Kotak Mahindra Bank Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Info Capsule, March 26,2019

[Type the company name] Info Capsule March 26, 2019 NITI AAYOG ORGANISES FINTECH CONCLAVE 20191 Over 300 stakeholders from across the Government, Banking and Start-up investors chart future of financial technologies To shape India’s continued ascendancy in FinTech, build the narrative for future strategy and policy efforts, and to deliberate steps for comprehensive financial inclusion, NITI Aayog organized a day-long FinTech Conclave in New Delhi today. The Conclave featured representatives from across the financial space – central ministries, regulators, bankers, start-ups, investors, service providers and entrepreneurs. Mr Shaktikanta Das, Governor of RBI inaugurated the Conclave in the presence of Mr Amitabh Kant, CEO, NITI Aayog and Mr Subhash Chandra Garg, Secretary, Department of Economic Affairs, Ministry of Finance. Giving the keynote address on ‘Opportunities and Challenges of FinTech’, Mr Das noted that FinTech has the potential to reshape the financial services and financial inclusion landscape in India in fundamental ways. He said, “We have to strike a subtle balance between effectively utilising FinTech while minimising its systemic impacts. By enabling technologies and managing risks, we can help create a new financial system which is more inclusive, cost-effective and resilient.” Mr Kant noted the need to evolve regulatory and policy paradigms keeping in mind the need of nearly 450 million millennials of India to access institutional credit and charting out the future of fintech in India in light of digital technologies such as block chain and artificial intelligence. Government of India’s efforts focused on Digital India and developing India Stack including Voluntary Aadhaar for financial inclusion have evoked significant interest from various stakeholders in the area of Financial Technology (FinTech). -

But Retail Prices Topped an Eye-Watering Rs. 85 a Kg in Bangalore Yesterday

Online edition of India's National Newspaper Wednesday, December 22, 2010 Date:22/12/2010 URL: http://www.thehindu.com/2010/12/22/stories/2010122258680100.htm Wholesale onion prices dip, raises hopes Staff Reporter But retail prices topped an eye-watering Rs. 85 a kg in Bangalore yesterday TOO HOT TO TOUCH?:Suddenly the onion is no longer a poor man's vegetable. BANGALORE: Speculative fever gripped the onion trade on Tuesday in Bangalore following a sharp decline in prices as a significant section of the buyers kept away, hoping that the slide will continue. However, retail markets in the city continued to remain buoyant, unmoved by the turmoil in the wholesale business. Trade sources speculated that the Union Government's order banning onion export, issued on Monday, may have played a role. Dappa, first quality onions, traded between Rs. 2,000 and Rs. 2,500 per bag (of 50 kg) on Tuesday, a decline of about 20 per cent over Monday's prices. Prices of other grades — gulti (very small), golta (small) and medium, also declined significantly. Gulti, generally regarded as the cheapest quality onions, traded between Rs. 600 and Rs. 800 per bag, compared to Rs. 800-1,000 on Monday. Hoping for a fall Traders reported a fall in prices as soon as the market opened on Tuesday. Venkappa T., a trader in the Yeshwantpur market, the biggest onion trading centre in the State, said: “Buyers [willing to gamble], waiting for prices to slide further, kept away from making purchases.” Prices are likely to stabilise “in a day or two”. -

Weekly GK Banking Capsule 2019 1

Weekly GK Banking Capsule 2019 1 | P a g e Weekly GK Banking Capsule 2019 WEEKLY GENERAL KNOWLEDGE BANKING & FINANCE CAPSULE (3rd to 9th March 2019) Banking News Intelligence and other technological capabilities of Hitachi AIIB approves loan for Andhra Pradesh Rural Roads Project. to SBI Payment Services. A loan agreement of USD 455 million was signed India and World Bank Signs Loan Agreement. between the Asian Infrastructure Investment Bank (AIIB) The Government of India, the State Government of and the Government of India for financing the Andhra Chhattisgarh and the World Bank signed a $25.2 Million Pradesh Rural Roads Projects. Loan Agreement to support the State’s Reforms in These projects will connect 3,300 habitations with a Expenditure Management. population of more than 250, and benefit around 2 The Chhattisgarh Public Financial Management and million people. Accountability Program, which is the First Bank-Financed It is the third project in Andhra Pradesh signed by the State-Level Project in Chhattisgarh in nearly a decade, AIIB after two projects in Power Sector and Water will also help the State strengthen its Direct Benefit Sector. Transfer (DBT) and Tax Administration Systems. This support will cover Expenditure Planning, Investment Asian Infrastructure Investment Bank Management, Budget Execution, Public Procurement, President: Jin Liquin and Accountability. Headquarters: Beijing, China India signs loan agreement with World Bank for Uttarakhand Disaster Recovery Project. SBI and Hitachi jointly launched digital payments platform. India has signed a loan agreement with the World Bank for State Bank of India (SBI) and Hitachi Payment Services Pvt 96 Million US dollars for additional financing of Ltd, a wholly-owned subsidiary of Hitachi Ltd has launched Uttarakhand Disaster Recovery Project. -

