Amazon's Moving Next Door

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Vs. Local-The Hungarian Retail Wars

Journal of Business and Retail Management Research (JBRMR) October 2015 Global Vs. Local-The Hungarian Retail Wars Charles S. Mayer Reza M. Bakhshandeh Central European University, Budapest, Hungary Key Words MNE’s, SME’s, Hungary, FMCG Retailing, Cooperatives, Rivalry Abstract In this paper we explore the impact of the ivasion of large global retailers into the Hungarian FMCG space. As well as giving the historical evolution of the market, we also show a recipe on how the local SME’s can cope with the foreign competition. “If you can’t beat them, at least emulate them well.” 1. Introduction Our research started with a casual observation. There seemed to be too many FMCG (Fast Moving Consumer Goods) stores in Hungary, compared to the population size, and the purchasing power. What was the reason for this proliferation, and what outcomes could be expected from it? Would the winners necessarily be the MNE’s, and the losers the local SME’S? These were the questions that focused our research for this paper. With the opening of the CEE to the West, large multinational retailers moved quickly into the region. This was particularly true for the extended food retailing sector (FMCG’s). Hungary, being very central, and having had good economic relations with the West in the past, was one of the more attractive markets to enter. We will follow the entry of one such multinational, Delhaize (Match), in detail. At the same time, we will note how two independent local chains, CBA and COOP were able to respond to the threat of the invasion of the multinationals. -

Lidl Expanding to New York with Best Market Purchase

INSIDE TAKING THIS ISSUE STOCK by Jeff Metzger At Capital Markets Day, Ahold Delhaize Reveals Post-Merger Growth Platform Krasdale Celebrates “The merger and integration of Ahold and Delhaize Group have created a 110th At NYC’s Museum strong and efficient platform for growth, while maintaining strong business per- Of Natural History formance and building a culture of success. In an industry that’s undergoing 12 rapid change, fueled by shifting customer behavior and preferences, we will focus on growth by investing in our stores, omnichannel offering and techno- logical capabilities which will enrich the customer experience and increase efficiencies. Ultimately, this will drive growth by making everyday shopping easier, fresher and healthier for our customers.” Those were the words of Ahold Delhaize president and CEO Frans Muller to the investment and business community delivered at the company’s “Leading Wawa’s Mike Sherlock WWW.BEST-MET.COM Together” themed Capital Markets Day held at the Citi Executive Conference Among Those Inducted 20 In SJU ‘Hall Of Honor’ Vol. 74 No. 11 BROKERS ISSUE November 2018 See TAKING STOCK on page 6 Discounter To Convert 27 Stores Next Year Lidl Expanding To New York With Best Market Purchase Lidl, which has struggled since anteed employment opportunities high quality and huge savings for it entered the U.S. 17 months ago, with Lidl following the transition. more shoppers.” is expanding its footprint after an- Team members will be welcomed Fieber, a 10-year Lidl veteran, nouncing it has signed an agree- into positions with Lidl that offer became U.S. CEO in May, replac- ment to acquire 27 Best Market wages and benefits that are equal ing Brendan Proctor who led the AHOLD DELHAIZE HELD ITS CAPITAL MARKETS DAY AT THE CITIBANK Con- stores in New York (26 stores – to or better than what they cur- company’s U.S. -

Lidl Has Finally Opened in Atlanta: How Will This Affect the Atlanta Supermarket Landscape?! Powder Springs - 1/16 Snellville - 1/30 Mableton - 2/13

