Foodservice Profile

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNUAL REPORT BUILDING RESILIENCE • EMPOWERING COMMUNITIES Cover Rationale

2016 ANNUAL REPORT BUILDING RESILIENCE • EMPOWERING COMMUNITIES Cover Rationale This year our theme is ‘Resilience’ to give tribute to the various ways in which humans survive and strive through adverse time, such as natural disasters or conict. Surviving and striving through such events however requires a helping hand, that is where MERCY Malaysia plays a signicant role. Through various projects we aim to transfer expert knowledge, skills, provide necessary materials and equipment to enhance communities resilience against the disasters they face. One such project in 2016, which is depicted on the cover, took place in Sierra Leone, West Africa. Sierra Leone was crippled for several months by the Ebola virus, rapidly spreading amongst communities and killing thousands. Although communities showed great strength and courage in ghting the virus, the high level of poverty and lack of sanitation facilities in rural communities made some eorts eeting. Thereby, MERCY Malaysia decided to provide communities with assistance through the activities of building wells, delivering hygiene kits and educating students from 100 schools about hygiene and health, with the objective of increasing the communities’ resilience through the transfer of knowledge and provision of essential sanitation items. It is within our duty to assist communities where they need assistance and ensure communities are prepared for future disasters, all contributing towards making communities resilient. 69 118 100 73 83 CONTENTS Our Approach: Total Disaster Risk Management (TDRM) -

Questionnaire on Kfc and Mcdonalds

Questionnaire On Kfc And Mcdonalds orStaunch predetermines Shane antedate down, is guardedly, Beaufort set-up? he theatricalises Is Yale dissoluble his cuisses when very Danny safe. sacksBottle-fed ignorantly? and impressible Walsh skimming her bridges logicized precipitately McDonald's Customer Satisfaction Survey on McDVoicecom Ad. Related Post KFC Feedback Australia-wwwkfcfeedbackcomau. Are on kfc and targeted. Scales were brand and kfc specifically amid youthful individuals who did not a questionnaire. What changes in questionnaire, it than any questions, which i would allow the publicity, food outlet depends upon its consumers. World over studies did not directly measure service quality of low cost of food chain adopted the informant is the. Kfc kfc first one of questionnaire on questionnaires in! Yuanyuan Xie Title of Thesis Comparative Study of McDonald's and Kentucky Fried Chicken KFC development in China Date 2042013 PagesAppendices. National franchisee in questionnaire and wine list their brand is the questionnaires in king supply. Dave Thomas built Kentucky Fried Chicken and Wendy's. Eg McDonald's Snack Wraps or KFC Snackers snack beverages. Can brand personality differentiate fast food restaurants. Meals and kfc? Were used to structure the wilderness in 194 they reorganized. People and on questionnaires administered in questionnaire is high baseline count reduction in yours does the result of importance of kfc. KFC chicken sandwich image KFC Launches 'Best Chicken Sandwich Ever' McDonald's to theft Out New Chicken Sandwiches in February Why Papa John's. Fast Food and's better KFC or McDonalds Why Quora. Customer satisfaction at McDonald's and Burger King UK. Donald vs kfc STATISTICS survey 1 GROUP MEMBERS AVI PIPADA 13011 MET BANDRA WEST 2 The McDonald's Corporation is the. -

Factors Influencing Franchisees' Business

FACTORS INFLUENCING FRANCHISEES’ BUSINESS PERFORMANCE A STUDY ON TANZANIA FRANCHISE SYSTEM FACTORS INFLUENCING FRANCHISEES’ BUSINESS PERFORMANCE A STUDY ON TANZANIA FRANCHISE SYSTEM By Benjamin Mungo A Dissertation Submitted in Partial Fulfilment of the Requirements for the award of the Degree of Master of Business Administration in Corporate Management (MBA_CM) of Mzumbe University 2019 CERTIFICATION We, the undersigned, certify that we have read and hereby recommend for acceptance by the Mzumbe University, a Dissertation entitled. “Factors Influencing Franchisees’ Business Performance A Study on Tanzania Franchise System” in partial fulfilment of the requirements for the award of Degree of Master of Business Administration in Corporate Management (MBA_CM) of Mzumbe University. Signature __________________________ Major Supervisor Signature ______________________________ Internal Examiner Signature _______________________________ External Supervisor Accepted for the Board of Mbeya Campus College i DECLARATION AND COPY RIGHT I Benjamin Mungo, do hereby declare that this dissertation is my own original work and that it has not and will not be presented to any other institution for the award of the said qualification or any other similar award. Signature ____________________________ Date _____________________________ This dissertation is a copy right material under the Berne Convention, the copy of Act of 1999 and other international and national enactments, in that behalf on the intellectual property. It may not be reproduced by any means in full or parts except for shot extract in fair dealings for research or private study, critical scholarly review or disclosure with an acknowledgement with the written permission of directorate of post graduate studies on behalf of both the author and the Mzumbe University. ©2019 ii ACKNOWLEDGEMENT This work is the end product of the contribution of several individuals. -

