In the Matter of New York Stock Exchange LLC, and NYSE Euronext

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Membership Application for New York Stock Exchange LLC and NYSE

Membership Application for New York Stock Exchange LLC1 and NYSE American LLC 1 NYSE membership permits the Applicant Firm, upon approval of membership, to participate in the NYSE Bonds platform. TABLE OF CONTENTS Page Application Process and Fees 2-3 Information and Resources 3 Explanation of Terms 4-5 Section 1 – Organizational Profile 6 Section 2 – Applicant Firm Acknowledgement 7 Section 3 – Application Questions 8-9 Section 4 – Floor Based Business 10 Section 5 – Key Personnel 11 Section 6 – Additional Required Documentation and Information 12-14 Section 7 – Designation of Accountant 15 Section 8 – Required Organizational Documents and Language Samples / References 16 NYSE and NYSE American Equities Membership Application - October 2019 1 APPLICATION PROCESS Filing Requirements Prior to submitting the Application for New York Stock Exchange LLC (“NYSE”) and/or NYSE American LLC (“NYSE American”) membership, an Applicant Firm must file a Uniform Application for Broker-Dealer Registration (Form BD) with the Securities and Exchange Commission and register with the FINRA Central Registration Depository (“Web CRD®”). Application Submission Applicant Firm must complete and submit all applicable materials addressed within the application as well as the additional required documentation noted in Section 6 of the application. Application and supplemental materials should be sent electronically to [email protected]. Please ensure all attachments are clearly labeled. NYSE Applicant Firm pays one of the below application fees (one-time fee and non-refundable): Clearing Firm $20,000 (Self-Clearing firm or Clears for other firms) Introducing Firm $ 7,500 (All other firms fall within this category) Non-Public Firm $ 2,500 (On-Floor firms and Proprietary firms) Kindly make check payable to “NYSE Market (DE), Inc.” and submit the check with your initial application. -

Stock Exchanges at the Crossroads

Fordham Law Review Volume 74 Issue 5 Article 2 2006 Stock Exchanges at the Crossroads Andreas M. Fleckner Follow this and additional works at: https://ir.lawnet.fordham.edu/flr Part of the Law Commons Recommended Citation Andreas M. Fleckner, Stock Exchanges at the Crossroads, 74 Fordham L. Rev. 2541 (2006). Available at: https://ir.lawnet.fordham.edu/flr/vol74/iss5/2 This Article is brought to you for free and open access by FLASH: The Fordham Law Archive of Scholarship and History. It has been accepted for inclusion in Fordham Law Review by an authorized editor of FLASH: The Fordham Law Archive of Scholarship and History. For more information, please contact [email protected]. Stock Exchanges at the Crossroads Cover Page Footnote [email protected]. For very helpful discussions, suggestions, and general critique, I am grateful to Howell E. Jackson as well as to Stavros Gkantinis, Apostolos Gkoutzinis, and Noah D. Levin. The normal disclaimers apply. An earlier version of this Article has been a discussion paper of the John M. Olin Center's Program on Corporate Governance, Working Papers, http://www.law.harvard.edu/programs/ olin_center/corporate_governance/papers.htm (last visited Mar. 6, 2005). This article is available in Fordham Law Review: https://ir.lawnet.fordham.edu/flr/vol74/iss5/2 ARTICLES STOCK EXCHANGES AT THE CROSSROADS Andreas M Fleckner* INTRODUCTION Nemo iudex in sua causa-No one shall judge his own cause. Ancient Rome adhered to this principle,' the greatest writers emphasized it, 2 and the Founding Fathers contemplated it in the early days of the republic: "No man is allowed to be a judge in his own cause; because his interest would '3 certainly bias his judgment, and, not improbably, corrupt his integrity. -

