -

The Donald Trump-Rupert Murdoch Relationship in the United States

The Donald Trump-Rupert Murdoch relationship in the United States When Donald Trump ran as a candidate for the Republican presidential nomination, Rupert Murdoch was reported to be initially opposed to him, so the Wall Street Journal and the New York Post were too.1 However, Roger Ailes and Murdoch fell out because Ailes wanted to give more positive coverage to Trump on Fox News.2 Soon afterwards, however, Fox News turned more negative towards Trump.3 As Trump emerged as the inevitable winner of the race for the nomination, Murdoch’s attitude towards Trump appeared to shift, as did his US news outlets.4 Once Trump became the nominee, he and Rupert Murdoch effectively concluded an alliance of mutual benefit: Murdoch’s news outlets would help get Trump elected, and then Trump would use his powers as president in ways that supported Rupert Murdoch’s interests. An early signal of this coming together was Trump’s public attacks on the AT&T-Time Warner merger, 21st Century Fox having tried but failed to acquire Time Warner previously in 2014. Over the last year and a half, Fox News has been the major TV news supporter of Donald Trump. Its coverage has displayed extreme bias in his favour, offering fawning coverage of his actions and downplaying or rubbishing news stories damaging to him, while also leading attacks against Donald Trump’s opponent in the 2016 presidential election, Hillary Clinton. Ofcom itself ruled that several Sean Hannity programmes in August 2016 were so biased in favour of Donald Trump and against Hillary Clinton that they breached UK impartiality rules.5 During this period, Rupert Murdoch has been CEO of Fox News, in which position he is also 1 See e.g. -

After the Meltdown

Tulsa Law Review Volume 45 Issue 3 Regulation and Recession: Causes, Effects, and Solutions for Financial Crises Spring 2010 After the Meltdown Daniel J. Morrissey Follow this and additional works at: https://digitalcommons.law.utulsa.edu/tlr Part of the Law Commons Recommended Citation Daniel J. Morrissey, After the Meltdown, 45 Tulsa L. Rev. 393 (2013). Available at: https://digitalcommons.law.utulsa.edu/tlr/vol45/iss3/2 This Article is brought to you for free and open access by TU Law Digital Commons. It has been accepted for inclusion in Tulsa Law Review by an authorized editor of TU Law Digital Commons. For more information, please contact [email protected]. Morrissey: After the Meltdown AFTER THE MELTDOWN Daniel J. Morrissey* We will not go back to the days of reckless behavior and unchecked excess that was at the heart of this crisis, where too many were motivated only by the appetite for quick kills and bloated bonuses. -President Barack Obamal The window of opportunityfor reform will not be open for long .... -Princeton Economist Hyun Song Shin 2 I. INTRODUCTION: THE MELTDOWN A. How it Happened One year after the financial markets collapsed, President Obama served notice on Wall Street that society would no longer tolerate the corrupt business practices that had almost destroyed the world's economy. 3 In "an era of rapacious capitalists and heedless self-indulgence," 4 an "ingenious elite" 5 set up a credit regime based on improvident * A.B., J.D., Georgetown University; Professor and Former Dean, Gonzaga University School of Law. This article is dedicated to Professor Tom Holland, a committed legal educator and a great friend to the author. -