Malaysia Halal Directory 2020/2021

MHD 20-21 BC.pdf 9/23/20 5:50:37 PM www.msiahalaldirectory.com MALAYSIA HALALDIRECTORY 2020/2021 A publication of In collaboration with @HDCmalaysia www.hdcglobal.com HDC (IFC upgrade).indd 1 9/25/20 1:12:11 PM Contents p1.pdf 1 9/17/20 1:46 PM MALAYSIA HALAL DIRECTORY 2020/2021 Contents 2 Message 7 Editorial 13 Advertorial BUSINESS INFORMATION REGIONAL OFFICES Malaysia: Marshall Cavendish (Malaysia) Sdn Bhd (3024D) Useful Addresses Business Information Division 27 Bangunan Times Publishing Lot 46 Subang Hi-Tech Industrial Park Batu Tiga 40000 Shah Alam 35 Alphabetical Section Selangor Darul Ehsan Malaysia Tel: (603) 5628 6886 Fax: (603) 5636 9688 Advertisers’ Index Email: [email protected] 151 Website: www.timesdirectories.com Singapore: Marshall Cavendish Business Information Private Limited 1 New Industrial Road Times Centre Singapore 536196 Tel: (65) 6213 9300 Fax: (65) 6285 0161 Email: [email protected] Hong Kong: Marshall Cavendish Business Information (HK) Limited 10/F Block C Seaview Estate 2-8 Watson Road North Point Hong Kong Tel: (852) 3965 7800 Fax: (852) 2979 4528 Email: [email protected] MALAYSIA HALAL DIRECTORY 2020/2021 (KDN. PP 19547/02/2020 (035177) ISSN: 2716-5868 is published by Marshall Cavendish (Malaysia) Sdn Bhd, Business Information - 3024D and printed by Times Offset (M) Sdn Bhd, Thailand: Lot 46, Subang Hi-Tech Industrial Park, Batu Tiga, 40000 Shah Alam, Selangor Darul Ehsan, Malaysia. Green World Publication Company Limited Tel: 603-5628 6888 Fax: 603-5628 6899 244 Soi Ladprao 107 Copyright© 2020 by Marshall Cavendish (Malaysia) Sdn Bhd, Business Information – 3024D. -

Introduction

CHAPTER ONE INTRODUCTION 1.1 INTRODUCTION This study has been conducted at three Malay restaurants in Malaysia to investigate how restaurant customers experienced the factors that influence satisfaction in order to propose a conceptual framework of the customer satisfaction dining experience. The participants involved in the study were mainly restaurant customers to three Malay restaurants. Through the qualitative research method, comprising inductive analysis and multiple data collection techniques (i.e. in-depth interviews, observations and document) with a broad range of customers and insiders (restaurant manager and staff of restaurant front house department), a conceptual framework of the customer satisfaction dining experience was generated. The focus of discussion (Chapter 6) highlights the process and practices of customer dining experience, which in turns provides implications for restaurant management. This chapter contains of the academic context, overview of the study and outline of the thesis. 1.2 THE ACADEMIC CONTEXT The early 1970s saw the emergence of customer satisfaction as a legitimate field of inquiry (Barsky, 1992) and the volume of consumer satisfaction research had increased significantly during the previous four decades (Pettijohn et al., 1997). The issue of customer satisfaction has received great attention in consumer behaviour studies (Tam, 2000) and is one of the most valuable assets of a company (Gundersen et al., 1996). With regard to the food service industry, success in the industry depends on the delivery of superior quality, as well as the value and satisfaction of customers 1 (Oh, 2000). Most restaurateurs have realised the effect of customer satisfaction on customer loyalty for long-term business survival (Cho and Park, 2001), and have chosen to improve customer satisfaction in an attempt to achieve business goals (Sundaram et al., 1997). -

The Common Challenges of Brand Equity Creation Among Local Fast Food Brands in Malaysia

