Measuring Monetary Policy Shocks in India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Info Capsule, March 26,2019

[Type the company name] Info Capsule March 26, 2019 NITI AAYOG ORGANISES FINTECH CONCLAVE 20191 Over 300 stakeholders from across the Government, Banking and Start-up investors chart future of financial technologies To shape India’s continued ascendancy in FinTech, build the narrative for future strategy and policy efforts, and to deliberate steps for comprehensive financial inclusion, NITI Aayog organized a day-long FinTech Conclave in New Delhi today. The Conclave featured representatives from across the financial space – central ministries, regulators, bankers, start-ups, investors, service providers and entrepreneurs. Mr Shaktikanta Das, Governor of RBI inaugurated the Conclave in the presence of Mr Amitabh Kant, CEO, NITI Aayog and Mr Subhash Chandra Garg, Secretary, Department of Economic Affairs, Ministry of Finance. Giving the keynote address on ‘Opportunities and Challenges of FinTech’, Mr Das noted that FinTech has the potential to reshape the financial services and financial inclusion landscape in India in fundamental ways. He said, “We have to strike a subtle balance between effectively utilising FinTech while minimising its systemic impacts. By enabling technologies and managing risks, we can help create a new financial system which is more inclusive, cost-effective and resilient.” Mr Kant noted the need to evolve regulatory and policy paradigms keeping in mind the need of nearly 450 million millennials of India to access institutional credit and charting out the future of fintech in India in light of digital technologies such as block chain and artificial intelligence. Government of India’s efforts focused on Digital India and developing India Stack including Voluntary Aadhaar for financial inclusion have evoked significant interest from various stakeholders in the area of Financial Technology (FinTech). -

Weekly GK Banking Capsule 2019 1

Weekly GK Banking Capsule 2019 1 | P a g e Weekly GK Banking Capsule 2019 WEEKLY GENERAL KNOWLEDGE BANKING & FINANCE CAPSULE (3rd to 9th March 2019) Banking News Intelligence and other technological capabilities of Hitachi AIIB approves loan for Andhra Pradesh Rural Roads Project. to SBI Payment Services. A loan agreement of USD 455 million was signed India and World Bank Signs Loan Agreement. between the Asian Infrastructure Investment Bank (AIIB) The Government of India, the State Government of and the Government of India for financing the Andhra Chhattisgarh and the World Bank signed a $25.2 Million Pradesh Rural Roads Projects. Loan Agreement to support the State’s Reforms in These projects will connect 3,300 habitations with a Expenditure Management. population of more than 250, and benefit around 2 The Chhattisgarh Public Financial Management and million people. Accountability Program, which is the First Bank-Financed It is the third project in Andhra Pradesh signed by the State-Level Project in Chhattisgarh in nearly a decade, AIIB after two projects in Power Sector and Water will also help the State strengthen its Direct Benefit Sector. Transfer (DBT) and Tax Administration Systems. This support will cover Expenditure Planning, Investment Asian Infrastructure Investment Bank Management, Budget Execution, Public Procurement, President: Jin Liquin and Accountability. Headquarters: Beijing, China India signs loan agreement with World Bank for Uttarakhand Disaster Recovery Project. SBI and Hitachi jointly launched digital payments platform. India has signed a loan agreement with the World Bank for State Bank of India (SBI) and Hitachi Payment Services Pvt 96 Million US dollars for additional financing of Ltd, a wholly-owned subsidiary of Hitachi Ltd has launched Uttarakhand Disaster Recovery Project. -

