Fair Housing Survey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LWCF Projects 1964 to 2019

FiscalYear CountyName AgencyName ProjectNumber ProjectName ProjectScope GrantAmount ProjectAddress ProjectCity ProjectZipCod Latitude Longitude e 2018/19 Kern City of Bakersfield 06-01827 Kaiser Permanente Construct 4 new football fields, a restroom and concession $3,000,000 9001 Ashe Road Bakersfield 93313 NULL NULL Sports Village stand, exercise outdoor gym area, 3 parking lots, Project installation of sports field lighting, and landscaping at the Kaiser Permanente Sports Village in the City of Bakersfield. 2018/19 Humboldt City of Eureka 06-01826 Sequoia Park Construct new trails, playground facilities, off-street ADA $1,525,000 3414 W Street Eureka 95503 NULL NULL Redwood Canopy compliant parking and new restrooms and renovate trails Walk and Trail in Sequoia Park in the City of Eureka. Project 2018/19 Riverside City of Indio 06-0130 South Jackson Park Construct a new approximately 0.5 mile trail with exercise $652,500 83100 Date Indio 92201 NULL NULL Accessibility stations and plant approximately 50 new trees, renovate Avenue Improvements existing playgrounds and provide ADA improvements at South Jackson Park in the City of Indio. 2018/19 Los Angeles City of Long Beach 06-01828 Davenport Park Construct a new multi-use sports field, shaded outdoor $2,016,000 2910 East 55th Long Beach 90805 NULL NULL Phase II seating area, and install exercise equipment with signage Way in Davenport Park in the City of Long Beach. 2018/19 Madera County of Madera 06-01829 Courthouse Park Construct a new playground, exercise stations, and picnic $203,747 210 W. Yosemite Madera 93637 NULL NULL Project area at Courthouse Park in the City of Madera. -

![Nature of Incident: Start Smart Program Location: Camarillo Police Station 3701 E. Las Posas Road Camarillo, Ca. 93010] Date &Am](https://docslib.b-cdn.net/cover/2903/nature-of-incident-start-smart-program-location-camarillo-police-station-3701-e-las-posas-road-camarillo-ca-93010-date-am-522903.webp)

Nature of Incident: Start Smart Program Location: Camarillo Police Station 3701 E. Las Posas Road Camarillo, Ca. 93010] Date &Am

Camarillo - Start Smart Program 1/28/2013 3:30:00 PM Nature of Incident: Start Smart Program Location: Camarillo Police Station 3701 E. Las Posas Road Camarillo, Ca. 93010] Date & Time: Thursday 21st @ 5:30 pm Unit Responsible: Camarillo Traffic Bureau Narrative: The Camarillo Police Department will be hosting a program to educate newly licensed and future drivers. The 'Start Smart' Program is a cooperative effort between the California Highway Patrol, Camarillo Police Department, teenage drivers, and their parents. In an attempt to remain proactive and not reactive, Start Smart is designed to help young drivers and their parents/guardians understand the responsibilities associated with driving a motor vehicle. Start Smart will show how a poor choice behind the wheel can change the lives of everyone involved. Our goal is to raise awareness and reduce the number of teen-related injuries and deaths due to collisions. Interested parents are asked to call Sergeant Renee Ferguson at 805-388-5132 for more information and for reservations call the Camarillo Police Department Community Resource Unit at 805-388-5155 to make a reservation. Space is limited to 20 students and their parents. There is no charge to attend the program. Deputy Preparing Media Deputy Robert Steele Release: Media Release Date: January 22, 2013 Follow-Up Contact: Sergeant Renee Ferguson (805) 388-5132 Approved by: Captain Bruce Macedo Ventura County Crime Stoppers will pay up to $1,000 reward for information, which leads to the arrest and criminal complaint against the person(s) responsible for this crime. The caller may remain anonymous. The call is not recorded. -