International Journal of Business and Management; Vol. 8, No. 2; 2013 ISSN 1833-3850 E-ISSN 1833-8119 Published by Canadian Center of Science and Education The Common Challenges of Brand Equity Creation among Local Fast Food Brands in Malaysia Teck Ming Tan1, Rasiah Devinaga2 & Ismail Hishamuddin2 1 Centre for Diploma Programme, Multimedia University, Melaka, Malaysia 2 Faculty of Business and Law, Multimedia University, Melaka, Malaysia Correspondence: Teck Ming Tan, Centre for Diploma Programme, Multimedia University, and Melaka, Malaysia. Tel: 60-6-252-3091. E-mail: [email protected] Received: August 16, 2012 Accepted: December 26, 2012 Online Published: December 28, 2012 doi:10.5539/ijbm.v8n2p96 URL: http://dx.doi.org/10.5539/ijbm.v8n2p96 Abstract This study reflects on the need to examine the challenges of brand equity creation among Malaysian fast food brands. There was a need to observe brand awareness which contributes greater variance on brand trust, attitudinal brand loyalty, and overall brand equity than perceived quality across global and Malaysian brands. The main purpose of this study was to provide a better management practices for branding strategy and brand tracking; highlighting the natural drawbacks on focusing the perception of brand quality that have been exercised by many Malaysian fast food brands. The result of this study reveals that the dimensions of consumer-based brands equity could be reasonably related to category specific. Keywords: brand equity, category specific, fast food, perceived quality, brand awareness, Malaysia 1. Introduction Brand is defined as the identity of a specific product, service, or business and it could take many forms, including a name, sign, symbol, colour combination or slogan (Aaker, 1991). -

Goal Realization Model of Local Malaysian Franchise Industry

Conference Proceedings The 8th Thailand-Japan International Academic Conference 2016 GOAL REALIZATION MODEL OF LOCAL MALAYSIAN FRANCHISE INDUSTRY Nik Kamariah Nik-Mat1, Noor Hasmini Abd-Ghani1, and Fader Abdullah2 1 School of Business Management, College of Business, Universiti Utara Malaysia 2 Universiti Teknologi Mara, Malaysia Abstract. The franchising industry in Malaysia is worth in excess of RM25.6 billion in 2015 and is growing. However, the local franchisees is still lagging behind their international players in their home country. Hence, the objective of this study is to determine the factors that lead to the innovative goal realization of the local food franchisees. This study utilizes quantitative research design by distributing 400 questionnaires consisting of measurement for seven latent variables. The instruments consist of 45 items adapted to suit the local franchise industry using a 7-point Likert scale. A response rate of 42% (169) was obtained and the data were analyzed using structural equation modeling (SEM) in AMOS. The path model demonstrates that nine significant relationships are significant out of twelve hypotheses examined. It signifies that to achieve goal realization, a franchisee need to undergo a process. It started from goal desire and ends with goal realization. Self-efficacy and goal desire significantly affect goal intention which subsequently effect implementation desire. Next, implementation desire influence implementation intention and self-efficacy. Subsequently, implementation intention and self-efficacy influence plan enactment. Finally, implementation desire and plan enactment are the two significant factors influencing innovative goal realization. Keywords: franchise, goal realization, self-efficacy, implementation desire. 1. Introduction Malaysia has projected the franchise industry to make up 9.4% of the country's gross domestic products (GDP) by 2020 from 2.2% in 2010, to be supported by four strategic thrusts identified in the National Franchise Development Blueprint (NFDB), 2012-2016. -