8-11 July 2021 Venice - Italy

3RD G20 FINANCE MINISTERS AND CENTRAL BANK GOVERNORS MEETING AND SIDE EVENTS 8-11 July 2021 Venice - Italy 1 CONTENTS 1 ABOUT THE G20 Pag. 3 2 ITALIAN G20 PRESIDENCY Pag. 4 3 2021 G20 FINANCE MINISTERS AND CENTRAL BANK GOVERNORS MEETINGS Pag. 4 4 3RD G20 FINANCE MINISTERS AND CENTRAL BANK GOVERNORS MEETING Pag. 6 Agenda Participants 5 MEDIA Pag. 13 Accreditation Media opportunities Media centre - Map - Operating hours - Facilities and services - Media liaison officers - Information technology - Interview rooms - Host broadcaster and photographer - Venue access Host city: Venice Reach and move in Venice - Airport - Trains - Public transports - Taxi Accomodation Climate & time zone Accessibility, special requirements and emergency phone numbers 6 COVID-19 PROCEDURE Pag. 26 7 CONTACTS Pag. 26 2 1 ABOUT THE G20 Population Economy Trade 60% of the world population 80 of global GDP 75% of global exports The G20 is the international forum How the G20 works that brings together the world’s major The G20 does not have a permanent economies. Its members account for more secretariat: its agenda and activities are than 80% of world GDP, 75% of global trade established by the rotating Presidencies, in and 60% of the population of the planet. cooperation with the membership. The forum has met every year since 1999 A “Troika”, represented by the country that and includes, since 2008, a yearly Summit, holds the Presidency, its predecessor and with the participation of the respective its successor, works to ensure continuity Heads of State and Government. within the G20. The Troika countries are currently Saudi Arabia, Italy and Indonesia. -

IBPS PO Prelims

WWW.CAREERPOWER.IN & WWW.BANKERSADDA.COM COMPETITION POWER – MARCH - 2 0 1 7 1 WWW.CAREERPOWER.IN & WWW.BANKERSADDA.COM From the Editor’s Desk Dear Readers, Bankers Adda in collaboration with Career Power brings to you Competition Power (March Edition). The reason why this collaboration is so important and a landmark event as both BA and Career Power has had a long and extremely successful association with students appearing for competitive exams. This magazine includes various initiatives that cover various aspects of Banking and SSC exams in an exhaustive manner. Keeping in mind the upcoming exams, we have covered Current Affairs for not only the month of January but also for the month of December under the name “Current Affairs Zinger”. To make learning easy for the students we have also introduced another initiative by the name "NEWS MAKER OF THE MONTH" which covers all the important people, appointments, awards, etc that have made news. Having covered the GK and CA portion in an exhaustive manner, we have also given equal importance and focus to all the other aspects of the exams, be it Covering each aspect of the various subjects (like reasoning, english, quant, computers) right from building the student's concepts to helping him practice a few topics.or be it Interview Preparation or Guidance and boosting the confidence of students. We Have It All Covered!!! Along with this we have also included Mock Papers on SSC CGL Tier I 2017 Practice Set, IBPS PO MAINS Reasoning And Quant Practice Set, Syndicate Bank PO 2017 Practice Set, IBPS PO Prelims | SBI PO Prelims 2017 : PRACTICE SET and IBPS Clerk Mains 2016 Memory Based following the respective exam pattern for practice for our readers, so that they can increase their speed and accuracy. -

Shock RBI Governor Resignation Creates More Uncertainties

Global Economics & Markets Research Email: [email protected] URL: www.uob.com.sg/research Macro + FX Strategy India: Shock RBI Governor Resignation Creates More Uncertainties Tuesday, 11 December 2018 Reserve Bank of India (RBI) Governor Urjit Patel quit with immediate effect on Monday (10 Dec) citing “personal reasons”, cutting short his three-year term which was to end in September 2019. His resignation came amidst several high-profile clashes between the government and RBI over a number of issues including the extent to which the banks are to recognize non-performing assets, Ho Woei Chen the injection of liquidity into the stressed non-banking finance sector, and higher dividend payment Economist [email protected] to the government to help narrow the fiscal deficit. The unexpected move also came ahead of RBI’s last board meeting scheduled this Friday (14-Dec) where governance changes are expected to be Peter Chia discussed. Senior FX Strategist [email protected] With intensifying concerns over the RBI’s independence, Moody’s has said that any attempt by the government to curtail the central bank’s independence would be credit negative. Fitch has also weighed in to say that Patel’s resignation has raised the macroeconomic risks. The RBI is expected to name an interim governor for the central bank soon with speculation pointing to N. S. Vishwanathan, currently the most senior of the four deputies at the central bank. Potential candidates for the next governor are said to include Vishwanathan, former RBI deputy governor Subir Gokarn as well as several names of current and former Finance Ministry officials. -