Lidl has finally opened in Atlanta: How will this affect the Atlanta supermarket landscape?! Powder Springs - 1/16 Snellville - 1/30 Mableton - 2/13 Lidl’s has three store-openings set for Atlanta this month. The first is Powder Springs on 1/16/19, followed by Snellville on 1/30/19 and Mableton on 2/13/19. If you haven’t been to a Lidl before, it’s a good-looking store and simple to shop. Very similar to an ALDI, but larger and with the same emphasis on house brands at an extreme discount to name brand products. Lidl ( 36,000 sf) has created an interesting store model for the US. Its stores are significantly larger than ALDI’s (12,000 -15,000 sf) and smaller than the traditional Kroger (45,000-80,000) or Publix store models (42,000- 48,000 sf). As heavily reported, LIDLs initial store openings in the US did not bring the traffic or volumes they hoped for. By opening three stores in the same size format, LIDL is taking a risk. Many (including me) feel that they should be opening in more dense markets and with smaller stores. continued retail specialists retail strategies retail specialists retail strategies My prediction is that these three openings will have minimal impact on the Atlanta “supermarket and real estate market. The Atlanta MSA already has over 340 grocery stores and another three is not going to change the landscape. First, these are all free-standing locations, so there’s no new supply of small shop space for lease. -

Trading with Costco

Trading with Costco Identifying how it plans to win and the supplier opportunities February 17 © IGD 2017 Page 1 Introduction This insight report was prepared by: Stewart Samuel Based in North America, Stewart Program Director, IGD Canada heads up all of IGD's research and coverage on the region. He regularly [email protected] travels across the US and Canada, @Stewart_IGD visiting stores, and meeting with senior retail and supplier teams. Costco continues to be one of the most successful retailers globally. For several years it has delivered consistent sales and profit growth, in the US and across its international markets. Currently it is the second largest retailer globally based on sales. At a time when other retailers have been testing and developing new store formats and aggressively pursuing ecommerce and digital initiatives, Costco has remained focused on its core offer. However, the retailer is making a more determined push with ecommerce and is set to expand its presence into two new markets this year. In this report we look at how the retailer plans to grow and develop over the next five years, and the opportunities for suppliers to engage in key markets. © IGD 2017 Source: IGD Research Page 2 Inside this report Costco today and tomorrow Costco in key markets Strategic priorities Supplier opportunities © IGD 2017 Page 3 Costco operates over 700 clubs across nine countries, with over 86m members. It Costco today plans to open its first clubs in France and Iceland this year. It also sells in China through its online Tmall store. While many of its existing markets offer significant expansion opportunities, regions such as Latin America and the Middle East and Africa could, over the long-term, be a source of future growth. -

Kroger: Value Trap Or Value Investment - a Deep Due Diligence Dive

Kroger: Value Trap Or Value Investment - A Deep Due Diligence Dive seekingalpha.com /article/4115509-kroger-value-trap-value-investment-deep-due-diligence-dive Chuck 10/23/2017 Walston The acquisition of Whole Foods Market, announced by Amazon ( AMZN) last June sent shockwaves through the grocery industry. 1/20 When the deal was finalized in August, Amazon announced plans to lower the prices of certain products by as much as a third. The company also hinted at additional price reductions in the future. Amazon Prime members will be given special savings and other in-store benefits once the online retail giant integrates its point of sale system into Whole Foods stories. 2/20 Analysts immediately predicted a future of widespread margin cuts across the industry. Well before Amazon's entry into stick and brick groceries, Kroger ( KR) experienced deterioration in comparable store sales. 3/20 (Source: Kroger Investor Presentation slideshow) (Source: SEC Filings via SA contributor Quad 7 Capital) Additionally, Kroger's recent results reflect gross margin compression. 4/20 (Source: SEC Filings via SA contributor Quad 7 Capital) After the takeover, Whole Foods initiated a price war. According to Reuters, prices at a Los Angeles Whole Foods store are lower on some products than comparable goods sold in a nearby Ralph's store owned by Kroger. The Threat From Amazon Research conducted by Foursquare Labs Inc. indicates the publicity surrounding Amazon's recent acquisition of Whole Foods, combined with the announcement of deep price cuts, resulted in a 25% surge in customer traffic. Not content to attack conventional grocers with their panoply of online food services and margin cuts, Amazon registered a trademark application for a meal-kit service. -

Discounters Go Digital: How Can Aldi and Lidl Tackle Grocery E-Commerce?

