Property Management Services Agreement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the United States District Court for the Eastern District of Texas Marshall Division Fundamental Innovation Systems Internati

Case 2:20-cv-00117 Document 1 Filed 04/23/20 Page 1 of 24 PageID #: 1 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF TEXAS MARSHALL DIVISION FUNDAMENTAL INNOVATION SYSTEMS INTERNATIONAL LLC, Plaintiff, Civil Action No. 2:20-cv-00117 vs. COOLPAD GROUP LIMITED, COOLPAD JURY TRIAL DEMANDED TECHNOLOGIES, INC., and YULONG COMPUTER TELECOMMUNICATION SCIENTIFIC (SHENZHEN) CO. LTD., Defendants. COMPLAINT FOR PATENT INFRINGEMENT AND JURY DEMAND Plaintiff Fundamental Innovation Systems International LLC (“Plaintiff” or “Fundamental”), by and through its undersigned counsel, brings this action against Defendants Coolpad Group Limited, Coolpad Technologies, Inc., and Yulong Computer Telecommunication Scientific (Shenzhen) Co. Ltd. (collectively “Defendants” or “Coolpad”) to prevent Defendants’ continued infringement of Plaintiff’s patents without authorization and to recover damages resulting from such infringement. PARTIES 1. Plaintiff is a Delaware limited liability company with a place of business located at 2990 Long Prairie Road, Suite B, Flower Mound, Texas 75022. 2. Plaintiff is the owner by assignment of all right, title, and interest in U.S. Patent Nos. 7,239,111 (the “’111 Patent”), 8,624,550 (the “’550 Patent”), 7,834,586 (the “’586 Patent”), 8,232,766 (the “’766 Patent”), and 7,986,127 (the “’127 Patent”) (collectively, the “Patents-in- Suit”). 06904-00001/12059581.3 Case 2:20-cv-00117 Document 1 Filed 04/23/20 Page 2 of 24 PageID #: 2 3. On information and belief, Defendant Coolpad Group Limited is a company duly organized and existing under the laws of the Cayman Islands, with a place of business located at Coolpad Information Harbor, No. -

GC Influencers Have Been Chosen Following Research Among Private Practice Lawyers and Other In-House Counsel

v GC Influencers CHINA 2019 Friday, 11th January 2019 JW Marriott Hotel, Hong Kong Programme Engaging content, networking and celebration with leading General Counsel and top ranked lawyers globally. GC Influencers For more informationCHINA visit 2019 chambers.com A5-Advert-Forums.idml 1 22/10/2018 12:17 Welcome SARAH KOGAN Editor Chambers Asia-Pacific Meet the most influential General Counsel in China today. Chambers has provided insight into the legal profession for over 30 years. During this time, in-house lawyers and third-party experts have shared their views on the value and importance placed on the role of the General Counsel. No longer just the ethical and legal heart of a business, these professionals now sit as influential participants at board level. Effective managers, industry pioneers, diversity and CSR champions: these Influencers show the way. Research Methodology: Our GC Influencers have been chosen following research among private practice lawyers and other in-house counsel. We identified the key areas in which GCs have displayed substantial influence: Engaging content, • Effective management and development of an in-house team • Navigation of substantial business projects such as M&A or strategic networking and business change. • Development of litigation strategy and understanding the pressures faced celebration with leading within industry General Counsel and top • Bringing diversity & inclusion and CSR to the forefront of industry. ranked lawyers globally. • Ability to influence and respond to regulatory change Our aim is to celebrate excellence within the legal profession. This dynamic hall of fame encourages collaboration among the in-house legal community. Our GC Influencers have created best practice pathways endorsed by both private practice and other in-house lawyers. -

China Consumer Close-Up

January 13, 2015 The Asian Consumer: A new series Equity Research China Consumer Close-up The who, what and why of China’s true consumer class Few investing challenges have proven more elusive than understanding the Chinese consumer. Efforts to translate the promise of an emerging middle class into steady corporate earnings have been uneven. In the first of a new series on the Asian consumer, we seek to strip the problem back to the basics: Who are the consumers with spending power, what drives their consumption and how will that shift over time? The result is a new approach that yields surprising results. Joshua Lu Goldman Sachs does and seeks to do business with +852-2978-1024 [email protected] companies covered in its research reports. As a result, Goldman Sachs (Asia) L.L.C. investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Sho Kawano Investors should consider this report as only a single factor +81(3)6437-9905 [email protected] Goldman Sachs Japan Co., Ltd. in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Becky Lu Appendix, or go to www.gs.com/research/hedge.html. +852-2978-0953 [email protected] Analysts employed by non- US affiliates are not registered/ Goldman Sachs (Asia) L.L.C. qualified as research analysts with FINRA in the U.S. January 13, 2015 Asia Pacific: Retail Table of contents PM Summary: A holistic view of the Asian consumer 3 China’s cohort in a regional context (a preview of India and Indonesia) 8 What they are buying and what they will buy next: Tracking 7 consumption desires 11 Seven consumption desires in focus 14 1. -