India's Central Bank Governor Urjit Patel Resigns Amid Tense Stand-Off

1/7/2019 India’s central bank governor Urjit Patel resigns amid tense stand-off | Financial Times Reserve Bank of India India’s central bank governor Urjit Patel resigns amid tense stand-off Reserve Bank of India head has been at odds with the government over its independence Urjit Patel cited ‘personal reasons’ for his decision to quit as central bank governor © Bloomberg Amy Kazmin in New Delhi and Simon Mundy in Mumbai DECEMBER 10, 2018 The head of India’s central bank resigned on Monday in the midst of a bruising battle with the prime minister over the institution’s independence and the direction of the country’s financial sector. Urjit Patel’s exit comes just days ahead of what was likely to be a contentious meeting of the Reserve Bank of India’s governing board, where Prime Minister Narendra Modi’s demands for looser financial and monetary policies were scheduled for debate. Tensions between the RBI and Mr Modi have been rising for months over the central bank’s hawkish monetary policy, use of its mounting reserves and the tough measures taken to clean up bad loans at India’s state-run banks. Mr Modi has been accused of demanding that the RBI ease back on its crackdown out of fear it will hit economic growth during his drive for re-election, particularly as liquidity in non-bank lenders has dried up after a series of defaults at IL&FS, a high-profile finance and infrastructure group. At a 10-hour board meeting last month, Mr Patel made a number of concessions under intense pressure from government nominees, including promising to review restrictions on new lending by banks that already have high levels of bad debt. -

Leadership Discourse and Policy Analysis at the Helm of Reserve Bank of India

Indian Public Policy Review 2021, 2(3): 32-40 Continuity or Change: Leadership Discourse and Policy Analysis at the Helm of Reserve Bank of India M S Sriram* Abstract Understanding the evolution of policy over long horizons is an interesting exercise. While it is possible to look at a policy approach ex-ante, many of the decisions of the policy makers are undertaken in response to an emerging situation and several times, there could be initiatives that seemingly have internal contradictions. Additionally, institutions like the Reserve Bank of India would have approaches institutionalised that shape the policy making and thoughts of the leaders at the helm of affairs. Understanding this process through chronological insights and seeing patterns is an exercise that this paper attempts. The paper looks at the speeches delivered by the Governors (and one Deputy Governor) of the RBI to find a pattern and meaning into the series of policy initiatives that the institution is undertaking. In looking at the patterns, the paper tries to build a narrative of an overarching concern that the leaders might have during their tenure. The paper picks up the speeches delivered by leaders at the helm of RBI from 2004 till 2018 and examines the policy discourse to understand the elements of continuity and change. Keywords: Monetary Policy Decisions, RBI Governors, Policy Discourse Publication Date: 07 May 2021 * Faculty member, Centre for Public Policy, Indian Institute of Management Bangalore Vol . 2 No. 3 Sriram: Leadership Discourse & Policy Analysis at the Helm of RBI 33 I. Introduction How does one examine the evolution of the policy and regulatory approach of a Central Bank over a period of time? This is an intriguing question. -

