Pakuwon Jati

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Together Possible TM

ANNUAL REPORT ID 2015 THE FUTURE OF OUR NATURE together possible TM WWF is one of the largest and most experienced independent conservation organizations, with over 5 million supporters and a global network active in more than 100 countries. WWF’s mission is to stop degradation of the planet’s natural environment and to build a future in which humans live in harmony with nature, by conserving the world’s biological diversity, ensuring that the use of renewable resources is sustainable, and promoting the reduction of pollution and wasteful consumption. CONTRIBUTORS WWF-Indonesia staff SUPERVISORY BOARD Arief T. Surowidjojo (Chair), Martha Tilaar (Vice Chair), John A. Prasetio ADVISORY BOARD Pia Alisjahbana (Chair), Arifin M. Siregar (Vice Chair), Djamaludin Suryohadikusumo, A.R Ramly, Kuntoro Mangkusubroto EXECUTIVE BOARD Kemal Stamboel (Chair), Rizal Malik, Shinta Widjaja Kamdani (Vice Chair), Tati Darsoyo, Jerry Ng, Alexander Rusli LAYOUT, DESIGN AND EDITING BY Catalyze Communications and BrightWater COVER PHOTO CREDIT © Ihwan Rafina/WWF-Indonesia Published in May 2016 CONTENTS A MeSSAge fRoM The ChAiRMAN & Ceo .....................................................2 1. PReServiNg natuRAl CAPital ..................................................................4 2. equitable ReSouRCe goVeRNANCe ....................................................14 3. PRoDuCe beTTeR .........................................................................................19 4. CoNSuMe MoRe wiSely .............................................................................26 -

Arrial Narrow, 14, Aligned Left

digitales archiv ZBW – Leibniz-Informationszentrum Wirtschaft ZBW – Leibniz Information Centre for Economics Aditi, Bunga Article The effect of services, price discount and brand equity on consumer purchase decisions in Go-Jek a technology start-up transport Provided in Cooperation with: Dimitrie Cantemir Christian University, Bucharest This Version is available at: http://hdl.handle.net/11159/3251 Kontakt/Contact ZBW – Leibniz-Informationszentrum Wirtschaft/Leibniz Information Centre for Economics Düsternbrooker Weg 120 24105 Kiel (Germany) E-Mail: [email protected] https://www.zbw.eu/econis-archiv/ Standard-Nutzungsbedingungen: Terms of use: Dieses Dokument darf zu eigenen wissenschaftlichen Zwecken This document may be saved and copied for your personal und zum Privatgebrauch gespeichert und kopiert werden. Sie and scholarly purposes. You are not to copy it for public or dürfen dieses Dokument nicht für öffentliche oder kommerzielle commercial purposes, to exhibit the document in public, to Zwecke vervielfältigen, öffentlich ausstellen, aufführen, vertreiben perform, distribute or otherwise use the document in public. If oder anderweitig nutzen. Sofern für das Dokument eine Open- the document is made available under a Creative Commons Content-Lizenz verwendet wurde, so gelten abweichend von diesen Licence you may exercise further usage rights as specified in Nutzungsbedingungen die in der Lizenz gewährten Nutzungsrechte. the licence. Leibniz-Informationszentrum Wirtschaft zbw Leibniz Information Centre for Economics Academic Journal of -

Results Presentation – 1H 2020 Disclaimer

Results Presentation – 1H 2020 Disclaimer By attending this presentation, you are agreeing to be bound by the restrictions set out below. Any failure to comply with these restrictions may constitute a violation of applicable securities laws. The information and opinions contained in this presentation are intended solely for your personal reference and are strictly confidential. The information and opinions contained in this presentation have not been independently verified, and no representation or warranty, expressed or implied, is made as to, and no reliance should be placed on the fairness, accuracy, completeness or correctness of, the information or opinions contained herein. It is not the intention to provide, and you may not rely on this presentation as providing, a complete or comprehensive analysis of the condition (financial or other), earnings, business affairs, business prospects, properties or results of operations of the company or its subsidiaries. The information and opinions contained in this presentation are provided as at the date of this presentation and are subject to change without notice. The company (including any of its affiliates, advisors and representatives) shall have any responsibility or liability whatsoever (in negligence or otherwise) for the accuracy or completeness of, or any errors or omissions in, any information or opinions contained herein nor for any loss howsoever arising from any use of this presentation. In addition, the information contained in this presentation contains projections and forward-looking statements that reflect the company's current views with respect to future events and financial performance. These views are based on a number of estimates and current assumptions which are subject to business, economic and competitive uncertainties and contingencies as well as various risks and these may change over time and in many cases are outside the control of the company and its directors. -

