Quarterly Report on the Pooled Money Investment Account

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Political Crisis in Rhetorical Exercises of the Early Roman Empire Shunichiro Yoshida the University of Tokyo

ISSN: 2519-1268 Issue 2 (Spring 2017), pp. 39-50 DOI: 10.6667/interface.2.2017.34 Political Crisis in Rhetorical Exercises of the Early Roman Empire SHUNICHIRO YOSHIDA The University of Tokyo Abstract The ancient Romans experienced a great political crisis in the first century B. C. They fought many civil wars, which ended the republic and led to the establishment of the empire. The nature of these civil wars and the new regime was a politically very sensitive question for the next generation and could not be treated in a direct manner. In this paper I shall examine how literature in this age dealt with this sensitive problem. Special attention will be paid on declamations (rhetorical exercises on fictitious themes), which discussed repeatedly themes concerned with political crises such as domestic discord or rule of a tyrant. Keywords: Latin Oratory, Rhetorical Training, Early Roman Empire, Roman Politics © 2017 Shunichiro Yoshida This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License. http://interface.ntu.edu.tw/ 39 Political Crisis in Rhetorical Exercises of the Early Roman Empire 1. Politics in Rome in the 1st Century B.C. Rome experienced its greatest political change in the 1st century B.C. Since the latter half of the previous century, its Republican system, which was established in the late 6th century B.C. according to the tradition, proved to contain serious problems. This led to repeated fierce civil wars in Rome. In the middle of the 1st century B.C., Caesar fought against Pompey and other members of the senatorial nobility who tried to defend the traditional system and defeated them completely. -

Thought and Practice in Mahayana Buddhism in India (1St Century B.C. to 6Th Century A.D.)

International Journal of Humanities and Social Sciences. ISSN 2250-3226 Volume 7, Number 2 (2017), pp. 149-152 © Research India Publications http://www.ripublication.com Thought and Practice in Mahayana Buddhism in India (1st Century B.C. to 6th Century A.D.) Vaishali Bhagwatkar Barkatullah Vishwavidyalaya, Bhopal (M.P.) India Abstract Buddhism is a world religion, which arose in and around the ancient Kingdom of Magadha (now in Bihar, India), and is based on the teachings of Siddhartha Gautama who was deemed a "Buddha" ("Awakened One"). Buddhism spread outside of Magadha starting in the Buddha's lifetime. With the reign of the Buddhist Mauryan Emperor Ashoka, the Buddhist community split into two branches: the Mahasaṃghika and the Sthaviravada, each of which spread throughout India and split into numerous sub-sects. In modern times, two major branches of Buddhism exist: the Theravada in Sri Lanka and Southeast Asia, and the Mahayana throughout the Himalayas and East Asia. INTRODUCTION Buddhism remains the primary or a major religion in the Himalayan areas such as Sikkim, Ladakh, Arunachal Pradesh, the Darjeeling hills in West Bengal, and the Lahaul and Spiti areas of upper Himachal Pradesh. Remains have also been found in Andhra Pradesh, the origin of Mahayana Buddhism. Buddhism has been reemerging in India since the past century, due to its adoption by many Indian intellectuals, the migration of Buddhist Tibetan exiles, and the mass conversion of hundreds of thousands of Hindu Dalits. According to the 2001 census, Buddhists make up 0.8% of India's population, or 7.95 million individuals. Buddha was born in Lumbini, in Nepal, to a Kapilvastu King of the Shakya Kingdom named Suddhodana. -

GOSPEL of JOHN Introduction

1 GOSPEL OF JOHN Introduction John’s Gospel has been called the ‘spiritual’ gospel. One reason for this is that Jesus not only ends up in heaven after his resurrection, but he comes down from heaven into the world rather than simply being born like any other child. Jesus is more self- conscious in this gospel of his heavenly origin and destiny, and he speaks more directly of his identity as divine. He also uses spiritual language that requires special understanding. The author of the gospel is said to be the ‘beloved disciple’ mentioned throughout as one of the 12. Traditionally, the beloved disciple has been associated with John. The date the gospel was written is also believed to be later than the other three, perhaps in the early 90s of the 1st century. Even though John’s gospel contains many central themes of the story of Jesus, it also has distinctive features about it that distinguish it from the other gospels. STRUCTURE OF JOHN’S GOSPEL 1) The gospel begins by tracing back Jesus’ origins all the way to God before the world was created. Jesus is not only identified with God’s creating Word, but he is also presented as being the incarnation of God’s love come to heal and bring the light of God into a world enveloped in darkness. Despite the hope inherent in Jesus having come into the world to save it, there is a clear indication that he will be tragically rejected by the majority. By rejecting Jesus, people are rejecting God. 2) The first 11 chapters of John have been called the book of ‘signs.’ Jesus performs miracles which are called ‘signs’ indicating that they point beyond themselves to a more deeply spiritual significance. -