Crpd Booklet Fall 2020

Fall 2020 “I can't change the direction of the wind, but I can adjust my sails to always reach my destination.” -Jimmy Dean To help keep kids of all ages (!) happy, healthy, and safe, we will continue to adjust our sails to meet the needs of the community. RECREATION PROGRAM GUIDE Registration for Fall 2020 Classes is ooeredwww.crpd.org on a rolling basis.www.facebook.com/ConejoRPD When classes become available, notices will be posted at www.crpd.org & on CRPD’s social media. BOARD OF DIRECTORS BROCHURE DIRECTORY George M. Lange .........................Chair Community Centers Doug Nickles ...............................Vice-Chair Borchard Community Center ..................................4 Susan L. Holt ...............................Director Borchard Skatepark ....................................................5 Chuck Huffer ...............................Director Nellie Cusworth ...........................Director Conejo Community Center. .....................................6 Outdoor Unit Programs.............................................7 The Board of Directors generally meets at 6:00pm two Thursdays per month at the Hillcrest Dos Vientos Community Center.............................8 Center, 403 West Hillcrest Drive, Thousand Oaks. Check www.crpd.org for specific dates. Thousand Oaks Community Center .................. 10 STAFF Old Meadows Center ............................................12 Jim Friedl ....................................General Manager Westlake Area Programs ......................................12 Tex Ward -

Economic Effects of Critical Habitat Designation for Lyon's Pentachaeta

ECONOMIC EFFECTS OF CRITICAL HABITAT DESIGNATION FOR LYON’S PENTACHAETA IN TWO CALIFORNIA COUNTIES Prepared For Division of Economics U.S. Fish & Wildlife Service 4401 North Fairfax Drive Arlington, VA 22203 Prepared By CRA International 5335 College Avenue, Suite 26 Oakland, California 94618 June 1, 2006 CRA No. D08739 I BACKGROUND On November 10, 2005, the U.S. Fish & Wildlife Service (Service) proposed critical habitat for the Lyon’s pentachaeta, Pentachaeta lyonii, pursuant to the Endangered Species Act of 1973.1 For this economic analysis, a total of 4,212 proposed acres in Ventura and Los Angeles are examined. This report quantifies the economic effects associated with the proposed designation of critical habitat. It does so by taking into account the cost of conservation-related measures that are likely to be associated with future economic activities that may adversely affect the habitat within the proposed boundaries. This information is intended to assist the Secretary in determining whether the benefits of excluding particular areas from the designation outweigh the biological benefits of including them.2 In addition, this information allows the Service to address the requirements of Executive Orders 12866 and 13211, and the Regulatory Flexibility Act (RFA), as amended by the Small Business Regulatory Enforcement Fairness Act (SBREFA).3 This report also complies with direction from the U.S. 10th Circuit Court of Appeals that “co-extensive” effects should be included in the economic analysis to inform decision-makers regarding which areas to designate as critical habitat.4 I.1 IDENTIFIED HABITAT The Service identified seven habitat units and fourteen subunits with known occurrences of pentachaeta. -

Land and Water Conservation Fund Program Funded Projects

Land and Water Conservation Fund Program Funded Projects Alameda County Alameda Creek Regional Park Alameda Creek-Coyote Hills Acq $819,997 Acquisition of 446 acres. Alameda Shoreline Park Alameda Shoreline Park $335,280 Picnic and play areas, trails Alvarado Community Center Alvarado/Chavez Park Dev $71,466 Development of a gazebo at Alvarado/Chavez Park to include renovated structure and new paint. Aquatic Park Aquatic Park Acquisition $24,633 Acquisition of 1.6 acre addition. Aquatic Park Dev $154,581 Picnic areas, tot lot, roads, parking, irrigation, landscaping, and playfields. Aquatic Park Dev $107,766 Play area, day camp,, picnic area, landscaping, pathways Ardenwood Park Ardenwood Regional Park Dev $201,600 Development of access roads, parking, landscaping, restrooms, utilities and stabilization of farm bdlgs Arrowhead Marsh Martin Luther King Jr Reg Shoreline $347,472 Develop 55 acres with picnic areas, sports and playfields, fishing facilities and trails. Arroyo/Castro Valley Swim P Arroyo/Castro Valley Swim Pdev $81,280 Renovated swim pools at Castro Valley and Arroyo Swim Centers Bateman Park Dev Bateman Park Dev $37,800 Tot lot, lighting, irrigation, landscaping, paths Caldecott Park Caldecott Park $202,400 Picnic areas, sports & playfields, trails, parking and restrooms Caldecott Park Acquisition $151,756 57.1 acres acquired adjacent to ftge road for regional sports facility Centennial Park Centennial Park $165,408 Picnic areas, sportsfields, playfields Central Park Central Park Bike Trail Dev $14,456 Site preparation of the Civic Center Knoll for parkland use - remove City Government Building and Police buildings, including reconstruction (fill & grade). Central Recreation Area Acquisition $32,946 Acquisition of 4 acres Central Recreation Area Dev $37,230 Day camping, picnicing, access road, fencing, moving utilities underground. -