China Chuanglian Education Financial Group Limited 中國創聯教育金融集團有限公司

China Chuanglian Education Financial Group Limited 中國創聯教育金融集團有限公司 年報 Annual Report 2017 2017 A N N U A L R E P O R T 2 0 17 中國創聯教育金融集團有限公司 年報 China Chuanglian Education Financial Group Limited (前稱「中國創聯教育集團有限公司」) (formerly known as “China Chuanglian Education Group Limited”) (於開曼群島註冊成立之有限公司 ) (incorporated in the Cayman Islands with limited liability) (股份代號:2371) (Stock Code: 2371) Page Contents Corporate Information 2 Financial Summary 3 Chairman’s Statement 4 Management Discussion and Analysis 7 Biographical Details of Directors and Senior Management 20 Corporate Governance Report 23 Environmental, Social and Governance Report 35 Report of the Directors 47 Independent Auditor’s Report 61 Consolidated Statement of Profit or Loss and 68 Other Comprehensive Income Consolidated Statement of Financial Position 70 Consolidated Statement of Changes in Equity 72 Consolidated Statement of Cash Flows 74 Notes to the Consolidated Financial Statements 76 Corporate Information Executive Directors Principal Bankers Mr. LU Xing (Chairman of the Board) Citibank, N.A. Mr. LI Jia Mr. WU Xiaodong Registered Office Mr. WANG Cheng Cricket Square Mr. LI Dongfu Hutchins Drive P.O. Box 2681 Independent Non-executive Directors Grand Cayman KY1-1111 Mr. LEUNG Siu Kee Cayman Islands Mr. WU Yalin Ms. WANG Shuping Principal Place of Business in Hong Kong Room 905–06, 9/F., Company Secretary China Evergrande Centre Mr. SUNG Chi Keung 38 Gloucester Road Wanchai, Hong Kong Audit Committee Principal Share Registrar and Transfer Office Mr. LEUNG Siu Kee (Chairman of the Audit Committee) SMP Partners (Cayman) Limited Mr. WU Yalin Royal Bank House — 3rd Floor Ms. WANG Shuping 24 Shedden Road P.O. -

2016Semi-Annual Report

CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds SEMI-ANNUAL 2016 REPORT For the six months ended 30 June 2016 Value Partners Limited 9th Floor, Nexxus Building 41 Connaught Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartners-group.com In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. This report shall not constitute an offer to sell or a solicitation of an offer to buy shares in any of the funds. Subscriptions are to be made only on the basis of the information contained in the explanatory memorandum, as supplemented by the latest semi-annual and annual reports. CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) CONTENTS Pages General information 2-3 Manager’s report 4-9 Statement of financial position (unaudited) 10 Investment portfolio (unaudited) 11-15 Investment portfolio movements (unaudited) 16 SEMI-ANNUAL REPORT 2016 For the six months ended 30 June 2016 1 CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) GENERAL INFORMATION Manager Legal Advisors Value Partners Limited With respect to Cayman Islands law 9th Floor, Nexxus Building Maples and Calder 41 Connaught Road Central 53rd Floor, The Center Hong Kong 99 Queen’s Road Central Hong Kong Directors of the Manager Dato’ Seri Cheah Cheng Hye With respect to Hong Kong law Mr. Ho Man Kei, Norman King & Wood Mallesons Mr. So Chun Ki Louis 13th Floor, Gloucester Tower The Landmark Trustee, Registrar, Administrator and 15 Queen’s Road Central Principal Office Hong Kong Bank of Bermuda (Cayman) Limited P.O. -

Electric Bus Revolution of Shenzhen City in China Report by India Smart Grid Forum (ISGF)