Chronology of the Falling Away 1St Century to The

Chronology of the Falling Away 1st Century to the Council of Nicaea – Louis Garbi "For I know this, that after my departure savage wolves will come in among you, not sparing the flock. "Also from among yourselves men will rise up, speaking perverse things, to draw away the disciples after themselves.” (Acts20:29-30) A.D. 49-100 The falling away from Christ can be identified with these characteristics: Religious systems associated with Jesus Christ mingling with Judaism, Gnosticism, philosophies of men, and false apostles. A love of power over others prevailed. 100-117 Ignatius, a bishop of Antioch, made a distinction between bishops and presbytery (elders). He upheld the idea that the bishop was the only one who had the right to baptize. He reminds one of Diotrophese (III John) when he wrote; “Do follow your bishop, as Jesus followed the Father.”1 Historically he would be described as a monarchical bishop (one who solely rules as an overseer). This marks a rejection of the scriptural example and command of multiple overseers being appointed in a given congregation. Also, its high handed tone does not exemplify the Spirit of Christ. 135-160 Gnosticism was at its height of influence among the churches, though it lingered long afterward. By the latter half of the first century, a concept of Christ was being taught which denied His fleshly existence, saying He came in an “appearance” of flesh. It is thought one reason for its acceptance was the difficulty some had in reconciling a member of the godhead possessing our earthly form. -

From the Jesus People to the Children of God – We Failed You 1

From the Jesus People to the Children of God – We Failed You 1 From the Jesus People to the Children of God – We Failed You By Mark McGee So much potential – 20 somethings in the middle of the so-called “Jesus Movement” of the early 1970s. We had the Word, we had the passion, we had the dreams, we had the music, most of all we had Jesus and He had us. We were going to change the world! So, what happened? What happened to our passion, our dreams, our hope for a new tomorrow? Where did it all go wrong? More than 40 years later and all I can do right now is apologize. From the Jesus People of the ’70s to the Children of God of the 21st century – we failed you, miserably. 40 years is a long time, plenty of time to get things right; plenty of time to see a generation of God’s people turn the world upside down. The 1st century believers turned their world upside down in a lot less time than that. Why couldn’t we? I will admit a great deal of sadness as I write this. I remember how exciting it was to be part of a movement of God to bring our nation back to Him and to see millions of lost people rescued in the Name of the Lord. As I think back through all the years of so many young Christians praying, worshiping, teaching, preaching, sharing, weeping – I wonder why. Why didn’t we see our nation turn to God? Why didn’t we see millions of lost people rescued in the Name of the Lord? Is Satan too powerful? Is God too weak? From the Jesus People to the Children of God – We Failed You 3 Would you be surprised if I told you the reason we haven’t seen a powerful movement of God in our nation for more than 40 years is because of the young Christians of the ’70s? Well, don’t be. -

Celtic Clothing: Bronze Age to the Sixth Century the Celts Were

Celtic Clothing: Bronze Age to the Sixth Century Lady Brighid Bansealgaire ni Muirenn Celtic/Costumers Guild Meeting, 14 March 2017 The Celts were groups of people with linguistic and cultural similarities living in central Europe. First known to have existed near the upper Danube around 1200 BCE, Celtic populations spread across western Europe and possibly as far east as central Asia. They influenced, and were influenced by, many cultures, including the Romans, Greeks, Italians, Etruscans, Spanish, Thracians, Scythians, and Germanic and Scandinavian peoples. Chronology: Bronze Age: 18th-8th centuries BCE Hallstatt culture: 8th-6th centuries BCE La Tène culture: 6th century BCE – 1st century CE Iron Age: 500 BCE – 400 CE Roman period: 43-410 CE Post (or Sub) Roman: 410 CE - 6th century CE The Celts were primarily an oral culture, passing knowledge verbally rather than by written records. We know about their history from archaeological finds such as jewelry, textile fragments and human remains found in peat bogs or salt mines; written records from the Greeks and Romans, who generally considered the Celts as barbarians; Celtic artwork in stone and metal; and Irish mythology, although the legends were not written down until about the 12th century. Bronze Age: Egtved Girl: In 1921, the remains of a 16-18 year old girl were found in a barrow outside Egtved, Denmark. Her clothing included a short tunic, a wrap-around string skirt, a woolen belt with fringe, bronze jewelry and pins, and a hair net. Her coffin has been dated by dendrochronology (tree-trunk dating) to 1370 BCE. Strontium isotope analysis places her origin as south west Germany. -