Too Big to Fail — U.S. Banks' Regulatory Alchemy

Journal of Business & Technology Law Volume 14 | Issue 2 Article 2 Too Big to Fail — U.S. Banks’ Regulatory Alchemy: Converting an Obscure Agency Footnote into an “At Will” Nullification of Dodd-Frank’s Regulation of the Multi-Trillion Dollar Financial Swaps Market Michael Greenberger Follow this and additional works at: https://digitalcommons.law.umaryland.edu/jbtl Recommended Citation Michael Greenberger, Too Big to Fail — U.S. Banks’ Regulatory Alchemy: Converting an Obscure Agency Footnote into an “At Will” Nullification of Dodd-Frank’s Regulation of the Multi-Trillion Dollar Financial Swaps Market, 14 J. Bus. & Tech. L. 197 () Available at: https://digitalcommons.law.umaryland.edu/jbtl/vol14/iss2/2 This Article is brought to you for free and open access by the Academic Journals at DigitalCommons@UM Carey Law. It has been accepted for inclusion in Journal of Business & Technology Law by an authorized editor of DigitalCommons@UM Carey Law. For more information, please contact [email protected]. Too Big to Fail—U.S. Banks’ Regulatory Alchemy: Converting an Obscure Agency Footnote into an “At Will” Nullification of Dodd-Frank’s Regulation of the Multi-Trillion Dollar Financial Swaps Market MICHAEL GREENBERGER*©1 ΎLaw School Professor, University of Maryland Carey School of Law, and Founder and Director, University of Maryland Center for Health and Homeland Security (“CHHS”); former Director, Division of Trading and Markets, U.S. Commodity Futures Trading Commission. The Institute for New Economic Thinking (“INET”) funded and published this article as a working paper on the Social Sciences Research Network on June 19, 2018 at https://www.ineteconomics.org/uploads/papers/WP_74.pdf. -

Understanding the Financial Crisis Eamonn K

NORTH CAROLINA BANKING INSTITUTE Volume 13 | Issue 1 Article 3 2009 Wall Street Meets Main Street: Understanding the Financial Crisis Eamonn K. Moran Follow this and additional works at: http://scholarship.law.unc.edu/ncbi Part of the Banking and Finance Law Commons Recommended Citation Eamonn K. Moran, Wall Street Meets Main Street: Understanding the Financial Crisis, 13 N.C. Banking Inst. 5 (2009). Available at: http://scholarship.law.unc.edu/ncbi/vol13/iss1/3 This Article is brought to you for free and open access by Carolina Law Scholarship Repository. It has been accepted for inclusion in North Carolina Banking Institute by an authorized administrator of Carolina Law Scholarship Repository. For more information, please contact [email protected]. WALL STREET MEETS MAIN STREET: UNDERSTANDING THE FINANCIAL CRISIS EAMONN K. MORAN* TABLE OF CONTENTS I. INTRODUCTION .............................................................................. 7 II. THE ORIGINS OF THE CREDIT CRISIS ...................................... 13 A. Federal Reserve Interest Rate Reductions ................. 13 B. The Nature of the Lender - Borrower Relationship ..... 15 C. Overextended Homeowners ........................................ 16 D. The Rise of Subprime Lending - The Essentials ..... 20 E. The Politics of Homeownership ................................... 25 F. The Current Housing Crisis: Reverberating Effects of Subprim e Lending ................................................... 30 III. FINANCIAL INNOVATION: THE GROWTH OF COMPLEX FINANCIAL INSTRUMENTS -

Comments of United States Senators Sherrod Brown and Elizabeth Warren

United States penate WASHINGTON, DC 20510 April 16,2014 Robert deV. Frierson Secretary Board of Governors of the Federal Reserve System 20th Street and Constitution Avenue, N.W. Washington, D.C. 20551 Re: Docket No. R-1479, RIN 7100 AE-10; Complementary Activities, Merchant Banking, and Other Activities of Financial Holding Companies Related to Physical Commodities Dear Mr. deV. Frierson: We appreciate the opportunity to comment on the Board of Governors of the Federal Reserve System's (the Board) Advance Notice of Proposed Rulemaking (ANPR) on the Bank Holding Company Act (BHCA) provisions enabling Financial Holding Companies (FHCs) to engage in various commercial activities. Our letter outlines the significant concerns associated with FHCs' expansion into activities that are commercial in nature, particularly their ownership of assets involved in the extraction, transportation, storage, and distribution of commodities and energy. We are concerned that commercial commodities and energy activities expose Board-regulated financial institutions to unprecedented and unmanageable financial, legal, environmental, and reputational risks. The Banking, Housing, and Urban Affairs' Subcommittee on Financial Institutions and Consumer Protection (FICP) held two hearings on this issue.1 The FICP Subcommittee's hearings identified a number of regulatory challenges and safety and soundness risks associated with FHCs' involvement in physical commodities and energy markets. Witness testimony discussed the important policy justifications for maintaining a legal separation between banking and commerce under the BHCA, identified potential safety and soundness risks associated with FHCs' direct ownership of physical commodity assets, and outlined the legal and regulatory context behind the erosion of the legal wall separating banking and commerce over the last two decades. -