DECEMBER 8, 2016 Discounters Go Digital: How Can Aldi and Lidl Tackle Grocery E-Commerce? Hard discounters Aldi and Lidl are moving into e-commerce in both the grocery and nongrocery categories. This year, Aldi announced it will move into the Chinese market purely through e-commerce, while Lidl Germany is planning to trial a grocery click-and-collect service in Berlin. These are our key takeaways on balancing no-frills discount with the added costs of e-commerce: 1) If discounters are willing to invest to build scale in grocery e- commerce, using “dark stores” dedicated to picking online orders seems to be a better option than picking from regular stores, due to the small size of the discounters’ stores. 2) New delivery options are lowering the costs of home delivery: using “Uberized” third-party couriers would be a more cost-effective, low- investment and scalable model than using temperature controlled, company-owned delivery trucks. This model is already being used by AmazonFresh in the UK. 3) We believe one significant challenge will be the deleveraging effect of smaller average basket sizes online: the highly limited choice offered by Aldi and Lidl will almost certainly yield lower online order values than at nondiscount rivals. This would make the economics of online retail even more detrimental for discounters than they are for their nondiscount peers. DEBORAH WEINSWIG, MANAGING DIRECTOR, FUNG GLOBAL RETAIL & TECHNOLOGY 1 [email protected] US: 917.655.6790 HK: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2016 The Fung Group. All rights reserved. DECEMBER 8, 2016 Introduction We are now seeing a flurry of E-Commerce and hard discount are fast-growing channels in a number of activity from discounters, markets. -

Shirley, 800 Montauk Highway

shirley, ny 800 montauk highway prime retail opportunities at the crossroads to shirley | for lease DEMOGRAPHICS 1 MILE 3 MILES 5 MILES Popula on 9,932 53,546 94,913 Median HHI $83,720 $79,871 $79,723 Loca on 800 Montauk Highway Shirley, NY Available 22,435 square feet 3,300 square feet 1,350 square feet - Currenly Pizzeria can be made available 1,350 square feet - Lease Out Rent Upon Request Extras TBD Co-Tenants LIDL (coming soon), Sonic, Capital One Bank, Dollar Tree, Sherwin-Williams Paint Store, H&R Block Area Retail Chase, Rite Aid, Boston Market, Applebees, AT&T, Wendy’s, Burger King, Dunkin’ Donuts, Kohl’s, McDonald’s, Taco Bell, T-Mobile, TD Bank, Sears, Marshalls, Ma ress Firm , CVS and Stop & Shop Comments • Grocery anchored shopping center • Shirley’s main intersec on • Four-way intersec on with traffi c light and incredible vehicular traffi c • Pizzeria can be made available • Call for other poten al availabili es For More Informa on: Russel Helbling | [email protected] | T 516 874 8070 x1506 Stu Fagen | [email protected] | T 516 874 8070 x1503 William Diakakis | [email protected] | T 516 874 8070 x1521 Nick Laffi n | laffi [email protected] | T 516 874 8070 x1520 ssabre.lifeabre.life shirley, ny 800 montauk highway For More Informa on: Russel Helbling | [email protected] | T 516 874 8070 x1506 Stu Fagen | [email protected] | T 516 874 8070 x1503 William Diakakis | [email protected] | T 516 874 8070 x1521 Nick Laffi n | laffi [email protected] | T 516 874 8070 x1520 ssabre.lifeabre.life shirley, ny 800 montauk highway For More Informa on: -

Netherlands Retail Foods Benelux Food Retail Market

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 1/26/2010 GAIN Report Number: NL0002 Netherlands Retail Foods Benelux Food Retail Market Approved By: Stephen Huete Prepared By: Marcel Pinckaers Report Highlights: Despite the current economic situation, the turnover of the Benelux food retail market in 2009 was €52.7 billion, 4.4% higher than previous year. In addition, the food retail market continues to consolidate further. Post: The Hague Author Defined: Section I. Market Summary Benelux Food Retail Market Approximately 80 percent of the Dutch food retail outlets are full service supermarkets, operating on floor space between 500 and 1,500 square meters located downtown and in residential areas. The remaining 20 percent includes superstores located in industrial parks, convenience stores near human traffic and department stores. In Belgium, full service supermarkets, like Colruyt and AD Delhaize, account for an estimated 75 percent of the market. The share of superstores and convenience stores in Belgium is higher than in the Netherlands, an estimated 25%. In Luxembourg, full service supermarkets like Cactus, Alvo and Match dominate the market as well. In all three markets, independent food retail stores are increasingly leaving the scene. On-going consolidation in the retail market, changing consumer demands and shrinking margins seem to drive this trend. The top 3 biggest retailers in the Netherlands, Albert Heijn, C1000, and Jumbo [1] , have a market share of 56 percent. The market for discounters like Aldi and Lidl has stabilized around 15%. -