![World History--Part 1. Teacher's Guide [And Student Guide]](https://docslib.b-cdn.net/cover/1845/world-history-part-1-teachers-guide-and-student-guide-2081845.webp)

World History--Part 1. Teacher's Guide [And Student Guide]

DOCUMENT RESUME ED 462 784 EC 308 847 AUTHOR Schaap, Eileen, Ed.; Fresen, Sue, Ed. TITLE World History--Part 1. Teacher's Guide [and Student Guide]. Parallel Alternative Strategies for Students (PASS). INSTITUTION Leon County Schools, Tallahassee, FL. Exceptibnal Student Education. SPONS AGENCY Florida State Dept. of Education, Tallahassee. Bureau of Instructional Support and Community Services. PUB DATE 2000-00-00 NOTE 841p.; Course No. 2109310. Part of the Curriculum Improvement Project funded under the Individuals with Disabilities Education Act (IDEA), Part B. AVAILABLE FROM Florida State Dept. of Education, Div. of Public Schools and Community Education, Bureau of Instructional Support and Community Services, Turlington Bldg., Room 628, 325 West Gaines St., Tallahassee, FL 32399-0400. Tel: 850-488-1879; Fax: 850-487-2679; e-mail: cicbisca.mail.doe.state.fl.us; Web site: http://www.leon.k12.fl.us/public/pass. PUB TYPE Guides - Classroom - Learner (051) Guides Classroom Teacher (052) EDRS PRICE MF05/PC34 Plus Postage. DESCRIPTORS *Academic Accommodations (Disabilities); *Academic Standards; Curriculum; *Disabilities; Educational Strategies; Enrichment Activities; European History; Greek Civilization; Inclusive Schools; Instructional Materials; Latin American History; Non Western Civilization; Secondary Education; Social Studies; Teaching Guides; *Teaching Methods; Textbooks; Units of Study; World Affairs; *World History IDENTIFIERS *Florida ABSTRACT This teacher's guide and student guide unit contains supplemental readings, activities, -

Download PDF Datastream

A Dividing Sea The Adriatic World from the Fourth to the First Centuries BC By Keith Robert Fairbank, Jr. B.A. Brigham Young University, 2010 M.A. Brigham Young University, 2012 Submitted in partial fulfillment of the requirements for the Degree of Doctor of Philosophy in the Program in Ancient History at Brown University PROVIDENCE, RHODE ISLAND MAY 2018 © Copyright 2018 by Keith R. Fairbank, Jr. This dissertation by Keith R. Fairbank, Jr. is accepted in its present form by the Program in Ancient History as satisfying the dissertation requirement for the degree of Doctor of Philosophy. Date _______________ ____________________________________ Graham Oliver, Advisor Recommended to the Graduate Council Date _______________ ____________________________________ Peter van Dommelen, Reader Date _______________ ____________________________________ Lisa Mignone, Reader Approved by the Graduate Council Date _______________ ____________________________________ Andrew G. Campbell, Dean of the Graduate School iii CURRICULUM VITAE Keith Robert Fairbank, Jr. hails from the great states of New York and Montana. He grew up feeding cattle under the Big Sky, serving as senior class president and continuing on to Brigham Young University in Utah for his BA in Humanities and Classics (2010). Keith worked as a volunteer missionary for two years in Brazil, where he learned Portuguese (2004–2006). Keith furthered his education at Brigham Young University, earning an MA in Classics (2012). While there he developed a curriculum for accelerated first year Latin focused on competency- based learning. He matriculated at Brown University in fall 2012 in the Program in Ancient History. While at Brown, Keith published an appendix in The Landmark Caesar. He also co- directed a Mellon Graduate Student Workshop on colonial entanglements. -