The European Sovereign Debt Crisis: Responses to the Financial Crisis

Volume V Spring 2011 The European Sovereign Debt Crisis: Responses to the Financial Crisis Lazaro Sandoval Erika Beltran Sodgerel Ulziikhutag, Temuun Zorigt The authors are Masters in International Commerce and Policy (ICP) students at the School of Public Policy, George Mason University, Arlington, VA. Corresponding author: Lazaro Sandoval – [email protected] ISSN: 1947-2633 Executive Summary The ongoing European sovereign debt crisis continues to shake financial markets and the Eurozone. The International Monetary Fund and the European Union (EU) have acted swiftly to diminish panic and uncertainty by providing emergency assistance to Greece, Ireland and Portugal. However, uncertainty remains and queries have arisen over the vigor and effectiveness of multi-lateral institutions like the EU. This paper will establish the origins of the crisis, enumerate European and international responses, bring to light possible alternatives to implemented policies, and finally explore the broader implications for Europe, the United States and the rest of the world. 2 1 Introduction The Eurozone‟s fiscally troubled economies, specifically Portugal, Ireland, Italy, Greece and Spain, triggered a severe crisis of confidence. The advent of the global financial crisis coupled with Greece‟s public debt admission in October 2009 sparked dismay throughout global markets as the full extent of Eurozone debt levels were unveiled. According to the Economist, Greece‟s budget deficit reached 15.4%, Ireland‟s was 14.3%, Spain‟s 11.2%, Portugal‟s 9.3%, and Italy‟s 5.3%, of GDP in 2009.1 The European Union (EU) rescued Greece and Ireland; most recently, Portugal admitted its need for a similar rescue loan. -

Wealth, Lobbying and Distributive Justice in the Wake of the Economic Crisis C.M.A

DIDN'T YOUR MOTHER TEACH YOU TO SHARE?*: WEALTH, LOBBYING AND DISTRIBUTIVE JUSTICE IN THE WAKE OF THE ECONOMIC CRISIS C.M.A. Mc Cauliff* *SELFISH OR SHARING? . .... .. 383 **ACKNOWLEDGMENTS .............................. ...... 383 * Yaron Brook, president of the Ayn Rand Institute, finds problems with what he calls "governmental influence, where 'somebody's need is a claim against our wealth."' As he sees it, "[t]he last 50 years have been an orgy of placing need above wealth creation, above personal pursuit of happiness." Andrew Martin, Give BB&T Liberty, But Not a Bailout, N.Y. TIMES, Aug. 2, 2009, at BU1 (explaining the views of followers of Ayn Rand, a refugee from communist Russia who proclaimed herself a radical for capitalism). Explaining this viewpoint, a speaker at a recent Ayn Rand convention told the story of a boy in the sandbox, who fights with another child who had taken the boy's toy truck. The boy's mother naturally stops him from fighting by telling him to share the use of the toy. The speaker says "that the mother has taught a horrible lesson" by implying that it is "bad to be selfish." Id. He concludes that "[t]o say man is bad because he is selfish is to say it's bad because he's alive." Id. (Presumably, the mother would still be able to stop the child from touching the metal pot on the stove or picking up a shiny knife.) The speaker, John A. Allison IV, is a banker whose bank BB&T, the eleventh largest bank, had problems during the financial crisis, but Allison insists that the government forced BB&T "to accept TARP money to obscure that [the government was] simply trying to save several large banks like Citigroup." Id. -