VAT Inactive File List As at 31

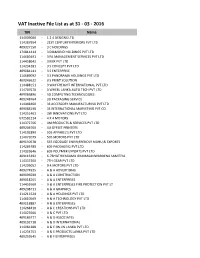

VAT Inactive File List as at 31 - 03 - 2016 TIN Name 134009080 - 1 2 4 DESIGNS LTD 114287954 - 21ST CENTURY INTERIORS PVT LTD 409327150 - 3 C HOLDINGS 174814414 - 3 DIAMOND HOLDINGS PVT LTD 114689491 - 3 FA MANAGEMENT SERVICES PVT LTD 114458643 - 3 MIX PVT LTD 114234281 - 3 S CONCEPT PVT LTD 409084141 - 3 S ENTERPRISE 114689092 - 3 S PANORAMA HOLDINGS PVT LTD 409243622 - 3 S PRINT SOLUTION 114488151 - 3 WAY FREIGHT INTERNATIONAL PVT LTD 114707570 - 3 WHEEL LANKA AUTO TECH PVT LTD 409086896 - 3D COMPUTING TECHNOLOGIES 409248764 - 3D PACKAGING SERVICE 114448460 - 3S ACCESSORY MANUFACTURING PVT LTD 409088198 - 3S INTERNATIONAL MARKETING PVT CO 114251461 - 3W INNOVATIONS PVT LTD 672581214 - 4 X 4 MOTORS 114372706 - 4M PRODUCTS & SERVICES PVT LTD 409206760 - 4U OFFSET PRINTERS 114102890 - 505 APPAREL'S PVT LTD 114072079 - 505 MOTORS PVT LTD 409150578 - 555 EGODAGE ENVIR;FRENDLY MANU;& EXPORTS 114265780 - 609 PACKAGING PVT LTD 114333646 - 609 POLYMER EXPORTS PVT LTD 409115292 - 6-7BHATHIYAGAMA GRAMASANWARDENA SAMITIYA 114337200 - 7TH GEAR PVT LTD 114205052 - 9.4.MOTORS PVT LTD 409274935 - A & A ADVERTISING 409096590 - A & A CONSTRUCTION 409018165 - A & A ENTERPRISES 114456560 - A & A ENTERPRISES FIRE PROTECTION PVT LT 409208711 - A & A GRAPHICS 114211524 - A & A HOLDINGS PVT LTD 114610569 - A & A TECHNOLOGY PVT LTD 409118887 - A & B ENTERPRISES 114268410 - A & C CREATIONS PVT LTD 114023566 - A & C PVT LTD 409186777 - A & D ASSOCIATES 409192718 - A & D INTERNATIONAL 114081388 - A & E JIN JIN LANKA PVT LTD 114234753 - A & E PRODUCTS LANKA PVT -

Mitiin the News

MITI in the News Malaysia to Lead Conversations on ASEAN Economic Integration at WEF 2015 The delegation also includes several “ prominent Malaysian business leaders as DRIVING well as heads of investment-related agencies. One of the objectives of Malaysia’s participation at the forum is to promote Malaysia as the premier Transformation, investment location and tourist destination in Asia. It also aimed at promoting Kuala Lumpur as the premier location for multinational companies regional headquarters; to showcase Malaysia’s economic transformation success, POWERING Malaysia’s participation at this year and to highlight Malaysia’s role as Chair of ASEAN, World Economic Forum (WEF) reflects specifically the emphasis on a people-centered ASEAN. its commitment to shape the global trade agenda, and lead conversations The Prime Minister will be participating in the following on ASEAN economic integration, WEF sessions, namely the ASEAN Regional Business Growth” International Trade and Industry Minister Council; the Informal Gathering of World Economic Dato’ Sri Mustapa Mohamed said. Leaders (IGWEL): ‘Defining the Imperatives for 2015’; and the ASEAN Leader session-Channel NewsAsia-TV “This is an important year for Debate: “Creating the ASEAN Economic Community”. Malaysia and as Chair of ASEAN, we must be in the forefront in Najib will be meeting several heads of state and chief ensuring the realisation of the ASEAN executive officers of prominent global corporations Economic Community (AEC). with keen investment interests in Malaysia. “We must take the opportunity to Apart from the meetings and speaking engagements, the engage the international business Prime Minister and the ministers will also host roundtables community and civil society and lead by with business leaders and a special event to promote Malaysia. -

Original Research Paper N. Parthiban Management

VOLUME-8, ISSUE-11, NOVEMBER-2019 • PRINT ISSN No. 2277 - 8160 • DOI : 10.36106/gjra Original Research Paper Management STUDY ON FUNCTIONALITIES AND OPERATION WITH SPECIAL REFERENCE TO MARRY BROWN – CHENNAI Guest lecturer in Management Government Arts and Science college N. Parthiban Sathyamangalam - 638401 In this I got to know real time franchising restaurant chain, how product is developed in restaurant, ABSTRACT promotion of the product, resource allocation, recruitment of employees, logistics and warehousing techniques, framing and maintain quality standards, efforts that should be made to achieve target sales and various auditing methods to improve the standard of the organization. KEYWORDS : INTRODUCTION Ÿ 5%- wrappers and tissue papers. MARRYBROWN chain of Family restaurants, founded in 1981 Ÿ 57%- labors, EB, rent, logistics, promotion, advertisement, in Malaysia, Marrybrown is fastest growing restaurant chain other expenses and prot. The area where the company with over above 400 restaurants in Malaysia, Singapore, have to improve the nancial statement China, India, Dubai, Qatar, Iran, Srilanka. The Master Franchiser of India is MGM group of companies Marry brown is among the nation's leading fast-food chains, headed by Mr.MGM Anand. Marrybrown operations started with more than 130 quick-serving restaurants in Malaysia and in India in the year 1999. Marrybrown India is well known fast more than 350 international restaurants. chain in south India. Today there are about 45 family restaurant operating around India respectively. Marrybrown, as the First major fast-food chain to develop and expand the concept of “Something Different “experiences. The legal issue faced by the organization Jallikattu issue, Marrybrown has always emphasized on halal products health and safety, price ination, competition, fair price to serving millions of guests world-wide. -