8-11 July 2021 Venice - Italy

3RD G20 FINANCE MINISTERS AND CENTRAL BANK GOVERNORS MEETING AND SIDE EVENTS 8-11 July 2021 Venice - Italy 1 CONTENTS 1 ABOUT THE G20 Pag. 3 2 ITALIAN G20 PRESIDENCY Pag. 4 3 2021 G20 FINANCE MINISTERS AND CENTRAL BANK GOVERNORS MEETINGS Pag. 4 4 3RD G20 FINANCE MINISTERS AND CENTRAL BANK GOVERNORS MEETING Pag. 6 Agenda Participants 5 MEDIA Pag. 13 Accreditation Media opportunities Media centre - Map - Operating hours - Facilities and services - Media liaison officers - Information technology - Interview rooms - Host broadcaster and photographer - Venue access Host city: Venice Reach and move in Venice - Airport - Trains - Public transports - Taxi Accomodation Climate & time zone Accessibility, special requirements and emergency phone numbers 6 COVID-19 PROCEDURE Pag. 26 7 CONTACTS Pag. 26 2 1 ABOUT THE G20 Population Economy Trade 60% of the world population 80 of global GDP 75% of global exports The G20 is the international forum How the G20 works that brings together the world’s major The G20 does not have a permanent economies. Its members account for more secretariat: its agenda and activities are than 80% of world GDP, 75% of global trade established by the rotating Presidencies, in and 60% of the population of the planet. cooperation with the membership. The forum has met every year since 1999 A “Troika”, represented by the country that and includes, since 2008, a yearly Summit, holds the Presidency, its predecessor and with the participation of the respective its successor, works to ensure continuity Heads of State and Government. within the G20. The Troika countries are currently Saudi Arabia, Italy and Indonesia. -

Management Innovator

Vol.9 No. 2 July- December 2016 ISSN 0974-6749 MANAGEMENT INNOVATOR -A peer reviewed research journal Published by Researcher’s Forum, Institute of Management in Kerala University of Kerala -695581 MANAGEMENT INNOVATOR ISSN 0974-6749 Vol. 9 No. 2 July 2016 Published on 1st January 2017 PEER REVIEWED RESEARCH JOURNAL Published by: Researcher’s Forum Institute of Management in Kerala University of Kerala Thiruvananthapuram- 695581 www.imk.ac.in MANAGEMENT INNOVATOR ISSN 0974-6749 Vol. 9 No. 2 July 2016 CONTENTS Editorial 1. Organized Retailing – A Study on Perception of Customers in 01 Thiruvananthapuram District Shijina A.S 2. Mentoring And Career Outcomes – A Study Among Select 05 Commercial Bank Employees In Kerala Ms. Roshan Therese Sebastian and Dr. Siby Zacharias 3. Key Factors Affecting Movie viewing in theatres by audience 11 G. Dhananjayan, Dr.R.Srinivasan & Dr. Srivasatava 4. Situating The Potential Of Local Entrepreneurship In 16 Responsible Tourism Initiatives Dr. Vysakh A S & Ms. Alphonsa Jospeh 5. Impact On Demonitisation Of Indian Bank Note 2016 and 21 Shift To Digital Banking Mr. Gregory Paul & Dr.K.S.Chandrasekar 6. Emerging trends in Human Resource Management- A sample survey 33 Ms. Neethu.S. Nair 7. A Study on Emerging Trends in Marketing, Ms. Nima Ravi 38 8. Emerging Opportunities In Backwater Tourism At Veli 43 Premkumar.U 9. A Study On The Role Of Multi-Skilling In Employee Engagement 49 Among The Employees Of ITI Limited Palakkad V.Smitha 10. General Co-Operative Marketing Societies In Economic and 54 Social Welfare – Opportunities And Challenges Sini Raj S 11. -