New 10 Year Lease THOUSAND OAKS CALIFORNIA

OFFERING MEMORANDUM THOUSAND OAKS CALIFORNIA New 10 year lease CONFIDENTIALITY AND DISCLAIMER The information contained in the following Marketing Brochure is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Marcus & Millichap and should not be made available to any other person or entity without the written consent of Marcus & Millichap. This Marketing Brochure has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. Marcus & Millichap has not made any investigation, and makes no warranty or representation, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the property and improvements, the presence or absence of contaminating substances, PCB’s or asbestos, the compliance with State and Federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property. The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable; however, Marcus & Millichap has not verified, and will not verify, any of the information contained herein, nor has Marcus & Millichap conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. -

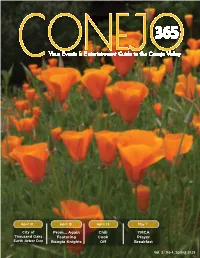

Spring 2015 2 | Spring 2015 | Conejo365 Content

April 18 April 18 April 25 May 7 City of Prom… Again Chili YMCA Thousand Oaks Featuring Cook Prayer Earth Arbor Day Boogie Knights Off Breakfast Vol. 2, No 4, Spring 2015 2 | www.conejo365.com Spring 2015 | Conejo365 Content Spring 2015 Vol. 2- Issue 4 4 Editor’s Letter 7 April Listings 12 May Listings 18 June Listings 26 Masthead Conejo365 | Spring 2015 www.conejo365.com | 3 Conejo365 is growing by leaps and bounds. Our readership continues to increase, while the event submissions for the magazine are exploding. This kind of acceptance is very gratifying and we fully expect to keep building on our early successes with help from our readers and our advertisers. In fact, the magazine would not even exist without our advertisers. Through their participation, we are able to offer Conejo365 to everyone in our area at no cost to them. Our advertisers have truly invested in our community by supporting this publication, so, I encourage all of our readers to use our partners’ services and attend their events. Speaking of events, the Conejo Valley offers an amazing variety of activities from which to choose any time of year. In one convenient place, we feature as many of these as we can in every issue of Conejo365. If you don’t find what interests you between our pages, let us know and we’ll make every effort to add it. We’re so fortunate to live in the Conejo Valley. It just doesn’t get much better than this, especially, in the late winter and early spring when we might get some rain to green things up like we did this year. -

United States Department of the Interior National Park Service Land & Water Conservation Fund --- Detailed Listing of Grants