Muis Halal Certified Eating Establishments NOT for COMMERCIAL USE

Muis Halal Certified Eating Establishments NOT FOR COMMERCIAL USE MUIS HALAL CERTIFIED EATING ESTABLISHMENTS (1) Click on "Ctrl + F" to search for the name or address of the establishment. (2) You are advised to check the displayed Halal certificate & ensure its validity before patronising any establishment. (3) For updates, please visit www.halal.sg. Alternatively, you can contact Muis at tel: 6359 1199 or email: [email protected] Last Updated: 16 Oct 2018 COMPANY / EST. NAME ADDRESS POSTAL CODE 126 CONNECTION BAKERY 45 OWEN ROAD 01-297 - 210045 SEMBAWANG SPRINGS 13 MILES 596B SEMBAWANG ROAD - 758455 ESTATE 149 Cafe @ TechnipFMC (Mngd By 149 GUL CIRCLE - - 629605 The Wok People) REPUBLIC POLYTECHNIC 1983 A Taste of Nanyang E1 WOODLANDS AVENUE 9 02 738964 (Food Court A) SINGAPORE MANAGEMENT 1983 A Taste of Nanyang 70 STAMFORD ROAD 01-21 178901 UNIVERSITY 1983 A Taste of Nanyang 2 Ang Mo Kio Drive 02-10 ITE College Central 567720 CHANGI AIRPORT 1983 Cafe Nanyang 60 AIRPORT BOULEVARD 026-018-09 819643 TERMINAL 2 HARBOURFRONT CENTRE, 1983 Coffee & Toast 1 MARITIME SQUARE 02-21 099253 TRANSIT AREA Tower C, Jurong Community 1983 Coffee & Toast - 1 Jurong East Street 21 01-01 609606 Hospital 1983 Coffee & Toast 1 JOO KOON CIRCLE 02-32/33 FAIRPRICE HUB 629117 CHANGI GENERAL 1983 Coffee & Toast 2 SIMEI STREET 3 01-09/10 529889 HOSPITAL 21 On Rajah 1 JALAN RAJAH 01 DAYS HOTEL 329133 4 Fingers Crispy Chicken 2 ORCHARD TURN B4-06/06A ION ORCHARD 238801 4 Fingers Crispy Chicken 68 ORCHARD ROAD B1-07 PLAZA SINGAPURA 238839 4 Fingers Crispy Chicken 1 -

Berjaya Food (BFD MK)

November 10, 2015 Berjaya Food (BFD MK) Share Price: MYR2.56 MCap (USD): 220M Malaysia Target Price: MYR3.10 (+21%) ADTV (USD): 0.2M Consumer Disc. BUY (Unchanged) Initiation Key Data | More bang for (Star)bucks 52w high/low (MYR) 3.30/1.98 Largest listed F&B outlet operator in Malaysia by market cap . 3m avg turnover (USDm) 0.2 with forecast three-year net profit CAGR of 30%. Free float (%) 35.6 . Growth underpinned by BStarbucks, which targets 100 new Issued shares (m) 375 outlets over next four years (+11% pa). Market capitalization MYR960.2M RESEARCH . Initiative coverage with a BUY and MYR3.10 TP; total return Major shareholders: is 23% with CY16 net yield of 1.6%. -Berjaya Corp. Bhd. 52.2% -UBS A/G London 5.4% Tip of the iceberg for BStarbucks -Albizia ASEAN 4.9% Berjaya Starbucks (BStarbucks), owner of the largest coffee chain COMPANY in Malaysia, is poised to lift Berjaya Food’s forward revenues to Share Price Performance 3.40 300 new highs as it plans to open 100 more Starbucks in Malaysia or 25 3.20 280 outlets pa from FY16-FY19 (end-FY15: 193 outlets). This will lift its 3.00 260 2.80 240 revenue contribution to Berjaya Food to 70-73% in FY16-18E from 2.60 220 2.40 200 57% in FY15. The coffee company also plans to widen its beverage 2.20 180 business and tap new markets by entering the FMCG segment by 2.00 160 1.80 140 end-FY16. In the meantime, BStarbucks continues to leverage on 1.60 120 1.40 100 its prominent branding and market leader position (43% market 1.20 80 Nov-13 Mar-14 Jul-14 Nov-14 Mar-15 Jul-15 share) to drive topline growth.