Electric Bus Revolution of Shenzhen City in China Report by India Smart Grid Forum (ISGF) Shenzhen is the only city in the world where all the public buses are electric. During the period from 2011 to 2017, they replaced all the diesel buses with electric buses. There are 16359 electric buses in operation in Shenzhen City. Significance of this number is to be viewed from the perspective that in 2017, there were only 956 electric buses in entire Europe and less than 500 in entire United States. (Please see table at Appendix –A for the number of electric buses in China and rest of the World). Brief History of Shenzhen City In 1979 the Chinese Government under President Deng Xiaoping established Special Economic Zones (SEZs) in the Pearl River Delta region, with Shenzhen being the first SEZ allowing foreign direct investments under the open economic policies. It was a small fishing village called Bao'an County with a population of 30,000 which was renamed as Shenzhen City in 1979. Shenzhen's official population was 12 million in 2005, making the demographic 99% migrants. Present population is estimated at 22 million (by 2010, there were 22 million registered SIM cards in Shenzhen).Fastest growth in human history. In the same period, the economic growth has also been unprecedented in history - GDP grew from 1.96 million RMB in 1979, to 500 billion RMB in 2005. In 2016, Shenzhen's GDP totaled US$303.37 billion - higher than that of countries like Portugal, the Republic of Ireland, and Vietnam. Its ppp per-capita GDP was $49,185 (unregistered migrant population not counted) as of 2016, on par with developed countries such as Australia and Germany. -

Form of Proxy

COOLPAD GROUP LIMITED 酷派集團有限公司 (incorporated in the Cayman Islands with limited liability) (Stock Code: 2369) FORM OF PROXY Form of proxy for use at the extraordinary general meeting (the “EGM”) of the shareholders of Coolpad Group Limited (the “Company”) to be held at Meeting Room 1, 3/F, Boton Group Building, intersection of Chuangke Road and Chaguang Road, Nanshan District, Shenzhen, the People’s Republic of China on Friday, 19 June 2020 at 3:30 p.m. (or as soon as practicable immediately after the conclusion or adjournment of the annual general meeting of the Company convened to be held at 3:00 p.m. on the same date and at the same place). I/We of (Note 1) being the registered holder(s) of (Note 2) share(s) of HK$0.01 each (the “Share(s)”) in the share capital of the Company, HEREBY APPOINT(Note 3) of or failing him/her, the chairman of the EGM, to act for me/us at my/our proxy(Note 4) at the EGM to be held at Meeting Room 1, 3/F, Boton Group Building, intersection of Chuangke Road and Chaguang Road, Nanshan District, Shenzhen, People’s Republic of China on Friday, 19 June 2020 at 3:30 p.m. (or as soon as practicable immediately after the conclusion or adjournment of the annual general meeting of the Company convened to be held at 3:00 p.m. on the same date and at the same place) for the purpose of considering and, if thought fit, passing the resolution set out in the notice convening the EGM and at the said meeting (or as soon as practicable immediately after the conclusion or adjournment of the annual general meeting of the Company convened to be held at 3:00 p.m. -

HK Talents Eye Greener Pastures in Bay Area

8 HK | BUSINESS Friday, June 22, 2018 CHINA DAILY HONG KONG EDITION HK talents eye greener pastures in Bay Area Guangdong cities prime the pump as One major SAR startups head north for a future goal of the plan (the Greater By CHAI HUA in Shenzhen Now, they’ve managed to get Bay Area) is to allow [email protected] hold of a plot of land about 20 times bigger than that Lo had at Hong Kong and With the the university and on which he blueprint has hinged his career. Macao to be bet- for the high- Lo aspires to be a farmer with ter integrated with profi led a di erence — using technol- Guangdong- ogy and planting by computer. Guangdong’s indus- Hong Kong- To be specific, the trio eyes Macao building the largest and most trial chains.” Greater Bay advanced aquaponics produc- Wang Fuqiang, director of the Area set in motion, member tion base in China. department of industrial planning cities of the Pearl River Delta Aquaponics — a novel and at the China Center for Interna- (PRD) cluster have emerged green farming technique their tional Economic Exchanges as potential fertile grounds for startup is developing — refers Hong Kong entrepreneurs from to the combination of aquacul- tural di erences. But, with the a wide spectrum of the city’s ture (raising fi sh) and hydro- national planning of the Bay budding industries. ponics (the soilless growing of Area in top gear, an improve- Victor Lo, Fung Leung and plants). The environmentally- ment in the situation may well Mandy Tam are all young entre- friendly and sustainable pro- be on the horizon. -