Grocery 101: Welcome to the World of Food Retail

This resource was created for the Nutrition Incentive Hub by National Grocers Association Foundation in July 2020. Grocery 101: Welcome to the World of Food Retail Overview of the Food Retail Industry U.S. supermarkets with annual sales of more than $2 million sold almost $412 billion of products in 2018, according to Progressive Grocer’s 2019 Consumer Expenditures Study. Shoppers spent $44 billion on fruits and vegetables in these stores, or almost 11 percent of their total purchases.i In September 2019, almost 250,000 retailers were authorized to accept Supplemental Nutrition Assistance Program (SNAP) benefits. These retailers redeemed more than $55 billion is SNAP benefits in 2018, accounting for more than 10 percent of the total U.S. food purchases in that year.ii Most FINI and GusNIP grantees are working with independent grocery stores, a subset of the food retail industry with a slightly different profile than the industry average. These stores tend to be smaller than the median included in FMI: The Food Industry Association’s data at 25,000 square feet rather than 42,000 square feet, and offer slightly fewer products.iii They account for 25 percent of supermarket industry sales and have almost 1 million employees.iv These stores are often owned by multigeneration grocery families or are employee-owned. Some grantees are working with corner stores, bodegas, or convenience stores, a group that represents a large percentage of the retailers authorized to accept SNAP but are not included in the industry data because many have annual sales of less than $2 million per year.v In general, most grocery sales (56%) come from the “center” of the store, which include grocery, dairy, frozen foods, health and beauty, tobacco, and liquor. -

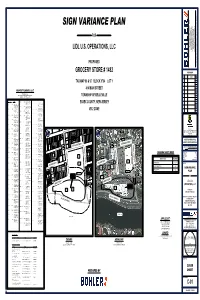

Lidl U.S. Operations, Llc Grocery Store # 1482

TM SIGN VARIANCE PLAN FOR BOHLER © LAND SURVEYING SUSTAINABLE DESIGN PERMITTING SERVICES LIDL U.S. OPERATIONS, LLC PROGRAM MANAGEMENT LANDSCAPE ARCHITECTURE TRANSPORTATION SERVICES SITE CIVIL AND CONSULTING ENGINEERING PROPOSED AUTHORIZATION FROM BOHLER. ONLY APPROVED, SIGNED AND SEALED PLANS SHALL BE UTILIZED FOR CONSTRUCTION PURPOSES THE INFORMATION, DESIGN AND CONTENT OF THIS PLAN ARE PROPRIETARY AND SHALL NOT BE COPIED OR USED FOR ANY PURPOSE WITHOUT PRIOR WRITTEN GROCERY STORE # 1482 REVISIONS DRAWN BY REV DATE COMMENT CHECKED BY TAX MAP 96 & 97 BLOCK 9704 LOT 1 414 MAIN STREET PROPERTY OWNERS LIST WITHIN 200' RADIUS (PER CERTIFIED LIST PROVIDED BY TOWNSHIP TOWNSHIP OF BELLEVILLE OF BELLEVILLE DATED 3/17/2021) BLOCK LOT OWNER 9602 6 C0025 DE CENTENO, OLGA I 309 MAIN STREET UNIT 2 9602 22 C0005 BELL, TRACY L ESSEX COUNTY, NEW JERSEY 9602 6 C0001 MEASSO, TARA BELLEVILLE, NJ 07109 295-307 MAIN STREET UNIT 90 RALPH STREET, UNIT-1 U-3E BELLEVILLE, NJ 07109 9602 6 C0026 LORENZO, OLGA & KENT, JO BELLEVILLE, NJ 07109 309 MAIN STREET, APT #4 9602 6 C0002 GRINBERG, ANNA & BELLEVILLE, NJ 07109 9602 22 C0006 MOORHOUSE, MICHAEL ALEKSANDR 295-307 MAIN STREET U-3E VB-2 ZONE 23 CAROL LANE 9602 6 C0027 HICKEY, BRIDGIT BELLEVILLE, NJ 07109 RICHBORO, PA 18954 309 MAIN ST UNIT-6B BELLEVILLE, NJ 07109 9602 22 C0007 BLEVIS, DIANE 9602 6 C0003 BROWN, JASHANA 295 MAIN AE. UNIT 1C 90 RALPH STREET U-6 9602 6 C0028 ABDALLA, KHALID BELLEVILLE, NJ 07109 BELLEVILLE, NJ 07109 730 RIFLE CAMP ROAD WOODLAND PARK, NJ 9602 22 C0008 SULLIVAN, JOSEPH J & 9602 6 C0004 COHEN, MARC 07424 PATRICIA 90 RALPH STREET APT-7 293-307 MAIN ST. -