Miniso Royal Plaza Surabaya Consumer Impulse Buying Behavior

Journal of Applied Management and Business Volume 2 Issue 1 July 2021 ISSN: 2745-6328 Miniso Royal Plaza Surabaya Consumer Impulse Buying Behavior Nurul Silfiyah Isnaini1*, Noerchoidah2* 1,2 Universitas PGRI AdiBuana Surabaya *Email: [email protected] ABSTRACT This research is to analyze the effect of price discount, visual merchandising, shopping lifestyle on impulse buying of Miniso Royal Plaza Surabaya consumers. The research data used were 105 respondents using multiple linear regression to analyze the data. The empirical results of the study prove that price discount has a positive and significant effect on impulse buying, visual merchandising has a positive and significant effect on impulse buying, shopping lifestyle has a positive and significant effect on impulse buying. Furthermore, it was simultaneously found that price discount, visual merchandising, shopping lifestyle on impulse buying. KEYWORDS Price Discount, Visual Merchandising, Shopping Lifestyle, Impulse Buying. INTRODUCTION The development of modern technology today has an impact on life that is becoming more practical, fast, and economical. Along with these technological developments, the existence of a modern retail business is also increasingly important and of course each has its own strategy to be able to compete with other modern retail businesses. Indonesia ranks third as the country with the largest population in Asia. This makes Indonesia a special attraction for modern retail businesses, both foreign and local retailers, to open opportunities and compete for consumers. Modern retail businesses must learn about the character and behavior of consumers so that the strategies that will be implemented can run well. One of the foreign modern retailers that has opened up opportunities in Indonesia is Miniso. -

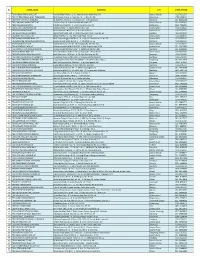

No STORE NAME ADDRESS2 CITY STORE PHONE 1 TBS

No STORE_NAME ADDRESS2 CITY STORE_PHONE 1 TBS PONDOK INDAH MALL JKT Pondok Indah Mall Lt. 1 - JL. Metro Pondok Indah Blok IIIB Jakarta Selatan 021-7692353 2 TBS CIPUTRA SERAYA MALL PEKANBARU Mall Ciputra Seraya Lt. Dasar No.18 - Jl. Riau No. 58 Pekanbaru 0761-868618 3 TBS PARIS VAN JAVA BANDUNG RL B20 Paris Van Java - Jl. Sukajadi 137 - 139, Bandung Bandung 022-82063649 4 TBS GANDARIA MAIN STREET JKT Gandaria City - Jl. Sultan Iskandar Muda No. 57 Jakarta Selatan 021-29053091 5 TBS E-WALK BALIKPAPAN E Walk Superblok GF - Jl. Jendral Sudirman No. 71 Balikpapan 0542-7586881 6 TBS KELAPA GADING MALL JKT Kelapa Gading - Jl. Boulevard Raya Kav. 144 Jakarta Utara 021-4533422 7 TBS PLAZA SENAYAN JKT Plaza Senayan 2 ND Floor - JL. Asia Afrika No. 8 Jakarta Pusat 021-5725179 8 TBS GALAXY MALL SURABAYA Galaxy Mall G.101-102 - Jl. Dharmahusada Indah Timur No.14 Surabaya 031-5915032 9 TBS PLUIT MEGA MALL JKT Mega Mall Pluit GF - JL. Pluit Indah Raya No. 36 Jakarta Utara 021-6683878 10 TBS TAMAN ANGGREK MALL JKT Mall Taman Anggrek UG Floor - JL. Letjen S. Parman Kav. 21 No. 78 Jakarta Barat 021-5639296 11 TBS BANDUNG INDAH PLAZA BANDUNG Bandung Indah Plaza GF NO. 5 - Jl. Merdeka No. 56 Bandung 022-4233521 12 TBS BLOK M PLAZA JKT Blok M Plaza UG - 01 - 02 - Jl. Bulungan No. 76 Keb. Baru Jakarta Selatan 021-7209041 13 TBS INDONESIA PLAZA JKT Plaza Indonesia LB# B-08 FLOOR - Jl. MH Thamrin Kav.28-30 Jakarta Pusat 021-29923853 14 TBS TRANS STUDIO MALL BANDUNG Bandung Supermall 1ST Floor - Jl. -