The Development and Evolution of China's Mobile Phone Industry

Working Paper Series No.2013-1 The Development and Evolution of China’s Mobile Phone Industry Shin-Horng Chen and Pei-Chang Wen April, 2013 Chung‐Hua Institution for Economic Research 1 The Development and Evolution of China’s Mobile Phone Industry Shin‐Horng Chen and Pei‐Chang Wen Chung‐Hua Institution for Economic Research, Taiwan Abstract This paper examines the development and evolution of China’s mobile phone industry, with a special focus on the effect of migration to smartphones on the industrial ecosystem and industrial transformation. The Chinese market was dominated not long ago by Shanzhai handset makers, which were often associated with notorious elements of bandit, copy cats, piracy, and illegal network access. However, in the migration from 2G to 3G and smartphones in China, a few home‐grown brands have become the leading suppliers of smartphones, outperforming international premium brands, such as Nokia, Motorola and even Apple. With an intensive case study, the paper takes into account the significance of layered platform‐based development in the migration towards smartphones and mobile digital services to examine the rise of the Chinese brands for smartphones. In addition, the paper discusses a co‐evolution process of social and market factors in shaping Chinese “good‐enough innovations”, highlighting the role of distinct demands in the Chinese market and the growing popularity of mobile internet services within Chinese walled garden with heavy regulations and censorship. Moreover, the paper discusses the role of industrial standards in the Chinese migration of smartphones, by referring to a “three‐level model for standards and innovation in ICT”, including the infrastructure, middleware (service platform) and application levels. -

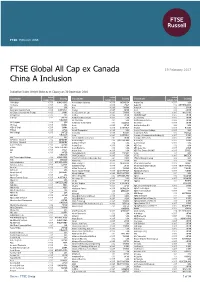

FTSE Global All Cap Ex Canada China a Inclusion

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 19 February 2017 China A Inclusion Indicative Index Weight Data as at Closing on 30 December 2016 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 1st Source <0.005 USA Acea <0.005 ITALY Aegon NV 0.02 NETHERLANDS 2U <0.005 USA Acer <0.005 TAIWAN Aena S.A. 0.02 SPAIN 360 Capital Industrial Fund <0.005 AUSTRALIA Acerinox <0.005 SPAIN Aeon 0.02 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Aces Electronic Co. Ltd. <0.005 TAIWAN Aeon (M) <0.005 MALAYSIA 3-D Systems <0.005 USA Achilles <0.005 JAPAN AEON DELIGHT <0.005 JAPAN 3i Group 0.02 UNITED Achillion Pharmaceuticals <0.005 USA Aeon Fantasy <0.005 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Financial Service <0.005 JAPAN 3M Company 0.26 USA Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN 3S Korea <0.005 KOREA Acom <0.005 JAPAN AerCap Holdings N.V. 0.02 USA 3SBio (P Chip) <0.005 CHINA Aconex <0.005 AUSTRALIA Aeroflot <0.005 RUSSIA 77 Bank <0.005 JAPAN Acorda Therapeutics <0.005 USA Aerojet Rocketdyne Holdings <0.005 USA 888 Holdings <0.005 UNITED Acron JSC <0.005 RUSSIA Aeroports de Paris 0.01 FRANCE KINGDOM Acrux <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 8x8 <0.005 USA ACS Actividades Cons y Serv 0.01 SPAIN Aerospace Hi-Tech (A) <0.005 CHINA A P Moller - Maersk A 0.02 DENMARK Actelion Hldg N 0.05 SWITZERLAND Aerosun (A) <0.005 CHINA A P Moller - Maersk B 0.02 DENMARK Activision Blizzard 0.06 USA AeroVironment <0.005 USA A.G.V. -

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms -

China Smart Devices

China smart devices EQUITY: TECHNOLOGY The next mega trend for 2014 and beyond? Global Markets Research LTE, Smart Homes, 3D Vision, EV, IT nationalism, 21 May 2014 Smart TVs, 4G smartphones and more… Anchor themes Despite the macro slowdown and Industry view: hardware + service to stimulate industry upgrade saturation in major technology We believe “hardware + service” has become an important business model to product lines, we think innovation drive the development of China’s IT hardware sector. In the past two years, and policy supports are the popularity of WeChat and mobile gaming has accelerated adoption of 3G incubating a new round of smartphones in China. Since 2013, IPTV services such as LeTV have started growth, potentially benefiting to reshape China’s TV industry. Looking ahead, we believe: players well positioned in various Mobile video services will stimulate growth of 4G smartphones TMT sub-sectors. TV game deregulation will become a new driver for Smart TVs in China Nomura vs consensus Air pollution may boost demand for EV and green home appliances We analyse China's TMT industry E-commerce will create new opportunities in O2O logistics from the perspective of a broad scope throughout the vertical & Smart home hardware is ready to incubate service and reshape the industry horizontal axis, and across sub- Concerns on IT security will benefit players in nationally strategic areas like sectors. semiconductor and enterprise equipment Research analysts 3D vision may help machines to better understand the real world and innovate the way people use e-commerce and auto driving. China Technology Regulatory policies still matter Leping Huang, PhD - NIHK As well as the above, government policy will play an important role in guiding [email protected] the development of China technology and telecoms.