The Benelux Food Retail Market Retail Foods Netherlands

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 6/25/2012 GAIN Report Number: NL2014 Netherlands Retail Foods The Benelux Food Retail Market Approved By: Mary Ellen Smith Prepared By: Marcel Pinckaers Report Highlights: The turnover of the Benelux food retail industry for 2011 is estimated at € 56.3 billion. For 2012, turnover is expected to increase by 2.5 percent. The retail market is fairly consolidated. Top 3 food retailers in the Netherlands have a market share of 64 percent while in Belgium the leading 3 retailers have 72 percent of the market. Sustainable food (including organic products) is one of the most important growth markets in food retail. The market share for private label products continues to go up in both Belgium and the Netherlands. The demand for convenient, healthy and new innovative products continues to be strong. Post: The Hague SECTION I. MARKET SUMMARY Benelux Food Retail Market Approximately 80 percent of the Dutch food retail outlets are full service supermarkets, operating on floor space between 500 and 1,500 square meters located downtown and in residential areas. Retailers with full service supermarkets have responded to the need of the Dutch to have these supermarkets close to their house. The remaining 20 percent includes mainly convenience stores (near office buildings and train/metro stations), some wholesalers and just a few superstores (convenient located alongside highways in shopping malls and industrial parks). The Belgians show a different shopping pattern. -

Global Powers of Retailing 2021 Contents

Global Powers of Retailing 2021 Contents Top 250 quick statistics 4 Global economic outlook 5 Top 10 highlights 8 Impact of COVID-19 on leading global retailers 13 Global Powers of Retailing Top 250 17 Geographic analysis 25 Product sector analysis 32 New entrants 36 Fastest 50 38 Study methodology and data sources 43 Endnotes 47 Contacts 49 Acknowledgments 49 Welcome to the 24th edition of Global Powers of Retailing. The report identifies the 250 largest retailers around the world based on publicly available data for FY2019 (fiscal years ended through 30 June 2020), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook, looks at the 50 fastest-growing retailers, and highlights new entrants to the Top 250. Top 250 quick statistics, FY2019 Minimum retail US$4.85 US$19.4 revenue required to be trillion billion among Top 250 Aggregate Average size US$4.0 retail revenue of Top 250 of Top 250 (retail revenue) billion 5-year retail Composite 4.4% revenue growth net profit margin 4.3% Composite (CAGR Composite year-over-year retail FY2014-2019) 3.1% return on assets revenue growth 5.0% Top 250 retailers with foreign 22.2% 11.1 operations Share of Top 250 Average number aggregate retail revenue of countries where 64.8% from foreign companies have operations retail operations Source: Deloitte Touche Tohmatsu Limited. Global Powers of Retailing 2021. Analysis of financial performance and operations for fiscal years ended through 30 June 2020 using company annual reports, press releases, Supermarket News, Forbes America’s largest private companies and other sources.