May 24 - 31 Please Share This Weekly Compilation with Friends and Colleagues

This Week in Wall Street Reform | May 24 - 31 Please share this weekly compilation with friends and colleagues. To subscribe, email [email protected], with “This Week” in the subject line. TABLE OF CONTENTS - The Trump Administration, Congress, & Wall Street - Consumer Finance and the CFPB - Enforcement - Executive Compensation - Investor Protection, SEC, Capital Markets - Mortgages and Housing - Private Funds - Small-Business Lending - Student Loans and For-Profit Schools - Systemic Risk - Taxes - Elections, Money and Politics - Other Topics T HE TRUMP ADMINISTRATION, CONGRESS & WALL STREET C ONSUMER FINANCE AND THE CFPB Reading Between The Lines Of CFPB’s Regulatory To-Do List | American Banker The biggest news about the Consumer Financial Protection Bureau's rulemaking to-do list may not be the items topping the agenda — but what was left off of it. The agency's recent spring rulemaking agenda includes significant items, including a new process for collecting small-business lending data as well as plans to update underwriting rules for loans backed by Fannie Mae and Freddie Mac. But a year and a half after the Trump administration assumed leadership of the bureau, heralding a series of regulatory relief changes, some in the industry might have been expecting more from the latest report. 1 While the rulemaking agenda suggests some significant moves by the agency in the near future, it leaves out mention of other areas of interest, such as compensation standards for loan originators, a more complete revamp of the CFPB's "Qualified Mortgage" standard and additional industry requests to water down the Dodd-Frank Act. CFPB Settles With Bsi Financial Services Over Numerous Mortgage Servicing Issues | HousingWire The Consumer Financial Protection Bureau announced Wednesday that an investigation into the business practices of BSI Financial Services found that the Texas-based mortgage servicer violated multiple federal laws over several years. -

Virtualfraud FEST 2020 300 YEARS of FRAUD

THE BERKELEY CENTER FOR LAW AND BUSINESS PRESENTS VirtualFRAUD FEST 2020 300 YEARS OF FRAUD JUNE 23 - 25, 2020 VIRTUAL SYMPOSIUM FRAUD FEST 2020 300 YEARS OF FRAUD Berkeley’s annual “Fraud Fest” program brings together thought leaders from the worlds of academia, finance, journalism, law, and more for an intimate discussion on the critical issues, technologies, and policies driving financial fraud around the world. Our 2019 symposium brought over 200 experts and practitioners to the Bay Area, and we look forward to continuing the conversation with you at our Virtual Symposium this summer DAY 1 | TUES. JUNE 23RD 8:30am - 9:00am PDT Virtual Waiting Room Opens 9:00am - 9:10am PDT Welcome Remarks Our conference co-chairs welcome participants to Fraud Fest 2020. Speakers Frank Partnoy, University of California, Berkeley Herb Greenberg, Pacific Square Research 9:10am - 9:40am PDT Opening Keynote: 300 Years of Fraud An exploration into the history of financial fraud and what our history tells us about the perpetuation of fraud today. Speaker Jim Chanos, Kynikos Associates 9:40am - 10:00am PDT Breakout Groups Participants will have the opportunity to join small breakout groups to discuss the Opening Keynote. 10:00am - 10:30am PDT Break 10:30am - 11:00am PDT The Great Debate A lively debate on short-selling and activism. Speakers Michele Johnson, Latham & Watkins Carson Block, Muddy Waters Capital 11:00am - 11:20am PDT Breakout Groups Participants will have the opportunity to join small breakout groups to discuss the Great Debate. 11:20am - 11:50am PDT Whistleblowers Panel A panel discussion on representing, and defending against, whistleblowers.