New Central Bank Governor in India

New Central Bank Governor in India The Reserve Bank of India’s (RBI) Governor, Urjit Patel resigned from his position earlier this week for “personal reasons”. He is the first central bank governor to resign after more than 43 years and has just been replaced by Shaktikanta Das, a figure more aligned to Prime Minister Narendra Modi and likely to accommodate the latter’s policy objectives. Das is set to govern over India’s top financial institution until 2021. As a member of the Economic Affairs Ministry, he had a hand in devising the most central and unpopular policies of the Modi government, namely the General Sales Tax which imposes an average 18% tax rate on most goods and demonetisation which invalidated 86% of the currency notes. These policies mostly hurt small and medium enterprises and caused the loss of more than 2 million jobs in the unregulated sector in urban zones. These developments have been thorns in the side of the Modi government, as the latter generally -but not solely- attracts votes from small businessmen and rural regions of India. This led the government to put the blame of its policy failures on the RBI, which led to a momentous showdown between the government and the central bank, meant to be autonomous. Over the last two years, India’s financial and economic sector saw the resignation of many key figures, who despite leaving for personal reasons, might have good grounds to have left as a reprimand against the government’s creeping foothold on the central bank. In 2016, the famed RBI Governor Raghuram Rajan was not given a second term by the government, something unprecedented in the last two decades. -

D.O. F. No.4(21)-B(SD)/2011 SHAKTIKANTA DAS, IAS Ministry Of

D.O. F. No.4(21)-B(SD)/2011 SHAKTIKANTA DAS, IAS Ministry of Finance Additional Secretary Department of Economic Affairs (Budget Division) Tel: - 23092804 North Block Fax: -23094052 New Delhi – 110 001 Email : [email protected] New Delhi, the September 30, 2011 Dear Financial Advisor, The Second batch of Supplementary Demands for Grants for 2011-2012 is to be presented to Parliament in the ensuing Winter Session. 2. The following types of Supplementary Demands may only be considered for inclusion in this batch: (i) Cases where advances from the Contingency Fund of India have been granted, which are required to be recouped to the fund; (ii) Payments against court decree which cannot be postponed; (iii) Additional funds immediately required which can be met by re- appropriation of savings in the grant but require prior approval of Parliament under the New Service/New Instrument of Service Rules. In all cases where the savings are available within the same section [Revenue/Capital and Charged/Voted] of the grant, only token supplementary should be proposed. In cases where the savings are available in the Revenue/Capital section or charged/voted section and the expenditure is to be incurred in another section [Revenue/Capital or Charged/Voted], full requirement may be proposed as a technical supplementary. It may be noted that the savings, against which the full amount is proposed in a different section, will be committed for surrender and will not be available for re-appropriation; and (iv) Cases where Ministry of Finance has specifically advised moving of Supplementary Demand in the Winter Session. -

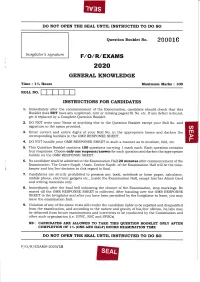

General Knowledge

-lv=lS DO NOT OPEN THE SEAL UNTIL INSTRUCTED TO DO SO Question Booklet No. 200016 Inuigilato r's sig nature F/O/ R/EXAMS 2020 GENERAL KNOWLEDGE Time : 172 Hours Maximum Marks : lOO ROLL NO. INSTRUCTIONS FOR CANDIDATES 1" Immediately after the commencement of the Examination, candidate should check that this Booklet does NOT have any unprinted, torn or missing pageslSi. No. etc. If any defect is found, get it replaced by a Complete Question Booklet. 2. DO NOT write your Name or anything else in the Question Booklet except your Roll No. and signature in the space provided. U' 3. Enter correct and entire digits of your Roll No. in the appropriate boxes and darken the m corresponding bubbles in the OMR RESPONSE SHEET. 4. DO NOT handle your OMR RESPONSE SHEET in such a manner as to mutilate, fold, etc. r 5. This Question Booklet contains 1OO questions carrying 7 mark each. Each question contains four responses. Choose only one response/answer for each question and darken the appropriate bubble on the OMR RESPONSE SHEET. 6. No candidate shall be admitted to the Examination Hall 20 minutes after commencement of the Examination. The Centre Supdt. Centre Supdt. of the Examination Hall will be the time- i /Asstt. It keeper and his/her decision in this regard. is finatr. 7. Candidates are strictly prohibited to possess anv book, notebook or loose paper, calculator, mobile phone, eiectronic gadgets etc., inside the Examination Hall, except his/her Admit Card and writing materiatrs on1y. 8. Immediately after the final bell indicating the closure of the Examination, stop markings. -