PT Pakuwon Jati Tbk Paparan Publik 26 Juni 2018 Table of Contents

PT Pakuwon Jati Tbk Paparan Publik 26 Juni 2018 Table of contents Section 1 Results summary 3 Section 2 Business summary 7 Section 3 Growth & strategy 14 Section 4 Capital management 18 Appendix A Company overview 22 Appendix B CSR Activities 2017 28 1 Section 1 Results Summary Results summary (Rp bn unless otherwise stated) 1Q 2018 1Q 2017 Variance Comments Revenue 1,647 1,378 +19.5% 22% increase in recurring revenues and 17% increase in development revenue recognition. Pakuwon Permai contributed Rp 413bn (25%) of revenues. Gross Profit1 944 794 +18.9% Gross Profit Margin (%) 57.3% 57.6% EBITDA1 923 756 +22.2% EBITDA Margin (%) 56.0% 54.8% Net Income for the Period2 694 518 +33.9% Net Income Margin (%) 42.1% 37.6% Net Income Attributable to Owners2 617 491 +25.5% Earning Per Share (Rp)2 Basic 12.81 10.20 +25.5% Notes: 1 Adjusted for acquisition related COGS from goodwill costs of Rp4bn in 1Q2018 and Rp7bn in 1Q2017 2 Adjusted for acquisition COGS from goodwill costs of Rp4bn in 1Q2018 and Rp7bn in 1Q2017, forex gain (loss) of (Rp42bn) and Rp20bn in 1Q2018 and 1Q2017 respectively, loss on derivative of Rp8bn and Rp3bn in 1Q2018 and 1Q2017 respectively, and penalty on redemption of bond payable of Rp 154bn in 1Q2017 3 Results breakdown Revenue by segment (1Q2018) Revenue by project (1Q2018) Revenue by geography (1Q2018) Hotel & Serviced Office sales Pakuwon Grand Apartments0.6% Office 7.4% City Pakuwon leasing 12.9% 5.2% Kota 4.0% Condo sales Kasablanka 32.0% 26.6% Jakarta Royal Plaza 40.4% 1.3% Gandaria Retail City Surabaya leasing 11.8% -

Daftar Usaha Pariwisata

DAFTAR USAHA PARIWISATA B A R No Nama Usaha Alamat Usaha 1 A Cafe Jl.Taman Sampoerna No.6 2 Ambrosia Jl. Wiyung Permai Tengah I (Komp. Perum. Dian Istana) 3 Angus House Jl. HR. Muhammad No.41 (GD.Halim Sakti Lt.8) 4 BAR TW ON HALL Jl. Basuki Rahmad No. 76 (Hotel Midtown Lt.1) 5 Bekisar Bar Jl. Sumatera No.1-15, (Hotel Sahid Surabaya Lt.1) 6 BOUGENVILLE LOUNGE Jl. Menur Pumpungan No. 62-64 Tower A Hotel Gunawangsa Manyar Lt. 23 7 Cafe Makassar Jl. Kapasari No. 116 8 Cafe Taman Jl. Pemuda No. 33-37 Surabaya Suites Hotel Lt.1 9 Capital Jl. Bukit Darmo Bourevard (Lenmarc Mall Level Ground Unit G-12) 10 CASTLE LOUNGE Jl. Basuki Rachmad No. 123-127 Crown Prince Hotel Lt. 6 11 Cat's Pajamas Jl. Taman Simpang No.7 12 CC Club Jl.Mayjend Sungkono No.7A Lt.2 13 Cheng And Brother Jl. Mayjend Yono Soewoyo No. 33 (Spazio Mall First Floor Unit.107) 14 Citilites Jl. Mayjend Sungkono No.101-103 (Hotel Java Paragon Lt.21) 15 Club 360 Jl. A.Yani No.16-18 (Royal Plaza Lt. II R-3) 16 Club Deluxe Jl. Tunjungan (Gedung TEC Lt. IV) 17 Coektail Lounge Jl. Panglima Sudirman No. 42-44, (Hotel Elmi Lt. Dasar) 18 Coffee Cafe Bar Jl. Raya Darmo No.68-78 (Hotel Mercure Grand Mirama Lt.1) 19 Colors Bar Jl. Sumatera No. 81 20 Coyote Bar Jl. Basuki Rahmat No. 8 - 12 (TP. 1 Lt. 1 Unit PE. 01/06-08) 21 Crystal Jade Jl. -

