300 Years of Fraud

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Value, Caution and Accountability in an Era of Large Banks and Complex Finance*

2011-2012 BETTING BIG 765 BETTING BIG: VALUE, CAUTION AND ACCOUNTABILITY IN AN ERA OF LARGE BANKS AND COMPLEX FINANCE* LAWRENCE G. BAXTER** Abstract Big banks are controversial. Their supporters maintain that they offer products, services and infrastructure that smaller banks simply cannot match and enjoy unprecedented economies of scale and scope. Detractors worry about the risks generated by big banks, their threats to financial stability, and the way they externalize costs of operation to the public. This article explains why there is no conclusive argument one way or the other and why simple measures for restricting the danger of big banks are neither plausible nor effective. The complex ecology of modern finance and the management and regulatory challenges generated by ultra-large banking, however, cast serious doubt on the proposition that the benefits of big banking outweigh its risks. Consequently, two general principles are proposed for further consideration. First, big banks should bear a greater degree of public accountability by reforming certain principles of corporate governance to require greater representation of public interests at the board and executive levels of big banks. Second, given the unproven promises of performance by big banks, their unimpressive actual record of performance, and the many hazards they inevitably generate or encounter, financial regulators should consciously adopt a strict cautionary approach. Under this approach, big banks would bear a very heavy onus to demonstrate in concrete terms that their continued growth – and even the maintenance of their current scale – can be adequately managed and supervised. * © Lawrence G. Baxter. ** Professor of the Practice of Law, Duke Law School. -

01:00:01 GFX Center Nickelodeon the Naked Brothers Band . 01:00

SHOW: (Job Name) Version: (Tape ID) PRODUCER: (Client Name) TIMECODE VISUALS AUDIO 01:00:01 GFX Center . Nickelodeon The Naked Brothers Band 01:00:03 Alex dancing around room and Alex <singing>: Milk is fun. It’s sippy and peppy. singing. Yip, yip, yippy. Drink milk and be a wild, happy guy like me. Whee hee! Hi. This is the song the milk Alex sitting on couch talking to people want me to sing so I can advertise my new I camera. Love Milk clothing line. I sing this song so people will remember to drink milk and while they’re drinking milk, they’ll remember to wear my clothes. Mm. But I don’t think the song captures 01:00:30 Alex takes drink of milk from the loveliness of the milk. Milk isn’t peppy or yippy; carton. milk is cozy as golden light. And they grow it from the fresh red and white cartons. But the clothes are awesome though, red, white and blue, do-rag, my colors. And check it out, a cow on the logo. Moo. And each has a bubble. Milk is a warm puppy, milk is my best friend, milk makes my 01:01:00 Alex points to various clothing tummy feel warm and cozy, milk is the bomb. And items. look, Alex Wolff socks tied just the way I like ‘em. Oh yeah, baby. Nat enters room, sits on couch and Nat: Alex where have you been? We need to talks to Alex. rehearse. Alex: Can’t you see I’m in the middle of important business? Nat: You’re eight. -

Notes and Sources for Evil Geniuses: the Unmaking of America: a Recent History

Notes and Sources for Evil Geniuses: The Unmaking of America: A Recent History Introduction xiv “If infectious greed is the virus” Kurt Andersen, “City of Schemes,” The New York Times, Oct. 6, 2002. xvi “run of pedal-to-the-medal hypercapitalism” Kurt Andersen, “American Roulette,” New York, December 22, 2006. xx “People of the same trade” Adam Smith, The Wealth of Nations, ed. Andrew Skinner, 1776 (London: Penguin, 1999) Book I, Chapter X. Chapter 1 4 “The discovery of America offered” Alexis de Tocqueville, Democracy In America, trans. Arthur Goldhammer (New York: Library of America, 2012), Book One, Introductory Chapter. 4 “A new science of politics” Tocqueville, Democracy In America, Book One, Introductory Chapter. 4 “The inhabitants of the United States” Tocqueville, Democracy In America, Book One, Chapter XVIII. 5 “there was virtually no economic growth” Robert J Gordon. “Is US economic growth over? Faltering innovation confronts the six headwinds.” Policy Insight No. 63. Centre for Economic Policy Research, September, 2012. --Thomas Piketty, “World Growth from the Antiquity (growth rate per period),” Quandl. 6 each citizen’s share of the economy Richard H. Steckel, “A History of the Standard of Living in the United States,” in EH.net (Economic History Association, 2020). --Andrew McAfee and Erik Brynjolfsson, The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies (New York: W.W. Norton, 2016), p. 98. 6 “Constant revolutionizing of production” Friedrich Engels and Karl Marx, Manifesto of the Communist Party (Moscow: Progress Publishers, 1969), Chapter I. 7 from the early 1840s to 1860 Tomas Nonnenmacher, “History of the U.S. -