FC Annex PRELIMS

Fifteenth Finance Commission XV Volume-II Annexes October 2020 Fifteenth Finance Commission ANNEXES Pages Chapter 1: Introduction Annex 1.1: Notification Regarding Constitution of 1 the Commission Annex 1.2: Notification Regarding Corrigendum in ToR 5 Annex 1.3: Notification Regarding Appointment as Member 6 Ministry in place of Part time Member of Finance (Department Annex 1.4: Notification Regarding Resignation of Member 7 of Economic from Commission Affairs) Annex 1.5: Notification Regarding Appointment of Member 8 in Commission Annex 1.6: Notification Regarding Addition/Amendment 9 in ToR Annex 1.7: Notification Regarding Addition/Amendment 11 in ToR Annex 1.8: ToR- wise Mapping of the Chapters of 13 FC-XV Report Annex 1.9: List of Sanctioned Posts 16 Annex 1.10: List of Functionaries 17 Annex 1.11: Letter from Ministry of Finance regarding 19 Delegation of Powers of Head of 'Department' to Shri Arvind Mehta, OSD to the Fifteenth Finance Commission Annex 1.12: Rules of Procedure 21 Annex 1.13: Public Notice inviting suggestion on ToR 24 Annex 1.14: Public Notice inviting suggestion on Additional ToR 27 Annex 1.15: Constitution of the Advisory Council to 28 the Commission Annex 1.16: Constitution of the High Level Group on 35 Health Sector Annex 1.17: Constitution of the Cash Credit Limit Committee 37 to review CCL Gap of Punjab i Fifteenth Finance Commission Pages Annex 1.18: Constitution of the Group to Examine the issues on 39 Defence and Internal Security Annex 1.19: Constitution of the High Level Expert Group 40 on Agriculture Exports -

E-Content for Ma Economics

E-CONTENT FOR M.A. ECONOMICS PROGRAMME SEM-II, CC-5 PREPARED BY PROF. DR. RAJ LUXMI, HOD, ECONOMICS MULTIPLE CHOICE QUESTIONS (MCQ) MODULE 1-5 MODULE-1 1. Which one of the following is a consequence of British Rule in India? (a) Decline of Indian Handicrafts (c) Commercialisation of agriculture (b) Zamindari system (d) All of these 2. Commercialisation of agriculture implies production of crops for ….. (a) Sale in markets (c) Export (b) Family consumption (d) Both (a) & (c) 3. Process of Industrialisation during British rule was mainly by ….. (a) Government enterprise (c) Both (a) & (b) (b) Private enterprise (d) None of these 4. PQLI is based on: (a) Access to safe drinking water (c) Two meals a day for whole year (b) Electricity connection (d) All of these 5. HDI is constructed on the basis of ….. (a) Life expectancy (c) Literacy (b) Per capita state domestic product (d) All of these 6. Which sector has the highest percentage share of employment in Indian Economy? (a) Agriculture (c) Services (b) Industry (d) None of these 7. Which sector has the highest share in GDP in India? (a) Agriculture (c) Services (b) Industry (d) None of these MODULE -2 1. Share of Agriculture Sector in Total Gross Domestic Product is ….. (a) More than 20% (c) Equal to 20% (b) Less than 20% (d) None of these 2. Share of Agriculture Sector in Indian total export is …… (a) More than 20% (c) Equal to 20% (b) Less than 20% (d) None of these 3. Horticulture includes …… (a) Fruits (c) Species (b) Vegetables (d) All of these 4. -