NO OUTLET NAME ADDRESS Yoshinoya, Grand Yogya Kepatihan 18, Jalan Kepatihan, Balonggede, Regol Yoshinoya Basuki Rahmat 8, Jalan

NO OUTLET NAME ADDRESS 1 Yoshinoya, Grand Yogya Kepatihan 18, Jalan Kepatihan, Balonggede, Regol 2 Yoshinoya Basuki Rahmat 8, Jalan Jendral Basuki Rahmat, Cipinang Besar Selatan, Jatinegara 3 YOSHINOYA, AEON Mall BSD City AEON Mall, Lantai Ground, Food Culture, Serpong, Tangerang 4 YOSHINOYA, Bandung Electronic Center Bandung Electronic Center, Lantai LG, Jl. Purnawarman No.13 ? 15, Braga, Bandung 5 YOSHINOYA, BG Junction BG Junction Surabaya, Lantai.Ground, Jl Bubutan No. 1-7, Bubutan, Surabaya 6 YOSHINOYA, Bintaro Plaza Bintaro Plaza, Gedung Annex 6, Area Outdoor, Jl. Bintaro Utama 3, Bintaro Sektor 3A, Bintaro, Jakarta 7 YOSHINOYA, Blok M Plaza Blok M Plaza, Lantai 5 Foodcourt, Jl. Bulungan No. 78, Kramat Pela, Kebayoran Baru, Jakarta Selatan 8 YOSHINOYA, Botani Square Botani Square, Lantai 2, Eatery Food Court, Jl. Pajajaran Raya, Bogor Tengah, Bogor 9 YOSHINOYA, Cibinong City Mall Cibinong City Mall, Lantai 1, Jl. Tegar Beriman No. 1, Cibinong, Bogor 10 YOSHINOYA, Cibubur Junction Cibubur Junction, Lantai LG, Jl. Jambore No. 14, Ciracas, Jakarta Timur 11 Yoshinoya, Cihampelas Walk Cihampelas Walk, 160, Jalan Cihampelas, Cipaganti, Coblong 12 YOSHINOYA, Cihampelas Walk Cihampelas Walk, Lantai 1, Jl. Cihampelas No. 160, Cihampelas, Bandung 13 YOSHINOYA, Citraland Ciputra Mall, Lantai LG Unit B, Jl. Arrteri S. Parman (Depan Lift), Grogol, Jakarta 14 YOSHINOYA, Mall Ciputra (Citraland) Ciputra Mall, Lantai LG Unit B, Jl. Arteri S Parman (Depan Lift), Grogol, Jakarta 15 YOSHINOYA, Ciputra World Ciputra World, Lantai Lower Ground, Jl. Mayjen Sungkono No. 87, Dukuh Pakis, Surabaya YOSHINOYA, Citra Xperience 16 Kemayoran Citra Tower Kemayoran, Jl. Casa No. 170, Kemayoran, Jakarta Pusat 17 YOSHINOYA, Kaliurang Jogja Desa Caturtunggal, Jl. -