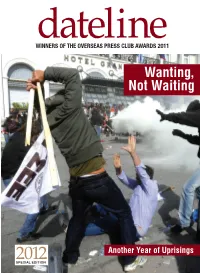

Wanting, Not Waiting

WINNERSdateline OF THE OVERSEAS PRESS CLUB AWARDS 2011 Wanting, Not Waiting 2012 Another Year of Uprisings SPECIAL EDITION dateline 2012 1 letter from the president ne year ago, at our last OPC Awards gala, paying tribute to two of our most courageous fallen heroes, I hardly imagined that I would be standing in the same position again with the identical burden. While last year, we faced the sad task of recognizing the lives and careers of two Oincomparable photographers, Tim Hetherington and Chris Hondros, this year our attention turns to two writers — The New York Times’ Anthony Shadid and Marie Colvin of The Sunday Times of London. While our focus then was on the horrors of Gadhafi’s Libya, it is now the Syria of Bashar al- Assad. All four of these giants of our profession gave their lives in the service of an ideal and a mission that we consider so vital to our way of life — a full, complete and objective understanding of a world that is so all too often contemptuous or ignorant of these values. Theirs are the same talents and accomplishments to which we pay tribute in each of our awards tonight — and that the Overseas Press Club represents every day throughout the year. For our mission, like theirs, does not stop as we file from this room. The OPC has moved resolutely into the digital age but our winners and their skills remain grounded in the most fundamental tenets expressed through words and pictures — unwavering objectivity, unceasing curiosity, vivid story- telling, thought-provoking commentary. -

The Donald Trump-Rupert Murdoch Relationship in the United States

The Donald Trump-Rupert Murdoch relationship in the United States When Donald Trump ran as a candidate for the Republican presidential nomination, Rupert Murdoch was reported to be initially opposed to him, so the Wall Street Journal and the New York Post were too.1 However, Roger Ailes and Murdoch fell out because Ailes wanted to give more positive coverage to Trump on Fox News.2 Soon afterwards, however, Fox News turned more negative towards Trump.3 As Trump emerged as the inevitable winner of the race for the nomination, Murdoch’s attitude towards Trump appeared to shift, as did his US news outlets.4 Once Trump became the nominee, he and Rupert Murdoch effectively concluded an alliance of mutual benefit: Murdoch’s news outlets would help get Trump elected, and then Trump would use his powers as president in ways that supported Rupert Murdoch’s interests. An early signal of this coming together was Trump’s public attacks on the AT&T-Time Warner merger, 21st Century Fox having tried but failed to acquire Time Warner previously in 2014. Over the last year and a half, Fox News has been the major TV news supporter of Donald Trump. Its coverage has displayed extreme bias in his favour, offering fawning coverage of his actions and downplaying or rubbishing news stories damaging to him, while also leading attacks against Donald Trump’s opponent in the 2016 presidential election, Hillary Clinton. Ofcom itself ruled that several Sean Hannity programmes in August 2016 were so biased in favour of Donald Trump and against Hillary Clinton that they breached UK impartiality rules.5 During this period, Rupert Murdoch has been CEO of Fox News, in which position he is also 1 See e.g. -

Is Enron Overpriced?