New Central Bank Governor in India

New Central Bank Governor in India The Reserve Bank of India’s (RBI) Governor, Urjit Patel resigned from his position earlier this week for “personal reasons”. He is the first central bank governor to resign after more than 43 years and has just been replaced by Shaktikanta Das, a figure more aligned to Prime Minister Narendra Modi and likely to accommodate the latter’s policy objectives. Das is set to govern over India’s top financial institution until 2021. As a member of the Economic Affairs Ministry, he had a hand in devising the most central and unpopular policies of the Modi government, namely the General Sales Tax which imposes an average 18% tax rate on most goods and demonetisation which invalidated 86% of the currency notes. These policies mostly hurt small and medium enterprises and caused the loss of more than 2 million jobs in the unregulated sector in urban zones. These developments have been thorns in the side of the Modi government, as the latter generally -but not solely- attracts votes from small businessmen and rural regions of India. This led the government to put the blame of its policy failures on the RBI, which led to a momentous showdown between the government and the central bank, meant to be autonomous. Over the last two years, India’s financial and economic sector saw the resignation of many key figures, who despite leaving for personal reasons, might have good grounds to have left as a reprimand against the government’s creeping foothold on the central bank. In 2016, the famed RBI Governor Raghuram Rajan was not given a second term by the government, something unprecedented in the last two decades. -

The Ornithology of Macroeconomic Policy: India's New Monetary Policy Framework

main heading sub heading table heading NMIMS JOURNAL OF ECONOMICS AND PUBLIC POLICY Volume I | Issue 1 • OCTOBER - NOVEMBER 2016 The ornithology of macroeconomic policy: India's new monetary policy framework SASHI SIVRAMKRISHNA No one is free, even the birds are chained to the sky. mall farmers. Majority of the – Bob Dylan farmers (82%) borrow less than Rs 5 lakhs, and 18% borrow inflation as an economist but was by the government.5 However, once between Rs 5 – 10 lakhs on a The hawks have landed able to utilize his overwhelming the dust settled, a more balanced per annum basis. Most farmers Hawks, doves and owls – some even personal aura to win support of the picture emerged6; in fact, Rajan (65.79%) ar speak of seagulls – but what have popular media and, at the same time, himself considered the formation of birds got to do with exert pressure on the government to the MPC as one of his unfinished macroeconomics? At first, such pay heed to his strong views. tasks at the RBI.7 But why would a ornithological labels seem an apt way Institutionally speaking, success came hawk want to propose and accept any of describing personalities of close to the very end of his tenure4, in dilution in autonomy over the setting individuals. Indeed, to an extent, August this year, when the of interest rates? The answer is not they are. But there is something more government notified the Lok Sabha of obvious. The inflation target along significant in these ornithological tags the retail inflation target of 4% (+2%) with an MPC that decides on interest that may often be overlooked; a as the anchor for monetary policy rates makes monetary rule-based discerning categorization of the until 2021. -

D.O. F. No.4(21)-B(SD)/2011 SHAKTIKANTA DAS, IAS Ministry Of

D.O. F. No.4(21)-B(SD)/2011 SHAKTIKANTA DAS, IAS Ministry of Finance Additional Secretary Department of Economic Affairs (Budget Division) Tel: - 23092804 North Block Fax: -23094052 New Delhi – 110 001 Email : [email protected] New Delhi, the September 30, 2011 Dear Financial Advisor, The Second batch of Supplementary Demands for Grants for 2011-2012 is to be presented to Parliament in the ensuing Winter Session. 2. The following types of Supplementary Demands may only be considered for inclusion in this batch: (i) Cases where advances from the Contingency Fund of India have been granted, which are required to be recouped to the fund; (ii) Payments against court decree which cannot be postponed; (iii) Additional funds immediately required which can be met by re- appropriation of savings in the grant but require prior approval of Parliament under the New Service/New Instrument of Service Rules. In all cases where the savings are available within the same section [Revenue/Capital and Charged/Voted] of the grant, only token supplementary should be proposed. In cases where the savings are available in the Revenue/Capital section or charged/voted section and the expenditure is to be incurred in another section [Revenue/Capital or Charged/Voted], full requirement may be proposed as a technical supplementary. It may be noted that the savings, against which the full amount is proposed in a different section, will be committed for surrender and will not be available for re-appropriation; and (iv) Cases where Ministry of Finance has specifically advised moving of Supplementary Demand in the Winter Session. -