PWON) Challenges from Falling Occupancy Rate

Pakuwon Jati Tbk (PWON) Challenges from Falling Occupancy Rate PWON booked total revenue of IDR1.34 trillion (315.2% YoY) in 2Q21. Development and Company Update | Sept 07, 2021 recurring income also grew 676.1% YoY and 195.5% YoY. While marketing sales also had a significant growth, the company is currently faced with challenges in the form of falling occupancy rates from several shopping malls under management. BUY Target Price (IDR) 585 Low Based Effect, 2Q21 Income Grows Significantly Consensus Price (IDR) 594 PWON’s income in 2Q21 reached IDR1.34 trillion (+315.2% YoY, +20% QoQ), or 77.3% higher than • TP to Consensus Price -1.5% our estimation. Meanwhile throughout 1H21 was recorded at IDR2.46 trillion (+25% YoY). Potential Upside +26.1% Development income in 2Q21 was booked at IDR625 billion (+676.1% YoY, +23.5% QoQ), while • recurring income was at IDR718 billion (+195.5% YoY, +17.8% QoQ). The significant increase was Shares data due to low based effect as the 2Q20 income was greatly impacted by the pandemic. Last Price (IDR) 464 GPM, and OPM recovered in 2Q21 at 48.5% and 34.1%. • Price Date as of Sept 06, 2021 • However, due to the early repayment of bonds, PWON has to pay a penalty of IDR99.43 billion. This 52 wk Range (Hi/Lo) 615/332 caused net profit in 2Q21 fell to IDR228 billion (-45.2% YoY, -3.8% QoQ), followed by declining Free Float (%) 31.3 NPM to 17% (-420bps QoQ). Outstanding sh.(mn) 48,160 Market Cap (IDR bn) 22,442 Need to Maintain Mall Occupancy Rate Market Cap (USD mn) 1,580 • Marketing sales in 1H21 was recorded at IDR821 billion or 59% of the target in 2021. -

P U T U S a N Perkara Nomor: 09/KPPU-L/2009

P U T U S A N Perkara Nomor: 09/KPPU-L/2009 Komisi Pengawas Persaingan Usaha Republik Indonesia selanjutnya disebut Komisi yang memeriksa dugaan pelanggaran Pasal 17 ayat (1), Pasal 20, Pasal 25 ayat (1) huruf a dan Pasal 28 ayat (2) Undang-undang Nomor 5 Tahun 1999 tentang Larangan Praktek Monopoli dan Persaingan Usaha Tidak Sehat selanjutnya disebut UU No. 5 Tahun 1999 berkaitan dengan dugaan praktek monopoli dan/atau persaingan usaha tidak sehat atas akuisisi PT Alfa Retailindo, Tbk yang dilakukan oleh :---------------------------------- Terlapor : PT Carrefour Indonesia, selanjutnya disebut Terlapor yang beralamat kantor di Gedung Carrefour Lantai 3, Jl. Lebak Bulus Raya No. 8, Jakarta Selatan 12310; ------------------------------------------------------------------------------------------------ telah mengambil Putusan sebagai berikut: ------------------------------------------------------ Majelis Komisi: ------------------------------------------------------------------------------------ Setelah membaca surat-surat dan dokumen-dokumen dalam perkara ini;------------------- Setelah membaca Laporan Hasil Pemeriksaan Pendahuluan;--------------------------------- Setelah membaca Laporan Hasil Pemeriksaan Lanjutan; ------------------------------------- Setelah membaca Tanggapan/Pembelaan/Pendapat Terlapor;-------------------------------- Setelah membaca Berita Acara Pemeriksaan (selanjutnya disebut “BAP”); --------------- TENTANG DUDUK PERKARA 1. Menimbang bahwa Sekretariat Komisi menerima laporan tentang adanya dugaan pelanggaran terhadap -