Is Enron Overpriced? It's in a bunch of complex businesses. Its financial statements are nearly impenetrable. So why is Enron trading at such a huge multiple? By Bethany McLean March 5, 2001 NEW YORK (FORTUNE) -- In Hollywood parlance, the "It Girl" is someone who commands the spotlight at any given moment -- you know, like Jennifer Lopez or Kate Hudson. Wall Street is a far less glitzy place, but there's still such a thing as an "It Stock." Right now, that title belongs to Enron, the Houston energy giant. While tech stocks were bombing at the box office last year, fans couldn't get enough of Enron, whose shares returned 89%. By almost every measure, the company turned in a virtuoso performance: Earnings increased 25%, and revenues more than doubled, to over $100 billion. Not surprisingly, the critics are gushing. "Enron has built unique and, in our view, extraordinary franchises in several business units in very large markets," says Goldman Sachs analyst David Fleischer. Along with "It" status come high multiples and high expectations. Enron now trades at roughly 55 times trailing earnings. That's more than 2 1/2 times the multiple of a competitor like Duke Energy, more than twice that of the S&P 500, and about on a par with new-economy sex symbol Cisco Systems. Enron has an even higher opinion of itself. At a late-January meeting with analysts in Houston, the company declared that it should be valued at $126 a share, more than 50% above current levels. "Enron has no shame in telling you what it's worth," says one portfolio manager, who describes such gatherings as "revival meetings." Indeed, First Call says that 13 of Enron's 18 analysts rate the stock a buy. -

After the Meltdown

Tulsa Law Review Volume 45 Issue 3 Regulation and Recession: Causes, Effects, and Solutions for Financial Crises Spring 2010 After the Meltdown Daniel J. Morrissey Follow this and additional works at: https://digitalcommons.law.utulsa.edu/tlr Part of the Law Commons Recommended Citation Daniel J. Morrissey, After the Meltdown, 45 Tulsa L. Rev. 393 (2013). Available at: https://digitalcommons.law.utulsa.edu/tlr/vol45/iss3/2 This Article is brought to you for free and open access by TU Law Digital Commons. It has been accepted for inclusion in Tulsa Law Review by an authorized editor of TU Law Digital Commons. For more information, please contact [email protected]. Morrissey: After the Meltdown AFTER THE MELTDOWN Daniel J. Morrissey* We will not go back to the days of reckless behavior and unchecked excess that was at the heart of this crisis, where too many were motivated only by the appetite for quick kills and bloated bonuses. -President Barack Obamal The window of opportunityfor reform will not be open for long .... -Princeton Economist Hyun Song Shin 2 I. INTRODUCTION: THE MELTDOWN A. How it Happened One year after the financial markets collapsed, President Obama served notice on Wall Street that society would no longer tolerate the corrupt business practices that had almost destroyed the world's economy. 3 In "an era of rapacious capitalists and heedless self-indulgence," 4 an "ingenious elite" 5 set up a credit regime based on improvident * A.B., J.D., Georgetown University; Professor and Former Dean, Gonzaga University School of Law. This article is dedicated to Professor Tom Holland, a committed legal educator and a great friend to the author. -

Too Big to Fail — U.S. Banks' Regulatory Alchemy

Journal of Business & Technology Law Volume 14 | Issue 2 Article 2 Too Big to Fail — U.S. Banks’ Regulatory Alchemy: Converting an Obscure Agency Footnote into an “At Will” Nullification of Dodd-Frank’s Regulation of the Multi-Trillion Dollar Financial Swaps Market Michael Greenberger Follow this and additional works at: https://digitalcommons.law.umaryland.edu/jbtl Recommended Citation Michael Greenberger, Too Big to Fail — U.S. Banks’ Regulatory Alchemy: Converting an Obscure Agency Footnote into an “At Will” Nullification of Dodd-Frank’s Regulation of the Multi-Trillion Dollar Financial Swaps Market, 14 J. Bus. & Tech. L. 197 () Available at: https://digitalcommons.law.umaryland.edu/jbtl/vol14/iss2/2 This Article is brought to you for free and open access by the Academic Journals at DigitalCommons@UM Carey Law. It has been accepted for inclusion in Journal of Business & Technology Law by an authorized editor of DigitalCommons@UM Carey Law. For more information, please contact [email protected]. Too Big to Fail—U.S. Banks’ Regulatory Alchemy: Converting an Obscure Agency Footnote into an “At Will” Nullification of Dodd-Frank’s Regulation of the Multi-Trillion Dollar Financial Swaps Market MICHAEL GREENBERGER*©1 ΎLaw School Professor, University of Maryland Carey School of Law, and Founder and Director, University of Maryland Center for Health and Homeland Security (“CHHS”); former Director, Division of Trading and Markets, U.S. Commodity Futures Trading Commission. The Institute for New Economic Thinking (“INET”) funded and published this article as a working paper on the Social Sciences Research Network on June 19, 2018 at https://www.ineteconomics.org/uploads/papers/WP_74.pdf. -