United States Department of the Interior National Park Service Land & Water Conservation Fund --- Detailed Listing of Grants Grouped by County --- Today's Date: 11/20/2008 Page: 1 California - 6 Grant ID & Type Grant Element Title Grant Sponsor Amount Status Date Exp. Date Cong. Element Approved District ALAMEDA 5 - XXX A ALAMEDA CREEK - COYOTE HILLS PAR EAST BAY REGIONAL PARK DIST. $819,996.64 C 8/24/1966 6/30/1970 13 19 - XXX D MARINE PARK CITY OF BERKELEY $100,000.00 C 12/27/1966 6/30/1968 9 99 - XXX A SHADOW CLIFFS AQUATIC PARK EAST BAY REGIONAL PARK DIST. $255,000.00 C 6/30/1969 7/1/1972 10 134 - XXX D AQUATIC PARK DEVELOPMENT CITY OF BERKELEY $154,581.00 C 4/23/1971 4/23/1976 9 138 - XXX A AQUATIC PARK ACQUISITION CITY OF BERKELEY $24,633.00 C 4/12/1971 10/1/1975 9 143 - XXX D WOODSTOCK PARK DEVELOPMENT CITY OF ALAMEDA $13,098.33 C 4/23/1971 10/1/1975 9 178 - XXX D MADISON SQUARE PARK DEVELOPMENT CITY OF OAKLAND $74,128.50 C 6/30/1971 10/1/1975 9 179 - XXX D CENTRAL RECREATION AREA DEVELOPMENT CITY OF OAKLAND $37,230.00 C 6/30/1971 10/1/1975 9 180 - XXX A CENTRAL RECREATION AREA ACQUISITION CITY OF OAKLAND $32,946.00 C 6/30/1971 10/1/1975 9 255 - XXX D DAL VALLE RESERVOIR PROJECT CA DEPARTMENT OF PARKS AND $896,427.00 C 5/25/1972 10/1/1976 9 RECREATION 258 - XXX D BERKELEY FISHING PIER WILDLIFE CONSERVATION BOARD $43,082.76 C 6/2/1972 10/1/1976 9 276 - XXX D LAKE MERRITT BICYCLE PATH CITY OF OAKLAND $15,300.00 C 1/12/1973 1/12/1978 9 332 - XXX D CENTRAL PARK BICYCLE TRAIL CITY OF FREMONT $14,455.69 C 2/22/1974 10/1/1977 10 338 - XXX D SAN LEANDRO SHORELINE PK DEV. -

Land and Water Conservation Fund Program Funded Projects

Land and Water Conservation Fund Program Funded Projects Alameda County Alameda Creek Regional Park Alameda Creek-Coyote Hills Acquisition 1966/67 $819,997 Acquisition of 446 acres. Alameda Shoreline Park Alameda Shoreline Park 1978/79 $335,280 Picnic and play areas, trails. Alvarado Community Center Alvarado/Chavez Park Development 2001/02 $71,466 Development of a gazebo at Alvarado/Chavez Park to include renovated structure and new paint. Aquatic Park Aquatic Park Acquisition 1970/71 $24,633 Acquisition of 1.6 acre addition. Aquatic Park Development 1970/71 $154,581 Picnic areas, tot lot, roads, parking, irrigation, landscaping, and play fields. Aquatic Park Development 1976/77 $107,766 Play area, day camp, picnic area, landscaping, pathways. Ardenwood Park Ardenwood Regional Park Development 1983/84 $201,600 Development of access roads, parking, landscaping, restrooms, utilities and stabilization of farm buildings. Arroyo Swim Center Arroyo/Castro Valley Swim Development 1979/80 $81,280 Renovated swim pools at Castro Valley and Arroyo Swim Centers. Bateman Mall Park Bateman Park Development 1983/84 $37,800 Tot lot, lighting, irrigation, landscaping, paths. Big Break Regional Shoreline Vintage Parkway Creek Development 2003/04 $202,700 Development of a trail bridge across the Vintage Parkway Creek Channel. Caldecott Park Caldecott Park 1980/81 $202,400 Picnic areas, sports & play fields, trails, parking and restrooms. Caldecott Park Acquisition 1976/77 $151,756 57.1 acres acquired adjacent to the road for regional sports facility. Castro Valley Swim Center Arroyo/Castro Valley Swim Development 1979/80 $81,280 Renovated swim pools at Castro Valley and Arroyo Swim Centers. Centennial Park Centennial Park 1979/80 $165,408 Picnic areas, sports fields, play fields. -