Daftar Optik Rekanan Astra Life - Optik Seis Bulan Januari 2021

DAFTAR OPTIK REKANAN ASTRA LIFE - OPTIK SEIS BULAN JANUARI 2021 Daftar dapat berubah sewaktu-waktu tanpa pemberitahuan terlebih dahulu, oleh karena itu sebelum melakukan pembelian kacamata, silahkan menghubungi nomor telepon 24 jam Astra Life - Admedika (021) 2960 3282 Diperbaharui 13-Jan-21 NO KODE ADMEDIKA CABANG OPTIK SEIS ALAMAT NO TELEPON ACEH 1 BANDA ACEH Optik Seis SUZUYA MALL BANDA ACEH* Lantai 2 Jl. Teuku Umar,Lamteumen Kota Banda Aceh (0651) 8084385 SUMATERA UTARA Lantai Dasar Unit A 19 & 20 Jl. H. Zainul Arifin No. 7 2 '3795 MEDAN Optik Seis SUN PLAZA (061) 4501336 Lantai 1 / AI No. 93 Jl. Jend. Gatot Subroto No. 30 '3796 MEDAN Optik Seis PLAZA MEDAN FAIR (EXPRESS) (061) 4140745 3 Lantai Upper Ground No. UG-17 Jl. Timor / Jawa No.1, Medan 4 '3797 MEDAN Optik Seis CENTER POINT MEDAN (061) 80501352 5 MEDAN Optik Seis DELI PARK* Lantai 2 No 08 Jl. Putri Hijau / Guru Patimpus No. 1 OPQ (061) 62000188 BATAM GF Blok GR-05 No. 10 Komplek Nagoya Hill Superblock Jl. Teuku Umar, Nagoya - Batam 6 '3798 BATAM Optik Seis NAGOYA HILL SHOPPING MALL (0778) 7493693 7 '4507 BATAM Optik Seis MEGA MALL BATAM CENTRE GF No. G275-276 Jl.Engku Putri Kel.Teluk Tering,Batam Kota 29461 (0778) 473529 8 BATAM Optik Seis GRAND BATAM MALL* Ground Floor No. GF-12 Jl. Pembangunan Kel.Batu Selicin , Lubuk Baja 29432 (0778) 4888985 KEPULAUAN RIAU Lantai Dasar No. 17 Jl. Riau No. 58 '3784 PEKANBARU - RIAU Optik Seis MAL CIPUTRA SERAYA (0761) 868617 9 10 '6940 PEKANBARU - RIAU Optik Seis LIVING WORLD PEKANBARU Lantai UG - 12B Jl. -

PT Pakuwon Jati Tbk Paparan Publik 25 Juni 2019 Table of Contents

PT Pakuwon Jati Tbk Paparan Publik 25 Juni 2019 Table of contents Section 1 Result summary 3 Section 2 Business summary 7 Section 3 Growth & strategy 14 Section 4 Capital management 18 Section 5 New Project Pipeline 22 Appendix A Company overview 26 Appendix B CSR Activities 2018 33 1 Section 1 Result summary 2 Results summary (Rp bn unless otherwise stated) 1Q 2019 1Q 2018 Variance Comments Revenue 1,711 1,647 +3.9% 7% increase in recurring revenues and 1% increase in development revenue recognition. Pakuwon Permai contributed Rp 655bn (38%) of revenues. Gross Profit1 1,007 936 +7.6% Gross Profit Margin (%) 58.9% 56.8% EBITDA1 993 923 +7.6% EBITDA Margin (%) 58.1% 56.0% Net Income for the Period2 800 694 +15.4% Net Income Margin (%) 46.8% 42.1% Net Income Attributable to Owners2 662 617 +7.4% Net Income Margin (%) 38.7% 37.4% Earnings Per Share (In Full Rupiah)2 Basic 13.75 12.80 +7.4% Notes: 1 Adjusted for acquisition related COGS from goodwill costs of Rp20bn in 1Q 2019 and Rp4bn in 1Q 2018 2 Adjusted for acquisition COGS from goodwill costs of Rp20bn in 1Q 2019 and Rp4bn in 1Q 2018, forex gain (loss) of Rp63bn in 1Q 2019 and (Rp42bn) in 1Q 2018 respectively, gain (loss) on derivative of Rp16bn in 1Q 2019 and (Rp8bn) in 1Q 2018 respectively. 3 Results breakdown Revenue by segment (1Q 2019) Revenue by project (1Q 2019) Revenue by geography (1Q 2019) Office Hotel & leasing Pakuwon Grand Serviced 4.0% City Pakuwon Apartments 7.0% 3.8% Kota 8.2% Royal Plaza Kasablanka Jakarta 1.4% 21.9% 35.7% Condo sales 36.3% Gandaria City 11.9% Surabaya