Broker-Dealer Registration and FINRA Membership Application

Broker-Dealer Concepts Broker-Dealer Registration and FINRA Membership Application Published by the Broker-Dealer & Investment Management Regulation Group September 2011 Following is an overview of the federal, state and self-regulatory organization (“SRO”) requirements for registration and qualification as a broker-dealer in the United States. We also discuss certain considerations relevant to the decision to register a broker-dealer with the U.S. Securities and Exchange Commission (“SEC” or the “Commission”), application for membership in the Financial Industry Regulatory Authority (“FINRA”) and other SROs, state registration and related costs. I. Jurisdiction .........................................................................................................................................................2 II. Exclusions from Registration.............................................................................................................................2 III. Broker-Dealer Registration and SRO Membership..........................................................................................2 A. SEC Registration .......................................................................................................................................... 2 B. FINRA and Other SRO Membership ............................................................................................................ 3 C. State Registration ........................................................................................................................................ -

NYSE Arca, Inc

NYSE Arca, Inc. Application for Market Maker* Registration *Includes Market Maker & Lead Market Maker TABLE OF CONTENTS Page Application Process 2 Checklist 3 Explanation of Terms 4 Application for Market Maker (Sections 1-5) 5-10 Revised October 2018 1 of 10 Application Process Filing Requirements Prior to submitting the Application to become a Market Maker, an applicant Broker-Dealer must have completed the Equity Trading Permit (“ETP”) application. A firm will not be eligible for approval as a Market Maker until after their ETP application is approved. Checklist Applicant ETP must complete and submit all materials as required in this Application Checklist (page 4) to [email protected]. If you have questions regarding the application, you may direct them to NYSE Arca Client Relationship Services: Email: [email protected]; Phone: (212) 896-2830. Application Process • Following submission of the Application for Market Maker Registration and supporting documents, NYSE Arca will review the application for completeness, assess the firm’s capital sufficiency, review registration and disclosure information for the Applicant and each listed Market Maker Authorized Trader, and review the Applicant’s written supervisory procedures. • Applicant ETP Broker-Dealers must designate within Section 1 whether they are applying as a Market Maker ETP (“METP”), and/or as a Lead Market Maker ETP (“LETP”). • Applicants who have completed and returned all documents without indication of a statutory disqualification, outstanding debt, civil judgment actions and/or regulatory disciplinary actions will be reviewed by NYSE Arca for approval or disapproval. • NYSE Arca will notify the applicant Broker-Dealer in writing of their decision. -

New York Stock Exchange LLC NYSE American LLC NYSE Arca, Inc

New York Stock Exchange LLC NYSE American LLC NYSE Arca, Inc. NYSE Chicago, Inc. NYSE National, Inc. (Collectively, “NYSE” or the “Exchanges”) Application for Membership INDICATE EXCHANGE(S) FOR WHICH APPLICANT IS SEEKING MEMBERSHIP (CHECK ALL THAT APPLY) ☐New York Stock Exchange LLC ☐NYSE Chicago ☐NYSE National ☐NYSE American ☐NYSE Arca ☐Equities ☐Equities ☐Options ☐Options INDICATE EXCHANGE(S) FOR WHICH APPLICANT IS AN EXISTING MEMBER (CHECK ALL THAT APPLY) ☐New York Stock Exchange LLC ☐NYSE Chicago ☐NYSE National ☐NYSE American ☐NYSE Arca ☐Equities ☐Equities ☐Options ☐Options INDICATE TYPE OF BUSINESS TO BE CONDUCTED WITH THIS APPLICATION (CHECK ALL THAT APPLY) Equities Options ☐Bonds ☐Clearing ☐Clearing ☐Floor Broker ☐Floor Broker ☐Limited Public Business ☐Blue Line ☐Market Maker ☐Institutional Broker ☐Specialist/eSpecialist ☐Market Maker* ☐Lead Market Maker (“LMM”) ☐Electronic Market Maker ☐Order Routing ☐Designated Market Maker (“DMM”) ☐Proprietary ☐Electronic Designated Market Maker (“eDMM”) ☐Agency ☐Lead Market Maker (“LMM”) ☐ DEA ☐Order Routing ☐Proprietary ☐Agency ☐Designated Examining Authority (“DEA”) INDICATE IF APPLICANT IS APPLYING FOR MEMBERSHIP AS DEA ☐ NYSE American ☐ NYSE Arca ☐ NYSE Chicago Applicants applying for a DEA must also complete EXHIBIT 1, ITSFEA Compliance Acknowledgment. APPLICATION TYPE ☐New Membership Applicant: ☐Applicant is seeking membership to an NYSE Exchange and is not currently a member of any NYSE Exchange ☐Applicant is a member of an NYSE Exchange and is seeking to add a new type of business** Applicant must submit this completed Application and ALL applicable materials identified in Checklist 1. ☐Supplemental Membership Applicant: Applicant is an approved member of at least one NYSE Exchange and is seeking membership to another NYSE SRO to conduct the same business they are currently approved to conduct Applicant must submit this completed Application and ALL applicable materials as outlined in Checklist 2. -