Draft Ventura County Regional Analysis to Fair Housing Choice-April 2010

Ventura County Regional Analysis of Impediments to Fair Housing Choice April 2010 Table of Contents Chapter 1 - Introduction .........................................................................................................1 A. Purpose of Report............................................................................................................1 B. Geographic Area Covered ...............................................................................................2 C. Legal Framework ............................................................................................................2 D. Lead Agency and Funding Sources ................................................................................6 E. Organization of Report ....................................................................................................6 F. Data and Methodology ....................................................................................................7 Chapter 2 - Community Outreach .........................................................................................9 A. Public Meetings ...............................................................................................................9 B. Fair Housing Survey......................................................................................................11 C. Service Provider Interviews ..........................................................................................16 Chapter 3 - Community Profile ............................................................................................17 -

Malibu Creek Ecosystem Restoration Study 2 3 Los Angeles and Ventura Counties, California 4 5 6 Appendix P 7 8 Coordination Act Report (CAR) 9 10 11

1 Malibu Creek Ecosystem Restoration Study 2 3 Los Angeles and Ventura Counties, California 4 5 6 Appendix P 7 8 Coordination Act Report (CAR) 9 10 11 12 13 14 15 U.S. Army Corps of Engineers 16 Los Angeles District 17 18 19 20 January 2017 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 This page was intentionally left blank for duplex printing. United States Department of the Interior FISH AND WILDLIFE SERVICE Ventura Fish and Wildlife Office 2493 Portola Road, Suite B Ventura, California 93003 IN REPLY REFER TO: 08EVEN00-2 01 3-CPA-OI I I May 17, 2013 Josephine R. Axt, Chief Planning Division, Los Angeles District U.S. Army Corps of Engineers P.O. Box 532711 Los Angeles, California 90053-2325 Subject: Draft Fish and Wildlife Coordination Act Report for the Malibu Canyon Ecosystem Restoration Project, Los Angeles County, California Dear Dr. Axt: Enclosed is a draft Fish and Wildlife Coordination Act Report by the U.S. Fish and Wildlife Service for the Malibu Canyon Ecosystem Restoration Project. This work product is provided under Military Interdepartmental Purchase Request number W81 EYN51336881 and the Scope of Work dated July 2007. We would appreciate your review of the document in its entirety with emphasis on the following section: Description of Biological Resources in the Project Area, Impacts of the Preferred Alternative on Biological Resources, Discussion and Conclusion, and Recommendation. We appreciate the cooperation your staff has provided during development of this Coordination Act Report, and we look forward to working with you to finalize this report. -

California Department of Parks and Recreation Office of Grants and Local Services

California Department of Parks and Recreation Office of Grants and Local Services Recreational Trails Program 10/23/2008 Project Number Porject Name Agency Amount 7/1/2008 RT-34-017 Western States/Pioneer Express Trail DPR Statewide Trails Office $173,800 Rehab. RT-19-032 Reconstruction of Eastside Neighborhood City of Pasadena, Parks & Natural Resources $175,000 & JPL Conn RT-30-023 Salt Creek Trail Enhancement Project City of Laguna Niguel $560,000 RT-34-016 Improving Del Paso Regional Park's Trails City of Sacramento $300,000 RT-04-004 Bidwell Park Middle Trail Rehabilitation City of Chico $175,802 Project RT-01-013 Historic Cryer Boathouse Bay Trail Gap City of Oakland, Comm & Econ Dev Agency $600,000 Closure, Oa RT-36-007 Pacific Electric Trail Segment 6 City of Fontana $250,000 RT-37-023 Encinitas Recreational Trail City of Encinitas $32,813 RT-30-022 Lincoln Avenue Multi-use Trail Staging City of Anaheim $415,024 Area RT-19-031 San Rafael Hills "Mountain Do" Trail City of Glendale $172,570 RT-29-002 Hirschman's Trail City of Nevada City $195,360 RT-29-001 Truckee River Trail Phase II Town of Truckee $290,200 RT-01-012 San Leandro Slough Bridge City of San Leandro $395,000 RT-30-020 Santa Ana Golden Loop Trail Rehabilitation City of Santa Ana, Parks, Rec & Comm Sv $253,440 RT-49-009 Hood Mountain - Lower Johnson Ridge County of Sonoma $117,500 Trail RT-30-021 Lemon Hill Recreation Trail City of Villa Park $666,300 RT-01-014 Livermore Area RPD Trail Segments H2 Livermore Area R.P.D.