Annual Report on Giving

PROFESSIONAL CHILDREN'S SCHOOL ANNUAL REPORT ON GIVING 2017–2018 132 West 60th Street HEAD OF SCHOOL New York, NY 10023 James Dawson pcs-nyc.org LIFE TRUSTEES Professional Children's School Charlotte M. Ford is a vibrant independent school Ernest H. Frank that provides a rigorous college- Peter P. Nitze preparatory education in a supportive environment for 2017–2018 BOARD OF TRUSTEES young people pursuing careers Eileen Mulry Dieck, Chair or pre-professional training in the Diane Kenney, Vice Chair performing arts, competitive sports, William Graham Jacobi, Treasurer + and other endeavors. Stephanie J. Hull, Secretary Michele Barakett ++ Donald B. Brant, Jr. Kristin Kennedy Clark Amy Crate * Pierce Cravens * Rachel Curry * James Dawson Joyce Giuffra Michael Gleicher * Melanie Harris * Nina v. K. Levent + John B. Murray Erica Marks Panush Susan Gluck Pappajohn * Raushan Sapar INSTITUTIONAL ADVANCEMENT COMMITTEE Amy Crate * Pierce Cravens * Rachel Curry * James Dawson Eileen Mulry Dieck Joyce Giuffra Michael Gleicher * Erica Marks Panush Susan Gluck Pappajohn * Raushan Sapar * Alumni + Board Term Ended in May 2018 ++ Board Term Began in May 2018 aspect of individuals within a shared space, but the deeper understanding of FROM HEAD OF SCHOOL community, per the dictionary, that draws on “the feeling of fellowship with others, DR. as a result of sharing common attitudes, interests and goals”. It is a collective JAMES sense of empowerment, a unified belief in dreams, a tribute to passion and interest, DAWSON an affirmation of remarkable young -

Rating the Raters: Enron and the Credit Rating Agencies

S. Hrg. 107–471 RATING THE RATERS: ENRON AND THE CREDIT RATING AGENCIES HEARING BEFORE THE COMMITTEE ON GOVERNMENTAL AFFAIRS UNITED STATES SENATE ONE HUNDRED SEVENTH CONGRESS SECOND SESSION MARCH 20, 2002 Printed for the use of the Committee on Governmental Affairs ( U.S. GOVERNMENT PRINTING OFFICE 79–888 PDF WASHINGTON : 2002 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2250 Mail: Stop SSOP, Washington, DC 20402–0001 VerDate 11-MAY-2000 15:46 Aug 14, 2002 Jkt 000000 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 79888.TXT SAFFAIRS PsN: SAFFAIRS COMMITTEE ON GOVERNMENTAL AFFAIRS JOSEPH I. LIEBERMAN, Connecticut, Chairman CARL LEVIN, Michigan FRED THOMPSON, Tennessee DANIEL K. AKAKA, Hawaii TED STEVENS, Alaska RICHARD J. DURBIN, Illinois SUSAN M. COLLINS, Maine ROBERT G. TORRICELLI, New Jersey GEORGE V. VOINOVICH, Ohio MAX CLELAND, Georgia PETE V. DOMENICI, New Mexico THOMAS R. CARPER, Delaware THAD COCHRAN, Mississippi JEAN CARNAHAN, Missouri ROBERT F. BENNETT, Utah MARK DAYTON, Minnesota JIM BUNNING, Kentucky JOYCE A. RECHTSCHAFFEN, Staff Director and Counsel CYNTHIA GOOEN LESSER, Counsel BETH M. GROSSMAN, Counsel THOMAS J. HOLLOMAN III, Legislative Fellow RICHARD A. HERLTING, Minority Staff Director WILLIAM M. OUTHIER, Minority Chief Counsel JANA A. SINCLAIR, Minority Counsel DARLA D. CASSELL, Chief Clerk (II) VerDate 11-MAY-2000 15:46 Aug 14, 2002 Jkt 000000 PO 00000 Frm 00002 Fmt 5904 Sfmt 5904 79888.TXT SAFFAIRS PsN: SAFFAIRS C O N T E N T S Opening statements: Page Senator Lieberman .......................................................................................... -