Roman Sculpture

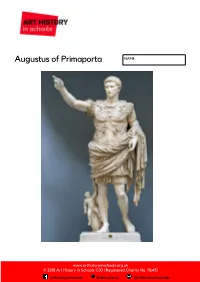

CLASSICAL SCULPTURE Lesson 3. Roman sculpture IES VILATZARA Javier Muro 1.1. Augustus' wife: Livia Augustus of Primaporta. Early 1st century AD (marble) after a bronze of the 1st century B.C. 1.1. CATALOGUING WORD BANK : Title Unknown, Sculptor Marble, Carved, Statue in the round Chronology Material Typology 1.1. FORMAL DESCRIPTION WORD BANK: Balanced Composition Weight Contrapposto Naturalistic, Treatment of forms: Armour, Cuirass or body, metal breastplate, draperies... Tunic, Crumpled toga, Reliefs Movement Arm, legs, limbs Movement Repose Serenity Expressivity Idealisation Portrait Roman sculpture Style Proportions Joints, Hair, Face http://web.mit.edu/21h.402/www/primaporta / Crumpled toga Armour, Cuirassor metal breastplate Reliefs 2. INTERPRETATION Iconography is the branch of art history which studies the identification, description, and the interpretation of the content of images. The word iconography literally means "image writing", or painting, and comes from the Greek εικον (image) and γραφειν (to write). Symbols are objects, characters, or other concrete representations of ideas, concepts, or other abstractions. 2.1. Read this text and relate the two columns in the grid below : The statue of Augustus of Primaporta depicts the youthful Augustus, the first Roman emperor, as a general of generals (cuirass) and as a civilian authority (toga), with a sceptre in his left hand and pointing the way to Rome’s imperial future with his right arm. Specifically, the statue celebrates Augustus’s recovery of Roman military standards lost in a battle some years ago. Augustus is depicted to be still and calm. There is little movement. Even on the breastplate (cuirass), there are no signs of battles or violence . -

New Testament Archaeology by Daniel J

New Testament Archaeology by Daniel J. Lewis © Copyright 2005 by Diakonos, Inc. Troy, Michigan United States of America 2 Backgrounds to New Testament Archaeology ..........................................................4 Technological Advances in the Hellenistic Period................................................5 The Architecture of Herod the Great .....................................................................6 The World of Jesus’ Early Life..................................................................................8 The Birth of Jesus ..................................................................................................8 The Childhood of Jesus..........................................................................................9 Jewish Household Culture in the 1st Century ......................................................12 Jesus’ Ministry in Galilee ........................................................................................13 The Villages of Galilee ........................................................................................13 The Lake and Its Culture .....................................................................................15 Jesus’ Passion in Jerusalem .....................................................................................16 Going to Jerusalem ..............................................................................................17 In Jerusalem .........................................................................................................17 -

Chronology Activity Sheet

What Is Chronology Chronology? The skill of putting events into time order is called chronology. History is measured from the first recorded written word about 6,000 years ago and so historians need to have an easy way to place events into order. Anything that happened prior to written records is called ‘prehistory’. To place events into chronological order means to put them in the order in which they happened, with the earliest event at the start and the latest (or most recent) event at the end. Put these events into chronological order from your morning Travelled to school Cleaned teeth 1. 2. 3. 4. Got dressed Woke up 5. 6. Had breakfast Washed my face How do we measure time? There are many ways historians measure time and there are special terms for it. Match up the correct chronological term and what it means. week 1000 years year 10 years decade 365 days century 7 days millennium 100 years What do BC and AD mean? When historians look at time, the centuries are divided between BC and AD. They are separated by the year 0, which is when Jesus Christ was born. Anything that happened before the year 0 is classed as BC (Before Christ) and anything that happened after is classed as AD (Anno Domini – In the year of our Lord). This means we are in the year 2020 AD. BC is also known as BCE and AD as CE. BCE means Before Common Era and CE means Common Era. They are separated by the year 0 just like BC and AD, but are a less religious alternative. -

Augustus of Primaporta NAME

NAME: Augustus of Primaporta www.arthistoryinschools.org.uk © 2018 Art History in Schools CIO | Registered Charity No. 116451 arthistoryinschools @ahischarity @arthistoryinschools Reading and research Please make sure you read/watch and take notes from the following: http://web.mit.edu/21h.402/www/primaporta/ https://en.wikipedia.org/wiki/Augustus_of_Prima_Porta http://mv.vatican.va/4_ES/pages/z-Patrons/MV_Patrons_04_03.html https://www.khanacademy.org/humanities/ancient-art-civilizations/roman/early- empire/v/augustus-of-primaporta-1st-century-c-e-vatican-museums https://www.youtube.com/watch?v=3yoJhEhkwBY Honour & Fleming ‘A World History of Art’ pp196-197 Summary of Key Facts Date: Who is this a portrait of? Style Size Material Who commissioned it? Where was it found? Art historical terms and concepts To which genre does this work belong? Who is it a portrait of? When did he rule Rome? Where does he look? (gaze) Describe his pose? What is the name given to his raised arm? What is the effect of this gesture? Why does he wear a senator’s robe as well as a military breastplate? Who is the small figure at his ankle? www.arthistoryinschools.org.uk © 2018 Art History in Schools CIO | Registered Charity No. 116451 arthistoryinschools @ahischarity @arthistoryinschools Why is this significant? Why is he bare foot? Describe his hair and facial features? Why is this significant? Some parts of this figure are idealised and others realistic. Make sure you know which and why? How big is this figure compared to you? What is the effect of this? www.arthistoryinschools.org.uk © 2018 Art History in Schools CIO | Registered Charity No.