FIFTEENTH FINANCE COMMISSION of INDIA—OECD HIGH-LEVEL ROUNDTABLE on FISCAL RELATIONS ACROSS LEVELS of GOVERNMENT Wednesday 4

FIFTEENTH FINANCE COMMISSION OF INDIA—OECD HIGH-LEVEL ROUNDTABLE ON FISCAL RELATIONS ACROSS LEVELS OF GOVERNMENT Wednesday 4 April 2018, Aftab Mehtab Hall The Taj Mahal Hotel, No.1 Man Singh Road, New Delhi A. Agenda 9.00 – 9.30 OPENING SESSION Opening Address by Mr. Shaktikanta Das, Member, 15th Finance Commission of India Introduction by Mr. Junghun KIM, Chair, OECD Fiscal Network and Vice President, KIPF, Korea 9.30 – 11.00 SESSION 1: “Sub-national debt, medium-term fiscal targets and sustainability” (Annex Questions 1-3) This session will cover the conceptual framework to determine medium term debt and fiscal targets for both general government and sub-national governments, including how to determine fiscal and debt targets and trajectories, and make them more sustainable. Top-down and bottom-up approaches will be discussed with country examples. OECD speakers: Ronnie Downes, Deputy Head of Budget Division, OECD Public Governance Directorate Isabelle Joumard, Head of India Desk, OECD Economics Department International discussant: Daniel Plaatjies, Chairman, Financial and Fiscal Commission, South Africa 11.00 – 11.15 COFFEE/TEA BREAK 11.15 – 13.00 SESSION 2: “Revenue sharing, conditional transfers and fiscal equalisation” (Annex Questions 4-7) This session will discuss how best to share tax revenues across levels of government, allocate transfers, design conditional grants, and determine fiscal balances. It will include how to avoid moral hazard problems, strengthen incentives, and promote tax collection efforts. And what role can -

Board of Governors (As of 31 December 2017)

ANNUAL REPORT 2017 www.adb.org/ar2017 Keywords: board of governors, governors, board Board of Governors (as of 31 December 2017) Member Governor Alternate Governor Afghanistan Eklil Ahmad Hakimi Mohammad Khalid Payenda1 Armenia Vache Gabrielyan Armen Hayrapetyan Australia Scott Morrison MP Kelly O'Dwyer MP Austria Johann Georg Schelling Elisabeth Gruber2 Azerbaijan Samir Sharifov Shahin Mustafayev Bangladesh Abul Maal A. Muhith Kazi Shofiqul Azam Belgium Johan Van Overtveldt Alexander De Croo3 Bhutan Lyonpo Namgay Dorji Nim Dorji Brunei Darussalam Pehin Dato Abdul Rahman Ibrahim Ahmaddin Abdul Rahman4 Cambodia Aun Pornmoniroth Vongsey Vissoth Canada Chrystia Freeland5 (vacant) China, People’s Republic of Xiao Jie Shi Yaobin Cook Islands Mark Brown Garth Henderson Denmark Morten Jespersen Jan Top Christensen6 Fiji Aiyaz Sayed-Khaiyum Ariff Ali7 Finland Elina Kalkku Satu Santala France Bruno Le Maire8 Odile Renaud-Basso Georgia Mamuka Bakhtadze9 Dimitry Kumsishvili10 Germany Hans-Joachim Fuchtel Marianne Kothe Hong Kong, China Paul Chan Mo-po11 Norman Chan India Arun Jaitley Subhash Chandra Garg12 Indonesia Sri Mulyani Indrawati Bambang P.S. Brodjonegoro Ireland Paschal Donohoe13 Paul Ryan Italy Ignazio Visco Gelsomina Vigliotti14 Japan Taro Aso Haruhiko Kuroda Kazakhstan Timur Suleimenov15 Ruslan Bekatayev16 1 Succeeded Mohammad Mustafa Mastoor in August. 2 Succeeded Gunther Schönleitner in March. 3 Succeeded Ronald de Swert in January. 4 Succeeded Nazmi Mohamad in April. 5 Succeeded Stephane Dion in January. 6 Succeeded Christian Dons Christensen in March. 7 Succeeded Barry Whiteside in May. 8 Succeeded Michel Sapin in July. 9 Succeeded Dimitry Kumsishvili in November. 10 Succeeded Giorgi Gakharia in November. 11 Succeeded John Tsang Chun-wah in January.