KAREN RADZIKOWSKI 1St Assistant Director

KAREN RADZIKOWSKI st 1 Assistant Director Television PROJECT DIRECTOR STUDIO / PRODUCTION CO. BILLIONS (seasons 5-6) Various Showtime EP: Brian Koppelman, David Levien, Andrew Ross Sorkin COLIN IN BLACK & WHITE (season 1) Ava DuVernay Netflix NY Unit EP: Ava DuVernay, Colin Kaepernick / Prod: Lyn Pinezich FBI: MOST WANTED (season 1) Various CBS / Universal Television EP: Dick Wolf, Arthur Forney, Peter Jankowski / Prod: Tom Sellitti ALTERNATINO (season 1) Various Comedy Central / Avalon Television EP: Jay Martel, Arturo Castro / Prod: Ayesha Rokadia AT HOME WITH AMY SEDARIS (seasons 1-2) Various truTV / A24 2018 + 2019 Emmy Nomination: Outstanding Variety/Sketch Series EP: Paul Dinello, Vernon Chatman, John Lee / Prod: Inman Young GOATFACE (variety/sketch) Asif Ali Comedy Central Cast: Hasan Minhaj EP: Asif Ali, Fahim Anwar / Prod: Steve Ast MARVEL’S IRON FIST (season 2) Various Netflix / Marvel Studios ep. 213 | tandem unit: ep. 204, 206 | 2nd unit: ep. 207 EP: Jim Chory, Dan Buckley / Prod: Lyn Pinezich RAMY (pilot presentation) Harry Bradbeer Hulu / A24 World Premiere: SXSW Film Festival EP: Jerrod Carmichael, John Hodges, Ravi Nandan Prod: Jamin O’Brien THE BREAKS (season 1) Various VH1 / Atlantic Pictures EP: Susan Levison, Bill Flanagan / Prod: Gary Giudice BALLERS (seasons 1-2) Simon Cellan Jones HBO EP: Dennis Biggs / Prod: Karyn McCarthy BURN NOTICE (2nd unit) Artie Malesci USA / Fox Television Studios EP: Terry Miller MAGIC CITY (season 1) Various Starz / Media Talent Group EP: Mitch Glazer, Ed Bianchi UNITED STATES OF TARA (season 3) Various Showtime / Dreamworks Television EP: Craig Zisk, Brett Baer, Dave Finkel / Prod: Dan Kaplow MAD MEN (2nd unit, season 4) Various AMC / Lionsgate Television EP: Matthew Weiner, Scott Hornbacher WARREN THE APE (season 1) Various MTV / MTV Productions EP: Kevin Chinoy GREG THE BUNNY (season 1) Various Fox / 20th Century Fox Television EP: Kevin Chinoy Features PROJECT DIRECTOR STUDIO / PRODUCTION CO. -

Understanding the Financial Crisis Eamonn K

NORTH CAROLINA BANKING INSTITUTE Volume 13 | Issue 1 Article 3 2009 Wall Street Meets Main Street: Understanding the Financial Crisis Eamonn K. Moran Follow this and additional works at: http://scholarship.law.unc.edu/ncbi Part of the Banking and Finance Law Commons Recommended Citation Eamonn K. Moran, Wall Street Meets Main Street: Understanding the Financial Crisis, 13 N.C. Banking Inst. 5 (2009). Available at: http://scholarship.law.unc.edu/ncbi/vol13/iss1/3 This Article is brought to you for free and open access by Carolina Law Scholarship Repository. It has been accepted for inclusion in North Carolina Banking Institute by an authorized administrator of Carolina Law Scholarship Repository. For more information, please contact [email protected]. WALL STREET MEETS MAIN STREET: UNDERSTANDING THE FINANCIAL CRISIS EAMONN K. MORAN* TABLE OF CONTENTS I. INTRODUCTION .............................................................................. 7 II. THE ORIGINS OF THE CREDIT CRISIS ...................................... 13 A. Federal Reserve Interest Rate Reductions ................. 13 B. The Nature of the Lender - Borrower Relationship ..... 15 C. Overextended Homeowners ........................................ 16 D. The Rise of Subprime Lending - The Essentials ..... 20 E. The Politics of Homeownership ................................... 25 F. The Current Housing Crisis: Reverberating Effects of Subprim e Lending ................................................... 30 III. FINANCIAL INNOVATION: THE GROWTH OF COMPLEX FINANCIAL INSTRUMENTS