General Knowledge

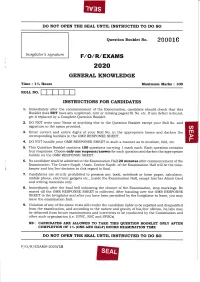

-lv=lS DO NOT OPEN THE SEAL UNTIL INSTRUCTED TO DO SO Question Booklet No. 200016 Inuigilato r's sig nature F/O/ R/EXAMS 2020 GENERAL KNOWLEDGE Time : 172 Hours Maximum Marks : lOO ROLL NO. INSTRUCTIONS FOR CANDIDATES 1" Immediately after the commencement of the Examination, candidate should check that this Booklet does NOT have any unprinted, torn or missing pageslSi. No. etc. If any defect is found, get it replaced by a Complete Question Booklet. 2. DO NOT write your Name or anything else in the Question Booklet except your Roll No. and signature in the space provided. U' 3. Enter correct and entire digits of your Roll No. in the appropriate boxes and darken the m corresponding bubbles in the OMR RESPONSE SHEET. 4. DO NOT handle your OMR RESPONSE SHEET in such a manner as to mutilate, fold, etc. r 5. This Question Booklet contains 1OO questions carrying 7 mark each. Each question contains four responses. Choose only one response/answer for each question and darken the appropriate bubble on the OMR RESPONSE SHEET. 6. No candidate shall be admitted to the Examination Hall 20 minutes after commencement of the Examination. The Centre Supdt. Centre Supdt. of the Examination Hall will be the time- i /Asstt. It keeper and his/her decision in this regard. is finatr. 7. Candidates are strictly prohibited to possess anv book, notebook or loose paper, calculator, mobile phone, eiectronic gadgets etc., inside the Examination Hall, except his/her Admit Card and writing materiatrs on1y. 8. Immediately after the final bell indicating the closure of the Examination, stop markings. -

FC Annex PRELIMS

Fifteenth Finance Commission XV Volume-II Annexes October 2020 Fifteenth Finance Commission ANNEXES Pages Chapter 1: Introduction Annex 1.1: Notification Regarding Constitution of 1 the Commission Annex 1.2: Notification Regarding Corrigendum in ToR 5 Annex 1.3: Notification Regarding Appointment as Member 6 Ministry in place of Part time Member of Finance (Department Annex 1.4: Notification Regarding Resignation of Member 7 of Economic from Commission Affairs) Annex 1.5: Notification Regarding Appointment of Member 8 in Commission Annex 1.6: Notification Regarding Addition/Amendment 9 in ToR Annex 1.7: Notification Regarding Addition/Amendment 11 in ToR Annex 1.8: ToR- wise Mapping of the Chapters of 13 FC-XV Report Annex 1.9: List of Sanctioned Posts 16 Annex 1.10: List of Functionaries 17 Annex 1.11: Letter from Ministry of Finance regarding 19 Delegation of Powers of Head of 'Department' to Shri Arvind Mehta, OSD to the Fifteenth Finance Commission Annex 1.12: Rules of Procedure 21 Annex 1.13: Public Notice inviting suggestion on ToR 24 Annex 1.14: Public Notice inviting suggestion on Additional ToR 27 Annex 1.15: Constitution of the Advisory Council to 28 the Commission Annex 1.16: Constitution of the High Level Group on 35 Health Sector Annex 1.17: Constitution of the Cash Credit Limit Committee 37 to review CCL Gap of Punjab i Fifteenth Finance Commission Pages Annex 1.18: Constitution of the Group to Examine the issues on 39 Defence and Internal Security Annex 1.19: Constitution of the High Level Expert Group 40 on Agriculture Exports