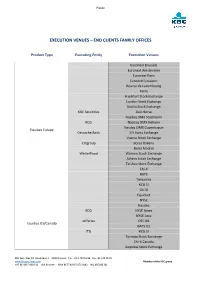

Execution Venues – End Clients Family Offices

Public EXECUTION VENUES – END CLIENTS FAMILY OFFICES Product Type Executing Entity Execution Venues Euronext Brussels Euronext Amsterdam Euronext Paris Euronext Lissabon Bourse de Luxembourg Xetra Frankfurt Stock Exchange London Stock Exchange Dublin Stock Exchange KBC Securities Oslo Borse Nasdaq OMX Stockholm KCG Nasdaq OMX Helsinki Nasdaq OMX Copenhague Equities Europe Deutsche Bank SIX Swiss Exchange Vienna Stock Exchange Citigroup Borsa Italiana Bolsa Madrid Winterflood Warsaw Stock Exchange Athens Stock Exchange Tel Aviv Stock Exchange Chi-X BATS Turquoise KCG SI Citi SI Equiduct NYSE Nasdaq KCG NYSE Amex NYSE Arca Jefferies OTC BB Equities US/Canada BATS US ITG KCG SI Toronto Stock Exchange Chi-X Canada Aequitas Stock Exchange KBC Securities NV Havenlaan 2 – 1080 Brussels Tel. +32 2 429 16 86 Fax +32 429 98 39 www.kbcsecurities.com Member of the KBC group VAT BE 0437.060.521 RLP Brussels IBAN BE77 4096 5474 0142 BIC KREDBE BB Public Product Type Executing Entity Execution Venues Tokyo Stock Exchange Instinet Hong Kong Stock Exchange Singapore Stock Exchange Equities Asia/Afrika Jefferies Sydney Stock Exchange Chi-X Johannesburg Stock Exchange Euronext Brussels KBC Securities Euronext Amsterdam Structured products Deutsche Bank Euronext Paris Banca IMI Frankfurt Stock Exchange Borsa Italiana Euronext Brussels KBC Securities Euronext Amsterdam Euronext Paris Listed Bonds Frankfurt Stock Exchange Banca IMI Bourse de Luxembourg Borsa Italiana Bloomberg MTF OTC Bonds KBC Bank Banca IMI Listed NAV-funds KBC Securities Euronext Amsterdam OTC NAV-funds Transfer Agents Euronext Brussels Euronext Amsterdam Euronext Paris KBC Securities Eurex Intercontinental Exchange Societe Generale AMEX Listed derivatives BATS AFS Boston Stock Exchange CBOE Merrill Lynch ISE Nasdaq NYSE Arca Philadelphia Stock Exchange KBC Securities NV Havenlaan 2 – 1080 Brussels Tel. -

NYSE Arca, Inc

NYSE Arca, Inc. Equity Trading Permit Application and Contracts TABLE OF CONTENTS Page Application Process 2 Application Checklist & Fees 3 Explanation of Terms 4 Application for Equity Trading Permit (Sections 1-6) 6 - 11 Individual Registration & Key Personnel (Section 7) 12-13 Designated Examining Authority (DEA) Applicant ETP (Section 8) 15 NYSE Arca ETP Application - October 2019 1 APPLICATION PROCESS Filing Requirements Prior to submitting the Application for Equity Trading Permit (“ETP”), an Applicant Broker-Dealer must file a Uniform Application for Broker-Dealer Registration (Form-BD) with the Securities and Exchange Commission and register with the FINRA Central Registration Depository (“Web CRD®”). Checklist Applicant Broker-Dealer must complete and submit all applicable materials addressed in the Application Checklist (page 4) to [email protected]. Note: All application materials sent to NYSE Arca will be reviewed by NYSE Arca’s Client Relationship Services (“CRS”) Department for completeness. The applications are then submitted to FINRA who performs the application approval recommendation. All applications are deemed confidential and are handled in a secure environment. CRS or FINRA may request applicants to submit documentation in addition to what is listed in the Application Checklist during the application review process, pursuant to NYSE Arca Rule 2.4. If you have questions on completing the application, you may direct them to: Client Relationship Services: Email: [email protected] or (212) 896-2830. Application Process • Following submission of the Application for Equity Trading Permit and supporting documents to NYSE Arca, Inc. (“NYSE Arca”), the application will be reviewed for accuracy and regulatory or other disclosures. NYSE Arca will submit the application to FINRA for review and approval recommendation. -

Thomson One Symbols

THOMSON ONE SYMBOLS QUICK REFERENCE CARD QUOTES FOR LISTED SECURITIES TO GET A QUOTE FOR TYPE EXAMPLE Specific Exchange Hyphen followed by exchange qualifier after the symbol IBM-N (N=NYSE) Warrant ' after the symbol IBM' When Issued 'RA after the symbol IBM'RA Class 'letter representing class IBM'A Preferred .letter representing class IBM.B Currency Rates symbol=-FX GBP=-FX QUOTES FOR ETF TO GET A QUOTE FOR TYPE Net Asset Value .NV after the ticker Indicative Value .IV after the ticker Estimated Cash Amount Per Creation Unit .EU after the ticker Shares Outstanding Value .SO after the ticker Total Cash Amount Per Creation Unit .TC after the ticker To get Net Asset Value for CEF, type XsymbolX. QRG-383 Date of issue: 15 December 2015 © 2015 Thomson Reuters. All rights reserved. Thomson Reuters disclaims any and all liability arising from the use of this document and does not guarantee that any information contained herein is accurate or complete. This document contains information proprietary to Thomson Reuters and may not be reproduced, transmitted, or distributed in whole or part without the express written permission of Thomson Reuters. THOMSON ONE SYMBOLS Quick Reference Card MAJOR INDEXES US INDEXES THE AMERICAS INDEX SYMBOL Dow Jones Industrial Average .DJIA Airline Index XAL Dow Jones Composite .COMP AMEX Computer Tech. Index XCI MSCI ACWI 892400STRD-MS AMEX Institutional Index XII MSCI World 990100STRD-MS AMEX Internet Index IIX MSCI EAFE 990300STRD-MS AMEX Oil Index XOI MSCI Emerging Markets 891800STRD-MS AMEX Pharmaceutical Index -

Nyse Group Announces 2020, 2021 and 2022 Holiday and Early Closings Calendar

INVESTORS NYSE GROUP ANNOUNCES 2020, 2021 AND 2022 HOLIDAY AND EARLY CLOSINGS CALENDAR Released : 09 December 2019 NEW YORK, December 9, 2019 -- NYSE Group announced today the 2022 holiday calendar and early closing dates for its cash equity markets: New York Stock Exchange, NYSE American, NYSE Arca Equities, NYSE Chicago, and NYSE National, as well as the NYSE American Options, NYSE Arca Options and NYSE Bonds markets. The 2020 and 2021 holiday and early closing dates are also set forth below. HOLIDAY 2020 2021 2022 New Year’s Day Wednesday, January 1 Friday, January 1 -- Martin Luther King, Jr. Day Monday, January 20 Monday, January 18 Monday, January 17 Washington's Birthday Monday, February 17 Monday, February 15 Monday, February 21 Good Friday Friday, April 10 Friday, April 2 Friday, April 15 Memorial Day Monday, May 25 Monday, May 31 Monday, May 30 Independence Day Friday, July 3 Monday, July 5 Monday, July 4 (July 4 holiday observed) (July 4 holiday observed) Labor Day Monday, September 7 Monday, September 6 Monday, September 5 Thanksgiving Day Thursday, November 26* Thursday, November 25* Thursday, November 24* Christmas Day Friday, December 25** Friday, December 24 Monday, December 26 (Christmas holiday observed) (Christmas holiday observed) * Each market will close early at 1:00 p.m. (1:15 p.m. for eligible options) on Friday, November 27, 2020, Friday, November 26, 2021, and Friday, November 25, 2022 (the day after Thanksgiving). Crossing Session orders will be accepted beginning at 1:00 p.m. for continuous executions until 1:30 p.m. on these dates, and NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 pm. -

NYSE Euronext and APX to Establish NYSE Bluetm, a Joint Venture Targeting Global Environmental Markets

NYSE Euronext and APX to Establish NYSE BlueTM, a Joint Venture Targeting Global Environmental Markets • NYSE Euronext will contribute its ownership in BlueNext in return for a majority interest in the joint venture; • APX, a leading provider of operational infrastructure and services for the environmental and energy markets, will contribute its business in return for a minority interest in the venture; • NYSE Blue will focus on environmental and sustainable energy initiatives, and will further NYSE Euronext’s efforts to increase its presence in environmental markets globally while attracting new partners and customers. New York, September 7, 2010 -- NYSE Euronext (NYX) today announced plans to create NYSE BlueTM, a joint venture that will focus exclusively on environmental and sustainable energy markets. NYSE Blue will include NYSE Euronext’s existing investment in BlueNext, the world’s leading spot market in carbon credits, and APX, Inc., a leading provider of regulatory infrastructure and services for the environmental and sustainable energy markets. NYSE Euronext will be a majority owner of NYSE Blue and will consolidate its results. Shareholders of APX, which include Goldman Sachs, MissionPoint Capital Partners, and ONSET Ventures, will take a minority stake in NYSE Blue in return for their shares in APX. Subject to customary closing conditions, including APX shareholder approval and regulatory approvals, the APX transaction is expected to close by the end of 2010. NYSE Blue will provide a broad offering of services and solutions including integrated pre-trade and post-trade platforms, environmental registry services, a front-end solution for accessing the markets and managing environmental portfolios, environmental markets reference data, and the BlueNext trading platform. -

Cross-Border Securities Activities Under SEC Rule 15A-6

Cross-Border Securities Activities Under SEC Rule 15a-6 Kathy H. Rocklen Benjamin J. Catalano February 2017 Jurisdictional Issues • The U.S. securities laws apply to broker-dealer activities in interstate commerce. - The term "interstate commerce" means trade, commerce, transportation, or communication among the several States, or between any foreign country and any State, or between any State and any place or ship outside thereof…” • Accordingly, the U.S. securities laws apply to foreign broker-dealers doing business in the United States. 2 63705721v1 Broker-Dealer Registration • Section 15(a) of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”) generally requires registration of foreign broker-dealers doing business with U.S. persons in the United States. - Section 15(a) requires a broker-dealer that uses the mails or any means of interstate commerce (the “jurisdictional means”) to effect transactions in or to induce or attempt to induce the purchase or sale of any security to register with the U.S. Securities and Exchange Commission (“SEC” or the “Commission”). - The definitions of “broker” and “dealer” under Sections 3(a)(4) and 3(a)(5) of the Exchange Act do not refer to nationality and include both domestic and foreign persons. - Under Rule 15a-6(b)(3), foreign broker-dealers are persons who are not resident in the United States, and not offices or branches of, or natural persons associated with, registered broker-dealers whose securities activities, if conducted in the United States, would fall within the definitions of broker or dealer. 3 63705721v1 Broker-Dealer Registration - Any use of the U.S. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange